Professional Documents

Culture Documents

Changes in Belgian Dismissal - V3

Uploaded by

fathim1356Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Changes in Belgian Dismissal - V3

Uploaded by

fathim1356Copyright:

Available Formats

What’s new?

The regime before

1 January 2014 Major changes

in Belgian

New notice periods for all

Transition rules

What else is changing?

Unresolved issues

What is the financial effect

of the reform?

dismissal rules

What’s new?

Following a Constitutional Court decision in 2011, the Belgian legislator had until

8 July 2013 to end the difference between the way it treats blue- and white-collar

workers on two accounts:

• the notice period in case of termination; and

• the absence of a guaranteed salary for the blue-collar worker’s first day of sick leave

(the so-called waiting day).

The court found the relevant legal provisions discriminatory (so non-constitutional)

but decided to keep them until 8 July 2013, to give the legislator time to harmonise

its treatment of the two kinds of workers.

Employer and trade union representatives negotiated a solution in July, which the

government then turned into a draft law. The law was voted on in late 2013 by parliament,

and it came into force on 1 January 2014. The Employment Contracts Act of 3 July 1978 (ECA)

has been amended accordingly. It introduces a new way to calculate the notice period for all

workers. As expected, blue-collar workers will see their notice period (or termination

indemnity paid in lieu) increase, and white-collar workers will see theirs decrease.

These new rules supersede the change in law brought about by the law of 12 April 2011,

which came into force in 2012 and affected employment contracts that started on or after

1 January 2012.

The regime before 1 January 2014

For contracts that existed before 1 January 2012:

• the minimum statutory notice for blue-collar workers on termination by the employer

was 28 or 56 days, depending on the length of service – less than 20 years or 20 or more.

Many industries increased the minimum through sector-level collective bargaining

agreements (CBAs); and

• the minimum statutory notice for white-collar workers was three months for each

(started) period of five years’ service. Employees whose annual gross salary was more

Satya Staes Polet than €32,254 were entitled to longer notice periods – often calculated according to the

Principal Associate

T +32 2 504 7594 ‘Claeys formula’.

E satya.staespolet@freshfields.com

For new contracts that started on or after 1 January 2012:

Jean-François Gerard

Head of Practice Development • minimum statutory notice of between 28 and 129 days for blue-collar workers, depending

T +32 2 504 7697

E jean-francois.gerard@freshfields.com on length of service and without prejudice of specific sector-level provisions;

Freshfields Bruckhaus Deringer llp 1

• for white-collar workers who used to earn less than €32,254 gross a year, three months

for each (started) period of five years’ service; and

• roughly 30 days’ notice for each year of service for employees who used to earn more

than €32,254, with a minimum of three months.

As of 1 January 2014, New notice periods for all

a single regime replaces As of 1 January 2014, a single regime replaces all the previous ones. There will no longer

all the previous ones. be a difference between blue-collar and white-collar workers.

There will no longer For dismissal and resignation, the new notice periods now depend solely on length of service.

be a difference between Salary levels and the employee’s position no longer affect the termination package for

white-collar workers.

blue-collar and white-

Notices are now expressed in weeks, not months or days, and the notice periods will be

collar workers.

calculated as follows:

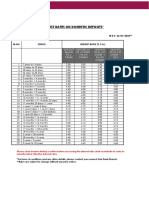

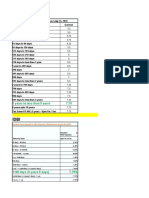

Service period from 1 January 2014 Notice (Employer) Notice (Employee)

0 – < 3 months 2 weeks 1 week

3 – < 6 months 4 weeks 2 weeks

6 – < 9 months 6 weeks 3 weeks

9 – < 12 months 7 weeks 3 weeks

12 – < 15 months 8 weeks 4 weeks

15 – < 18 months 9 weeks 4 weeks

18 – < 21 months 10 weeks 5 weeks

21 – < 24 months 11 weeks 5 weeks

2 – < 3 years 12 weeks 6 weeks

3 – < 4 years 13 weeks 6 weeks

4 – < 5 years 15 weeks 7 weeks

5 – < 6 years 18 weeks 9 weeks

6 – < 7 years 21 weeks 10 weeks

7 – < 8 years 24 weeks 12 weeks

8 – < 9 years 27 weeks 13 weeks

9 – < 10 years 30 weeks 13 weeks

10 – < 11 years 33 weeks 13 weeks

11 – < 12 years 36 weeks 13 weeks

12 – < 13 years 39 weeks 13 weeks

13 – < 14 years 42 weeks 13 weeks

14 – < 15 years 45 weeks 13 weeks

15 – < 16 years 48 weeks 13 weeks

16 – < 17 years 51 weeks 13 weeks

17 – < 18 years 54 weeks 13 weeks

18 – < 19 years 57 weeks 13 weeks

19 – < 20 years 60 weeks 13 weeks

20 – < 21 years 62 weeks 13 weeks

21 – < 22 years 63 weeks 13 weeks

After 21 years’ service, the notice period increases by one additional week for each year

of service.

The employer can still choose between a termination with notice to be worked or an

immediate termination with payment in lieu of notice. The payment in lieu of notice

is still based on the annual gross salary and benefits, as under the old rules.

2 Major changes in Belgian dismissal rules, March 2014

Transition rules apply Transition rules

to employees hired Transition rules apply to employees hired before 1 January 2014, but dismissed after

before 1 January 2014, this date.

but dismissed after Phase 1

this date. The old rules in place on 31 December 2013 apply to service years accrued before 2014.

There is one exception: white-collar workers who earn more than €32,254 (annual gross)

will be entitled to one month for each year of service accrued before 1 January 2014,

with a minimum of three months. The so-called Claeys formula is no longer relevant

and cannot be called on in negotiation by employees.

Phase 2

The new regime applies to service years accrued from 1 January 2014.

The total notice period is made up of the notice periods accrued under phases 1 and 2.

The same rule applies to blue-collar workers. But because this would lead to continued

discrimination for blue-collar workers under current employment contracts, they will be

entitled to an additional dismissal indemnity paid by the state. This indemnity is equal to

the difference between the notice or payment in lieu calculated on the basis of the transition

rules and the notice or payment in lieu that would apply if the new rules applied to their

whole service. Blue-collar workers who are not entitled to this dismissal indemnity will

still be entitled to a so-called dismissal allowance. Other rules apply in specific sectors.

Here are two examples

A white-collar worker hired on 1 January 2000 and terminated on 1 January 2015 and who

earns more than €32,254 gross a year will be entitled to 13 months’ notice for the period

between 1 January 2000 and 31 December 2013, plus eight weeks for 2014.

A blue-collar worker in the food industry hired on 1 January 2000 and terminated on

1 January 2015 will be entitled to 147 days’ notice for the period between 1 January 2000

and 31 December 2013, plus eight weeks for 2014. The blue-collar worker will also be entitled

to the dismissal indemnity paid by the state.

Notice periods notified What else is changing?

as of 1 January 2014

Start date of the notice period

start on the Monday Notice periods notified as of 1 January 2014 start on the Monday that follows the notification

that follows the date, and no longer on the first day of the month after the notification date. Dismissals by

notification date and registered mail take effect on the third day after they are sent. So to start on the next Monday,

notices must be sent on the Wednesday at the latest.

no longer on the first

day of the month after Trial period

the notification date. The trial period no longer exists. It used to allow for shorter notice periods during the first

few months of the employment relationship. So, it did not make sense to keep these now

that notice periods are a lot shorter. Trial periods in contracts signed before 2014 will stay

in place until their agreed term.

Where the end of the trial period was the trigger for specific entitlements or obligations

(eg non-compete clause, schooling clause), the reference to the former trial period is

replaced by ‘the first six months of the employment relationship’.

In student contracts and in interim and temporary employment contracts, the first three

days of effective employment remain a trial period. During this period both parties may

end the contract without notice or payment in lieu.

Freshfields Bruckhaus Deringer LLP 3

Motivation of the dismissal and unfair dismissal

Until now, an employer wasn’t obliged to justify dismissing an employee. However,

a (sometimes formal) justification was needed in circumstances such as dismissals

for gross misconduct or dismissals of protected employees. Blue-collar workers enjoyed

a specific protection – ie they could claim that their dismissal was not based on their

performance or attitude, or on economic reasons and, if the employer could not prove

otherwise, they were entitled to an extra six months’ indemnity.

Under the national CBA no. 109, which the National Works Council entered into on

12 February 2014, dismissals notified from 1 April 2014 will have to be justified if requested

by the dismissed employee. And from the same date, the specific protection for blue-collar

workers under the unfair dismissal rules will no longer exist, except for certain categories

of blue-collar employees.

The dismissed employee may ask the employer to give the reasons for the dismissal by

registered mail within two months after the effective end of the contract. The employer

must respond by registered mail within two months from this request. The employer’s

response must give concrete reasons for the dismissal.

Employers may, of course, give the reasons for the dismissal when the dismissal is notified.

In this case, and if it gives concrete reasons for the dismissal, the employer does not have

to respond to a later formal employee request.

An employer that does not respond to the employee’s request (and has not given the reasons

for the dismissal) is subject to a fine of two weeks of the employee’s salary and benefits.

If the dismissal is clearly unreasonable, the employer may be ordered to pay an indemnity

equal to at least three and at most 17 weeks’ salary and benefits. The employee may claim

additional damages under civil law.

A dismissal is considered clearly unreasonable if the employee is under an open-ended

Dismissals notified contract, the reasons for the dismissal are unrelated to the employee’s attitude or

from 1 April 2014 performance or to the operational requirements of the business and if it would not have

will have to be been decided by a normal and reasonable employer.

justified if In a dispute, the burden of proof will be divided as follows:

requested by the • if the employer has given the reasons for the dismissal in line with statutory provisions,

dismissed employee. each party must provide the relevant supporting evidence of the alleged facts;

• if the employer has not given the alleged reasons for the dismissal, it must provide

supporting evidence that the dismissal was not clearly unreasonable; and

• the employee who has not asked for the reasons for the dismissal must provide

supporting evidence that the dismissal was clearly unreasonable if (s)he wants

to claim any indemnification.

The CBA does not apply to dismissals during the first six months of service, interim

contracts, student contracts, dismissals with a view to access the early retirement regime,

dismissals with a view to retirement, dismissals within the framework of restructurings,

dismissals subject to a statutory procedure and dismissals for gross misconduct.

Belgium remained one of the few European countries where dismissals did not have

to be justified. But with these new rules, Belgium has ended this situation.

While the new dismissal rules should put an end to the discussions around the length

of notice or the amount of payment in lieu, the newly introduced obligation of justification

will, conversely, trigger new forms of discussions before court. It is expected that parties

will try to avoid such discussions by settling on the justification for the dismissal,

in exchange for an additional indemnity.

4 Major changes in Belgian dismissal rules, March 2014

Outplacement

Under the old rules, outplacement only had to be offered to employees who were dismissed

after they reached the age of 45.

Under the new regime, dismissed employees will be entitled to outplacement as soon as they

are entitled to 30 weeks’ notice, regardless of their age and provided that they are not

dismissed for gross misconduct or within the framework of a restructuring. The old regime

will apply to employees aged 45 years or more who are not entitled to 30 weeks’ notice.

When the employee is dismissed with a notice to be worked, the outplacement service has

to amount to 60 hours. It is mainly used during the hours of paid leave to which the

employee is entitled to search for a new job.

When the employee is dismissed and paid in lieu of notice, the outplacement must have

a value of one-twelfth of the annual salary earned during the preceding civil year, with,

however, a minimum of €1,800 and a maximum of €5,500. If the employee accepts the

outplacement, four weeks’ pay will be deducted from the payment in lieu; if the employee

refuses, the four weeks’ pay will not be deducted. From 1 January 2016, the four weeks’ pay

will be deducted even if the employee refuses.

By 1 January 2019, sectors should implement rules providing that two-thirds of the notice

or payment in lieu (with a minimum of 26 weeks) will be worked or paid, while one-third

will be paid out through redeployment measures.

Collective dismissals and social plans

The old rules still apply to collective dismissals when the employees are dismissed within

a collective dismissal that was decided and notified before 31 December 2013 and they

fall within the scope of a social plan that was filed with the Ministry of Labour on

31 December 2013, at the latest.

Top managers in listed companies

Executive directors, members of the executive committee and managing directors of listed

companies must comply with specific requirements set out by the 2009 Governance Code

and confirmed by law on 6 April 2010.

In summary, conventional severance indemnity is capped at 12 months. It can go up to

18 months if advised by the remuneration committee and above 18 with a vote from the

general meeting. These requirements are unaffected by the new dismissal rules. According

to the draft new Belgian Banking law, which is under discussion in parliament, similar

rules should also apply to financial institutions in the short term.

Waiting day

From 1 January 2014, blue-collar workers will receive their guaranteed salary from the first

day of sick leave.

Unresolved issues

We are far from full harmony between blue- and white-collar workers’ statuses. So for now

differences will remain, and these could lead to other decisions from the Constitutional

Court and more changes.

Freshfields Bruckhaus Deringer LLP 5

What is the financial effect of the reform?

The exact financial effect of the changes will vary from one industry to another, but it looks

clear that blue- collar-heavy industries will see a net increase in termination costs.

Employers who have mostly white-collar workers might think they are safe. But the changes

we have looked at in this briefing are not the only ones. Under a royal decree that came into

force on 1 October 2013, several indemnities paid at the end of the employment relationship

and that used to be exempt from social security contributions – indemnities of clientele and

indemnities paid on the basis of non-compete covenants, among other things – entered into

after the end of the employment contract are now subject to those contributions.

freshfields.com

Freshfields Bruckhaus Deringer LLP is a limited liability partnership registered in England and Wales with registered number OC334789. It is authorised and regulated by the Solicitors Regulation

Authority. For regulatory information please refer to www.freshfields.com/support/legalnotice. Any reference to a partner means a member, or a consultant or employee with equivalent standing

and qualifications, of Freshfields Bruckhaus Deringer LLP or any of its affiliated firms or entities. This material is for general information only and is not intended to provide legal advice.

© Freshfields Bruckhaus Deringer LLP, March 2014, 00444

You might also like

- CG16 - 18 Employment ContractsDocument4 pagesCG16 - 18 Employment ContractsArdamitNo ratings yet

- Banco Filipino v. Monetary Board Liquidation Authority CaseDocument2 pagesBanco Filipino v. Monetary Board Liquidation Authority CasexxxaaxxxNo ratings yet

- E-Learning Market - Global Outlook Forecast 2019-2024 Arizton PDFDocument291 pagesE-Learning Market - Global Outlook Forecast 2019-2024 Arizton PDFAnamitra BasuNo ratings yet

- Agarwal Automobiles: Inventory ManagementDocument10 pagesAgarwal Automobiles: Inventory ManagementAmit Sen50% (2)

- STONZ vs NZRDA MECA Comparison July 2021Document6 pagesSTONZ vs NZRDA MECA Comparison July 2021hlouis8No ratings yet

- Interest Rates On "Fixed Deposit Plus" (Premature Withdrawal Not Permitted)Document1 pageInterest Rates On "Fixed Deposit Plus" (Premature Withdrawal Not Permitted)KislayNikharNo ratings yet

- Guide to Employment Law UpdatesDocument82 pagesGuide to Employment Law UpdatesMihai VoicuNo ratings yet

- 3475665-Guguianu - 1 2Document9 pages3475665-Guguianu - 1 2ElenaNo ratings yet

- Employment Act Malaysia 2022 Updates - Work Hours MalaysiaDocument3 pagesEmployment Act Malaysia 2022 Updates - Work Hours MalaysiaKan WAI LEONGNo ratings yet

- Group BenefitsDocument2 pagesGroup BenefitsredcolNo ratings yet

- Interest Rates On Deposits: Nri DepositDocument2 pagesInterest Rates On Deposits: Nri DepositTradiyo ForexNo ratings yet

- FD Interest RatesDocument2 pagesFD Interest RatesHimanshu MilanNo ratings yet

- Preview DocumentDocument10 pagesPreview DocumentYnah Acrol AbarrapNo ratings yet

- Fixed Deposit Wef 26 01 2022Document4 pagesFixed Deposit Wef 26 01 2022Buddhadev DasNo ratings yet

- Thai Labor LawDocument56 pagesThai Labor LawmichaelsalalimaNo ratings yet

- Summary of Cambodian Labour LawDocument3 pagesSummary of Cambodian Labour LawMike AndyNo ratings yet

- Labor Laws in Bangladesh Garment SectorDocument14 pagesLabor Laws in Bangladesh Garment Sectorkaminey420No ratings yet

- Preview DocumentDocument9 pagesPreview Documentkenneth.talatalaNo ratings yet

- Payroll Notes 1Document4 pagesPayroll Notes 1Rijah WeiweiNo ratings yet

- Uae Labour Law SummaryDocument28 pagesUae Labour Law SummaryJEAN SAGUANNo ratings yet

- Term Time OnlyDocument9 pagesTerm Time Onlyips.tineretNo ratings yet

- Interest Rates On Domestic Deposits : Deposits - Less Than 5 Crores W.E.F. 14/12/2021Document4 pagesInterest Rates On Domestic Deposits : Deposits - Less Than 5 Crores W.E.F. 14/12/2021Vinay GuptaNo ratings yet

- CA 2 - Community Corrections and Father of ProbationDocument11 pagesCA 2 - Community Corrections and Father of Probationalyxandra2302 almogueraNo ratings yet

- Employment Law ExplainedDocument44 pagesEmployment Law ExplainedThelettera FollowedbybNo ratings yet

- 2000 BAIL BOND GUIDEDocument9 pages2000 BAIL BOND GUIDEangelito rasalanNo ratings yet

- Guide to Malaysian Employment Law BasicsDocument6 pagesGuide to Malaysian Employment Law BasicsRaph TNo ratings yet

- STONZ MECA Benefits (By STONZ)Document2 pagesSTONZ MECA Benefits (By STONZ)hlouis8No ratings yet

- 2023 08 International Payroll GuideDocument46 pages2023 08 International Payroll Guidesgideon681No ratings yet

- Blackboard PTOand Sick Leave PolicyDocument5 pagesBlackboard PTOand Sick Leave PolicyTimothie SpearmanNo ratings yet

- BIPO Times July 2022 enDocument12 pagesBIPO Times July 2022 enKamantha Sri JayaweeraNo ratings yet

- Government Agencies Guide Industrial RelationsDocument21 pagesGovernment Agencies Guide Industrial RelationsshakteshwaranNo ratings yet

- LabStan - July 16-17, 23-24, 30-31, Aug 6-7Document25 pagesLabStan - July 16-17, 23-24, 30-31, Aug 6-7CandypopNo ratings yet

- Letter of Offer: Maggie Perez, 2/7 Philip Street, Strathfield NSW 2135Document3 pagesLetter of Offer: Maggie Perez, 2/7 Philip Street, Strathfield NSW 2135Ruchini ThejakaNo ratings yet

- ICICI Bank term deposit rates July 2010Document7 pagesICICI Bank term deposit rates July 2010C Sunil ReddyNo ratings yet

- Employment Law in Malaysia What You Need To KnowDocument3 pagesEmployment Law in Malaysia What You Need To KnowJiana NasirNo ratings yet

- Salient Features of New Labour LawsDocument27 pagesSalient Features of New Labour LawsCharles MalodaNo ratings yet

- Guide to Singapore Employment LawsDocument19 pagesGuide to Singapore Employment LawsquachtohoangNo ratings yet

- Implementation of EU Directives On Work-Life Balance and On Transparent and Predictable Working ConditionsDocument38 pagesImplementation of EU Directives On Work-Life Balance and On Transparent and Predictable Working ConditionsAdelina Elena OlogeanuNo ratings yet

- $19 Letters of OfferDocument3 pages$19 Letters of OfferSebastian D SimoesNo ratings yet

- Indonesia employment law guide on contract, permanent, and outsourcing workersDocument15 pagesIndonesia employment law guide on contract, permanent, and outsourcing workerstedyNo ratings yet

- Migrantski Radnici Know Your RightsDocument14 pagesMigrantski Radnici Know Your RightsAnnabel Amalija LeeNo ratings yet

- Revision of Interest Rate On Term Deposits Wef 04.08.2022 1Document2 pagesRevision of Interest Rate On Term Deposits Wef 04.08.2022 1Anu BhandariNo ratings yet

- Domestic Fixed Deposits 13 OctoberDocument3 pagesDomestic Fixed Deposits 13 OctoberjoyfulsenthilNo ratings yet

- Revised Penal Code Crime PenaltiesDocument8 pagesRevised Penal Code Crime Penaltiesrevertlyn100% (1)

- Title 3 P e N A L T I e S Chapter 4 Application of Penalties Section 3 TabulationDocument1 pageTitle 3 P e N A L T I e S Chapter 4 Application of Penalties Section 3 TabulationLawStudent101412No ratings yet

- Content of Contract & Sample ContractDocument2 pagesContent of Contract & Sample ContractkabirgillNo ratings yet

- Summary of Penalties - RPC PDFDocument11 pagesSummary of Penalties - RPC PDFGanyfer DoradoNo ratings yet

- ASM Global Tacoma 2022 - Rate SheetDocument1 pageASM Global Tacoma 2022 - Rate SheetDylan DeSantisNo ratings yet

- NHS Employers Summary of Junior Doctors Contract 12 FebDocument14 pagesNHS Employers Summary of Junior Doctors Contract 12 FebJonathan 'Andy' TanNo ratings yet

- 2021 05 EN Ulkomaalaisena Tyontekijana Suomessa PDFDocument20 pages2021 05 EN Ulkomaalaisena Tyontekijana Suomessa PDFSt JakobNo ratings yet

- Relaxo Footwears LTD Leave Policy Final V3 0Document13 pagesRelaxo Footwears LTD Leave Policy Final V3 0Joseph RajkumarNo ratings yet

- Fixed Deposit Wef 04 07 2022Document4 pagesFixed Deposit Wef 04 07 2022Amit PrasadNo ratings yet

- Interest Rates On NRI DepositsDocument2 pagesInterest Rates On NRI DepositsrahulpriyanNo ratings yet

- Fixed DepositDocument20 pagesFixed DepositsysnetrasaNo ratings yet

- Employment LawDocument28 pagesEmployment LawAjmal HaziqNo ratings yet

- Employment Contract - DraftDocument6 pagesEmployment Contract - DraftMarvin LimNo ratings yet

- Table of Penalties RPCDocument3 pagesTable of Penalties RPCRhys GuiamadelNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsY_AZNo ratings yet

- Recent Amendments in Labour LawDocument7 pagesRecent Amendments in Labour LawLovepreet KaurNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsV NaveenNo ratings yet

- Fixed Deposit Interest RatesDocument2 pagesFixed Deposit Interest Ratessasi 'sNo ratings yet

- Notice-of-termination-and-redundancy-payDocument4 pagesNotice-of-termination-and-redundancy-paytulkd91No ratings yet

- C.H.A.P.P.S.: CLOCKABLE HOURS APPLICATION PROCESS AND PAY SYSTEMFrom EverandC.H.A.P.P.S.: CLOCKABLE HOURS APPLICATION PROCESS AND PAY SYSTEMNo ratings yet

- Spirax Sarco - Types of Safety ValveDocument9 pagesSpirax Sarco - Types of Safety Valvefathim1356No ratings yet

- Engineering & Piping DesignDocument36 pagesEngineering & Piping DesignkumarkumaeNo ratings yet

- Tsa Pce Article Cui8041Document8 pagesTsa Pce Article Cui8041fathim1356No ratings yet

- FP132I, Bondstrand Corrosion GuideDocument12 pagesFP132I, Bondstrand Corrosion Guidefathim1356No ratings yet

- FPI FiberglassbookDocument164 pagesFPI FiberglassbookA_ValsamisNo ratings yet

- Afrox Product Reference Manual (New) 266 - 81171Document744 pagesAfrox Product Reference Manual (New) 266 - 81171fathim1356100% (1)

- Goodwin Cryogenic BrochureDocument6 pagesGoodwin Cryogenic BrochureJorge BeltranNo ratings yet

- Promat PDFDocument5 pagesPromat PDFamadan64No ratings yet

- Prevent pulsation problemsDocument10 pagesPrevent pulsation problemsfathim1356No ratings yet

- Industrial InsulationDocument9 pagesIndustrial Insulationahad_shiraziNo ratings yet

- Gasket Design BrochureDocument70 pagesGasket Design BrochureAmreusit Saschimbnumele100% (2)

- API Bull 2v Erta - 2004Document1 pageAPI Bull 2v Erta - 2004fathim13560% (1)

- B 366 - 04 - QJM2NG - Factory-Made Wrought Nickel and Nickel Alloy FittingsDocument9 pagesB 366 - 04 - QJM2NG - Factory-Made Wrought Nickel and Nickel Alloy Fittingstruong27123No ratings yet

- LISEGA Catalog 2010Document7 pagesLISEGA Catalog 2010Olivier RioNo ratings yet

- B31.3 Code Case 178 PDFDocument16 pagesB31.3 Code Case 178 PDFmfathi1356No ratings yet

- 2019 Dse Bafs 2a (E)Document10 pages2019 Dse Bafs 2a (E)lehcarNo ratings yet

- Expenses Internal AuditDocument19 pagesExpenses Internal AuditLamineNo ratings yet

- Assignment On MoneybhaiDocument7 pagesAssignment On MoneybhaiKritibandhu SwainNo ratings yet

- Major Activities of NabardDocument13 pagesMajor Activities of NabardAbhishek .SNo ratings yet

- ROLE OF NBFCs IN INDIAN ECONOMIC DEVELOPMENTDocument20 pagesROLE OF NBFCs IN INDIAN ECONOMIC DEVELOPMENTROHIT RANENo ratings yet

- 18bba033 OAPDocument49 pages18bba033 OAPBhoomi MeghwaniNo ratings yet

- Gititi 20122Document16 pagesGititi 20122Kavita HindiNo ratings yet

- Migrating Lotus Notes Applications To SharePointDocument8 pagesMigrating Lotus Notes Applications To SharePointparvesh2001No ratings yet

- Process Integration Scenario in SAP PI 7.1Document19 pagesProcess Integration Scenario in SAP PI 7.1Durga Prasad Anagani100% (1)

- Government Cover Letter TemplateDocument6 pagesGovernment Cover Letter Templatefgwsnxvhf100% (1)

- MGT-351 Human Resource Management Chapter-11 Establishing Strategic Pay PlansDocument22 pagesMGT-351 Human Resource Management Chapter-11 Establishing Strategic Pay PlansShadman Sakib FahimNo ratings yet

- Buzz Chronicles - Thread 23453Document6 pagesBuzz Chronicles - Thread 23453sahil ajaytraderNo ratings yet

- Project Report Ritesh SonawaneDocument66 pagesProject Report Ritesh SonawaneRitesh SonawaneNo ratings yet

- 55787.-Full-Time MBA Brochure 2023Document21 pages55787.-Full-Time MBA Brochure 2023Backup PertamaNo ratings yet

- Business Combination - TheoriesDocument11 pagesBusiness Combination - TheoriesMILLARE, Teddy Glo B.No ratings yet

- ABITRIA Online Assignment Chapter 11 and 12 1Document1 pageABITRIA Online Assignment Chapter 11 and 12 1Ian LamayoNo ratings yet

- Test Bank For International Business Environments Operations 14 e 14th Edition John Daniels Lee Radebaugh Daniel SullivanDocument26 pagesTest Bank For International Business Environments Operations 14 e 14th Edition John Daniels Lee Radebaugh Daniel Sullivannataliebuckdbpnrtjfsa100% (24)

- Basics & House Property - PaperDocument5 pagesBasics & House Property - PaperVenkataRajuNo ratings yet

- (This Letter Is Digitally Signed) : Cummins India Limited Registered Office Cummins India Office CampusDocument28 pages(This Letter Is Digitally Signed) : Cummins India Limited Registered Office Cummins India Office CampusKrishna Raj KNo ratings yet

- كتاب ادارة المعرفةDocument21 pagesكتاب ادارة المعرفةمصطفے الكبيسےNo ratings yet

- New Kyung Dong Bus Schedule from Yongsan to Osan and HumphreysDocument2 pagesNew Kyung Dong Bus Schedule from Yongsan to Osan and HumphreysClair AllenNo ratings yet

- ANU College of Law: Legal Studies Research Paper SeriesDocument38 pagesANU College of Law: Legal Studies Research Paper SeriesPratim MajumderNo ratings yet

- FPT ShopDocument25 pagesFPT ShopNhư MaiNo ratings yet

- White Paper On E Business Tax Implementation in R 12 Presented atDocument31 pagesWhite Paper On E Business Tax Implementation in R 12 Presented atyasserlionNo ratings yet

- Bus 5112 - Written Assignment Polly Pet Food Finacial StatementDocument5 pagesBus 5112 - Written Assignment Polly Pet Food Finacial Statementmynalawal100% (2)

- Corporate Finance Week 4 Slide SolutionsDocument4 pagesCorporate Finance Week 4 Slide SolutionsKate BNo ratings yet

- Doodle Business & Consulting Toolkit by SlidesgoDocument75 pagesDoodle Business & Consulting Toolkit by SlidesgoKiki Kiki100% (1)