Professional Documents

Culture Documents

Investing Analysis

Uploaded by

agrawal.ishan20Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investing Analysis

Uploaded by

agrawal.ishan20Copyright:

Available Formats

Mid term project report

Hilary’s financial goals

To craft a compelling pitch for Hilary, our team at WGAM will tailor the investment strategy to align

with her specific financial goals. We will emphasize a personalized approach, showcasing how our

understanding of her unique circumstances, aspirations, and risk tolerance will drive our investment

decisions. Highlighting the dual objectives of long-term growth and shorter-term profitability, our

strategy will demonstrate versatility to accommodate her evolving needs.

We'll emphasize transparency, providing a clear rationale for each stock and ETF selection, backed by

thorough industry and company analyses. Our pitch will underscore a commitment to diligent

research and continuous monitoring, ensuring adaptability to market dynamics. The introduction of

the new ETF requirement will be presented as an innovative element enhancing diversification and

risk management in her portfolio.

Moreover, recognizing the importance of her existing retirement plan, our team will explicitly

delineate how our strategy complements and enhances her overall financial landscape. We aim to

set ourselves apart by not just managing investments but by becoming strategic partners in her

financial journey.

Through a dynamic and engaging pitch, we will convey not only the expertise of WGAM's analyst

teams but also our dedication to providing a tailored, client-centric investment solution that goes

beyond the conventional approach.

Your team’s current investment strategy

Our current team strategy would revolve around a thorough and personalized approach to meet

Hilary's financial goals. Here are key components of our strategy:

1. Client-Centric Approach: Prioritize understanding Hilary's unique circumstances, aspirations, and

risk tolerance. -Tailoring our investment strategy to align with her specific financial objectives,

emphasizing on client-first mentality.

2. Diversified Portfolio Construction: we are conducting in-depth industry and company analyses to

inform stock and ETF selection. we will Integrate the new ETF requirement creatively to enhance

diversification and risk management.

3. Long-Term and Short-Term Profitability: we are Developing a balanced strategy that addresses

both long-term growth and shorter-term profitability, aligning with Hilary's dual objectives.

4. Transparency and Communication: we would Clearly communicate our rationale behind each

investment decision in a transparent manner. Emphasize ongoing communication and reporting to

keep Hilary informed about our portfolio's performance and any necessary adjustments.

5. Risk Management: Implement risk management measures and guidelines, considering both

short-term and long-term factors. Highlighting our team's ability to adapt the strategy based on

market dynamics, ensuring a proactive and vigilant approach.

6. Integration with Existing Retirement Plan: Explicitly demonstrate how the proposed strategy

complements and enhances Hilary's existing retirement investment plan. Showcasing the synergy

between the two plans, positioning WGAM as a holistic financial partner.

7. Innovation and Adaptability: Embrace our innovative aspect of the new ETF requirement,

showcasing adaptability to industry changes. Position our team as forward-thinking, leveraging the

Wharton Investment Simulator to gain valuable market experience.

By combining these elements, our team would create a comprehensive strategy that not only meets

Hilary's financial goals but also sets WGAM apart in a competitive landscape.

You might also like

- Strategic Funds Portfolio For 2025 (2020 Edition) June2020 PDFDocument40 pagesStrategic Funds Portfolio For 2025 (2020 Edition) June2020 PDFKOUSHIKNo ratings yet

- Project Report On Portfolio ConstructionDocument37 pagesProject Report On Portfolio ConstructionMazhar Zaman67% (3)

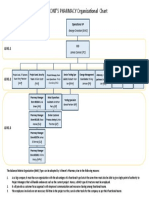

- Wilmont's Pharmacy Organizational ChartDocument1 pageWilmont's Pharmacy Organizational ChartPeter Je Dilao100% (1)

- CHP 1Document10 pagesCHP 1Avinash DoshiNo ratings yet

- Fin Management - p2Document37 pagesFin Management - p2Ma. Elene MagdaraogNo ratings yet

- Financial Policy and Corporate StrategyDocument10 pagesFinancial Policy and Corporate StrategyPravesh PangeniNo ratings yet

- An Introduction To Hedge Funds: Pictet Alternative InvestmentsDocument16 pagesAn Introduction To Hedge Funds: Pictet Alternative InvestmentsGauravMunjalNo ratings yet

- Financial Policy and Corporate Strategy: 1. Strategic Financial Decision Making Frame WorkDocument9 pagesFinancial Policy and Corporate Strategy: 1. Strategic Financial Decision Making Frame WorksumanthNo ratings yet

- PIMCO EqS Pathfinder Fund Overview PO6015Document4 pagesPIMCO EqS Pathfinder Fund Overview PO6015tennismonkeyNo ratings yet

- JohnhinvestmentsDocument2 pagesJohnhinvestmentsapi-247644767No ratings yet

- Financial Policy and Corporate Strategy: Learning OutcomesDocument10 pagesFinancial Policy and Corporate Strategy: Learning Outcomesमोहित शर्माNo ratings yet

- Investment Policy StatementDocument3 pagesInvestment Policy StatementIbtasam jamilNo ratings yet

- Meteor Training PresentationDocument32 pagesMeteor Training Presentationsisko1104No ratings yet

- Understanding Strategy-7Document51 pagesUnderstanding Strategy-7madhuragarwalNo ratings yet

- Nbs Lyt Pug XKR 1703006546420Document2 pagesNbs Lyt Pug XKR 1703006546420aditiNo ratings yet

- SFM PDFDocument328 pagesSFM PDFZainNo ratings yet

- Financial PolicyDocument12 pagesFinancial PolicyRoshini ChinnappaNo ratings yet

- Quant Case StudyDocument2 pagesQuant Case StudySaakshi ChoudharyNo ratings yet

- Financial Policy and Corporate Strategy: Learning OutcomesDocument831 pagesFinancial Policy and Corporate Strategy: Learning OutcomesARUNENDRA SINGHNo ratings yet

- Corporate Profile: Our IdentityDocument6 pagesCorporate Profile: Our IdentityMandu GangadharNo ratings yet

- Seminar On Hedge FundsDocument35 pagesSeminar On Hedge FundsManishNo ratings yet

- Advantages and Pitfalls of Raising Private EquityDocument3 pagesAdvantages and Pitfalls of Raising Private EquitymanishkbaidNo ratings yet

- Mutual FundsDocument77 pagesMutual FundsHarjas KaurNo ratings yet

- Hedge Fund StrategiesDocument2 pagesHedge Fund StrategiesPradnya Kulal0% (1)

- TOPIC I - IntroductionDocument10 pagesTOPIC I - IntroductionJeffrey RiveraNo ratings yet

- Evaluating Portfolio and Making Investment DecisionsDocument19 pagesEvaluating Portfolio and Making Investment DecisionsIshan FactsNo ratings yet

- H.I.G. Advantage Fund Sep19Document56 pagesH.I.G. Advantage Fund Sep19waichew92No ratings yet

- FAQ - CR Value FundDocument4 pagesFAQ - CR Value FundArun KumarNo ratings yet

- Project: Investment ManagementDocument13 pagesProject: Investment ManagementdivvyankguptaNo ratings yet

- Various Strategies Used by Hedge Funds 1714027781Document14 pagesVarious Strategies Used by Hedge Funds 1714027781Hang HoangNo ratings yet

- Asset Management GuideDocument13 pagesAsset Management GuideEisan HashmiNo ratings yet

- SFM Text BookDocument299 pagesSFM Text BookGopika CA100% (1)

- SFM NotesDocument11 pagesSFM NotesHanuma GonellaNo ratings yet

- Who We Are: David Elliot Shaw (Born March 29, 1951)Document6 pagesWho We Are: David Elliot Shaw (Born March 29, 1951)Mahesh GoswamiNo ratings yet

- 301 What Is Business PolicyDocument18 pages301 What Is Business Policymba HHMNo ratings yet

- Portfolio Mangemnt Services Draft 28-7-14Document14 pagesPortfolio Mangemnt Services Draft 28-7-14Yash GaonkarNo ratings yet

- Yasir Bhai ProjectDocument71 pagesYasir Bhai ProjectFaizan Sir's TutorialsNo ratings yet

- Team 3 Funding and Income Sources Invesment StrategiesDocument12 pagesTeam 3 Funding and Income Sources Invesment Strategiesocampojohnoliver1901182No ratings yet

- Stanley Funds ResearchDocument115 pagesStanley Funds ResearchWaleed TariqNo ratings yet

- Long-Term Stock Investing Plan TemplateDocument2 pagesLong-Term Stock Investing Plan TemplateMixo HlaiseNo ratings yet

- CA Final SFM Compiler Ver 6.0Document452 pagesCA Final SFM Compiler Ver 6.0Accounts Primesoft100% (1)

- Sa 2113062 Vanguard Investment Principles EngDocument41 pagesSa 2113062 Vanguard Investment Principles EnganyirobleszapataNo ratings yet

- Salient Features of Corporate Level StrategyDocument4 pagesSalient Features of Corporate Level Strategyvarun rajNo ratings yet

- 1 - Nature and Scope of Strategic Financial ManagementDocument26 pages1 - Nature and Scope of Strategic Financial ManagementAiko GuintoNo ratings yet

- Business Policy and Strategic Unit 3Document4 pagesBusiness Policy and Strategic Unit 3maneesh110093No ratings yet

- Unleashing The Power of InvestmentDocument2 pagesUnleashing The Power of InvestmentMoataz abd el fattahNo ratings yet

- SAPM by Syam Kerala University s3 MbaDocument88 pagesSAPM by Syam Kerala University s3 Mbasyam kumar sNo ratings yet

- SFM Theory With SolutionsDocument64 pagesSFM Theory With SolutionsNisen ShresthaNo ratings yet

- Managing A Stock Portfolio A Worldwide Issue Chapter 11Document20 pagesManaging A Stock Portfolio A Worldwide Issue Chapter 11HafizUmarArshadNo ratings yet

- 02.2014PortfolioSpotlight DiversifyingStrategiesDocument7 pages02.2014PortfolioSpotlight DiversifyingStrategiesgiani_2008No ratings yet

- Id 49 BMDocument13 pagesId 49 BMMd Majedul HaqueNo ratings yet

- Our Mission & Six Step Investment ProcessDocument2 pagesOur Mission & Six Step Investment ProcessKiran S RaoNo ratings yet

- Product Guide-Portfolio Funds-ENDocument18 pagesProduct Guide-Portfolio Funds-ENJuasadf IesafNo ratings yet

- UNIT - I - Financial PlanningDocument5 pagesUNIT - I - Financial PlanningUnmesh SKNo ratings yet

- DW-Gann Timetable + Stock PlanDocument3 pagesDW-Gann Timetable + Stock PlanMixo HlaiseNo ratings yet

- Portfolio Investment ProcessDocument6 pagesPortfolio Investment ProcessmayurroyalssNo ratings yet

- Production Strategy: TypesDocument4 pagesProduction Strategy: TypesthakuranitaNo ratings yet

- Nvestment Nvironment: 1.1. Introduction To InvestmentDocument12 pagesNvestment Nvironment: 1.1. Introduction To InvestmentAzizul AviNo ratings yet

- Advanced Financial Managment FinalDocument9 pagesAdvanced Financial Managment FinalMohit BNo ratings yet

- Group 7Document24 pagesGroup 7Abby ParNo ratings yet

- Audit EvidenceDocument5 pagesAudit EvidenceMay RamosNo ratings yet

- Mba Wto NotesDocument7 pagesMba Wto NotesAbhishek SinghNo ratings yet

- Corporate ListDocument22 pagesCorporate Listsumeet sourabhNo ratings yet

- SHR PDFDocument3 pagesSHR PDFAditya EnterprisesNo ratings yet

- CEMDocument9 pagesCEMChristineNo ratings yet

- Brand Extension Vs Line ExtensionDocument2 pagesBrand Extension Vs Line ExtensionJubayer AhmedNo ratings yet

- Economic Impact of TourismDocument22 pagesEconomic Impact of TourismBalachandar PoopathiNo ratings yet

- Glaxo Smith Kline (GSK) PLC PESTEL and Environment AnalysisDocument16 pagesGlaxo Smith Kline (GSK) PLC PESTEL and Environment Analysisvipul tutejaNo ratings yet

- Financial Projection of Surgecial EquipmentsDocument97 pagesFinancial Projection of Surgecial EquipmentsSudhakaar ShakyaNo ratings yet

- 1 - Kagiso Mmusi Uif - 20230711 - 0001Document8 pages1 - Kagiso Mmusi Uif - 20230711 - 0001Kagiso Kagi MmusiNo ratings yet

- Sales and Distribution Strategies of ZaraDocument3 pagesSales and Distribution Strategies of Zarasurabhimandhani100% (1)

- HSEQ Goals and Targets: OMV-EP GuidelineDocument7 pagesHSEQ Goals and Targets: OMV-EP GuidelineMoaatazz Nouisri100% (1)

- Chapter 7 Audit of The Purchases and Payment CycleDocument34 pagesChapter 7 Audit of The Purchases and Payment CycleRishika RapoleNo ratings yet

- Chapter 7 - Dynamics of Financial Crises in Emerging Economies and ApplicationsDocument49 pagesChapter 7 - Dynamics of Financial Crises in Emerging Economies and ApplicationsJane KotaishNo ratings yet

- Cost Accounting ExercisesDocument3 pagesCost Accounting ExercisesilovesweetangelNo ratings yet

- Reliance MoneyDocument53 pagesReliance MoneyAmith B IngalahalliNo ratings yet

- STM Assignment Workbook - V1.2Document22 pagesSTM Assignment Workbook - V1.2Abhijeet DashNo ratings yet

- Case StudyDocument6 pagesCase Studydavidkecelyn06No ratings yet

- Consumer Behaviour With Product (Ready-To-Eat Product)Document73 pagesConsumer Behaviour With Product (Ready-To-Eat Product)Apeksha100% (1)

- Andrew Aziz How To Day Trade For A Living AUDIOBOOK FIGSDocument50 pagesAndrew Aziz How To Day Trade For A Living AUDIOBOOK FIGSjrrguitar50% (16)

- PhonePe CreditKartDocument12 pagesPhonePe CreditKartGitanjoli BorahNo ratings yet

- Human Resouces OutsourcingDocument18 pagesHuman Resouces OutsourcingsamrulezzzNo ratings yet

- What Are The Indirect TaxesDocument3 pagesWhat Are The Indirect Taxesatmiya2010No ratings yet

- List of ProjectDocument6 pagesList of ProjectPradeep BiradarNo ratings yet

- Chapter One Why Are Financial Institutions Special? True/FalseDocument15 pagesChapter One Why Are Financial Institutions Special? True/FalseWalaa MohamedNo ratings yet

- Project SEAWEED NAMBUNGDocument3 pagesProject SEAWEED NAMBUNGsafarNo ratings yet

- Public RevenueDocument90 pagesPublic RevenuekhanjiNo ratings yet

- THEORY OF DEMOGRAPHIE Lecture02Document67 pagesTHEORY OF DEMOGRAPHIE Lecture02taik khiderNo ratings yet

- Fundamental Analysis 3rd SemDocument23 pagesFundamental Analysis 3rd SemSagar PatilNo ratings yet