Professional Documents

Culture Documents

Advanced FA I - Individual Assignment 1

Uploaded by

Hawultu AsresieCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Advanced FA I - Individual Assignment 1

Uploaded by

Hawultu AsresieCopyright:

Available Formats

Q1.

On January1,2010, Lifan motors Plc has acquired a 60% ownership interest in Horizon

Company by investing ETB 420,000. The remaining ownership interest(40%) of Horizon belongs

to YaYo Engineering plc. which invested ETB 280,000. The bylaw of Horizon requires at least

75% vote of owners on its major financial and operating decisions .

After operating for one year, Horizon has prepared the following income statement and Balance

sheet on decemeber31,2010

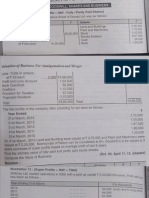

Horizon / Income Statement

For the Year Ended December 31, 2010

Revenue 2,000,000

Less: Costs and expense ( 200,000)

Net Income 800,000

Horizon / Balance sheet

December 31, 2010

Current Assets ETB 1,300,000 Liabilities & Equity

PPE 2,000,000 Current Liabilities 1,000,000

Total Assets 3,300,000 Long-Term Liabilities 800,000

Total Liabilities 1,800,000

Owners Equity

Lifan 900,000

YaYo 600,000

Total Liabilities & Capital 3,300,000

Question 1. What is the level of influence that lifan exerts over major decision of

Horizon company(Investee). (single control, joint control, significant influence or no

significant influence)

Question 2. Assume Horizon is a joint operation for Lifan Motors

a) Record the investment made by lifan on January 1,2010

b) Record the profit reported by Horizon on the book of lifan on decemeber31,2010

c) Complete the missing items in the following Separate income statement and

balance sheet of Lifan

Lifan /P &L Statement

For the Year Ended December 31, 2010

Revenue 5,000,000

Investment income ________

Less: Costs ( 3,000,000)

Net Income ___________

Lifan /Balance sheet

December 31, 2010

Current Assets ETB 1,00,000

Investment in Horizon _______

PPE 2,000,000

Total Assets _________

Liabilities & Capital

Current Liabilities 200,000

Long-Term Liabilities 800,000

Total Liabilities 1,000,000

Owners Equity 2,900,000

Total Liabilities & Capital 3,900,000

d) Complete the following work sheet for lifan Motors and prepare proportionally

consolidated Income statement and balance sheet

Items Lifan Motors Share in the Elimination Consolidated

Horizon balance

P & L statement

Sales

Investment income

Costs

Net income

Balance Sheet

Current assets

Investment

PPE

Total assets

Current liability

Long term liablity

Dec31,2010,capital

Total lia & capital

Question 3. Assume Horizon is a joint Venture for Lifan Motors

a) Record the investment made by lifan on January 1,2010

b) Record the profit reported by Horizon on the book of lifan on decemeber31,2010

c) Prepare separate Income statement and balance sheet for lifan

Question4. Assume Eat Fruit Enterprise has been operating for the last 5 years. The authorized capital

of the enterprise is 8,000,000 birr. The balance of legal reserve at the end of 5th year is 1,580,000.

The net income of 6th year and 7th year are birr 100,000 and 300,000 respectively. If other reserve of

50,000 was allowed in 6th year and nil in 7th year:

I. compute state dividend of 6th and 7th year.

II. Record closing profit of 6th and 7th year to appropriate accounts

Question5. Assume Alebejimla Enterprise has been operating for the last 5 years. The authorized capital

of the enterprise is 18,000,000 birr. The following are Income statement and balance sheet prepared on

June30,2013

Alebejimla Enterprise

Balance Sheet

June30, 2013 (Br ‘000)

Assets Book Value Fair Value

Cash 10,000 10,000

Accounts Receivable 2,000 1,800

Inventory 3,000 4,200

Property, Plant and equipment (net) 8,000 10,000

Total assets 23,000 26,000

Liabilities and Capital

Accounts Payable 300 300

Income tax payable 100 100

State Dividend Payable 150 150

Total Liability 550 550

State Capital 18,000

Legal Reserve 3,600

Other Reserves 850

Total Liabilities and Capital 23,000

Assume the enterprise was sold for 30 million birr to Ato Kemal on July 2, 2012.

Required:

i. Compute goodwill of the company , if any

ii. Journalize the Privatization of the enterprise ,assuming :

a. the firm will Continue with the old books .

b. Assume the firm will keep New books

You might also like

- Coca-Cola Residual Income Valuation TemplateDocument8 pagesCoca-Cola Residual Income Valuation TemplateAman TaterNo ratings yet

- I1.2-Financial Reporting QPDocument8 pagesI1.2-Financial Reporting QPConstantin NdahimanaNo ratings yet

- Cash Flow StatementDocument3 pagesCash Flow StatementanupsuchakNo ratings yet

- AIS - Chapter 1 AIS OverviewDocument17 pagesAIS - Chapter 1 AIS OverviewErmias GuragawNo ratings yet

- 13 Week Cash Flow ModelDocument16 pages13 Week Cash Flow ModelASChipLeadNo ratings yet

- The 2014 Big Four Firms Performance Analysis Big4.Com Jan 2015Document34 pagesThe 2014 Big Four Firms Performance Analysis Big4.Com Jan 2015avinash_usa2003No ratings yet

- Uber and Its Global StrategyDocument17 pagesUber and Its Global StrategySuhas Manangi100% (3)

- Precision Based Trading King. D Boateng IG@kingboatengofficialDocument24 pagesPrecision Based Trading King. D Boateng IG@kingboatengofficialnicholasNo ratings yet

- Post TransactionsDocument28 pagesPost TransactionsagnesNo ratings yet

- Spa Wellness IndustryDocument37 pagesSpa Wellness IndustryAkhil Rupani100% (1)

- Ia3 Midterm QuizDocument11 pagesIa3 Midterm QuizJalyn Jalando-onNo ratings yet

- Project Report On HDFC LTD Home Loan SchemesDocument63 pagesProject Report On HDFC LTD Home Loan Schemesramandeep0974% (19)

- © The Institute of Chartered Accountants of India: ST STDocument6 pages© The Institute of Chartered Accountants of India: ST STVishal MehraNo ratings yet

- CASH FLOW Revision-1 PDFDocument12 pagesCASH FLOW Revision-1 PDFBHUMIKA JAINNo ratings yet

- Accounting For Holding Co. (Lecture 3) : Total 12,00,000 6,00,000Document6 pagesAccounting For Holding Co. (Lecture 3) : Total 12,00,000 6,00,000Michael JimNo ratings yet

- Mas DocumentsDocument12 pagesMas DocumentsLorie Grace LagunaNo ratings yet

- Week 7 Seminar QuestionsDocument4 pagesWeek 7 Seminar QuestionsBhanu TejaNo ratings yet

- Bengal CorporationDocument2 pagesBengal CorporationTowhidul IslamNo ratings yet

- Relax CompanyDocument7 pagesRelax CompanyRegine CalipusanNo ratings yet

- 162 PresummativeDocument5 pages162 PresummativeMeichigo SwadeeNo ratings yet

- AnswerDocument53 pagesAnswerM ShNo ratings yet

- Tutorial 6-Long-Term Debt-Paying Ability and ProfitabilityDocument2 pagesTutorial 6-Long-Term Debt-Paying Ability and ProfitabilityGing freexNo ratings yet

- FINANCIAL REPORTING - PDF May 2012Document9 pagesFINANCIAL REPORTING - PDF May 2012Catherine dumenuNo ratings yet

- CSTUDY Jul22 BBAHONS AFM8 Final 20221205090450Document8 pagesCSTUDY Jul22 BBAHONS AFM8 Final 20221205090450Melokuhle MhlongoNo ratings yet

- Adobe Scan Jan 30, 2023Document6 pagesAdobe Scan Jan 30, 2023Karan RajakNo ratings yet

- What Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Document12 pagesWhat Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Nguyễn HoàngNo ratings yet

- F 13 Financial Accounting CpaDocument9 pagesF 13 Financial Accounting CpaMarcellin MarcaNo ratings yet

- CA Inter Adv. Accounting Top 50 Question May 2021Document117 pagesCA Inter Adv. Accounting Top 50 Question May 2021Sumitra yadavNo ratings yet

- 2017 MJDocument4 pages2017 MJRasel AshrafulNo ratings yet

- Decision Case 12-4Document2 pagesDecision Case 12-4cbarajNo ratings yet

- MA - Vertical Statement Question BankDocument18 pagesMA - Vertical Statement Question Bankmanav.vakhariaNo ratings yet

- 3.BACC III 2016 End - Docx ModeratedDocument7 pages3.BACC III 2016 End - Docx ModeratedsmlingwaNo ratings yet

- FR 1 QDocument17 pagesFR 1 QG INo ratings yet

- Tutorial 6 With Solutions-Long-Term Debt-Paying Ability and ProfitabilityDocument5 pagesTutorial 6 With Solutions-Long-Term Debt-Paying Ability and ProfitabilityGing freexNo ratings yet

- Finals Quiz No. 1 AnswersDocument4 pagesFinals Quiz No. 1 AnswersMergierose DalgoNo ratings yet

- Case 1.: Additional InformationDocument3 pagesCase 1.: Additional InformationPearl Jade YecyecNo ratings yet

- 162 PreSummative2Document4 pages162 PreSummative2Alvin John San JuanNo ratings yet

- Problem 1 Adv. Acct. IIDocument4 pagesProblem 1 Adv. Acct. IISamuel DebebeNo ratings yet

- December-12Document3 pagesDecember-12Kathleen MarcialNo ratings yet

- Business Combinations Midterm 2023 For LMSDocument4 pagesBusiness Combinations Midterm 2023 For LMSSarah Del teodoroNo ratings yet

- Advanced Financial Accounting-Part 2Document4 pagesAdvanced Financial Accounting-Part 2gundapola83% (6)

- Funds Flow StatementDocument5 pagesFunds Flow StatementAshfaq ZameerNo ratings yet

- CAFM FULL SYLLABUS FREE TEST DEC 23-Executive-RevisionDocument7 pagesCAFM FULL SYLLABUS FREE TEST DEC 23-Executive-Revisionyogeetha saiNo ratings yet

- Financial Accounting-Iii - HonoursDocument7 pagesFinancial Accounting-Iii - HonoursAlankrita TripathiNo ratings yet

- Accountancy Review: Detailed Reconciliation of Opening and Closing Retained EarningsDocument5 pagesAccountancy Review: Detailed Reconciliation of Opening and Closing Retained EarningsEricha MutiaNo ratings yet

- Accounting 315 - Quiz Business CombinationDocument5 pagesAccounting 315 - Quiz Business CombinationAlexNo ratings yet

- Activity 3.1Document13 pagesActivity 3.1kel dataNo ratings yet

- Section A - CASE QUESTIONS (Total: 50 Marks)Document9 pagesSection A - CASE QUESTIONS (Total: 50 Marks)Vong Yu Kwan EdwinNo ratings yet

- CE On Quasi-ReorganizationDocument1 pageCE On Quasi-ReorganizationalyssaNo ratings yet

- Class 2 HomeworkDocument7 pagesClass 2 HomeworkAngel MéndezNo ratings yet

- Audit of Financial StatementsDocument3 pagesAudit of Financial StatementsGwyneth TorrefloresNo ratings yet

- PQ - Covnersion Partnership To CompanyDocument8 pagesPQ - Covnersion Partnership To CompanyAnshul BiyaniNo ratings yet

- Chapter 1 17 PROBLEMS PDFDocument46 pagesChapter 1 17 PROBLEMS PDFSARAH ANDREA TORRESNo ratings yet

- EXERCISE Cashflow of The CompanyDocument41 pagesEXERCISE Cashflow of The CompanyDev lakhaniNo ratings yet

- Additional Questions 5Document13 pagesAdditional Questions 5Sanjay SiddharthNo ratings yet

- Consolidation TutorialDocument8 pagesConsolidation TutorialPrageeth Roshan WeerathungaNo ratings yet

- P1 - ReviewDocument14 pagesP1 - ReviewEvitaAyneMaliñanaTapit0% (2)

- Audit of Shareholder's EquityDocument4 pagesAudit of Shareholder's EquityRosalie Colarte LangbayNo ratings yet

- Audit of Financial StatementsDocument4 pagesAudit of Financial StatementsBrit NeyNo ratings yet

- Valuation of Goodwill & Shares 45Document6 pagesValuation of Goodwill & Shares 45Sumeet KanojiaNo ratings yet

- Masters Technological Institute of MindanaoDocument3 pagesMasters Technological Institute of MindanaoPang SiulienNo ratings yet

- 2, Questions and Answers 2, Questions and AnswersDocument35 pages2, Questions and Answers 2, Questions and AnswersCarlos John Talania 1923No ratings yet

- H.B Commerce ClassesDocument3 pagesH.B Commerce ClassesPavan BachaniNo ratings yet

- Fa May June - 2012Document4 pagesFa May June - 2012xodic49847No ratings yet

- SLLC - 2021 - Acc - C - Review Question 2 - Ratio AnalysisDocument3 pagesSLLC - 2021 - Acc - C - Review Question 2 - Ratio AnalysisChamela MahiepalaNo ratings yet

- FRS 107 Ie 2016BBDocument10 pagesFRS 107 Ie 2016BBAmelia RahmawatiNo ratings yet

- 01 Long QuizDocument6 pages01 Long Quizgiana riveraNo ratings yet

- AIS - Chapter 3 Relational DatabaseDocument24 pagesAIS - Chapter 3 Relational DatabaseErmias GuragawNo ratings yet

- Advanced II - Chapter 0 TaxDocument79 pagesAdvanced II - Chapter 0 TaxHawultu AsresieNo ratings yet

- Accounting II - Assignment 1Document5 pagesAccounting II - Assignment 1Hawultu AsresieNo ratings yet

- Afa-Ii CH-5Document51 pagesAfa-Ii CH-5Benol MekonnenNo ratings yet

- Accounting II - Assignment 1Document5 pagesAccounting II - Assignment 1Hawultu AsresieNo ratings yet

- AIS - Chapter 5 System Development (Slide) .Document102 pagesAIS - Chapter 5 System Development (Slide) .Ermias GuragawNo ratings yet

- AIS - Chapter 2 Overview of The Business ProcessesDocument24 pagesAIS - Chapter 2 Overview of The Business ProcessesErmias GuragawNo ratings yet

- Homework 1 (Pump Prime, Consumer Equality, Multiplier Formula)Document8 pagesHomework 1 (Pump Prime, Consumer Equality, Multiplier Formula)Jester LabanNo ratings yet

- Baird Global Healthcare Report 2016-2017Document16 pagesBaird Global Healthcare Report 2016-2017venkata.krishnanNo ratings yet

- Human Resources Law Employment and Labour India PDFDocument28 pagesHuman Resources Law Employment and Labour India PDFVinay KhatriNo ratings yet

- Sandra Clarke and Sarah Greer, Land Law Directions 2e Chapter 5: LeasesDocument3 pagesSandra Clarke and Sarah Greer, Land Law Directions 2e Chapter 5: LeasesEdwin OlooNo ratings yet

- Management Accounting - I: - Dr. Sandeep GoelDocument18 pagesManagement Accounting - I: - Dr. Sandeep GoelAnkur ShrimaliNo ratings yet

- International Economics 13th Edition Carbaugh Test BankDocument15 pagesInternational Economics 13th Edition Carbaugh Test Bankjethrodavide6qi100% (35)

- Kalai or ProjectDocument30 pagesKalai or ProjectKalai SNo ratings yet

- Decision Analysis ProblemDocument2 pagesDecision Analysis ProblemGeejayFerrerPaculdo50% (2)

- Business Canvas Model: Key Partners: Key Activities: Value Proposition: Customer Relationship: Customer SegmentDocument1 pageBusiness Canvas Model: Key Partners: Key Activities: Value Proposition: Customer Relationship: Customer SegmentSAMSAD BIN ZUBAIR 1712008630No ratings yet

- Brazil Plastic IndustryDocument11 pagesBrazil Plastic IndustryminhiseNo ratings yet

- Summer Training Report by Deepak DhingraDocument94 pagesSummer Training Report by Deepak Dhingraashurpt1288% (8)

- HRM - Recuirtment - and - Selection - IBAIS UniversityDocument87 pagesHRM - Recuirtment - and - Selection - IBAIS UniversityarhijaziNo ratings yet

- Cash FlowDocument23 pagesCash FlowSundara BalamuruganNo ratings yet

- Accounting: Plant AssetsDocument41 pagesAccounting: Plant AssetsFlower T.No ratings yet

- Spinoff Splitoff Splitup CarveoutDocument2 pagesSpinoff Splitoff Splitup CarveouttransitxyzNo ratings yet

- Mir Mohammad Ali KhanDocument8 pagesMir Mohammad Ali KhanHannah WatsonNo ratings yet

- Documents For IPTV Permission - 1Document2 pagesDocuments For IPTV Permission - 1chandan kumar SinghNo ratings yet

- PT Indo Premier Sekuritas Trade ConfirmationDocument1 pagePT Indo Premier Sekuritas Trade ConfirmationDhan RamadhanNo ratings yet

- 2p Kap Kcom 5102-6102 PDFDocument32 pages2p Kap Kcom 5102-6102 PDFbilalNo ratings yet

- Cva ResumeDocument4 pagesCva ResumemutyalapatiNo ratings yet

- Dakota Corporation Had The Following Shareholders Equity Account Balances atDocument1 pageDakota Corporation Had The Following Shareholders Equity Account Balances atTaimur TechnologistNo ratings yet

- Bank Profitability and Liquidity Management: A Case Study of Selected Nigerian Deposit Money BanksDocument24 pagesBank Profitability and Liquidity Management: A Case Study of Selected Nigerian Deposit Money BanksSangam NeupaneNo ratings yet

- FIN010 Mutual-FundsDocument4 pagesFIN010 Mutual-FundsLanz Mark RelovaNo ratings yet