Professional Documents

Culture Documents

DS - 04 - 05 - 03 - YVON - e en

Uploaded by

Eddoha WafaeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DS - 04 - 05 - 03 - YVON - e en

Uploaded by

Eddoha WafaeCopyright:

Available Formats

Accounting and

Auditing

Audit

General audit approach

YVON Case - Statement

Duratio 30 minutes

n:

Difficulty from 1 to 5 (5 being the most 2

difficult):

Status Optional

:

SA XAVIER owns 70% of the capital of SARL YVON, whose essential characteristics are set out i n Appendix 1.

This company has had a statutory auditor since the close of 12/31/N-3, as the mandatory appointment

thresholds w e r e exceeded in N-4.

On February 15 N+1, the company's chartered accountant sent you the draft annual financial statements. Upon

receipt of this document, you decide to start your audit work.

You have set a materiality threshold for the financial statements taken as a whole equal to 20% of net income,

i.e. €22,000.

Work to do

1. What is a significance threshold? What is its purpose? In which document is it embodied?

As part of your work, you have decided to confirm the company's significant third-party customers and

suppliers. As part of this process, you have selected 80% of the trade receivables and payables shown on the

balance sheet.

Work to do

2. What is the procedure for requesting confirmation from third parties and how does i t work?

On examining the company's past trade receivables, your attention is drawn to a trade receivable that is now

over a year old, amounting to €80,400 (VAT at 20%). By consulting the company register website and ordering

a K-Bis extract for this company, you learn that the company has been the subject of a court-ordered

receivership judgment published in the BODACC dated

October 19 N. In addition, you learn that SARL YVON has failed to declare its claim to the judicial

representative.

Work to do

3. How would you assess your opinion on the annual financial statements if :

- the manager modifies the annual accounts;

- the manager does not amend the annual financial statements.

4. Given that the SARL no longer exceeds the thresholds for appointing a statutory auditor, what

happens to the company's statutory auditor?

Cas YVON - Statement -

1/2

Accounting and

Auditing

At the shareholders' meeting to approve the financial statements for year N, scheduled for June 30 N+1, the

company's manager is also planning to put on the agenda the conversion of the SARL into a société par actions

simplifiée (SAS).

Work to do

5. What happens to the statutory auditor's mandate if the conversion to an SAS is approved?

6. Is it necessary to appoint a transformation commissioner for this operation?

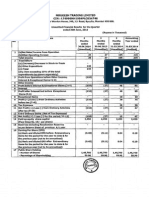

APPENDIX 1

Main characteristics of SARL YVON

Share capital: €50,000 divided into 500 shares of €100 Share

ownership :

- 70% or 350 shares held by XAVIER ;

- 30% or 150 shares held by 3 individuals (50 shares each).

Year-end date: December 31 Key figures :

N-1 N

Workforce 35 employees 35 employees

Sales figures 2 552 000 € 2 433 000 €

EBITDA 214 000 € 187 000 €

Net income 142 000 € 114 000 €

Availability 165 000 € 142 000 €

Balance sheet total 1 123 000 € 1 103 000 €

Date of the general meeting called to approve the financial statements for the year ended 12/31/N: June 30,

N+1 The company does not benefit from the reduced corporate income tax rate.

Cas YVON - Statement -

2/2

You might also like

- Finance For Non Financial Managers: Avingtrans and Flowtech Fluid Power PWCDocument11 pagesFinance For Non Financial Managers: Avingtrans and Flowtech Fluid Power PWCThanapas Buranapichet100% (2)

- Instant Download Ebook PDF Financial Accounting 18th Edition PDF ScribdDocument41 pagesInstant Download Ebook PDF Financial Accounting 18th Edition PDF Scribdmarian.hillis984100% (40)

- Financial Accounting and Reporting: Blank PageDocument28 pagesFinancial Accounting and Reporting: Blank PageMehtab NaqviNo ratings yet

- Financial and Managerial Accounting 18th Edition Williams Test BankDocument25 pagesFinancial and Managerial Accounting 18th Edition Williams Test BankEugeneMurraykspo100% (46)

- Cba Financial StatementsDocument27 pagesCba Financial Statementsreagan blaireNo ratings yet

- AUDIT REPORT OLGATUNI CAMP LIMITED - 2020 - Financial StatementsDocument19 pagesAUDIT REPORT OLGATUNI CAMP LIMITED - 2020 - Financial StatementsRohit RathiNo ratings yet

- Financial Statement Project 1 1Document38 pagesFinancial Statement Project 1 1ABHISHEK SHARMANo ratings yet

- BP2F - ISA 805 - 31 12 2021 SignedDocument7 pagesBP2F - ISA 805 - 31 12 2021 SignedEyob HayelomNo ratings yet

- SQA Accounting Assignment 1Document7 pagesSQA Accounting Assignment 1SENITH J100% (1)

- Mercury Mining Investment LTD - Audited Reports For 2022Document16 pagesMercury Mining Investment LTD - Audited Reports For 2022tankodanjumacNo ratings yet

- Tut 8 Submission QuestionsDocument6 pagesTut 8 Submission Questionsxabaandiswa8No ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Audit Account 6ayFRaWgLGNIKooY0xwLsEsyRaxCV12xMHSCZHJpDocument16 pagesAudit Account 6ayFRaWgLGNIKooY0xwLsEsyRaxCV12xMHSCZHJpSamson OlubodeNo ratings yet

- Review Chapter 4 and Chapter 5Document17 pagesReview Chapter 4 and Chapter 5Khánh PhươngNo ratings yet

- FF 2011 enDocument55 pagesFF 2011 enWang Hon YuenNo ratings yet

- Annual Report: Registered OfficeDocument312 pagesAnnual Report: Registered OfficeDNo ratings yet

- Valuer Holding AS IFRS Combined Financial Statements 2019-2020Document29 pagesValuer Holding AS IFRS Combined Financial Statements 2019-2020Athena ShaeNo ratings yet

- Financial Accounting and Reporting SESSION TOPIC 2: Review of Worksheet Preparation Learning OutcomesDocument5 pagesFinancial Accounting and Reporting SESSION TOPIC 2: Review of Worksheet Preparation Learning OutcomesKhen HernandezNo ratings yet

- Final Grace CorpDocument14 pagesFinal Grace CorpKarl Chua100% (1)

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- ACC6050 Module 3 AssignmentDocument9 pagesACC6050 Module 3 AssignmentFavourNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- dASE Statment Sinke - CBEDocument50 pagesdASE Statment Sinke - CBEHashim TuneNo ratings yet

- Ar2021 - Financial-Statement MalaysiaDocument186 pagesAr2021 - Financial-Statement MalaysiaDian MaulanaNo ratings yet

- Basic Accounting Lesson 7: Worksheet and Financial StatementsDocument33 pagesBasic Accounting Lesson 7: Worksheet and Financial StatementsGutierrez Ronalyn Y.No ratings yet

- DR Nizam Latha Incorporated 2020 AFSDocument11 pagesDR Nizam Latha Incorporated 2020 AFShumayra.m16No ratings yet

- BBPW3103 - Topic02 - EnglishDocument67 pagesBBPW3103 - Topic02 - EnglishclairynaNo ratings yet

- The Accounting Cycle - Part6Document15 pagesThe Accounting Cycle - Part6RaaiinaNo ratings yet

- Bharat Hotels Annual Report 2020 2021Document232 pagesBharat Hotels Annual Report 2020 2021Sahjad Hashmi100% (1)

- Annual Report Nutek 2008 09Document92 pagesAnnual Report Nutek 2008 09avneesh99No ratings yet

- Rodell Accounts Year Ending 31/03/07Document13 pagesRodell Accounts Year Ending 31/03/07unlockdemocracyNo ratings yet

- Self-Paced Learning Module: Senior High SchoolDocument11 pagesSelf-Paced Learning Module: Senior High SchoolJanelle Gonzaga BuenaNo ratings yet

- EduX.F3A 1 01-CAIXINDocument10 pagesEduX.F3A 1 01-CAIXINvetNo ratings yet

- FCL Financial Statements 2015Document26 pagesFCL Financial Statements 2015adebo_yemiNo ratings yet

- Financial Management Accounting - MB 0025Document14 pagesFinancial Management Accounting - MB 0025deeptibhardwajNo ratings yet

- ActivityDocument3 pagesActivitycaryl remillaNo ratings yet

- Balance Sheet Gitanjali Ventures DMCC 2010-11Document16 pagesBalance Sheet Gitanjali Ventures DMCC 2010-11Bilal AhmadNo ratings yet

- Valiant Communications LimitedDocument11 pagesValiant Communications LimitedAmrut BhattNo ratings yet

- Alba 2020 ACCOUNTSDocument13 pagesAlba 2020 ACCOUNTSAngaza Construction100% (1)

- Worksheet For FM Chap 2Document3 pagesWorksheet For FM Chap 2Gemechis Lema0% (2)

- 032017Document107 pages032017Aditya MakwanaNo ratings yet

- Financial Statements 3Document213 pagesFinancial Statements 3Liliana MNo ratings yet

- Tempest Accounting and AnalysisDocument10 pagesTempest Accounting and AnalysisSIXIAN JIANGNo ratings yet

- BCOM - Year 3 - Accounting 3 - Question BankDocument28 pagesBCOM - Year 3 - Accounting 3 - Question BankBrian Ombura OkalNo ratings yet

- (L) Chapter 13 Accounts For Limited CompanyDocument13 pages(L) Chapter 13 Accounts For Limited CompanyCHZE CHZI CHUAHNo ratings yet

- Information For General Accident PLC Preference ShareholdersDocument3 pagesInformation For General Accident PLC Preference ShareholderssaxobobNo ratings yet

- Ias 1 & Ias 2-Bact-307-Admin-2019-1Document35 pagesIas 1 & Ias 2-Bact-307-Admin-2019-1Letsah BrightNo ratings yet

- Grade11 Fabm1 Q2 Week7Document14 pagesGrade11 Fabm1 Q2 Week7Mickaela MonterolaNo ratings yet

- Publication - 2020 08 11Document111 pagesPublication - 2020 08 11Nicolas GomezNo ratings yet

- CH 1 Part 1Document41 pagesCH 1 Part 1hstptr8wdwNo ratings yet

- AFS HardwareDocument32 pagesAFS HardwareThabiso MojakisaneNo ratings yet

- Fundamentals of Finance: Ignacio Lezaun English Edition 2021Document17 pagesFundamentals of Finance: Ignacio Lezaun English Edition 2021Elias Macher CarpenaNo ratings yet

- Financial Statement AnalysisDocument14 pagesFinancial Statement AnalysisnabhayNo ratings yet

- First Semester - AY 2020-2021: C-AE13: Financial Accounting and ReportingDocument6 pagesFirst Semester - AY 2020-2021: C-AE13: Financial Accounting and Reportingfirestorm riveraNo ratings yet

- Candidate Material 3 - TradingDocument18 pagesCandidate Material 3 - Tradingwaqas aliNo ratings yet

- 3 Years Audited Account 200Document51 pages3 Years Audited Account 200Raymond SmithNo ratings yet

- Answers March2012 f1Document10 pagesAnswers March2012 f1kiransookNo ratings yet

- LXL Gr12Acc 08 Exam-Questions-Live 04jun2015Document6 pagesLXL Gr12Acc 08 Exam-Questions-Live 04jun2015Nezer Byl P. VergaraNo ratings yet

- Annual Report For The Financial Year 2019 2020Document202 pagesAnnual Report For The Financial Year 2019 2020Sandeep ThatheraNo ratings yet

- SCALP Handout 038 PDFDocument2 pagesSCALP Handout 038 PDFAine Arie HNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- RossCF9ce PPT Ch25Document19 pagesRossCF9ce PPT Ch25js19imNo ratings yet

- Topic 3 - Joint ArrangementsDocument5 pagesTopic 3 - Joint Arrangementsduguitjinky20.svcNo ratings yet

- PC - Zydus Life Q2FY24 Update - Nov 2023 20231107233830Document7 pagesPC - Zydus Life Q2FY24 Update - Nov 2023 20231107233830Research AnalystNo ratings yet

- MNRC Memorandum Circular No 2 Series of 2020Document33 pagesMNRC Memorandum Circular No 2 Series of 2020legworxcaNo ratings yet

- Intro To Financial Analysis AssignmentDocument4 pagesIntro To Financial Analysis AssignmentAshar AlamNo ratings yet

- 2023 Grade 11 Provincial Examination Accounting P1 (English) November 2023 Question PaperDocument12 pages2023 Grade 11 Provincial Examination Accounting P1 (English) November 2023 Question PaperChantelle IsaksNo ratings yet

- Assignment 5 Consolidation Intercompany Sale of MerchandiseDocument3 pagesAssignment 5 Consolidation Intercompany Sale of MerchandiseAivan De LeonNo ratings yet

- Bookkeeping Mock Questions2022 - GG1712Document10 pagesBookkeeping Mock Questions2022 - GG1712Karan KhannaNo ratings yet

- Practie-Test-For-Econ-121-Final-Exam 1Document1 pagePractie-Test-For-Econ-121-Final-Exam 1mehdi karamiNo ratings yet

- AP.3402 Audit of Property Plant and EquipmentDocument5 pagesAP.3402 Audit of Property Plant and EquipmentMonica GarciaNo ratings yet

- ML140GKDocument3 pagesML140GKMai Nữ Song NgânNo ratings yet

- Statement of Account: NO 23 Persiaran Anggerik 1 Taman Anggerik 33000 Kuala Kangsar, PerakDocument3 pagesStatement of Account: NO 23 Persiaran Anggerik 1 Taman Anggerik 33000 Kuala Kangsar, PerakYoga LingamNo ratings yet

- CANARA Statement 2 May 22 To 1 April 23Document62 pagesCANARA Statement 2 May 22 To 1 April 23Ashwani KumarNo ratings yet

- Balance Sheet: Alexei Alvarez Drobush, CFA, FRM Fabricio Chala, CFA, FRMDocument43 pagesBalance Sheet: Alexei Alvarez Drobush, CFA, FRM Fabricio Chala, CFA, FRMJhonatan Perez VillanuevaNo ratings yet

- UntitledDocument4 pagesUntitledMuhammad AbdullahNo ratings yet

- Stock Market Thesis TopicsDocument7 pagesStock Market Thesis Topicsggzgpeikd100% (1)

- Chapter 1 ExerciseDocument11 pagesChapter 1 ExerciseUsama MukhtarNo ratings yet

- Accrual AccountingDocument7 pagesAccrual AccountingMUHAMMAD ARIF BASHIRNo ratings yet

- Hancock9e Testbank ch10Document17 pagesHancock9e Testbank ch10杨子偏No ratings yet

- GJ GL TB AjpDocument17 pagesGJ GL TB AjpseviraaawrNo ratings yet

- FINMNN1 Chapter 4 Short Term Financial PlanningDocument16 pagesFINMNN1 Chapter 4 Short Term Financial Planningkissmoon732No ratings yet

- Test Bank For Intermediate Accounting Reporting and Analysis 3rd Edition James M WahlenDocument36 pagesTest Bank For Intermediate Accounting Reporting and Analysis 3rd Edition James M Wahlenimplumededgebonea3ny100% (50)

- Exercise Chapter 3Document3 pagesExercise Chapter 3Phương ThảoNo ratings yet

- How To Get Into Equity Research AnalystDocument20 pagesHow To Get Into Equity Research Analystsmita.devneNo ratings yet

- MF Sample PaperDocument17 pagesMF Sample PaperPrem KumarNo ratings yet

- Group 1 - Exercise 5Document4 pagesGroup 1 - Exercise 5Nguyen Tan AnhNo ratings yet

- AJoCS.03.02.86 95Document10 pagesAJoCS.03.02.86 95guandaru1No ratings yet

- Resa Afar (1) Preweek (b43)Document34 pagesResa Afar (1) Preweek (b43)MellaniNo ratings yet