Professional Documents

Culture Documents

2.3.1 Future Values of Annuities

Uploaded by

Anh ThưCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2.3.1 Future Values of Annuities

Uploaded by

Anh ThưCopyright:

Available Formats

Chapter 2: Mathematics of Finance

1 Simple Interest (F)

2 Compound Interest (F)

3 Present Values and Future Values of Annuities (C)

4 Loans and Amortization

Le Ba Khiet, Phd. Faculty of Mathematics & Statistics, TDTU November 4, 2022 1 / 10

2.3.1 Future Values of Annuities

Example 1

Van invests $2, 000 at the end of each year for 10 years (to age 28) in

an account that pays 12% compounded annually. How much money

does Van have at age 28?

→ Van’s contributions form an annuity.

What is an annuity?

An annuity is a financial plan characterized by regular payments. For

example

+ a savings plan: the regular payments are contributions to the account

+ a payment plan (such as for retirement): regular payments are made

from an account, often to an individual.

Le Ba Khiet, Phd. Faculty of Mathematics & Statistics, TDTU November 4, 2022 2 / 10

2.3.1 Future Values of Annuities

Example 1

Van invests $2, 000 at the end of each year for 10 years (to age 28) in

an account that pays 12% compounded annually. How much money

does Van have at age 28?

→ Van’s contributions form an annuity.

What is an annuity?

An annuity is a financial plan characterized by regular payments. For

example

+ a savings plan: the regular payments are contributions to the account

+ a payment plan (such as for retirement): regular payments are made

from an account, often to an individual.

Le Ba Khiet, Phd. Faculty of Mathematics & Statistics, TDTU November 4, 2022 2 / 10

2.3.1 Future Values of Annuities

Future Values of Annuities

The sum of all payments plus all interest earned.

Ordinary Annuities

Characterized by the same payments made at the end of each equal

interval.

Example 2

Suppose you invested $100 at the end of each year for 5 years in an

account that paid interest at 10% compounded annually. How much

money would you have in the account at the end of the 5 years?

Le Ba Khiet, Phd. Faculty of Mathematics & Statistics, TDTU November 4, 2022 3 / 10

2.3.1 Future Values of Annuities

Future Values of Annuities

The sum of all payments plus all interest earned.

Ordinary Annuities

Characterized by the same payments made at the end of each equal

interval.

Example 2

Suppose you invested $100 at the end of each year for 5 years in an

account that paid interest at 10% compounded annually. How much

money would you have in the account at the end of the 5 years?

Le Ba Khiet, Phd. Faculty of Mathematics & Statistics, TDTU November 4, 2022 3 / 10

2.3.1 Future Values of Annuities

Future Values of Annuities

The sum of all payments plus all interest earned.

Ordinary Annuities

Characterized by the same payments made at the end of each equal

interval.

Example 2

Suppose you invested $100 at the end of each year for 5 years in an

account that paid interest at 10% compounded annually. How much

money would you have in the account at the end of the 5 years?

Le Ba Khiet, Phd. Faculty of Mathematics & Statistics, TDTU November 4, 2022 3 / 10

2.3.1 Future Values of Annuities

The future value of the annuity is

S = 100 + 100 × 1.1 + 100 × 1.12 + 100 × 1.13 + 100 × 1.14

= 100(1 + 1.1 + 1.12 + 1.13 + 1.14 )

= R(1 + a + a2 + a3 + a4 )

a5 − 1 (1 + i)5 − 1 (1 + i)5 − 1 (1 + i)n − 1

= R =R =R =R ,

a−1 (1 + i) − 1 i i

where R = 100, a = 1 + i = 1 + 0.1 and n = 5.

Le Ba Khiet, Phd. Faculty of Mathematics & Statistics, TDTU November 4, 2022 4 / 10

2.3.1 Future Values of Annuities

Lemma

We have

an − 1

1 + a + a2 + ... + an−1 = , where a > 1.

a−1

Proof.

Note that

(a − 1)(an−1 + an−2 + ... + a + 1)

= (an + an−1 + ... + a2 + a) − (an−1 + an−2 + ... + a + 1)

= an − 1

and the conclusion follows.

Le Ba Khiet, Phd. Faculty of Mathematics & Statistics, TDTU November 4, 2022 5 / 10

2.3.1 Future Values of Annuities

Lemma

We have

an − 1

1 + a + a2 + ... + an−1 = , where a > 1.

a−1

Proof.

Note that

(a − 1)(an−1 + an−2 + ... + a + 1)

= (an + an−1 + ... + a2 + a) − (an−1 + an−2 + ... + a + 1)

= an − 1

and the conclusion follows.

Le Ba Khiet, Phd. Faculty of Mathematics & Statistics, TDTU November 4, 2022 5 / 10

2.3.1 Future Values of Annuities

How to find the future value?

If a periodic payment R is made for n periods at an interest rate i per

period, the future value of an ordinary annuity is given by

(1 + i)n − 1

S=R .

i

Example 3

Hung invests $1, 000 at the end of each year for 30 years (to age 60) in

an account that pays 12% compounded annually. How much money

does Hung have at age 60?

Le Ba Khiet, Phd. Faculty of Mathematics & Statistics, TDTU November 4, 2022 6 / 10

2.3.1 Future Values of Annuities

How to find the future value?

If a periodic payment R is made for n periods at an interest rate i per

period, the future value of an ordinary annuity is given by

(1 + i)n − 1

S=R .

i

Example 3

Hung invests $1, 000 at the end of each year for 30 years (to age 60) in

an account that pays 12% compounded annually. How much money

does Hung have at age 60?

Le Ba Khiet, Phd. Faculty of Mathematics & Statistics, TDTU November 4, 2022 6 / 10

2.3.1 Future Values of Annuities

Example 4

Thien An invests $1, 000 at the end of each of 8 years in an account

that earns 12% compounded annually.

After the initial 8 years, no additional contributions are made, but the

investment continues to earn 12% compounded annually for 30 more

years (until An is age 60).

How much does An have at age 60?

Le Ba Khiet, Phd. Faculty of Mathematics & Statistics, TDTU November 4, 2022 7 / 10

2.3.1 Future Values of Annuities

Remark

Thien An contributes $8, 000 ($1, 000/year for 8 years) to obtain $

368,497.75 at age 60 while Phi Hung invests $30, 000 ($1, 000/year for

30 years) but only receive $241, 332.68 at age 60.

→ the power of time and compounding.

Example 5 (Time to Reach a Goal)

A small business invests $3000 at the end of each month in an account

that earns 10% compounded monthly. How long will it take until the

business has $180, 000 to buy its own office building?

Le Ba Khiet, Phd. Faculty of Mathematics & Statistics, TDTU November 4, 2022 8 / 10

2.3.1 Future Values of Annuities

Remark

Thien An contributes $8, 000 ($1, 000/year for 8 years) to obtain $

368,497.75 at age 60 while Phi Hung invests $30, 000 ($1, 000/year for

30 years) but only receive $241, 332.68 at age 60.

→ the power of time and compounding.

Example 5 (Time to Reach a Goal)

A small business invests $3000 at the end of each month in an account

that earns 10% compounded monthly. How long will it take until the

business has $180, 000 to buy its own office building?

Le Ba Khiet, Phd. Faculty of Mathematics & Statistics, TDTU November 4, 2022 8 / 10

2.3.1 Future Values of Annuities

Annuities Due

Unlike an ordinary annuity, an annuity due has the periodic payments

made at the beginning of the period.

Thus the future value of an annuity due is

(1 + i)n − 1

Sdue = S(1 + i) = R (1 + i).

i

Le Ba Khiet, Phd. Faculty of Mathematics & Statistics, TDTU November 4, 2022 9 / 10

2.3.1 Future Values of Annuities

Example 6

Find the future value of an investment if $200 is deposited at the

beginning of each month for 7 years and the interest rate is 9.6%

compounded monthly.

Exercises

Page 30: 2.3: 1–3

Le Ba Khiet, Phd. Faculty of Mathematics & Statistics, TDTU November 4, 2022 10 / 10

2.3.1 Future Values of Annuities

Example 6

Find the future value of an investment if $200 is deposited at the

beginning of each month for 7 years and the interest rate is 9.6%

compounded monthly.

Exercises

Page 30: 2.3: 1–3

Le Ba Khiet, Phd. Faculty of Mathematics & Statistics, TDTU November 4, 2022 10 / 10

You might also like

- S&Z 6.5 PDFDocument25 pagesS&Z 6.5 PDFEbasNo ratings yet

- Chapter 5 Simple Interest NewDocument21 pagesChapter 5 Simple Interest NewAlmira BonifacioNo ratings yet

- What Is The Time Value of MoneyDocument6 pagesWhat Is The Time Value of MoneySadia JuiNo ratings yet

- Coumpound Interest and Mean MedianDocument15 pagesCoumpound Interest and Mean MediankvdheerajkumarNo ratings yet

- Module 5Document9 pagesModule 53 stacksNo ratings yet

- HW 1Document3 pagesHW 1Kristina AbuladzeNo ratings yet

- Financial Maths Intro Compound Interest DepreciationDocument33 pagesFinancial Maths Intro Compound Interest DepreciationsanjibmNo ratings yet

- 3353 TVM Lecture 3Document31 pages3353 TVM Lecture 3herueuxNo ratings yet

- Session 5 and 6 - Time Value of MoneyDocument24 pagesSession 5 and 6 - Time Value of MoneyDebi PrasadNo ratings yet

- Tugas Manajemen Keuangan (Maulana Ikhsan Tarigan) 197007091Document5 pagesTugas Manajemen Keuangan (Maulana Ikhsan Tarigan) 197007091Maulana IkhsanNo ratings yet

- Note 06 AllDocument7 pagesNote 06 AllFd AhNo ratings yet

- General Ordinary Annuity ExperimentalDocument6 pagesGeneral Ordinary Annuity Experimentalbobbyforteza92No ratings yet

- Midterm RevisionDocument27 pagesMidterm RevisionTrang CaoNo ratings yet

- 2324EE HW1 G (Group#2)Document5 pages2324EE HW1 G (Group#2)mytinhszNo ratings yet

- General Mathematics 2nd Quarter Module #2Document32 pagesGeneral Mathematics 2nd Quarter Module #2John Lloyd RegalaNo ratings yet

- QF2101 Tut 1 Financial Math ProblemsDocument3 pagesQF2101 Tut 1 Financial Math ProblemsWei Chong KokNo ratings yet

- Time Value of Money Assignment A. GutierrezDocument6 pagesTime Value of Money Assignment A. GutierrezTPA TPANo ratings yet

- ACTL10001 Introduction to Actuarial Studies Problem SetsDocument29 pagesACTL10001 Introduction to Actuarial Studies Problem SetshollowkenshinNo ratings yet

- Grade 11 Math MOd 6Document12 pagesGrade 11 Math MOd 6John Lois VanNo ratings yet

- General Mathematics: Quarter 2 - Module 1 Simple and Compound InterestsDocument21 pagesGeneral Mathematics: Quarter 2 - Module 1 Simple and Compound InterestsThegame1991ususus100% (1)

- MBA II Night - Financial Management - ObjectiveDocument15 pagesMBA II Night - Financial Management - Objectivemukarram123No ratings yet

- Mathematics of Finance FormulasDocument29 pagesMathematics of Finance FormulasTareq IslamNo ratings yet

- Compound Interest: Compounded Mo Re Than Once A Yea RDocument24 pagesCompound Interest: Compounded Mo Re Than Once A Yea RCristine CañeteNo ratings yet

- Sol Ex Rate ExerciceDocument5 pagesSol Ex Rate ExerciceleahbngNo ratings yet

- Financial MathematicsDocument44 pagesFinancial MathematicsJhon Albert RobledoNo ratings yet

- q2 Mod2 InterestmaturityfutureandpresentvaluesinsimpleandcompoundinterestsDocument35 pagesq2 Mod2 InterestmaturityfutureandpresentvaluesinsimpleandcompoundinterestsZerofen RevolutionNo ratings yet

- CH 6 PDFDocument97 pagesCH 6 PDFZe Black EraNo ratings yet

- Activity Set - 1Document5 pagesActivity Set - 1Eunice AmorantoNo ratings yet

- Chapter 3 - Capital BugetingDocument32 pagesChapter 3 - Capital BugetingNguyễn Ngàn NgânNo ratings yet

- Interests and Economic EquivalanceDocument38 pagesInterests and Economic EquivalanceMohammad Hamayoon HemmatNo ratings yet

- Financial Management:: The Time Value of Money-Annuities and Other TopicsDocument77 pagesFinancial Management:: The Time Value of Money-Annuities and Other TopicsBen OusoNo ratings yet

- Application of Differential Calculus in Math of Investment: Polytechnic University of The PhilippinesDocument9 pagesApplication of Differential Calculus in Math of Investment: Polytechnic University of The PhilippinesGeralyn MiralNo ratings yet

- MA170 Chapter 2Document10 pagesMA170 Chapter 2ishanissantaNo ratings yet

- TVM- The Importance of Time Value of MoneyDocument25 pagesTVM- The Importance of Time Value of MoneyamatulmateennoorNo ratings yet

- Time Value of Money - STDocument63 pagesTime Value of Money - STmy hoang100% (1)

- Chap 002Document63 pagesChap 002محمد عقابنةNo ratings yet

- Consumer Mathematics: Gwendolyn TadeoDocument14 pagesConsumer Mathematics: Gwendolyn TadeoproximusNo ratings yet

- Financal MathematicsDocument41 pagesFinancal MathematicsGeorge PauloseNo ratings yet

- Lecture 10 - Introduction To Math of FinanceDocument36 pagesLecture 10 - Introduction To Math of FinancejunainhaqueNo ratings yet

- Compound vs Simple Interest GuideDocument8 pagesCompound vs Simple Interest GuideEldrick CortezNo ratings yet

- ProblemsDocument28 pagesProblemsKevin NguyenNo ratings yet

- Simple and Compound Interest: Concept of Time and Value OfmoneyDocument11 pagesSimple and Compound Interest: Concept of Time and Value OfmoneyUnzila AtiqNo ratings yet

- Grade 11 Lesson Plan on Simple vs Compound InterestDocument3 pagesGrade 11 Lesson Plan on Simple vs Compound InterestJennylyn Rosas100% (1)

- 1.0 Time Value of MoneyDocument54 pages1.0 Time Value of MoneyAbuBakerNo ratings yet

- FINA2303 2018-2019 Fall Quiz SolutionsDocument5 pagesFINA2303 2018-2019 Fall Quiz SolutionsSin TungNo ratings yet

- What Is The Time Value of Money Exercise2Document8 pagesWhat Is The Time Value of Money Exercise2Sadia JuiNo ratings yet

- 2020 Maths Standard 2 HSC TrialDocument58 pages2020 Maths Standard 2 HSC Trialjosiemilla828No ratings yet

- Finance Problems TeacherDocument7 pagesFinance Problems TeachersaraNo ratings yet

- FM I CH IiiDocument8 pagesFM I CH IiiDùķe HPNo ratings yet

- First-Reporter-Compound-Interest .2Document25 pagesFirst-Reporter-Compound-Interest .2Mherie Joy Cantos GutierrezNo ratings yet

- Southeast University Assignment on Time Value of MoneyDocument11 pagesSoutheast University Assignment on Time Value of MoneyNifaz KhanNo ratings yet

- Compoun Interest New - 412310955Document21 pagesCompoun Interest New - 412310955Kathryn Santos50% (2)

- Learning Packet 1 - Math 16 Mathematics of Investment (Student's Copy)Document14 pagesLearning Packet 1 - Math 16 Mathematics of Investment (Student's Copy)Armando Dacuma AndoqueNo ratings yet

- TVM: The Time Value of MoneyDocument42 pagesTVM: The Time Value of MoneyUsman KhanNo ratings yet

- What's More: Quarter 2 - Module 7: Deferred AnnuityDocument4 pagesWhat's More: Quarter 2 - Module 7: Deferred AnnuityChelsea NicoleNo ratings yet

- Financial Mathematics Lecture Notes Fina PDFDocument71 pagesFinancial Mathematics Lecture Notes Fina PDFTram HoNo ratings yet

- Lecture 1Document32 pagesLecture 1Остап ЖолобчукNo ratings yet

- Math Fluency Activities for K–2 Teachers: Fun Classroom Games That Teach Basic Math Facts, Promote Number Sense, and Create Engaging and Meaningful PracticeFrom EverandMath Fluency Activities for K–2 Teachers: Fun Classroom Games That Teach Basic Math Facts, Promote Number Sense, and Create Engaging and Meaningful PracticeRating: 4 out of 5 stars4/5 (1)

- Data Interpretation Guide For All Competitive and Admission ExamsFrom EverandData Interpretation Guide For All Competitive and Admission ExamsRating: 2.5 out of 5 stars2.5/5 (6)

- Bad Debts and Provision For Bad DebtsDocument7 pagesBad Debts and Provision For Bad DebtsSyed Ali HaiderNo ratings yet

- Standard Bank Deposit Payment NoticeDocument1 pageStandard Bank Deposit Payment NoticeJoseph ThuoNo ratings yet

- Banco Scotiabank A 31 Dic2017 UsDocument2 pagesBanco Scotiabank A 31 Dic2017 UsHenry olmos torresNo ratings yet

- LAT321 Assessment 10Document6 pagesLAT321 Assessment 10Jingle TeroNo ratings yet

- Residual Income ValuationDocument6 pagesResidual Income ValuationKumar AbhishekNo ratings yet

- Acts of Sri LankaDocument1 pageActs of Sri LankaChalithaNo ratings yet

- Agreement DoxDocument2 pagesAgreement Doxcrislyn mae tagapia0% (1)

- Agent Network Accelerator Research: Indonesia Country Report SummaryDocument51 pagesAgent Network Accelerator Research: Indonesia Country Report SummaryfandieconomistNo ratings yet

- Chapter 25 Acctg FOR Derivatives & Hedging Transactions Part 2 Afar Part 2 Chapter 25 Acctg FOR Derivatives & Hedging Transactions Part 2 Afar Part 2Document11 pagesChapter 25 Acctg FOR Derivatives & Hedging Transactions Part 2 Afar Part 2 Chapter 25 Acctg FOR Derivatives & Hedging Transactions Part 2 Afar Part 2Jan OleteNo ratings yet

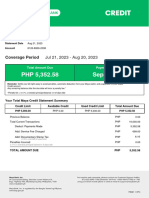

- MayaCredit SoA 2023AUGDocument3 pagesMayaCredit SoA 2023AUGJoMaye RodinasNo ratings yet

- CHP 6 Internal ReconstructionDocument60 pagesCHP 6 Internal ReconstructionRonak ChhabriaNo ratings yet

- Manage Credit Risk & Improve ProfitsDocument11 pagesManage Credit Risk & Improve ProfitsHakdog KaNo ratings yet

- Bdo Loan FormDocument4 pagesBdo Loan FormChristineNo ratings yet

- IncomeDocument4 pagesIncomevanvunNo ratings yet

- Banco Popular StatementDocument2 pagesBanco Popular StatementLong Home ProductsNo ratings yet

- InstructionsDocument2 pagesInstructionsPrysciliadeep KaurNo ratings yet

- PdfjoinerDocument115 pagesPdfjoinerAnisha SapraNo ratings yet

- Direction: Provide The Step-By-Step Solutions To The Following Problems. (5 Items X 5 Points)Document3 pagesDirection: Provide The Step-By-Step Solutions To The Following Problems. (5 Items X 5 Points)Monique BalteNo ratings yet

- General Math Second Quarter Exam ReviewDocument5 pagesGeneral Math Second Quarter Exam ReviewAgnes Ramo100% (1)

- Chapter 02-1Document21 pagesChapter 02-1Muntazir HussainNo ratings yet

- Form 16 Excel FormatDocument4 pagesForm 16 Excel FormatAUTHENTIC SURSEZNo ratings yet

- Accounting Test Bank - Bank ReconciliationDocument2 pagesAccounting Test Bank - Bank ReconciliationAyesha RGNo ratings yet

- Chapter 17 International Banking - Reserves Debt and RiskDocument47 pagesChapter 17 International Banking - Reserves Debt and Riskngletramanh203No ratings yet

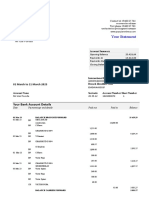

- Bank Reconciliation: Mrs. Rosalie Rosales-Makil, Cpa, LPT, MbaDocument18 pagesBank Reconciliation: Mrs. Rosalie Rosales-Makil, Cpa, LPT, MbaPSHNo ratings yet

- Introductory Econometrics For Finance' © Chris Brooks 2002 1Document11 pagesIntroductory Econometrics For Finance' © Chris Brooks 2002 1tagashiiNo ratings yet

- 14 Super Simple Ways To Build Residual IncomeDocument4 pages14 Super Simple Ways To Build Residual IncomeZain RehanNo ratings yet

- Credit Management of JBL Final PDFDocument39 pagesCredit Management of JBL Final PDFmili dattaNo ratings yet

- Corporate Financial AccountingDocument4 pagesCorporate Financial AccountinghareshNo ratings yet

- Askari Bank Internship ReportDocument76 pagesAskari Bank Internship Reportmalik omerNo ratings yet

- AU-Unitholder-notice-Vanguard AMMA Tax Statement GlossaryDocument4 pagesAU-Unitholder-notice-Vanguard AMMA Tax Statement GlossaryNick KNo ratings yet