Professional Documents

Culture Documents

BNU

BNU

Uploaded by

Martins Martins0 ratings0% found this document useful (0 votes)

6 views3 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views3 pagesBNU

BNU

Uploaded by

Martins MartinsCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 3

ica de Timor-Leste

Autoridade Tributaria

Rua Aitarak Laran Dili,Ministeriu das Financas, Pezu 8, Telf. 74002070/74002071

Personal Details

Month Year TIN Tax Payer Name Establishment Name

june 2023 1350699 Filomono Martins ‘SEINARU RAFAEL UNIPESSOAL LDA

1.Wages Income Tax

“otal Gross Wages Paid during the month Total Wages Income Tax

$830.00 $60.00

2.Witholding Tax

‘witholding Type tn [cross Payment [rate [un — | withotaing tax Calculation

2.1 Prizes and Lotteries 45 | s000 rox [50 | s0.00

2.2- Royalties 35 | so.00 rox [60 | s0.00

2.3 Rent land and Buildings 65. | s000 10% [70 | s0.00

2.4 Construction and Building Activities | 75 | so.00 2% [a0 | so00

2.5 Construction Consulting Services| 85 _ | $0.00 4% [20 | s0.00

2.6 Mining and Mining Support Services | 95 _ | $0.00 45% | 100. | s0.00

2.7-Transportation Ar and Sea 105 | so.00 264% [110 | $0.00

2.8- Non Resident Without PE 118 | $0.00 tox [120 | $0.00

Total Witholding Tax $0.00

3. Service Tax-—

Hotel Senvtes * [ Restaurant and Bar Services| | Tolecommunication Services | Total Sales _| Service Payable Tax

$0.00 | $0.00 1j/ 3 [ [80.00 $0.00 $0.00

4. Annual Income:Tax Installment

Total Tumover Rate? Total Turnover by 0.5%

$0.00 . 0.05% $0.00

Submitted at 2023-07-04 page 1 of 2 Generated at 2023-07-04

Republica Democratica de Timor-Leste

Autoridade Tributaria

Rua Aitarak Laran Dili, Ministeriu das Financas, Pezu 8, Telf. 74002070/74002071

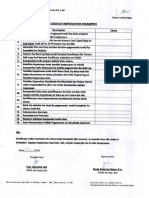

5.Payment Advice - Summary of Payment

TIN Month/Fulan Tinan/year

1350699 june 2023

Tax pe Total Bank Account

1. Wages Income Tax $60.00 ‘AIG 206442.10,001

2.Wtholding Tax 30.00 ‘AIC 286830.10.001

3, Service Tax $0.00) ‘AIC 286636.10,001

4, Annual Income Tax installment $0.00 ‘ACI 286639.10,001

Total Taxes paid $60.00

Important Notice

For taxpayers that have payment in bank, please be aware that you need to make the payment within

the allowed days (before 15 of the following month) after you have submitted the form online. You

need to print this form with you and have it paid in the designated Bank. Once you have paid, have it

scanned and upload it to e-Services portal as the evidence of payment

Important Notice about P24 Payment

For taxpayers that have made payment in P24 ATM, please be aware that you must pay additional

$.50 cent fee for each of tax type (each transaction on each tax type). This is directly surcharged

for the fee of using P24 ATM Machine. You can declare these fees at the end of the year in the Annual

Income Tax form as other tax deductible expenses

ils of offici:

| who made the payment at the Bank Sp Bnv Timer

Times

Complete Name Date

Submitted at 2023-07-04 page 2 of 2 Generated at 2023-07-04

®& BNU Timor perosrT0 wiNERARrO

INDIVIDUAL INCOME TAX

DILI TIMOR LESTE

DELI

TIMOR

DATA: 05-07-2023 CONTA A CREDITAR: 28644210001 MOEDA: USD

DESCRITIVO: 1350699

Valor a depositar: 60,00 USD

—— certiticagie exctusiva e obrigatéria pete any —

BNU 1 2023/07/05 08:52:44 DEPNO 26 2

Conta ereditar: 28646210901) 60,00 uso 46720133 257067829

do Depositante

Assinatura do Caixa

niga Gora omponitos, $n | dade Social: ar, doto X11, 62 1000-900 Lisbon Fortean Capit

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Bronjong Cassa Boq - pdf2Document1 pageBronjong Cassa Boq - pdf2Martins MartinsNo ratings yet

- Bronjong Cassa3Document1 pageBronjong Cassa3Martins MartinsNo ratings yet

- Chack List Inspection OPDocument1 pageChack List Inspection OPMartins MartinsNo ratings yet

- Naskah Publikasi Hendry Tri Wibowo PDFDocument6 pagesNaskah Publikasi Hendry Tri Wibowo PDFKriswantoWisanggeniNo ratings yet

- Monthly Report 157150Document2 pagesMonthly Report 157150Martins MartinsNo ratings yet

- Left Elev.: Manutensaun Edificio DnrsDocument1 pageLeft Elev.: Manutensaun Edificio DnrsMartins MartinsNo ratings yet

- Azazaz 2Document1 pageAzazaz 2Martins MartinsNo ratings yet

- Technical Proposal BNCTL OECUSSEDocument26 pagesTechnical Proposal BNCTL OECUSSEMartins MartinsNo ratings yet

- Democratica de Timor Leste: Approved by Checked byDocument1 pageDemocratica de Timor Leste: Approved by Checked byMartins MartinsNo ratings yet

- Data Sheet Width Flange BeamDocument32 pagesData Sheet Width Flange BeamIrvan IskandarNo ratings yet

- Tecnico: Full Partition WorksDocument1 pageTecnico: Full Partition WorksMartins MartinsNo ratings yet