Professional Documents

Culture Documents

REVIEW

Uploaded by

thuminh07112003Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

REVIEW

Uploaded by

thuminh07112003Copyright:

Available Formats

BANKING UNIVERSITY-HCMC Student’s name: ……………………….…….

DEPARTMENT OF FOREIGN LANGUAGES Class: …………......…………………

Reg.No.: ……………………………

END – OF – UNIT REVIEW

Không còn khả năng trả nợ

hội đồng hành chính; lập pháp; viện

I. Match the words with their definitions

insolvency chamber

giám định sổ sách forensic accounting tax accounting accountancy profession

1.an accountant working in this areas acts for a person or company that is no longer able to pay their debts or a

company whose liabilities exceed its assets insolvency forensic accounting

2. when a company’s financial records are officially checked because illegal activity is suspected

3. an area of work that needs advanced education and specific training chamber accountancy

4. official body of auditors, who check that a company’s financial report is true and honestprofession

5. prepare for a company’s financial information in order to calculate the proportion of their profit which they

must pay to their government tax accounting

II. Match the words/ phrases with their correct definitions.

tax exempt amortization total liabilities

leasing earnings per share

leasing

1. an agreement where the owner of something allows someone else to use it for a specific time for a sum of money

2. the ratio that calculates the profit made on a per-share basis. This is quoted by U.S. publicly held companies in their

financial statements. earnings per share

3. when you don’t have to pay tax on certain income tax exempt

4. writing an intangible asset off over a number of years amorization

5. the total legal obligations of a company to pay other parties total liabilities

III. Complete the text about looking for work abroad with words from the box.

a. choice d. small g. respected j. goals

b. qualifications e. accountancy h. finances k. hardworking

c. opportunities f. bookkeepers i. accountants l. auditors

IAFP – Your passport to the future

small

All organisations around the world, large or (1)_________, need someone who can understand and

finances

manage their (2)__________. So a career as an accountant will give you excellent job prospects. With the

qualifications you can work in many different countries. Qualified (4)accountants

right (3)____________, ________ are always in

demand from Australia to Azerbaijan. The question is not Where can I go? But Where do I want to go?

goals

Whatever your career (5)_________, accountancy

you need to think seriously about a professional (6) ___________

qualification. There are many to choose from –and the (7) _________ you make now will affect your

choice

opportunities

career options in the future. A good qualification is your passport to a variety of career (8)____________.

We offer first-class qualifications to ambitious, capable, and (9) ___________

hardworking people who are looking for

respected

a rewarding career in accountancy, finance and management. Our qualifications are (10) __________

worldwide by employers, governments and the accountancy profession itself.

IV. Fill in the numbered blanks with the correct words/ phrases given in the box. Write your answers on the

Answer sheet.

period expenses depreciation generally income it

auditing operating revenues profit making net

The profit and loss account

Companies' annual reports contain a profit and loss account. This is a financial statement which shows the difference

revenues

between the (1)……… and expenses of a period. Non-profit (or not-for-profit) organizations such as charities, public

generally

universities and museums (2)………. produce an income and expenditure account. If they have more income than

profit

expenditure this is called a surplus rather than a (3)………..

At the top of these statements is total sales revenue or turnover: the total amount of money received during a specific

(4)……….

period Next is the cost of sales, also known as cost of goods sold (COGS): the costs associated with (5)………. making the

products that have been sold, such as raw materials, labour, and factory expenses. The difference between the sales

expenses

revenue and the cost of sales is gross profit. There are many other costs or (6)………. that have to be deducted from gross

profit, such as rent, electricity and office salaries. These are often grouped together as selling, general and administrative

expenses (SG&A). depreciation

The statement also usually shows EBITDA (earnings before interest, tax, (7)……….. and amortization) and EBIT

(earnings before interest and tax). The first figure is more objective because depreciation and amortization expenses can

vary depending on which system a company uses.

After all the expenses and deductions is the (8)………… net profit, often called the bottom line. This profit can be distributed

as dividends (unless the company has to cover past losses), or transferred to reserves.

V. Read the article below and answer the questions below.

The future of accounting

The traditional view of accountants as merely “bean counters” is slowly becoming a thing of the past. For

centuries, accountants have been employed to report on the numbers. They have sat there in their little corner,

surrounded by stacks of paper and computer printouts, and have told us whether or not we have made a profit.

But more and more, accountants are finding that management doesn’t need them to report on the numbers. With

today’s technology, management already has access to software programs which do this work for them.

So what will the future accountant do? According to Mr Hamilton-Smythe, the Managing Director f KHZ

Enterprises, the large international manufacturing company, accountants will be employed “to help companies

change the numbers. Their expertise and knowledge of the business will be called upon to prepare strategies.

They will become consultants and advisers. And their skills will need to change accordingly. They will be

involved in international meetings, in giving presentations, running international teams, writing reports, and

making decisions.”

This is going to require a significant change in the general public’s opinion of accountants, who in turn will

need to develop skills not traditionally associated with the job. The image of the guy in the corner with stacks of

paper will change to one of a high flyer, someone who is critical to the success of the organisation.

1. What have accountants done for centuries?

The accountants have been employed to report on the numbers

……………………………………………………………………………………………………………..

2. With today’s technologies, what can management do without the help of accountants?

……………………………………………………………………………………………………………..

Management has access to software programs which do the report for them

3. What will management need accountants to do in the future?

……………………………………………………………………………………………………………..

Accountants will help companies change the numbers

4. What other jobs will the future accountants do?

They are consultants and advisers

……………………………………………………………………………………………………………..

5. How will the image of the guy in the corner with stacks of paper change?

……………………………………………………………………………………………………………..

The image of the guy in the corner with stacks of paper will change to one of a high flyer, who is critical to the success of

the organisation

VI. Read the following passage and answer the questions briefly.

Accounting

In the past, a company's financial records were kept in real books or ledgers - hence the term bookkeeping – so a

company kept a separate sales ledger for sales made, a purchasing ledger for things bought, a cash ledger, and others.

Today, of course, these records are mostly kept on computers in electronic form.

Even today, the company accountants may use these books to prepare the management accounts. These are

prepared monthly, or even weekly in very big companies. They are not published outside the company, but provide

information for controlling the business by giving an up-to-date statement of the company's current financial trading.

They help to answer questions such as: ‘Are sales going to plan?’ and ‘What is happening to our costs?’

But a modern company is also regulated by laws (e.g. the Companies Acts in the UK), and these laws require

a company to publish official financial statements for regulators and shareholders to inspect. This means that the

accountants have to prepare a second annual summary set of accounts, the Statutory Financial Accounts which include a

balance sheet, income statement, and cash-flow statement, according to recognised accounting standards.

These statutory accounts summarize the financial statements for the last year. But the accountants must make sure that the

company reports its official results according to the accounting standards created by the accounting profession. For

example, the company must follow a principle of ‘consistency’ (it cannot keep changing its accounting systems every

year); it must be ‘prudent’ (careful) in its estimate of the value of things it owns; and the directors must believe that the

company has enough money to continue trading next year as a ‘going concern’.

These basic principles have been incorporated into national accounting standards in different ways in different

countries. But globalization has created a growing pressure for all companies worldwide to use the same reporting

standards developed by the international accounting organization, the IFSA.

1. What information can you find in the books or ledgers of a company?

2. What is the purpose of the management accounts?

3. What is the reason for having the statutory financial accounts?

4. What are accounting standards?

5. What is the role of the IFSA?

1. We can find the information about sales made, things bought, cash flow.

2. It provides information for controlling the business by giving an up-to-date statement of the company's current financial

trading

3. Because laws require a company to publish official financial statements for regulators and shareholders to inspect

4. They are the basic principles have been incorporated into national accounting standard

5. It has created a growing pressure for all companies worldwide to use the same reporting standards developed by the

international accounting organization

You might also like

- SolotionsDocument34 pagesSolotionsabdulrahman Abdullah100% (1)

- Sample For Solution Manual For Financial Accounting 11th Edition by Libby and LibbyDocument35 pagesSample For Solution Manual For Financial Accounting 11th Edition by Libby and LibbyAviv Avraham100% (1)

- Solution Manual For Financial Statement Analysis 10th Edition by SubramanyamDocument49 pagesSolution Manual For Financial Statement Analysis 10th Edition by SubramanyamKatrinaYoungqtoki100% (80)

- Ans Quiz 1Document13 pagesAns Quiz 1Jazzy Mercado100% (2)

- FALL 2019 Mid Term Exam-Fin IDocument5 pagesFALL 2019 Mid Term Exam-Fin IAnas100% (2)

- Makineg A Career in Accounting Read The Text and Answer The Questions BelowDocument5 pagesMakineg A Career in Accounting Read The Text and Answer The Questions BelownoureddieNo ratings yet

- Accounting ratios analysisDocument2 pagesAccounting ratios analysisTuan AnhNo ratings yet

- Managerial Accounting ReportsDocument4 pagesManagerial Accounting ReportsNhiên HạNo ratings yet

- Revison Unit 1,2Document3 pagesRevison Unit 1,2Nhiên HạNo ratings yet

- Unit 3 Making A Career in Accounting IIDocument9 pagesUnit 3 Making A Career in Accounting IIHang NguyenNo ratings yet

- Chapter 4 - PUTERI AMALIA - 2010313320025Document6 pagesChapter 4 - PUTERI AMALIA - 2010313320025putri amaliaNo ratings yet

- TA CN Tai Chinh Ngan Hang 21.7 (2) - 40 - Unit 4 - Financial StatementsDocument17 pagesTA CN Tai Chinh Ngan Hang 21.7 (2) - 40 - Unit 4 - Financial StatementsPhương NhiNo ratings yet

- UTS English 3 PekalonganDocument4 pagesUTS English 3 PekalonganLarassNo ratings yet

- Analyze Cash FlowsDocument20 pagesAnalyze Cash FlowsA cNo ratings yet

- Fabm Week 2Document13 pagesFabm Week 2asnairahNo ratings yet

- Test 1-Unit-18 (SV)Document8 pagesTest 1-Unit-18 (SV)Phan Ha MyNo ratings yet

- Financial Accounting Libby 7th Edition Solutions ManualDocument36 pagesFinancial Accounting Libby 7th Edition Solutions Manualwalerfluster9egfh3100% (38)

- Edc76Financial Accounting I - An Introductory PerspectiveDocument21 pagesEdc76Financial Accounting I - An Introductory PerspectiveAmitesh PandeyNo ratings yet

- Unit 19 Accounting and Financial Statement Pre-Reading Tasks DiscussionDocument3 pagesUnit 19 Accounting and Financial Statement Pre-Reading Tasks DiscussionTrúc Đan HồNo ratings yet

- Important Questions For CBSE Class 11 Accountancy Chapter 9 - Financial Statements 1Document10 pagesImportant Questions For CBSE Class 11 Accountancy Chapter 9 - Financial Statements 1ABHISHEK SINGHNo ratings yet

- Giao Trinh Tacn Ke Toan Tai ChinhDocument76 pagesGiao Trinh Tacn Ke Toan Tai ChinhMinh Lý TrịnhNo ratings yet

- Financial TrainingDocument15 pagesFinancial TrainingGismon PereiraNo ratings yet

- Financial PerformanceDocument2 pagesFinancial PerformanceNgọc NguyễnNo ratings yet

- Revised BDM - Sample Q&A SolveDocument13 pagesRevised BDM - Sample Q&A SolveSonam Dema DorjiNo ratings yet

- Ncert SolutionsDocument33 pagesNcert SolutionsArif ShaikhNo ratings yet

- Chapter 1 Direct Reading GuideDocument10 pagesChapter 1 Direct Reading GuideOsiris HernandezNo ratings yet

- English For The Financial Sector: Mohamed - Diab@univ-Msila - DZDocument5 pagesEnglish For The Financial Sector: Mohamed - Diab@univ-Msila - DZAli KerbabiNo ratings yet

- G12 Fabm2 Week2Document16 pagesG12 Fabm2 Week2Whyljyne Glasanay100% (1)

- UTS-Bhs Inggris Akuntansi MalamDocument1 pageUTS-Bhs Inggris Akuntansi MalamAnonymous Fn7Ko5riKT100% (1)

- Fabm 2Document19 pagesFabm 2leiNo ratings yet

- Full Download Financial Accounting A Business Process Approach 3rd Edition Reimers Solutions ManualDocument36 pagesFull Download Financial Accounting A Business Process Approach 3rd Edition Reimers Solutions Manualdrizitashao100% (43)

- AuditingDocument8 pagesAuditingrazvan valentinNo ratings yet

- Sample Test Ta5Document4 pagesSample Test Ta5ngoccb17.jpcNo ratings yet

- Quiz 1 Introduction To Accounting Without AnswerDocument9 pagesQuiz 1 Introduction To Accounting Without AnswerJazzy Mercado100% (2)

- Q- CHAPTER 2Document11 pagesQ- CHAPTER 2phuonganh020804No ratings yet

- Absolute Financial EnglishDocument5 pagesAbsolute Financial EnglishÁyelen RogerNo ratings yet

- HW 1Document15 pagesHW 1ANo ratings yet

- Latihan Soal Bahasa Inggris PDFDocument13 pagesLatihan Soal Bahasa Inggris PDFFitria Nur HidayahNo ratings yet

- TACNKT ENP315 - 203 - D01 KTGK Test 200820Document3 pagesTACNKT ENP315 - 203 - D01 KTGK Test 200820Trần Thị Bích TuyềnNo ratings yet

- UNIT FOUR - AccountingDocument32 pagesUNIT FOUR - AccountingCristea GianiNo ratings yet

- ExercisesDocument9 pagesExercisesvirginia sheraNo ratings yet

- Understand Financial Statements and Accounting ConceptsDocument6 pagesUnderstand Financial Statements and Accounting ConceptsPolina Nalistia IrawanNo ratings yet

- Key Technical Questions For Finance InterviewsDocument27 pagesKey Technical Questions For Finance InterviewsSeb SNo ratings yet

- Asignación 2 FSRADocument5 pagesAsignación 2 FSRAElia SantanaNo ratings yet

- ĐỀ-kiểm tra tacn2 hvtc Học viện tài chínhDocument7 pagesĐỀ-kiểm tra tacn2 hvtc Học viện tài chínhMinh Anh NguyenNo ratings yet

- Current Assets Current LiabilitiesDocument7 pagesCurrent Assets Current LiabilitiesShubham GuptaNo ratings yet

- In Final Fulfillment of The Curriculum Requirements inDocument56 pagesIn Final Fulfillment of The Curriculum Requirements inangelonoyasam16No ratings yet

- Financial Accounting Libby 7th Edition Solutions ManualDocument5 pagesFinancial Accounting Libby 7th Edition Solutions Manualstephaniehornxsoiceygfp100% (44)

- Business OrganisationsDocument5 pagesBusiness OrganisationsStanciuAlexandruNo ratings yet

- Chapter4 Aldiansyah 2010313210048Document5 pagesChapter4 Aldiansyah 2010313210048AldiansyahNo ratings yet

- BBA 1st Sem. FULL SYLLABUS Basic AccountingDocument115 pagesBBA 1st Sem. FULL SYLLABUS Basic AccountingYash KhattriNo ratings yet

- Module - 1: What Do You Already Know?Document23 pagesModule - 1: What Do You Already Know?Lene Corpuz100% (1)

- Dwnload Full Cornerstones of Financial Accounting Canadian 1st Edition Rich Solutions Manual PDFDocument36 pagesDwnload Full Cornerstones of Financial Accounting Canadian 1st Edition Rich Solutions Manual PDFjayden77evans100% (12)

- Full Download Cornerstones of Financial Accounting Canadian 1st Edition Rich Solutions ManualDocument36 pagesFull Download Cornerstones of Financial Accounting Canadian 1st Edition Rich Solutions Manualcolagiovannibeckah100% (30)

- CH 01Document29 pagesCH 01Xinni XuNo ratings yet

- Chapter 13 To 15Document13 pagesChapter 13 To 15Cherry Mae GecoNo ratings yet

- Principles of AccountingDocument183 pagesPrinciples of AccountingJoe UpZone100% (1)

- Financial Management - ANIMAWDocument50 pagesFinancial Management - ANIMAWAnimaw100% (2)

- Anglais 3 6 01 01Document6 pagesAnglais 3 6 01 01lb. zinouNo ratings yet

- ROUND UP SESSION Accounting 1 16 12 2020Document6 pagesROUND UP SESSION Accounting 1 16 12 2020Ben Abdallah RihabNo ratings yet

- UNIT 4 - Module I 75: Accounting OBJECTIVES: After Studying This Chapter You Should Be Able ToDocument0 pagesUNIT 4 - Module I 75: Accounting OBJECTIVES: After Studying This Chapter You Should Be Able ToLuiza BoleaNo ratings yet

- VERTICAL BAND SAW MACHINE BUSINESS PLANDocument21 pagesVERTICAL BAND SAW MACHINE BUSINESS PLANsisay SolomonNo ratings yet

- Sky High Institute: Important - Tax Sem 5Document46 pagesSky High Institute: Important - Tax Sem 5Harsh JainNo ratings yet

- Ratio Analysis of Ambuja CementDocument16 pagesRatio Analysis of Ambuja CementTusarkant BeheraNo ratings yet

- Chapter 2 Partnership OperationsDocument9 pagesChapter 2 Partnership OperationsmochiNo ratings yet

- Installment Sales QDocument5 pagesInstallment Sales QRed YuNo ratings yet

- FS AnalysisDocument51 pagesFS AnalysisJecelyn PaganaNo ratings yet

- Chapter 10Document5 pagesChapter 10Ailene QuintoNo ratings yet

- Accounting For Manufacturing Concern Lecture 1Document3 pagesAccounting For Manufacturing Concern Lecture 1marites yuNo ratings yet

- Final CTPM Chapter 1-ProblemDocument14 pagesFinal CTPM Chapter 1-Problembalaji RNo ratings yet

- Financial Ratio AnalysisDocument10 pagesFinancial Ratio AnalysisSehat TanNo ratings yet

- Shree Krishna Ban Program Code: MBA Enrollment No: 018IUKL-HCMMBA1080Document7 pagesShree Krishna Ban Program Code: MBA Enrollment No: 018IUKL-HCMMBA1080bhuvanNo ratings yet

- Activity 1 FinMaDocument3 pagesActivity 1 FinMaDiomela BionganNo ratings yet

- Business PlanDocument33 pagesBusiness PlanMan Preet100% (2)

- Atlas Battery Limited: 1. Vision StatementDocument31 pagesAtlas Battery Limited: 1. Vision Statementloverboy_q_sNo ratings yet

- Boat ThingsDocument12 pagesBoat ThingsVanya QuistoNo ratings yet

- Production of Sterile Water For Injection. WFI (Water For Injection) Manufacturing. Water For Pharmaceutical Purposes.-792178 PDFDocument64 pagesProduction of Sterile Water For Injection. WFI (Water For Injection) Manufacturing. Water For Pharmaceutical Purposes.-792178 PDFGajjkNo ratings yet

- Sales and Cost Data ChartDocument17 pagesSales and Cost Data ChartSheila Mae BenedictoNo ratings yet

- BSBFIM601-Manage Finance Project - D Learner Assessment Guide and EvidenceDocument19 pagesBSBFIM601-Manage Finance Project - D Learner Assessment Guide and Evidenceozdiploma assignmentsNo ratings yet

- Consolidated Statement Formula01 PDFDocument2 pagesConsolidated Statement Formula01 PDFNiña Rica PunzalanNo ratings yet

- Chapter 3 Fs AnalysisDocument8 pagesChapter 3 Fs AnalysisYlver John YepesNo ratings yet

- Final Account (Solution) RainbowDocument4 pagesFinal Account (Solution) RainbowIsteehad RobinNo ratings yet

- Supersonic Stereo WACC AnalysisDocument6 pagesSupersonic Stereo WACC AnalysisAfran KhalidNo ratings yet

- Ratio Analysis of Heidelbergcement Bangladesh & Lafargeholcim BangladeshDocument24 pagesRatio Analysis of Heidelbergcement Bangladesh & Lafargeholcim BangladeshShajada Md. Mohsin 2022139630No ratings yet

- FABM Globe PaperDocument18 pagesFABM Globe PaperJulian AlbaNo ratings yet

- Tutorial 8Document3 pagesTutorial 8Aaron Tan Wayne JieNo ratings yet

- PT Ramawijaya Sport Memorial Journal Adjustment December 2017Document29 pagesPT Ramawijaya Sport Memorial Journal Adjustment December 2017DarDer DorNo ratings yet

- Trend Percentage Analysis 2019Document5 pagesTrend Percentage Analysis 2019Rachit SrivastavaNo ratings yet

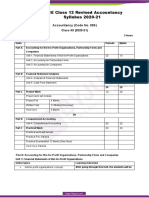

- CBSE Class 12 Revised Accountancy Syllabus 2020-21Document8 pagesCBSE Class 12 Revised Accountancy Syllabus 2020-21Harry AryanNo ratings yet