Professional Documents

Culture Documents

FAQs On CEPA - 2

FAQs On CEPA - 2

Uploaded by

nikesh6171Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FAQs On CEPA - 2

FAQs On CEPA - 2

Uploaded by

nikesh6171Copyright:

Available Formats

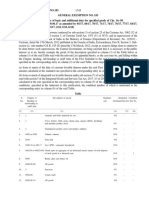

Under the Agreement the UAE will eliminate tariffs on 97% of the tariff

lines (total tariff lines -7581) accounting for 99% of the Indian exports to the

UAE in value terms, which includes immediate elimination of tariff on 80.3%

lines. Further, 1089 products (14.4% of tariff lines) and 180 products (2.4% of

tariff lines) are in Phased Elimination, where the basic customs duty would be

brought to zero in a phased manner of 5 years and 10 years respectively by the

UAE from the date of entry into force of CEPA. Also, 35 products (0.5 %) are

in Phased reduction list where the UAE is offering India up to 50% tariff

reduction. The UAE have kept only 187 products constituting 2.4% of the total

lines in the exclusion list.

There are 11908 tariff lines of India comprising equivalent number of

products. 7694 products (64.61%) have been identified in the Immediate

Elimination list; imports from the UAE on these would become duty free

immediately upon entry into force of the CEPA. 2176 products (18.27%) and

225 products (1.89%) are in Phased Elimination, where the basic customs duty

would be brought to zero in a phased manner of 5/7 years and 10 years

respectively from the date of entry into force of CEPA. 656 products (5.51%)

are in Phased reduction list where the UAE has been given up to 50% tariff

reduction with or without a tariff-rate quota (TRQ). Considering domestic

sensitivities, remaining 1157 products (9.72%) have been kept in exclusion list.

Question 5: What are the important categories of products in the exclusion

list of the India-UAE CEPA?

Answer: Considering domestic sensitivities, 1157 products (9.72%) have been

kept in exclusion list. A large quantum of products in the following categories

have been kept in the exclusion category-

i. Jewellery (except for 2.5 tons Quota for gold jewellery)

ii. Dairy products

iii. Fruits, vegetables, and nuts

iv. Cereals

v. Tea, Coffee, spices

vi. Sugar

vii. Food preparations (instant coffee/ tea, sharbat, betel nut, pan masala,

sugar syrup etc)

viii. Tobacco products

ix. Petroleum waxes and coke

3

You might also like

- Chapter 3: India's Trade PoliciesDocument9 pagesChapter 3: India's Trade PoliciesSona ParthiNo ratings yet

- Chapter-Vi Impact of Wto On Indian Agriculture Implication of Wto Agreement On Agriculture For IndiaDocument26 pagesChapter-Vi Impact of Wto On Indian Agriculture Implication of Wto Agreement On Agriculture For IndiaChandanNo ratings yet

- Central Excise DutyDocument3 pagesCentral Excise DutyRanvijay Kumar BhartiNo ratings yet

- Foreign Trade PolicyDocument32 pagesForeign Trade PolicyRitushukla0% (1)

- Exim Policy IndiaDocument6 pagesExim Policy Indiaamitkumar9001No ratings yet

- Draft Comprehensive ITC (HS) Export Policy 2019 PDFDocument958 pagesDraft Comprehensive ITC (HS) Export Policy 2019 PDFAnonymous M48MXarNo ratings yet

- A) International Trade Statistics of Bangladesh B) Picture of World TradeDocument15 pagesA) International Trade Statistics of Bangladesh B) Picture of World TradedadajadabNo ratings yet

- Hs Final 2017Document506 pagesHs Final 2017samerkalmoniNo ratings yet

- Ghana Customs HS CodeDocument737 pagesGhana Customs HS CodeKWAKU HACKMAN50% (2)

- So What Is The Exim Policy All About?: Whom Does It Apply To?Document6 pagesSo What Is The Exim Policy All About?: Whom Does It Apply To?Ankit RavalNo ratings yet

- Update On India Uae Cepa - ELP LawDocument8 pagesUpdate On India Uae Cepa - ELP LawELP LawNo ratings yet

- Impact of TPPA On Agrofood Sector - UPM@29march16Document25 pagesImpact of TPPA On Agrofood Sector - UPM@29march16ikhwanstorageNo ratings yet

- Qatar Food and Agricultural Import Regulations and StandardsDocument24 pagesQatar Food and Agricultural Import Regulations and StandardssazaliNo ratings yet

- Duty Free Tariff Preference Scheme PDFDocument53 pagesDuty Free Tariff Preference Scheme PDFVikram GuptaNo ratings yet

- Duty Free Tariff Preference (Dftpi-Ldc) Scheme Announced by India For Least Developed Countries (LdcsDocument53 pagesDuty Free Tariff Preference (Dftpi-Ldc) Scheme Announced by India For Least Developed Countries (LdcsMoges TolchaNo ratings yet

- Afta CeptDocument23 pagesAfta CeptjaputcuteNo ratings yet

- Export Process of Sugar: Jagannath International Management School, KalkajiDocument11 pagesExport Process of Sugar: Jagannath International Management School, KalkajiAmit PrakashNo ratings yet

- Foreign Trade Policy March 2012Document26 pagesForeign Trade Policy March 2012Anas TalibNo ratings yet

- Parle Quality System and HR TechniquesDocument82 pagesParle Quality System and HR TechniquesKhushboo SharmaNo ratings yet

- GSP SchemeDocument3 pagesGSP SchemeRamasamikannan RamasamikannanNo ratings yet

- Agriculture Law: RS22541Document6 pagesAgriculture Law: RS22541AgricultureCaseLawNo ratings yet

- EXIM PolicyDocument54 pagesEXIM PolicymaanirathodNo ratings yet

- EXIM PolicyDocument65 pagesEXIM PolicyJasleen DuttaNo ratings yet

- Maldives Export and Import Act Act No. 31 of 1979Document19 pagesMaldives Export and Import Act Act No. 31 of 1979LafzuNo ratings yet

- Food Processing - Indian Regulatory & Policy Environment: Problem Areas and Anomalies in The Tax StructureDocument3 pagesFood Processing - Indian Regulatory & Policy Environment: Problem Areas and Anomalies in The Tax StructurehiteshbambhaniyaNo ratings yet

- Direct TaxDocument13 pagesDirect TaxRajveer Singh SekhonNo ratings yet

- ITC (HS), 2012 Schedule 1 - Import PolicyDocument10 pagesITC (HS), 2012 Schedule 1 - Import Policystudent1291No ratings yet

- Financial (Supplementary) BILL 2021: Mini Budget 2022Document6 pagesFinancial (Supplementary) BILL 2021: Mini Budget 2022Ghayoor ZafarNo ratings yet

- Uganda Incentive Regime 2006-07Document20 pagesUganda Incentive Regime 2006-07Katamba JosephNo ratings yet

- Comprehensive Manual On 4ad RefundsDocument50 pagesComprehensive Manual On 4ad RefundshaamaNo ratings yet

- CustomsDocument9 pagesCustomsVarsha ThampiNo ratings yet

- Border TaxationDocument6 pagesBorder TaxationShariful Islam JoyNo ratings yet

- Nigeria Import TariffDocument8 pagesNigeria Import TariffJoao Paulo BicalhoNo ratings yet

- Guidebook Food Vegetables Fruits Processed ProductsDocument40 pagesGuidebook Food Vegetables Fruits Processed ProductsJavier Cerda100% (1)

- Incentives To ExportDocument5 pagesIncentives To ExportAmol NewaseNo ratings yet

- Food Laws and RegulationsDocument8 pagesFood Laws and RegulationsGajendra Singh RaghavNo ratings yet

- Scheme 1Document19 pagesScheme 1Jayesh ValwarNo ratings yet

- HSN Codes PDFDocument35 pagesHSN Codes PDFSundeep RajNo ratings yet

- Import Procedure For India: Principal Law & Import Policy Principal LawDocument4 pagesImport Procedure For India: Principal Law & Import Policy Principal LawbharaniapnNo ratings yet

- Iii. Trade Policies and Practices by Measure (1) M D A I (I) Customs ProceduresDocument31 pagesIii. Trade Policies and Practices by Measure (1) M D A I (I) Customs ProceduresTri Putra Agro HarmonisNo ratings yet

- International Business EnvironmentDocument13 pagesInternational Business EnvironmentSaif RahmanNo ratings yet

- Questions and AnswerDocument12 pagesQuestions and AnswerANGIELA GANDOLANo ratings yet

- Unit 2 Export Promotion ImmDocument4 pagesUnit 2 Export Promotion ImmDeepika RanaNo ratings yet

- Budget 2009Document7 pagesBudget 2009JayNo ratings yet

- Customs Duty Calculation FormulaDocument4 pagesCustoms Duty Calculation Formulabibhas1No ratings yet

- GST - Introduction To GST & Concept of SupplyDocument40 pagesGST - Introduction To GST & Concept of Supplydeepak singhalNo ratings yet

- Press Release 45 GSTC 210917 212016Document8 pagesPress Release 45 GSTC 210917 212016RepublicNo ratings yet

- Export Promotion SchemesDocument45 pagesExport Promotion Schemesasifanis100% (1)

- G.E. 183 PDFDocument118 pagesG.E. 183 PDFchandramohanNo ratings yet

- The Solvent Extractors Association of IndiaDocument8 pagesThe Solvent Extractors Association of IndiaVijay BaghrechaNo ratings yet

- Export-Policy-2006-09 - English PDFDocument35 pagesExport-Policy-2006-09 - English PDFmusharat_shafiqueNo ratings yet

- Import Policy in India: Sunil K. MishraDocument15 pagesImport Policy in India: Sunil K. MishraMridulPrateekSinghNo ratings yet

- 2018 - UAE Import Regulations FoodDocument8 pages2018 - UAE Import Regulations Foodmaf fandigNo ratings yet

- An Import Is Any Good or Service Brought Into One Country From Another Country in A Legitimate FashionDocument21 pagesAn Import Is Any Good or Service Brought Into One Country From Another Country in A Legitimate FashionsolankikavitaNo ratings yet

- Food and Agricultural Import Regulations and Standards - Narrative - Bangkok - Thailand - 8!14!2009Document33 pagesFood and Agricultural Import Regulations and Standards - Narrative - Bangkok - Thailand - 8!14!2009Putra WuNo ratings yet

- 2 - CPTPP Viet Nam's Commitments in Some Key Areas - ENDocument25 pages2 - CPTPP Viet Nam's Commitments in Some Key Areas - ENMTCB BlogNo ratings yet

- Effect of WTOGATT On Indian SSIDocument1 pageEffect of WTOGATT On Indian SSIJeyarajasekar Ttr100% (2)

- Milk and Milk Products Order, 1992Document3 pagesMilk and Milk Products Order, 1992ermukulchaudharycsNo ratings yet

- Potential Exports and Nontariff Barriers to Trade: Sri Lanka National StudyFrom EverandPotential Exports and Nontariff Barriers to Trade: Sri Lanka National StudyNo ratings yet

- PP-Selection-Guide EL 03Document1 pagePP-Selection-Guide EL 03nikesh6171No ratings yet

- PP-Selection-Guide EL 01Document1 pagePP-Selection-Guide EL 01nikesh6171No ratings yet

- PP-Selection-Guide EL 05Document1 pagePP-Selection-Guide EL 05nikesh6171No ratings yet

- FAQs On CEPA - 1Document1 pageFAQs On CEPA - 1nikesh6171No ratings yet

- FAQs On CEPA - 1Document1 pageFAQs On CEPA - 1nikesh6171No ratings yet