Professional Documents

Culture Documents

Verka Milk Plant Mohali: A Financial Analysis: Roope7606@cumail - in

Uploaded by

sharmaanita7761Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Verka Milk Plant Mohali: A Financial Analysis: Roope7606@cumail - in

Uploaded by

sharmaanita7761Copyright:

Available Formats

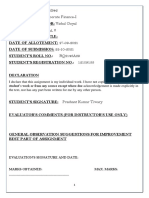

Pramana Research Journal ISSN NO: 2249-2976

Verka milk plant Mohali: A Financial Analysis

Roop Kamal, Assistant Professor, Chandigarh University

E-mail: Roope7606@cumail.in

Introduction

The company has been well known by its brand name "VERKA" especially In Punjab and

Haryana. Chandigarh Milk Plant was set up in year 1961-1962 to meet the milk initially. But

it was not able to fulfill the growing requirements of Chandigarh City. Due to this reason

another plant set up in September 1980 at Mohali (Punjab), which is adjoining to Chandigarh.

"The Ropar Distt. Co-op Producer Union". It is one of the "MILKFED" group located at

S.A.S Nagar, Mohali (PUNJAB). It was registered on 05.07.1978 under Punjab Co-operative

Societies Act, 1961. It started its operations on September, 1980.

Plant at a glance

Establishment 1980 :The Ropar District Co-operative Milk

Producers :Union Milk Plant, Mohali.

Brand Name :Verka

Installed Capacity :1,00,000Litres of Milk Per Day

Status :Co-operative Society

Head Office :Milkfed, Punjab, Sector 34, Chandigarh

Plant :The Ropar District Co-operative Milk

Producers :Union Ltd. Milk Plant, S.A.S Nagar, Mohali

Objectives of the study

1. To know the financial position of the organization.

2. To study the periodic changes in the financial performance by preparing common size

statement analysis of the year 2014-15.

Data analysis & interpretation.

Current Position of Verka Milk Plant, Mohali:

A. Details of number of members and societies enrolled under Verka Milk Plant

Mohali:

Volume 8, Issue 8, 2018 254 https://pramanaresearch.org/

Pramana Research Journal ISSN NO: 2249-2976

Financial Year No. of Societies Enrolled No. of Members Enrolled

2011-12 966 49237

2012-13 1010 50549

2013-14 1047 52596

2014-15 1051 57354

2015-16 1091 61950

B. Details of milk procurement by Milk Plant Mohali:

Financial Year Milk Procurement Liters (%)age Increase

Per Kg/ LPKG

2011-12 217598 or 2.18 lakh 11%

2012-13 246895 or 2.47 lakh 13%

2013-14 274525 or 2.75 lakh 11%

2014-15 319504 or 3.19 lakh 16%

2015-16 296905 or 2.97 lakh 4%

C. Distribution of Cattle Feed and Processed Seeds to Society Members

Financial Year Distribution of Cattle Feed Distribution of Processed

in Quintals (Qtl.) Seeds in Quintals (Qtl.)

2011-12 26743 879

2012-13 26485 991

2013-14 28718 1150

2014-15 29038 1507

2015-16 19313 2216

Volume 8, Issue 8, 2018 255 https://pramanaresearch.org/

Pramana Research Journal ISSN NO: 2249-2976

MILK PLANT MOHALI PROFIT AND LOSS GROWTH FOR THE FIVE YEARS

1. COMPARATIVE STATEMENTS:

The comparative financial statements are statements of the financial position of different

period of time. The elements of financial position are shown in a comparative form so as

to give an idea of financial position at two or more periods

From practical point of view, generally, two financial statements are prepared in

comparative form for financial analysis purpose. These are balance sheet and income

statement.

Comparative Balance Sheet:

The comparative balance sheet analysis is the study of the trend of the same items, and

computed items in two or more balance sheets of the same business enterprise on

different dates. The changes in periodic balance sheet items reflect the conduct of a

business. The changes can be observed by comparison of balance sheet at the beginning

and at the end of the period and these changes can

help in forming an opinion about the progress of an enterprise.

Percentage change =absolute change/figures of the previous yr*100

Volume 8, Issue 8, 2018 256 https://pramanaresearch.org/

Pramana Research Journal ISSN NO: 2249-2976

Comparative Balance Sheet As on 31-03-2014 & 31-03-2015

PARTICULARS 2014 2015 +/- Amt in Rs % inc.

or dec.

CURRENT ASSETS

INVENTORIES 26527392.47 254148874.25 -1378518.2 5.19

SUNDRY DEBTORS 12842442.06 10407961.45 -2434480.61 18.95

LOANS & ADVANCES 80846671.42 84321187.49 3474516.07 4.29

9888867.14

CLOSING STOCK OF RAW MILK 17763810.54 7874943.4 79.63

CLOSING STOCK OF MILK 279958249.92 291288560.69 11330310.77 4.04

PRODUCTS

Total 410063623.01 428930394.41 18866771.4 4.60

INVESTMENTS 17500100.00 17500100.00 0 0

CASH & BANK

BALANCES :-

CASH IN HAND 26752.63 32920 6167.37 23.05

BANKS AS PER 131743378.99 118645929.43 -13097449.56 9.94

SCHEDULE

Total 131770131.62 118678849.43 -13091282.19 -9.9

FIXED ASSETS :-

Total FIXED ASSETS :- 517437208.41 686409157.84 168971949.43 32.65

Liabilities

AUTHORISED SHARE

CAPITAL :-

50000 SHARES OF RS. 1000 100000000.00 100000000.00 0 0%

EACH

ISSUED SUBSCRIBED &

PAID UP CAPITAL :-

SHARE CAPITAL TO SOC. 64849000.00 66128500 58720500 90.5

SECURED LOANS :_ 159083332.00 262179292 103095960 64.8

RESERVES & SURPLUS :- 391358549.56 476592258.83 85206567.27 21.77

CURRENT LIABILITIES AND

PROVISIONS :-

Total of C.L 383682344.51 303685228.83 20.84

Grand Total 1076771063.04 1251518502.68 174747439.64 16

Volume 8, Issue 8, 2018 257 https://pramanaresearch.org/

Pramana Research Journal ISSN NO: 2249-2976

Interpretation Of Comparative Balancesheet

1. It reveals that during 2015 there has been increased in fixed assets by 168971949.43 i.e,

by 32.6% while the share capital has increased to 58720500 i.e, by90.5%

2. The current assets has increased by 18866771.4 and current liabilities has decreased by

79969973.68

3. Financial position is good.

b. Comparative Income Statement:

The comparative income statement gives the results of the operations of the business. The

statement discloses the net profit or net loss resulting from the operation of the business.

Such statements show the operating results for a number of accounting periods so that

changes in absolute data from one period to another period may be stated in terms of

absolute changes or in terms of percentages. This statement helps in deriving meaningful

conclusion as it is very easy to ascertain the changes in sales volume, administrative

expenses, selling and distribution expenses, cost of sales etc.

Percentage change =absolute change/figures of the previous yr*100

COMPARATIVE INCOME STATEMENT as on 31.3.2014and 31.3.2015

PARTICULARS 2014 2015 +/- Amt in Rs % inc or

decr

SALE OF MILK 1071585741.35 1097092207.81 25506466.46 2.38

PROD

Sale of Milk 4515726495.37 5277987953.92 762261458.55 16.88

Others sale 383048224.02 350372468.39 -32675755.63 -8.53

Total 5970360460.74 6725452630.12 755092169.38 12.64

Less: cost of goods 5653373037.3 6366316825.21 712943787.91 12.61

sold

Gross profit 316987423.45 359135804.91 42148381.45 13.29

Add Misc. Income 18157533.89 24336340.68 6178806.79 34.02

Total profit 335144957.35 383472145.59 48327188.24 14.41

Less: Indirect

Expenses

Store/pur/Enng.Exp 38171438.23 39125837.80 954399.57 2.50

Admn/Accts.Exp 74964395.46 92703896.10 17739500.64 23.66

Distt.Exp.Milk/pro 56586233.47 68734002.05 12147768.58 21.4

Financial Expenses 44303530.00 37182697 -7120833 -16.07

Depreciation 36502799.23 58397030.59 21894231.36 59.97

Volume 8, Issue 8, 2018 258 https://pramanaresearch.org/

Pramana Research Journal ISSN NO: 2249-2976

Total 250528396.39 296143463.54 45615067.15 18.20

Net Profit 84616560.96 87328682.05 2712121.09 3.20

Interpretation Of Comparative Income Statement

1. Total sales of the company increased by 12.64% as compare to 2014. And gross profit

of the company also increased by 13.29%.. and net profit of the company also increased

by 3.20%.

2. The current financial position of Verka Milk Plant is good.

2) COMMON SIZE STATEMENT:

Common size financial statements are those in which figures reported are converted to some

common base. Items in the financial statements are presented as percentage or ratios to total

of the items and a common base for comparison is provided. Hence vertical analysis becomes

possible. Each percentage shows the relation of the individual item to its respective total.

Common size statements may be used for balance sheet as well as income statement.

a Common Size Income Statement:

In such a statement, sales figure is assumed to be equal to 100 and all other figures of cost or

expenses are expressed as percentage of sales. The increase in sales will certainly increase the

selling expenses and administrative or financial expenses. In case the volume of sales is

increases to a certain extent, administrative and financial expenses may go up. So, a

relationship between sales and other items in income statements.

COMMON SIZE INCOME STATEMENT as on 31.3.2014 and 31.3.2015

Items 2014 2015 %age of net %age of net

sales 2014 sales 2015

A.Net sales 5970360460.74 6725452630.12 100 100

B. COGS 5653373037.3 6366316825.21 94.69 94.66

C. Gross profit 316987423.46 359135804.91 5.30 5.33

(A-B)

D. (less) 250528396.39 296143463.54 4.19 4.40

operating

expenses

E. operating 66459027.07 62992341.37 1.11 0.93

profit

(C-D)

F.(Add)other 18157533.89 24336340.68 0.304 0.36

Volume 8, Issue 8, 2018 259 https://pramanaresearch.org/

Pramana Research Journal ISSN NO: 2249-2976

incomes

Net profit before 84616560.96 87328682.05 1.41 1.29

tax

G.(Less)income 25000000 22707797 0.41 0.33

tax

Net income after 59616560.96 64620885.05 0.99 0.96

tax

b. Common Size Balance Sheet:

In a common size balance sheet, total assets or total liabilities are taken as 100 and all figures

are expressed as percentage of total, comparative common size balance sheet for different

periods helps to highlight the trend in different items. If it is prepared for different firms in an

industry, it facilitates to judge the relative soundness and helps in understand their financial

Common Size Balance Sheet as on 31.3.2014 and 31.3.2015

Assets 2014 2015 %age %age

change in change in

2014 2015

Fixed assets 51743208.41 686409157.84 54.75 60.59

Investments 17500100 17500100 1.85 1.54

Current assets 410063623.01 428930394.41 43.39 37.86

Total 945000931.42 1132839652.25 100 100

Liabilities

Share capital 64849000 66128500 6.49 5.96

Reserves and surplus 391385691.56 476592258.83 39.17 42.99

Secured loans 159083332 262179292 15.92 23.64

Current liabilities 383655202.51 303685228.83 38.40 27.39

Total 998973226.07 1108585279.66 100 100

Conclusion:-

1. Most of the current assests of the company have increased in 2015 as compare to 2014.

2. In comparative balance sheet analysis of the verka milk plant, the current liabilities

increased by 16% and current assets increased by 4.60%

3. Verka milk plant sales is increasing day by day from last few years.

4. In the year 2015 the gross profit and net profit of the company has increased .

Bibliography

1. www.economictimes.com

2. https://www.edupristine.com/blog/ratio-analysis-introduction

Volume 8, Issue 8, 2018 260 https://pramanaresearch.org/

You might also like

- Tata Motors Company Valuation 2021-2024Document25 pagesTata Motors Company Valuation 2021-2024Manveet SinghNo ratings yet

- Analysis of Financial Statements in The Sugar Industry: April 2017Document11 pagesAnalysis of Financial Statements in The Sugar Industry: April 2017balajiNo ratings yet

- HMT Machine Tools Annual Report Highlights 2016-17Document89 pagesHMT Machine Tools Annual Report Highlights 2016-17Druva GeejagarNo ratings yet

- K-Electric WordDocument11 pagesK-Electric Wordwaqasawan914No ratings yet

- Two Company Ratio Analysis ComparisonDocument16 pagesTwo Company Ratio Analysis ComparisonSubashNo ratings yet

- Economics ProjectDocument20 pagesEconomics ProjectSahil ChandaNo ratings yet

- Word Accounting ProjectDocument12 pagesWord Accounting ProjectMuhammad BilalNo ratings yet

- Investment Club TaskDocument7 pagesInvestment Club TaskRohitakshi SharmaNo ratings yet

- Assignment OF Banking and Working Capital ON Financial Accounts and Working Capital OF GailDocument9 pagesAssignment OF Banking and Working Capital ON Financial Accounts and Working Capital OF GailSachin Kumar BassiNo ratings yet

- KTIS 2014 - Lopburi KBE PDFDocument195 pagesKTIS 2014 - Lopburi KBE PDFAddo HernandoNo ratings yet

- Group 9 - ONGC - MA ProjectDocument13 pagesGroup 9 - ONGC - MA ProjectShubham JainNo ratings yet

- fm2 Project Phase 1Document7 pagesfm2 Project Phase 1SACHIN THOMAS GEORGE MBA19-21No ratings yet

- Accounting Question 2Document8 pagesAccounting Question 2Moustafa Almoataz100% (1)

- Group 12 - Coffee DayDocument14 pagesGroup 12 - Coffee DaySayan MondalNo ratings yet

- Confidence Cement FinalDocument164 pagesConfidence Cement FinalShartaj Aziz Hossain 1722200No ratings yet

- Cement Industry Project ReportDocument152 pagesCement Industry Project ReportManahil KhanNo ratings yet

- Data Analysis of Balance Sheet and Profit & Loss Statement of Bindal Duplex Paper LtdDocument24 pagesData Analysis of Balance Sheet and Profit & Loss Statement of Bindal Duplex Paper LtdSarthakNo ratings yet

- 2.3 Business StatisticsDocument29 pages2.3 Business StatisticsAlexander GonzálezNo ratings yet

- Financial Report On Lafarge Cement PakistanDocument36 pagesFinancial Report On Lafarge Cement PakistanSaaDii KhanNo ratings yet

- Harish Anchan: Re:-Annual Report For The Financial Year Ended 31 March 2023Document209 pagesHarish Anchan: Re:-Annual Report For The Financial Year Ended 31 March 2023abhi1234kumar402389No ratings yet

- Project Prepared and Presented By:: Jinia Biswas Sruti Jain Vibhav KaushalDocument19 pagesProject Prepared and Presented By:: Jinia Biswas Sruti Jain Vibhav Kaushalmanisha sonawaneNo ratings yet

- Ultratech Cement 1. Overview of Ultratech Cement: Chart TitleDocument5 pagesUltratech Cement 1. Overview of Ultratech Cement: Chart TitleashuuuNo ratings yet

- Term-Paper-Group-D NiloyDocument21 pagesTerm-Paper-Group-D Niloyomarsakib19984No ratings yet

- AmulDocument25 pagesAmulAnsh OzaNo ratings yet

- Milk Products PDFDocument12 pagesMilk Products PDFKamal KrupaNo ratings yet

- SRN: PES1PG20MB214 Name: Pooja V: Indian Mumbai Conglomerate Aditya Birla GroupDocument4 pagesSRN: PES1PG20MB214 Name: Pooja V: Indian Mumbai Conglomerate Aditya Birla GroupPooja VNo ratings yet

- Wooly Cox Limited: Common Size Balance Sheet Description/Year 15-MarDocument12 pagesWooly Cox Limited: Common Size Balance Sheet Description/Year 15-Marmahiyuvi mahiyuviNo ratings yet

- D489 Abhishek JSWphase 2Document44 pagesD489 Abhishek JSWphase 2Yash KalaNo ratings yet

- Cement SectorDocument21 pagesCement SectorManahil KhanNo ratings yet

- Changes in Working Capital and Income Trend AnalysisDocument33 pagesChanges in Working Capital and Income Trend AnalysisMythili KarthikeyanNo ratings yet

- Bajaj Auto Apr 2023Document10 pagesBajaj Auto Apr 2023dhruv.bhandari.0301No ratings yet

- Annual Report 2017 Full Final PDFDocument164 pagesAnnual Report 2017 Full Final PDFBahrul UlumNo ratings yet

- Coromandel Company AnalysisDocument10 pagesCoromandel Company AnalysisSatya swaroop ReddyNo ratings yet

- Dhampur Sugar Mills Management Team and HistoryDocument41 pagesDhampur Sugar Mills Management Team and HistoryVinit MandavkarNo ratings yet

- Financial analysis of 3-year company data focusing on current ratio, debt ratio, return on investment and moreDocument13 pagesFinancial analysis of 3-year company data focusing on current ratio, debt ratio, return on investment and morepsana99gmailcomNo ratings yet

- Sapm AssignmentDocument4 pagesSapm Assignment401-030 B. Harika bcom regNo ratings yet

- Z - Score Model: Percentage Working Capital/Total AssetDocument15 pagesZ - Score Model: Percentage Working Capital/Total AssetMortein RajNo ratings yet

- Term Paper On Premier Cement Mills Ltd. - Group 7Document19 pagesTerm Paper On Premier Cement Mills Ltd. - Group 7Jannatul TrishiNo ratings yet

- Pdfcoffee.com Amul Project Report PDF Free (1)Document111 pagesPdfcoffee.com Amul Project Report PDF Free (1)dhvanichauhan476No ratings yet

- Oil and Natural Gas CorporationDocument5 pagesOil and Natural Gas CorporationSarju MaviNo ratings yet

- Priyanka Matrial 2Document198 pagesPriyanka Matrial 2riddhiNo ratings yet

- Corporate Finance Ka Ye DusraDocument16 pagesCorporate Finance Ka Ye Dusraprashant kumar tiwaryNo ratings yet

- Hindustan Petroleum Corporation LTDDocument14 pagesHindustan Petroleum Corporation LTDHoney DarjiNo ratings yet

- Annual Report 2016 17 NewDocument79 pagesAnnual Report 2016 17 Newsabey22991No ratings yet

- General Insurance Corporation of IndiaDocument6 pagesGeneral Insurance Corporation of IndiaGukan VenkatNo ratings yet

- Rohit Amul ReportDocument40 pagesRohit Amul Reportaditya ambreNo ratings yet

- Performance Analysis of Public Sector Banks in IndiaDocument10 pagesPerformance Analysis of Public Sector Banks in IndiaSajna NadigaddaNo ratings yet

- Bank of AmericaDocument23 pagesBank of AmericaAzər ƏmiraslanNo ratings yet

- SMK Cookies Manufacturing Project ReportDocument24 pagesSMK Cookies Manufacturing Project ReportMuthu KumarNo ratings yet

- Financial Management Project: Presented byDocument16 pagesFinancial Management Project: Presented byAsif KhanNo ratings yet

- Nestle and Britannia RatiosDocument21 pagesNestle and Britannia RatiosKartik RawatNo ratings yet

- And Investment Holdings 32015Document10 pagesAnd Investment Holdings 32015Milan PetrikNo ratings yet

- SMART 15 Aug 2016Document45 pagesSMART 15 Aug 2016siva kNo ratings yet

- AIBEA PRESS RELEASE 30 5 18 Bank Strike TodayDocument5 pagesAIBEA PRESS RELEASE 30 5 18 Bank Strike Todaylove05kumar05No ratings yet

- Learning Competencies: Let's Recall (Review)Document7 pagesLearning Competencies: Let's Recall (Review)hiNo ratings yet

- Powergrid Corporation of India history and financialsDocument9 pagesPowergrid Corporation of India history and financialsShringar ThakkarNo ratings yet

- Ganesh Textiles case analysis: Reducing inventory to improve cash flowDocument10 pagesGanesh Textiles case analysis: Reducing inventory to improve cash flowYOGESH NISHANTNo ratings yet

- Financial Management Analysis of Vardhman, Grasim, Raymond and SiyaramsDocument13 pagesFinancial Management Analysis of Vardhman, Grasim, Raymond and SiyaramsSaharsh SaraogiNo ratings yet

- Top Picks-June 2015Document9 pagesTop Picks-June 2015saveclipNo ratings yet

- A Investment Platform for Future: Self Help a Self Operating BankingFrom EverandA Investment Platform for Future: Self Help a Self Operating BankingNo ratings yet

- Med - Leaf - Full ReportDocument31 pagesMed - Leaf - Full ReportAdithya s kNo ratings yet

- Marketing Plan: Walton NextDocument26 pagesMarketing Plan: Walton NextAnthony D SilvaNo ratings yet

- Student Report Card ManagementDocument38 pagesStudent Report Card ManagementKannan Thangaraju41% (17)

- Materi MatrikulasiDocument72 pagesMateri MatrikulasiAyziffyNo ratings yet

- Trade Register 2017 2022Document9 pagesTrade Register 2017 2022CatherineNo ratings yet

- 6 1 Reducing Rational Expressions To Lowest TermsDocument21 pages6 1 Reducing Rational Expressions To Lowest Termsapi-233527181No ratings yet

- Business and Tech Mock Exam (8Document11 pagesBusiness and Tech Mock Exam (8Jack PayneNo ratings yet

- Incremental Analysis Decision MakingDocument4 pagesIncremental Analysis Decision MakingMa Teresa B. CerezoNo ratings yet

- Code: Final Exam in English: Grade 8Document7 pagesCode: Final Exam in English: Grade 8Luka EradzeNo ratings yet

- Understanding Social Problems - PPTDocument21 pagesUnderstanding Social Problems - PPTaneri patel100% (1)

- Revista Mexicana de Ciencias Forestales Vol. 9 (49Document32 pagesRevista Mexicana de Ciencias Forestales Vol. 9 (49dacsilNo ratings yet

- Chapter 3 Case Study - Not Sold OutDocument1 pageChapter 3 Case Study - Not Sold OutSagarika SinhaNo ratings yet

- How To Read An EKG Strip LectureDocument221 pagesHow To Read An EKG Strip LectureDemuel Dee L. BertoNo ratings yet

- Detailed Lesson PlanDocument7 pagesDetailed Lesson PlanPrecious BuenafeNo ratings yet

- Balancing Uncertainty in Structural DecisionDocument10 pagesBalancing Uncertainty in Structural DecisionAfifi MohammadNo ratings yet

- Evaluating Usability of Superstore Self-Checkout KioskDocument48 pagesEvaluating Usability of Superstore Self-Checkout Kioskcipiripi14No ratings yet

- Calculation of Drug Dosages A Work Text 10th Edition Ogden Test Bank DownloadDocument8 pagesCalculation of Drug Dosages A Work Text 10th Edition Ogden Test Bank Downloadupwindscatterf9ebp100% (26)

- Isoefficiency Function A Scalability Metric For PaDocument20 pagesIsoefficiency Function A Scalability Metric For PaDasha PoluninaNo ratings yet

- Ahu KitDocument37 pagesAhu KitLaurentiu LapusescuNo ratings yet

- CH 6 SandwichesDocument10 pagesCH 6 SandwichesKrishna ChaudharyNo ratings yet

- Week 14 - LECTURE ACTIVITY 14 - Metamorphic RX Key ConceptsDocument4 pagesWeek 14 - LECTURE ACTIVITY 14 - Metamorphic RX Key ConceptsJessel Razalo BunyeNo ratings yet

- Haas Accessories FlyerDocument12 pagesHaas Accessories FlyerAndrewFranciscoNo ratings yet

- Biblical Productivity CJ MahaneyDocument36 pagesBiblical Productivity CJ MahaneyAnthony AlvaradoNo ratings yet

- Analysis of NOx in Ambient AirDocument12 pagesAnalysis of NOx in Ambient AirECRDNo ratings yet

- Sonic sdw45Document2 pagesSonic sdw45Alonso InostrozaNo ratings yet

- Aluminum Wire Data and PropertiesDocument31 pagesAluminum Wire Data and PropertiesMaria SNo ratings yet

- Astm d5580Document9 pagesAstm d5580Nhu SuongNo ratings yet

- Core Java AdvancedDocument103 pagesCore Java AdvancedRavi Chandra Reddy MuliNo ratings yet

- L-Ascorbic AcidDocument3 pagesL-Ascorbic AcidJemNo ratings yet

- Microeconomics Lecture - Profit Maximization and Competitive SupplyDocument48 pagesMicroeconomics Lecture - Profit Maximization and Competitive Supplybigjanet100% (1)