Professional Documents

Culture Documents

CCM

Uploaded by

joekvedusa0 ratings0% found this document useful (0 votes)

5 views3 pagesCross cultural management notes

Original Title

Ccm

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCross cultural management notes

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views3 pagesCCM

Uploaded by

joekvedusaCross cultural management notes

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

High-quality standards in international accounting are crucial

for several reasons, as they provide a framework for

consistency, comparability, and reliability in financial

reporting across different countries and organizations. Here's

an explanation highlighting the need for high-quality standard

sin international accounting:

Investor Confidence: High-quality accounting standards

inspire confidence among domestic and foreign investors.

When financial statements adhere to these standards,

investors can make informed decisions, assess risk accurately,

and allocate capital efficiently.

Global Capital Flows: In today's interconnected world, capital

flows across borders are common. High-quality accounting

standards make it easier for investors to assess and compare

investment opportunities in different countries. This

promotes cross-border investments and economic growth.

Reduced Information Asymmetry: Uniform standards reduce

information asymmetry between companies and their

stakeholders. This leads to better-informed decisions, lowers

the cost of capital, and ultimately benefits the broader

economy.

Cross-Border Mergers and Acquisitions: Companies involved

in cross-border mergers and acquisitions need to evaluate the

financial health and performance of potential targets. High-

quality accounting standards facilitate this process by

ensuring that financial statements are prepared and

presented in a consistent and transparent manner.

Risk Management: International businesses are exposed to

various risks, including currency risk, interest rate risk, and

political risk. Accurate and consistent financial reporting,

driven by high-qualitystandards, helps organizations identify

and manage these risks effectively.

Global Trade: High-quality accounting standards are essential

for international trade. They enable businesses to assess the

financial stability of their trading partners and make informed

decisions about trade credit, reducing the risk onion-

payment.

Regulatory Compliance: Many countries require or encourage

the use of international accounting standards. Complying

with these standards is often a legal requirement for

companies that operate internationally, ensuring they adhere

to best practices.

Resource Allocation: Governments and regulatory bodies use

financial information to allocate resources, such as tax

revenue and subsidies, efficiently. High-quality standards help

ensure that these decisions are based inaccurate and

comparable data.

Consistency and Comparability: Uniform standards make it

easier to compare financial information between companies

and across industries, fostering healthy competition and

aiding market efficiency.

Global Economic Stability: Financial crises, like the 2008

global financial crisis, underscore the importance of

transparent and reliable financial reporting. High-quality

accounting standards can help mitigate the severity of such

crises by providing early warning signs.

Corporate Governance: High-quality standards encourage

good corporate governance practices. They enhance

transparency, accountability, and ethical behaviour, which are

essential for long-term business sustainability.

Education and Training: International accounting standards

create a common foundation for accounting education

andtraining worldwide. Professionals trained in these

standards can work effectively in diverse international

settings.

In conclusion, high-quality standards in international

accounting are vital for fostering trust, facilitating global

economic activities, and ensuring the efficient allocation of

resources. They play a central role in enabling businesses,

investors, and regulators to make informed decisions that

contribute to economic stability and growth on a global scale.

You might also like

- Acc 414 International AccountingDocument177 pagesAcc 414 International AccountingEmmanuel AbolajiNo ratings yet

- SEC Concept Release: International Accounting Standards: Securities and Exchange CommissionDocument50 pagesSEC Concept Release: International Accounting Standards: Securities and Exchange CommissionSreeramulu Satish KumarNo ratings yet

- ENGLISH International Accounting StandardsDocument11 pagesENGLISH International Accounting StandardsNaz AlyamazNo ratings yet

- International Accounting StandardsDocument70 pagesInternational Accounting Standardsitse okoroNo ratings yet

- ST - Rock's College of Commerce & Science: Project Name OnDocument17 pagesST - Rock's College of Commerce & Science: Project Name OnNevil SuraniNo ratings yet

- Portfolio Aya Azif 18Document6 pagesPortfolio Aya Azif 18Aya AzifNo ratings yet

- JUSTIFDocument2 pagesJUSTIFMAY RODRIGUEZNo ratings yet

- Coursework AssignmentDocument3 pagesCoursework AssignmentMubashar RanaNo ratings yet

- W1 Module 2 The Environment For Financial Accounting and Reporting Part 2Document5 pagesW1 Module 2 The Environment For Financial Accounting and Reporting Part 2leare ruazaNo ratings yet

- CFAS MODULE and Ass PDFDocument86 pagesCFAS MODULE and Ass PDFhellokittysaranghaeNo ratings yet

- Cfas Module and AssDocument86 pagesCfas Module and AsshellokittysaranghaeNo ratings yet

- Kelompok 4 BI (Tampil) - Ch19 Ch20Document37 pagesKelompok 4 BI (Tampil) - Ch19 Ch20iyudNo ratings yet

- Module 1 - Development of Financial Reporting Framework and Standard-Setting BodiesDocument8 pagesModule 1 - Development of Financial Reporting Framework and Standard-Setting BodiesAndrealyn DitanNo ratings yet

- Module 1 - Development of Financial Reporting Framework and Standard Setting Body PDFDocument6 pagesModule 1 - Development of Financial Reporting Framework and Standard Setting Body PDFAubrey CatalanNo ratings yet

- CFAS MODULE and AssDocument87 pagesCFAS MODULE and AsshellokittysaranghaeNo ratings yet

- CFAS MODULE and AssDocument87 pagesCFAS MODULE and AsshellokittysaranghaeNo ratings yet

- Harmonization of Accounting StandardsDocument5 pagesHarmonization of Accounting StandardsEse UmoekaNo ratings yet

- Accounting Profession in BangladeshDocument21 pagesAccounting Profession in BangladeshWahidNo ratings yet

- Accounts For Managers Assignment: Amity International Business SchoolDocument5 pagesAccounts For Managers Assignment: Amity International Business SchoolAchin AgarwalNo ratings yet

- Cfas Material 1Document22 pagesCfas Material 1Maybeline BonifacioNo ratings yet

- Ias GabDocument3 pagesIas Gabjudith gabuleNo ratings yet

- Seminar AuditDocument7 pagesSeminar AuditMichael BusuiocNo ratings yet

- International Financial Reporting StandardsDocument5 pagesInternational Financial Reporting StandardsStephanie Jean Magbanua CortezNo ratings yet

- 3Document3 pages3mariengg446No ratings yet

- IVSC Global Regulatory Convergence and The Valuation Profession May 2014Document6 pagesIVSC Global Regulatory Convergence and The Valuation Profession May 2014Vishwajeet UjhoodhaNo ratings yet

- Introduction IADocument26 pagesIntroduction IAMohamed AbdiNo ratings yet

- Acfm Ch-Two 2022Document46 pagesAcfm Ch-Two 2022mihiretche0No ratings yet

- Cfas 1Document10 pagesCfas 1Bea charmillecapiliNo ratings yet

- Accounts NotesDocument15 pagesAccounts NotessharadkulloliNo ratings yet

- Cfas Material 1 PDFDocument6 pagesCfas Material 1 PDFErmelyn GayoNo ratings yet

- Unit ThreeDocument5 pagesUnit ThreeTIZITAW MASRESHA100% (1)

- FinAnal ReportDocument10 pagesFinAnal Reportreymartdiuyan305No ratings yet

- Amity Law School Analysis and Financial Reporting Analysis Reporting of Financial Statements (International)Document11 pagesAmity Law School Analysis and Financial Reporting Analysis Reporting of Financial Statements (International)namrataNo ratings yet

- Introduction of IFRS-Issues and ChallengesDocument12 pagesIntroduction of IFRS-Issues and ChallengesAbhisshek GautamNo ratings yet

- International Financial AnalysisDocument36 pagesInternational Financial AnalysisPriyaGnaeswaran100% (1)

- BUS 1.3 - Financial Awareness - Q1Document8 pagesBUS 1.3 - Financial Awareness - Q1ruzaiqNo ratings yet

- Financial Accounting and Reporting 02Document6 pagesFinancial Accounting and Reporting 02Nuah SilvestreNo ratings yet

- Financial Accounting and Reporting 02Document6 pagesFinancial Accounting and Reporting 02Nuah SilvestreNo ratings yet

- Accounting Standard of BangladeshDocument9 pagesAccounting Standard of BangladeshZahidnsuNo ratings yet

- Paris Graduate School of Management Accounting2 (AC206) AssignmentDocument9 pagesParis Graduate School of Management Accounting2 (AC206) AssignmentAyanleke Julius OluwaseunfunmiNo ratings yet

- Course Title - Financial Accounting - 1Document19 pagesCourse Title - Financial Accounting - 1IK storeNo ratings yet

- Rationale For The Use of International Accounting StandardsDocument8 pagesRationale For The Use of International Accounting StandardsCarmel ThereseNo ratings yet

- Chapter 1 - Financial ReportingDocument7 pagesChapter 1 - Financial ReportingrtohattonNo ratings yet

- Accounting QuizDocument14 pagesAccounting QuizMarthen YoparyNo ratings yet

- Analyze An Area of International AuditingDocument7 pagesAnalyze An Area of International AuditingMunaNo ratings yet

- 3Document3 pages3mariengg446No ratings yet

- Benefits of Global Accounting StandardsDocument2 pagesBenefits of Global Accounting StandardsJones EdombingoNo ratings yet

- Jinky SanturiasDocument33 pagesJinky SanturiasLyceljine C. TañedoNo ratings yet

- Unit 1 Introduction To Indian Accounting Standard Accounting StandardDocument44 pagesUnit 1 Introduction To Indian Accounting Standard Accounting Standardbu butccmNo ratings yet

- Mastering Bookkeeping: Unveiling the Key to Financial SuccessFrom EverandMastering Bookkeeping: Unveiling the Key to Financial SuccessNo ratings yet

- DLOs FINANCIAL REPORTING STANDARDSDocument4 pagesDLOs FINANCIAL REPORTING STANDARDSAira Malinab100% (1)

- Scope of International AccountingDocument22 pagesScope of International AccountingMr. Rain Man100% (2)

- International Standard of Accounting:: Submitted by Submitted To Smester Assignment Reg No CollegeDocument11 pagesInternational Standard of Accounting:: Submitted by Submitted To Smester Assignment Reg No CollegeHassam HussainNo ratings yet

- Assignment: Principles of AccountingDocument11 pagesAssignment: Principles of Accountingmudassar saeedNo ratings yet

- Unit 8 International Financial Management: StructureDocument19 pagesUnit 8 International Financial Management: StructurerajatNo ratings yet

- International Accounting IssuesDocument29 pagesInternational Accounting IssuesHetal GadhviNo ratings yet

- Paris Graduate School of Management Accounting2 (AC206) AssignmentDocument8 pagesParis Graduate School of Management Accounting2 (AC206) AssignmentAyanleke Julius OluwaseunfunmiNo ratings yet

- Id 17301119Document88 pagesId 17301119Nilima RashidNo ratings yet

- Accounting For ManagersDocument235 pagesAccounting For Managerssajaggrover100% (2)

- 04 Subjective / Subjektif 2: Format Latihan: Subjektif. Tiada Sistem Pemarkahan, Contoh Jawapan DiberikanDocument16 pages04 Subjective / Subjektif 2: Format Latihan: Subjektif. Tiada Sistem Pemarkahan, Contoh Jawapan Diberikanforyourhonour wongNo ratings yet

- Earnest Money AgreementDocument2 pagesEarnest Money AgreementAtty. Jefferson B. YapNo ratings yet

- Mod 1 - TVM - Intuition Discounting - Problem Set 1Document15 pagesMod 1 - TVM - Intuition Discounting - Problem Set 1Natarajan Rajasekaran0% (1)

- General Terms and ConditionsDocument8 pagesGeneral Terms and ConditionsSudhanshu JainNo ratings yet

- 6 Disposal of Fixed AssetsDocument6 pages6 Disposal of Fixed Assetsశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Bank For International SettlementsDocument8 pagesBank For International SettlementsJózsef SoltészNo ratings yet

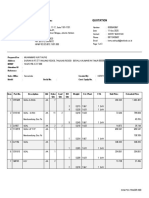

- PT Trakindo Utama: QuotationDocument3 pagesPT Trakindo Utama: QuotationANISNo ratings yet

- Nike FInancial ResourceDocument2 pagesNike FInancial ResourceهانيNo ratings yet

- DCF ModelDocument7 pagesDCF ModelSai Dinesh BilleNo ratings yet

- Private Equity Model Template For InvestorsDocument12 pagesPrivate Equity Model Template For InvestorsousmaneNo ratings yet

- M1A Version 4.6 Nov 2020Document190 pagesM1A Version 4.6 Nov 2020shaun loiNo ratings yet

- Debt InstrumentsDocument5 pagesDebt InstrumentsŚáńtőśh MőkáśhíNo ratings yet

- Ethics CaseDocument38 pagesEthics Casemeochip21No ratings yet

- VN Cuts From DollarDocument4 pagesVN Cuts From DollarThanh NguyenNo ratings yet

- Econ 231, Chapter 15: GDP and National IncomeDocument8 pagesEcon 231, Chapter 15: GDP and National IncomeTienNo ratings yet

- Conceptual Map of The Mexican Financial SystemDocument2 pagesConceptual Map of The Mexican Financial SystemJuan BautistaNo ratings yet

- Financialization of HousingDocument2 pagesFinancialization of HousingKara Sen100% (1)

- Finance AssignmentDocument2 pagesFinance AssignmentYEOH SENG WEI NICKLAUSNo ratings yet

- Fax To: Email To: 415-449-3446: Customer Statement of Disputed TransactionDocument2 pagesFax To: Email To: 415-449-3446: Customer Statement of Disputed TransactionbugzyNo ratings yet

- Topic 6Document82 pagesTopic 6Narcisse ChanNo ratings yet

- Final Intermediate 1 2015 2016Document10 pagesFinal Intermediate 1 2015 2016ZeeNo ratings yet

- Project Report On Reliance MoneyDocument70 pagesProject Report On Reliance Moneysubhash_92No ratings yet

- Business Mathematics: Quarter 1 - Module 9: Solving Problems On Simple InterestDocument25 pagesBusiness Mathematics: Quarter 1 - Module 9: Solving Problems On Simple InterestFrancis GullasNo ratings yet

- Kumpulan Kuis Akuntansi 1-15 Dan ScribdDocument18 pagesKumpulan Kuis Akuntansi 1-15 Dan ScribdRizki PurbaNo ratings yet

- Assignment 1 of Macroeconomics: Chapter 10: Measuring A Nation's IncomeDocument8 pagesAssignment 1 of Macroeconomics: Chapter 10: Measuring A Nation's IncomeLeo ChristNo ratings yet

- One Track Minds. The Surprising Psychology of The InternetDocument292 pagesOne Track Minds. The Surprising Psychology of The InternetArt Marr100% (2)

- Mrunal Handout 4 CSP20Document50 pagesMrunal Handout 4 CSP20Margesh PatelNo ratings yet

- Merchant Banking Is A Combination of Banking and Consultancy ServicesDocument3 pagesMerchant Banking Is A Combination of Banking and Consultancy ServicessynayakNo ratings yet

- The Best Trading Time For Each Pair of CurrenciesDocument18 pagesThe Best Trading Time For Each Pair of CurrenciesGenc GashiNo ratings yet

- 4052 Xls Eng Prof BLAINE KITCHENWAREDocument11 pages4052 Xls Eng Prof BLAINE KITCHENWAREMafernanda GR67% (6)