Professional Documents

Culture Documents

Lecture Notes Complete

Uploaded by

Chetna DubeyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lecture Notes Complete

Uploaded by

Chetna DubeyCopyright:

Available Formats

lOMoARcPSD|18505429

Lecture notes - Complete

International Commercial Law (Deakin University)

Studocu is not sponsored or endorsed by any college or university

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

MLL336 International Commercial Law

Topic 1 Introduction

What is it?

Collection of disciplines

Public and private international law

Governments acting publicly vs. privately

o Main focus on private in this unit

Performance, settlement.

Sources of ICL

Treaties/ conventions/ protocols

Model Laws: blueprint legislation that states can enact in their own

jurisdiction. States not bound

Contractually agreed upon rules

Soft Law: like model law, but not intended to be enacted into state

legislation, but rather to be used for contractual agreements etc. Used as

instruments.

Domestic Law: where no international convention is available

Examples

CISG: UN Convention on International Sale of Goods

S86 Goods Act 1958: convention implemented. Also attached to Schedule

UNCITRAL Model Law on international commercial arbitration

S16 International Arbitration Act: Model law given force of law. Also

attached as schedule

Lex Mercatoria

Transnational practices developed through the course of international trade

Controversy over credibility

Conflict of Laws

Three main questions:

Jurisdiction?

o Voth v Manildra: Court may nevertheless decline to hear the case, if

court is clearly inappropriate forum

Balancing approach has been less significiant

Applicable law?

o Substantive and procedural law

Lex causae: applicable substantive law

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

Bonython v Cth: parties have a choice of law if they can agree,

if not courts will use closest connection test.

o Private international law v domestic law

Enforcement?

o Australian and English courts have long recognized and enforced

foreign judgements.

o In the absence of a treaty, a local court recognizes and enforces

foreign judgment only when such enforcement is consistent with

local law governing that matter.

o Enforcement of foreign judgments in all Australian states but

Queensland, still regulated by statutes of parliaments (pg.770)

o Re Word Publishing Co LTD.: Court may refuse to register foreign

judgment because:

Made in a country which has not been approved by governor

general as being eligible for the benefit of the Act under the

reciprocal principle

It is of the kind that has not been approved by GG as being

registrable under the Act under the reciprocal principle

More than 6 years from the date of application for

registration, and

Contrary to any provisions of the Act or the rules of the court,

which hears the application.

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

Topic 2 International Sale of Goods

Terminology

CISG: United Nations Convention on Contracts for The International Sale of goods.

(Aka Vienna sales convention)

UNCITRAL: United Nations Commission on International trade Law

UNIDROIT: International Institute for the Unification of private law

International Sale of Goods

Contract law and statutory rules for sales contracts: Basic contract law

and on top of that we have specific legislation (goods Act) which is used to

supplement basic contract law and deal with areas not covered.

International sale of goods is present where we have a sale of goods with an

international element.

o Not just factual international element but one that the law

recognizes as international.

o Aim to harmonize and unify the law, in order to promote

international trade and economic trade. And reduce transaction

costs.

Introducing CISG

Applies specifically for contracts for international sale of goods

Not a comprehensive code

E.g. CIETAC award Para. 13.3, 16.16.2, 16.16.3

Introducing The UNIDROIT Principles

Superficially similar, but fundamentally different to CISG

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

o Soft law rather than convention, and hence do not exist as part of

any states domestic law, but states may choose to adopt them.

Where there is a conflict between choice of law between the

parties, arbitrators may choose to adopt UNIDROIT (Rare).

o International commercial contracts in general, rather than solely

international sale of goods

o Broader subject matters covered than the CISG

o They can assist to interpret other bodies of law, such as CISG.

Application of CISG Around the world

Potentially governing 80% of the world’s international goods trade

http://www.uncitral.org/uncitral/en/uncitral_texts/sale_goods/1980CISG_

status.html

Binds member states at public international law to each other

Incorporated into laws of member states if they choose to sign up to

convention.

o Monist States: by signing up to convention, it signals an automatic

incorporation into domestic law.

o Dualist states: Even after signing up, they make a distinction

between international and domestic law, and international

conventions must be implemented into domestic legislation.

Goods Act s86 and 87: gives CISG Power of law in Victoria, for international

sale of goods. CISG becomes Victorian law in this element.

As appose to UK: Who is not a signatory to CISG and has not included a

provision in their Goods Act about the CISG and ordinary UK law applies

internationally

CISG: Application and Contract Formation

Application

Art. 1 CISG:

This Convention applies to contracts of sale of goods between

Parties whose places of business are in different States:

a) When the States are Contracting States; or

b) When the rules of private international law lead to the application of

the law of a Contracting State

If court or arbitrator decided that the law of the contracting

state party applied. E.g. court decides Australian law applied in

decision of UK v AUS.

Legal internationality: Only requires ‘place of business’ to be

international, goods themselves don’t need to cross borders.

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

Art. 2 CISG:

This Convention does not apply to sales:

a) Of goods bought for personal, family or household use (business to

business contracts only), unless the

Seller, at any time before or at the conclusion of the contract, neither knew

nor ought to have known that the goods were bought for any such use;

b) By auction;

c) On execution or otherwise by authority of law;

d) Of stocks, shares, investment securities, negotiable instruments or

money;

e) Of ships, vessels, hovercraft or aircraft;

f) Of electricity.

Art. 3 CISG: mixed contracts (all in, or all out)

1. Contracts for the supply of goods to be manufactured or produced

are to be considered sales unless the party who orders the goods undertakes

to supply a substantial part of the materials necessary for such manufacture

or production.

2. This Convention does not apply to contracts in which the preponderant

(50%) part of the obligations of the party who furnishes the goods consists

in the supply of labour or other services.

Article 4 (Boundaries)

This Convention governs only the formation of the contract of sale and

the rights and obligations of the seller and the buyer arising from such a

contract. In particular, except as otherwise expressly provided in this Convention, it

is not concerned with:

a) The validity of the contract or of any of its provisions or of any usage;

b) The effect, which the contract may have on the property in, the goods sold.

Article 5

This Convention does not apply to the liability of the seller for death

or personal injury caused by the goods to any person.

Article 6

The parties may exclude the application of this Convention or, subject to

article 12, derogate from or vary the effect of any of its provisions

Exclusion: Even if all boxes are ticked off, parties may exclude its operation,

provided they have a sufficient reason for it.

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

Article 7

1. In the interpretation of this Convention, regard is to be had to its

international character and to the need to promote uniformity in its

application and the observance of good faith in international trade.

International Character: CISG provisions don’t necessarily

don’t have the same meaning as similar provisions in

domestic law.

Uniformity: Eventhough foreign decisions on CISG are not

binding, verdicts made using CISG around the world, should

be used as a guide for uniformity requirements.

Good faith: when interpreting CISG, we should keep good faith

norms in mind. (not definitive)

2. Questions concerning matters governed by this Convention which are not

expressly settled in it are to be settled in conformity with the general

principles on which it is based or, in the absence of such principles,

in conformity with the law applicable by virtue of the rules of private

international law.

Note: different to gaps referred to in Article 4.

Still refers to contract formation issues, but aspects, which

are not expressly mentioned in the CISG.

General principles to be derived from CISG, scholarly

literature and common law. If still can’t be solved, another

body of law must be referred to.

Contract Formation

Starting Point:

Art. 4 CISG: the CISG includes contract formation rules

Where the CISG applies – its provisions determine whether,

how, and when a binding contract is concluded (ie. formed)

Important! Keep in mind:

Art. 7(1) CISG: autonomous interpretation

CISG rules need to be interpreted differently to domestic law.

General comments:

• Offer and acceptance methodology

• No requirement for consideration

• Electronic communications accommodated

• And always remember Art. 7(1) CISG’s autonomous interpretation rule

Rules for Contract Formation

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

1. Offer

Article 14:

1)

One or more specific persons

Sufficiently definitive

Indicates intention of the offeror to be bound with acceptance

A proposal is sufficiently definite if it indicates the goods and expressly or

implicitly fixes or makes provision for determining the quantity and

the price.

2) A proposal other than one addressed to one or more specific persons is to be

considered merely as an invitation to make offers, unless the contrary is

clearly indicated by the person making the proposal.

Art. 15(1): An offer becomes effective when it reaches the offeree.

2. Acceptance

Article 18:

1) A statement made by or other conduct of the offeree-indicating assent to an

offer is an acceptance. Silence or inactivity does not in itself amount to

acceptance.

2) Within reasonable time

3) An act may be a form of acceptance, without notice to the offeror

3. Rejection, revocation and withdrawal of Offers

Art.17 (Rejection): An offer, even if it is irrevocable, is terminated when a

rejection reaches the offeror.

Art.16 (Revocation):

1) Until a contract is concluded an offer may be revoked if the

revocation reaches the offeree before he has dispatched an

acceptance.

2) However, an offer cannot be revoked:

a) If it indicates, whether by stating a fixed time for acceptance

or otherwise, that it is irrevocable; or

b) If it was reasonable for the offeree to rely on the offer as

being irrevocable and the offeree has acted in reliance on the

offer.

Art.15 (Withdrawal):

2) An offer, even if it is irrevocable, may be withdrawn if the withdrawal

reaches the offeree before or at the same time as the offer.

4. Quasi-Postal acceptance rule

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

Eventhough there is no postal acceptance rule under Article 16, no revocation can

apply, after acceptance has been dispatched.

5. Withdrawing acceptance

Art. 22: An acceptance may be withdrawn if the withdrawal reaches the offeror

before or at the same time as the acceptance would have become effective.

6. Late acceptance and modified acceptance

Art 21: late acceptance can be effective if offeror promptly informs the offeree that

it is satisfactory

Art.19: Default rule is that variations that do not materially alter terms of

contract, do lead to acceptance, unless the offeror promptly objects.

19(3): examples of terms that materially alter .

7. Conclusion

Art.23: A contract is concluded at the moment when an acceptance of an offer

becomes effective in accordance with the provisions of this Convention.

Note: specifies time when contract is formed, but not where.

Further points:

Art.11: Contracts don’t need to be concluded in writing.

Art.8: must look at parties’ subjective interpretation of a contract. If this

isn’t clear then an objective test is to be used and surrounding

circumstances can also be used to determine intent.

Art. 9: The parties are bound by any usage to which they have agreed and by

any practices, which they have established between themselves.

o Implied knowledge that trade practices are applicable, unless otherwise

agreed.

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

CISG: OBLIGATIONS & REMEDIES

Rights & Obligations

Seller’s Obligations

Art. 30: Seller’s obligations:

Must deliver goods

Hand over any documents

Transfer property in goods

As required by the contract and this conventions

Note:

Art.6 (Provisions in contract has primacy over CISG), but CISG is default.

Art.4: Actual rules for passing of property outside CISG

Delivery of Goods and handing over of documents (Art.31-34)

Art 31: If seller is not bound to deliver in any particular way, then:

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

Where contract involves carriage of goods: handing over goods to first

carrier to transmission to the buyer

For specific goods still to be manufactured: placing goods at buyer’s

disposal at place of production

Placing goods at buyer’s disposal at seller’s place of business

Art. 32:

Where seller hands goods to a carrier and they aren’t clearly identifiable to

the contract by markings or shipping documents, seller must notify buyer of

the consignment specifying the goods.

Where seller is bound to arrange carriage for goods, he must ensure proper

and appropriate transportation to the place fixed

If seller is not bound to effect insurance in respect to carriage, he must, at

buyer’s request, provide all information necessary to enable him to effect

such insurance.

Art 33:seller must deliver goods

On the day of the fixed date of contract

If there is a period of time, within that period

Or within reasonable time if nothing is specified

Art 34:

If seller is bound to hand over documents he must do so at time and place

specified by contract.

If he hands it over before that time, he may cure any lack of conformity in

the documents, if it doesn’t cause buyer unreasonable inconvenience. Buyer

still retains right to claim damages, pursuant to CISG.

Conformity

Art 35:

1. Goods must be of same quantity, quality and description required by

contract and packaged in manner required by contract.

2. Except where parties have otherwise agreed, goods do not conform with

contract unless:

a. Fit for purpose for ordinary use of goods of same description

b. Fit for any particular purpose expressly or impliedly made known to

seller at time of contract, except where buyer did not rely or was

unreasonable to rely on seller’s judgment

c. Has same qualities as model/sample shown to buyer by seller

d. Packaged in manner usual for such goods, or adequate manger to

preserve and protect goods

3. Seller not liable under ss2 if buyer knew or could not have been unaware of

lack of conformity at time of conclusion of contract.

Examinations and notice requirements

Art 38:

1. Buyer must examine goods or cause examination within as shorter period as

practicable

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

2. For carriage situations, examination may happen upon arrival

3. Where buyer redirects goods and seller has known this, examination may

happen upon arrival at new destination

Art 39:

1. Buyer loses right to lack of conformity, if he doesn’t notify seller within

reasonable time after he discovered it or ought to have discovered

2. Or, 2 years after goods handed to buyer.

Art 40:

Seller cannot rely on 38 and 39, where he knew of lack of conformity or could not

have been unaware and did not disclose to buyer

Art 44:

Buyer may reduce price in accordance with Art 50 or claim damages, except for loss

of profit if he has reasonable excuse for his failure to give required notice.

Buyer’s Obligation

Art 53:Buyer must

Pay the price

Take delivery as required

Note: subject to Art 6(party autonomy)

Payment of price

Art 54: includes taking steps and complying with formalities required under

contract or any laws to enable payment to be made

Art 55: where price isn’t expressly mentioned at conclusion of contract, parties are

considered to have impliedly made reference to price generally for such goods

under comparable circumstances in the trade concerned

Art 56: if price fixed by weight, net weights is to be used

Art 57

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

1. Is place of payment not specified, buyer must pay at seller’s business place

or if payment is to be mad upon handing over of goods, at the place where

that takes place.

2. Seller must bear any increase in expenses incidental to payment, caused by

change in place of business subsequent to conclusion of contract

Art 58:

1. Where time of payment not specified, it must occur, when seller places either

the goods or documents at buyer’s disposal.

2. For carriage situations, seller may dispatch the goods on terms where goods

or documents will not be handed over unless payment is made.

3. Buyer not bound to pay price until he has examined, unless procedures are

inconsistent with him having such an opportunity

Art 59:

Buyer must pay price on date fixed or determinable by contact or CISG, without

need for any request by seller.

Taking delivery

Art 60:

Act reasonably to enable seller to make delivery

Take over the goods

Note: subject to Art 6(party autonomy)

REMEDIES

Buyer’s Remedies (Seller’s breach)

Main source

Art 45(1): buyer may exercise rights (ART. 46-52) and claim damages (74-77)

Buyer may exercise rights

Art 46:

1. Buyer may require performance by seller.

Art 28: confirms that consideration must be given to law of specific country

where court is sitting

2. If goods do not conform with contract, and there is a fundamental breach,

buyer may request substitute goods, with respect to Article 39

3. May also require repair, with respect to article 39

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

47:

1. Buyer may fix additional time for performance by seller and buyer may not

perform any remedy during that period for breach of contract unless seller

has notified he will not perform. However damages for delay in performance

still available to buyer.

48:

1. Seller may remedy at own expense even after delivery date any failure to

perform obligations if it doesn’t inconvenience the buyer

2. If the seller requests buyer to make known if he will accept such

performance and buyer does not respond within reasonable time, seller may

perform within reasonable time and buyer cannot use remedy within that

time.

3. Buyer must receive such a request for it to be effective.

49:

1. Buyer may declare the contract avoided:

a. Seller’s failure to perform is a fundamental breach (Art.25) of

contact

b. Where there is non-delivery and seller does not deliver within

additional period of time fixed by buyer under 47 or declares he will

not deliver

2. Where delivery has occurred, buyer cannot avoid unless he does so:

a. Late delivery

b. Any breach other than late delivery, within reasonable time

i. After he knew or ought to have known of breach

ii. After expiration of additional period of time under 47 or

seller declared he will not deliver

iii. After expiration of additional period indicated by seller in

accordance with 48, or after buyer had declared he will not

accept performance.

NOTE: Art 7: CISG Autonomous interpretation of CISG.

50: Buyer may reduce price if goods do not conform, regardless of whether or not

price has already been paid. Must be in proportion to goods that were actually

delivered to properly conforming goods.

However, if seller remedies any failure to perform under 37 or 48, or if buyer

refuses to accept performance, buyer may not reduce price

51: Part Delivery

1. If only part of the goods have been delivered in conformity, 46-50 only

applies to the missing part

2. Contract may only be avoided in its entirely if incomplete delivery is a

fundamental breach.

52:

1. If seller delivers before fixed date, buyer has discretion to take or not to.

2. If seller delivers excess quantity, buyer has discretion to accept, but must pay

for excess at contract rate.

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

Seller’s Remedies

Art 61(1): Seller may exercise rights as provided in 62-65 and claim damages as

provided in 74-77

62: may require buyer to perform (pay price and take delivery)

63:

1. Seller may fix additional period for buyer to perform

2. Unless seller has received notice from buyer that he will not perform within

that period, seller may not resort to remedy for breach, but is still able to

claim damages for delay in performance

64:

1. Seller may avoid:

a. Buyer’s failure to perform is fundamental breach

b. If buyer does not in accordance with 63, perform his obligations or

declares he will not do so

2. Where buyer has paid, seller cannot avoid unless:

a. Late performance by buyer, before seller has become aware that

performance has been rendered, or

b. In respect of any breach other than late performance within

reasonable time

i. After he knew or ought to have known of breach

ii. After expiration of additional period of time under 63 or after

buyer has declared he will not perform

65: If Buyer must specify form or other features of goods and fails to do so in

reasonable time, seller may make a judgment in accordance with requirement of

buyer made known to him, but he must inform the buyer and give him reasonable

ti9me to make a different specification.

Damages (same for both buyer and seller)

Refer back to 45(Buyer) and 61(seller), as source to use damages.

Art. 74: Damages consist of a sum equal to the loss, including loss of profit, suffered

by the other party as a consequence of breach. May not exceed loss with the party in

breach foresaw at time of conclusion of contact.

75: If contract is avoided, and buyer has bought replacement goods or seller has

resold goods, party claiming damages may recover difference between contract

price and price in substitute transaction.

76:

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

1. If contract is avoided, and no purchase or resale has happened, party may

recover the difference between fixed price and current price at the time of

avoidance.

a. However is party claiming damages, has avoided the contract after

taking over the goods the current price at the time of taking over

the goods shall be applied and not the price at the time of avoidance.

77: A party who relies on a breach of contract must take such measures as

are reasonable in the circumstances to mitigate the loss, including loss of

profit, resulting from the breach. If he fails to take such measures, the party

in breach may claim a reduction in the damages in the amount by which the

loss should have been mitigated.

Topic 3 International Carriage of Goods

Carriage of Goods

Only carriage by sea & Air will be considered in this Unit.

Carriage contracts: separate, but complementary to international Sale of Goods

contract.

Carriage of Goods by Sea

Sea as a mode of transport

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

Shipper & Carriers

Regulates by various international instruments

Uniformity in this area of law would harness trade/reduce costs etc.

Instruments

• International Convention for the Unification of Certain Rules of Law

Relating to Bills of Lading 1924

• Hague Rules

• Brussels Protocol Amending the Hague Rules Relating to Bills of Lading

1968

• Hague-Visby Rules

• United Nations Convention on the Carriage of Goods by Sea 1978

• Hamburg Rules

• United Nations Convention on Contracts for the International Carriage of

Goods Wholly or Partly by Sea 2008

• Rotterdam Rules

Hague Rules & Hague-Visby Rules

Large number of signatory states, as well as states that incorporate into

their law without formally adopting.

Australia Position: Carriage of Goods by Sea Act 1991(Cth)

Hamburg Rules

UN Instrument

Not adopted in Australia, but see Carriage of Goods by Sea Act review

mechanisms

o S2 (3) CGSA: provides a review mechanism, to adopt Hamburg rules,

but these weren’t followed and so Hamburg rules automatically

repealed.

34 State parties

o Note: many countries who sign but haven’t ratified and entered into

force.

Rotterdam Rules

Idea is to supersede other regimes and further enhance uniformity and

harmonization. Aim is to consolidate other regimes into one body.

A number of signatories, only 3 State parties, and not enforced in any

country in the world.

Australia has not signed

o S88 (2): signature not enough, must also be ratified

o S89: If a state adopts convention, earlier conventions (Hague etc.)

are to be denounced.

Specific Provisions:

Article 94: Entry into Force

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

20 countries must ratify in order to come into force (not yet achieved)

Article 1 Definition:

Contract of Carriage: carrier carries goods from one place to another

against payment of freights. Contract shall provide for several modes of

transport in addition to sea carriage.

Carrier: Enters into contract of carriage with shipper, and has the carriage

obligations. Performing party may differ from carrier themselves.

Shipper: Enters into contract of carriage with carrier

Consignee: person entitled to delivery of goods under contract of carriage

Transport document: Document issued under a contract of carriage by

carrier (includes electronic documents)

Goods: Wares, merchandise and articles of every kind that a carrier

undertakes to carry under contract. Includes packing.

Freight: remuneration payable to carrier for carriage.

Article 2: regard has to be had to international character, promote uniformity and

good faith in international trade.

4: Any provision that limits liability or provides defence for either the carrier or

shipper, applied in any judicial or arbitral proceeding.

5: Scope of convention

Place of receipt and place of delivery must be in different states, and

Port of loading of sea carriage and port of discharge in different states.

8: Any transport document may be recorded electronically, given consent of both

parties. Both electronic communications and written communications are treated

equally.

Obligations of Parties

Carrier:

11: Carrier shall carry goods to destination and deliver goods to consignee.

12: period of responsibility of carrier starts when carrier or performing party

receives goods for carriage and ends when goods are delivered.

13: Specific obligations of carrier

14: Specific obligations applicable to voyage

16: Carrier may sacrifice goods at sea, when sacrifice is reasonable for common

safety, or preserve human life or other property.

Liability of Carrier:

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

17: only liability for things that happen during period of responsibility defined

earlier.

Carrier relived from liability in particular situations outlined in 17(3).

18: Carrier is liable for breach by performing party, master or crew of ship,

employees of carrier or performing party, any other persons who performs carrier’s

obligations.

21: delay in delivery occurs when goods not delivered at destination in contract,

within time agreed.

23 (4): No compensation in respect of delay is payable unless notice of loss due to

delay was given to carrier within 21 days of delivery of goods.

24: when deviation occurs.

26: When loss or damage occurs outside carrier’s responsibility, another instrument

may be used to determine result.

Obligations of Shipper

27: Shipper has to deliver goods ready for carriage, and must be in condition that

they will withstand intended carriage.

30: Shipper liable for loss or damage when it was caused by breach of shipper’s

obligations. Liability may be severed.

32: Shipper must inform carrier of dangerous nature of goods and must be marked

and labeled. They may be liable for loss or damage if this doesn’t occur. Must be

causal connection between loss and failure to notify or label.

41: general rule is that transport document is prima facie evidence of carrier’s

receipt of goods (same as bill of lading).

Delivery of goods

43: obligation to accept delivery by consignee.

48: goods remain undelivered even at place of destination, where consignee

doesn’t collect or refuses to accept receipt or carrier is not allowed to deliver due to

laws.

Carrier may store goods, unpack, move or cause goods to be sold or

destroyed if laws require it.

Reasonable notice must be given by carrier

49: nothing in convention affects right of carrier pursuant to the contract of

carriage.

Limits of liability

59: 875 units of account per package or 3 units per kilo. Parties may agree on

higher limit, but not a lower one.

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

Unit of account is the special drawing right as defined by international

monetary fund. (Keeps the limit of liability from fluctuating like other

currencies)

60: Limits of liability for delay

61: loss of benefit from limitation of liability.

62: sets a 2 year limitation period for judicial and arbitral proceedings,

commencing from date of delivery by carrier or when good should have been

delivered.

64: extensions of time limit

Jurisdiction & Arbitration

States have a choice to implement these provisions 66-78

Validity of Contractual terms

79:

83: nothing in this convention affects application of any convention regulation

global vessel limitation

85: Don’t apply to passengers and their luggage.

Carriage of Goods by Air

Montreal convention 1999 (most contempary)

Enforced in Australia and by a large number of states.

Provisions

Scope

1: This Convention applies to all international carriage of persons, baggage or

cargo performed by aircraft for reward. It applies equally to gratuitous carriage

by aircraft performed by an air transport undertaking

International carriage: place of departure and destination must be in

different states or where in single state party if there is a stopover in

another country.

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

2: convention applies to carriage performed by government

5: Air waybill or cargo receipt contents

9: non-compliance with requirements of receipt in Article 5, does not affect

validity of contract.

11: Air waybill is prima facie evidence of the conclusion of contract

13: Delivery of Cargo

18: Damage to cargo

The carrier is liable for damage sustained in the event of the destruction or loss of

or damage to, cargo upon condition only that the event, which caused the damage

so sustained, took place during the carriage by air.

However, the carrier is not liable if and to the extent it proves that the destruction,

or loss of, or damage to, the cargo resulted from one or more of the following:

Inherent defect, quality or vice of that cargo;

Defective packing of that cargo performed by a person other than the

carrier or its servants or agents;

An act of war or an armed conflict;

An act of public authority carried out in connection with the entry, exit or

transit of the cargo.

19: Carrier is liable from losses that come about by delay but not liable when they

prove them and their agents took all measures that could reasonably be required to

avoid damage or that it was impossible for them to take such measures.

20: Exoneration: If the carrier proves that the damage was caused or contributed

to by the negligence or other wrongful act or omission of the person claiming

compensation, or the person from whom he or she derives his or her rights, the

carrier shall be wholly or partly exonerated from its liability to the claimant to the

extent that such negligence or wrongful act or omission caused or contributed to

the damage

22: Limits of liability (read full)

4150 special drawing rights

23: converting special drawing rights to monetary units

24: limits reviewed at 5-year intervals

25 and 26: party’s can increase to increase limits but not reduce, so consignee and

shipper are protected.

27: carrier still has freedom on contract

49: Mandatory application of convention

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

If convention applies, its application if mandatory

50: Insurance

By signing up to convention, there’s an obligation on states to implement a form of

insurance in their domestic law and airline regulations.

51: Extraordinary circumstances

57: no reservation

Warsaw System

• Warsaw Convention 1929

• Hague Protocol 1955

• Guadalajara Convention 1961

• Montreal Protocol No. 4(different to Montreal 1999)

Chicago system

Sharing of civil airspace.

Australia: Civil Aviation (Carrier’s liability) Act 1959 (Cth)

• Part IA – Montreal Convention 1999

• Part II – Warsaw Convention and Hague Protocol

• Part III – Warsaw Convention without Hague Protocol

• Part IIIA – Guadalajara Convention

• Part IIIC – Montreal Protocol No. 4

• Part IV – Other carriage (where no applicable convention)

Topic 4 Letters of Credit

Role of Payment

Payment is an inherent part of goods of trade.

Problems in Payment

International payment is much different to everyday payments, as the issues of

time and distance is prevalent.

Considerations that effect method of payment:

Exchange control regulations of particular countries

Exchange risks

Domestic regulation of financial transactions

Export and import licenses

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

Financial credibility of the other party

Fraud in documentation

Reliability of the other’s performance

Effectiveness of communication

Effectiveness of recourse against each other

Tensions: Seller prefers payment as early as possible, but buyer prefers payment to

differ as long as possible, until they receive item.

Basic Methods of Payment

Direct payment v Intermediated payment

Eventhough each method of payment has no legal standing, parties are bound by

method agreed upon in sales contract.

Cash in advance

o Cash in advance of contractual performance.

o Most of the risk on Buyer

Open account

o Payment by buyer at particular time or on occurrence of particular

event.

o More balanced risk between seller and buyer

Collection

o Intermediated method

o Bank acts on seller’s behalf to collect payment.

o Buyer pays for the price of the contract in exchange for the

documents of title over the goods with the assistance of the bank

o More balanced risk of payment than open account.

Documentary Credit (Letter of Credit)

Matrix of contracts that’s work together involving buyer, seller, bank(s)

See Para 4.90. (standard model)

UCP 600 Rules:

Set of rules governing how letters of credit works. Not a body of law, but a body of

contractual rules, that can be used by buyer and seller.

Note: applicable law may vary in various contracts in a letter of credit.

Categories of letters of credit:

See pg.465.

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

Topic 5 Trade Agreements

International Trade Agreements

Nature of WTO (World Trade Organisation)

International trading system

Established by series of international treaties

Public international law

o Eventhough countries don’t necessarily trade with each other they

set laws that regulate how private companies trade internationally.

Important, because it is the only true international trading system.

1st January 1995

Built on GATT 1947

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

WTO Agreements

Final Act

Marrakesh Agreement

Annexes:

o 1A – Trade in goods

Includes GATT1994, but is not the same as the original GATT

and has been amended.

Also includes agreements on agriculture, textiles and clothing

etc.

o 1B – Trade in services

General Agreement on Trade in services

o 1C – IP

Intellectual property Rights

o 2 – DSU

Rules on disputes will be resolved

o 3 – TPRM

Trade policy review mechanism of member states

o 4 – Plurilateral agreement (PTA’s)

4(a): trade in civil Aircraft

4(b): Agreement on Government Procurement

Note: Annexes 1A-3 are ‘integral’ agreements and must be adopted by member

states. Annex 4 is ‘optional’.

Functions of WTO

Art. 3 WTO Agreements

5 main tasks:

1. Implement and Administer WTO Agreement and its Annexes. Includes

providing a framework for administering PTA’s se out in Annex 4, for states

that have ratified them.

2. Provide a forum of negotiation for members to discuss issues of concern

3. Provide a dispute settlement mechanism pursuant to the understanding on

Rules and Procedures Governing the settlement of disputes (DSU).

4. Administer the trade Policy Review Mechanism established under Annex 3.

5. Cooperate with international Monetary fund (IMF) and the International

Bank for reconstruction and development (IBRD).

Organisational Structure of WTO

Art. 4

Ministerial Conference

o Highest decision making body

o Represented by all members, meeting once every 2 years

General Council

o Second highest authority

o Represented by all members

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

o Not a rule making body, however it can make administrative or

limited policy decisions for the implementation of agreements under

WTO Agreement.

o Has discretion to perform functions of Dispute Settlement body and

Trade policy Review Body. This ensures the function can be

performed even when the relevant bodies fails to perform tasks

adequately.

Dispute Settlement Body (sits through General council)

Trade Policy review Body (sits through general council)

o No decision making power itself

Council for trade in goods

Council for trade in-services

Council for intellectual property

Various Functional bodies and Committees

Key principle: Non-discrimination

Most favoured nation (at the border)

o Member states given at the border, same rights best treatment given

to non-member/member states.

National treatment (behind the border)

o Once goods cross a border, foreign goods can’t be subject to higher

rate of GST than locally produced goods.

Ensures traders are on a level playing field with each other, in comparison to local

business activity.

WTO Dispute Settlement

Dispute Settlement Process (DSP)

Key principles: Equitable, Fast, effective, mutually acceptable

WTO members have agreed that if they believe fellow-members are

violating trade rules, they will use the multilateral system of settling

disputes instead of taking action unilaterally

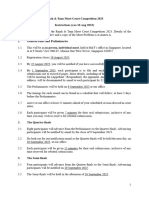

How long to settle a dispute? back to top

These approximate periods for each stage of a dispute settlement procedure are target

figures — the agreement is flexible. In addition, the countries can settle their dispute

themselves at any stage. Totals are also approximate.

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

60 days Consultations, mediation, etc

45 days Panel set up and panellists appointed

6 months Final panel report to parties

3 weeks Final panel report to WTO members

60 days Dispute Settlement Body adopts report (if no appeal)

Total = 1 year (Without appeal)

60-90 days Appeals report

30 days Dispute Settlement Body adopts appeals report

Total = 1y 3m (With appeal)

First stage: consultation (up to 60 days). Before taking any other actions the

countries in dispute have to talk to each other to see if they can settle their

differences by themselves. If that fails, they can also ask the WTO director-general

to mediate or try to help in any other way.

Second stage: the panel (up to 45 days for a panel to be appointed, plus 6

months for the panel to conclude). If consultations fail, the complaining country can

ask for a panel to be appointed. The country “in the dock” can block the creation of

a panel once, but when the Dispute Settlement Body meets for a second time, the

appointment can no longer be blocked (unless there is a consensus against

appointing the panel).

Officially, the panel is helping the Dispute Settlement Body make rulings or

recommendations. But because the panel’s report can only be rejected by consensus

in the Dispute Settlement Body, its conclusions are difficult to overturn. The panel’s

findings have to be based on the agreements cited.

The panel’s final report should normally be given to the parties to the dispute

within six months. In cases of urgency, including those concerning perishable goods,

the deadline is shortened to three months.

The agreement describes in some detail how the panels are to work. The main

stages are:

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

Before the first hearing: each side in the dispute presents its case in writing to

the panel.

First hearing: the case for the complaining country and defence: the

complaining country (or countries), the responding country, and those that have

announced they have an interest in the dispute, make their case at the panel’s first

hearing.

Rebuttals: the countries involved submit written rebuttals and present oral

arguments at the panel’s second meeting.

Experts: if one side raises scientific or other technical matters, the panel may

consult experts or appoint an expert review group to prepare an advisory report.

First draft: the panel submits the descriptive (factual and argument) sections

of its report to the two sides, giving them two weeks to comment. This report does

not include findings and conclusions.

Interim report: The panel then submits an interim report, including its

findings and conclusions, to the two sides, giving them one week to ask for a review.

Review: The period of review must not exceed two weeks. During that time, the

panel may hold additional meetings with the two sides.

Final report: A final report is submitted to the two sides and three weeks later,

it is circulated to all WTO members. If the panel decides that the disputed trade

measure does break a WTO agreement or an obligation, it recommends that the

measure be made to conform with WTO rules. The panel may suggest how this

could be done.

The report becomes a ruling: The report becomes the Dispute Settlement

Body’s ruling or recommendation within 60 days unless a consensus rejects it. Both

sides can appeal the report (and in some cases both sides do).

Note: Only governments can sue or be sued.

But, Business’ can lobby governments.

Regional Trade Agreements

Rationale for RTA’s

They cover aspects that fall outside scope of WTO agreements

They may be able to improve areas over and above WTO system

Example RTA’s

• European Union (EU)

• Asia Pacific Economic Co-Operation (APEC)

• Association of South East Asian Nations (ASEAN)

• North American Free Trade Agreement (NAFTA)

• Australia – New Zealand Closer Economic Relations (ANZCER)

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

How do these RTA’s distinguish themselves from WTO’s and how are they

significant?

Australia NZ Relations (ANZER)

To eliminate barriers to trade between Australia and NZ in a gradual and

progressive manner under an agreed timetable and with minimum

disruption.

Preferential treatment given to each other with respect to tariffs (atleast

5% less) compared to another country. Contravenes WTO’s non-

discrimination policy.

Trans-Pacific Partnership Agreement

Under negotiation

12 negotiating parties

Highly controversial- ISDS

Key interests and benefits

The TPP has the potential to forge stronger economic links between

economies in the Asia-Pacific region based on common rules for trading. It is

in Australia’s interests to be involved in order to shape the direction of the

initiative.

The TPP will provide new opportunities for Australian goods to be used in

manufacturing and production processes in the region.

Australia does not have existing trade agreements with a number of the

current TPP parties. The TPP could provide Australian exporters of goods

and services with increased access to these new markets. The TPP could also

build on the FTAs Australia has concluded by providing additional access for

Australian goods and services into those TPP countries.

The TPP provides an opportunity to benefit Australia’s significant services

sector, through enhanced access for service suppliers involved in education,

legal, financial, mining and agricultural services.

The TPP will provide substantive outcomes on electronic commerce, which

will benefit consumers and businesses.

Investor-state dispute settlement (ISDS) is an instrument of public

international law, that grants an investor the right to use dispute settlement

proceedings against a foreign government.

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

Topic 6 Foreign Investment Law

Foreign Investment – In General

Motivations for Foreign investment

Post WW11, number of newly independent countries, in need of help for

economic development.

Traditional viewpoint was to nationalize instead of looking for foreign

investment.

o Expropriation: Government taking control of foreign investors’

asset in their country.

Australia’s foreign investment Policy 2013: The Government welcomes

foreign investment. It has helped build Australia’s economy and will

continue to enhance the wellbeing of Australians by supporting economic

growth and prosperity

Conflict of interest between foreign investor and host state, and so it is

closely regulated.

o Foreign investors have private profit motives in mind, whilst Host

states have their states economic growth as their main motive.

Economic Advantages

AFP 2013: Foreign investment brings many benefits. It supports existing jobs and

creates new jobs, it encourages innovation, it introduces new technologies and

skills, it brings access to overseas markets and it promotes competition amongst

our industries

Who is involved?

Foreign Investor:

Is a party undertaking foreign investment activities

Maybe private or government entity (mostly private)

IS not a citizen of the host state

Host State

State in which the foreign investment occurs

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

Foreign Investment: Two main types as defined by UNCTAD

Foreign Direct investment (FDI): investment involving a long term

relationship and reflecting a lasting interest and control by a resident entity

in one economy (investor) in an enterprise resident in an economy other

that of the investor

Foreign portfolio Investment (FPI): Entry of funds into a country where

foreigners make purchases in the country’s stock and bond markets,

sometimes for speculation

Note: Foreign investment is not a mere sale of goods or supply of services!! Hence it

differs from previous topics of sale of goods.

Forms (pg. 567)

Multinational corporations

Joint Ventures

Sole foreign ventures

Licensing and countertrade

BOT projects (not a form of expropriation)

Foreign takeovers and acquisition

Foreign Investment- International regulation

Another conflict of interest: host country may wish to regulate foreign investment,

whereas the capital exporting country (home of investor) may feel the need to

protect it’s nationalists’ interests for the purposes of promoting its overseas

investment and trade.

No comprehensive treaty, but many soft law instruments that aren’t

binding. (576-592)

Closest we have come:

(Draft) Multilateral Agreement on investment:

Didn’t go pat 1998, where negotiations broke down. It is very hard to regulate

internationally in this area. What to regulate? How to regulate? Minimum

standards? The conflict of interests that are present makes it hard to find the right

balance. Not as easy as the GATT regulations on sales of goods etc.

Investment Arbitration

Bilateral investment treaties (BIT’s): If they include ISDS clauses, can

provide for investment arbitration to resolve disputes

Washington convention 1965: IXIT arbitration happens autonomously

Protections granted (encourage investment) and effective enforcement

provided (arbitration)

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

Phillip Morris claim: ISDS mechanism contained in Australia-Hong Kong

agreement.

Foreign Investment- Domestic (Australian) Regulation

Foreign Acquisitions & Takeovers Act 1975 (Cth):

S18 Acquisition of Shares is our main focus. (Also includes associated sections)

S16: Applies within and outside Australia

S17: All persons required to comply, whether resident or citizen as well as all

corporations

S18 (2): Treasurer may prohibit proposed acquisition where;

Person(s) proposes to acquire shares, or corporation proposes to issue

shares, and

o This would result in a corporation not previously controlled by

foreign persons, now being controlled by a foreign person, or

o A corporation being controlled by a foreign person, would not be

controlled by a new foreign person

And, that result would be contrary to national interests.

Considerations include;

Australian Policy 2013: national security, competition, and other Australian

policies, impact on economy and community, as well as character of

investor.

S18 (1): defines corporation. Look at s7 for definition of ‘business’.

S13A (1): s18 not applicable to shares in exempt corporation

Exempt Corporation defined in s13A (4).

Under 5mil. Of assets under this Act.

Control: s18 (7A): foreign person holds a controlling interest in the corporation or 2

or more foreign persons hold an aggregate controlling interest in the corporation;

S9 (2): Substantial interest or aggregate substantial interest equates to a

controlling interest.

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

Foreign Persons: s5 (1): person not residing in Australia

Proposal to acquire shares: s5 (3)

S26: compulsory notification to treasurer for proposal to acquire shares.

Consequences

S30 and 31

S18 (4): treasurer can order to dispose of shares.

S39: The Governor-General may make regulations, not inconsistent with this Act,

prescribing all matters required or permitted by this Act to be prescribed or

necessary or convenient to be prescribed for carrying out or giving effect to this Act.

This is the section that validates FATR 1989 regulations.

Foreign Acquisitions & Takeover Regulations 1989:

Prescribe higher values for ‘Exempt Corporation’, than in S13A.

Note how, the Act, the regulations, and the policy work in tandem to regulate this

area, in the absence of an international treaty.

However, domestic legislation only prohibits exceptional cases of foreign

investment, but there is no benchmark that needs to be met. Hence, there is a pre-

determined idea that foreign investment is endorsed in Australia.

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

Topic 7 International Dispute Resolution

International Dispute Resolution

Three principal means:

Negotiation/mediation

‘Settlement’

Informal: controlled entirely by parties themselves

Usually voluntary to commence/continue. (Sometimes parties may involve

dispute resolution system in their contract)

It is only after this method is attempted, that parties go to other methods

like arbitration.

Eventhough this is a voluntary method there are UNCITRAL model laws that

are relevant.

State court litigation

Very different to previous method

Recourse to ordinary state courts

Using ordinary state court litigation to resolve an international commercial

dispute

Disputes externally (judges and courts) resolved. This is binding on parties.

There is however conflict of laws issues (enforcement?).

Defined procedure

International commercial arbitration

Parties resort to external entity (impartial arbitrator(s))

Domestic law is very important and plays a key role

Supported by international conventions, state law and contractual

agreements (also soft law).

Eventhough it is voluntary, this ends after the process is entered into. From

then on parties can’t pull out.

Flexible procedure: parties can agree on how process will happen, if they

can’t there are a broad set of fall back rules, and arbitrators can help

decide on process too.

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

State Court litigation

Choice of forum and commencing proceedings

o Forum shopping: looking for the most favourable forum for the

client.

Carrying out the proceedings

o Applying ordinary court procedures on international law

o Procedural rules of the court will apply, but they will decide on

applicable law, if parties haven’t agreed it on.

Enforcing judgments

o If defendant doesn’t have assets in particular country where

litigation occurs, then judgment will have to be enforced in another

country where assets are held. (Enforcement topic 1)

o Doesn’t involve a re-hearing. Winning party tries to enforce their

favourable judgment in another country.

No review of decision and whether it was right/wrong. Purely

a procedural question.

Not an automatic right

Enforcement law of place of enforcement is relevant here.

Common law/legislation

Treaties?

No worldwide convention

In Australia, common law:

Enforceable judgment must satisfy following 3:

Foreign court has jurisdiction (Schisby v Westenbolz)

Judgment must be final (Vogel v R and A kohnstamm)

Judgment must be for a fixed sum

But now,

Foreign Judgment Act 1991

S6: holder of foreign judgment may aply to an appropriate court for registration of

the judgment. Once judgment is registered in a state Supreme Court, it is regarded

as the judgment of the court registering it and is register able, in other states and

territories.

S5 AND 6.: Court may refuse to register foreign judgment because:

Made in a country which has not been approved by governor

general as being eligible for the benefit of the Act under the

reciprocal principle

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

It is of the kind that has not been approved by GG as being

registrable under the Act under the reciprocal principle

More than 6 years from the date of application for

registration, and

Contrary to any provisions of the Act or the rules of the court,

which hears the application.

S5: reciprocity

GG may allow foreign judgments to be registered under the Act if he or she is

satisfied that the country would reciprocally enforce Australian judgments in

similar circumstances

S7: Court may set aside registration: (pg773)

If they decide court has no jurisdiction

Judgment obtained by fraud

Reversed or set aside in original country

Enforcement is contrary to public policy

International Commercial Arbitration

Pryles Reading:

o Arbitration is the ‘usual’ method

o It is flexible

o Scope for parties themselves to appoint arbitrators, with specific

expertise in the area, even if they cant practice law

o Neutral/ arbitral set

o International enforceability of awards (New york Convention)

o Freedom to choose governing laws

How does it work?

Recognized and supported by law, which makes it effective

Several instruments, that interact with each other

o Conventions

o Model laws

o Contractual rules

o Ordinary domestic law

All countries have (state) arbitration law- a lex arbitri: regulates arbitral

proceedings in a country.

Validates arbitration that occurs in that country

International Arbitration Act

o S16, gives the UNCITRAL model law force in Australia

UNCITRAL 1985 model law was made as a guide for countries when enacting own

legislation

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

o UNCITRAL Revised in 2006 but has no force, until countries decide to

amend their own legislation accordingly.

o A default regime for arbitrators to follow. Only procedural law not

substantive law. Only sets out process, doesn’t deal with actual

legal outcome.

Art 19:

1: Subject to the provisions of this Law, the parties are free to agree on the

procedure to be followed by the arbitral tribunal in conducting the proceedings

There are procedural rule formats, which the parties can choose from and

agree upon, that work as an overlay to the model law. (E.g. ACICA rules)

Mandatory provisions: can’t be changed by parties. These are decided by

case law and scholarly writings.

o E.g. Art 18: equal treatment

ACICA Rules

Institutional arbitration: arbitrations that are supervised by a particular

international body that is not the court of a particular country. They usually

have their own set f rules that can be employed by the parties. E.g. ACICA

rules

Note: These rules can be used in other countries as well, not just Australia.

Ad hoc rules: arbitration rules may still be used, but there is no institution that is

supervises and the court does this instead. The parties may adopt ad hoc rules such

as UNCITRAL arbitration rules.

Enforcement regime:

Instead of rendering judgments, arbitrators render awards to resolve the dispute.

Like judgments, party may want to enforce the award in another country. They rely

on New York Convention.

Adopted in Australian law: S3-14 International Arbitration Act.

o Art4 New York: Court must not re-examine arbitrators decision on

facts, when enforcing the award.

Consent in Arbitration

Art 7 Model Law: Must be initial consent

Once consent is given, parties then cant later withdraw. If they do courts can

refer parties back to arbitration. (Art 2(3) NYC)

Governing Law

Art 19 Model Law: Parties have autonomy to choose the procedural law

(so ACICA rules shall override Art 28 if parties so choose)

Art 28 model law: substantive law on how to decide on dispute (not

mandatory law)

o 28(1): parties may choose substantive law that will apply.

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

o 28(2): Arbitrators can decide on choice of law, using conflict of laws

rule, if the parties can’t decide themselves. (Restricted to national

legal systems and cannot apply lex mercatoria or UNIDROIT

principles.)

Art 34(1) ACICA: similar principle to art 28 of model law.

o Difference to Art 28 model law is that Tribunal isn’t restricted and

Lex Mercatoria and UNIDROIT can be used. And conflict of laws rules

isn’t required, when deciding choice of law.

Other Arbitral related bodies

ACICA

IAMA

CIArb

Challenging Awards

Can be challenged not appealed

o Different to appeal because decision cannot be changed, merely a

judgment on whether award stands or not.

o Can be done in 2 ways:

i. Art 34 Model Law: party that has award rendered against

them can challenge in Australian court. (Proactive approach)

If challenge is successful award ceases to exist

ii. Wait until other party tries to enforce award in another

country and challenge under Art 5 of NYC. (More passive)

If challenge is successful award still stands, but is

not enforceable in that particular country.

Both types can only be used for procedural due process issues, not on

substantive law issues.

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

Topic 8 Current Issues A: Regulating

International Commercial Contracts at the global

and Regional levels

An analysis of current developments, regarding the harmonisation of international

commercial contract law, at the global and regional levels

The Swiss Proposal

Proposal by government of Switzerland, that UNCITRAL should undertake further

work in the areas of harmonizing International Commercial Contract law.

It is suggested that UNICTRAL should increase their scope to greater than

just sale of goods.

Still just a proposal. Highly controversial

Advocates, argue the benefits of harmonizing laws to make trade easier and

efficient.

The common European Sales Law (CESL)

Intended to be applicable regionally (EU)

Come about as a result of continual pushed within EU to harmonize law

between member states

Intended to non be compulsory unlike CISG

Aimed at sales context, but Also covers consumer transactions

Bit more progressed than Swiss proposal, as there is a draft made for it.

CISG V CESL

Principles of Asian contract Law

Intended to be a collection of commonly acknowledged Contract law

principles of Asia.

Driven by scholars not governments

Intended to be Non-binding soft law instrument

If China, the world’s second largest economy, Japan, the world’s third largest

economy, and South Korea will cooperate, it will absolutely attract the world’s

attention. The significant volume of transactions among the three countries calls

for common rules. But all 3 are members of CISG, so why is PACL relevant or

needed?

CISG only covers sales contracts

CISG doesn’t cover every aspect of contracts

CISG outdated?

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

2012 Review of Australian Contract Law

Idea proposed for review of Australian Contract Law

o Controversial because majority of contract law is from common law

o Aim to more closely align Australian contract law with international

contract law. And use the CISG as a guide.

Globalization, and Regionalization of international Commercial Contract Law

Aim to harmonize law either regionally (CESL) or globally (CISG).

Processes are related, because they inform each other.

Regionalization may in fact fracture global harmonisation, as it may lead to

a number of different systems around the world.

Harmonisation, only as good as the quality of the law.

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

lOMoARcPSD|18505429

Topic 9 Current Issues B: E-Commerce Law and

International Commercial Contracts

A consideration of the work of UNCITRAL in preparing

e-commerce laws to facilitate cross-border trade in modern global commerce

E-Commerce Law

Branch of law that is developed to deal with modern communication technologies.

Reason we need it, is due to the tension that exists to previous law that requires

writing requirements and modern technology that may not be treated as

‘writing’.

In jurisdictions where these ‘writing requirements’ still exist, there is tension

as to whether modern technologies should be treated as ‘writing’.

Functional equivalence: modern communication technologies should be given same

treatment as traditional paper-based counterparts, for the purposes of existing

laws that require ‘writing’.

This leads to harmonisation, as there aren’t boundaries due to writing issues.

UNCITRAL’s E-Commerce Work

Electronic Communications Conventions (ECC)

o Contemporary Instrument

o 2006, so up to date

o UNCITRAL considered this as the preferred law

o Purpose is functional equivalence

o 6 ratified countries (Honduras, Singapore and Dominican republic

were first 3)

Model Law on Electronic Commerce (MLEC)

Model Law on Electronic Signatures

Functional Equivalence and the CISG

Art 11:General rule is there are no form requirements. But,

Art 12: Writing requirements can still apply, f domestic laws of particular countries

say so.

New York Convention

Art 2: does show a writing requirement.

Hence, purpose of e-commerce laws is to ensure functional equivalence, so these

provisions in CISG and NYC, can be satisfied by Electronic communications as well.

Downloaded by Chetna Dubey (chetna.dubey.773@gmail.com)

You might also like

- IBT OutlineDocument99 pagesIBT OutlineDamion N Calisha Francis100% (2)

- Developing Neutral Legal Standards Int Contracts PDFDocument33 pagesDeveloping Neutral Legal Standards Int Contracts PDFKhan BabaNo ratings yet

- Vocabulary For IeltsDocument11 pagesVocabulary For IeltsPhu Ha-Van100% (1)

- Preservation and Spoliation of EvidenceDocument8 pagesPreservation and Spoliation of EvidencecleincoloradoNo ratings yet

- The Sources of International LawDocument33 pagesThe Sources of International LawEyka AzdNo ratings yet

- Education Assistance Retention Agreement v3 - 112021Document6 pagesEducation Assistance Retention Agreement v3 - 112021Omkar DesaiNo ratings yet

- 04 CisgDocument24 pages04 Cisgnur farhana shahiraNo ratings yet

- January 2007 Philippine Jurisprudence CasesDocument5 pagesJanuary 2007 Philippine Jurisprudence CasesjafernandNo ratings yet

- G.R, No. 231859 Feb. 19,: Gerardo C. Roxas vs. Baliwag Transit, Inco. And/or Joselito S. TengcoDocument4 pagesG.R, No. 231859 Feb. 19,: Gerardo C. Roxas vs. Baliwag Transit, Inco. And/or Joselito S. TengcoKristine Ann DikiNo ratings yet

- PIL ReviewerDocument23 pagesPIL ReviewerRC BoehlerNo ratings yet

- Commercial ArbitrationDocument23 pagesCommercial Arbitrationamour860No ratings yet

- Choice of Law in International ContractsDocument18 pagesChoice of Law in International ContractsBM Ariful IslamNo ratings yet

- Most Recit Questions Revolved Around Art. 38 (1) Memorize The Sources of PILDocument14 pagesMost Recit Questions Revolved Around Art. 38 (1) Memorize The Sources of PILAinah KingNo ratings yet

- Conflict of Laws (Private International Law) NotesDocument476 pagesConflict of Laws (Private International Law) NotesRaju KD87% (54)

- International Commercial Law NotesDocument63 pagesInternational Commercial Law NotesAaron100% (2)

- Attorney-client privilege case on compromising insurance policiesDocument38 pagesAttorney-client privilege case on compromising insurance policiesYl LeyrosNo ratings yet

- Pil Cheat Final Summary Public International LawDocument22 pagesPil Cheat Final Summary Public International LawMahir100% (1)

- Case Digest (Eusebio - Garcia)Document5 pagesCase Digest (Eusebio - Garcia)burn_iceNo ratings yet

- Treaty and customary international law sourcesDocument11 pagesTreaty and customary international law sourcesGiwangga Moch. FernandaNo ratings yet

- Art. 845-854Document20 pagesArt. 845-854Liz ZieNo ratings yet

- International Commercial Law NotesDocument63 pagesInternational Commercial Law Notespriyasohanpal2No ratings yet

- International Trade and FinanceDocument13 pagesInternational Trade and FinanceDeepesh SinghNo ratings yet

- United Nations Convention On Contracts For The International Sale of Goods, 1980Document30 pagesUnited Nations Convention On Contracts For The International Sale of Goods, 1980Mehraan ZoroofchiNo ratings yet

- Lesson 11 - International Contract (Part II)Document35 pagesLesson 11 - International Contract (Part II)Hồng UyênNo ratings yet

- Sources of International Trade LawDocument4 pagesSources of International Trade Lawanayadas.ipu095728No ratings yet

- The Actors in International Trade Regulators, Private Actors, Natural and Physical Persons International OrganisationsDocument10 pagesThe Actors in International Trade Regulators, Private Actors, Natural and Physical Persons International OrganisationsShantanu Biswas LinkonNo ratings yet

- Instruments of International Commercial ContractDocument10 pagesInstruments of International Commercial ContractPratyush PrakarshNo ratings yet

- International Contract LawDocument10 pagesInternational Contract LawWessel JordaanNo ratings yet

- Transnational Business Law - EditedDocument15 pagesTransnational Business Law - EditedMashaal FNo ratings yet

- Sales ContractDocument13 pagesSales Contractl a t h i f a hNo ratings yet

- Sources of Public International Law: by DR Rahul SrivastavaDocument62 pagesSources of Public International Law: by DR Rahul SrivastavaMAYANK MALHOTRA 19213220No ratings yet

- INTERNATIONAL SALES LAWDocument12 pagesINTERNATIONAL SALES LAWDmitry LJ100% (1)

- The Sources of International Law-2Document37 pagesThe Sources of International Law-2Muhd Ariffin NordinNo ratings yet

- Law of TreatiesDocument22 pagesLaw of TreatiesarmsarivuNo ratings yet

- Cisg and inDocument4 pagesCisg and inPrashant MauryaNo ratings yet

- ICA Moot Issue - ILSA 2023Document14 pagesICA Moot Issue - ILSA 2023Kina HoNo ratings yet

- Hpi Topik III-IVDocument21 pagesHpi Topik III-IVivan rickyNo ratings yet

- Comparative Outlook of The Enforcement of Uncitral Model Law in India and UkDocument18 pagesComparative Outlook of The Enforcement of Uncitral Model Law in India and UkAnirudh KaushalNo ratings yet

- Contract LawDocument22 pagesContract Lawfoodandhealth2023No ratings yet

- UN Convention on International Sale of GoodsDocument24 pagesUN Convention on International Sale of GoodsNefelibata100% (1)

- International commercial contracts and the role of UNIDROIT PrinciplesDocument27 pagesInternational commercial contracts and the role of UNIDROIT PrinciplesRicardo Bruno BoffNo ratings yet

- The Proper Law of The Contract or The Lex CausaeDocument7 pagesThe Proper Law of The Contract or The Lex CausaeAubid ParreyNo ratings yet

- IntroductionDocument5 pagesIntroductionSankalp RajNo ratings yet

- Conflict of LawsDocument15 pagesConflict of LawsAkash Shrivastava100% (3)

- CISG v. UCC: Key Distinctions and Applications: Aditi Ramesh Petra Ghicu Cara PutmanDocument10 pagesCISG v. UCC: Key Distinctions and Applications: Aditi Ramesh Petra Ghicu Cara Putmana sNo ratings yet

- International LawDocument91 pagesInternational Lawikmal_jamilNo ratings yet

- International LawDocument12 pagesInternational Lawsamlet3No ratings yet

- Contract of International Sales and Goods (CSIG)Document10 pagesContract of International Sales and Goods (CSIG)Clement HiiNo ratings yet

- Private International Law: United Nations Convention On Contracts For International Sale of Goods (CISG)Document22 pagesPrivate International Law: United Nations Convention On Contracts For International Sale of Goods (CISG)Aslan GNo ratings yet

- Conflict of Laws Issues in International Trade and Business Contracts: A Critical AnalysisDocument6 pagesConflict of Laws Issues in International Trade and Business Contracts: A Critical AnalysisSAURABH SINGHNo ratings yet

- Tutorial Questions On CISGDocument2 pagesTutorial Questions On CISGNBT OONo ratings yet

- 20075261650298762Document28 pages20075261650298762Naresh KumarNo ratings yet

- Application of CISG to International Govt. Contracts for the Procurement of GoodsDocument27 pagesApplication of CISG to International Govt. Contracts for the Procurement of GoodsIshikaa SethNo ratings yet

- Bacher CISGScopeofapplicationDocument14 pagesBacher CISGScopeofapplicationAbhinand ErubothuNo ratings yet

- Hukum Perniagaan InternasionalDocument47 pagesHukum Perniagaan InternasionalAzizah AlsaNo ratings yet

- The Sources of International Law - Part 2Document30 pagesThe Sources of International Law - Part 2Christine Mwambwa-BandaNo ratings yet

- Algeria ArbitrationDocument24 pagesAlgeria ArbitrationSteven AldrichNo ratings yet

- General Overview of International Commercial ArbitrationDocument35 pagesGeneral Overview of International Commercial ArbitrationlheeyamNo ratings yet

- A Guide To Procedural Issues in International ArbitrationDocument13 pagesA Guide To Procedural Issues in International Arbitrationabuzar ranaNo ratings yet