Professional Documents

Culture Documents

Cost Accounting Assignment Summary

Uploaded by

jaribhaiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost Accounting Assignment Summary

Uploaded by

jaribhaiCopyright:

Available Formats

COST CONCEPTS, USES AND CLASSIFICATION

Costs can be classified in various ways depending on their purpose, such as determining inventory

valuations or to help decision-making.

Manufacturing costs are grouped into the following.

• Direct materials

• Direct labor

• Manufacturing overhead

• Prime versus Conversion Costs

Non-manufacturing costs include the following.

• Selling (marketing) costs

• Administrative costs

Marketing and administrative costs are incurred in both manufacturing and merchandising firms.

Period vs. Product costs:

• Periods costs are expensed in the time period in which they are incurred.

• Product costs are added to units of product as they are incurred and not treated as expenses until

the units are sold.

Costs can be classified into three basic categories:

• Variable costs

• Fixed costs

• Semi-variable costs

Variable Costs vary in total in direct proportion to changes in activity, such as direct materials and gasoline

expense.

Fixed Costs remain constant in total regardless of changes in activity, such as rent, insurance, and taxes.

Semi-variable Costs vary with changes in volume but do not vary in direct proportion.

Standard Costs:

They are predetermined production or operating costs that are compared with actual costs to measure the

performance of a costing department.

Cost classifications for Decision-Making:

It includes differential costs, opportunity costs, and sunk costs.

Differential Costs differ between alternatives. The cost may exist in only one of the alternatives or the

total amount of the cost may differ between the alternatives.

Opportunity costs are the potential benefit given up by selecting one alternative over another.

Sunk costs are incurred and cannot be changed by any decision made now or in the future.

You might also like

- Cost Concepts & Classification ShailajaDocument30 pagesCost Concepts & Classification ShailajaPankaj VyasNo ratings yet

- UNIT 5 - Pricing DecisionsDocument47 pagesUNIT 5 - Pricing Decisionsp nishithaNo ratings yet

- Module 2 - Introduction To Cost ConceptsDocument51 pagesModule 2 - Introduction To Cost Conceptskaizen4apexNo ratings yet

- Cost ConceptsDocument5 pagesCost Conceptssyed HassanNo ratings yet

- Chapter 2:cost Terms, Concepts, and ClassificationsDocument8 pagesChapter 2:cost Terms, Concepts, and ClassificationsTaslim ArifNo ratings yet

- Cost Accounting: Basic ConceptsDocument30 pagesCost Accounting: Basic ConceptsAmna SaifullahNo ratings yet

- Cost & Management Accounting - Lec 2Document30 pagesCost & Management Accounting - Lec 2Agnes JosephNo ratings yet

- Managerial Accounting - An OverviewDocument29 pagesManagerial Accounting - An OverviewZoiba EkramNo ratings yet

- Cost Accounting CH 1Document29 pagesCost Accounting CH 1Mohd Azhari Hani SurayaNo ratings yet

- Temp 2Document29 pagesTemp 2KIMBERLY MUKAMBANo ratings yet

- Cost ConceptsDocument32 pagesCost Conceptsamira samirNo ratings yet

- Apparel CostingDocument41 pagesApparel CostingJitu KhanNo ratings yet

- FIN600 Module 3 Notes - Financial Management Accounting ConceptsDocument20 pagesFIN600 Module 3 Notes - Financial Management Accounting ConceptsInés Tetuá TralleroNo ratings yet

- Marginal Costing TheoryDocument16 pagesMarginal Costing TheoryGabriel BelmonteNo ratings yet

- Introduction To Cost Terms and PurposesDocument20 pagesIntroduction To Cost Terms and PurposesDr. Alla Talal YassinNo ratings yet

- Module 4Document27 pagesModule 4Gandeti SantoshNo ratings yet

- Cost Accounting-A Managerial Emphasis, 16 Edition, Srikant/ George/ Madhav/ ChristopherDocument18 pagesCost Accounting-A Managerial Emphasis, 16 Edition, Srikant/ George/ Madhav/ ChristopherFahim Ashab ChowdhuryNo ratings yet

- Cost Term, Concepts and ClassificationsDocument17 pagesCost Term, Concepts and ClassificationsMd. Abu NaserNo ratings yet

- Introduction To Cost & Management AccountingDocument25 pagesIntroduction To Cost & Management AccountingNokutenda K GumbieNo ratings yet

- Managerial Accounting: Cost TerminologyDocument18 pagesManagerial Accounting: Cost TerminologyHibaaq Axmed100% (1)

- CA Final Project....Document15 pagesCA Final Project....Obaida ZulfiqarNo ratings yet

- Sba1501 Management Accounting Unit IvDocument77 pagesSba1501 Management Accounting Unit Ivsandhya lakshmanNo ratings yet

- Chapter 2Document16 pagesChapter 2mbalenhle jezaNo ratings yet

- Cost Accounting IDocument147 pagesCost Accounting IBilisummaa LammiiNo ratings yet

- Chapter 1: Marginal Costing & Profit PlanningDocument32 pagesChapter 1: Marginal Costing & Profit PlanningSwatiNo ratings yet

- Y12.U5.31 - CostsDocument5 pagesY12.U5.31 - CostsRuxandra ZahNo ratings yet

- DSFDFJM LLKDocument27 pagesDSFDFJM LLKDeepak R GoradNo ratings yet

- Cost Concept: Cost Interpretation Depends UponDocument20 pagesCost Concept: Cost Interpretation Depends UponDheeraj AroraNo ratings yet

- Cost AccountingDocument36 pagesCost AccountingDevanshu PatelNo ratings yet

- TYPES OF COST in Decision MakingDocument10 pagesTYPES OF COST in Decision Making170 piyush kadamNo ratings yet

- Costs Concepts, Uses & ClassificationsDocument9 pagesCosts Concepts, Uses & ClassificationsnavbaigNo ratings yet

- Sec C - Cost Behavior and Cost ObjectsDocument11 pagesSec C - Cost Behavior and Cost ObjectsDao Mai PhuongNo ratings yet

- Cost Classification or Cost Flow in An OrgaizationDocument8 pagesCost Classification or Cost Flow in An OrgaizationvaloruroNo ratings yet

- Managerial and Financial AccountingDocument42 pagesManagerial and Financial AccountingRodrigo de Oliveira LeiteNo ratings yet

- Cost Ch. IIDocument83 pagesCost Ch. IIMagarsaa AmaanNo ratings yet

- Chapter2-Colin DruryDocument3 pagesChapter2-Colin DruryMarioNo ratings yet

- Managerial Accounting 1Document27 pagesManagerial Accounting 109123609935No ratings yet

- PricingDocument10 pagesPricingshlakaNo ratings yet

- Cost Concepts and ClassificationsDocument22 pagesCost Concepts and ClassificationsgraceNo ratings yet

- ACG2071 - Chapter 1Document4 pagesACG2071 - Chapter 1Fabian NonesNo ratings yet

- Atp 106 LPM Accounting - Topic 6 - Costing and BudgetingDocument17 pagesAtp 106 LPM Accounting - Topic 6 - Costing and BudgetingTwain JonesNo ratings yet

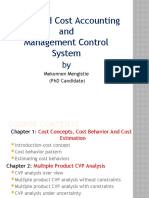

- Advanced Cost Accounting and Management Control System: Mekonnen Mengistie (PHD Candidate)Document62 pagesAdvanced Cost Accounting and Management Control System: Mekonnen Mengistie (PHD Candidate)Kalkidan ZerihunNo ratings yet

- Merchandisers - . - ManufacturerDocument4 pagesMerchandisers - . - ManufacturerRazzele Loraine AyadNo ratings yet

- Analysis of Classification of CostDocument3 pagesAnalysis of Classification of Costrabiaqais7No ratings yet

- Elements and Classification of CostDocument5 pagesElements and Classification of CostMaster VINAYNo ratings yet

- Segregation of New Product Cost and Pricing in Industrial MarketDocument27 pagesSegregation of New Product Cost and Pricing in Industrial MarketMarielle CambaNo ratings yet

- 2 - Cost Concepts and BehaviorDocument3 pages2 - Cost Concepts and BehaviorPattraniteNo ratings yet

- Cost Accounting: - PROF Arti ModiDocument23 pagesCost Accounting: - PROF Arti ModiVishal JadhavNo ratings yet

- Cost Classification: Prepared By: Talha Majeed Khan (M.Phil), Lecturer UCP, Faculty of Management StudiesDocument9 pagesCost Classification: Prepared By: Talha Majeed Khan (M.Phil), Lecturer UCP, Faculty of Management StudieszubairNo ratings yet

- ME Unit 2Document53 pagesME Unit 2Rutvij GiteNo ratings yet

- PDF Topic 2 COST CONCEPT AND CLASSIFICATIONDocument53 pagesPDF Topic 2 COST CONCEPT AND CLASSIFICATIONJessaNo ratings yet

- Managerial Accounting - Chapter3Document27 pagesManagerial Accounting - Chapter3Nazia AdeelNo ratings yet

- Session Objectives:: Different Basis For Classification ofDocument12 pagesSession Objectives:: Different Basis For Classification ofOmkar Reddy PunuruNo ratings yet

- Meaning of CostDocument8 pagesMeaning of CostSwarup Singh DeoNo ratings yet

- Chapter 5 - PriceDocument99 pagesChapter 5 - PriceFarrah SokriNo ratings yet

- Chapter Four Basic Cost AccountingDocument34 pagesChapter Four Basic Cost AccountingBettyNo ratings yet

- Indirect CostDocument10 pagesIndirect CostBramodh JayanthiNo ratings yet

- Hum 2217 (Acc) CostingDocument6 pagesHum 2217 (Acc) CostingNourin TasnimNo ratings yet

- Lecture 15Document13 pagesLecture 15Huzaifa NadeemNo ratings yet

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet