Professional Documents

Culture Documents

Accountancy Paper Class 11 Term 2

Accountancy Paper Class 11 Term 2

Uploaded by

Ranjan RoyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accountancy Paper Class 11 Term 2

Accountancy Paper Class 11 Term 2

Uploaded by

Ranjan RoyCopyright:

Available Formats

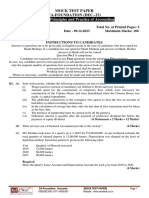

[TE] T I M E E D U T O R

ACCOUNTANCY

CLASS 11

Max. Marks : 40 Time: 1 hours

1. On 1st April 2020 Tata Technologies ltd. purchased five machines of Rs. 60,000 each.

Depreciation @ 10 % p.a. on initial cost has been charged from the profit and loss

account and credited to provision for depreciation account.

On 1st April 2022 one machine was sold for Rs. 42,750 and on 31st August 2024

another machine was sold for Rs.31,800. An improved model costing Rs. 1,00,000

was purchased on 1st October 2021. Books are closed on on 31st march each year.

(10)

You are required to show

(i) Machinery account

(ii) Provision for depreciation account

(iii) Machinery disposal account.

2. Rectify the following errors: (10)

i. Salary paid ₹ 5,000 was debited to employee’s personal account.

ii. Rent Paid ₹ 4,000 was posted to landlord’s personal account.

iii. Cash received from Kohli ₹ 2,000 was posted to Kapoor’s account.

iv. Goods withdrawn by proprietor for personal use ₹ 1,000 were debited to

sundry expenses account.

v. Goods returned to Subhman ₹ 4,000 were recorded as ₹ 400.

vi. Credit purchases from Rohan ₹ 9,000 were not recorded.

vii. Sales return book overcast by ₹ 300.4

viii. Cash sales ₹ 2,000 were posted to the debit of sales account as ₹ 5,000.

ix. Goods returned to Mahendra ₹ 4,000 were posted to the credit of Narendra

as ₹ 3,000.

x. Depreciation provided on machinery ₹ 4,000 was posted as ₹ 400.

You might also like

- Issuance of Share and DebenturesDocument5 pagesIssuance of Share and DebentureshamdanNo ratings yet

- SET E XI ACCOUNTS Unit Test MTP 2023-24 by Praful SirDocument5 pagesSET E XI ACCOUNTS Unit Test MTP 2023-24 by Praful SirnisharvishwaNo ratings yet

- Test 5 Principles and Practice of AccountingDocument6 pagesTest 5 Principles and Practice of Accountingshreya shettyNo ratings yet

- © The Institute of Chartered Accountants of India: TH ST THDocument6 pages© The Institute of Chartered Accountants of India: TH ST THomkar sawantNo ratings yet

- CA Foundation MTP 2020 Paper 1 QuesDocument6 pagesCA Foundation MTP 2020 Paper 1 QuesSaurabh Kumar MauryaNo ratings yet

- © The Institute of Chartered Accountants of India: TH ST THDocument15 pages© The Institute of Chartered Accountants of India: TH ST THGaurav KumarNo ratings yet

- DEPRECIATION2Document2 pagesDEPRECIATION2PearlNo ratings yet

- Test Series: April, 2021 Mock Test Paper 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument7 pagesTest Series: April, 2021 Mock Test Paper 2 Intermediate (New) : Group - I Paper - 1: AccountingHarsh KumarNo ratings yet

- 6104 - Accounting For Managers MBA FT 2021Document4 pages6104 - Accounting For Managers MBA FT 2021akshitapaul19No ratings yet

- Accounts RTP Foundation Nov 2020Document25 pagesAccounts RTP Foundation Nov 2020Jayasurya MuruganathanNo ratings yet

- File 9563Document29 pagesFile 9563dhananijeneelNo ratings yet

- +1 Accountancy ONLINE Final Examination 2021Document5 pages+1 Accountancy ONLINE Final Examination 2021Rajwinder BansalNo ratings yet

- Session Ending Examination 2019Document7 pagesSession Ending Examination 2019madhudevi06435No ratings yet

- RTP June 2018 QnsDocument14 pagesRTP June 2018 QnsbinuNo ratings yet

- Accounts 11th Class Sample PaperDocument8 pagesAccounts 11th Class Sample PaperVineet SinghNo ratings yet

- Acc Full Test 3Document6 pagesAcc Full Test 3Periyanan VNo ratings yet

- AbdulSamad 12 15796 1 DepreciationDocument12 pagesAbdulSamad 12 15796 1 DepreciationSyed SumamaNo ratings yet

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocument25 pagesPaper - 1: Principles & Practice of Accounting Questions True and Falsegargee thakareNo ratings yet

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocument29 pagesPaper - 1: Principles & Practice of Accounting Questions True and FalseMayur bhujadeNo ratings yet

- Depreciation 28-10-23Document8 pagesDepreciation 28-10-23RONAK THE LEGENDNo ratings yet

- Rabindra Vidya Niketan Practical Question Paper Subjects - Accountancy Full Mark - 08 Time-20 MinutesDocument1 pageRabindra Vidya Niketan Practical Question Paper Subjects - Accountancy Full Mark - 08 Time-20 MinutesSuvam SahuNo ratings yet

- Class 11 Accounts Half Yearly SPDocument9 pagesClass 11 Accounts Half Yearly SPRakesh AgarwalNo ratings yet

- Mock Paper - 2017-18 Class-Xi: General InstructionsDocument6 pagesMock Paper - 2017-18 Class-Xi: General InstructionsMukul YadavNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaJayaprakash VenkatesanNo ratings yet

- Accounting EquationsDocument1 pageAccounting EquationsMurtaza JamaliNo ratings yet

- Ambience Academy: STD 11 Commerce Account DepeciationDocument2 pagesAmbience Academy: STD 11 Commerce Account DepeciationMenu GargNo ratings yet

- 11 Accountancy SP 2Document17 pages11 Accountancy SP 2Vikas Chandra BalodhiNo ratings yet

- TestDocument3 pagesTestMehak AliNo ratings yet

- Accountancy: General InstructionsDocument5 pagesAccountancy: General InstructionsSwami NarangNo ratings yet

- 11 Accountancy SP 1 PDFDocument17 pages11 Accountancy SP 1 PDFSumit MazumderNo ratings yet

- T I C A P: Foundation Examinations Spring 2009Document4 pagesT I C A P: Foundation Examinations Spring 2009Robert AngelioNo ratings yet

- 650d55c860e827001812a329 - ## - Accountancy Master Test - 2 - Questions - 650d55c860e827001812a329Document4 pages650d55c860e827001812a329 - ## - Accountancy Master Test - 2 - Questions - 650d55c860e827001812a329sushil262004No ratings yet

- SAMPLE PAPER - (Solved) : For Examination March 2018 Accountancy Class - XIDocument14 pagesSAMPLE PAPER - (Solved) : For Examination March 2018 Accountancy Class - XISaksham AroraNo ratings yet

- Fall 2008 Past PaperDocument4 pagesFall 2008 Past PaperKhizra AliNo ratings yet

- RE Exam FA Sem I MFM MMM MHRDMDocument4 pagesRE Exam FA Sem I MFM MMM MHRDMPARAM CLOTHINGNo ratings yet

- Accountancy Sample PaperDocument6 pagesAccountancy Sample PaperDevansh BawejaNo ratings yet

- Practice Paper by Dr. Vinod Kumar: For Final Examination March 2021Document16 pagesPractice Paper by Dr. Vinod Kumar: For Final Examination March 2021Pushpinder KumarNo ratings yet

- 11 Sample Papers Accountancy 2020 English Medium Set 1 PDFDocument13 pages11 Sample Papers Accountancy 2020 English Medium Set 1 PDFpriyaNo ratings yet

- Qus. MTP Accounts - 09.12.23Document5 pagesQus. MTP Accounts - 09.12.23karann021003No ratings yet

- UT 1 AccountsDocument4 pagesUT 1 Accountskarishma prabagaranNo ratings yet

- 4 MarksDocument4 pages4 MarksEswari GkNo ratings yet

- Part - A (: Time Allowed: 3 Hours Maximum Marks: 90Document4 pagesPart - A (: Time Allowed: 3 Hours Maximum Marks: 90NameNo ratings yet

- Nov - 19 - Question and AnswersDocument15 pagesNov - 19 - Question and AnswersVidhi AgrawalNo ratings yet

- CA Inter Accounting Full Test 1 Nov 2022 Unscheduled Test PaperDocument18 pagesCA Inter Accounting Full Test 1 Nov 2022 Unscheduled Test Papersinku123No ratings yet

- Test Series: March, 2022 Mock Test Paper 1 Foundation Course Paper - 1: Principles and Practice of AccountingDocument5 pagesTest Series: March, 2022 Mock Test Paper 1 Foundation Course Paper - 1: Principles and Practice of AccountingVinithaNo ratings yet

- UntitledDocument269 pagesUntitledvijaypeketiNo ratings yet

- Term Test-1 FAR-1Document6 pagesTerm Test-1 FAR-1Dua FarmoodNo ratings yet

- First Semester MBA Degree Examination, May/June 2010: Accounting For ManagersDocument4 pagesFirst Semester MBA Degree Examination, May/June 2010: Accounting For Managersnitte5768No ratings yet

- CA Foundation Accounts RTP Nov22Document29 pagesCA Foundation Accounts RTP Nov22adityatiwari122006No ratings yet

- DepreciationDocument15 pagesDepreciationYash AggarwalNo ratings yet

- 11th BK Final Exam Quesiton Paper March 2021Document5 pages11th BK Final Exam Quesiton Paper March 2021Harendra Prajapati100% (1)

- Spring 2009 Past PaperDocument4 pagesSpring 2009 Past PaperKhizra AliNo ratings yet

- Concepts and Accounting Equations Test - 02Document2 pagesConcepts and Accounting Equations Test - 02Khushi GuptaNo ratings yet

- Class 11 Accountancy Worksheet - 2023-24Document17 pagesClass 11 Accountancy Worksheet - 2023-24Yashi BhawsarNo ratings yet

- CPT Mock Question PaperDocument40 pagesCPT Mock Question PaperbaburamNo ratings yet

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocument29 pagesPaper - 1: Principles & Practice of Accounting Questions True and FalsePiyush GoyalNo ratings yet

- Revision Test Paper: Cap-Ii: Advanced Accounting: Questions Accounting For DepartmentsDocument153 pagesRevision Test Paper: Cap-Ii: Advanced Accounting: Questions Accounting For Departmentsshankar k.c.No ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Innovative Infrastructure Financing through Value Capture in IndonesiaFrom EverandInnovative Infrastructure Financing through Value Capture in IndonesiaRating: 5 out of 5 stars5/5 (1)