Professional Documents

Culture Documents

Assignment 2

Uploaded by

will.li.shuaiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 2

Uploaded by

will.li.shuaiCopyright:

Available Formats

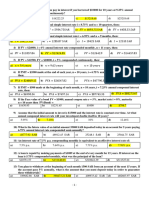

Q1: If you put up $10,000 today in exchange for a 7.

5 percent, 12-year annuity, what

will the annual cash flow will be?

1

1−

(1 + 𝑟)𝑡

𝑃𝑉 = 𝐶 ∗ { }

𝑟

PV=$10000

r=7.5%

t=12

1

1−(1+0.075)12

Then, 10000 = 𝐶 ∗ { 0.075

} , C≈$1292.78

Q2: Bob’s Life Insurance Co. is trying to sell you an investment policy that will pay you

and your heirs $1,000 per year forever. If the required rate of return on this investment

is 12 percent, how much will you pay for the policy?

This problem is about the valuation of a perpetuity. A perpetuity is a financial instrument that

pays a fixed amount forever.

𝐶 1000

𝑃𝑉 = = ≈ $8333.33

𝑟 0.12

Q3:You want to buy a new sports coupe for $43,950, and the finance office at the

dealership has quoted you a 14.3 percent APR (Annual Percentage Rate) loan for 60

months to buy the car. What will your monthly payments be? What is the effective

annual rate on this loan?

Set:

M:Monthly Payment

r:Monthly Rate=0.143/12≈0.011916

[(1 + 𝑟)𝑛 − 1]

𝑃𝑉 = 𝑀 ∗ { }

𝑟(1 + 𝑟)𝑛

1.01191660 −1

43950 = 𝑀 ∗ [0.011916∗1.01191660 ] M≈$1029.274

𝐸𝐴𝑅 = (1 + 𝑟)12 − 1 = 1.01191612 − 1 ≈ 15.25%

Q4 : Royal Bank charges 7.5 percent compounded quarterly on its business loans.

Dominion Bank charges 8.0 percent compounded semiannually. As a potential borrower,

which bank would you go for a new loan?

Royal Bank compounded Quarterly, n=4;

Dominion Bank compounded Semiannually, n=2;

For Royal Bank:

0.075 4

𝐸𝐴𝑅 = (1 + ) − 1 ≈ 7.71%

4

For Dominion Bank:

0.08 2

𝐸𝐴𝑅 = (1 + ) − 1 ≈ 8.16%

2

Compare with the two banks, as a potential borrower, choose Royal Bank.

Q5.

Coupon: 5€

FV=Par=100€

r=6%

t=10

5 5 (100+5)

Then the bond’s 𝑃𝑉 = (1+0.06)1 + (1+0.06)2 + ⋯ + (1+0.06)10 ≈ 92.65€

You might also like

- Sibilski OdpDocument35 pagesSibilski Odpkalineczka.rausNo ratings yet

- Math Solution for Finance AssignmentsDocument11 pagesMath Solution for Finance AssignmentsJoy ChowdhuryNo ratings yet

- FM Practice Questions KeyDocument7 pagesFM Practice Questions KeykeshavNo ratings yet

- Math 101 Simple AnnuityDocument30 pagesMath 101 Simple AnnuityAdi Garcia ArcenasNo ratings yet

- 1b) Extra Financial Maths Solutions To Practice QuestionsDocument15 pages1b) Extra Financial Maths Solutions To Practice QuestionsWilliam ZhaoNo ratings yet

- Simple and Compound Interest: Concept of Time and Value OfmoneyDocument11 pagesSimple and Compound Interest: Concept of Time and Value OfmoneyUnzila AtiqNo ratings yet

- Vn1001630 - Vo Thi Phuong Thuy - CFDocument9 pagesVn1001630 - Vo Thi Phuong Thuy - CFThunder StormNo ratings yet

- Solution 4Document5 pagesSolution 4askdgas50% (2)

- CH03Document5 pagesCH03Mohsin SadaqatNo ratings yet

- Chapter 7Document11 pagesChapter 7Muhammad WaqasNo ratings yet

- Lecture Time Value of MoneyDocument44 pagesLecture Time Value of MoneyAdina MaricaNo ratings yet

- Econ 215-Ch.4-hwSMDocument12 pagesEcon 215-Ch.4-hwSMAnnNo ratings yet

- Chapter 6 - Bond ValuationDocument52 pagesChapter 6 - Bond Valuationhafizxyz77% (13)

- Annuities 101Document6 pagesAnnuities 101Chrystal Jasmine J. RoqueNo ratings yet

- Homework 1 SolnsDocument2 pagesHomework 1 SolnsNoahIssaNo ratings yet

- GF520 Unit2 Assignment CorrectionsDocument7 pagesGF520 Unit2 Assignment CorrectionsPriscilla Morales86% (7)

- Corporate Finance (Chapter 4) (7th Ed)Document27 pagesCorporate Finance (Chapter 4) (7th Ed)Israt Mustafa100% (1)

- Chapter 6 Bond ValuationDocument50 pagesChapter 6 Bond ValuationAnanth Krishnan100% (1)

- Chapter 5 Part 1Document6 pagesChapter 5 Part 1das23dasdaNo ratings yet

- hw1 AnsDocument7 pageshw1 AnsMingyanNo ratings yet

- hw1 SolutionsDocument3 pageshw1 SolutionsJohn SmithNo ratings yet

- Chapter 3 Time Value of Money - Practice ProblemsDocument22 pagesChapter 3 Time Value of Money - Practice ProblemsAkshat SinghNo ratings yet

- Time Value of MoneyDocument20 pagesTime Value of MoneyAkashdeep SaxenaNo ratings yet

- Tutorial 4 - MemoDocument3 pagesTutorial 4 - MemoNelly MalatjiNo ratings yet

- Group Assignment 1Document5 pagesGroup Assignment 1pushmbaNo ratings yet

- Period Payment Principal Part Interest Part BalanceDocument2 pagesPeriod Payment Principal Part Interest Part BalancehampiNo ratings yet

- FV FV: ExplanationDocument54 pagesFV FV: Explanationenergizerabby83% (6)

- Lecture notes week 2-2Document32 pagesLecture notes week 2-2Dang QuangNo ratings yet

- Chap4 ModifiedDocument66 pagesChap4 ModifiedRuba AwwadNo ratings yet

- Simple Debt AmortizationDocument4 pagesSimple Debt AmortizationAmer IbrahimNo ratings yet

- SBE211-Regular ExamDocument4 pagesSBE211-Regular ExamThanh Hoa TrầnNo ratings yet

- Time Value of Money: SolutionsDocument12 pagesTime Value of Money: SolutionsParth Hemant PurandareNo ratings yet

- Homework 3 - StudentDocument6 pagesHomework 3 - StudentMarket FarmersNo ratings yet

- Chapter-10: Valuation & Rates of ReturnDocument22 pagesChapter-10: Valuation & Rates of ReturnTajrian RahmanNo ratings yet

- Metta Dina Gloria - Nim 207007050 - Manajemen KeuanganDocument4 pagesMetta Dina Gloria - Nim 207007050 - Manajemen KeuanganmettaNo ratings yet

- Sinking Fund and Present Value FormulasDocument32 pagesSinking Fund and Present Value FormulasniginkabrahamNo ratings yet

- TVM Exercises: - in The First Year: - in The Second YearDocument2 pagesTVM Exercises: - in The First Year: - in The Second YearCu Thi Hong NhungNo ratings yet

- Midterm Exam II Solution KeyDocument4 pagesMidterm Exam II Solution KeyyarenNo ratings yet

- 0.77 Points: FV PV+ (PVXRXT)Document26 pages0.77 Points: FV PV+ (PVXRXT)hirevNo ratings yet

- Annuity 121205084127 Phpapp02Document9 pagesAnnuity 121205084127 Phpapp02Fritz FatigaNo ratings yet

- Discounted Cash Flow ValuationDocument33 pagesDiscounted Cash Flow ValuationShadow IpNo ratings yet

- 2 Time Value of MoneyDocument46 pages2 Time Value of MoneyABHINAV AGRAWALNo ratings yet

- Money Amp Amp BankingDocument15 pagesMoney Amp Amp BankingMaxim IgoshinNo ratings yet

- Time Value of MoneyDocument10 pagesTime Value of MoneyAnu LundiaNo ratings yet

- m7PRPTTY PDFDocument4 pagesm7PRPTTY PDFAshley De GuzmanNo ratings yet

- 001 EeDocument12 pages001 EejingNo ratings yet

- Bond and Stock Problem SolutionsDocument3 pagesBond and Stock Problem SolutionsLucas AbudNo ratings yet

- Chap006 3thầy.NDocument10 pagesChap006 3thầy.NKeity TranNo ratings yet

- Kundu MathsDocument9 pagesKundu MathsDJ GAMERNo ratings yet

- TVM ChallengingDocument5 pagesTVM Challengingnabeelarao100% (1)

- Time Value of MoneyDocument36 pagesTime Value of Moneybisma9681No ratings yet

- Capital Budgeting and FinancingDocument21 pagesCapital Budgeting and FinancingCérine AbedNo ratings yet

- Time ValueDocument10 pagesTime ValueBhaskar VishalNo ratings yet

- Excel TVM Functions PDFDocument8 pagesExcel TVM Functions PDFVishal GoelNo ratings yet

- Solutions of Selected Problems in Chapter 4 - The Time Value of Money (Part 2)Document10 pagesSolutions of Selected Problems in Chapter 4 - The Time Value of Money (Part 2)Sana Khan100% (1)

- FM19 Finals Q1 Stocks Bonds PortfolioDocument4 pagesFM19 Finals Q1 Stocks Bonds PortfolioJuren Demotor DublinNo ratings yet

- FIN118 Final B Solution 2Document3 pagesFIN118 Final B Solution 2alassafsultan63No ratings yet

- FM - Lecture 2 - Time Value of Money PDFDocument82 pagesFM - Lecture 2 - Time Value of Money PDFMi ThưNo ratings yet