Professional Documents

Culture Documents

Cash Business Account 1099k

Uploaded by

garydeservesmithCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash Business Account 1099k

Uploaded by

garydeservesmithCopyright:

Available Formats

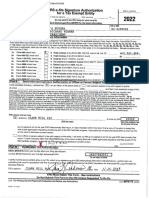

Block, Inc.

f/k/a Square, Inc. If you have questions contact:

1955 Broadway https://cash.app/contact

MSC 415

Oakland, CA 94612

GARY F SMITH

166 Desmond Street

Rochester, NY 14615

Instructions for Payee

You have received this form because you have either (a) accepted payment cards for payments, or Box 1a. Shows the aggregate gross amount of payment card/third party network transactions made

(b) received payments through a third party network in the calendar year reported on this form. to you through the PSE during the calendar year.

Merchant acquirers and third party settlement organizations, as payment settlement entities (PSEs), Box 1b. Shows the aggregate gross amount of all reportable payment transactions made to you

through the PSE during the calendar year where the card was not present at the time of the transaction

must report the proceeds of payment card and third party network transactions made to you on or the card number was keyed into the terminal. Typically, this relates to online sales, phone sales, or

Form 1099-K under Internal Revenue Code section 6050W. The PSE may have contracted with an catalogue sales. If the box for third party network is checked, or if these are third party network

electronic payment facilitator (EPF) or other third party payer to make payments to you. transactions, Card Not Present transactions will not be reported.

If you have questions about the amounts reported on this form, contact the FILER whose Box 2. Shows the merchant category code used for payment card/third party network transactions

information is shown in the upper left corner on the front of this form. If you do not recognize the (if available) reported on this form.

FILER shown in the upper left corner of the form, contact the PSE whose name and phone number Box 3. Shows the number of payment transactions (not including refund transactions) processed

are shown in the lower left corner of the form above your account number. through the payment card/third party network.

Box 4. Shows backup withholding. Generally, a payer must backup withhold if you did not furnish

If the Form 1099-K is related to your business, see Pub. 334 for more information. If the Form

1099-K is related to your work as part of the gig economy, see www.IRS.gov/GigEconomy. your TIN or you did not furnish the correct TIN to the payer. See Form W-9, Request for Taxpayer

Identification Number and Certification, and Pub. 505. Include this amount on your income tax return

See the separate instructions for your income tax return for using the information reported on

this form. as tax withheld.

Boxes 5a-5l. Show the gross amount of payment card/third party network transactions made to you

Payee’s taxpayer identification number (TIN). For your protection, this form may show only the last for each month of the calendar year.

four digits of your TIN (social security number (SSN), individual taxpayer identification number (ITIN),

Boxes 6-8. Show state and local income tax withheld from the payments.

adoption taxpayer identification number (ATIN), or employer identification number (EIN)). However,

the issuer has reported your complete TIN to the IRS. Future developments. For the latest information about developments related to Form 1099-K and its

instructions, such as legislation enacted after they were published, go to www.irs.gov/Form1099K.

Account number. May show an account number or other unique number the PSE assigned to

distinguish your account. Free File Program. Go to www.irs.gov/FreeFile to see if you qualify for no-cost online federal tax

preparation, e-filing, and direct deposit or payment options.

CORRECTED (if checked)

FILER’S name, street address, city or town, state or province, country, ZIP or FILER’S TIN OMB No. 1545-2205

foreign postal code, and telephone no.

Block, Inc. 80-0429876 Payment Card

f/k/a Square, Inc. PAYEE’S TIN and Third Party

1955 Broadway

MSC 415

437592990 À¾¶¶ Network

1a Gross amount of payment Transactions

Oakland, CA 94612 card/third party network

transactions

$ 33,921.50 Form 1099-K

1b Card Not Present 2 Merchant category code

transactions Copy B

Check to indicate if FILER is a (an): Check to indicate transactions For Payee

Payment settlement entity (PSE) X reported are: $ 33,921.50 5399

Payment card 3 Number of payment 4 Federal income tax This is important tax

Electronic Payment Facilitator transactions withheld

information and is

(EPF)/Other third party Third party network X 222 $ being furnished to

PAYEE’S name, street address (including apt. no.), city or town, state or province, 5a January 5b February the IRS. If you are

country, and ZIP or foreign postal code

$ 2,034.00 $ 1,096.00 required to file a

GARY F SMITH 5c March 5d April return, a negligence

166 Desmond Street penalty or other

$ 5,900.00 $ 10,363.00 sanction may be

Rochester, NY 14615 5e May 5f June imposed on you if

taxable income

$ 3,890.00 $ 1,454.00 results from this

5g July 5h August transaction and the

$ 1,467.00 $ 6,393.50 IRS determines that it

5i September 5j October has not been

reported.

PSE’S name and telephone number $ 562.00 $

Block, Inc. https://cash.app/contact 5k November 5l December

$ $ 762.00

Account number (see instructions) C9D21B35-1107341 6 State 7 State identification no. 8 State income tax withheld

NY 800429876 7 $

Form 1099-K (Rev. 1-2022) (Keep for your records) www.irs.gov/Form1099K Department of the Treasury - Internal Revenue Service

2H8701 5.000

You might also like

- P010 636211442428322820 T14385011dupD1 PDFDocument1 pageP010 636211442428322820 T14385011dupD1 PDFAnonymous pY5EUXUpaNo ratings yet

- Form 1099Document6 pagesForm 1099Joe LongNo ratings yet

- Robinhood Crypto LLC 85 Willow Road Menlo Park, Ca 94025Document4 pagesRobinhood Crypto LLC 85 Willow Road Menlo Park, Ca 94025Jack BotNo ratings yet

- Ldentification: Request For andDocument1 pageLdentification: Request For andclaraNo ratings yet

- Form 1099ADocument6 pagesForm 1099ABenne JamesNo ratings yet

- Attention:: Not File Copy A Downloaded From This Website. The Official Printed Version of This IRS Form IsDocument6 pagesAttention:: Not File Copy A Downloaded From This Website. The Official Printed Version of This IRS Form IsBenne James50% (2)

- Instructions For Recipient: Copy BDocument2 pagesInstructions For Recipient: Copy Bjohana150218No ratings yet

- IRS E-File Signature Authorization For Form 1041: Employer Identification NumberDocument2 pagesIRS E-File Signature Authorization For Form 1041: Employer Identification NumberJerry MandorNo ratings yet

- 2021 - 1099-NEC - GreenWay Waste & Recycling of Indiana LLC - 11367636 - Sol PinedaDocument3 pages2021 - 1099-NEC - GreenWay Waste & Recycling of Indiana LLC - 11367636 - Sol PinedaRolando Pineda100% (1)

- 1099-b Whfit FormDocument6 pages1099-b Whfit FormYarod EL100% (4)

- Verification of Reported IncomeDocument3 pagesVerification of Reported IncomepdizypdizyNo ratings yet

- Us 1099 2022Document4 pagesUs 1099 2022mks12No ratings yet

- RTMF 990Document49 pagesRTMF 990Craig MaugerNo ratings yet

- Interactive Form W-9 Form From EchoSign - Com Electronic SignatureDocument1 pageInteractive Form W-9 Form From EchoSign - Com Electronic SignatureEchoSign95% (19)

- Img 0001 PDFDocument9 pagesImg 0001 PDFAnonymous mzkNojivNo ratings yet

- Attention:: WWW - Irs.gov/form1099Document8 pagesAttention:: WWW - Irs.gov/form1099kmufti7No ratings yet

- f1099k 2019Document13 pagesf1099k 2019pyatetskyNo ratings yet

- 1099-Div 2021 3350349Document1 page1099-Div 2021 3350349Adam Clifton0% (1)

- F 1099 ADocument6 pagesF 1099 AWb Warnabrother Hatchet50% (2)

- Documents (942,202212311058, F99NEE)Document2 pagesDocuments (942,202212311058, F99NEE)LertoraNo ratings yet

- Laura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyDocument144 pagesLaura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyGabe KaminskyNo ratings yet

- FW 9Document6 pagesFW 9Jasen GordenNo ratings yet

- TimeClock Plus LLC LOCKBOX W-9 2023 (6) 1Document1 pageTimeClock Plus LLC LOCKBOX W-9 2023 (6) 1rofira9450No ratings yet

- Tax Form 1099nec 20230121Document2 pagesTax Form 1099nec 20230121God Is GreatNo ratings yet

- f1099msc 2019Document8 pagesf1099msc 2019pyatetsky100% (1)

- NKC Form w9 SignedDocument4 pagesNKC Form w9 SignedLakes EvansNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationcoldsunlightNo ratings yet

- All Withholding Is A Gift!Document8 pagesAll Withholding Is A Gift!Tom Harkins100% (2)

- US Internal Revenue Service: f8453p - 2001Document2 pagesUS Internal Revenue Service: f8453p - 2001IRSNo ratings yet

- 23-Fwd: 1950's Paparazzi - Performer Contract & W-9Document2 pages23-Fwd: 1950's Paparazzi - Performer Contract & W-9Julio BarriereNo ratings yet

- Lyft 1099K 1239385631162661398 2019 PDFDocument1 pageLyft 1099K 1239385631162661398 2019 PDFJohn Matthew Cruel100% (1)

- Cash 1099Document4 pagesCash 1099Trish HitNo ratings yet

- Request For Copy of Tax ReturnDocument2 pagesRequest For Copy of Tax ReturnAsjsjsjsNo ratings yet

- US Licensed Business Registration ChecklistDocument4 pagesUS Licensed Business Registration ChecklistYohana LazosNo ratings yet

- Cash 1099Document6 pagesCash 1099Shub OutNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationZak CascaNo ratings yet

- Attention:: Order Information Returns and Employer Returns OnlineDocument6 pagesAttention:: Order Information Returns and Employer Returns OnlinepdizypdizyNo ratings yet

- f4506c AccessibleDocument2 pagesf4506c AccessibleRoberto Monterrosa100% (1)

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationAnonymous YGChV39tfD100% (1)

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationYut ChiaNo ratings yet

- IVES Request For Transcript of Tax Return: First)Document2 pagesIVES Request For Transcript of Tax Return: First)GlendaNo ratings yet

- Irs Form w-9 Uc BerkeleyDocument1 pageIrs Form w-9 Uc BerkeleyMike De JesusNo ratings yet

- Irs Form 1099aDocument6 pagesIrs Form 1099aNylinad Etnerfacir Obmil50% (2)

- F 1099 CDocument6 pagesF 1099 Cmoritzjohn50% (2)

- Newmass W9Document2 pagesNewmass W9Christian PazNo ratings yet

- Nonemployee Compensation: Copy B For RecipientDocument1 pageNonemployee Compensation: Copy B For RecipientNubia LisboaNo ratings yet

- Mesh w9 PDFDocument4 pagesMesh w9 PDFKevin ColemanNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationAnonymous mzTmqelNo ratings yet

- CORRECTED (If Checked) : Payment Card and Third Party Network TransactionsDocument2 pagesCORRECTED (If Checked) : Payment Card and Third Party Network TransactionsCarter NiselyNo ratings yet

- What Is and Is Not Reportable On 1099Document9 pagesWhat Is and Is Not Reportable On 1099joy100% (3)

- Form 1040 Schedule BDocument1 pageForm 1040 Schedule BGwo GwppyNo ratings yet

- Document 932023 103600 AM Pd1VYJRDDocument4 pagesDocument 932023 103600 AM Pd1VYJRDBoeroNo ratings yet

- US Internal Revenue Service: f8404 - 2003Document2 pagesUS Internal Revenue Service: f8404 - 2003IRSNo ratings yet

- CORRECTED (If Checked) : Payment Card and Third Party Network TransactionsDocument2 pagesCORRECTED (If Checked) : Payment Card and Third Party Network TransactionsROCIO menjivarNo ratings yet

- Attention:: WWW - Irs.gov/form1099Document8 pagesAttention:: WWW - Irs.gov/form1099Marquita HunterNo ratings yet

- w-9 FormDocument4 pagesw-9 Formapi-350005045No ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationtestNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and Certificationhanakog5972No ratings yet

- Savills LawsuitDocument18 pagesSavills LawsuitRobert GarciaNo ratings yet

- Pearlvine Fast Track Income Plan Free PDF - PearlvineGuideDocument1 pagePearlvine Fast Track Income Plan Free PDF - PearlvineGuidebet47No ratings yet

- Bitumen Prices Wef 16 01 12Document2 pagesBitumen Prices Wef 16 01 12Mahadeva PrasadNo ratings yet

- Credit Rating AgencyDocument3 pagesCredit Rating AgencyJaved KhanNo ratings yet

- Rupsa Dhar - 22PGDM197 - FIN1106Document5 pagesRupsa Dhar - 22PGDM197 - FIN1106Rupsa DharNo ratings yet

- Commerce Past Questions and AnswersDocument37 pagesCommerce Past Questions and AnswersBabucarr Nguda Jarju100% (2)

- Most Important Terms and Conditions (A) Schedule of Fees and Charges 1. Joining Fee, Annual Fees, Renewal FeesDocument8 pagesMost Important Terms and Conditions (A) Schedule of Fees and Charges 1. Joining Fee, Annual Fees, Renewal FeesbashasaruNo ratings yet

- Strategic Choices - Getz PharmaDocument21 pagesStrategic Choices - Getz PharmaYashra NaveedNo ratings yet

- Canadian Business and Society Ethics Responsibilities and Sustainability Canadian 4th Edition Sexty Test BankDocument12 pagesCanadian Business and Society Ethics Responsibilities and Sustainability Canadian 4th Edition Sexty Test Bankbuhlbuhladhesive.edfn100% (22)

- Roll No. 15 TYBAF Project FileDocument68 pagesRoll No. 15 TYBAF Project FileNehaNo ratings yet

- DAP 229 - Financial Management: Capital Budgeting Techniques / MethodDocument12 pagesDAP 229 - Financial Management: Capital Budgeting Techniques / MethodJezibel MendozaNo ratings yet

- 0520Document3 pages0520RJ Rishabh TyagiNo ratings yet

- Mca4020 SLM Unit 09Document31 pagesMca4020 SLM Unit 09AppTest PINo ratings yet

- HRM PPT-1Document16 pagesHRM PPT-1Jasdeep OberoiNo ratings yet

- IDX LQ45 February 2018Document184 pagesIDX LQ45 February 2018Aprilia Dwi PurwaniNo ratings yet

- Core Vs ComprehensiveDocument4 pagesCore Vs ComprehensivedevNo ratings yet

- Usadf-Fish 2Document12 pagesUsadf-Fish 2clark philipNo ratings yet

- Advance Management Accounting Test - 3 Suggested Answers / HintsDocument18 pagesAdvance Management Accounting Test - 3 Suggested Answers / HintsSumit AnandNo ratings yet

- Plagiarism Declaration Form (T-DF)Document12 pagesPlagiarism Declaration Form (T-DF)Nur HidayahNo ratings yet

- Bachelor of Accountancy - AU Table & Curriculum Structure - Group ADocument3 pagesBachelor of Accountancy - AU Table & Curriculum Structure - Group AYong JiaNo ratings yet

- Operations Management (OPM530) - C12 QualityDocument54 pagesOperations Management (OPM530) - C12 Qualityazwan ayop100% (1)

- Course Syllabus - Strama 1st Sem Ay 2017-2018Document10 pagesCourse Syllabus - Strama 1st Sem Ay 2017-2018api-1942418250% (1)

- 01-09-2015 PDFDocument4 pages01-09-2015 PDFWa Riz LaiNo ratings yet

- Hello World: Macroeconomics Theory N. Gregory MankiwDocument2 pagesHello World: Macroeconomics Theory N. Gregory MankiwTristian Kurniawan SNo ratings yet

- Accenture ASEAN Consumer Research CPGDocument20 pagesAccenture ASEAN Consumer Research CPGtswijayaNo ratings yet

- Relevance of Norwegian Model For Developing Countriesfaroukal-KasimDocument22 pagesRelevance of Norwegian Model For Developing Countriesfaroukal-Kasimtsar_philip2010No ratings yet

- P2 - Non Current AssetsDocument43 pagesP2 - Non Current AssetsSidra QamarNo ratings yet

- SEC OpDocument11 pagesSEC OpeasyisthedescentNo ratings yet

- Aniket Doshi-86 Devrath Kadam-87 Nikita Kamath-88 Saloni Parikh-99 Ushma Thakker-114Document8 pagesAniket Doshi-86 Devrath Kadam-87 Nikita Kamath-88 Saloni Parikh-99 Ushma Thakker-114Nikita KamathNo ratings yet

- Introduction To MicroeconomicsDocument43 pagesIntroduction To MicroeconomicsVũ Thùy DươngNo ratings yet