Professional Documents

Culture Documents

Financial Report Digs 1

Financial Report Digs 1

Uploaded by

ayaanlori9898Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Report Digs 1

Financial Report Digs 1

Uploaded by

ayaanlori9898Copyright:

Available Formats

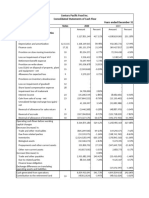

18. Provision for diminution in the value of (10,527) (10.437) 20.

964

19. investments § 344.738 7,401,341 6.221.709

20. (net) 144,318 . =

21. Profit / (loss) before tax - . .

22. Provision for tax - Income tax 8,200,421 7,401,341 6.221.709

23. Provision for tax - Fringe Benefit Tax 29,740,598 23,061,274 16,829.881

24. Profit / (loss) after tax 681,697,876 556,467,823 495.870.630

Profit / oss) carried to Balance Sheet 663,163,117 $39,217,921 482,358.890

MISCELLANEOUS

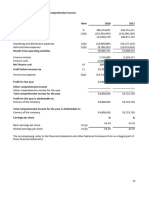

(A) Policyholders' account

Total Funds [Refer note (a) below]

Total investments

25. Yield on investments (%) [Refer note 15% 12% 9%

(b) below] 40,394,085 33,423,317 27,100.477

(B) Shareholders' account

Total Funds [Refer note (c) below]

Total investments 30,702,378 23,534,637 18,115,872

26. Yield on investments (%) [Refer note 9% 9% 8%

(d) below]

27. Yield on total investments [Refer note 15% 12% 9%

(e) below]

28. Paid up equity capital 10,000,000 10,000,000 10,000,000

29. Net worth [Refer note (f) below] 40,394,085 33,423,317 27,100,477

30. Total Assets [Refer note (g) below] 722,106,587 589,965,403 523,189,518

31. Earnings per share C) 8.20 7.40 6.22

32. Book value per share (>) 40.39 33.42 27.10

Net of reinsurance

Includes the effect of gains / losses on sale of investments

Jain College of Engineering, Department of MBA, Belagavi. 43

You might also like

- P14 - Statement of Cashflows Requirement No. 1: Kim Zairelle Bibal Bsa - IiiDocument7 pagesP14 - Statement of Cashflows Requirement No. 1: Kim Zairelle Bibal Bsa - Iiishineneigh00No ratings yet

- Rs. in 000: Ans.6 (A) Hadi Limited Statement of Comprehensive Income For The Year Ended 31 December 2016Document4 pagesRs. in 000: Ans.6 (A) Hadi Limited Statement of Comprehensive Income For The Year Ended 31 December 2016Sameen KhanNo ratings yet

- Part 4 - Topic Part: CSR of IbblDocument38 pagesPart 4 - Topic Part: CSR of IbblfahadNo ratings yet

- FR Mock Exam 4 - SolutionsDocument13 pagesFR Mock Exam 4 - Solutionsiram2005No ratings yet

- Infot RobinsonDocument3 pagesInfot Robinsonkingofkins04No ratings yet

- Financial Analysis DataSheet KECDocument22 pagesFinancial Analysis DataSheet KECSuraj DasNo ratings yet

- Time Watch Investments 1Q2010 Results 131109Document12 pagesTime Watch Investments 1Q2010 Results 131109WeR1 Consultants Pte LtdNo ratings yet

- Last Five Years Financial Performance 2021Document1 pageLast Five Years Financial Performance 2021rahman.mahfuz9966No ratings yet

- Last Five Years Financial Performance 2021Document1 pageLast Five Years Financial Performance 2021Md AzizNo ratings yet

- Notes 2020 Cash Flows From Operating ActivitiesDocument5 pagesNotes 2020 Cash Flows From Operating ActivitiesKei SenpaiNo ratings yet

- Hablon Production Center Statement of Financial Performance For The Years Ended December 31Document41 pagesHablon Production Center Statement of Financial Performance For The Years Ended December 31angelica valenzuelaNo ratings yet

- Financial Analysis Data Sheet - Raymonds (2023) - Revised (29 Jun, 2023)Document22 pagesFinancial Analysis Data Sheet - Raymonds (2023) - Revised (29 Jun, 2023)b23005No ratings yet

- Solutions To Capital Budgeting Problems Capital Budgeting Handout 3 Expansion Problems Ellis Construction Company T 0 Initial InvestmentDocument9 pagesSolutions To Capital Budgeting Problems Capital Budgeting Handout 3 Expansion Problems Ellis Construction Company T 0 Initial InvestmentAnand SridharanNo ratings yet

- Far160 Dec 2018 Q4 PublishDocument5 pagesFar160 Dec 2018 Q4 PublishNur Anis AqilahNo ratings yet

- Time Watch Investments Limited Unaudited 2nd QTR 1HF2009 Financial Statement 090210Document13 pagesTime Watch Investments Limited Unaudited 2nd QTR 1HF2009 Financial Statement 090210WeR1 Consultants Pte LtdNo ratings yet

- A. Net IncomeDocument8 pagesA. Net IncomeAeron Paul AntonioNo ratings yet

- Income Statement and Balance Sheet ExerciseDocument2 pagesIncome Statement and Balance Sheet ExerciseMujieh NkengNo ratings yet

- FIN 422-Midterm AssDocument43 pagesFIN 422-Midterm AssTakibul HasanNo ratings yet

- Spandana Sporthy Balance SheetDocument1 pageSpandana Sporthy Balance SheetMs VasNo ratings yet

- GCB-Q3 2023 - Interim - ReportDocument16 pagesGCB-Q3 2023 - Interim - ReportGan ZhiHanNo ratings yet

- Digitally Signed by Debolina Karmakar Date: 2023.08.10 12:39:40 +05'30'Document5 pagesDigitally Signed by Debolina Karmakar Date: 2023.08.10 12:39:40 +05'30'Mahesh hamneNo ratings yet

- DCF Case Sample 1Document4 pagesDCF Case Sample 1Gaurav SethiNo ratings yet

- September 2022: Our Reference: PPL/CS/PSX-0200 Your Reference: Date: 27 October 2022Document3 pagesSeptember 2022: Our Reference: PPL/CS/PSX-0200 Your Reference: Date: 27 October 2022AftabNo ratings yet

- Vertical Analysis of URC Income StatementDocument1 pageVertical Analysis of URC Income StatementMalou De MesaNo ratings yet

- Summary - Comparative (2020 vs. 2019)Document5 pagesSummary - Comparative (2020 vs. 2019)Neil David ForbesNo ratings yet

- 02 BacarraIN2020 FSDocument9 pages02 BacarraIN2020 FSRichard MendezNo ratings yet

- CLOUD 10102023160435 BMOutcomeCloudRevised-1Document7 pagesCLOUD 10102023160435 BMOutcomeCloudRevised-1pallabbasakNo ratings yet

- Abans QuarterlyDocument14 pagesAbans QuarterlyGFMNo ratings yet

- Consol Result Mar23Document16 pagesConsol Result Mar23Amit KumarNo ratings yet

- 93 - Final Preaboard AFAR SolutionsDocument11 pages93 - Final Preaboard AFAR SolutionsLeiNo ratings yet

- Tata Motors Group Q4 Annual Financial Results FY19 20Document10 pagesTata Motors Group Q4 Annual Financial Results FY19 20Anil Kumar AkNo ratings yet

- Sept 2020Document6 pagesSept 2020akshay kausaleNo ratings yet

- Horizontal AnalysisDocument1 pageHorizontal AnalysisnazreenNo ratings yet

- 2021 Con Quarter04 SoiDocument2 pages2021 Con Quarter04 SoiMohammadNo ratings yet

- CURRENT ISSUES IN ACCOUNTING Final Exam Dec 22Document14 pagesCURRENT ISSUES IN ACCOUNTING Final Exam Dec 22Fungai MajuriraNo ratings yet

- Balance Sheet: Current AssetsDocument3 pagesBalance Sheet: Current AssetsMustafa IbrahimNo ratings yet

- NPV Lesson 2Document5 pagesNPV Lesson 2Barack MikeNo ratings yet

- RatiosDocument6 pagesRatiosWindee CarriesNo ratings yet

- MBA104 - Almario - Parco - Case Study LGAOP02Document25 pagesMBA104 - Almario - Parco - Case Study LGAOP02Jesse Rielle CarasNo ratings yet

- 2021 Con Quarter04 CFDocument2 pages2021 Con Quarter04 CFMohammadNo ratings yet

- Tutorial 1 Presentation of FS (A)Document7 pagesTutorial 1 Presentation of FS (A)fooyy8No ratings yet

- Financial ReportsDocument14 pagesFinancial Reportssardar amanat aliHadian00rNo ratings yet

- Vvi 2008Document1 pageVvi 2008Ashik Uz ZamanNo ratings yet

- Strategic Finance All Question-13Document1 pageStrategic Finance All Question-13TheNOOR129No ratings yet

- FAR210 Aug 2023 S PDFDocument10 pagesFAR210 Aug 2023 S PDFNUR AYUNI BALQISH AHMAD MULIADINo ratings yet

- KotakDocument3 pagesKotak41 lavanya NairNo ratings yet

- Finals Q1 BOT SolutionsDocument5 pagesFinals Q1 BOT SolutionsSIMONGIL SOTTONo ratings yet

- Income Statements: Brown & Company PLCDocument5 pagesIncome Statements: Brown & Company PLCprabathdeeNo ratings yet

- CHAPTER 14 - CFS Advance IAS7Document15 pagesCHAPTER 14 - CFS Advance IAS7Hạnh Nguyễn HồngNo ratings yet

- Bata Shoe Company (Bangladesh) LimitedDocument1 pageBata Shoe Company (Bangladesh) LimitedMutasin FouadNo ratings yet

- PrinceDocument2 pagesPrinceSandeep Kumar YadavNo ratings yet

- SPIL Q2FY22 Financial ResultsDocument10 pagesSPIL Q2FY22 Financial ResultsKARANNo ratings yet

- ENTI Ver 1Document72 pagesENTI Ver 1krishna chaitanyaNo ratings yet

- Statement of Financial Position: Horizontal AnalysisDocument12 pagesStatement of Financial Position: Horizontal AnalysisJeane Mae BooNo ratings yet

- Company Accounts - SOCIDocument1 pageCompany Accounts - SOCIMuhammad UmerNo ratings yet

- Ayala Corporation and Subsidiaries Consolidated Statements of Financial PositionDocument6 pagesAyala Corporation and Subsidiaries Consolidated Statements of Financial PositionbyuntaexoNo ratings yet

- 03financial Statement Analysis 1Document11 pages03financial Statement Analysis 1Jon Nell Laguador BernardoNo ratings yet

- UntitledDocument135 pagesUntitledRohol Amin RajuNo ratings yet

- Chapter 7 Financial Aspect ScheduleDocument13 pagesChapter 7 Financial Aspect ScheduleAleelNo ratings yet

- Efficiency of Investment in a Socialist EconomyFrom EverandEfficiency of Investment in a Socialist EconomyMieczyslaw RakowskiNo ratings yet