Professional Documents

Culture Documents

Volume Price Action Analysis

Uploaded by

KapilSahu100%(1)100% found this document useful (1 vote)

129 views238 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

100%(1)100% found this document useful (1 vote)

129 views238 pagesVolume Price Action Analysis

Uploaded by

KapilSahuCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 238

114/28, 4'52 PM Volume Price Acton Analysis in Trading - Price Analysis

Volume Price Action Analysis

Back to: Trading with Smart Money

Volume Price Action Analysis in Trading

In this article, | am going to discuss Volume Price Action Analysis in Trading. Please read our previous article

where we discussed 3 Rules for Volume Analysis in Trading. At the end of this article, you will understand the

following.

1. Understani

19 Market Structure through Volume Swing Analy:

2, Strength and weakness of swing through volume price action analysis

3, How to analyze volume in trading

Understanding Market Structure through volume analysis

In the frst part, we have studied 3 laws of volume analysis. These are

1, THE LAW OF SUPPLY AND DEMAND

2, THE LAW OF CAUSE AND EFFECT

3, THE LAW OF EFFORT VS RESULT

Based on these laws we know the analysis of the big picture is market structure analysis using volume. Because

the final decision-making depends open the market structure:

Market Structure

It is similar to learning to read a new alphabet-once you understand the characters, you can read the words, and

once you know the words you can read the story. So market structure consists of short-term swing

* The market moves in an up downswing, what we call a market swing. In a healthy bull trend, the upswing

generally exceeds the downswing in length, the reverse is true for the bear market

* Hence by observing market swing, we are able to glimpse into the structure of the market and get clues on

whether the market will move up or down

hitpsdotnetutorals. nevlessonWvalume-price-acton-analysis! wr

114/28, 4'52 PM Volume Price Acton Analysis in Trading - Price Analysis

* So basically price move in an uptrend or downtrend

1. In a healthy bull, the trend Price Makes Higher High (HH) and Higher Low (HL)

2. In a healthy bear, the trend Price Makes Lower High (LH) and Lower Low (LL)

hitpsdotnetutorals. nevlessonWvalume-price-acton-analysis!

air

iw

| | HL

i! hi Hl Uptiend— Price making

i

nt

a DOWNTREND

Price make Lower High (LH) and

Lower Low(LL)

ha “

uw 4 Masry

Ms +

"y

- +

Let's understand the rally (opposite of decline)

114/28, 4'52 PM Volume Price Acton Analysis in Trading - Price Analysis

What happens during the rally?

During the rally, what has been going on? Two things

1. First the buying of stock by those who are covering their previous short sales(after knowing that they are in

the wrong direction) and

2. Second, actual new buying by those who expect the advance to continue

What happens after the rally?

1. Ifthe rally is due to more short covers than long buyers then, itis likely to be declined in future

2. If the rally is due to actual new buying, the trend is likely to continue

How can I tell which type of rally is? (Short covering or long buying)

Watch the volume and momentum of price changes

© IF PRICE is rising with momentum and VOLUME is rising, it means the market is STRONGLY BULLISH. The

move Is by long buyers. HARMONEY

* IF PRICE is rising but VOLUME is falling and momentum also falling, it means the market is WEAKLY

BULLISH. The move is by short covering. DIVERGENCE.

Why PRICE is rising and VOLUME rising in the rally?

For price to overcome selling pressure created by

1. Profittaking selling order

2, New selling order at the market top

What indicates HARMONEY & DIVERGENCE?

It should be noted that the price movement will be in direct proportion to the amount of effort expended.

* If the effort is in harmony with the result it is a sign of the strength of the movement and suggests its

continuation. If the effort is in divergence with the result it is a sign of weakness of the movement and

suggests a reversal

* The result tends to be in direct proportion to harmony or divergence. If divergence is suggested, a smaller

divergence tends to generate a smaller result, and a larger divergence, a larger result. On the other hand, If

hitpsdotnetutorals. nevlessonWvalume-price-acton-analysis! anr

114/28, 4'52 PM Volume Price Acton Analysis in Trading - Price Analysis

harmony is suggested, a greater effort will cause a movement of long duration; while a slight effort will be

reflected in a movement of shorter duration,

General Rules for Interpreting Volume to determine the health of a trend

1. If PRICE is rising and VOLUME is risi

1g, it means the market is STRONGLY BULLISH.

Volume helps us to determine the health of a trend. An uptrend is strong and healthy if volume increases as the

price move with the trend and decreases when the price goes counter-trend (correction periods or ‘pullbacks’)

2. If PRICE is rising but VOLUME is falling, it means the market is WEAKLY BULLISH. Uptrend weakening

‘When prices are rising and volume is decreasing, it tells that a trend is unlikely to continue. Price may still attempt

to rise at a lesser pace, and once sellers take control (which is usually signified by an increase in volume on a down

bar or candle), prices will fall

1. If PRICE is falling, VOLUME is rising, the market is STRONGLY BEARISH.

2. If PRICE is falling and VOLUME is falling, the market is WEAKLY BEARISH. Downtrend weakening

Price-Volume Relationships

Price-Volume Relat inship Implication for the Trend

Price is rising and Strong Uptrend

Volume is rising

Price is rising and Uptrend Weakening

Volume is declining

Price is declining and Strong Downtrend

Volume is rising

Price is declining and Downtrend Weakening

Volume is declining

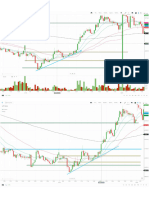

Understanding Market Structure through Volume Swing Analysis

‘The movements of the price do not develop in periods of time of equal duration, but they do it in the swing of

different sizes, for this reason, we have to study the relationship between the upward and downward swings

hitpsdotnetutorals. nevlessonWvalume-price-acton-analysis!

sir

114/28, 4'52 PM Volume Price Acton Analysis in Trading - Price Analysis

‘The swing of the market furnishes a clear insight into changes in supply and demand. By learning to judge all sizes

(both up and downswings) of market swings, you will gradually learn to spot the time when a rally, and the time

when a reaction has stopped and is about to reverse. These are the turing points.

Here we have to find out

1. Strength and weakness of swing through volume analysis or find out harmony and divergence

2. volume analysis at the key level for decision making

Strength and weakness of swing through volume analysis

‘There are two methods to find out strengths and weaknesses in swing through volume analysis

1) Compare the volume of the current price swing with the volume of the previous price swing in the

same direction? What itis telling? Harmony or divergence

2) Compare the volume of the current price swing with the volume of the previous price swing in the

opposite direction? What itis telling? harmony or divergence

A Compare the volume of the current price swing with the volume of the previous price

‘swing in the same direction.

This means comparing the current impulse swing vs. the previous impulse swing. What it is telling? Volume

increasing or decreasing or the same volume. Let's understand the divergence

hitpsdotnetutorals. nevlessonWvalume-price-acton-analysis! wir

114/23, 4:52 PM Volume Price Acton Analysis in Trading - Price Analysis

SWING B

Erinn DIVERGENCE

HARMONEY A

VOLUME

* Compare the volume of UP-swings (A) and upswing (B). Note the decreased VOLUME of the swing (B),

indicating a reduction in bullish VOLUME. Weakness is appearing on the bullish side.

* When prices are rising and volume is decreasing, it tells that the trend is unlikely to continue. Price may still

attempt to rise at a slower pace, and once sellers take control (which is usually signified by an increase in

volume on a down bar or candle), prices will fall

* The move is by short-covering RALLY

* A low volume upswing as the market attempts to rally above these old tops is telling you clearly that the

market is not going anywhere

* High volume up bars in the same areas is certainly indicating that there is supply in the market. If the market

makers and specialists are stil bullish they will have to absorb any supply that appears, this will allow prices

to continue up.

Let’s understand harmony

hitpsdotnetutorals. nevlessonWvalume-price-acton-analysis! mr

114/23, 4:52 PM Volume Price Acton Analysis in Trading - Price Analysis

SWING B

DIVERGENCE

* When comparing current upswing B volume with previous upswing a volume. Note the increasing VOLUME

‘on A swing, indicating an increase in BULLISH STRENGTH. BULLISH price swings are showing signs of

strength

* RISING PRICE IS ACCOMPANIED BY RISING VOLUME. It means the market is STRONGLY BULLISH.

Price will continue the trend

* High volume up bars in the same areas is certainly indicating that there is supply in the market. If the market

makers and specialists are stil bullish they will have to absorb any supply that appears,

will allow prices

to continue up

Compare the volume of the current price swing with the volume of the previous price

swing in the opposite direction.

Means compare impulse volume vs, retrace (pullback) volume. In general, a healthy trend has increasing volume

on impulse move and decreasing volume on retrace volume. Let's understand harmony

hitpsdotnetutorals. nevlessonWvalume-price-acton-analysis!

114/23, 4:52 PM Volume Price Acton Analysis in Trading - Price Analysis

SWING B

I

YA A

aaa

a

——

| elm ULL

* When comparing current downswing B volume with previous upswing A volume. it shows volume decreasing.

Strength is now clearly on the bullish side.

* Price movement is expected in the direction of strength. When prices are falling and volume is decreasing, it

tells traders that the trend is unlikely to continue in the down direction. Price may stil attempt to fall at a

slower pace, and once buyers take control (which is usually signified by an increase in volume on an up bar

or candle), prices will move up

Let’s understand the divergence

hitpsdotnetutorals. nevlessonWvalume-price-acton-analysis!

err

114/23, 4:52 PM Volume Price Acton Analysis in Trading - Price Analysis

SR acto rape

VOLUME

When comparing the current upswing B volume with the previous upswing A volume IT SHOWS PRICE is falling

and VOLUME is rising, it means bearish PRESSURE OVERCOME bullish PRESSURE. TREND CONTINUE IN

down DIRECTION

Please watch the following video if you want to learn and understand the Volume Price Action Analysis concept in

a better way.

hitpsdotnetutorals. nevlessonWvalume-price-acton-analysis!

son7

1814/23, 4:52 PM Volume Price Acton Analysis in Trading - Price Analysis

Volume Price Action Analysis in Trading. How to use volume price analysis in stc

In the next article, | am going to discuss Volume Spread Analysis in Trading in detail, Here, in this article | try to

explain the Volume Price Action Analysis in Trading. | hope you enjoy this Volume Price Action Analysis in

Trading article. Please join my Telegram Channel and YouTube Channel as well as my Facebook Group to leam

more and clear your doubts.

~ Previous Lesson Next Lesson -

Volume Analysis in Trading Volume Spread Analysis in Trading

9 thoughts on “Volume Price Action Analysis”

KENNEDY

JULY 30, 2020 AT 2:41 PM

| enjoyed this tutor. | have a question

My question is:

Ifa candle is bullish (green) and the volume of the candle is bearish in color (red), what does it signifies or what is

the candle telling us about the market?

Reply

hitpsdotnetutorals. nevlessonWvalume-price-acton-analysis! nr

114/28, 4'52 PM ‘Volume Price Action Analysis in Trading Price Analysis

PRAKASH KUMAR

‘APRIL 10, 2021 AT 433 PM

GAPDOWN

Reply

RAJENDRA

‘APRIL 28, 2023 AT 12555 PM

It tells the candle itis a bullish volume but bulls are not able to push the price above the close of the previous

close

Reply

SHABBIR

‘OCTOBER 30, 2020 AT 601 PM

sir one article on base candle with highest volume in detail and secrets

Reply

RUPESH BATRA

‘OCTOBER 31, 2020 AT 850 AM

Very nice,thanks, keep the good work continue

Reply

RUPESH BATRA

(OCTOBER 31, 2020 AT 853 AM

Make some videos on swing trading and on moving average also , this tutorial is very nice , I'm regularly following

you on telegram and also ur subscriber on you tube, thanks

Reply

(MANGULU RANA

MARCH 14,2021 AT 12:15 PM

hitpsdotnetutorals. nevlessonWvalume-price-acton-analysis! san7

114/28, 4'52 PM ‘Volume Price Action Analysis in Trading Price Analysis

Sir me ap ka video dekha bahuth achalaga.

Me ap ko thankyou baltahu or ap ka all video me dek ne kelly chahatahu please sms.

Reply

SAGAR

JULY 23, 2022 AT 11:27 AM

Thank you so much

Reply

RAM

FEBRUARY 16,2023 AT 10:12 PM

Very very nice explanation,

Thank you so much sir

Reply

Leave a Reply

Your email address will not be published. Required fields are marked *

Comment *

Name*

Email*

Website

hitpsdotnetutorals. nevlessonWvalume-price-acton-analysis! s3n7

814/29, 4:52 PM ‘Volume Price Action Analysis in Trading Price Analysis

Price Action

© How to Study Candlestick

© Candlestick Analysis in Trading

© Price Action Analysis

© Advanced Price Action Analysis

© Thrust Pullback and Measuring Move Analysis

© How to Trade with Smart Money

© Supply and Demand Zone Trading

© How to Day Trade with Trend

© Multiple Time Frame Analysis

© Head and Shoulder Patterns

© How to Trade with Support and Resistance

© Advanced Candlestick Analysis

© Trendline Trading Strategy

© WRB Trading Strategy

Day Trading Strategies

© Wa? Trading Strategy

© Gap Trading Strategies

© Intraday Open High Open Low Trading Strategy

© PIN BAR Trading Strategy

© Trading with Sideways Price Action Area

© Pullback Trading Strategy

© Intraday Breakout Trading Strategy

Risk Management

© 3 Techniques for Risk Management in Trading

© 4 Things | Wish | Knew When | Started Trading

Stock Selection & Live Scanner

© How to Make Your Own Day Trading Scanner

© Stock Selection for Intraday Trading

Intraday Trading Course

© Intraday Trading Course

© Multiple Timeframe Analysis for Intraday Trading

© Wa? Trading

© Opening Range Trading Strategy

hitpsdotnetutorals. nevlessonWvalume-price-acton-analysis! snr

114/28, 4'52 PM ‘Volume Price Action Analysis in Trading Price Analysis

Opening Range Breakout

Volume Price Action Analysis

Volume Analysis in Trading

Volume Price Action Analysis

Volume Spread Analysis in Trading

Candlestick Pattern Analysis,

Finding Entry Opportunity using Volume Spread Analysis

Spring and Upthrust Trading Strategy

\VSA Trading Strategy

Option Chain Analysis

Option Chain Analysis in Trading

Indicator

RSI Trading Strategy

BTsT

BIST Trading Strategy

‘TECHNICAL ANALYSIS MASTERCLASS

Technical Analysis in Trading

Market Structure in Trading

Understanding Market Structure through Swing

Supply and Demand Trading (Part - 1)

Supply and Demand Trading (Part - 2)

Chart Patterns

‘Top 7 Chart Patterns in Trading Every Trader Needs to Know

How to Trade Bull Flag and Bear Flag Pattern

CPR and Pivot Point and VWAP Trading System

Pivot Point Trading Strategies

Central Pivot Range Trading Strategy

Swing Trading Strategy Using Pivot Point

Trading Strategies

Darvas Box Trading Strategy

Volatility Contraction Pattern Trading Strategy

Volume Spike Trading Strategy

Fibonacci Trading Strategy

Fibonacci Trading Strategy using Confluence Factor

hitpsdotnetutorals. nevlessonWvalume-price-acton-analysis!

ssn7

114/28, 4'52 PM Volume Price Acton Analysis in Trading - Price Analysis

Smart Money Trading Strategies

Pullback Trading Master Class

How to Become a Successful Trader

Most Popular Trading Books

Cs mec mer CeO au ee Ca a eee

ASP.NET Core Tutorials ASP.NET MVC Tutorials ASP.NET Web API Tutorials C Tutoria

NET Programs Tutorials CNET Tutorials Cloud Computing Tutorials

Data Structures and Algorithms Tutorials Design Patterns Tutorials DotNet Interview Questions and Answers

oe ea a a oR Oc

Se ee ce Mera Rc ee et

eS eee se cet

ASP.NET ¢ CONROE MCL c

GETITON

De ao eae Ee

Google Play

hitpsdotnetutorals. nevlessonWvalume-price-acton-analysis!

114/28, 4'52 PM Volume Price Acton Analysis in Trading - Price Analysis

hitpsdotnetutorals. nevlessonWvalume-price-acton-analysis! snr

114/28, 4'52 PM ‘Volume Spread Analysis in Trading - Price Action Aralysis.

Volume Spread Analysis in Trading

Back to: Trading with Smart Money

Volume Spread Analysis in Trading

In this article, | am going to discuss Volume Spread Analysis in Trading. Please read our previous article, where

we discussed Volume Price Action Analysis in detail. At the end of this article, you will understand the following

pointers.

1, What is volume spread analysis?

2, How to use volume spread analysis in trading?

3, Market structure with respect to volume spread analysis

4, Volume spread analysis

5. Selling climax

6. Stopping volume

7. How to trade based on selling climax and stopping volume?

MARKET STRUCTURE With Respect To Volume Spread Analysis

Let us understand bullish trend formation, The bearish trend turned into the bullish trend

Price goes through 4 phases. These are

Phase A. Stopping the previous bearish trend

Phase B. Construction of the cause (accumulation)

Phase C. Test for confirmation (testing supply after accumulation)

Phase D. Bullish Trend out of range.

hitpsdotnetutorals. nevlessonWvolume-spread-analysis-n-trading! +20

14/28, 4:52 PM ‘Volume Spread Analysis in Trading - Price Action Aralysis.

PHASE A. PHASE B PHASE C PHASE D

Largest

recto back

[({<————_

Ultra high__ > Test of supply

volume

‘We will come to this market structure later. Just understand the overall concept

How to analyze volume activity in the chart

1. Through volume price action(VPA) (discussed in the Previous article)

2. Through volume spread analysis(VSA) (we will discuss in this article)

Let’s understand how to differentiate different types of volumes like

1. Average volume

2. Below average volume

3, High volume

4, Utrachigh volume

Now we have four types of volume. Let's find out in the chart

Volume always moves in a cycle.

Rule ~ You can visually compare Mountain Peaks to identify volume peaks structure. The key is to understand the

structure of the peak clearly. Volume peak has the following characteristics:

Rising Volume — Peak (Highest Point)— Falling Volume

hitpsdotnetutorals. nevlessonWvolume-spread-analysis-n-trading! 2120

1814/23, 4:52 PM ‘Volume Spread Analysis in Trading - Price Action Aralysis.

RISING VOLUME

FALLING VOLUME ULTRA HIGH VOLUME AS THIS VOLUME GREATER

‘THAN LAST PICK VOLUME

Pick

HIGH VOLUME

Pick

HIGH VOLUME

Pick

ABOVE AVERAGE VOLUME

AVERAGE VOLUME

BELOW AVERAGE VOLUME

Average and Above Average Volume: Above Average Volume is the Highest Volume in the current session which

is higher than the average volume but itis lower than the previous peak Volume. Average Volume is the volume that

coincides with Moving Average 20 of the volume indicator

High volume and Ultra-high volume: high volume is volume equal to the previous pick volume. Ultra-High Volume

is the Highest Volume in the current session. It is higher than the previous peak volume.

aa ne ay ides: tae tO DO

HIGH VOLUME ULTRA HIGH ULTRA HIGH

ABOVE AVERAGE Vo ime VOLUME

VOLUME

Bearish and Bullish Volume

Bearish Volume is marked in Red and it shows bearish activity. Bullish Volume is marked in green and it shows

bullish activity. if demand volume is greater than supply volume then overall bullish volume

itpsidotnetutorals.netlessonvvolume-spread-analysis

20

114/23, 4:52 PM Volume Spread Analysis in Trading - Price Action Aralysis.

Test of supply

volume

Sign of strength means. The stopping action of the downtrend

Phase A. Stopping the previous bearish trend (the sign of strength)

Again recall the volume interpretation

+ Smart money has no interest in the upside ~ Low volume,

+ Smart money is selling into the public buying — Higher volume.

© The ultra-high volume-the classic trap of "Smart Money

Now we have found two important rules for volume spread analysi:

* Rule Number 1— Weakness appears on an Up candle. Supply when it comes, it comes on an up candle.

* Rule Number 2~ Strength Appears on a Down candle, Demand when it comes, it comes on a down

candle.

‘Some volume spread analysis that suggests the end of the downtrend. These are

1. Selling climax

2. Stopping volume

3, End of falling market

hitpsdotnetutorals. nevlessonWvolume-spread-analysis-i-trading! 20

114/28, 4'52 PM ‘Volume Spread Analysis in Trading - Price Action Aralysis.

Now we will discuss these 3 pointers

What is a selling climax?

This condition marks the end of the approaching end of a particular downtrend. This panic selling by retailers (or the

Public) creates an extreme expansion of the price spread and an expansion of the volume, this action may occur

over one day or over several days which is matched by buying (demand) of:

1. experienced smart money

2. large interests

The classic characteristics of a selling climax:

* There must be a trend to reverse. (after a significant extended down move on the time frame of interest )

* The trend will accelerate to the downside with wide spreads down closing in the middle or high

* Volume expands dramatically

© Often occurs one more than one bar

* Must be tested for entry

DIVERGENCE

HARMONEY

Peery voLuMe

Decay

itpsidotnetutorals.netlessonvvolume-spread-analysis

DIVERGEN

Seo

cant

9120

1814/28, 4'52 PM ‘Volume Spread Analysis in Trading - Price Action Aralysis.

aa wm oe a Se i mo

Aselling climax is generally followed by a secondary reaction why?

‘Two possible outcomes after selling climax

1. Either the professional money is BUYING into the SELLING [see the end of a DOWN market]

2, There is a trading range OR technical support level to the left and. (trend continuation)

Let's first understand for a trend continuation after selling the climax

If buying during the Selling Climax was principally for the purpose of supporting prices temporarily and checking a

panic or relieving a panicky situation, this support stock will continue after a technical bounce from support. If price

supply sufficiently to drive prices through the lows of the climax day and bring about a new decline, that is, a

resumption of liquidation.

hitpsdotnetutorals. nevlessonWvolume-spread-analysis-i-trading! +0120

114/23, 4:52 PM ‘Volume Spread Analysis in Trading - Price Action Aralysis.

Trend reversal after selling climax

After a technical rally, if prices test climax low with volume decreasing and hold around or above the climax lows,

then we have an indication of support and the completion of liquidation. This tells us that there is no selling

Pressure or no Supply, (i.e. no more sellers) an obvious conclusion that the market is going to rally as shown on the

right side of the image

If the test’ is successful, we can expect higher prices, especially if the test is on low volume and narrow spread

down bar into the same area where you first saw the very high volume. This is a strong BUY signal.

Time To Buy The Market AFTER TEST

1. Look for selling climax

2, Wait for the successful test(/ower volume and narrower spread)OF selling climax day low

3. Any reversal candlestick pattern(like engulfing or outside bar or pin bar)

4. Buy above that candle

5, STOP LOSS below the low

itpsidotnetutorals.netlessonvvolume-spread-analysis 11120

114/23, 4'52 PM ‘Volume Spread Analysis in Trading - Price Action Aralysis.

Larges

reactiorNpullback

Selling climax

Test of suppl:

Ultra high _>

volume

+e a eso

we it

. “al A.

only Jud at -

ty, jr =

“fl

ro i J

pyle ‘il ir

setingcinox | iM

low volume test of selling

climaxlow

hitpsdotnetutorals. nevlessonWvolume-spread-analysis-i-trading! 1220

114/23, 4'52 PM ‘Volume Spread Analysis in Trading - Price Action Aralysis.

4 jt

hi |

{ i oh pe!

1M

ri

SEELING CLIMAX ">| Py

~ * | SPRINGTEST =

Stopping volume

What is stopping volume?

* To stop a down move and demand has to overcome the supply

* Its the volume of smart money coming into the market and stopping It from falling further

* What is happening is that the weight of the selling pressure has become so great at this point, that even the

‘smart money moving into the market has the insufficient muscle to stop the market from falling in one

session. It takes two or three sessions for the brakes to be applied and is like our tanker.

Characteristics of stopping volume

* Demand overcoming supply

* Occur after an extended down move

* Volume expand significantly

© Bar close-mid or high and body narrow (lower shadow)

* Often occurs one more than one bar. The first bar close may be low 2 bar close-mid or high

hitpsdotnetutorals. nevlessonWvolume-spread-analysis-i-trading! 1320

114/23, 4:52 PM \Volume Spread Analysis in Trading - Price Action Aralysis.

HARMONE 1 vERGENCE a7

imey=

SHADOW

LUME INCREASING

AVERAGE VOLUME

STOPPING VOLUME

‘Two possible outcomes after seeing stopping volume

Ifthe volume had represented SELLING, how can the spread be narrow? There are only two possible outcomes for

a narrow spread DOWN-day on very high volume.

1. Either the professional money is BUYING into the SELLING [see the end of a DOWN market].

2, There is a trading range to the left and the professional money is prepared to absorb the buying from traders.

from the support region

Trend continuation after seeing stopping volume

This topic will be covered in the next separate arlicle

Trend reversal after seeing stopping volume

After seeing the stopping volume. If the ‘test’is successful, we can expect higher prices, especially if the test is on

low volume and narrow spread down bar into the same area where you first saw the very high volume. This is a

strong BUY signal

hitpsdotnetutorals. nevlessonWvolume-spread-analysis-n-trading! 1420

114/28, 4'52 PM ‘Volume Spread Analysis in Trading - Price Action Aralysis.

nll \

SELLING CLIMAX

oS

en (i

How to trade after seeing stopping volume?

Time To Buy The Market AFTER TEST

1. If the day closes on the lows, you now have to wait to see what happens the next day.

2. Ifthe next day is level or up, this must surely show buying on the previous day as well,

3, wait for the market to come back down into the area of stopping volume on LOW VOLUME narrower spread

4, The time to buy the market is when we begin to trend up As the trend begins. Any reversal candlestick

pattern (like engulfing or outside bar or pin bar). This shows us that there are no sellers or no Supply

5. Buy above that candle

6. STOP LOSS below the low

In the next article, | am going to discuss the followings,

1, How testing is down and different types of testing

2. Finding support and resistance based on the volume spread analysis method

Please watch the following video if you want to learn and understand Volume Spread Analysis in the Trading

concept in a better way.

hitpsdotnetutorals. nevlessonWvolume-spread-analysis-i-trading! +9120

1814/23, 4:52 PM Volume Spread Analysis in Trading - Price Action Aralysis.

Volume Spread Analysis(VSA). How to use volume ...

In the next article, | am going to discuss Reversal Candlestick Pattern Analysis in detail. Here, in this article, | try

to explain Volume Spread Analysis in Trading. | hope you enjoy this article. Please join my Telegram

Channel and YouTube Channel as well as my Facebook Group to leam more and clear your doubts,

= Previous Lesson Next Lesson ~

Volume Price Action Analysis Candlestick Pattern Analysis

1 thought on “Volume Spread Analysis in Trading”

FRANK

FEBRUARY 1, 2022 AT 11:08 PM

Hello,

‘Thx for your very good explanations.

Ihave got one question regarding the volume indicator:

The bars of the standard MT4 volume indicator just tell you whether the volume was higher in comparison to the

previous bar (then the current bar becomes red or vice versa

hitpsdotnetutorals. nevlessonWvolume-spread-analysis-n-trading! 16120

114/28, 4'52 PM ‘Volume Spread Analysis in Trading - Price Action Aralysis.

But when | see it right, your volume indicator shows red bars for example when the selling power was higher. And

the volume is displayed by the hight of the volume candle,

‘When | understand it right the standard MT4 indicator does not show whether the selling power was higher but

only the volume quantity.

Could you please let me know which volume indicator you use,

Thx

Reply

Leave a Reply

Your email address will not be published. Required fields are marked *

Comment *

Name*

Email*

Website

Sa’

Price Action

How to Study Candlestick

Candlestick Analysis in Trading

Price Action Analysis,

hitpsdotnetutorals. nevlessonWvolume-spread-analysis-i-trading! +720

‘1423, 452 PM ‘Volume Spread Analysis in Trading - Price Action Analys's

‘Advanced Price Action Analysis

Thrust Pullback and Measuring Move Analysis

How to Trade with Smart Money

Supply and Demand Zone Trading

How to Day Trade with Trend

Multiple Time Frame Analysis

Head and Shoulder Patterns

How to Trade with Support and Resistance

Advanced Candlestick Analysis

Trendline Trading Strategy

WRB Trading Strategy

Day Trading Strategies

‘WAP Trading Strategy

Gap Trading Strategies

Intraday Open High Open Low Trading Strategy

PIN BAR Trading Strategy

Trading with Sideways Price Action Area

Pullback Trading Strategy

Intraday Breakout Trading Strategy

Risk Management

3 Techniques for Risk Management in Trading

4 Things | Wish | Knew When | Started Trading

‘Stock Selection & Live Scanner

How to Make Your Own Day Trading Scanner

Stock Selection for Intraday Trading

Intraday Trading Course

Intraday Trading Course

Multiple Timeframe Analysis for intraday Trading

WAP Trading

‘Opening Range Trading Strategy

‘Opening Range Breakout

Volume Price Action Analysis

Volume Analysis in Trading

Volume Price Action Analysis

Volume Spread Analysis in Trading

Candlestick Pattern Analysis

hitpsdotnetutorals. nevlessonWvolume-spread-analysis-n-trading!

114/28, 4'52 PM ‘Volume Spread Analysis in Trading - Price Action Aralysis.

Finding Entry Opportunity using Volume Spread Analysis

Spring and Upthrust Trading Strategy

\VSA Trading Strategy

Option Chain Anal

Option Chain Analysis in Trading

Indicator

RSI Trading Strategy

BIST

BIST Trading Strategy

‘TECHNICAL ANALYSIS MASTERCLASS

Technical Analysis in Trading

Market Structure in Trading

Understanding Market Structure through Swing

Supply and Demand Trading (Part - 1)

Supply and Demand Trading (Part ~ 2)

Chart Patterns

Top 7 Chart Patterns in Trading Every Trader Needs to Know

How to Trade Bull Flag and Bear Flag Pattern

CPR and Pivot Point and VWAP Trading System

Pivot Point Trading Strategies

Central Pivot Range Trading Strategy

Swing Trading Strategy Using Pivot Point

‘Trading Strategies

Darvas Box Trading Strategy

Volatility Contraction Pattern Trading Strategy

Volume Spike Trading Strategy

Fibonacci Trading Strategy

Fibonacci Trading Strategy using Confluence Factor

‘Smart Money Trading Strategies

Order Block Trading Strategy

Smart Money Market Structure Trading Strategy

Breaker Block Trading Strategy

Liquidity Hunting o Stop Hunting in Trading

Sniper Order Block Entry Trading Strategy

hitpsdotnetutorals. nevlessonWvolume-spread-analysis-i-trading!

114/28, 4'52 PM ‘Volume Spread Analysis in Trading - Price Action Aralysis.

Pullback Trading Master Class

How to Become a Successful Trader

Most Popular Trading Books

ontact ADO.NET Tutorial Angular Tutorials ASP.NET Core Blazor Tuturi

ASP.NET Core Tutorials ASP.NET MVC Tutorials ASP.NET Web API Tutorials C Tutorials

C#.NET Programs Tutorials C#.NET Tutorials Cloud Computing Tutorials,

Data Structures and Algorithms Tutorials Design Patterns Tutorials DotNet Interview Questions and Answers

De oe ae eee Reco

Pane eRe ae art Se eae

eo ee ee ase ea

ASP.NET Core Web API Tutorials HTML Tutorials

GETITON

Pea eaten

le TeTefe| Aad oa

itpsidotnetutorals.netlessonvvolume-spread-analysis

20120

1814/28, 4'52 PM Candlestick Pattom Analysis - Volume Price Action Analysis,

Candlestick Pattern Analysis

Back to: Trading with Smart Money

CANDLESTICK Pattern Analysis

In this article, 1 am going to cover all Reversal Candlestick Pattern Analyses in detail. In the previous article, we

have discussed Candlestick Analysis in Trading, PIN BAR Trading Strategy, Wide range of candle analyses. And

in this article, we will cover 2 candle reversal patterns

Outside Reversal Pattern

BULLISH OUTSIDE REVERSAL PATTERN STRUCTURE

1. The first candle is a narrow range candle or Doji

2. The second candle completely engulfs the first candle and closes above the first candle high.

3. The second candle is low below the first candle low, but the close must be above the first candle close and

high above the previous candle high

4, The second candle should be accompanied by a high volume

hitpsdotnotutorals. ntvlessonicandlastickpatter-analysis!

1814/28, 4'52 PM Candlestick Pattom Analysis - Volume Price Action Analysis,

HIGH

NARROW RANGE CANDLE

PREFER DOJI ——l WIDE RANGE CANDLE

CLOSE ABOVE THE HIGH

Low OF SMALL CANDLE

“aromas 1 \ | i 1 ‘i |

“yaa

= a

OUTSIDE REVERSAL PATTERN PSYCHOLOGY

‘What exactly is going on at these levels? Let us understand the two candlestick pattern psychology. The first candle

should be narrow or doj.

hitpsdotnotutorals. ntvlessonicandlastickpatter-analysis! amt

1814/28, 4'52 PM Candlestick Pattom Analysis - Volume Price Action Analysis,

‘A Doji represents either one of two things:

* Buyers and sellers are equally strong

* Indecision in the market if appears after an extended move

Basically, smart money testing the selling pressure below support to make sure there is no new business to be

done at these levels. When no selling pressure below the low of the previous candle, smart money starts to drive

price up

Basically, smart money testing the selling pressure below

‘support to make sure there is no new business to be done at t

i l =

these eves When no seling pressure below fo of previous -

ancle smertmoney str ave price up

i ath yi i

How do Reversal candlestick Patterns work?

yt

Reversal candlestick psychology is one of the reasons why reversal patterns are such effective predictors of price

reversals. Here's an example:

tps idotnetutorals.netlessonicandlastick-patter-analysis! sit

1814/28, 4'52 PM Candlestick Pattom Analysis - Volume Price Action Analysis,

The bullish OUTSIDE REVERSAL pattern has

formed and the market is moving up. All the

previous sellers are now at loss, and will be

looking to exit their positions with BUY trades,

forming an area of support.

‘SUPPOR ZONE

| Itprces retrace back nto the range ofthe bearish candlestick | | i

body, you can bet that the previous sellers will quickly BUY to

close their trades, pushing the market price back up 4

LOW OF BULLISH OUTSIDE REVERSAL PATTERN As support

hitpsdotnotutorals. ntvlessonicandlastickpatter-analysis! am

1814/28, 4'52 PM Candlestick Pattom Analysis - Volume Price Action Analysis,

4a sms we oa sade

AXISEANK

BULLISH OUTSIDE

et rw

atte

BULLISH OUTSIDE REVERSAL PATTERN should be followed by bullish price action. One more bull candle

should be formed to confirm the bullish reversal or validated the bullish engulfing candle

HDFCBANK

BULLISH OUTSIDE REVERSAL PATTERN

followed by bullish pice action

by,

FAILED TO

FOLLOWTHROUGH

They will work best in trending conditions. Trade with the trend. In an uptrend, bullish outside reversal patlerns work

better,

tps idotnetutorals.netlessonicandlastick-patter-analysis! sit

1814/28, 4'52 PM Candlestick Pattom Analysis - Volume Price Action Analysis,

> a= a oY eS RY ta

HOFCEANK

ie"

ii i Ly t wt

Pr \ he, iw ‘yet

They will work best in trending conditions

i i Wea ity

Trade from support or resistance level

How do we trade it?

1, Buy above the bullish Engulfing pattem

2. Stop loss below of the pattern

tps idotnetutorals.netlessonicandlastick-patter-analysis! ent

1814/28, 4'52 PM Candlestick Pattom Analysis - Volume Price Action Analysis,

ENTRY ABOVE OF THE

ERN

HIGH

STOP LOSS BELOW OF

THE PATTERN

Low

Stay tuned | will add the remaining reversal patter to this article. In the next article, | am going to discuss Finding

Entry Opportunities using Volume Spread Analysis in Trading. Here in this article, | try to explain Reversal

Candlestick Pattern Analysis in detail. 1 hope you enjoy this article. Please join my Telegram

Channel and YouTube Channel as well as my Facebook Group to leam more and clear your doubts,

+ Previous Lesson Next Lesson +

Volume Spread Analysis in Trading Finding Entry Opportunity using

Volume Spread Analysis

1 thought on “Candlestick Pattern Analysis”

SHEKHER NISHANK

FEBRUARY 16,2021 AT 7.29 AM

hitpsdotnotutorals. ntvlessonicandlastickpatter-analysis! mm

1814/28, 4'52 PM Candlestick Pattom Analysis - Volume Price Action Analysis,

what does average lower wick represent 22? (a) rejection from the level (b) warning that market is showing that it

can move till that level and we should wait for the call trade

Reply

Leave a Reply

Your email address will not be published. Required fields are marked *

Comment *

Name*

Email*

Website

Price Action

How to Study Candlestick

Candlestick Analysis in Trading

Price Action Analysis

‘Advanced Price Action Analysis

Thrust Pullback and Measuring Move Analysis

How to Trade with Smart Money

Supply and Demand Zone Trading

How to Day Trade with Trend

Multiple Time Frame Analysis

Head and Shoulder Patterns

tps idotnetutorals.netlessonicandlastick-patter-analysis! amt

1423, 452M Candlestick Pattem Analysis - Volume Price Action Analysis

How to Trade with Support and Resistance

Advanced Candlestick Analysis

Trendline Trading Strategy

WRB Trading Strategy

Day Trading Strategies

WAP Trading Strategy

Gap Trading Strategies

Intraday Open High Open Low Trading Strategy

PIN BAR Trading Strategy

Trading with Sideways Price Action Area

Pullback Trading Strategy

Intraday Breakout Trading Strategy

Risk Management

3 Techniques for Risk Management in Trading

4 Things | Wish | Knew When | Started Trading

Stock Selection & Live Scanner

How to Make Your Own Day Trading Scanner

Stock Selection for Intraday Trading

Intraday Trading Course

Intraday Trading Course

Multiple Timeframe Analysis for Intraday Trading

war Trading

‘Opening Range Trading Strategy

‘Opening Range Breakout

Volume Price Action Analysis

Volume Analysis in Trading

Volume Price Action Analysis

Volume Spread Analysis in Trading

Candlestick Pattern Analysis

Finding Entry Opportunity using Volume Spread Analysis

Spring and Upthrust Trading Strategy

\VSA Trading Strategy

Option Chain Analysi

Option Chain Analysis in Trading

Indicator

tps idotnetutorals.netlessonicandlastick-patter-analysis! amt

1814/28, 4'52 PM Candlestick Pattom Analysis - Volume Price Action Analysis,

RSI Trading Strategy

BTsT

BIST Trading Strategy

‘TECHNICAL ANALYSIS MASTERCLASS

Technical Analysis in Trading

Market Structure in Trading

Understanding Market Structure through Swing

Supply and Demand Trading (Part - 1)

Supply and Demand Trading (Part - 2)

Chart Patterns

Top 7 Chart Patterns in Trading Every Trader Needs to Know

How to Trade Bull Flag and Bear Flag Pattern

CPR and Pivot Point and VWAP Trading System

Pivot Point Trading Strategies

Central Pivot Range Trading Strategy

Swing Trading Strategy Using Pivot Point

1g Strategies

Darvas Box Trading Strategy

Volatility Contraction Pattern Trading Strategy

Volume Spike Trading Strategy

Fibonacci Trading Strategy

Fibonacci Trading Strategy using Confluence Factor

‘Smart Money Trading Strategies

Order Block Trading Strategy

Smart Money Market Structure Trading Strategy

Breaker Block Trading Strategy

Liquidity Hunting or Stop Hunting in Trading

Shiper Order Block Entry Trading Strategy

Pullback Trading Master Class

6 Price Action Pullback Trading Strategy Types You Should Know

‘Top Mistakes to Avoid When Pullback Trading and How to Overcome Them?

Pullback or Reversal in Trading: How to Spot the Difference

2 Pullback Trading Strategies You Must Know

How to Become a Successful Trader

Free Price Action Trading Course

tps idotnetutorals.netlessonicandlastick-patter-analysis! son

1814/28, 4'52 PM Candlestick Pattom Analysis - Volume Price Action Analysis,

Most Popular Trading Books

ed eee ae et ace kere ce

ASP.NET Core Tutorials ASP.NET MVC Tutorials ASP.NET Web API Tutorials C Tutorials

CHNET Programs Tutorials C#.NET Tutorials Cloud Computing Tutorials

Sete en eon ee ee ree

Java Tutorials Entity Framework Tutorials JavaScript Tutorials LINQ Tutorials Python Tutorials

Sel ate Re ee ee CT cee ac

Java Struts Tutorials C++ Tutorials JSP Tutorials MySQL Tutorials Oracle Tutorials

ASP.NET Core Web API Tutorials HTML Tutorials

: GET ITON

D> oo ie Play | M

Sir how | can get your notes in book form

Reply

Leave a Reply

Your email address will not be published. Required fields are marked *

Comment *

Name*

Email*

hitpssidotnetutorals.netlessonivsa-tracing stvategy! s3n7

814/29, 4:59 PM

Website

Price Action

\VSA Trading Strategy in Deal - Volume Spread Analysis

How to Study Candlestick

Candlestick Analysis in Trading

Price Action Analysis

‘Advanced Price Action Analysis

Thrust Pullback and Measuring Move Analysis

How to Trade with Smart Money

Supply and Demand Zone Trading

How to Day Trade with Trend

Multiple Time Frame Analysis

Head and Shoulder Patterns

How to Trade with Support and Resistance

Advanced Candlestick Analysis

Trendline Trading Strategy

WRB Trading Strategy

Day Trading Strategies

‘WAP Trading Strategy

Gap Trading Strategies

Intraday Open High Open Low Trading Strategy

PIN BAR Trading Strategy

Trading with Sideways Price Action Area

Pullback Trading Strategy

Intraday Breakout Trading Strategy

Risk Management

3 Techniques for Risk Management in Trading

4 Things | Wish | Knew When | Started Trading

Stock Selection & Live Scanner

How to Make Your Own Day Trading Scanner

Stock Selection for Intraday Trading

Intraday Trading Course

Intraday Trading Course

Multiple Timeframe Analysis for intraday Trading

hitpsdotnetutorals. netlessonivea-rading-statogy!

snr

1423, 453M \V8A Trading Strategy in Deta- Volume Spread Analysis

WAP Trading

‘Opening Range Trading Strategy

‘Opening Range Breakout

Volume Price Action Analysis

Volume Analysis in Trading

Volume Price Action Analysis

Volume Spread Analysis in Trading

Candlestick Pattern Analysis

Finding Entry Opportunity using Volume Spread Analysis

Spring and Upthrust Trading Strategy

\VSA Trading Strategy

Option Chain Analysis

Option Chain Analysis in Trading

Indicator

RSI Trading Strategy

BTsT

BIST Trading Strategy

‘TECHNICAL ANALYSIS MASTERCLASS

Technical Analysis in Trading

Market Structure in Trading

Understanding Market Structure through Swing

Supply and Demand Trading (Part - 1)

Supply and Demand Trading (Part - 2)

Chart Patterns

‘Top 7 Chart Patterns in Trading Every Trader Needs to Know

How to Trade Bull Flag and Bear Flag Pattern

CPR and Pivot Point and VWAP Trading System

Pivot Point Trading Strategies

Central Pivot Range Trading Strategy

Swing Trading Strategy Using Pivot Point

Trading Strategies

Darvas Box Trading Strategy

Volatility Contraction Patter Trading Strategy

Volume Spike Trading Strategy

Fibonacci Trading Strategy

hitpsdotnetutorals. nevlessonivea-rading.stategy!

ssn7

1814/23, 4:53 PM SA Trading Strategy in Deal - Volume Spread Analysis.

Smart Money Trading Strategies

Pullback Trading Master Class

How to Become a Successful Trader

Most Popular Trading Books

Rete os ae ee amt ca et arn oe canal

ASP.NET Core Tutorials ASP.NET MVC Tutorials ASP.NET Web AP! Tutorials C Tutorials

C#.NET Programs Tutorials C#NET Tutorials Cloud Computing Tutorial

Data Structures and Algorithms Tutorials Design Patterns Tutorials DotNet Interview Questions and Answers

Java Tutorials Entity Framework Tutorials JavaScript Tutorials LINQ Tutorials Python Tutorials

SOLID Principles Tutorials SQL Server Tutorials Trading Tutorials JDBC Tutorials Java Servlets Tutorials

Java Struts Tutorials C++ Tutorials JSP Tutorials MySQL Tutorials Oracle Tuto

ASP.NET Core Web API Tutorials HTML Tutorials

GETITON

t Net Tutorials | Website Design by Sun

Google Play

hitpsdotnotutorals.nevlessonivea-rading-siategy!

814/28, 4.53 PM SA Trading Strategy in Detal- Volume Spread Analysis,

hitpssidotnetutorals.netlessonivsa-tracing stvategy! snr

Volume trading

awe AY

USeao@onoco

What IS volume?

Perry

SET a Ce aL RAV el Teale)

Pao aee

MOST CONFUSING BY RETAILERS

PAV) wate laser 1a

Only method you should know(basic discuused)

Logic

Summary

What IS volume?

1. Price = direction of the trend

2. Volume =strength of the trend

3. Price and volume confirms the market direction

4. Divergence leads to market weakness

* For Each transaction there have a buyer anda

seller. | mean buyers always equal to sellers .

* Then what is buying and selling volume?

ic Bo

What is buying and selling

ells

i Bo

Relative volume

Ro

RULE 1: harmony

If price rallies and has spread and

Ne nseconreana eee

and decrease on retraces against the

dominant trend

Key-4[e

Ro

RULE 4: climax VOLUME

Ro

If

ry.

f saya l , Trost tertag + yr

I

RULE 4: climax VOLUME

Pru eer lag

Ae Tel Ronse R TL Le)

Cie aoa

Tre RR Ce RCL)

PE NAD oe CUE las

i Bo

RULE 5: STOPPING ACTION

Harmony

Harmony

price ranges and’

volume according)

\\ Divergence

and high volume

RULE 6: significant volume

VET atmo ee TesTallieclag

price highs and lows .As the market

approaches those levels again, is

volume more (showing strength) or

less (showing weakness) than the last

ARO cOCaoie

fr}

What to do?

Ho

Is ly QoL

TOW VOLUME TEST PRICE UNABLE TO RE|

LOW VOLUME TEST PRICE WUICKLY SHOW SM STEEL FEEL WEAK MARKET

QUICK REVERSE

Is ly QoL

TOW VOLUME TEST PRICE UNABLE TO RE|

LOW VOLUME TEST PRICE WUICKLY SHOW SM STEEL FEEL WEAK MARKET

QUICK REVERSE

URES cme RELY IS

ot {

2

LOW VOLUME TEST PRICE UNABLE TO REVERSE

LOW VOLUME TEST PRICE WUICKLY SHOW SM STEEL FEEL WEAK MARKET

QUICK REVERSE

3 rules for volume analysis

These are the 3 rules that based our volume analysis

1. THE LAW OF SUPPLY AND DEMAND

2. THE LAW OF CAUSE AND EFFECT

3. THE LAW OD EFFORT VS RESULT

LEARN TO TRADE

1 THE LAW OF UPPLY AND DEMAND i

The law define as When demand is greater than supply then price will rise to

meet this demand and conversely when supply is greater than demand then

price will fall

4 fundamental principle of supply and demand

oem Om Cle |

SRV) lier iuulel mole cial)

Semel RCo ee Ll Cee

= Divergence leads to market weakness

BULLISH CHARACTER BEARISH CHARACTER

afe)me) iS we) RU)

Mal aeR atta tse Meee le A eee Ron ISs

$ ay

PRICE DECREASE WITH VOLUME INCREASE

a 4 PRICE INCREASE WITH VOLUME DECRESE

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- (A K Ray S K Gupta) Mathematical Methods in ChemiDocument28 pages(A K Ray S K Gupta) Mathematical Methods in ChemiKapilSahuNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- (A K Ray S K Gupta) Mathematical Methods in ChemiDocument53 pages(A K Ray S K Gupta) Mathematical Methods in ChemiKapilSahuNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- 3 Factsheet - Nifty - Oil - and - GasDocument2 pages3 Factsheet - Nifty - Oil - and - GasKapilSahuNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Smart Money ConceptDocument99 pagesSmart Money ConceptKapilSahuNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Ordinary Differential EquationsDocument12 pagesOrdinary Differential EquationsKapilSahuNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Trading StrategiesDocument74 pagesTrading StrategiesKapilSahuNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Gama Sir (Iit-Kgp) : Scanned by CamscannerDocument162 pagesGama Sir (Iit-Kgp) : Scanned by Camscannerdeepak pandeyNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Journal Pre-Proof: IIMB Management ReviewDocument60 pagesJournal Pre-Proof: IIMB Management ReviewKapilSahuNo ratings yet

- 3 Special Price ActionDocument6 pages3 Special Price ActionKapilSahuNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Tuning PI Controllers For Stable Processes With Specifications On Gain and Phase MarginsDocument8 pagesTuning PI Controllers For Stable Processes With Specifications On Gain and Phase MarginsKapilSahuNo ratings yet

- Modelling and Simulation of Continuous Catalytic Distillation Processes PDFDocument278 pagesModelling and Simulation of Continuous Catalytic Distillation Processes PDFSarelys ZavalaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- IIT Guwahati M.Tech. in Chemical Engineering COAP-Round-2: List of Selected Candidates For AdmissionDocument1 pageIIT Guwahati M.Tech. in Chemical Engineering COAP-Round-2: List of Selected Candidates For AdmissionKapilSahuNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Irctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Document3 pagesIrctcs E-Ticketing Service Electronic Reservation Slip (Personal User)KapilSahuNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Brochure Chem-Conflux20 IIDocument1 pageBrochure Chem-Conflux20 IIKapilSahuNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Modeling of Reactive Distillation Column For The Production of Ethyl AcetateDocument5 pagesModeling of Reactive Distillation Column For The Production of Ethyl AcetateKapilSahuNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Section: General Aptitude: Ans: ADocument22 pagesSection: General Aptitude: Ans: AKapilSahuNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)