Professional Documents

Culture Documents

Macroeconomics Canadian Edition 6th Edition N Gregory Mankiw-154

Uploaded by

Rehan Habib0 ratings0% found this document useful (0 votes)

70 views1 pageThe document discusses the flow of money between households, firms, and the government. Households receive income from firms, pay taxes to the government, consume goods and services, and save through financial markets. Firms receive revenue from sales and pay for production costs. Households and firms borrow for investment goods like homes and factories. The government receives tax revenue and uses it to fund government spending, with surpluses or deficits depending on whether spending exceeds taxes.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses the flow of money between households, firms, and the government. Households receive income from firms, pay taxes to the government, consume goods and services, and save through financial markets. Firms receive revenue from sales and pay for production costs. Households and firms borrow for investment goods like homes and factories. The government receives tax revenue and uses it to fund government spending, with surpluses or deficits depending on whether spending exceeds taxes.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

70 views1 pageMacroeconomics Canadian Edition 6th Edition N Gregory Mankiw-154

Uploaded by

Rehan HabibThe document discusses the flow of money between households, firms, and the government. Households receive income from firms, pay taxes to the government, consume goods and services, and save through financial markets. Firms receive revenue from sales and pay for production costs. Households and firms borrow for investment goods like homes and factories. The government receives tax revenue and uses it to fund government spending, with surpluses or deficits depending on whether spending exceeds taxes.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

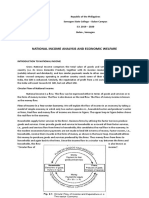

Let’s look at the flow of dollars from the viewpoints of these actors.

Households receive income and use it to pay taxes to the government, to

consume goods and services, and to save through the financial markets.

Firms receive revenue from the sale of the goods and services they

produce and use it to pay for the factors of production. Households and

firms borrow in financial markets to buy investment goods, such as

houses and factories. The government receives revenue from taxes and

uses it to pay for government purchases. Any excess of tax revenue over

government spending is called public saving, which can be either positive

(a budget surplus) or negative (a budget deficit).

In this chapter we develop a basic classical model to explain the economic

interactions depicted in Figure 3-1. We begin with firms and look at what

determines their level of production (and thus the level of national

income). Then we examine how the markets for the factors of production

distribute this income to households. Next, we consider how much of this

income households consume and how much they save. In addition to

discussing the demand for goods and services arising from the

consumption of households, we discuss the demand arising from

investment and government purchases. Finally, we come full circle and

examine how the demand for goods and services (the sum of

consumption, investment, and government purchases) and the supply of

goods and services (the level of production) are brought into balance.

You might also like

- Government and the Economy: Enriching Language and Literacy Through ContentFrom EverandGovernment and the Economy: Enriching Language and Literacy Through ContentNo ratings yet

- Introduction To The Circular Flow of Economic Activity:: HouseholdsDocument6 pagesIntroduction To The Circular Flow of Economic Activity:: HouseholdsAmanda SantosNo ratings yet

- Means Introduction of Income Into The FlowDocument3 pagesMeans Introduction of Income Into The FlowJaira AndanNo ratings yet

- Summary Of "The Economic System" By Armando Fastman: UNIVERSITY SUMMARIESFrom EverandSummary Of "The Economic System" By Armando Fastman: UNIVERSITY SUMMARIESNo ratings yet

- Circular Flow of Economic ActivityDocument7 pagesCircular Flow of Economic ActivityanonymNo ratings yet

- The Circular Flow of Economic ActivityDocument8 pagesThe Circular Flow of Economic ActivityShrahi Singh KaranwalNo ratings yet

- Circular Flow ModelDocument7 pagesCircular Flow ModelshaheenNo ratings yet

- Assignments ECO - 1Document8 pagesAssignments ECO - 1Nagamani RajeshNo ratings yet

- Circular Flow of Income - GeeksforGeeksDocument7 pagesCircular Flow of Income - GeeksforGeeksAyush KumarNo ratings yet

- What Determines The Demand ForDocument25 pagesWhat Determines The Demand ForSuruchi SinghNo ratings yet

- Circular Flow of Economic ActivityDocument8 pagesCircular Flow of Economic ActivityUma BalasubramanianNo ratings yet

- Midterm LecDocument5 pagesMidterm Lecmary joyNo ratings yet

- 3 Circular Flow of Economic ActiDocument4 pages3 Circular Flow of Economic ActiCHINMAY AGRAWALNo ratings yet

- Circular Flow of Funds: Through The EconomyDocument10 pagesCircular Flow of Funds: Through The EconomyHaji Saif UllahNo ratings yet

- Business FinanceDocument8 pagesBusiness FinanceHaji Saif UllahNo ratings yet

- Unit 2 Public FinanceDocument29 pagesUnit 2 Public Financehakunguyn646No ratings yet

- Chapter 1: The Economy and The Financial SystemDocument30 pagesChapter 1: The Economy and The Financial SystemGwy RubisNo ratings yet

- Unit 2Document14 pagesUnit 2sonika7No ratings yet

- SummaryDocument59 pagesSummaryNefta BaptisteNo ratings yet

- Macro Economics AssignmentDocument20 pagesMacro Economics AssignmentSWAPNIL GUPTANo ratings yet

- 11 Activity 1Document1 page11 Activity 1John HachuelaNo ratings yet

- Introduction To Macroeconomics: After Reading This Section, You Should Be Able ToDocument33 pagesIntroduction To Macroeconomics: After Reading This Section, You Should Be Able ToKhaster NavarraNo ratings yet

- Eso Ass FRDocument2 pagesEso Ass FRmintuwondeNo ratings yet

- Mb1102 Me - U IV - Dr.r.arunDocument24 pagesMb1102 Me - U IV - Dr.r.arunDr. R. ArunNo ratings yet

- 3 1 The Level of Economic ActivityDocument75 pages3 1 The Level of Economic ActivityMohammad Farhan NewazNo ratings yet

- UntitledDocument7 pagesUntitledFakayode AdedamolaNo ratings yet

- Chapter 2 The Circular FlowDocument11 pagesChapter 2 The Circular FlowClaire Ann Salazar BorjaNo ratings yet

- Vol 991 EconDocument2 pagesVol 991 EconregdddNo ratings yet

- Introduction To MacroeconomicsDocument8 pagesIntroduction To Macroeconomicsksylviakinyanjui2No ratings yet

- 1 - Economy and The Financial SystemDocument7 pages1 - Economy and The Financial SystemGracia MariaNo ratings yet

- MEBE - 02 - Circular FlowDocument22 pagesMEBE - 02 - Circular Flownagarajan adityaNo ratings yet

- Lecture 2. Mr. AllicockDocument60 pagesLecture 2. Mr. AllicockPrecious MarksNo ratings yet

- Activity OneDocument8 pagesActivity Oneveda sai kiranmayee rasagna somaraju AP22322130023No ratings yet

- Eco CfoiDocument5 pagesEco CfoiAMNA MOAZZAMNo ratings yet

- Entrepreneurs in A Market EconomyDocument46 pagesEntrepreneurs in A Market EconomyRahul KumarNo ratings yet

- What Is 'Microeconomics': Microeconomics Is The Study of The Behaviour of The Individual Units (Like AnDocument5 pagesWhat Is 'Microeconomics': Microeconomics Is The Study of The Behaviour of The Individual Units (Like AnMae Jane AguilarNo ratings yet

- Income WelfareDocument14 pagesIncome WelfareAie GeraldinoNo ratings yet

- Macro Environ-Circular Flow of IncomeDocument33 pagesMacro Environ-Circular Flow of Incomeamankamat2002No ratings yet

- Assignment No. 2Document2 pagesAssignment No. 2Mary Antonette LastimosaNo ratings yet

- Summary of Topics After MidtermDocument20 pagesSummary of Topics After MidtermSyeda Bisma AliNo ratings yet

- Business Study TodayDocument4 pagesBusiness Study TodayTae TaeNo ratings yet

- Chap 2 M1Document9 pagesChap 2 M1science boyNo ratings yet

- Lorena Kukovičić - TAXATIONDocument17 pagesLorena Kukovičić - TAXATIONlorenaNo ratings yet

- Part I Introduction To TaxationDocument56 pagesPart I Introduction To TaxationabrehamdNo ratings yet

- Circular Flow of EconomicsDocument7 pagesCircular Flow of EconomicsAmandeep sainiNo ratings yet

- Lecture 2Document13 pagesLecture 2ashrrakat31No ratings yet

- Chapter 2 National IncomeDocument29 pagesChapter 2 National Incomeliyayudi0% (1)

- #1 National IncomeDocument37 pages#1 National Incomerupnath10102002No ratings yet

- Taquiso TaxationDocument6 pagesTaquiso TaxationAVERY JAN SILOSNo ratings yet

- Cheating NoteDocument3 pagesCheating NoteMirza Rayyan Baig MUGRNo ratings yet

- Arpan 5Document1 pageArpan 5Matthew Alison ApostolNo ratings yet

- The Circular Flow of Economic ModelDocument10 pagesThe Circular Flow of Economic Modelroa99No ratings yet

- Business Week4, QuizDocument12 pagesBusiness Week4, QuizadaNo ratings yet

- Macroeconomics Canadian Edition 6th Edition N Gregory Mankiw-152Document1 pageMacroeconomics Canadian Edition 6th Edition N Gregory Mankiw-152Rehan HabibNo ratings yet

- Macroeconomics 5th YearsDocument31 pagesMacroeconomics 5th YearsDavid LyeluNo ratings yet

- IIM Trichy PI Kit 2023Document69 pagesIIM Trichy PI Kit 2023Glen DsouzaNo ratings yet

- Measuring and Understanding The National Economy: Objectives For Chapter 8Document19 pagesMeasuring and Understanding The National Economy: Objectives For Chapter 8Anonymous BBs1xxk96VNo ratings yet

- National IncomeDocument11 pagesNational IncomeAmmar AleeNo ratings yet

- Eco457 Assignment of Group 6Document14 pagesEco457 Assignment of Group 6Ridiana TonnyNo ratings yet

- Day 5 - Cash FlowsDocument24 pagesDay 5 - Cash FlowsRehan HabibNo ratings yet

- Day 4 - CompleteDocument42 pagesDay 4 - CompleteRehan HabibNo ratings yet

- Assignment 1 QuestionsDocument2 pagesAssignment 1 QuestionsRehan HabibNo ratings yet

- Business Activities and Accounting InformationDocument8 pagesBusiness Activities and Accounting InformationRehan HabibNo ratings yet

- Day 2Document24 pagesDay 2Rehan HabibNo ratings yet