Professional Documents

Culture Documents

Adv Acc - Buy Back and Liquidation

Uploaded by

rshyams165Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adv Acc - Buy Back and Liquidation

Uploaded by

rshyams165Copyright:

Available Formats

ADVANCED ACCOUNTING SHORT NOTES PROBLEMS

Buy-Back of Securities

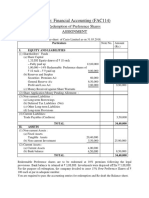

Q. 1 The Balance Sheet of Modern Ltd. as on 31st March, 2018 is as follows:

Equity & Liabilities Rs. Assets Rs.

1. Shareholders’ Funds 1. Non-Current Assets

A) Share Capital Fixed Assets 66,00,000

Equity Share Capital of Rs.10 50,00,000 Investments 18,00,000

each

B) Reserves & Surplus 2. Current Assets

General Reserve 6,50,000 Stock 11,87,000

Securities Premium 5,40,000 Trade Receivables 9,60,000

Profit and Loss account 3,75,000 Cash and Bank balance 7,10,000

2. Non-Current Liabilities

12% Debentures 25,00,000

Term Loan 13,25,000

3. Current Liabilities

Trade Payables 8,67,000

Total Equity & Liabilities 1,12,57,000 Total Assets 1,12,57,000

The shareholders adopted the resolution on the date of above-mentioned Balance Sheet to:

a. Buy Back 20% of the paid-up capital @ Rs. 15 each

b. Issue 5,000 13% Debentures of Rs.100 each at a premium of 10% to finance the

buyback of shares

c. Maintain a balance of Rs. 3,00,000 in general reserve account; and

d. Sell investments worth Rs. 8,00,000 for Rs. 6,50,000. You are required to pass the

necessary journal entries to record the above transactions.

Q. 2 Perrotte Ltd. has the following Capital Structure as on 31.3.17

Particulars (Rs. in crores)

a. Equity Share Capital (Shares of Rs. 10 each fully paid) 330

b. Reserves and Surplus

General Reserve 240

Securities premium account 90

Profit & Loss Account 90

Infrastructure Development Reserve 180 600

c. Loan Funds 1,800

CA_STUDENTS’ STUDY CIRCLE 76

ADVANCED ACCOUNTING SHORT NOTES PROBLEMS

The Shareholders of Perrotte Ltd. on the recommendation of their Board of Directors, have

approved on 12.9.17 a proposal to buy back the maximum permissible number of Equity

shares considering the large surplus funds available at the disposal of the company.

The prevailing market value of the company’s share is Rs. 25 per share and in order to induce

the existing shareholders to offer their shares for buyback, it was decided to offer a price of

20% over market.

You are required to compute the maximum number of shares that can be bought back in the

light of the above information and also under a situation where the loan funds of the company

were either Rs. 1,200 crores or Rs. 1,500 crores.

Assuming that the entire buy back is completed by 9.12.2017, show the accounting entries in

the company’s books in each situation. [Note: Infrastructure Reserve is created to satisfy

Income-tax Act requirements]

Q. 3 Extra Ltd. furnishes you with the following summarized Balance Sheet as on 31.3.18:

Equity & Liabilities Rs. Assets Rs.

Equity shares of Rs. 10 each fully paid 100 Fixed assets less depreciation 50

9% Redeemable preference shares 20 Investments at cost 120

of Rs. 100 each fully paid

Capital Reserves 8 Current assets 142

Revenue Reserves 50

Securities premium 60

10% Debentures 4

Current liabilities 70

312 312

a. The company redeemed the preference shares at a premium of 10% on 1st April, 2018

b. It also bought back 3 lakhs equity shares of Rs. 10 each at Rs. 30 per share. The

payment for the above was made out of huge bank balances, which appeared as a

part of the current assets

c. Included in its investment were “investments in own debentures” costing Rs. 2 lakhs

(face value Rs. 2.2 lakhs). These debentures were cancelled on 1st April, 2018.

d. The company had 1,00,000 equity stock options outstanding on the above-mentioned

date, to the employees at Rs. 20 when the market price was Rs. 30 (This was included

under current liabilities). On 1.4.18 employees exercised their options for 50,000

shares.

e. Pass the journal entries to record the above and prepare Balance sheet on 1.4.18

CA_STUDENTS’ STUDY CIRCLE 77

ADVANCED ACCOUNTING SHORT NOTES PROBLEMS

Q. 4 W, X, Y and Z hold Equity capital is held by in the proportion of 40:30:10:20. A, B, C and

D hold preference share capital in the proportion of 30:40:20:10. If the paid up capital of the

company is Rs. 40 lakh and Preference share capital is Rs. 20 lakh, find their voting rights in

case of resolution of winding up of the company.

CA_STUDENTS’ STUDY CIRCLE 78

ADVANCED ACCOUNTING SHORT NOTES PROBLEMS

LIQUIDATION OF COMPANIES

LISTS TO BE USED IN STATEMENT OF AFFAIRS:

List A Assets not specifically pledged

List B Assets specifically pledged [secured creditors having fixed charge]

List C Preferential Creditors

List D Secured creditors having floating charge

List E Unsecured Creditors – Non-Preferential

List F Preference Share Holders

List G Equity Share Holders

List H Surplus/Deficiency Statement

FORMAT – STATEMENT OF AFFAIRS:

Assets not specifically Pledged [LIST A] {The following List is only illustrative and

not exhaustive:}

Cash

Debtors

Bills Receivable

Loose Tools

Calls in Arrears

Total I

Assets Specifically Pledged [LIST B] [figures are imaginary]

Items Realisable Outstanding Deficiency Surplus

Value liability

Land & Building 100000 70000 - 30000

Plant & Machinery 40000 125000 85000 -

Total surplus 30000

I + 30000 = J

Summary of Gross Assets

Assets not specifically pledged [As per List A] I

Assets specifically pledged [as per List B] 140000

Total [I + 140000] K

Discharge of Liabilities

Gross Liabilities Particulars Amount

B/Fd J

110000 Secured creditors having specific charge [as per List ----

[70000+40000] B]

J

L Preferential Creditors [as per List C] L

M

CA_STUDENTS’ STUDY CIRCLE 79

ADVANCED ACCOUNTING SHORT NOTES PROBLEMS

N Secured Creditors having floating charge [as per List N

D]

O

P Unsecured creditors – Non preferential [as per List E] P

Q [including deficiency of Rs.85000] R

Summary of cross verification

Summary of Gross Assets K

Summary of Gross Liabilities Q

K–Q R

Payment of Capital

B/Fd R

Preference Share Holder [as per S

List F]

T

Equity Share Holder [as per List G] U

If it is positive – Surplus

If it is negative – Deficiency V

List H – Surplus / Deficiency Statement

Amount

I Items decreasing Surplus or Increasing Deficiency W

Estimated realizable value of assets < Book Value

P & L balance in assets side

Contingent liability

II Items Increasing Surplus or Decreasing Deficiency X

Estimated realizable value of assets > Book value

Reserves in liabilities side

III Surplus W – X = Y [Or] Should be equal to V

Deficiency W – X = Z

IMPORTANT POINTS:

• All assets are to be considered at their realisable value

• All liabilities including contingent liabilities are to be considered

• Statement of Affairs should be prepared even before the appointment of liquidator.

Therefore, legal expenses, liquidators remuneration and liquidation expenses will not

be included

• Calls in arrears will be included in LIST A (Uncalled capital will not be included). The

amount which is not recoverable on calls-in-arrears is shown as deduction from called

up capital. Therefore, share capital will be taken at before deducting towards calls in

arrears

CA_STUDENTS’ STUDY CIRCLE 80

ADVANCED ACCOUNTING SHORT NOTES PROBLEMS

• If only a portion of Call in arrears is recoverable, then to the extent it will be shown in

List A. At the time of “Settlement of Capital”, consider capital only to the extent of

balance capital (i.e. capital – Call in arrears irrecoverable)

• Uncalled capital if any, will be shown as a note at the end of the “Statement of affairs”

• Unclaimed dividend if any will be shown as unsecured creditors. However this amount

will be paid only after payment of unsecured creditors

• If no information is given, generally debentures (including interest till the date of

liquidation) are treated as having floating charge on all the assets of the company.

Debenture interest after liquidation till the date of actual payment shall be considered

only if the company is solvent. Where the company is insolvent, interest is payable up

to the date of liquidation.

• Liability in respect of bills discounted by the company is contingent; any amount

expected to be paid in respect of bills discounted should be included in List E

LIQUIDATOR’S FINAL STATEMENT

Liquidator’s Final Statement of Account:

It is the duty of the liquidator to realize the assets of the company under liquidation and

settle the account of every creditor proving his claim against the company

It is therefore, necessary for him to prepare a statement showing how much he realised

and how the same was disbursed among the claimants.

Liquidator has to maintain a “Cash Book” for receipts and payments and has to submit a

summary of the same to the court in case of compulsory winding up and to the company

in case of voluntary winding up

Such summary statement is called as “Liquidator’s Final Statement of Account”

“Sources of Cash for Settlement” to the Liquidator:

Sources of Cash

Net Result of Cash in Hand Surplus from Sale proceeds of Contributions

Trading activity Secured the Assets made by

& Creditors contributories

Order of payment/Presentation for Liquidators Final Statement:

Note: 1 Secured Creditors [Wholly or Partly]

Payment to secured creditors is not shown in liquidator’s final statement of account

Secured Creditors will be settled to the extent of their claim or the amount realised by

sale of securities held by them whichever is less

If the claims of secured creditors are less than the securities realised, then the

surplus will be shown as receipt

If the claims of the secured creditors are more than the securities realised, then the

balance amount [unsatisfied] is included with “Unsecured Creditors”

CA_STUDENTS’ STUDY CIRCLE 81

ADVANCED ACCOUNTING SHORT NOTES PROBLEMS

Note: 2 Liquidator’s Remuneration:

Liquidator’s Remuneration shall be fixed as follows:

Fixed as a % on Fixed as % on

the assets the payment

Fixed Amount Others Combination

realised made to

Important Points:

a. While calculating liquidator’s remuneration on assets realised, the amount of cash and

bank balance is not included. However, if the inclusion of cash and bank balance is

specifically mentioned, then it should be taken into consideration

b. In case if liquidator’s remuneration is fixed as a % on assets realised, and the security is

realised by the creditors themselves, then the remuneration of the liquidator on the assets

realised will be the “Surplus received from secured creditors”

c. In case if liquidator’s remuneration is fixed as a % on the payment made to creditors:

i) If sufficient amount is available to make payment to creditors and liquidator’s remuneration,

then,

Remuneration = [Amount due to creditors x Rate fixed]

ii) If sufficient amount is not available to make payment to creditors, then

Remuneration = [Amount due to creditors x Rate/(100+Rate)]

Note: 3 Payments and Order of Presentation

Preferential creditors have priority over debenture holders [carrying floating charge]

However, while preparing the liquidator’s final statement of account, payment to

preferential creditors is shown after the payment to debenture holders [having floating

charge]

Note: 4 Interest on Liabilities:

In case of solvent companies, interest on liabilities [loan, debenture etc.] is payable upto

the date of payment

In case of insolvent companies, interest on liabilities is payable upto the date of winding

up

A company is said to be solvent, if the assets realised are sufficient to pay all creditors

of the company in full, and some surplus is left over

Note: 5 Unsecured Creditors

Liability in respect of dividend or amounts due to shareholders on account of profits will

be included in the category of unsecured creditors. However, payments regarding

dividend etc.. will be made only after the outsiders are satisfied

A contingent liability may become a actual liability on the happening of a certain event. In

that case, it amount should be included in the category of unsecured creditors.

CA_STUDENTS’ STUDY CIRCLE 82

ADVANCED ACCOUNTING SHORT NOTES PROBLEMS

Note: 6 Preference Shareholders

If preference dividend are declared but not paid, then they are paid as debt and not as

arrear

If preference dividend is in arrear [cumulative preference share only] for one or more

years, and it has not been declared, then unless otherwise mentioned in the articles,

arrears should be paid, only when, after making payment to preference capital and equity

capital in full and surplus is left. To be precise, preference dividend can be paid if it is in

arrear, even before making payment to equity shareholders by virtue of provision in the

articles of company

If the shares are not specifically stated as non-cumulative, then it should be treated as

cumulative

No dividend is generally payable for any period falling after the commencement of winding

up

Note: 7 Treatment of Surplus:

Amount left over after paying to preference shareholders will go to equity shareholders

Any surplus leftover will again goes to equity shareholders, unless the preference shares

are participating preference shares

If preference shares are participating preference shares, then they have a right to share

the surplus left after paying equity share capital

Note: 8 Treatment of Calls in Arrear and Calls in advance

Before making payment to contributories, if there are any calls-in-arrears, it should be

collected by the liquidator first. Similarly if there is any calls-in-advance, it should be returned

to the concerned shareholders before making any payment for capital

Note: 9 Appointment of Receiver:

Sometimes, debenture holders may have power (as per the agreement) to appoint a receiver

in certain circumstances. If a receiver is appointed, he shall realise the assets specifically /

generally. He shall meet the expenses/payment in priority to the debenture holders including

his expenses and remuneration but excluding liquidator’s remuneration. After settling the

above, balance amount will be utilised for satisfying debenture holders.

After satisfying debenture holders, balance amount left will be handover to Liquidator. Duty

of the liquidator is to satisfy the unsecured creditors and shareholders. The receiver shall

prepare “Receipts and Payments account/Receiver’s Final Statement” and shall submit the

same together with surplus if any left, to the company (if it is going concern) or to the liquidator

of the company (if liquidating concern). Note: Except for any special circumstances, the

official liquidator can be appointed as receiver to avoid expenses and conflict.

CA_STUDENTS’ STUDY CIRCLE 83

ADVANCED ACCOUNTING SHORT NOTES PROBLEMS

Practical Questions

Q. 1 Mr. God is appointed as liquidator of Ego Ltd. in voluntary Liquidation, on 1st July 2018.

Following balances are extracted from the books on that date:

Equity & Liabilities Rs.

1. Shareholders’ Funds

A) Share Capital

Capital 24,000 shares of Rs.5 each 1,20,000

Less: Calls in Arrears ( 7,500) 1,12,500

B) Reserves & Surplus

Profit & loss A/c (52,500)

2. Non-Current Liabilities

Debentures 75,000

3. Current Liabilities

Bank Overdraft 27,000

Liabilities for purchases 30,000

Total Equity & Liabilities 1,92,000

Assets Rs.

1. Non-Current Assets

Machinery 45,000

Leasehold Properties 60,000

2. Current Assets

Stock-in-trade 1,500

Trade Receivables 90,000

Less: Reserve for Bad & Doubtful Debts (15,000) 75,000

Investments 9,000

Cash in Hand 1,500

Total Assets 1,92,000

You are required to prepare a statement of affairs to be submitted to the meeting of the

creditors. The following Assets are valued as under:

Machinery Rs.90,000

Leasehold Properties Rs.1,09,000

Investments Rs.6,000

Stock-in- trade Rs.3,000

Bad debts are Rs.3,000 and the doubtful debts are Rs. 6,000 which are estimated to realise

Rs.3,000. The bank overdraft is secured by deposit of the title deeds of leasehold properties.

Preferential Creditors are Rs.1,500. Telephone rent outstanding is Rs.120.

CA_STUDENTS’ STUDY CIRCLE 84

ADVANCED ACCOUNTING SHORT NOTES PROBLEMS

Q. 2 Prepare SOA as far as possible of Luck Ltd. which went into liquidation on 30.6.18

Particulars Amount

Equity Share Capital – 20,000 Equity Shares of Rs.10 each, Rs.5 paid-up 1,00,000

7% Preference Share Capital – 20,000 Shares of Rs.10 each fully paid 2,00,000

6% First Mortgage Debentures secured by a Floating charge upon the whole of 1,50,000

the assets of the company except un-called capital

Fully Secured Creditors (value of Securities Rs.35,000) 30,000

Partly Secured Creditors (value of Securities Rs.10,000) 20,000

Preferential Creditors for rent, taxes, salaries or wages 6,000

Bills Payable 1,00,000

Unsecured Creditors 70,000

Bank Overdraft 10,000

Bills Receivable in Hand 15,000

Bills Discounted (one bill for Rs.10,000 estimated to be bad) 30,000

Investments in shares – Estimated value Rs.35,000 (deposited with secured 50,000

creditors)

G.P. Notes: estimated values Rs.10,000 (deposited with secured creditors) 15,000

Book debts:

Good 10,000

Doubtful (estimated to produce 50 paisa in a rupee) 7,000

Bad 6,000

Land and Building (estimated to produce Rs.1,00,000) 1,50,000

Stock –in- Trade (estimated to produce Rs.40,000) 50,000

Machinery and Tools (estimated to produce Rs.2,000) 5,000

Cash in Hand 100

Q. 3 For “M Ltd.” winding up order has been issued as on 31.3.18. The Reserves of the

company on 1.4.17 amounted to Rs. 7,500. You are required to prepare “Statement of Affairs

& Deficiency Account”

Particulars Amount Particulars Amount

Freehold premises (book value 3,75,000 Bank overdraft – unsecured 58,125

Rs.4,50,000) valued at

First mortgage of freehold 3,00,000 Cash in Hand 825

premises

Second mortgage of freehold 1,12,500 Stock (at cost Rs.50,850) 33,900

premises

estimated to realise

CA_STUDENTS’ STUDY CIRCLE 85

ADVANCED ACCOUNTING SHORT NOTES PROBLEMS

8% debentures carrying a 1,50,000 Issued Capital:

floating charge on the

undertaking, interest due 1st

January and 1st July and paid on

due dates

Managing Director’s 22,500 Equity Shares of Rs.10 each 1,50,000

emoluments Not an e/ee

fully called up

(6 months) NON pref

Staff salary unpaid (one month) 16,050 Calls-in-arrears, Rs.3,000 1,500

estimated to realise

Trade Receivables Unsecured creditors 2,96,250

– Good 31,500 Contingent liability in respect 18,000

of a claim for damages

Rs.37,500 – estimated to be

settled for

– Doubtful (estimated to realise 12,900 Tax liability for year ending 5,250

50%) 31.3.2016

– Bad 72,750 Tax liability for year ending 1,275

31.3.2017

Plant and Machinery (book value 1,74,000 Tax liability for year ending 2,700

Rs.2,47,500) estimated to realise 31.3.2018

Liquidator’s Final Statement of Account:

Q. 4 A company went into liquidation on 31.3.18, when the following Balance Sheet was

prepared:

Equity & Liabilities Rs.

1. Shareholders’ Funds

A) Share Capital

19,500 shares of Rs.10 each 1,95,000

fully paid

B) Reserves & Surplus

Profit & Loss A/c (98,680)

2. Non-Current Liabilities

Partly secured (on freehold 55,310

property)

Unsecured 99,790

3. Current Liabilities

Trade Payables (Preferential) 24,200

Bank Overdraft (unsecured) 12,000

Total Equity & Liabilities 2,87,620

CA_STUDENTS’ STUDY CIRCLE 86

ADVANCED ACCOUNTING SHORT NOTES PROBLEMS

Assets Rs.

1. Non-Current Assets

Goodwill and patents 50,000

Freehold building 48,000

Plant 65,500

2. Current Assets

Stock-in-trade 56,800

Cash 2,500

Trade Receivables 64,820

Total Assets 2,87,620

The Liquidator realized the assets as follows: Freehold property Rs. 35,000, Plant Rs. 51,000,

Stock-in-trade Rs. 39,000 Trade Receivables Rs. 58,500 and cash Rs. 2,500. The expenses

of liquidation amounted to Rs. 1,000 and the liquidator's remuneration was agreed to 2.5%

on the amount realised and 2% on the amount paid to unsecured creditors. You are required

to prepare the liquidator's final account.

Q. 5 The following particulars relate to a Limited Company which has gone into voluntary

liquidation. You are required to prepare the Liquidator’s Statement of Account allowing for his

remuneration @ 2½% on all assets realized excluding call money received and 2% on the

amount paid to unsecured creditors including preferential creditors.

Share capital issued:

10,000 Preference shares of Rs.100 each fully paid up.

50,000 Equity shares of Rs.10 each fully paid up.

30,000 Equity shares of Rs.10 each, Rs.8 paid up.

Assets realized Rs.20,00,000 excluding the amount realized by sale of securities held by

partly secured creditors.

Rs.

Preferential creditors 50,000

Unsecured creditors 18,00,000

Partly secured creditors (Assets realized Rs.3,20,000) 3,50,000

Debenture holders having floating charge on all assets of the company 6,00,000

Expenses of liquidation 10,000

A call of Rs.2 per share on the partly paid equity shares was duly received except in case of

one shareholder owning 1,000 shares. Also calculate the percentage of amount paid to the

unsecured creditors to the total unsecured creditors.

CA_STUDENTS’ STUDY CIRCLE 87

ADVANCED ACCOUNTING SHORT NOTES PROBLEMS

Q. 6 X Ltd went into voluntary liquidation on 31.12.17 when their Balance sheet read as

follows:

Equity & Liabilities Rs.

1. Shareholders’ Funds

A) Share Capital

15,000 10% cumulative preference shares of Rs.100/- each fully paid 15,00,000

7,500 equity shares of Rs.100 each, Rs.75 paid 5,62,500

22,500 equity shares of Rs.100 each, Rs.60 paid 13,50,000

B) Reserves & Surplus

Profit and Loss a/c. (8,53,750)

2. Non-Current Liabilities

15% Debentures secured by a floating charge 7,50,000

3. Current-Liabilities

Interest outstanding on Debentures 1,12,500

Trade Payables 9,56,250

Total Equity & Liabilities 43,77,500

Assets Rs.

1. Non-Current Assets

Land and Buildings 7,50,000

Machinery and Plant 18,75,000

Patents 3,00,000

2. Current Assets

Stock 4,02,500

Trade Receivables 8,25,000

Cash at Bank 2,25,000

Total Assets 43,77,500

Preference dividends were in arrears for 2 years and the creditors included preferential

creditors of Rs. 38,000. The assets were realised as follows: Land and Buildings Rs. 9,00,000;

Machinery and Plant Rs. 15,00,000; Patents Rs. 2,25,000; Stocks Rs. 4,50,000; Trade

Receivables Rs. 6,00,000.

The expenses of liquidation amounted to Rs.27,250. The liquidator is entitled to a commission

of 3% on assets realised except cash. Assuming the final payments including those on

debentures were made on 30th June, 2018, show the liquidator's final statement of Account.

CA_STUDENTS’ STUDY CIRCLE 88

ADVANCED ACCOUNTING SHORT NOTES PROBLEMS

Q. 7 The Beetel Valley Mining Co. Ltd. went into voluntary liquidation on 1.1.18, as its mines

had reached such a state of depletion that it become too costly to excavate further minerals.

The Liquidator, whose remuneration is 3% on realisation of assets and 2% on distribution to

shareholders, realized all the assets. The following was the position of the company on

31.12.17.

Particulars Rs.

Cash on Realisation of Assets 5,00,000

Expenses of Liquidation 9,000

Unsecured creditors (including salaries for 1 month prior to liquidation, 68,000

Rs.6,000)

5,000 6% Preference Shares of Rs.30 each (dividend paid up to 31st 1,50,000

December, 2016)

10,000 Equity Shares of Rs.10 each, Rs.9 per share called and paid up 90,000

General Reserve as at 31st December 2017 1,20,000

Profit and Loss Account as at 31st December, 2017 20,000

Under the Articles of Association of the company the Preference Shareholders’ have the right

to receive one third of the surplus remaining after repaying the equity share capital.

Q. 8 The following is the Balance Sheet of Over Confident Ltd., as on 31st December 2018.

Equity & Liabilities Rs.

1. Shareholders’ Fund

A) Share Capital

10,000 7% Preference Shares of Rs.10 1,00,000

each

10,000 Equity Shares of Rs.10 each, 1,00,000

fully paid

5,000 Equity Shares of Rs.10 each, 42,500

Rs.8.50 paid

B) Reserves & Surplus

Profit and Loss Account (33,500)

2. Non-Current Liabilities

6% Debentures 2,50,000

Loan on Mortgage 30,000

3. Current Liabilities

Bank Overdraft 25,000

Trade Creditors 55,000

Income Tax payable 20,000

Total Equity & Liabilities 5,89,000

CA_STUDENTS’ STUDY CIRCLE 89

ADVANCED ACCOUNTING SHORT NOTES PROBLEMS

Assets Rs.

1) Non-Current

Assets

Sundry Assets 5,29,000

Preliminary Expenses 10,000

Buildings 50,000

Total Assets 5,89,000

The mortgage was secured on the buildings and the debentures were secured by a floating

charge on all the asset of the company. The debenture holders appointed a Receiver. A

Liquidator was also appointed, the company being voluntarily wound-up. The expenses of

liquidation were Rs.2,000. The Receiver was entrusted with the task of realizing the Buildings

which fetched Rs.40,000. The Receiver took charge of "Sundry Assets" amounting to

Rs.4,00,000 and sold them for Rs.3,70,000. The Bank was secured by a personal guarantee

of the directors who discharged their obligations in full.

The balance of the assets realised by liquidator for Rs.1,25,000. The remuneration of the

liquidator was Rs.750. Preference dividend was in arrear for 3 years. Prepare the accounts

to be submitted by the Receiver and Liquidator.

B LIST OF CONTRIBUTORIES

Q. 9 The Liquidation of MP Ltd. commenced on April 2, 2018 certain creditors could not

receive payments out of the realisation of assets and out of the contributions from "A" list

contributories. The following are the details of certain transfers took place in 2017 and 2018.

Shareholders No. of Date of Creditors remaining unpaid

outstanding shares ceasing to be and at the date of ceasing to

transferred member be member

X 1,500 1st March Rs.4,000

2017

A 1,000 1st May 2017 Rs.6,000

st

B 1,500 1 October Rs.7,500

2017

C 300 1st Nov 2017 Rs.8,000

st

D 200 1 Feb. 2018 Rs.9,000

All the shares were Rs. 10 each Rs. 6 paid up ignoring expenses, remuneration to liquidator,

etc. show the amount to be realized from the various persons listed above.

CA_STUDENTS’ STUDY CIRCLE 90

You might also like

- Learning Unit 7 - Elimination of Intragroup TransactionsDocument61 pagesLearning Unit 7 - Elimination of Intragroup TransactionsThulani NdlovuNo ratings yet

- 3054 Faca-V L 8Document8 pages3054 Faca-V L 8ab6154951No ratings yet

- Commerce (Regular) Accounting For Specialised Institutions (Group A: Accounting and Finance) Paper - 3.5 (A)Document4 pagesCommerce (Regular) Accounting For Specialised Institutions (Group A: Accounting and Finance) Paper - 3.5 (A)Sanaullah M SultanpurNo ratings yet

- Internal ReconstructionDocument8 pagesInternal Reconstructionsmit9993No ratings yet

- 5.liquidation of Companies PDFDocument7 pages5.liquidation of Companies PDFgracel angela tolejanoNo ratings yet

- Paper18 Solution PDFDocument24 pagesPaper18 Solution PDFI'm Just FunnyNo ratings yet

- Accounting For Holding Co. (Lecture 3) : Total 12,00,000 6,00,000Document6 pagesAccounting For Holding Co. (Lecture 3) : Total 12,00,000 6,00,000Michael JimNo ratings yet

- SEM III - Advanced Accounting (EM)Document4 pagesSEM III - Advanced Accounting (EM)Abdul MalikNo ratings yet

- Fa 5Document14 pagesFa 5divyayella024No ratings yet

- Accountancy 12th SPSDocument4 pagesAccountancy 12th SPSMahesh TandonNo ratings yet

- Limited Company Format A2 (Repaired)Document7 pagesLimited Company Format A2 (Repaired)Sterling ArcherNo ratings yet

- Buy Back of Shares HandoutDocument15 pagesBuy Back of Shares Handoutdhiren.c.shekar99No ratings yet

- Afar 02: Corporate Liquidation: I. True or False - Theory of AccountsDocument5 pagesAfar 02: Corporate Liquidation: I. True or False - Theory of AccountsRoxell CaibogNo ratings yet

- Dissolution of A PartnerDocument11 pagesDissolution of A PartnerjdsiNo ratings yet

- Abc Unit 3 PDFDocument7 pagesAbc Unit 3 PDFLuckygirl JyothiNo ratings yet

- Paper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Document56 pagesPaper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Basant OjhaNo ratings yet

- Corporate Accounting - IIDocument2 pagesCorporate Accounting - IISiva KumarNo ratings yet

- Corporate Accounting IIDocument5 pagesCorporate Accounting II2vj77sn8x5No ratings yet

- CA Bcom PH 3rd Sem 2016Document7 pagesCA Bcom PH 3rd Sem 2016Gursirat KaurNo ratings yet

- Internal Reconstruction NotesDocument16 pagesInternal Reconstruction NotesAkash Mehta100% (1)

- Corporate Accounting Ii 2020Document4 pagesCorporate Accounting Ii 2020joe josephNo ratings yet

- Preference Shares AssignmentDocument4 pagesPreference Shares AssignmentDhairya ShahNo ratings yet

- AdvDocument19 pagesAdvashwin krishnaNo ratings yet

- CP 123 PDFDocument4 pagesCP 123 PDFJoshi DrcpNo ratings yet

- 18CSU13 PSG College of Arts & Science Bcom (CS) Degree Examination May 2021Document5 pages18CSU13 PSG College of Arts & Science Bcom (CS) Degree Examination May 202119BCS531 Nisma FathimaNo ratings yet

- Ca-Ii May 2022Document6 pagesCa-Ii May 2022Gayathri V GNo ratings yet

- Admission of A Partner PDFDocument8 pagesAdmission of A Partner PDFSpandan DasNo ratings yet

- Financial Statement Sums - 230329 - 001857Document26 pagesFinancial Statement Sums - 230329 - 001857AppleNo ratings yet

- RTP June 19 QnsDocument15 pagesRTP June 19 QnsbinuNo ratings yet

- June 2019Document182 pagesJune 2019shankar k.c.No ratings yet

- Class 12 AccountsDocument5 pagesClass 12 AccountsVishal AgarwalNo ratings yet

- CBSE 12 Accountancy 2017-1Document21 pagesCBSE 12 Accountancy 2017-1mohit pandeyNo ratings yet

- Fin Reporting and FSA-fund Flow Statment 6th Sem by VS (Vinay Shaw0 For MorningDocument12 pagesFin Reporting and FSA-fund Flow Statment 6th Sem by VS (Vinay Shaw0 For MorningSarfraz AhmedNo ratings yet

- Cap III Group I RTP Dec 2023Document111 pagesCap III Group I RTP Dec 2023meme.arena786No ratings yet

- MA A-3 Ratio AnalysisDocument3 pagesMA A-3 Ratio AnalysisShilpa AroraNo ratings yet

- National Institute of Technology Goa: Programme Name: B.Tech. End Semester Examinations, May-2021Document4 pagesNational Institute of Technology Goa: Programme Name: B.Tech. End Semester Examinations, May-2021Vishal KevatNo ratings yet

- RTP Dec 18 QNDocument21 pagesRTP Dec 18 QNbinu100% (1)

- Balance Sheet CompanyDocument16 pagesBalance Sheet CompanyNidhi ShahNo ratings yet

- Asset Base Approach ProblemsDocument5 pagesAsset Base Approach Problemspratik waliwandekarNo ratings yet

- Consolidation Question PaperDocument42 pagesConsolidation Question PaperNick VincikNo ratings yet

- Final Ca: MAY '19 Financial ReportingDocument13 pagesFinal Ca: MAY '19 Financial ReportingJINENDRA JAINNo ratings yet

- Advanced Accounts MTP M21 S2Document19 pagesAdvanced Accounts MTP M21 S2Harshwardhan PatilNo ratings yet

- Test Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument6 pagesTest Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingOcto ManNo ratings yet

- Coursebook Answers: Answers To Test Yourself QuestionsDocument2 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii83% (40)

- Important Que Advanced Cor AccDocument18 pagesImportant Que Advanced Cor Accvineethaj2004No ratings yet

- IPS Academy, IBMR Session Jan-June 2020 BBA II Semester: Assignment Of: Financial ManagementDocument6 pagesIPS Academy, IBMR Session Jan-June 2020 BBA II Semester: Assignment Of: Financial ManagementDrShailesh Singh ThakurNo ratings yet

- Chapter 4 Liquidation of Companies TYBAFDocument4 pagesChapter 4 Liquidation of Companies TYBAFvikax90927No ratings yet

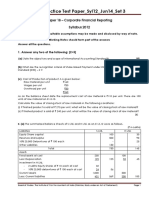

- P18 - Practice Test Paper - Syl12 - Jun14 - Set 3: Paper 18 - Corporate Financial Reporting Syllabus 2012Document9 pagesP18 - Practice Test Paper - Syl12 - Jun14 - Set 3: Paper 18 - Corporate Financial Reporting Syllabus 2012ChandreshNo ratings yet

- ACC16 - HO 1 - Corporate LiquidationDocument5 pagesACC16 - HO 1 - Corporate LiquidationAubrey DacirNo ratings yet

- Advanced AccountingDocument68 pagesAdvanced AccountingOsamaNo ratings yet

- Valuation of SharesDocument10 pagesValuation of SharesAmira JNo ratings yet

- Dwaraka Doss Goverdhan Doss Vaishnav College (Autonomous) Arumbakkam, Chennai - 600 106. Department of Corporate Secretaryship Core Paper V-Corporate AccountingDocument4 pagesDwaraka Doss Goverdhan Doss Vaishnav College (Autonomous) Arumbakkam, Chennai - 600 106. Department of Corporate Secretaryship Core Paper V-Corporate AccountingNeeraj DNo ratings yet

- Accountancy QP 3 (A) 2023Document5 pagesAccountancy QP 3 (A) 2023mohammedsubhan6651No ratings yet

- Corrporate ModelDocument10 pagesCorrporate Modelnithinjoseph562005No ratings yet

- Sem-5 10 BCOM HONS DSE-5.2A CORPORATE-ACCOUNTING-0758Document5 pagesSem-5 10 BCOM HONS DSE-5.2A CORPORATE-ACCOUNTING-0758hussain shahidNo ratings yet

- The Commerce Villa: Time: 1.5 Hour Marks: 40 Topic: Debentures & Financial Statements of A Company (AC - 06)Document11 pagesThe Commerce Villa: Time: 1.5 Hour Marks: 40 Topic: Debentures & Financial Statements of A Company (AC - 06)Shreyas PremiumNo ratings yet

- Age No 5Document126 pagesAge No 5Deeran DhayanithiRPNo ratings yet

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Lets Analyze Bvps and Eps ParconDocument9 pagesLets Analyze Bvps and Eps ParconJeric TorionNo ratings yet

- Exercise Advanced Accounting SolutionsDocument14 pagesExercise Advanced Accounting SolutionsMiko Victoria Vargas75% (4)

- THREEBond and Stock Valuation - BondDocument22 pagesTHREEBond and Stock Valuation - BondRaasu KuttyNo ratings yet

- SEBI ICDR Regulations PDFDocument255 pagesSEBI ICDR Regulations PDFjayeshNo ratings yet

- Financial Management: FINA 6212Document81 pagesFinancial Management: FINA 6212Yuhan KENo ratings yet

- Stocks and Their Valuation: After Studying This Chapter, Students Should Be AbleDocument35 pagesStocks and Their Valuation: After Studying This Chapter, Students Should Be AbleShantanu ChoudhuryNo ratings yet

- The Accounting Cycle: Reporting Financial Results: Mcgraw-Hill/IrwinDocument28 pagesThe Accounting Cycle: Reporting Financial Results: Mcgraw-Hill/Irwinazee inmixNo ratings yet

- INVENTORY MANAGEMENT TechniquesDocument24 pagesINVENTORY MANAGEMENT TechniquesWessal100% (1)

- Istilah Ekonomi Dalam Bahasa InggrisDocument3 pagesIstilah Ekonomi Dalam Bahasa InggrisJuharNo ratings yet

- True or False-Conceptual Framework and Accounting StandardsDocument3 pagesTrue or False-Conceptual Framework and Accounting StandardsSaeym SegoviaNo ratings yet

- Bonds CalculationsDocument9 pagesBonds CalculationsNajwanOdehNo ratings yet

- Crash Course Sheet - NEW-48-60 (1) - 2Document13 pagesCrash Course Sheet - NEW-48-60 (1) - 2MBaralNo ratings yet

- Taxation Matters Relating To Securities and DerivativesDocument60 pagesTaxation Matters Relating To Securities and DerivativesAnjali JainNo ratings yet

- Acc 201 CH 9Document7 pagesAcc 201 CH 9Trickster TwelveNo ratings yet

- The Information Approach To Decision UsefulnessDocument26 pagesThe Information Approach To Decision UsefulnessDiny Fariha ZakhirNo ratings yet

- Preqin Quarterly Update Private Debt Q3 2019Document8 pagesPreqin Quarterly Update Private Debt Q3 2019dNo ratings yet

- Shane Ellis TheoryDocument13 pagesShane Ellis TheoryYukihiro100% (1)

- Job Batch CostingDocument21 pagesJob Batch CostingsamiNo ratings yet

- Module 2 EquityDocument14 pagesModule 2 EquityFujoshi BeeNo ratings yet

- Ratios Used To Evaluate Short Term Financial Position (Short Term Solvency and Liquidity)Document3 pagesRatios Used To Evaluate Short Term Financial Position (Short Term Solvency and Liquidity)MJNo ratings yet

- Kresta - KPMG Independent Expert Report (Pages 39 To 96)Document96 pagesKresta - KPMG Independent Expert Report (Pages 39 To 96)Celine LowNo ratings yet

- Chapter 7 CBMDocument10 pagesChapter 7 CBMShaikh Saifullah KhalidNo ratings yet

- Leverage Buyout Project2Document22 pagesLeverage Buyout Project2arnab_b87No ratings yet

- International Bond MarketDocument15 pagesInternational Bond MarketHarvinton LiNo ratings yet

- Basics of Stock Market-S1Document36 pagesBasics of Stock Market-S1shivam4822No ratings yet

- CFR Paper 2020 PDFDocument10 pagesCFR Paper 2020 PDFharoon nasirNo ratings yet

- Credit RatingDocument33 pagesCredit RatingPALLAVI DUREJANo ratings yet

- SY BBA Management Accouting NotesDocument31 pagesSY BBA Management Accouting NotesadityaNo ratings yet

- Chapter 2 PQ FMDocument5 pagesChapter 2 PQ FMRohan SharmaNo ratings yet

- Lec 10Document26 pagesLec 10danphamm226No ratings yet