Professional Documents

Culture Documents

ITC StockReport 20231212 1335

Uploaded by

aarushisoral1Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ITC StockReport 20231212 1335

Uploaded by

aarushisoral1Copyright:

Available Formats

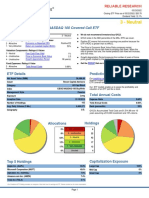

ITC LTD.

Trendlyne Stock Report

Cigarettes-Tobacco Products Dec 12, 2023 01:33 PM

Food Beverages & Tobacco

₹456.5 (0.9% ) 52 Week High Low

325.4

456.5

499.7

Market Cap: 5.7T Avg Daily Volume: 7.0M

NSE | Dec 12, 2023 01:33 PM

DVM SUMMARY

Expensive Star D V M

These stocks are bullish in nature, strong in quality and technical aspects, but bad in valuations. Investors need to be cautious on their returns earned.

Momentum Score

Durability Score (D) High Financial Strength Valuation Score (V) Expensive Valuation (M) Technically Moderately Bullish

Bad Medium Good Bad Medium Good Bad Medium Good

75 28 62

0 35 55 100 0 30 50 100 0 35 60 100

ANALYST RECOMMENDATION TRENDLYNE CHECKLIST

Consensus Recommendation Target Price

BUY 510 (11.65%) 66.7% Passed in checklist

Financials 7 1

21 10 3

Total : 34 Ownership 1 1 2

Strong Buy Buy Hold Sell Strong Sell

Peer Comparison 1 2

Current Price High Estimate

456.5 585

Value & Momentum 5 3

Total 14 7 2

450 509.67

Low Estimate Average Estimate

The consensus recommendation is based on 34 analyst recommendations. The Consensus Estimate The Trendlyne Checklist checks if the company meets the key criteria for financial health and

is the aggregate analyst estimates for listed Indian companies. consistent growth.

KEY STATISTICS

Ratios Financials

TTM PE Ratio ROE Annual % ROCE Annual % Operating Revenue TTM Cr Revenue Growth Annual YoY Net Profit Annual Cr

%

28.2 27.8 35.8 70278.3 19191.7

16.7

Market Runner Up Market Leader Market Leader Market Leader Market Leader

Low in industry

EBIT Annual Margin % TTM PEG Ratio Long Term Debt To Equity

Annual Net Profit TTM Growth % Dividend yield 1yr % EPS TTM Growth %

36.4 1.7

- 16.9 3.4 16.9

Market Leader PEG TTM is much higher than 1

Below industry Median Market Runner Up Below industry Median

Below industry Median

PRICE VOLUME CHARTS

1 Year Return : 33.7% 5 Year Return : 66.2%

500

400

450

300

400

200

350

300 100

FEB APR JUN AUG OCT DEC JAN JUL JAN JUL JAN JUL JAN JUL JAN JUL

Copyright © Giskard Datatech Pvt Ltd Page 1 of 14 All rights reserved

ITC LTD. Trendlyne Stock Report

Cigarettes-Tobacco Products Dec 12, 2023 01:33 PM

Food Beverages & Tobacco

Durability Summary

Durability Score ITC Ltd. has a durability score of 75, which indicates High Financial Strength.

75 / 100

A High Durability Score (greater than 55) indicates good and consistent financial performance : stable revenues, cash flows, and low debt.

The Durability score looks at many different metrics, including long-term performance data, to identify stocks that have stood the test of time.

High Financial Strength

Bad Medium Good

75

0 35 55 100

Durability Trend ITC Ltd. : Dec '22 - Dec '23 Durability v/s Peers

100

ITC 75.0

75

Godfrey Phillips India 75.0

GOOD

50

VST Industries 50.0

MEDIUM

25 65.0

NTC Industries

0 Sinnar Bidi Udyog

Jan '23 Feb '23 Mar '23 Apr '23 May '23 Jun '23 Jul '23 Aug '23 Sep '23 Oct '23 Nov '23 Dec '23

0 10 20 30 40 50 60 70 80

Score Distribution (% of time in each zone) Variability (Range)

Good Medium Bad Maximum Minimum ITC Ltd. (75) has highest Durability score amongst its peers. and tied with Godfrey Phillips India

100.0% 0% 0% 75.0 (11 Dec '23) 55.0 (02 Feb '23) Ltd. and 2 others

Financial Metrics

Total Revenue Annual Cr Net Profit Annual Cr Tax Annual Cr Revenue Growth Annual YoY %

72,917.34 16.7% YoY Mar'23 19,191.66 25.9% YoY Mar'23 6,438.4 22.9% YoY Mar'23 16.7% -18.4% YoY Mar'23

100k 30k 10k 30

72917.3 20.4

20185.1 6438.4 6841.9

20k 5916.4 6313.9 20 16.7

52001.9 15306.2 15242.7 5237.3

45280.8 4441.8 4555.3 11.6

50k 11271.2 5k

10

10k 2.9

1.7

-0.2

0

0 0 0

-10

8

3

M

M

'1

'1

'2

'2

'2

'2

'1

'1

'2

'2

'2

'2

'1

'1

'2

'2

'2

'2

TT

TT

TT

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

Mar'18 Mar'19 Mar'20 Mar'21 Mar'22 Mar'23

M

Total Revenue Annual Cr growth is higher Net Profit Annual Cr growth is higher than Tax Annual Cr growth is higher than Revenue Growth Annual YoY % is falling

than historical averages. historical averages. historical averages. faster than historical averages.

CAGR 2Y 18.5% CAGR 2Y 20.8% CAGR 2Y 18.9% CAGR 2Y 1047.0%

3Y 11.9% 3Y 7.8% 3Y 13.2% 3Y 78.7%

5Y 10.0% 5Y 11.2% 5Y 1.7% 5Y 58.5%

Operating Profit Margin Annual % Net Profit TTM Growth % Operating Revenues Qtr Cr Net Profit Qtr Cr

35.2% 6.5% YoY Mar'23 25.9% 63.8% YoY Mar'23 17,774.47 3.9% YoY Sep'23 4,898.07 6.0% YoY Sep'23

40 50 20k 7.5k

32.8 33.1 17108 17164.5

36.4 36.4 37 18489.5

35.2 25.9 17704.5 17634.9 17774.5 5006.6 5175.5 5104.9

21.6 4619.8 4898.1

25 15.8 5k 4389.8

20 10k

0 2.5k

-14

0 -25 0 0

Mar'18 Mar'19 Mar'20 Mar'21 Mar'22 Mar'23 Mar'20 Mar'21 Mar'22 Mar'23 Jun'22 Sep'22 Dec'22 Mar'23 Jun'23 Sep'23 Jun'22 Sep'22 Dec'22 Mar'23 Jun'23 Sep'23

Operating Profit Margin Annual % is growing Operating Revenues Qtr Cr growth is higher Net Profit Qtr Cr is falling faster than

faster than historical averages. than historical averages. historical averages.

CAGR 2Y 236.0%

CAGR 2Y 3.7% 3Y 6.3% YoY 3.9% YoY 6.0%

3Y -1.7% 5Y 0% QoQ 3.6% QoQ -4.1%

5Y -0.7%

Copyright © Giskard Datatech Pvt Ltd Page 2 of 14 All rights reserved

ITC LTD. Trendlyne Stock Report

Cigarettes-Tobacco Products Dec 12, 2023 01:33 PM

Food Beverages & Tobacco

Balance Sheet

Total Assets Annual Cr Total ShareHolders Funds Annual Cr Working Capital Annual Cr

85,883 11.2% YoY Mar'23 69,155.3 10.7% YoY Mar'23 25,931.5 17.5% YoY Mar'23

100k 100k 40k

85883

77367 73819.3 77259.6 29945.6

71798.4 69155.3

64288.9 65273.3 25931.5

59140.9 60347.3 62455.6 24302.3

52510.1 21735.3 22068.7

50k 50k 20k 17143.5

0 0 0

Mar'18 Mar'19 Mar'20 Mar'21 Mar'22 Mar'23 Mar'18 Mar'19 Mar'20 Mar'21 Mar'22 Mar'23 Mar'18 Mar'19 Mar'20 Mar'21 Mar'22 Mar'23

Total Assets Annual Cr growth is higher than Total ShareHolders Funds Annual Cr growth Working Capital Annual Cr growth is higher

historical averages. is higher than historical averages. than historical averages.

CAGR 2Y 7.86% CAGR 2Y 7.05% CAGR 2Y 3.3%

3Y 3.54% 3Y 1.94% 3Y -4.68%

5Y 5.96% 5Y 5.66% 5Y 8.63%

Cashflow

Cash from Operating Activity Annual Cr Cash from Investing Activity Annual Cr Cash from Financing Annual Activity Cr Net Cash Flow Annual Cr

18,877.5 19.7% YoY Mar'23 -5,732.3 -156.1% YoY Mar'23 -13,006 4.2% YoY Mar'23 139.2 420.2% YoY Mar'23

20k 10k 0 500

334.2

15775.5 18877.5 5682.9

14689.7

13169.4 12583.4 12527.1 169.1 139.2

-6221.1 -6868.6

10k 0 -10k -8181.5 0

-43.5

-2238.5

-13580.5 -13006 -165.6

-5545.7 -5732.3 -18633.8 -423.8

-6174

-7113.9

0 -10k -20k -500

Mar'18 Mar'19 Mar'20 Mar'21 Mar'22 Mar'23 Mar'18 Mar'19 Mar'20 Mar'21 Mar'22 Mar'23 Mar'18 Mar'19 Mar'20 Mar'21 Mar'22 Mar'23 Mar'18 Mar'19 Mar'20 Mar'21 Mar'22 Mar'23

Cash from Operating Activity Annual Cr Cash from Investing Activity Annual Cr is Cash from Financing Annual Activity Cr Net Cash Flow Annual Cr growth is higher

growth is higher than historical averages. falling faster than historical averages. growth is higher than historical averages. than historical averages.

CAGR 2Y 22.76% CAGR 2Y -0.43% CAGR 2Y 16.45% CAGR 2Y 157.32%

3Y 8.72% 3Y 2.44% 3Y -16.71% 3Y -25.31%

5Y 7.47% 5Y 4.23% 5Y -15.89% 5Y 196.59%

Financial Ratios

ROE Annual % ROCE Annual % RoA Annual % Current Ratio Annual

27.8% 13.7% YoY Mar'23 35.8% 12.3% YoY Mar'23 22.3% 13.3% YoY Mar'23 2.9 2.6% YoY Mar'23

40 40 30 6

31 31 31.9

29.8 28.5 35.8 22.3

27.8 19.8 19.7 4.1

23.4 24.4 20 17.5 17.5 17.8 4

21.5 21.3 21.8 3.2 3.3

2.9 2.8 2.9

20 20

10 2

0 0 0 0

Mar'18 Mar'19 Mar'20 Mar'21 Mar'22 Mar'23 Mar'18 Mar'19 Mar'20 Mar'21 Mar'22 Mar'23 Mar'18 Mar'19 Mar'20 Mar'21 Mar'22 Mar'23 Mar'18 Mar'19 Mar'20 Mar'21 Mar'22 Mar'23

ROE Annual % is growing faster than ROCE Annual % is growing faster than RoA Annual % is growing faster than Current Ratio Annual growth is higher than

historical averages. historical averages. historical averages. historical averages.

CAGR 2Y 12.82% CAGR 2Y 12.11% CAGR 2Y 11.97% CAGR 2Y -6.08%

3Y 5.79% 3Y 6.32% 3Y 4.14% 3Y -11.26%

5Y 5.28% 5Y 2.91% 5Y 4.97% 5Y 0.24%

Net Profit Margin Annual % Interest Coverage Ratio Annual EBIT Annual Margin %

27.4% 7.3% YoY Mar'23 639.9 12.0% YoY Mar'23 36.4% 6.4% YoY Mar'23

40 1000 50

31.5 39.3 39.7 40.9

36.5 36.4

26.4 26.5 27.2 27.4 34.2

25.5 639.9

571.5

20 500 422.4 403.5 25

369.7

190

0 0 0

Mar'18 Mar'19 Mar'20 Mar'21 Mar'22 Mar'23 Mar'18 Mar'19 Mar'20 Mar'21 Mar'22 Mar'23 Mar'18 Mar'19 Mar'20 Mar'21 Mar'22 Mar'23

Net Profit Margin Annual % is growing faster Interest Coverage Ratio Annual growth is EBIT Annual Margin % is growing faster than

than historical averages. lower than historical averages. historical averages.

CAGR 2Y 0.39% CAGR 2Y 25.93% CAGR 2Y -0.12%

3Y -4.61% 3Y 20.07% 3Y -3.8%

5Y 0.71% 5Y 27.5% 5Y -1.51%

Copyright © Giskard Datatech Pvt Ltd Page 3 of 14 All rights reserved

ITC LTD. Trendlyne Stock Report

Cigarettes-Tobacco Products Dec 12, 2023 01:33 PM

Food Beverages & Tobacco

Key Metrics - Peer Comparison

COMPARISON

ITC LTD. GODFREY PHILLIPS INDIA LTD. VST INDUSTRIES LTD. NTC INDUSTRIES LTD. SINNAR BIDI UDYOG LTD.

(1) (2) (3) (4) (5)

Valuation Score 28.0 56.2 38.5 53.5 20.2

P/E Ratio TTM 28.2 13.6 16.6 17.3 64.7

Forward P/E Ratio 27.4 14.3 16.1 - -

PEG Ratio TTM 1.7 0.3 -1.4 -0.5 0.6

Forward PEG Ratio 2.6 0.5 -4.6 - -

Price to Book Value 8.2 3.1 4.3 1.3 6.5

Price to Sales TTM 8.1 2.5 3.5 2.6 5.3

Price to Sales Annual 6.7 2.7 3.8 1.7 1.4

EV to EBITDA 17.1 9.7 10.5 8.0 17.1

Market Cap to Sales 6.7 2.7 3.8 1.7 1.4

Price to Free Cash Flow 139.2 -11.1 4.6 1.4 -0.0

Graham Number 142.5 1540.6 1849.7 95.4 162.8

Copyright © Giskard Datatech Pvt Ltd Page 4 of 14 All rights reserved

ITC LTD. Trendlyne Stock Report

Cigarettes-Tobacco Products Dec 12, 2023 01:33 PM

Food Beverages & Tobacco

Valuation Summary

Valuation Score ITC Ltd. has a valuation score of 28, which indicates an Expensive Valuation.

28 / 100

A High Valuation Score (greater than 50) indicates the stock is competitively priced at current P/E, P/BV and share price.

The Valuation helps you identify stocks which are still bargains, and whose strengths are not fully priced into the share price.

Expensive Valuation

Bad Medium Good

28

0 30 50 100

Valuation Trend ITC Ltd. : Dec '22 - Dec '23 Valuation v/s Peers

100

ITC 28.0

75

Godfrey Phillips India 56.2

GOOD

50

VST Industries 38.5

MEDIUM

25 53.5

NTC Industries

0 Sinnar Bidi Udyog 20.2

Jan '23 Feb '23 Mar '23 Apr '23 May '23 Jun '23 Jul '23 Aug '23 Sep '23 Oct '23 Nov '23 Dec '23

0 10 20 30 40 50 60

Score Distribution (% of time in each zone) Variability (Range)

Good Medium Bad Maximum Minimum ITC Ltd. (28) has fourth-highest Valuation score amongst its peers, behind VST Industries Ltd.

0% 0% 100.0% 27.8 (21 Nov '23) 21.0 (10 May '23) (38)

P/E Buy Sell Zone

ITC Ltd. has spent 90.9% of the time below the current P/E 28.2. This puts it in the PE Strong Sell

Zone

Strong Sell Zone 90.9% into P/E buy sell zone This is based on the tendency of the P/E value to revert to its historical mean.

If the P/E value has spent most of its time below the current value, then it means that most gains

have probably been realised already, and it is time to sell.

Strong upside potential % time spent below current P/E Gains already realized If the P/E value has spent very little time below the current value, then it means that there is strong

potential upside, and it is time to buy.

Valuation Metrics

PE TTM Price to Earnings Price To Sales Annual Dividend Payout CP Annual % Graham Number

28.2 7.9% YoY Dec'23 6.7 31.9% YoY Dec'23 35.5% -7.0% YoY Dec'23 142.5 10.2% YoY Dec'23

40 10 50 200

41.6 41.5

7.5 44.9 38.1

28.2 6.7 35.5 142.5

26.1 129.3

5.5 115.2 113.7 115.4

20.2 20.9 5.1

20 5 4.3 25 100

13.9

0 0 0 0

Mar'20 Mar'21 Mar'22 Mar'23 Dec'23 Mar'20 Mar'21 Mar'22 Mar'23 Dec'23 Mar'20 Mar'21 Mar'22 Mar'23 Dec'23 Mar'20 Mar'21 Mar'22 Mar'23 Dec'23

Price To Sales Annual growth is higher than Dividend Payout CP Annual % is falling faster

historical averages. than historical averages.

CAGR 2Y 10.4% CAGR 2Y 13.1%

3Y 22.1% CAGR 2Y 10.9% CAGR 2Y -7.6% 3Y 4.5%

5Y - 3Y 16.2% 3Y -5.2% 5Y -

5Y -1.3% 5Y -5.1%

Copyright © Giskard Datatech Pvt Ltd Page 5 of 14 All rights reserved

ITC LTD. Trendlyne Stock Report

Cigarettes-Tobacco Products Dec 12, 2023 01:33 PM

Food Beverages & Tobacco

Momentum Summary

Momentum Score ITC Ltd. has a Momentum score of 62, which indicates that it is Technically Moderately Bullish.

62 / 100

A High Momentum Score indicates the stock is seeing buyer demand, and is bullish across its technicals compared to the rest of the stock

universe.

Momentum is a very effective short term score, while Durability and Valuation help assess the stock’s health over the long term.

Technically Moderately Bullish

Bad Medium Good

62

0 35 60 100

Momentum Trend ITC Ltd. : Dec '22 - Dec '23 Momentum v/s Peers 11 Dec '23

100

ITC 61.8

75

Godfrey Phillips India 55.5

GOOD

50

VST Industries 51.5

MEDIUM

25 69.0

NTC Industries

0 Sinnar Bidi Udyog 48.2

Jan '23 Feb '23 Mar '23 Apr '23 May '23 Jun '23 Jul '23 Aug '23 Sep '23 Oct '23 Nov '23 Dec '23

0 10 20 30 40 50 60 70 80

Score Distribution (% of time in each zone) Variability (Range)

Good Medium Bad Maximum Minimum ITC Ltd. (62) has second-highest Momentum score amongst its peers, behind NTC Industries

54.4% 45.6% 0% 70.5 (24 Jul '23) 43.4 (07 Nov '23) Ltd. (69)

Price Change Analysis Key Momentum Metrics

LTP : 456.5 RSI MFI

1 Day 454 460

57.3 54.8

1 Week 448.5 464.8

RSI is 57.3, RSI below 30 is considered oversold MFI is 54.8, MFI below 30 is considered

and above 70 overbought oversold and above 70 overbought

1 Month 434.15 464.8

3 Months 425.5 464.8

MACD MACD Signal Line

6 Months 425.5 499.7

4.2 2.6

1 Year 325.35 499.7

MACD is above its center and signal Line, this MACD is above its center and signal Line, this

3 Year 196.9 499.7 is a bullish indicator. is a bullish indicator.

5 Year 134.6 499.7

ATR

100 150 200 250 300 350 400 450 500 550

6.8

ATR is low in its industry

Simple Moving Averages Exponential Moving Averages

ITC Ltd. is trading above 8 out of 8 SMAs. ITC Ltd. is trading above 8 out of 8 EMAs.

BULLISH BULLISH

8/8 8/8

Bullish v/s Bearish SMAs Bullish v/s Bearish SMAs

(if the current price is above a moving average, it is considered bullish) (if the current price is above a moving average, it is considered bullish)

5Day SMA Rs 454.9 50Day SMA Rs 441 5Day EMA Rs 452.6 26Day EMA Rs 444.6

10Day SMA Rs 448.7 100Day SMA Rs 447.2 10Day EMA Rs 449.9 50Day EMA Rs 443.3

20Day SMA Rs 443.6 150Day SMA Rs 446.8 12Day EMA Rs 448.8 100Day EMA Rs 441.2

30Day SMA Rs 440 200Day SMA Rs 433 20Day EMA Rs 445.8 200Day EMA Rs 424.2

Copyright © Giskard Datatech Pvt Ltd Page 6 of 14 All rights reserved

ITC LTD. Trendlyne Stock Report

Cigarettes-Tobacco Products Dec 12, 2023 01:33 PM

Food Beverages & Tobacco

Momentum Oscillators Pivot Support & Resistances

ITC Ltd. is trading above 5 out of 9 Oscillators in bullish zone. ITC Ltd. at 456.50 is trading above it's resistance R2 456.08.

BEARISH NEUTRAL BULLISH 460

R3 - 458.6

3/9 1/9 5/9 458

LTP - 456.5

456 R2 - 456.1

Bullish v/s Bearish Oscillators

(if an oscillator is in its negative range, it is considered bearish)

R1 - 454.3

454

RSI(14) 57.3 MACD(12, 26, 9) 4.2 452 PIVOT - 451.8

Stochastic Oscillator 62.3 Stochastic RSI 51.8 450 S1 - 450.0

CCI 20 74.7 William -40.3 448

S2 - 447.5

Awesome Oscillator 16.5 Ultimate Oscillator 52.3 446 S3 - 445.7

Momentum Oscillator 14.7

444

Neutral Bullish Bearish

Volatility Metrics

Beta

1 month 3 month 1 year 3 year ADX Day Bollinger Bands Mid_20_2

0.77 0.35 0.11 0.04 21.5 443.6

ADX is below industry Median Bollinger Bands Mid_20_2 is low in its industry

beta value for 3 month indicates price tends to be less volatile than the market

Daily Volume Analysis Active Candlesticks

Daily average delivery volume over the past week is 64.1%

Bullish Candlestick Pattern Bearish Candlestick Patterns

11 Dec, 2023 3.9M 7.0M

Bullish Harami No active candlesticks

Week 9.2M 14.4M

Month 6.6M 10.3M

0 2M 4M 6M 8M 10M 12M 14M 16M

Combined Delivery Volume NSE + BSE Traded Volume

Daily Avg. Delivery Volume %

11 Dec, 2023 Week Month

56.2% 64.1% 63.9%

Copyright © Giskard Datatech Pvt Ltd Page 7 of 14 All rights reserved

ITC LTD. Trendlyne Stock Report

Cigarettes-Tobacco Products Dec 12, 2023 01:33 PM

Food Beverages & Tobacco

Checklist Summary

Trendlyne Checklist Score

66.7% pass 14 | 7

=

Financial

7|1

+

Value & Momentum

5|3

+

Ownership

1|2|1

+

Peer Comparison

1|2

Financial Value & Momentum

7 criteria met | 1 not met 5 criteria met | 3 not met

Company has seen consistent profit growth in the last eight The stock is in the Buy Zone according to its historical P/E?

quarters? No

Yes The stock is in the Buy Zone according to its historical P/E

Stock has seen consistent profit growth in the last eight quarters

The stock is in the Buy Zone according to its historical P/BV?

Company has seen consistent sales growth in the last eight quarters? No

No The stock is in the Buy Zone according to its historical P/BV

Stock has seen consistent sales growth in the last eight quarters

Company's valuation score signals overall affordability?

Company has high Trendlyne Durability Score? No

Yes Company's valuation score signals overall affordability

Stock has high Trendlyne Durability Score (>=60)

Trendlyne Momentum Score shows bullishness?

Company has high Piotroski Score? Yes

Yes Trendlyne Momentum Score shows bullishness

Stock has high Piotroski Score (>= 7)

Stock is trading above all short term SMAs?

Company has Low Debt? Yes

Yes Stock is trading above all short term SMAs

Stock has Low Debt

Stock is trading above all long term SMAs?

Shareholder Value: Company has Strong ROE? Yes

Yes Stock is trading above all long term SMAs

Shareholder Value: Stock has Strong ROE

Stock has bullish candlesticks?

Company has Positive Net Cash Flow? Yes

Yes Stock has bullish candlesticks OR Stock has no bearish candlesticks

Stock has Positive Net Cash Flow

Stock has active positive breakouts?

Company is generating increasing cash from operations? Yes

Yes Stock has active positive breakouts

Positive CFO for last 2 years

Ownership Peer Comparison

1 criteria met | 3 not met 1 criteria met | 2 not met

FII/FPI or DIIs are buying the stock? Company is giving better long term returns than the industry?

Yes

Institutions have been increasing stake in the company over the past Yes Company is giving better long term returns than the industry

four quarters

Company's sales growth is better than the industry median?

Promoters are buying the stock or ownership is stable? No

No Company's sales growth is better than the industry median

Promoters are buying the stock or ownership is stable

Company's profit growth is better than the industry median?

Promoter pledge is low and not increasing? No

No Company's profit growth is better than the industry median

Promoter pledge is low and not increasing

Insider have not sold stock in the past 3 months?

No

Insider have not sold stock in the past 3 months

Copyright © Giskard Datatech Pvt Ltd Page 8 of 14 All rights reserved

ITC LTD. Trendlyne Stock Report

Cigarettes-Tobacco Products Dec 12, 2023 01:33 PM

Food Beverages & Tobacco

Forecaster

Consensus Recommendation Share Price Target

Consensus Recommendation Share Price Target (Avg)

BUY ₹ 509.67 (11.6% upside)

700

600

585.0

21 21 21 21 21

20 500 509.7

450.0

400

11 11 10 10 10 10

300

2 2 2 3 3 3

2023-07-31 2023-08-28 2023-09-30 2023-10-30 2023-11-30 2023-12-11 200

FY21 FY22 FY23 FY24 FY25

Strong Buy Buy Hold Sell Strong Sell

Future Avg. Estimate High Estimate Low Estimate

The consensus recommendation from 34 analysts for ITC Ltd. is BUY

ITC Ltd.'s share price target is above the current price, with an upside of 12.2%

Key Metrics - Average Estimates Actual Revenue Avg. Estimate

EPS Interest expense Net income

25 80 30k

16.7 18.6 20669.6 23083.8

15.1

9.7% 10.3% 56.7 18763.6 9.3%

20 -0.5% 43.4 43.8 25k

12.3 60 -16.3% 45.9 41.4 -0.1%

10.7 -0.7% -8.5% 1.1% 3.7% 1.0%

15069.6

15 -0.6% 20k 13202.5 -0.1%

-1.3%

40

10 15k

5 20 10k

FY21 FY22 FY23 FY24 FY25 FY21 FY22 FY23 FY24 FY25 FY21 FY22 FY23 FY24 FY25

-0.6% -0.7% -0.5% 9.7% 10.3% -16.3% -8.5% 1.1% 3.7% 1.0% -1.3% -0.1% -0.1% 9.3% 0%

Surprises Estimate Surprises Estimate Surprises Estimate

EPS is expected to grow by 10.7% in FY24 Interest expense is expected to grow by 3.8% in FY24 Net income is expected to grow by 10.2% in FY24

ITC Ltd.'s EPS was lower than average estimate 3 times in past 3 ITC Ltd.'s Interest expense was lower than average estimate 2 ITC Ltd.'s Net income was lower than average estimate 3 times

years times in past 3 years in past 3 years

Depreciation & amortization Cash flow per share Dividend per share

2500 20 30

1850.0 13.9 16.3 18.1 16.4

1760.2 10.6 15.0

1635.0 1737.8 4.9% 3.3% 11.4% 10.0% 12.9 8.4%

1620.4 5.5% 13.3% 10.9 15.0%

2000 1.1% -4.3% 15 20 10.3 -1.2%

-3.6% 10.8 4.1% 5.1%

-13.3%

1500 10 10

1000 5 0

FY21 FY22 FY23 FY24 FY25 FY21 FY22 FY23 FY24 FY25 FY21 FY22 FY23 FY24 FY25

-3.6% 1.1% -4.3% 5.5% 4.9% -13.3% 13.3% 3.3% 11.4% 10.0% 4.1% 5.1% -1.2% 15.0% 8.4%

Surprises Estimate Surprises Estimate Surprises Estimate

Depreciation & amortization is expected to grow by 5.9% in Cash flow per share is expected to grow by 12.8% in FY24 Dividend per share is expected to grow by 17.6% in FY24

FY24 ITC Ltd.'s Cash flow per share was higher than average estimate ITC Ltd.'s Dividend per share was higher than average estimate

ITC Ltd.'s Depreciation & amortization was lower than average 2 times in past 3 years 2 times in past 3 years

estimate 2 times in past 3 years

Copyright © Giskard Datatech Pvt Ltd Page 9 of 14 All rights reserved

ITC LTD. Trendlyne Stock Report

Cigarettes-Tobacco Products Dec 12, 2023 01:33 PM

Food Beverages & Tobacco

Forecaster Actual Revenue Avg. Estimate

Free cash flow EBIT Revenue

30k 30k 100k

15068.1 18504.3 20430.1 22486.9 24294.9 27294.0 68425.2 70508.6 78304.0

13015.5 6.5% 13.3% 9.4% -0.9% 8.3% 11.0% 2.7% 0.4% 10.0%

55624.9

20k 11528.0 -0.1% 17239.7 75k 1.3%

-14.0% 0.2% 45172.9

14739.7 0.7%

20k

-5.3%

10k 50k

0 10k 25k

FY21 FY22 FY23 FY24 FY25 FY21 FY22 FY23 FY24 FY25 FY21 FY22 FY23 FY24 FY25

-14.0% -0.1% 6.5% 13.3% 9.4% -5.3% 0.2% -0.9% 8.3% 11.0% 0.7% 1.3% 2.7% 0.4% 10.0%

Surprises Estimate Surprises Estimate Surprises Estimate

Free cash flow is expected to grow by 15.3% in FY24 EBIT is expected to grow by 9.0% in FY24 Revenue is expected to grow by 0.4% in FY24

ITC Ltd.'s Free cash flow was lower than average estimate 2 ITC Ltd.'s EBIT was lower than average estimate 2 times in past ITC Ltd.'s Revenue was higher than average estimate 3 times in

times in past 3 years 3 years past 3 years

Capital expenditure Cash EPS

4k 25

18.1 20.1

2383.3 2427.4 9.7% 9.9%

16.8

22.0% 1.8%

3k 2178.6 20 -2.6%

2029.3 13.8

2045.1 -10.7% -14.7%

12.2 -1.7%

-22.6%

2k 15 -2.5%

1k 10

FY21 FY22 FY23 FY24 FY25 FY21 FY22 FY23 FY24 FY25

-22.6% -10.7% -14.7% 22.0% 1.8% -2.5% -1.7% -2.6% 9.7% 9.9%

Surprises Estimate Surprises Estimate

Capital expenditure is expected to grow by 28.2% in FY24 Cash EPS is expected to grow by 10.7% in FY24

ITC Ltd.'s Capital expenditure was lower than average estimate ITC Ltd.'s Cash EPS was lower than average estimate 3 times in

3 times in past 3 years past 3 years

Copyright © Giskard Datatech Pvt Ltd Page 10 of 14 All rights reserved

ITC LTD. Trendlyne Stock Report

Cigarettes-Tobacco Products Dec 12, 2023 01:33 PM

Food Beverages & Tobacco

Shareholding Summary Shareholding Trend

60%

Promoter -%

42.7% 43.0% 43.4% 43.6% 43.3%

42.0% 40%

DII

FII 43.3%

20%

Public 14.7%

-% -% -% -% -%

0%

Others -% Sep 2022 Dec 2022 Mar 2023 Jun 2023 Sep 2023

Promoter FII DII

0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50%

Retail investors (FII) form the biggest shareholding segment Promoter , FII , DII , over the Sep 2023 quarter

Mutual Fund Holding and Action

400 Mutual Funds have increased holdings from 9.17% to 9.40% in Sep 2023 qtr.

359.0 369.0 368.0

370.0 375.0

Number of MF schemes increased from 383 to 395 in Sep 2023 qtr.

300

FII/FPI have decreased holdings from 43.62% to 43.34% in Sep 2023 qtr

200 Number of FII/FPI investors decreased from 1826 to 1822 in Sep 2023 qtr

158.0 149.0 151.0

139.0

87.0 86.0 Institutional Investors have decreased holdings from 85.58% to 85.32% in Sep

100 76.0

59.0 52.0 2023 qtr

0

Jun-2023 Jul-2023 Aug-2023 Sep-2023 Oct-2023

Net Holders Bought some / all Sold some / all

Major Shareholders ITC Ltd. : Sep '23

FII DII

Name Shares % Change % Name Shares % Change %

Tobacco Manufacture 23.9% - Life Insurance Corpor 15.2% -8.7%

rs (India) Limited ation of India

Myddleton Investmen 3.9% -3.9% Specified Undertaking 7.8% -7.4%

t Company Limited of the Unit Trust of In

dia

Bulk / Block Deals

Date Client Name Deal Type Action Avg Price Qty Exchange

14 Nov'22 ISHARES CORE EMERGING MARKETS MAURITIUS CO Block Sell 356.4 4,603,983 NSE

14 Nov'22 ISHARES CORE MSCI EMERGING MARKETS ETF Block Purchase 356.4 4,603,983 NSE

03 Nov'22 ISHARES CORE EMERGING MARKETS MAURITIUS CO Block Sell 354.6 4,603,984 NSE

03 Nov'22 ISHARES CORE MSCI EMERGING MARKETS ETF Block Purchase 354.6 4,603,984 NSE

25 Oct'22 ISHARES CORE EMERGING MARKETS MAURITIUS CO Block Sell 347.7 2,476,950 NSE

25 Oct'22 ISHARES CORE MSCI EMERGING MARKETS ETF Block Purchase 347.7 2,476,950 NSE

17 Oct'22 ISHARES CORE EMERGING MARKETS MAURITIUS CO Block Sell 332.1 3,892,494 BSE

17 Oct'22 ISHARES CORE MSCI EMERGING MARKETS ETF Block Purchase 332.1 3,892,494 BSE

11 Oct'22 ISHARES CORE EMERGING MARKETS MAURITIUS CO Block Sell 327.9 3,806,279 NSE

11 Oct'22 ISHARES CORE MSCI EMERGING MARKETS ETF Block Purchase 327.9 3,806,279 NSE

Copyright © Giskard Datatech Pvt Ltd Page 11 of 14 All rights reserved

ITC LTD. Trendlyne Stock Report

Cigarettes-Tobacco Products Dec 12, 2023 01:33 PM

Food Beverages & Tobacco

Insider Trading / SAST

Reporting Date Client Name Client Type Regulation Action Avg Price Qty Mode

15 Feb'22 SANJEEV SEKSARIA Immediate Relative Insider Trading Acquisition 232.3 40,000 Gift

13 Dec'21 LN BALAJI Immediate Relative Insider Trading Disposal 234.8 21,500 Market Sale

12 Nov'21 JAYANT AWASTHI Immediate Relative Insider Trading Pledge 228.8 5,000 Creation Of Pledge

09 Nov'21 S RANGRASS Immediate Relative Insider Trading Acquisition 226.6 20,000 Off Market

12 Aug'21 SANDIP DATTA Employee Insider Trading Disposal 216 5,000 Market Sale

12 Aug'21 SANDEEP KAUL Employee Insider Trading Pledge 210 30,000 Creation Of Pledge

12 Aug'21 RAJIV TANDON Director Insider Trading Disposal 216.8 20,000 Market Sale

12 Aug'21 DEBOJIT GHOSH Employee Insider Trading Disposal 209.9 15,500 Market Sale

12 Aug'21 BAPPADITYA RAY CHAUDHURI Employee Insider Trading Disposal 213 30,000 Market Sale

12 Aug'21 ASHESH AMBASTA Employee Insider Trading Disposal 214.1 25,000 Market Sale

Copyright © Giskard Datatech Pvt Ltd Page 12 of 14 All rights reserved

ITC LTD. Trendlyne Stock Report

Cigarettes-Tobacco Products Dec 12, 2023 01:33 PM

Food Beverages & Tobacco

ABOUT THE COMPANY

ITC Ltd.

ITC ITC is one of India's foremost private sector companies with a Gross Revenue of ? 69,481 crores and Net Profit of ? 18,753.31 crores (as on 31.03.2023). ITC has a diversified presence in FMCG, Hotels, Packaging,

Paperboards & Specialty Papers and Agri(Source : Company Web-site)

website: www.itcportal.com

BRANDS OWNED BY THE COMPANY

Sunbean Savlon Vivel Fiama AASHIRVAAD

Essenza Di Wills ITC Master Chef Fabelle chocolate Gumon Candyman

Paperkraft B Natural Kitchen of india Dermafique Classmate

WLS AIM Homelites Charmis Shower to Shower

Mangaldeep Nim wash Nimyle Superia Engage

Farmland Wonderz Milk Mint-O Sunfeast Yippee Bingo

Sunfeast

MANAGEMENT INFORMATION

Tandon R Rajput A K Lahiri D Malik H

Executive Director Senior Vice President(Corporate Affairs) Chief Operating Officer(India Tobacco Division) Divisional Chief Executive(Food Services)

₹7.24Cr. 2023-3-31 ₹5.64Cr. 2023-3-31 ₹5.49Cr. 2023-3-31 ₹5.46Cr. 2023-3-31

Gross Remuneration Year Gross Remuneration Year Gross Remuneration Year Gross Remuneration Year

DIRECTOR INFORMATION

Sanjiv Puri Nakul Anand Sumant Bhargavan SUPRATIM DUTTA

Chairman & Managing Director Executive Director Whole-time Director Whole Time Director & CFO

₹16.32Cr. 2023 ₹8.19Cr. 2023 ₹7.59Cr. 2023 ₹2.01Cr. 2023

Gross Remuneration Year Gross Remuneration Year Gross Remuneration Year Gross Remuneration Year

Copyright © Giskard Datatech Pvt Ltd Page 13 of 14 All rights reserved

ITC LTD. Trendlyne Stock Report

Cigarettes-Tobacco Products Dec 12, 2023 01:33 PM

Food Beverages & Tobacco

Detailed stock report terminology

Trendlyne’s stock report is a comprehensive company analysis report based on its durability, valuation and momentum scores along with the forecaster data, to give you a detailed analysis. The report also

includes Trendlyne’s checklist summary, technical analysis, peer comparison, mutual fund holdings details, insider trading and more.

Durability Score Trendlyne Checklist Score

Durability scores are calculated from 0-100, with zero the worst and 100 the best. Trendlyne Checklist evaluates a stock based on its financial performance, ownership, peer

Durability scores above 55 are considered good(G) and below 35 are considered bad(B). comparison, value and momentum. This helps give an overall performance of the

Scores between 35-55 are considered neutral/Medium/Middle(M). company based on the score.

Stocks with a high durability score (top 20 percentile) are companies that have

consistently and over time, demonstrated good growth and cash flow, stable revenues

and profits, and low debt. PE buy/sell zone

The durability score considers several different metrics and ratios around earnings and

models these over time. Our stocks with high durability scores outperform the index The PE buy/sell zone is calculated based on how many days a stock has traded at its

significantly current PE level. The current PE is compared to the stock’s historical PE performance, to

find out how often (for how many days in the past) the stock has traded at its current PE

value.

Valuation Score If the stock has usually traded above its current PE level (it’s at a higher PE for the

majority of trading days), then the stock is cheaper than usual and in the PE buy zone.

Valuation scores are calculated from 0-100, with zero the worst and 100 the best. If the stock has usually traded below its current PE level (it’s at a lower PE for the

Valuation scores above 50 are considered good(G) and below 30 are considered bad(B). majority of trading days), then the stock is more expensive than usual and in the PE sell

Scores between 30-50 are considered neutral/Medium/Middle(M) zone.

Stocks with a high valuation score (top 20 percentile) are companies whose business and

financial advantages have not yet been priced into their share price. These companies

typically have strong earnings but are currently flying under the radar, and Trendlyne’s Price Volume Charts

valuation score helps shine a spotlight on these companies.

Firms with a low valuation score (bottom 20 percentile) are expensive stocks that have Price volume charts are a type of financial chart that combines two key pieces of

good broker coverage and already have their strengths priced in. They are popular but information about a stock: its price and trading volume. They are commonly used in

pricey. If you are buying them now it would be for a steep price tag: valuation scores help technical analysis to identify trends and patterns in the market.

you identify that. In a price volume chart, the price of the security is plotted on the vertical axis, while the

trading volume is shown on the horizontal axis. Each data point on the chart represents a

single trading day, and the size of the data point may be proportional to the trading

Momentum Score volume.

Scores are calculated from 0-100, with zero being the worst and 100 the best.

Momentum scores above 59 are considered good(G) and below 30 are considered Peer Comparison

bad(B). Scores between 30-59 are considered neutral/Medium/Middle(M)

Momentum score or momentum score identifies the bullish/bearish nature of the stock. Peer comparison in financial analysis is a method of comparing the financial performance

Stocks with a high momentum score (which is calculated daily from over 30 technical and position of one company to its competitors or peers in the same industry or sector.

indicators) are seeing their share price rise, and increase in volumes and sentiment. The purpose of this comparison is to gain insights into how the company is performing

A low and falling momentum score indicates a falling share price. The pace at which this is relative to its competitors and to identify areas where it may be underperforming or

changing is also important for the momentum score. overperforming. In Trendlyne’s stock report, DVM scores are also included in the peer

comparison section.

Analyst recommendation

Technical Analysis

Analyst recommendation of a stock is an assessment made by financial analysts or

brokerage firms about the investment potential of a particular stock. It is usually based Technical analysis is a method of analyzing stocks and other financial instruments that

on a thorough analysis of the company's financial performance, market trends, industry relies on charts and statistical indicators to identify trends and patterns in price and

outlook, and other factors that may impact the stock's value. trading volume.

The analyst recommendation of a stock typically takes the form of a rating or a Key momentum metrics included - relative strength index (RSI), Stochastic RSI, Ultimate

recommendation, such as "buy," "hold," or "sell." The recommendation is usually Oscillator, moving average convergence divergence (MACD), average true range (ATR),

accompanied by a price target, which is the analyst's estimate of the stock's fair value. money flow index (MFI), William, CCI 20 and Awesome Oscillator. Simple and

A low and falling momentum score indicates a falling share price. The pace at which this is exponential moving averages are also included.

changing is also important for the momentum score. To analyse the volatility of the stock, Beta over different periods of time, Average

Directional Movement Index and Bollinger bonds are used. Along with this, active

candlesticks, daily volume analysis is also provided in the rapport.

Disclaimer

© 2023 Giskard Datatech Pvt Ltd

Republication or redistribution of Giskard content, including by framing or similar means, is prohibited without the prior written consent of Giskard. All information in this report is assumed to be

accurate to the best of our ability. Giskard is not liable for any errors or delays in Giskard content, or for any actions taken in reliance on such content. Any forward-looking statements included in the

Giskard content are based on certain assumptions and are subject to a number of risks and uncertainties that could cause actual results to differ materially from current expectations.

Copyright © Giskard Datatech Pvt Ltd Page 14 of 14 All rights reserved

You might also like

- Options As A Strategic Investment PDFDocument5 pagesOptions As A Strategic Investment PDFArjun Bora100% (1)

- Test For Certificate - Coursera - PassedDocument1 pageTest For Certificate - Coursera - Passedmitochondri100% (2)

- Solution Selection Matrix: Project GoalDocument8 pagesSolution Selection Matrix: Project GoalMoanis HusseinNo ratings yet

- Chennpetro Stockreport 20231027 1724Document14 pagesChennpetro Stockreport 20231027 1724adcb704No ratings yet

- LXCHEM StockReport 20231011 1009Document14 pagesLXCHEM StockReport 20231011 1009rajbus lessNo ratings yet

- TITAN StockReport 20230913 0850Document14 pagesTITAN StockReport 20230913 0850bloggingbongoNo ratings yet

- VEDL StockReport 20240410 1623Document14 pagesVEDL StockReport 20240410 1623sunny996316192No ratings yet

- ZENSARTECH StockReport 20240123 0818Document13 pagesZENSARTECH StockReport 20240123 0818Proton CongoNo ratings yet

- IRFC StockReport 20240214 1118Document12 pagesIRFC StockReport 20240214 1118Sashibhusan NayakNo ratings yet

- Indigopnts Stockreport 20231022 2029Document14 pagesIndigopnts Stockreport 20231022 2029Ayush SaxenaNo ratings yet

- IRB StockReport 20240205 1614Document14 pagesIRB StockReport 20240205 1614Chetan ChouguleNo ratings yet

- SOUTHBANK StockReport 20230911 0016Document13 pagesSOUTHBANK StockReport 20230911 0016rameshwardas1980No ratings yet

- ICICIBANK StockReport 20231101 1053Document13 pagesICICIBANK StockReport 20231101 1053SaadNo ratings yet

- IOC StockReport 20231122 1820Document14 pagesIOC StockReport 20231122 1820dherirmpkbqzfavunqNo ratings yet

- IRB StockReport 20231024 0120Document14 pagesIRB StockReport 20231024 0120Ashutosh AgarwalNo ratings yet

- PENIND StockReport 20230828 1023Document14 pagesPENIND StockReport 20230828 1023Chetan ChouguleNo ratings yet

- MOIL StockReportDocument14 pagesMOIL StockReportMohak PalNo ratings yet

- VBL StockReport 20230907 1553Document14 pagesVBL StockReport 20230907 1553Sangeethasruthi SNo ratings yet

- ASHOKA StockReport 20231111 0031Document14 pagesASHOKA StockReport 20231111 0031yashbhutada156No ratings yet

- SUNPHARMA StockReportDocument14 pagesSUNPHARMA StockReportJyotishman SahaNo ratings yet

- INFIBEAM StockReport 20230919 0135Document13 pagesINFIBEAM StockReport 20230919 0135sunny996316192No ratings yet

- HDFCBANK StockReport 20240117 1055Document13 pagesHDFCBANK StockReport 20240117 1055RAKESH ANABNo ratings yet

- KOTAKBANK StockReportDocument13 pagesKOTAKBANK StockReportSSK SNo ratings yet

- BAJAJFINSV-StockReport-2024 Jan 07-1614Document14 pagesBAJAJFINSV-StockReport-2024 Jan 07-1614ankit.johnnyNo ratings yet

- RTSPOWR StockReport 20230916 1222Document12 pagesRTSPOWR StockReport 20230916 1222Firaa'ol GizaachooNo ratings yet

- MORNINGSTARDocument5 pagesMORNINGSTARhectorhernandez5576No ratings yet

- Average Score: Perdana Petroleum (Perdana-Ku)Document11 pagesAverage Score: Perdana Petroleum (Perdana-Ku)Zhi Ming CheahNo ratings yet

- Jamna Auto Share Price, Jamna Auto Stock Price, JDocument2 pagesJamna Auto Share Price, Jamna Auto Stock Price, Jmuthu27989No ratings yet

- 3 - Neutral: Global X Funds: Global X NASDAQ 100 Covered Call ETFDocument3 pages3 - Neutral: Global X Funds: Global X NASDAQ 100 Covered Call ETFphysicallen1791No ratings yet

- Aray FordDocument3 pagesAray Fordphysicallen1791No ratings yet

- AlphaIndicator KOBA 20230212Document11 pagesAlphaIndicator KOBA 20230212Zhi_Ming_Cheah_8136No ratings yet

- Abbvie Inc. Report 11.29.23Document3 pagesAbbvie Inc. Report 11.29.23physicallen1791No ratings yet

- Average Score: Spritzer (Spritzer-Ku)Document11 pagesAverage Score: Spritzer (Spritzer-Ku)Zhi_Ming_Cheah_8136No ratings yet

- Average Score: Texchem Resources (Texchem-Ku)Document11 pagesAverage Score: Texchem Resources (Texchem-Ku)Zhi_Ming_Cheah_8136No ratings yet

- First Solar, Inc. (FSLR) : 3 - NeutralDocument6 pagesFirst Solar, Inc. (FSLR) : 3 - NeutralCarlos TresemeNo ratings yet

- AlphaIndicator ECOH 20201031Document11 pagesAlphaIndicator ECOH 20201031hajdahNo ratings yet

- Zecon (Zecon-Ku) : Average ScoreDocument11 pagesZecon (Zecon-Ku) : Average ScoreEyet OsmiNo ratings yet

- Abcl 2021 11 17Document4 pagesAbcl 2021 11 17eciffONo ratings yet

- Cerrado Gold (TSXVCERT) - Stock Price, News & Analysis - Simply Wall STDocument1 pageCerrado Gold (TSXVCERT) - Stock Price, News & Analysis - Simply Wall STpkbe5358 MynameNo ratings yet

- Average Score: Tex Cycle Technology (M) (Texcycl-Ku)Document11 pagesAverage Score: Tex Cycle Technology (M) (Texcycl-Ku)Zhi_Ming_Cheah_8136No ratings yet

- 11.24.23 Nividia Report FORD ResearchDocument3 pages11.24.23 Nividia Report FORD Researchphysicallen1791No ratings yet

- Multi RSI Sell: Read MoreDocument1 pageMulti RSI Sell: Read MoreghanshyamdsainiNo ratings yet

- Bajaj Finance LTD: BajfinanceDocument5 pagesBajaj Finance LTD: BajfinancesdgzhgbNo ratings yet

- 3M India Share Price, Financials and Stock AnalysisDocument9 pages3M India Share Price, Financials and Stock AnalysisGaganNo ratings yet

- Sustainable Earnings Growth: Snapshot Value of Stock Based OnDocument35 pagesSustainable Earnings Growth: Snapshot Value of Stock Based OnlkamalNo ratings yet

- Quality Management and Six Sigma: Ravi Shankar DenduluriDocument63 pagesQuality Management and Six Sigma: Ravi Shankar DenduluriNidheesh RajasekharanNo ratings yet

- Momentum PicksDocument23 pagesMomentum PicksK.praveenNo ratings yet

- Arbutus Biopharma Corp. REPORT 11.29.23Document3 pagesArbutus Biopharma Corp. REPORT 11.29.23physicallen1791No ratings yet

- Factsheet Nifty Alpha50Document2 pagesFactsheet Nifty Alpha50sumonNo ratings yet

- Problem Solving & Decision Making - 20 Apr - GoldCoinIndoDocument23 pagesProblem Solving & Decision Making - 20 Apr - GoldCoinIndoBagas FernandoNo ratings yet

- R611 Iifi Urja-InDocument11 pagesR611 Iifi Urja-InShailesh ChhajedNo ratings yet

- Lly Report 8 April 2024Document3 pagesLly Report 8 April 2024physicallen1791No ratings yet

- SR Research SVCDocument8 pagesSR Research SVCshNo ratings yet

- Screenshot 2021-09-23 at 20.45.43Document1 pageScreenshot 2021-09-23 at 20.45.43Yadav ShailendraNo ratings yet

- Average Score: Mega Sun City Holdings (Megasun-Ku)Document11 pagesAverage Score: Mega Sun City Holdings (Megasun-Ku)Zhi_Ming_Cheah_8136No ratings yet

- Page 1 of 2 Assessment of Working Capital Requirements Name: M/S S K Auto PartsDocument2 pagesPage 1 of 2 Assessment of Working Capital Requirements Name: M/S S K Auto PartsAnsari JiNo ratings yet

- Avoid: Downgraded $3116.42 2.7% 5 DaysDocument1 pageAvoid: Downgraded $3116.42 2.7% 5 DaysKapilNo ratings yet

- Average Score: Yes Bank (Yesbank-In)Document11 pagesAverage Score: Yes Bank (Yesbank-In)Vivek S MayinkarNo ratings yet

- Stock Report For MHODocument11 pagesStock Report For MHOtaree156No ratings yet

- How to Select Investment Managers and Evaluate Performance: A Guide for Pension Funds, Endowments, Foundations, and TrustsFrom EverandHow to Select Investment Managers and Evaluate Performance: A Guide for Pension Funds, Endowments, Foundations, and TrustsNo ratings yet