Professional Documents

Culture Documents

Income Tax - Chap 09

Uploaded by

ZainioOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax - Chap 09

Uploaded by

ZainioCopyright:

Available Formats

Income Tax: Chapter #09: AOP and NPO

Misc. Concepts:

In case of a deceased individual, legal representative of the deceased person shall be liable for the tax

liability of the deceased person. However, legal representative shall pay only that tax which can be

recovered from him.

Any income of a minor child taxable under head income from business shall be chargeable to tax as

income of the parent of the child. It shall not apply where the income of a minor child is from a business

inquired through an inheritance. Any income of minor child other than business income is taxable in the

hand of minor.

AOP:

AOP is separate entity from its owners and shall pay tax separately from member of the AOP. AOP is

resident if control and management of AOP is situated wholly or partly in Pakistan at any time of the tax

year. A resident AOP is taxed on its worldwide income whereas non-resident is taxed on its Pakistani

source income. Profit on debt paid by AOP to its members shall not be allowed as deductible expense to

AOP. JV is treated as AOP.

Where AOP has paid tax on its income, any amount paid to the members of AOP is exempt from tax.

However, it shall be added in the income of the members for rate purposes only. Losses of AOP cannot

be adjusted against income of members and vice versa.

Incase where company is a member of AOP, the share of profit of company shall not be added in the

taxable income of AOP and shall be deducted from the taxable income of AOP and added in the income

of company under head income from other sources. However, this shall not be applicable in case of loss.

Loss from AOP is added back in the income of company. Further, share of company from turnover of

AOP shall be added in the turnover of company in order to calculate 1.25% minimum turnover tax.

Loss incurred by a company can be set off against share of profit in AOP. Company shall also be given tax

credit for any tax withheld in AOP( tax credit shall be given in relation to company’s share).

Not for Profit Organizations:

Tax credit of 100% is allowed subject to meeting the conditions as mentioned in section 100-C. Tax

credit on FTR income and minimum tax is also given. Capital gain and dividend income is fully taxable.

Property income is exempt.

Admin and management expenditures shall not increase 10% of receipts. However, this is not applicable

where the operation of NPO have commenced during the preceding 3 years and total receipts during the

tax year are less than 100 million. This limit is applicable only to NPOs and not to trusts. Further, this is

applicable to admin expenses only and not to cost of operations.

If NPO, welfare and trusts are unable to spend more than 75% of their income on charitable and welfare

activities, the amount not spend shall be taxed @10% whereas their status of NPO shall remain intact.

If 100% tax credit is not applicable, then tax is charged @29%/20%.

You might also like

- Income Taxation Finals - CompressDocument9 pagesIncome Taxation Finals - CompressElaiza RegaladoNo ratings yet

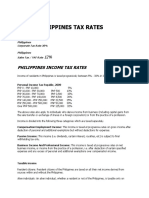

- Philippines Income Tax Rates Guide - Individual, Corporate, Capital GainsDocument6 pagesPhilippines Income Tax Rates Guide - Individual, Corporate, Capital GainsKristina AngelieNo ratings yet

- Income Tax - Chap 10Document2 pagesIncome Tax - Chap 10ZainioNo ratings yet

- Philippines Tax RatesDocument7 pagesPhilippines Tax RatesJL GEN0% (1)

- Earnings and Profits Is As FollowsDocument3 pagesEarnings and Profits Is As Followscmau08No ratings yet

- Income Tax - Chap 07Document6 pagesIncome Tax - Chap 07ZainioNo ratings yet

- Categories of Income and Tax RatesDocument5 pagesCategories of Income and Tax RatesRonel CacheroNo ratings yet

- Philippines Tax RatesDocument7 pagesPhilippines Tax RatesRonel CacheroNo ratings yet

- Business Tax Laws in The PhilippinesDocument12 pagesBusiness Tax Laws in The PhilippinesEthel Joi Manalac MendozaNo ratings yet

- Business Tax Laws (Phils)Document15 pagesBusiness Tax Laws (Phils)Jean TanNo ratings yet

- Thailand Corporate Income TaxDocument31 pagesThailand Corporate Income TaxPrincessJoyGinezFlorentinNo ratings yet

- Rohit SinghDocument9 pagesRohit SinghRohit SinghNo ratings yet

- Tax exemptions and incentives for minimum wage earners, BMBEs, cooperatives, non-profit entitiesDocument2 pagesTax exemptions and incentives for minimum wage earners, BMBEs, cooperatives, non-profit entitiesdailydoseoflawNo ratings yet

- Heads of IncomeDocument6 pagesHeads of Incomevijay kumarNo ratings yet

- View in Online Reader: Text Size +-RecommendDocument7 pagesView in Online Reader: Text Size +-RecommendRhea Mae AmitNo ratings yet

- International Tax: Bangladesh Highlights 2020Document8 pagesInternational Tax: Bangladesh Highlights 2020Mehadi HasanNo ratings yet

- Learning Guide: Accounts and Budget SupportDocument19 pagesLearning Guide: Accounts and Budget Supportmac video teachingNo ratings yet

- Income Tax - Chap 01Document8 pagesIncome Tax - Chap 01ZainioNo ratings yet

- CORPORATE TAX PLANNINGDocument48 pagesCORPORATE TAX PLANNINGShakti TandonNo ratings yet

- Tax Structure of Pakistan: (A Bird Eye View)Document16 pagesTax Structure of Pakistan: (A Bird Eye View)Kiran AliNo ratings yet

- Corporate Tax: Residency of CompaniesDocument2 pagesCorporate Tax: Residency of CompaniesLimpho Teddy PhateNo ratings yet

- Assignment III-LGS311-12th-DECDocument2 pagesAssignment III-LGS311-12th-DECMohammad Iqbal SekandariNo ratings yet

- CORPORATE TAX CALCULATORDocument11 pagesCORPORATE TAX CALCULATORmohanraokp2279No ratings yet

- Philippines Corporate Tax RatesDocument2 pagesPhilippines Corporate Tax RatesAike SadjailNo ratings yet

- Legal M e M o R A N D U MDocument3 pagesLegal M e M o R A N D U MmyrahjNo ratings yet

- Income From Other SourcesDocument27 pagesIncome From Other Sourcesanilchavan100% (1)

- Income Tax On Individuals Part 2Document22 pagesIncome Tax On Individuals Part 2mmhNo ratings yet

- Notes To Business Taxation: Corporate Income Tax Tax BaseDocument7 pagesNotes To Business Taxation: Corporate Income Tax Tax BaseAngela AralarNo ratings yet

- DTC - FinalDocument18 pagesDTC - FinalvjranavjNo ratings yet

- Corporate Income Taxes and Tax RatesDocument38 pagesCorporate Income Taxes and Tax RatesShaheen ShahNo ratings yet

- Pakistan Tax Structure Explained: Income, Sales, Corporate and MoreDocument23 pagesPakistan Tax Structure Explained: Income, Sales, Corporate and MoreAsif Rasool ChannaNo ratings yet

- Assignment On Corporate Taxation in BangladeshDocument9 pagesAssignment On Corporate Taxation in Bangladeshsalekin0070% (1)

- Taxation System in IndiaDocument30 pagesTaxation System in IndiaSwapnil Pisal-DeshmukhNo ratings yet

- Executive Summary Of Corporate TaxationDocument5 pagesExecutive Summary Of Corporate TaxationJohnNo ratings yet

- Taxation fringe benefits ZimbabweDocument5 pagesTaxation fringe benefits ZimbabweTawanda Tatenda HerbertNo ratings yet

- March BIR RulingsDocument13 pagesMarch BIR Rulingscarlee014No ratings yet

- CS Professional Programme Tax NotesDocument47 pagesCS Professional Programme Tax NotesRajey Jain100% (2)

- Thailand's Corporate Income Tax OverviewDocument13 pagesThailand's Corporate Income Tax Overviewhasanarif0257No ratings yet

- Corporate Income Tax GuideDocument46 pagesCorporate Income Tax GuideCanapi AmerahNo ratings yet

- MBA104 - Almario - Parco - Chapter 1 Part 2 Individual Assignment Online Presentation 1Document23 pagesMBA104 - Almario - Parco - Chapter 1 Part 2 Individual Assignment Online Presentation 1Jesse Rielle CarasNo ratings yet

- Income Tax in IndiaDocument19 pagesIncome Tax in IndiaConcepts TreeNo ratings yet

- Final MF0003 2nd AssigDocument6 pagesFinal MF0003 2nd Assignigistwold5192No ratings yet

- Vaishnavi ProjectDocument72 pagesVaishnavi ProjectAkshada DhapareNo ratings yet

- Fiscal Regime For A Business Set UpDocument13 pagesFiscal Regime For A Business Set Upmurfa0019No ratings yet

- DTTL Tax Bangladeshhighlights 2023Document10 pagesDTTL Tax Bangladeshhighlights 2023steveNo ratings yet

- Japan Tax Profile: Produced in Conjunction With The KPMG Asia Pacific Tax CentreDocument15 pagesJapan Tax Profile: Produced in Conjunction With The KPMG Asia Pacific Tax CentreKris MehtaNo ratings yet

- Taxation-Direct-and-Indirect - AssignmentDocument8 pagesTaxation-Direct-and-Indirect - AssignmentAkshatNo ratings yet

- DTTL Tax Unitedarabemirateshighlights 2016Document2 pagesDTTL Tax Unitedarabemirateshighlights 2016AhmedKhanNo ratings yet

- BASICS OF TAXATION (Income Tax Ordinance, 1984) Updated Till Finance Act. 2013 by Prof. Mahbubur RahmanDocument14 pagesBASICS OF TAXATION (Income Tax Ordinance, 1984) Updated Till Finance Act. 2013 by Prof. Mahbubur RahmansaadmansheedyNo ratings yet

- ch-02-03 LLP TaxationDocument38 pagesch-02-03 LLP Taxationdean.socNo ratings yet

- Lecture Notes - Atty Steve Part 1Document9 pagesLecture Notes - Atty Steve Part 1Tesia MandaloNo ratings yet

- 132.tax On Dividends - FDD.02.25.10 PDFDocument3 pages132.tax On Dividends - FDD.02.25.10 PDFKarla BarbacenaNo ratings yet

- DTTL Tax Bangladeshhighlights 2016Document3 pagesDTTL Tax Bangladeshhighlights 2016অরণ্য আহমেদNo ratings yet

- Chapter 7: Introduction To Regular Income TaxDocument5 pagesChapter 7: Introduction To Regular Income TaxArna Kaira Kjell DiestraNo ratings yet

- DTTL Tax Pakistanhighlights 2018 PDFDocument5 pagesDTTL Tax Pakistanhighlights 2018 PDFAhsan IqbalNo ratings yet

- What Is NAVDocument3 pagesWhat Is NAVVikas SinghNo ratings yet

- Tax On Salary: Income Tax Law & CalculationDocument7 pagesTax On Salary: Income Tax Law & CalculationSyed Aijlal JillaniNo ratings yet

- Chapter 13 ADocument22 pagesChapter 13 AAdmNo ratings yet

- Tajir Dost SchemeDocument5 pagesTajir Dost SchemeZainioNo ratings yet

- Wapda Jobs 2023 OTS Advertisement in PDFDocument1 pageWapda Jobs 2023 OTS Advertisement in PDFAsadNo ratings yet

- Income Tax - Chap 01Document8 pagesIncome Tax - Chap 01ZainioNo ratings yet

- CFAP 5 Winter 2021Document2 pagesCFAP 5 Winter 2021ZainioNo ratings yet

- CFAP 5 Winter 2021Document2 pagesCFAP 5 Winter 2021ZainioNo ratings yet

- CFAP 5 Winter 2021Document2 pagesCFAP 5 Winter 2021ZainioNo ratings yet

- CFAP 5 Winter 2021Document2 pagesCFAP 5 Winter 2021ZainioNo ratings yet

- CFAP 5 Winter 2022Document2 pagesCFAP 5 Winter 2022ZainioNo ratings yet

- CFAP 5 Winter 2021Document2 pagesCFAP 5 Winter 2021ZainioNo ratings yet

- Analyze Marketing Offers with This Quick WorksheetDocument1 pageAnalyze Marketing Offers with This Quick WorksheetZainioNo ratings yet

- Sharing Expenses When Transferring Real Estate TitleDocument2 pagesSharing Expenses When Transferring Real Estate TitlePogi akoNo ratings yet

- Dissolution of Comp. Docs - Requirements.sss .Bir .Pagibig - LguDocument2 pagesDissolution of Comp. Docs - Requirements.sss .Bir .Pagibig - Lgujaciem100% (1)

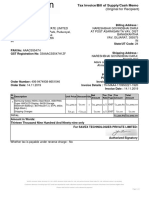

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Baba KelaNo ratings yet

- Midterm Taxation ExamDocument37 pagesMidterm Taxation ExamANDREA LOIS OTEYZA75% (4)

- ApplicationformDocument3 pagesApplicationformShehryar07No ratings yet

- Credit Card Statement: Payment Amount in PKR Debit My Silkbank A/C # Accept My Payment Through Cheque # Bank BranchDocument6 pagesCredit Card Statement: Payment Amount in PKR Debit My Silkbank A/C # Accept My Payment Through Cheque # Bank BranchTri Adi NugrohoNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Ajay DarjiNo ratings yet

- PayPal's Split from eBay: 5 Reasons Behind the SeparationDocument7 pagesPayPal's Split from eBay: 5 Reasons Behind the SeparationAlisa BisopNo ratings yet

- Meru Cabs trip receipt from Mumbai to airportDocument2 pagesMeru Cabs trip receipt from Mumbai to airportMuzammil0% (1)

- Escape From TaxationDocument3 pagesEscape From TaxationQueen Valle100% (1)

- Mulberry Homes: George John Mystic Rose Thrissur 5112018Document1 pageMulberry Homes: George John Mystic Rose Thrissur 5112018Melwin PaulNo ratings yet

- Income Tax - OutlineDocument5 pagesIncome Tax - OutlineMa. Corazon M. CristobalNo ratings yet

- CIR Vs Toshiba Information Equipment (Phils) Inc: 150154: August 9, 2005: J.Document12 pagesCIR Vs Toshiba Information Equipment (Phils) Inc: 150154: August 9, 2005: J.Iris MendiolaNo ratings yet

- TSE's 5 Year Projection Key Drivers SummaryDocument6 pagesTSE's 5 Year Projection Key Drivers SummaryMatthew SiagianNo ratings yet

- Journal Voucher TitleDocument20 pagesJournal Voucher TitlegaurabNo ratings yet

- CFC, FSC and Tax HavensDocument14 pagesCFC, FSC and Tax Havensdigvijay bansalNo ratings yet

- Dunkin' Egift CardsDocument2 pagesDunkin' Egift CardsRafael TombesiNo ratings yet

- Hotel Saibaba Deluxe: Opp Bus Stand, COIMBATOREDocument5 pagesHotel Saibaba Deluxe: Opp Bus Stand, COIMBATOREteenu joseNo ratings yet

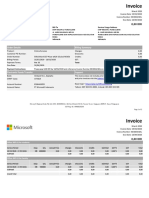

- Invoiceoffice 365Document2 pagesInvoiceoffice 365Muhammad Irfan Ilyas AssagafNo ratings yet

- IDT 2 New Question PaperDocument11 pagesIDT 2 New Question Paperneha manglaniNo ratings yet

- ECWANDC Funding - Vendor W9 FormDocument1 pageECWANDC Funding - Vendor W9 FormEmpowerment Congress West Area Neighborhood Development CouncilNo ratings yet

- Qfix-Payment-Receipt-Semester Fees PDFDocument1 pageQfix-Payment-Receipt-Semester Fees PDFParth Shah100% (1)

- ZFG Bahrain SS-PDF 592Document16 pagesZFG Bahrain SS-PDF 592ahmet aslanNo ratings yet

- Tax Invoice: Name Address State State Code Description AmountDocument1 pageTax Invoice: Name Address State State Code Description AmountArun UpadhyeNo ratings yet

- Tax Review Part 1Document29 pagesTax Review Part 1JImlan Sahipa IsmaelNo ratings yet

- 5 - Profit and Loss WorksheetDocument8 pages5 - Profit and Loss WorksheetMarc Joshua VillordonNo ratings yet

- Topic: Tax Refunds Commissioner of Internal Revenue V. Univation Motor Philippines, Inc. (Formerly Nissan Motor Philippines)Document2 pagesTopic: Tax Refunds Commissioner of Internal Revenue V. Univation Motor Philippines, Inc. (Formerly Nissan Motor Philippines)Joshua Erik MadriaNo ratings yet

- HI5020 Final AssessmentDocument15 pagesHI5020 Final AssessmentTauseef AhmedNo ratings yet

- Acct Statement - XX5598 - 09112023Document21 pagesAcct Statement - XX5598 - 09112023jyotigunu817No ratings yet

- Manila Wine Merchants v. CIRDocument3 pagesManila Wine Merchants v. CIRPio MathayNo ratings yet