Professional Documents

Culture Documents

Q2 Lister Limited

Uploaded by

amosmalusi50 ratings0% found this document useful (0 votes)

9 views1 pageAccounting

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAccounting

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views1 pageQ2 Lister Limited

Uploaded by

amosmalusi5Accounting

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

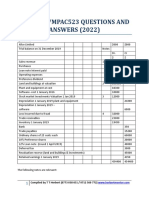

Question: Lister Limited

The following information was obtained from the books of Lister Limited.

Statement of financial position items at 31 December 2020

31/12/202 31/12/2019

0

EQUITY AND LIABILITIES

Ordinary share capital (R1 shares) 600 000 400 000

10% Redeemable preference shares (R1 shares) - 75 000

Retained income 1 200 000 1 050 000

6% Debentures - 60 000

Revaluation reserve fund 25 000 -

Account payables 280 000 155 000

SARS (income tax) 60 000 30 000

Shareholders for dividends 60 000 40 000

ASSETS

Land and buildings 1 050 000 750 000

Machinery at cost 575 000 505 000

Accumulated depreciation on machinery 385 000 375 000

Vehicles at cost 276 000 276 000

Accumulated depreciation on vehicles 80 000 50 000

Unlisted investments - 20 000

Bank 29 000 50 000

Additional information in respect of the financial year ended 31 December 2020:

1. Income tax expense according to the Statement of profit or loss and other

comprehensive income, R130 000.

2. The following dividends were declared during the financial year:

Preference dividends, R3 750

Ordinary dividends, R83 625

3. Interest to the amount of R3 000 was paid to debenture holders.

4. During the year a machine, originally costing R150 000 and already depreciated

with R130 000, was traded in at a loss of R10 000 for a new machine costing

R200 000. The rest of machinery purchases expanded operations.

5. No other fixed asset was sold during the year.

6. Cash received from clients, R1 000 000.

7. Cash paid to suppliers and employees, R450 625.

You are required to:

1. Prepare the cash flow statement of Lister Limited for the year ended

31 December 2020.

You might also like

- Q4 Matshaba LimitedDocument1 pageQ4 Matshaba Limitedamosmalusi5No ratings yet

- Q3 NNF LimitedDocument2 pagesQ3 NNF Limitedamosmalusi5No ratings yet

- All Aboard LTD QuestionDocument2 pagesAll Aboard LTD QuestionLesego BaneleNo ratings yet

- ACC705 Corporate Accounting AssignmentDocument9 pagesACC705 Corporate Accounting AssignmentMuhammad AhsanNo ratings yet

- Q5 Vikings LimitedDocument2 pagesQ5 Vikings Limitedamosmalusi5No ratings yet

- Accounting Advanced Level Test#1: Section A Anwser All The QuestionsDocument6 pagesAccounting Advanced Level Test#1: Section A Anwser All The QuestionsHuzaifa AbdullahNo ratings yet

- ACC 401-2023 GA 2-EvenDocument3 pagesACC 401-2023 GA 2-EvenOhene Asare PogastyNo ratings yet

- Tutorial On Ratio AnalysisDocument4 pagesTutorial On Ratio AnalysisRajyaLakshmiNo ratings yet

- Retirment of PartnerDocument30 pagesRetirment of PartnerRoozbeh ElaviaNo ratings yet

- Tanza EngDocument2 pagesTanza Engisabella.desa04No ratings yet

- 04 Extra Question Pack For Chapter 4 After Initial AcquisitionDocument3 pages04 Extra Question Pack For Chapter 4 After Initial AcquisitionhlisoNo ratings yet

- Capital Reorganization QuestionsDocument20 pagesCapital Reorganization QuestionsProf. OBESENo ratings yet

- MA A-3 Ratio AnalysisDocument3 pagesMA A-3 Ratio AnalysisShilpa AroraNo ratings yet

- Accounting 22 2016Document10 pagesAccounting 22 2016Thulani NdlovuNo ratings yet

- Tutorial QuestionsDocument2 pagesTutorial QuestionsNishika KaranNo ratings yet

- Accountancy Review: Detailed Reconciliation of Opening and Closing Retained EarningsDocument5 pagesAccountancy Review: Detailed Reconciliation of Opening and Closing Retained EarningsEricha MutiaNo ratings yet

- Q9 Galito LimitedDocument2 pagesQ9 Galito Limitedamosmalusi5No ratings yet

- Tutorial 11 QsDocument3 pagesTutorial 11 QsDylan Rabin PereiraNo ratings yet

- Finals Quiz 2 Buscom Version 2Document3 pagesFinals Quiz 2 Buscom Version 2Kristina Angelina ReyesNo ratings yet

- Pricilla AFAR Question PaperDocument2 pagesPricilla AFAR Question PaperjasonnumahnalkelNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- Question 6 Chic Homes LTD GroupDocument5 pagesQuestion 6 Chic Homes LTD GroupsavagewolfieNo ratings yet

- Financial Accounting 2B Tutorials - 013048Document19 pagesFinancial Accounting 2B Tutorials - 013048Pinias ShefikaNo ratings yet

- Acc hw2Document5 pagesAcc hw2pujaadiNo ratings yet

- Sujan Sir Assignment (MBA)Document18 pagesSujan Sir Assignment (MBA)Habibur RahmanNo ratings yet

- IAS 29 FINANCIAL REPORTING IN HYPERINFLATIONERY ECONOMIES (2021 Latest)Document5 pagesIAS 29 FINANCIAL REPORTING IN HYPERINFLATIONERY ECONOMIES (2021 Latest)Tawanda Tatenda HerbertNo ratings yet

- Accounting 2B Final Assessment OpportunityDocument8 pagesAccounting 2B Final Assessment OpportunityThulani NdlovuNo ratings yet

- Cash flow problemsDocument9 pagesCash flow problemsSharu BsNo ratings yet

- Model Question PaperDocument3 pagesModel Question Paperi.am.dheeraj8463No ratings yet

- Support Material Financial Statement PDFDocument6 pagesSupport Material Financial Statement PDFsanele dlaminiNo ratings yet

- Vertical Financial StatementDocument4 pagesVertical Financial StatementForam VasaniNo ratings yet

- I1.2-Financial Reporting QPDocument8 pagesI1.2-Financial Reporting QPConstantin NdahimanaNo ratings yet

- Chapter 6 - Consolidated Financial Statements (Part 3)Document41 pagesChapter 6 - Consolidated Financial Statements (Part 3)Rena Jocelle NalzaroNo ratings yet

- Q7 Mguni LimitedDocument2 pagesQ7 Mguni Limitedamosmalusi5No ratings yet

- 2016-01-08 Exame enDocument6 pages2016-01-08 Exame enbarbaraNo ratings yet

- Afar Assign#01. H_jikDocument5 pagesAfar Assign#01. H_jikjasonnumahnalkelNo ratings yet

- Chapter 21 - QB - Q1 - SolutionDocument4 pagesChapter 21 - QB - Q1 - SolutionRichard SibekoNo ratings yet

- Fund Flow Statement WorksheetDocument3 pagesFund Flow Statement WorksheetAnish AroraNo ratings yet

- Cash Flow Statement AssignmentDocument2 pagesCash Flow Statement AssignmentYoungsonya JubeckingNo ratings yet

- Previous Year Question Paper (FSA)Document16 pagesPrevious Year Question Paper (FSA)Alisha ShawNo ratings yet

- HI5020 Tutorial Question Assignment T3 2020 FinalDocument7 pagesHI5020 Tutorial Question Assignment T3 2020 FinalAamirNo ratings yet

- Statement of Cash FlowsDocument11 pagesStatement of Cash FlowsanjuNo ratings yet

- FSA Vertical FormatDocument10 pagesFSA Vertical FormatMayank BahetiNo ratings yet

- 2020 Acc 410 Test 1Document8 pages2020 Acc 410 Test 1Kesa Metsi100% (1)

- Tutorial Cash FlowDocument18 pagesTutorial Cash FlowmellNo ratings yet

- College Business Exam Covers Key Accounting ConceptsDocument9 pagesCollege Business Exam Covers Key Accounting ConceptsNicole TaylorNo ratings yet

- Prepare financial statements and cash flow statementDocument4 pagesPrepare financial statements and cash flow statementrishi dhungel100% (1)

- AnswerDocument53 pagesAnswerM ShNo ratings yet

- RTP May 16 GRP-1Document140 pagesRTP May 16 GRP-1Shakshi AgarwalNo ratings yet

- Solution Practice 9 Business Combinations and ImpairmentDocument8 pagesSolution Practice 9 Business Combinations and ImpairmentGuinevereNo ratings yet

- ACCT10002 Tutorial 9 ExercisesDocument6 pagesACCT10002 Tutorial 9 ExercisesJING NIENo ratings yet

- Group assignment on FSDocument4 pagesGroup assignment on FSHuyền TrangNo ratings yet

- ACCT6005 COMPANY ACCOUNTING ASSESSMENT 2 CASE STUDYDocument8 pagesACCT6005 COMPANY ACCOUNTING ASSESSMENT 2 CASE STUDYRuhan SinghNo ratings yet

- 05 Corporate LiquidationDocument4 pages05 Corporate LiquidationEric CauilanNo ratings yet

- P&L Statement for 1999 FinancialsDocument5 pagesP&L Statement for 1999 FinancialsambitiousfirkinNo ratings yet

- ALICE LIMITED FINANCIAL STATEMENTSDocument44 pagesALICE LIMITED FINANCIAL STATEMENTSTawanda Tatenda HerbertNo ratings yet

- Abyas Amalgamation IPCC G 1 & 2Document34 pagesAbyas Amalgamation IPCC G 1 & 2Caramakr ManthaNo ratings yet

- What Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Document12 pagesWhat Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Nguyễn HoàngNo ratings yet

- Jimmy Lim - Perbaikan UAS ICAEWDocument9 pagesJimmy Lim - Perbaikan UAS ICAEWJimmy LimNo ratings yet

- GST CERTIFICATE FormatDocument3 pagesGST CERTIFICATE FormatMohit MishraNo ratings yet

- Cir vs. SC Johnson Son Inc. and CA DigestDocument2 pagesCir vs. SC Johnson Son Inc. and CA DigestJumel John H. ValeroNo ratings yet

- Straight Line Depreciation How To Calculate ItDocument5 pagesStraight Line Depreciation How To Calculate ItM ShahidNo ratings yet

- Turkish Leasing MarketDocument16 pagesTurkish Leasing Marketlévai_gáborNo ratings yet

- CR Questions 60+Document102 pagesCR Questions 60+George NicholsonNo ratings yet

- T1 Swatch 2010 - Teacher's NotesDocument23 pagesT1 Swatch 2010 - Teacher's NotesaNo ratings yet

- 14Document106 pages14Alex liaoNo ratings yet

- Turning A Corner: Vaccinations To Spearhead Leasing and Rental RecoveryDocument4 pagesTurning A Corner: Vaccinations To Spearhead Leasing and Rental RecoveryMichelle GozonNo ratings yet

- Taxation Philippines: Leasehold ImprovementsDocument17 pagesTaxation Philippines: Leasehold Improvementsmarklogan67% (3)

- European Tax Handbook PDFDocument2 pagesEuropean Tax Handbook PDFTamaraNo ratings yet

- Sri Sai Enterprises - GST Reg. CertificateDocument3 pagesSri Sai Enterprises - GST Reg. CertificateHarikrishan BhattNo ratings yet

- EOR Tax RegimeDocument6 pagesEOR Tax RegimeRaycharlesNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Omkesh PanchalNo ratings yet

- 2021 Douglas County Budget PresentationDocument43 pages2021 Douglas County Budget PresentationinforumdocsNo ratings yet

- TAX COMPLIANCE PIN ISSUEDDocument1 pageTAX COMPLIANCE PIN ISSUEDMacPraise HoldingsNo ratings yet

- Unpacking The Local Gov't. Code of 1991 (LGA)Document167 pagesUnpacking The Local Gov't. Code of 1991 (LGA)Estudyante Blues100% (1)

- dtDocument550 pagesdtShreya JainNo ratings yet

- Central Recordkeeping Agency Transaction StatementDocument1 pageCentral Recordkeeping Agency Transaction StatementRamakantaSahooNo ratings yet

- Balance Sheet TutorialDocument68 pagesBalance Sheet TutorialavadcsNo ratings yet

- Week 1 and Two For Offline LearnersDocument5 pagesWeek 1 and Two For Offline LearnersJemalyn De Guzman TuringanNo ratings yet

- Tender 16 M032Document29 pagesTender 16 M032neettiyath1No ratings yet

- Annual Report 2012 PDFDocument115 pagesAnnual Report 2012 PDFJnanamNo ratings yet

- Economics Chat PDFDocument53 pagesEconomics Chat PDFSUBHAM RATHEENo ratings yet

- SWOT of EIH Ltd.Document13 pagesSWOT of EIH Ltd.Sahil AhammedNo ratings yet

- Administrative System of The Princely State of Swat: Dr. Sultan - I-RomeDocument14 pagesAdministrative System of The Princely State of Swat: Dr. Sultan - I-RomeRoidar HussainNo ratings yet

- bcom-CORPORATE ACCOUNTING I - JAN 23Document5 pagesbcom-CORPORATE ACCOUNTING I - JAN 23xyxx1221No ratings yet

- Opportunity ScreeningDocument39 pagesOpportunity Screeningglaide lojero100% (1)

- GST Towards A Rational and Simple Indirect Tax Structure - IJREAMV04I023802Document8 pagesGST Towards A Rational and Simple Indirect Tax Structure - IJREAMV04I023802Rashmi Ranjan PanigrahiNo ratings yet

- Jamb Econs Questions 1 5Document50 pagesJamb Econs Questions 1 5princewills130No ratings yet

- ACC2001 Lecture 10 Interco TransactionsDocument42 pagesACC2001 Lecture 10 Interco Transactionsmichael krueseiNo ratings yet