Professional Documents

Culture Documents

Studying Social Justice of Taxes in Legal System of Afghanistan

Studying Social Justice of Taxes in Legal System of Afghanistan

Uploaded by

Editor IJTSRDCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Studying Social Justice of Taxes in Legal System of Afghanistan

Studying Social Justice of Taxes in Legal System of Afghanistan

Uploaded by

Editor IJTSRDCopyright:

Available Formats

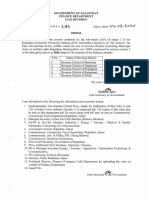

International Journal of Trend in Scientific Research and Development (IJTSRD)

Volume 7 Issue 5, September-October 2023 Available Online: www.ijtsrd.com e-ISSN: 2456 – 6470

Studying Social Justice of Taxes in Legal System of Afghanistan

Noor Mohammad Hashmat, Abdul Malek Sididqi

Assistant Professor, Faculty of Law & Political Science, Al-Beroni University, Golbahar, Afghanistan

ABSTRACT How to cite this paper: Noor

Tax justice is very important to the legitimacy of the tax system in Mohammad Hashmat | Abdul Malek

Afghanistan. On the one hand, any taxes cannot be derived from the Sididqi "Studying Social Justice of

people without a legal basis, and on the other hand, the taxes should Taxes in Legal System of Afghanistan"

be fair and reasonable. Regarding taxes in Afghanistan, it seems that Published in

International Journal

in some cases, the taxes consisting of direct and indirect taxes are not of Trend in

justifiable. The very major examples are the VAT (Value Added Scientific Research

Tax), the tax on credit cards, and some tax on income in the legal and Development

system of Afghanistan. During determining tax, the tax authorities (ijtsrd), ISSN: 2456-

should evaluate the life and characteristics of taxpayers to determine 6470, Volume-7 | IJTSRD59862

whether they have the ability to pay tax or not. These are the Issue-5, October

concerns regarding the social justice of taxes. So, we are trying to 2023, pp.16-21, URL:

find the response to this question: Is social justice respected and www.ijtsrd.com/papers/ijtsrd59862.pdf

observed in the tax legal system of Afghanistan? No doubt, in some

cases, the taxes in Afghanistan are not rightful. The economic Copyright © 2023 by author (s) and

International Journal of Trend in

conditions of people are not equal. Most people in Afghanistan are Scientific Research and Development

very poor. As a result, tax authorities should assess people's living Journal. This is an

conditions. In addition, the government should codify fair taxes for Open Access article

the people. The method of the research will be descriptive and distributed under the

analytical. The method of collecting data is librarianship. We terms of the Creative Commons

reviewed books, articles, magazines, and the national laws of Attribution License (CC BY 4.0)

Afghanistan. (http://creativecommons.org/licenses/by/4.0)

KEYWORDS: Afghanistan, Legal System, Social Justice, Taxes

INTRODUCTION

The taxation system can be divided into three seek to gain the consent of the people. That’s why the

categories: direct taxes such as the individual income tax is a bridge between the government and the

tax and corporate income tax; indirect taxes such as people. If the people do not accept, the government is

the value added tax (VAT), the banking and insurance not able to impose a tax. Therefore, it's important to

transaction tax, the special consumption tax, and the study and evaluate the social justice of taxes.

telecommunications tax; and other government Observing and respecting the social justice of taxes

revenues drawn from factor incomes, social funds, encourages people to pay the tax with their own

and privatization revenues" (Genckaya, 2018:10). In consent.

the case of Afghanistan, through history, the core of

Research question: Is the social justice respects and

Afghan governance has been feudal in nature, which observes in tax’s legal system of Afghanistan?

is evident from the rural and agricultural nature of the

country’s industry and demography. Government Hypotheses: It seems that the system of taxes in

revenues have long depended on taxes on farmers and Afghanistan is not right. The personalization of taxes

foreign rents (Nijat, 2014:10). So, the question of that is the legacy of social justice is vague. In some

social justice in taxation is raised. Is it fair and cases, there are no differences between rich and poor

justifiable to impose a tax on farmers and some others people in paying taxes.

who are not able to pay? The answer is negative. No Objective of the research:

doubt Afghanistan’s governments have tried to bring 1. In order to find ways of finding solutions for

some reforms for social justice, but it’s not enough. those problems that exist in the way of taxes

Not only in Afghanistan but also in some other through legal means,

regional and international countries, the social justice 2. Exploring the definite role of the government in

of taxes is very important. The government should generating income for the expenditure of the state

@ IJTSRD | Unique Paper ID – IJTSRD59862 | Volume – 7 | Issue – 5 | Sep-Oct 2023 Page 16

International Journal of Trend in Scientific Research and Development @ www.ijtsrd.com eISSN: 2456-6470

through a right path that is fair and justice for the Afghanistan, there isn’t any new research about the

people social justice of taxes. There are inequalities in this

3. Spread of my knowledge regarding socio- regard, and we try our best to find the facts about the

economic, political, trade, and cultural aspects of inequalities in tax among taxpayers.

the taxes. Significance of Study

Literature Reviews: It’s considerably important for Afghanistan to find

The issue of justifiable taxes is not new. There are so resources for its expenditure.one way of finding

many legal bases in Afghanistan in this regard: the resources are taxes, but much more important is to get

abandoned constitution of Afghanistan mentions that tax in a rightful way. Since, in some countries if the

any tax cannot be imposed without the canon of law. taxes are injustice so, the government will face with

The measure of tax should be on the basis of social societal problems. Finance and tax system of

justice by law (Islamic Republic of Afghanistan, Afghanistan are not new. Afghanistan codified many

2004: Article 42). Thomas and Nojumi in their laws on these issues but several years wars caused

articles, Bringing More Effective Governance to some people cannot pay taxes because of their low

Afghanistan: Pathways to Stability, In criticizing the income. Because of the above issues, it’s very

systems of tax revenue in Afghanistan, the author important to work in this research and find a solution.

raised the problem regarding tax revenue that will not Methodology

be spent by the municipalities, even though the The method of the research is descriptive and

municipalities collect the taxes themselves. It seems analytical. The method of collecting data is for a

that the author identified the unjustifiability of the tax librarian. The authors review many books, articles,

system in Afghanistan. The authors expressed that the national laws of Afghanistan, and other academic

provincial governors should take responsibility for resources.

meeting local needs with local resources (Barfield

Theoretical basis of social justice and its relation

and Nojumi, 2019:4). The author of the research,

with tax

Nijat, said government revenues have long been

Not at all like equity within the broad sense, may

dependent on taxes on farmers and foreign rent (Nijat,

social justice be a generally later concept, born of the

2014:10). Although taxation and justice are classic

battles encompassing the mechanical insurgency and

debates, they are also relevant to the changing

the approach of communist (and afterward, in a few

environment of society and the economic system. The

parts of the world, social law based and Christian

system should adapt a fair and acceptable tax on the

democratic) sees on the organization of society. It

basis of reality (Durankey, 2019). The website Tax

could be a concept rooted very dubiously within the

Justice.Uk expressed that "tax justice is one of the

Anglo-Saxon political culture. (United Nation:

pathways to social justice. Just as the movement for

2014:2)

women’s rights and labor rights, or the right to health

care and education, are important elements of our Religions, thinkers and philosophers support the

social fabric, so is the movement for tax justice. phenomenon of social justice. Quran Karim says: we

Ultimately, we want to build a just society that serves, create a group of them who recommend for right and

protects, and promotes the participation of the most implement the right with justice (Quran Karim, Araf:

"Ultimately, we want to build a just society that verses of 181).

serves, protects, and promotes the participation of the The other western and socialist thinkers propound

most vulnerable" (www.taxjustice.uk). Taxation is their views about relation of justice with tax which

one of the tools that the government uses to generate are as follows:

revenue, but the important point is the consent of the

people (https://www.lesrencontreseconomiques.fr). The world renowned economist Adam Smith came up

Tax systems can contribute to social justice through with the canons of taxation for the first time in his

issues like raising revenue for public spending on famous book, 'The Wealth of Nations'. He has been

services, redistributing wealth to reduce inequalities acknowledged as the best tax economist of all times.

between high and low-income groups and between Smith propagated in his theorem of Welfare

women and men, and supporting accountable Economics that an agile market, of its own accord,

governance by giving taxpayers an opportunity to see will apportion a country's resources most efficiently.

and comment on how taxes are spent (Abdel Karim, He advocated that imposition of taxes must be done

2018). only to sustain a government in a restricted way and

must satisfy four maxims: equity, transparency,

There are many articles and books regarding the convenience and efficiency. He maintained that

social justice of taxes, which I reviewed. Regarding maximization of wealth was possible if nations

@ IJTSRD | Unique Paper ID – IJTSRD59862 | Volume – 7 | Issue – 5 | Sep-Oct 2023 Page 17

International Journal of Trend in Scientific Research and Development @ www.ijtsrd.com eISSN: 2456-6470

maintained free markets and limited taxes. Taxes economic or distributive justice. That is why they

must support four legitimate functions: (i) national arouse such strong passions, fueled not only by

defense, (ii) justice (iii) universal education; and (iv) conflicts of economic self-interest but also by

good roads and communication. conflicting ideas of justice or fairness. A graph

He states that the above mentioned functions are showing the variation in marginal tax rates, or the

advantageous to the entire society and may be paid by percentage of income paid in taxes by different

a common input by the whole society. The user fees income groups, or the percent of the total tax burden

must assist in helping to cover roadway expenses and carried by different segments of the population, is

that the rich should pay for their children's education. bound to get a rise out of almost anybody. While

He thus anticipated both social externalities and user people don't agree about what is fair, there is a

pay principles (Mahajan, 2021: 262) Adam Smith widespread sense that tax policy poses the issue of

presented Four Principles for the taxes which are as fairness in an immediate way. How much should be

follows: paid by whom, and for what purposes, what should be

exempt from taxation or deductible from the tax base,

1. Canon of Equity: The principle of equity states what kinds of inequalities are legitimate in after-tax

that there must be economic and social justice for income or in the taxes paid by different people-these

people. To achieve this equity, every person must are morally loaded and hotly disputed questions about

contribute to the government according to his our obligations to one another through the fiscal

capacity to give. So, the ability to pay' premise operations of our common government. Yet while it

logically leads to the richer class paying more. On is clear that these questions have to do with justice,

the other hand, the payer enjoys the security and they have generated less sophisticated discussion,

benefits being provided by the Government. from a moral point of view, than other public

2. Canon of Certainty: Any tax that has to be levied questions that (Murphy, 2002:3)

by the Government must be certain, that is, in Other tax measures were proposed by Bentham in his

fixed terms without any ambiguity. The person pamphlet entitled Proposal for a Mode of Taxation

who has to pay must know the terms much prior (1794). His idea was to redress the balance between

to when he has to pay, the manner of paying and landowners, who suffered a considerable burden in

the amount. Any tax that is levied must adhere to the form of land tax, and the commercial classes, who

the principle of certainty. This would ascertain, to paid none at all on income such as interest received

some extent, the total amount by way of tax from loans, government and personal annuities, joint

collection to the Government. Adam Smith stock company dividends, and profits from trade and

specified the words, 'clear and plain', 'to certain' to professional incomes. He also classified income as

make it to a common man to pay taxes correctly. temporary or perpetual. Perpetual income could be

3. Canon of Convenience: The canon of passed on from generation to generation (for instance,

convenience, as the name suggests, aims at the rent). He proposed to tax income received on a

tax-payer's convenience. He must be able to pay graduated basis above a subsistence level.

his taxes in an easy and simple manner. Bentham also set out his preferred order of taxes.

4. Canon of Efficiency: This principle propagates Indirect taxes were preferable to direct ones, because

that a tax must be planned in such a way that it a man could choose not to buy a good on which a tax

does not burden an individual while adding to the had been imposed. This is certainly true of taxes on

public treasury of a State. To achieve this, luxury goods, of which Bentham approved, but not of

administrative costs and economic distortions taxes on necessities, which he considered oppressive,

must be kept to a minimum as they might hinder although he favored direct taxes in the form of his

the industry of people and avoid from giving intestacy tax as best of all, though there was less of a

employment to people. According to Smith, here choice in managing it. He condemned tax imposed on

the main thrust is on efficiency of a tax that would law proceedings as the worst tax of all, as it was a tax

let the annual produce of the land and labour of on the distress of individuals. It should be abolished,

society, the real wealth and revenue of a nation together with taxes on medicines, on insurance

the same as before. Simplicity and economy are against disaster, on contracts, and on the media of

latent in the last principle (same) (political) information, such as on newspapers.

Bentham's contribution to tax theory was substantial.

In a capitalist economy, taxes are not just a method of He enshrined in his philosophy the idea that a tax can

payment for government and public services: They only be imposed by law, moving far away from the

are also the most important instrument by which the social contract theorists, who accepted that tax was

political system puts into practice a conception of

@ IJTSRD | Unique Paper ID – IJTSRD59862 | Volume – 7 | Issue – 5 | Sep-Oct 2023 Page 18

International Journal of Trend in Scientific Research and Development @ www.ijtsrd.com eISSN: 2456-6470

something paid in return for protection from the state National budget document for fiscal year 2015

a voluntary alienation of rights. He did not accept that (National Budget document: 2015: P 7). Ministry of

rights could exist unless granted by law, so he had a finance claimed that the economy condition of

diametrically opposed starting point for his Afghanistan is impacted by the direct national

philosophy. He had almost made his utilitarian tax income. 2014 presidential election and withdrawal of

philosophy out of Adam Smith's fourth canon foreign forces from Afghanistan had its negative

efficiency. If tax is conceived of along the lines of impact on economy of Afghanistan. Therefore, the

least sacrifice/maximum utility, then one does not government increased and imposed a tax on the

need any other criteria However, this concept is mobile credit card. The people raised their voice

predicated on human behavior proceeding alone this against this kind of tax but no one heard them. No

particular philosophical path, and, while Bentham is doubt many countries imposed this kind of tax on

consistent in all aspects of his moral, political and their people. But my argument is, the tax should not

economic philosophy, it is, again, an idealized be equal to all both poor and rich. Those who use

approach(Frecknall,2015:30) more credit cards should pay more, but those who use

So, tax is also a kind of benefit which the government fewer credit cards should pay less. This is not

gets that from the people. It is a responsibility which justifiable that both rich and poor pay the same. Many

every citizenship of a country should pay it to the scholars suggest that tax collectors should receive tax

government. But one important point is that it should on the base of economic condition of the taxpayers.

be reasonable and justifiable. In a country like of 3. Occupation tax

Afghanistan, we have both poor and rich but most of Regarding occupation tax the Afghanistan Income tax

the people are poor. There are some kinds of taxes law notice as follows: Fixed tax on small business (all

which are levied unequal. In the following, we are types) 13 (1) Natural persons, who are engaged in

going to study them and compare them with the laws small business activities and are not subject to

which support justice in paying taxes. withholding tax or exemptions stated in this law, shall

1. Value added taxes pay fixed tax according to the provisions of Article 75

Article 2 “Value Added Tax”: An indirect tax of this law. (2) Natural persons mentioned in

imposed on a supply of taxable goods, services and paragraph (1) of this Article shall be required to file a

imports; Article 4 (1) Value Added a taxpayer shall tax return according to the provisions of this law

levy Tax on a taxable supply and on a taxable import. (Afghanistan Income Tax Law: Article 74).

(2) The rate of Value Added Tax is 10% applied to Determining fixed tax on small business activities

the value of the taxable supply and taxable import. (All Types)14 (1) Where natural persons mentioned

The above articles 2 and 4 related to the VALUE in paragraph (1) of Article 74 of this law have income

ADDED TAX LAW, which is issued in the year 2016 (sales) of up to Afs. 150,000 from sources subject to

and amended in the year 2017. On the base of above tax within a tax year they shall be exempt from tax.

law, they coerce the merchants to pay the tax from (2) Where persons mentioned in paragraph (1) of this

most of the grocery like flour, oil, sugar etc. These Article have income (sales) of more than Afs.

groceries consume by all the people. In fact, the 150,000 up to Afs. 10,000,000 for a tax year, they

merchant does not pay the taxes. He/she added the shall be required to pay 1.5 % fixed tax from their

value on the value of goods. There are no difference total annual sales after excluding exempt income set

among rich and people. We claim that this tax is not forth in paragraph (1) of this Article. (3) Where

reasonable. Social justice does not observe in this natural persons mentioned in paragraph (1) of this

kind of tax. Asian Development Bank data in the year Article have income (sales) of more than Afs.

2020, in Afghanistan 49.4% of the population lived 10,000,000 for a tax year they shall be required to pay

below of the national poverty line. 1.5% fixed tax from their total annual sales after

(https://www.adb.org/) Therefore, most of the people excluding exempt income set forth in paragraph (1) of

are poor. It is difficult for them to pay taxes for this Article (Afghanistan Income Tax Law: Article

consuming food ingredients. In Addition most of the 75). But guidance No 25 Stabilizing the fixed tax of

people are jobless, which has a negative impact on guilds for the fiscal year 1401 decrease the tax from

their social life. 1.5 % to 0.5 %.

2. Tax on credit cards It imposed the above taxes on shopkeepers, toiletry,

On 23rd September 2015 government of Afghanistan barbers, butchery, bakery, doctors, technicians and

declared a statute that each individual of Afghanistan some other individuals who work and gain income.

who uses mobile should pay 10% of Tax. This was a The new guidance and regulations gave some

change in tax revenue rates which is added in discounts to the taxpayers. But the problem is about

@ IJTSRD | Unique Paper ID – IJTSRD59862 | Volume – 7 | Issue – 5 | Sep-Oct 2023 Page 19

International Journal of Trend in Scientific Research and Development @ www.ijtsrd.com eISSN: 2456-6470

fixing and calculating taxes. There is a very at the boundary between two categories (The same

complicated procedure for receiving taxes. According source, 2018:66).

to the current policy, the measurement and

Conclusion

stabilization of the taxes should be done as self-

Tax and social justice related closely with each other.

assessment. Based on this method, the taxpayer must

In Afghanistan any law, regulation, procedures and

calculate and pay the tax payable according to the

guidance can’t implement efficiently without social

rules of the tax laws.. However, because of the lack of

justice. In fact most of the laws and regulation

professional capacity, a real person who is engaged in

designed in the arena of social justice principles. But

small economic activities cannot measure the tax and

in some cases the procedures can’t support the poor

cannot list the real tax, therefore the relevant tax

people. Particularly, in the area of indirect tax on

administration is obliged (Guidance No-25, 2022).

credit cards, value added taxes and taxes on guilds.

The civil servants go to the Natural person’s shops, However, it’s very important that the people also

who are engaged in small business activities. They support the government by paying their taxes. People

specify the time, for example, for an hour and and government are two side of one coin. They

calculate the income of the person and by that should support each other. Afghanistan’s economy

calculate the day, then the month and then the year. need to be supported and should be stands by its own

After exemptions, deductions and expenses, civil legs. Therefore, the government should bring some

servants imposed the tax on the taxpayers. I believe amendments in the laws and regulations on the base

we cannot observe justice with this method of of the values and socio-economic status of its people.

collecting tax from the individuals. One problem is

Recommendations

the method of collecting tax. The second problem;

1. The bureaucratic process of taxation is very

during collecting tax, civil servants do not observe the

complicated. So, the tax system in Afghanistan

principle of making taxes personal.

should be modernized.

The above principle means that in order to calculate

2. Social Justice is the cornerstone of the tax system

and collect taxes from each person, we should take

in Afghanistan, so the government should design

his special situation in terms of expenses into

the tax fair and justifiable.

consideration and only his income should not be the

criterion for tax determination. Equal income holders 3. The scholars do research and work more in tax in

do not have to pay equal taxes; because they may Afghanistan.

have different expenses (9:47), in this principle, the 4. The lawyers review the tax’s laws and regulation

type of income and expenses and the characteristics and point out the weakness and strengthen of

of each taxpayer should also be considered. For them. The government held conferences and

example, in most tax systems, they differentiate encouraged the lawyers and economists to do

between income from capital and income from work, field research in order to solve the challenges of

and tax income from capital more than income from the tax system.

work (Rahmani, 2018:47)

5. The government encourages Specialized person to

4. Increase in total tax work in the tax administration honestly in order to

Tax progress is said to be total when all taxable help economic development.

objects are subject to a single percentage and this

percentage rises with the rise of the taxable object. References

For example, if the income of 0 to 1 million Afghanis [1] Abdul Karim, N. (2018). Tax Justice and

is subject to 10% tax and the income of 1 to 2 million sustainable Development in the Arab Region,

is subject to 15% tax, and generally the income of 2 FORDFOUNDATION. Online:

to 3 million is subject to 20% tax. It has a major flaw https://www.fordfoundation.org/

and that is that there will be a major injustice in the [2] Bariefelt and Nojumi, N. (2019). Bringing

amount of tax payable at the border between the two More Effective Governance to Afghanistan: 10

limits. For example, based on the above-mentioned Pathways to Stability, Volume XVII Number

composition, we consider two people, one of whom 4.Middle policy council.

earns 19,500,000 and the other earns 2,000,000

Afghanis. The first one will pay 292,500 Afghanis [3] Durankey,B.(2019). Taxation and social justice,

and the second one will pay 41,000 Afghanis. It can University of National and World Economy.

be seen that the difference of 100,000 Afghanis Online.

causes an increase of 17,000 Afghanis in the tax. This [4] Frecknall, Hughes,J.(2015). The Theory,

major difference shows a type of tax gross injustice is Principle and Management of Taxation an

@ IJTSRD | Unique Paper ID – IJTSRD59862 | Volume – 7 | Issue – 5 | Sep-Oct 2023 Page 20

International Journal of Trend in Scientific Research and Development @ www.ijtsrd.com eISSN: 2456-6470

Introduction, London and New York: [8] Nijat, A .( 2014). Governance in Afghanistan

Routledge Taylor and Francis Groups. an introduction, Kabul, Afghanistan Research

Retrieved in 29th July 2023 from: and Evaluation Unite.

https://www.google.com.af/books/edition/The_ [9] Rahmani, A. (2018). Financial Law, Kabul:

Theory_Principles_and_Management_of/- Sayeed.

0vBAAAQBAJ?hl=en&gbpv=1&dq=social%2

0of%20justice%20four%20principle%20adam Further Reading

%20smith%20about%20tax&pg=PA35&prints [1] DEPARTMENT OF ECONOMIC AND

ec=frontcover. SOCIAL AFFAIRS.(2006). Social Justice in an

Open World The Role of the United Nations,

[5] ˜Genckaya, O and others (2018). Sustainable

New York :United Nation. Retrieved from

Governance indicators, Turkey: Bertelsmann .

www.un.org/esa/

[6] Mahajan & others.(2021). FINANCIAL [2] Islamic Republic of Afghanistan.(2004).

ADMINISTRATION IN INDIA, Second

Constitution, Kabul : Ministry of Justice.

Edition, India: PHI Learning Pvt. Ltd.

Retrieved in 29th July 2023 from: [3] Ministry of Finance, Guideline No. (25)

https://www.google.com.af/books/edition/FINA Stabilizing the fixed tax of guilds for the fiscal

NCIAL_ADMINISTRATION_IN_INDIA_Sec year 2022.

ond/tpgbEAAAQBAJ?hl=en&gbpv=1&pg=PP [4] Value Added Tax Law as published in Official

1&printsec=frontcover Gazette number 1209 dated 13 April 2016

[7] Murphy, L & Nagel T.(2002). The myth of incorporating consolidated amendments

Ownership Taxes and Justice, New york: published in the Official Gazette number 1244

OXFORD University Press. Retrieved in 29th dated 29 January 2017

July 2023 from: [5] https://www.adb.org/

https://www.google.com.af/books/edition/The_

Myth_of_Ownership/zHw8DwAAQBAJ?hl=en [6] https://www.taxjustice.Uk

&gbpv=1&pg=PP1&printsec=frontcover [7] https://www.investopedia.com/terms/s/social-

justice.asp

[8] https://www.lesrencontreseconomiques.

@ IJTSRD | Unique Paper ID – IJTSRD59862 | Volume – 7 | Issue – 5 | Sep-Oct 2023 Page 21

You might also like

- Tax Avoidance and Tax EvasionDocument14 pagesTax Avoidance and Tax EvasionKRISHNA GATTANI100% (1)

- Remedies of The TaxpayerDocument4 pagesRemedies of The TaxpayerAngelyn Sanjorjo50% (2)

- Donors Tax Quiz Answers and SolutionsDocument14 pagesDonors Tax Quiz Answers and SolutionsRalph Lawrence Francisco BatangasNo ratings yet

- Torque Reducer Sub PDFDocument101 pagesTorque Reducer Sub PDFMohammed Ali YoussefNo ratings yet

- TAX 1 Atty. Dela RosaDocument9 pagesTAX 1 Atty. Dela RosaweewoouwuNo ratings yet

- ABAKADA Guro Partylist v. ErmitaDocument7 pagesABAKADA Guro Partylist v. ErmitaCedrickNo ratings yet

- Transfer Taxes: Atty. Kim M. Aranas Faculty, USC-SOLGDocument61 pagesTransfer Taxes: Atty. Kim M. Aranas Faculty, USC-SOLGethel hyugaNo ratings yet

- Samar Electric Cooperative vs. CIRDocument3 pagesSamar Electric Cooperative vs. CIRAnneNo ratings yet

- Cir Vs Central LuzonDocument1 pageCir Vs Central LuzonJf ManejaNo ratings yet

- Burgersmosquerafairness - A Dire International Tax Standard Intertax, Issue 12, 2017Document17 pagesBurgersmosquerafairness - A Dire International Tax Standard Intertax, Issue 12, 2017Rebecca Van der HoevenNo ratings yet

- Determinant Factors of Exist Gaps Between The Tax Payers and Tax Authority in Ethiopia, Amhara Region The Case of North Gondar ZoneDocument6 pagesDeterminant Factors of Exist Gaps Between The Tax Payers and Tax Authority in Ethiopia, Amhara Region The Case of North Gondar ZonearcherselevatorsNo ratings yet

- The Relationship Between The Implementation of The Voluntary Disclosure Program With The Principle of Justice in TaxationDocument12 pagesThe Relationship Between The Implementation of The Voluntary Disclosure Program With The Principle of Justice in TaxationAJHSSR JournalNo ratings yet

- Literature Review of Taxation in PakistanDocument7 pagesLiterature Review of Taxation in Pakistannydohavihup2100% (1)

- Wealthy Tax Non-Filers in A Developing CountryDocument27 pagesWealthy Tax Non-Filers in A Developing CountryBella SawanNo ratings yet

- Good Governance and Personal Income Tax Compliance in Nigeria A. E. Okoye P. A. Isenmila,, A. I. OseniDocument15 pagesGood Governance and Personal Income Tax Compliance in Nigeria A. E. Okoye P. A. Isenmila,, A. I. OseniRaima CABARONo ratings yet

- Effect of Tax Avoidance and Tax EvasionDocument13 pagesEffect of Tax Avoidance and Tax EvasionChe DivineNo ratings yet

- Chapter One: 1.1. Background of The StudyDocument28 pagesChapter One: 1.1. Background of The StudyEmebet TesemaNo ratings yet

- Research Paper On Tax Evasion in IndiaDocument7 pagesResearch Paper On Tax Evasion in Indiahjuzvzwgf100% (1)

- A Good Tax SystemDocument3 pagesA Good Tax SystemMartha ShinganoNo ratings yet

- Tax Literacy and Its Impact On The Individual Taxpayers With Reference To Indian Tax PayersDocument9 pagesTax Literacy and Its Impact On The Individual Taxpayers With Reference To Indian Tax Payersakshay kharteNo ratings yet

- Proposal On COVID 19 - Edited - Doc XDocument3 pagesProposal On COVID 19 - Edited - Doc XMulugeta AkaluNo ratings yet

- Tax Competition Literature ReviewDocument6 pagesTax Competition Literature Reviewmgojgerif100% (2)

- Case Studies in EconomicsDocument6 pagesCase Studies in EconomicsAndrea PepitoNo ratings yet

- What Is Tax?Document3 pagesWhat Is Tax?Aque LangtoeNo ratings yet

- Commented Feb 11 2019Document19 pagesCommented Feb 11 2019Adem MelakuNo ratings yet

- Wealth Tax in Bosnia and Herzegovina: A Contribution Towards Equality and DemocratizationDocument32 pagesWealth Tax in Bosnia and Herzegovina: A Contribution Towards Equality and DemocratizationSwastik GroverNo ratings yet

- The Benefits' Program of Electronic Invoice As A Tool To Tackle Tax EvasionDocument10 pagesThe Benefits' Program of Electronic Invoice As A Tool To Tackle Tax EvasionIJAERS JOURNALNo ratings yet

- Fiscal Justice Global Track Record: Oxfam's Tax, Budget and Social Accountability WorkDocument42 pagesFiscal Justice Global Track Record: Oxfam's Tax, Budget and Social Accountability WorkOxfamNo ratings yet

- Fiscal Justice Global Track Record: Oxfam's Tax, Budget and Social Accountability WorkDocument42 pagesFiscal Justice Global Track Record: Oxfam's Tax, Budget and Social Accountability WorkOxfamNo ratings yet

- Fiscal Justice Global Track Record: Oxfam's Tax, Budget and Social Accountability WorkDocument42 pagesFiscal Justice Global Track Record: Oxfam's Tax, Budget and Social Accountability WorkOxfamNo ratings yet

- Fiscal Justice Global Track Record: Oxfam's Tax, Budget and Social Accountability WorkDocument42 pagesFiscal Justice Global Track Record: Oxfam's Tax, Budget and Social Accountability WorkOxfamNo ratings yet

- Fiscal Justice Global Track Record: Oxfam's Tax, Budget and Social Accountability WorkDocument42 pagesFiscal Justice Global Track Record: Oxfam's Tax, Budget and Social Accountability WorkOxfamNo ratings yet

- Fiscal Justice Global Track Record: Oxfam's Tax, Budget and Social Accountability WorkDocument42 pagesFiscal Justice Global Track Record: Oxfam's Tax, Budget and Social Accountability WorkOxfamNo ratings yet

- Fiscal Justice Global Track Record: Oxfam's Tax, Budget and Social Accountability WorkDocument42 pagesFiscal Justice Global Track Record: Oxfam's Tax, Budget and Social Accountability WorkOxfamNo ratings yet

- Fiscal Justice Global Track Record: Oxfam's Tax, Budget and Social Accountability WorkDocument42 pagesFiscal Justice Global Track Record: Oxfam's Tax, Budget and Social Accountability WorkOxfamNo ratings yet

- Fiscal Justice Global Track Record: Oxfam's Tax, Budget and Social Accountability WorkDocument42 pagesFiscal Justice Global Track Record: Oxfam's Tax, Budget and Social Accountability WorkOxfamNo ratings yet

- Fiscal Justice Global Track Record: Oxfam's Tax, Budget and Social Accountability WorkDocument42 pagesFiscal Justice Global Track Record: Oxfam's Tax, Budget and Social Accountability WorkOxfamNo ratings yet

- Fiscal Justice Global Track Record: Oxfam's Tax, Budget and Social Accountability WorkDocument42 pagesFiscal Justice Global Track Record: Oxfam's Tax, Budget and Social Accountability WorkOxfamNo ratings yet

- Fiscal Justice Global Track Record: Oxfam's Tax, Budget and Social Accountability WorkDocument42 pagesFiscal Justice Global Track Record: Oxfam's Tax, Budget and Social Accountability WorkOxfamNo ratings yet

- 1.3 1 Perception of Tax Evasion Among Tax Payers of Robe Town Administration EthiopiaDocument13 pages1.3 1 Perception of Tax Evasion Among Tax Payers of Robe Town Administration EthiopiaAlem Abebe AryoNo ratings yet

- Tax Perception and Compliance Behavior in Nekemte TownDocument9 pagesTax Perception and Compliance Behavior in Nekemte TownarcherselevatorsNo ratings yet

- The Design of Tax Systems and CorruptionDocument17 pagesThe Design of Tax Systems and CorruptionHamse A KhaireNo ratings yet

- Drivers of Tax Payer's Motivation and Tax Compliance Level: The Nigeria ExperienceDocument8 pagesDrivers of Tax Payer's Motivation and Tax Compliance Level: The Nigeria ExperienceInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Mohammad Ali Jinnah University: AssignmentDocument4 pagesMohammad Ali Jinnah University: AssignmentMuhammad TuhaNo ratings yet

- Microeconomics Group Assignment (Report Writing)Document9 pagesMicroeconomics Group Assignment (Report Writing)Abdirizak AhmedNo ratings yet

- Tax Education Balance Between Direct and Indirect Taxation. Establishment of The OECD and Examination of Its Application To The Tax Rates of GreeceDocument5 pagesTax Education Balance Between Direct and Indirect Taxation. Establishment of The OECD and Examination of Its Application To The Tax Rates of GreeceKOPSIDAS ODYSSEASNo ratings yet

- Literature Review On Tax ComplianceDocument10 pagesLiterature Review On Tax Complianceafdttjcns100% (1)

- DeterminantsDocument13 pagesDeterminantsAubrrryNo ratings yet

- A Short Discourse On The Present Philippine Tax System and Administration From A Law Student's PerspectiveDocument16 pagesA Short Discourse On The Present Philippine Tax System and Administration From A Law Student's Perspectivemaica_prudenteNo ratings yet

- Tax AvoidanceDocument38 pagesTax AvoidancerampayareNo ratings yet

- Reflections On The Realities and Challenges of Income Tax Administration in NigeriaDocument10 pagesReflections On The Realities and Challenges of Income Tax Administration in NigeriaAdedapo AdeluyiNo ratings yet

- 5310 16909 1 PBDocument13 pages5310 16909 1 PBgunaNo ratings yet

- 1 PBDocument11 pages1 PBMarina KhouryNo ratings yet

- Ijebv20!3!83.Sabahindianjournal s2Document14 pagesIjebv20!3!83.Sabahindianjournal s2abelfkrNo ratings yet

- Principles and Importance of Taxation To The Nigerians EconomyDocument11 pagesPrinciples and Importance of Taxation To The Nigerians Economyfatima aliNo ratings yet

- Journal On Compliance With Taxation in East Gojjam-Ethiopia PDFDocument10 pagesJournal On Compliance With Taxation in East Gojjam-Ethiopia PDFFasika AbedomNo ratings yet

- Canons of TaxationDocument6 pagesCanons of TaxationAbdur RahmanNo ratings yet

- ParagWaknis Blackeconomy Ideas4india PDFDocument3 pagesParagWaknis Blackeconomy Ideas4india PDFParag WaknisNo ratings yet

- DocumentDocument5 pagesDocumentSamira PatrickNo ratings yet

- Thesis On Taxation in EthiopiaDocument6 pagesThesis On Taxation in Ethiopialaurajohnsonphoenix100% (2)

- Indonesian Taxation: for Academics and Foreign Business Practitioners Doing Business in IndonesiaFrom EverandIndonesian Taxation: for Academics and Foreign Business Practitioners Doing Business in IndonesiaNo ratings yet

- Literature Review On Personal Income Tax in NigeriaDocument7 pagesLiterature Review On Personal Income Tax in NigeriabeemwvrfgNo ratings yet

- Factors Influencing Taxpayers To Engage in Tax EvaDocument17 pagesFactors Influencing Taxpayers To Engage in Tax EvaabelfkrNo ratings yet

- RESEARCHDocument5 pagesRESEARCHmanuelitofuentescruzNo ratings yet

- Tech TP FTDocument24 pagesTech TP FTTeresa TanNo ratings yet

- Role of Taxation in Equal Distribution of The Economic Resources in A CountryDocument9 pagesRole of Taxation in Equal Distribution of The Economic Resources in A CountrySarada Biswas100% (1)

- Jurnal PajakDocument12 pagesJurnal PajakkrisnasavitriNo ratings yet

- Tax Assignment Final PDFDocument20 pagesTax Assignment Final PDFABNo ratings yet

- Activating Geospatial Information For Sudans Sustainable Investment MapDocument13 pagesActivating Geospatial Information For Sudans Sustainable Investment MapEditor IJTSRDNo ratings yet

- Challenges Faced by The Media in An Attempt To Play Their Roles in Public Awareness On Waste Management in Buea and DoualaDocument18 pagesChallenges Faced by The Media in An Attempt To Play Their Roles in Public Awareness On Waste Management in Buea and DoualaEditor IJTSRDNo ratings yet

- Sustainable EnergyDocument8 pagesSustainable EnergyEditor IJTSRDNo ratings yet

- Design Simulation and Hardware Construction of An Arduino Microcontroller Based DC DC High Side Buck Converter For Standalone PV SystemDocument6 pagesDesign Simulation and Hardware Construction of An Arduino Microcontroller Based DC DC High Side Buck Converter For Standalone PV SystemEditor IJTSRDNo ratings yet

- International Journal of Trend in Scientific Research and Development (IJTSRD)Document13 pagesInternational Journal of Trend in Scientific Research and Development (IJTSRD)Editor IJTSRDNo ratings yet

- A Pharmaceutical Review On Kaanji and Its Wide Range of ApplicabilityDocument6 pagesA Pharmaceutical Review On Kaanji and Its Wide Range of ApplicabilityEditor IJTSRDNo ratings yet

- Deconstructing The Hijra Narrative Reimagining Trans Identities Through Literary PerspectivesDocument6 pagesDeconstructing The Hijra Narrative Reimagining Trans Identities Through Literary PerspectivesEditor IJTSRDNo ratings yet

- Educational Unity Embracing Diversity For A Stronger SocietyDocument6 pagesEducational Unity Embracing Diversity For A Stronger SocietyEditor IJTSRDNo ratings yet

- Collective Bargaining and Employee Prosocial Behaviour in The Hospitality Sector in Port HarcourtDocument10 pagesCollective Bargaining and Employee Prosocial Behaviour in The Hospitality Sector in Port HarcourtEditor IJTSRDNo ratings yet

- Differential Equations Third Order Inhomogeneous Linear With Boundary ConditionsDocument6 pagesDifferential Equations Third Order Inhomogeneous Linear With Boundary ConditionsEditor IJTSRDNo ratings yet

- Consumers' Impulsive Buying Behavior in Social Commerce PlatformsDocument5 pagesConsumers' Impulsive Buying Behavior in Social Commerce PlatformsEditor IJTSRDNo ratings yet

- An Analysis On The Use of Image Design With Generative AI TechnologiesDocument4 pagesAn Analysis On The Use of Image Design With Generative AI TechnologiesEditor IJTSRDNo ratings yet

- Women Before and After Islam With Special Reference To ArabDocument3 pagesWomen Before and After Islam With Special Reference To ArabEditor IJTSRDNo ratings yet

- Artificial Intelligence A Boon in Expanding Online Education Through Social Media and Digital Marketing Post Covid 19Document9 pagesArtificial Intelligence A Boon in Expanding Online Education Through Social Media and Digital Marketing Post Covid 19Editor IJTSRDNo ratings yet

- Effectiveness of Video Teaching Program On Knowledge Regarding 5Fs of Disease Transmission Food, Finger, Fluid, Fomite, Faces Among Children at Selected Setting, ChennaiDocument3 pagesEffectiveness of Video Teaching Program On Knowledge Regarding 5Fs of Disease Transmission Food, Finger, Fluid, Fomite, Faces Among Children at Selected Setting, ChennaiEditor IJTSRDNo ratings yet

- An Investigation of The Temperature Effect On Solar Panel Efficiency Based On IoT TechnologyDocument7 pagesAn Investigation of The Temperature Effect On Solar Panel Efficiency Based On IoT TechnologyEditor IJTSRDNo ratings yet

- Sustainable Development A PrimerDocument9 pagesSustainable Development A PrimerEditor IJTSRDNo ratings yet

- To Assess The Knowledge and Attitude of Non Professionals Regarding COVID 19 Vaccination A Descriptive StudyDocument4 pagesTo Assess The Knowledge and Attitude of Non Professionals Regarding COVID 19 Vaccination A Descriptive StudyEditor IJTSRDNo ratings yet

- Challenges in Pineapple Cultivation A Case Study of Pineapple Orchards in TripuraDocument4 pagesChallenges in Pineapple Cultivation A Case Study of Pineapple Orchards in TripuraEditor IJTSRDNo ratings yet

- Role of Dashamooladi Niruha Basti Followed by Katibasti in The Management of "Katigraha" W.R.S To Lumbar Spondylosis A Case StudyDocument3 pagesRole of Dashamooladi Niruha Basti Followed by Katibasti in The Management of "Katigraha" W.R.S To Lumbar Spondylosis A Case StudyEditor IJTSRDNo ratings yet

- Evan Syndrome A Case ReportDocument3 pagesEvan Syndrome A Case ReportEditor IJTSRDNo ratings yet

- Knowledge Related To Diabetes Mellitus and Self Care Practice Related To Diabetic Foot Care Among Diabetic PatientsDocument4 pagesKnowledge Related To Diabetes Mellitus and Self Care Practice Related To Diabetic Foot Care Among Diabetic PatientsEditor IJTSRDNo ratings yet

- A Study To Assess The Effectiveness of Art Therapy To Reduce Depression Among Old Age Clients Admitted in Saveetha Medical College and Hospital, Thandalam, ChennaiDocument5 pagesA Study To Assess The Effectiveness of Art Therapy To Reduce Depression Among Old Age Clients Admitted in Saveetha Medical College and Hospital, Thandalam, ChennaiEditor IJTSRDNo ratings yet

- Financial Risk, Capital Adequacy and Liquidity Performance of Deposit Money Banks in NigeriaDocument12 pagesFinancial Risk, Capital Adequacy and Liquidity Performance of Deposit Money Banks in NigeriaEditor IJTSRDNo ratings yet

- Importance of Controlled CreditDocument3 pagesImportance of Controlled CreditEditor IJTSRDNo ratings yet

- H1 L1 Boundedness of Rough Toroidal Pseudo Differential OperatorDocument8 pagesH1 L1 Boundedness of Rough Toroidal Pseudo Differential OperatorEditor IJTSRDNo ratings yet

- A Study On Human Resource AccountingDocument3 pagesA Study On Human Resource AccountingEditor IJTSRDNo ratings yet

- Concept of Shotha W.S.R To Arishta LakshanaDocument3 pagesConcept of Shotha W.S.R To Arishta LakshanaEditor IJTSRDNo ratings yet

- An Approach To The Diagnostic Study On Annavaha Srotodusti in Urdwaga Amlapitta WSR To Oesophagogastroduodenoscopic ChangesDocument4 pagesAn Approach To The Diagnostic Study On Annavaha Srotodusti in Urdwaga Amlapitta WSR To Oesophagogastroduodenoscopic ChangesEditor IJTSRDNo ratings yet

- A Study To Assess The Knowledge Regarding Iron Deficiency Anemia Among Reproductive Age Women in Selected Community ThrissurDocument4 pagesA Study To Assess The Knowledge Regarding Iron Deficiency Anemia Among Reproductive Age Women in Selected Community ThrissurEditor IJTSRDNo ratings yet

- Tutorial 7Document3 pagesTutorial 7Muntasir AhmmedNo ratings yet

- 04 CIR v. S.C. Johnson and Son, Inc.Document10 pages04 CIR v. S.C. Johnson and Son, Inc.ada mae santoniaNo ratings yet

- Ca. Keval Mota: Customs Act, 1962 (5/5)Document1 pageCa. Keval Mota: Customs Act, 1962 (5/5)Ceritifiedd killerNo ratings yet

- EOR Tax RegimeDocument6 pagesEOR Tax RegimeRaycharlesNo ratings yet

- CASE No. 20 BPI Leasing Corporation vs. CA, November 18, 2003Document2 pagesCASE No. 20 BPI Leasing Corporation vs. CA, November 18, 2003Al Jay MejosNo ratings yet

- Goods and Services Tax (GST) Is A Successor To VAT Used in India On The Supply of Goods andDocument3 pagesGoods and Services Tax (GST) Is A Successor To VAT Used in India On The Supply of Goods andTPA LVBD PARAMAKUDINo ratings yet

- Thesis Title Page Margins EditedDocument1 pageThesis Title Page Margins EditedImman DCPNo ratings yet

- Presentación País PARAGUAY (Inglés) Enero-2023Document36 pagesPresentación País PARAGUAY (Inglés) Enero-2023vivianaliNo ratings yet

- ESSO Standard Eastern Inc vs. Acting Commissioner of CustomDocument1 pageESSO Standard Eastern Inc vs. Acting Commissioner of CustomAldin Lucena AparecioNo ratings yet

- Order 3520227869817Document3 pagesOrder 3520227869817Malik Imran Khaliq AwanNo ratings yet

- 3.3 Exercise Key AnswerDocument2 pages3.3 Exercise Key AnswerKHAkadsbdhsgNo ratings yet

- Chapter 24 Sales Exempted EntryDocument5 pagesChapter 24 Sales Exempted EntryTEJA SINGHNo ratings yet

- Government of Rajasthan Finance Department (Tax Division) : Joint Secretary:o The GovernmentDocument1 pageGovernment of Rajasthan Finance Department (Tax Division) : Joint Secretary:o The GovernmentAmitNo ratings yet

- Real-Estate 101 - The Cost of Transferring A Land Title in The Philippines - PHILREP Realty CorpDocument8 pagesReal-Estate 101 - The Cost of Transferring A Land Title in The Philippines - PHILREP Realty CorpcarmanvernonNo ratings yet

- Kuch Toofani Karte Hai FC ContestDocument16 pagesKuch Toofani Karte Hai FC ContestShamik DattaNo ratings yet

- William Levinson and William Levinson, Assignee of F.M.P. Corporation, Formerly Known As Fairmount Motor Products Co., Inc. v. United States, 496 F.2d 651, 3rd Cir. (1974)Document9 pagesWilliam Levinson and William Levinson, Assignee of F.M.P. Corporation, Formerly Known As Fairmount Motor Products Co., Inc. v. United States, 496 F.2d 651, 3rd Cir. (1974)Scribd Government DocsNo ratings yet

- Informe en Ingles - Planeamiento TributarioDocument11 pagesInforme en Ingles - Planeamiento TributarioHELEN YAZURI DUCLOS LONGOBARDINo ratings yet

- Introduction Unit of Income TaxDocument5 pagesIntroduction Unit of Income TaxRishabNo ratings yet

- Solved Indicate Which Courts Decided The Cases Cited Below Also IndicateDocument1 pageSolved Indicate Which Courts Decided The Cases Cited Below Also IndicateAnbu jaromiaNo ratings yet

- Employee and Employer Taxes ExplanationDocument1 pageEmployee and Employer Taxes ExplanationKim KimNo ratings yet

- Tax 1 (I) - Guiding Principles For POEMDocument11 pagesTax 1 (I) - Guiding Principles For POEMRACHITNo ratings yet

- Manila International Airport Authority vs. Court of Appeals, 495 SCRA 591, July 20, 2006Document127 pagesManila International Airport Authority vs. Court of Appeals, 495 SCRA 591, July 20, 2006Jane BandojaNo ratings yet