Professional Documents

Culture Documents

Saha Enterprises-1

Uploaded by

Sujit RoyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Saha Enterprises-1

Uploaded by

Sujit RoyCopyright:

Available Formats

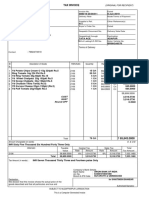

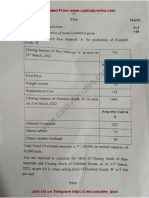

Tax- Invoice e-Invoice

IRN : 86d099f23643d6893401e0c632b772c090bd3fc63d3d-

c6d962d5687fbb7741b8

Ack No. : 182314770892008

Ack Date : 3-Nov-23

Aarya Enterprises Invoice No. Dated

Franchise of Parle Agro Pvt Ltd AE/873/23-24 3-Nov-23

Jotiakali ( North ) ,Fulbari GP-2 Delivery Note Mode/Terms of Payment

Siliguri-734015 Advance

GSTIN/UIN: 19ABFFA0094A1ZW Dispatch Doc No. Delivery Note Date

State Name : West Bengal, Code : 19

E-Mail : producton@aaryabailley.com Dispatched through Destination

Buyer (Bill to)

Raju Alipurduar

Saha Enterprise Bill of Lading/LR-RR No. Motor Vehicle No.

Station Para, Near Petrol Pump,Maya Takies Road,

Alipurduar, 7059100783 dt. 3-Nov-23 WB73E6363

GSTIN/UIN : 19CFCPK6708Q1ZS Terms of Delivery

State Name : West Bengal, Code : 19 For

Sl Description of Goods HSN/SAC Quantity Rate Rate per Amount

No. (Incl. of Tax)

1 Bailley 1 Ltr 22011010 50 Ctn 130.00 110.17 Ctn 5,508.50

(600 Pc)

2 Bailley 2 Ltr ( 9 Pc ) 22011010 8 Ctn 195.00 165.25 Ctn 1,322.00

(72 Pc)

3 Bailley 500 ML 22011010 72 Ctn 140.00 118.64 Ctn 8,542.08

(1,440 Pc)

4 Bailley 250 Ml 22011010 100 Ctn 200.00 169.49 Ctn 16,949.00

(4,000 Pc)

5 Bailley 5 Ltr 22011010 50 Ctn 49.98 42.36 Ctn 2,118.20

(50 Pc)

6 Bailley 5 Ltr 22011010 3 Ctn 0.39 0.33 Ctn 0.99

(3 Pc)

34,440.77

CGST 3,099.68

SGST 3,099.68

continued to page number 2

SUBJECT TO SILIGURI JURISDICTION

This is a Computer Generated Invoice

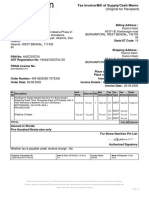

Tax- Invoice(Page 2)

Aarya Enterprises Invoice No. Dated

Franchise of Parle Agro Pvt Ltd AE/873/23-24 3-Nov-23

Jotiakali ( North ) ,Fulbari GP-2 Delivery Note Mode/Terms of Payment

Siliguri-734015 Advance

GSTIN/UIN: 19ABFFA0094A1ZW Dispatch Doc No. Delivery Note Date

State Name : West Bengal, Code : 19

E-Mail : producton@aaryabailley.com Dispatched through Destination

Buyer (Bill to)

Raju Alipurduar

Saha Enterprise Bill of Lading/LR-RR No. Motor Vehicle No.

Station Para, Near Petrol Pump,Maya Takies Road,

Alipurduar, 7059100783 dt. 3-Nov-23 WB73E6363

GSTIN/UIN : 19CFCPK6708Q1ZS Terms of Delivery

State Name : West Bengal, Code : 19 For

Sl Description of Goods HSN/SAC Quantity Rate Rate per Amount

No. (Incl. of Tax)

Less : Round Off (-)0.13

Total 283 Ctn ₹ 40,640.00

Amount Chargeable (in words) E. & O.E

INR Forty Thousand Six Hundred Forty Only

HSN/SAC Taxable CGST SGST/UTGST Total

Value Rate Amount Rate Amount Tax Amount

22011010 34,440.77 9% 3,099.68 9% 3,099.68 6,199.36

Total 34,440.77 3,099.68 3,099.68 6,199.36

Tax Amount (in words) : INR Six Thousand One Hundred Ninety Nine and Thirty Six paise Only

Company's Bank Details

A/c Holder's Name: Aarya Enterprises

Declaration Bank Name : Punjab National Bank

We declare that this invoice shows the actual price of A/c No. : 0444008700005637

the goods described and that all particulars are true and Branch & IFS Code: Hill Cart Road & PUNB0044400

correct. SWIFT Code :

Customer's Seal and Signature for Aarya Enterprises

Authorised Signatory

SUBJECT TO SILIGURI JURISDICTION

This is a Computer Generated Invoice

You might also like

- Fred Tam Trader SystemDocument4 pagesFred Tam Trader Systempriyaked100% (1)

- Banking and Finance LawDocument4 pagesBanking and Finance LawDinh VinhNo ratings yet

- IndrajitDocument2 pagesIndrajitSujit RoyNo ratings yet

- Chhavi TradersDocument1 pageChhavi Traderssadhu agasheNo ratings yet

- Ashok Garments - June'20Document1 pageAshok Garments - June'20sk mNo ratings yet

- Tax Invoice Cum Challan: Sancheti AssociatesDocument2 pagesTax Invoice Cum Challan: Sancheti AssociatesRahul SahaNo ratings yet

- 1661h Dsiend HSDBDocument5 pages1661h Dsiend HSDBMatiullahNo ratings yet

- Partho Da 3Document1 pagePartho Da 3FOUR SUM ENTERPRISENo ratings yet

- CGST SGST Sale Invoice BioDocument1 pageCGST SGST Sale Invoice BioRonak BothraNo ratings yet

- Inv - 485Document2 pagesInv - 485arnabmukherjee.1212005No ratings yet

- Gopal Trading Co.Document1 pageGopal Trading Co.tabu 1No ratings yet

- Invoice No. SS069 Shreevim UpDocument1 pageInvoice No. SS069 Shreevim Upranjitghosh684No ratings yet

- Sales DTA23-24002581Document1 pageSales DTA23-24002581bjitsrkrNo ratings yet

- New Padma Perfumery Works - 060322Document1 pageNew Padma Perfumery Works - 060322Shubham ShawNo ratings yet

- IKEA billPrint23Mar20201018300605Document70 pagesIKEA billPrint23Mar20201018300605Ahsan DharNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)NAGARJUNANo ratings yet

- Rahee Qu 47Document2 pagesRahee Qu 47nikhilNo ratings yet

- Tax Invoice: SNB/19-20/00411 8-Jun-2019Document3 pagesTax Invoice: SNB/19-20/00411 8-Jun-2019aaditya rajNo ratings yet

- Tax Invoice: Kedia PolymerDocument1 pageTax Invoice: Kedia Polymerchotonpl95No ratings yet

- Sample Invoice & Daybook From TallyDocument3 pagesSample Invoice & Daybook From TallyNavneet KhemaniNo ratings yet

- JB Xerox 0044Document2 pagesJB Xerox 0044rudraprasad520No ratings yet

- Tax InvoiceDocument5 pagesTax Invoicedigitalseva.japanigateNo ratings yet

- Debit NoteDocument4 pagesDebit NoteCP KANPURNo ratings yet

- Inv G487Document1 pageInv G487ALOK SINGHNo ratings yet

- Pushp 2Document1 pagePushp 2rockstaruniNo ratings yet

- 456Document1 page456KrishaNo ratings yet

- Biva 2 PDFDocument1 pageBiva 2 PDFVinayak Trading CompanyNo ratings yet

- T BookDocument2 pagesT BookThiru EEENo ratings yet

- InvoiceDocument1 pageInvoicehariNo ratings yet

- Sales 3742Document1 pageSales 3742momskitchen.storeNo ratings yet

- Minar Plastic 0104 - 240329 - 151232Document3 pagesMinar Plastic 0104 - 240329 - 151232minarplastic200No ratings yet

- Invoice HealthgenieDocument1 pageInvoice HealthgenieImrul KayesNo ratings yet

- Ajio FN8747303352 1699713216772Document1 pageAjio FN8747303352 1699713216772nitin.iipmbNo ratings yet

- Tax Invoice: Tax Amount Amount Rate ValueDocument4 pagesTax Invoice: Tax Amount Amount Rate ValueaaftabganaiNo ratings yet

- Subha Fertilizer 20-Mar-24: Tax InvoiceDocument1 pageSubha Fertilizer 20-Mar-24: Tax InvoiceSupriya SanpuiNo ratings yet

- 1659 PDF ConverterDocument5 pages1659 PDF ConverterMatiullahNo ratings yet

- GST Invoice: SL No. 1 2.000 KG. 2 2.000 KGDocument2 pagesGST Invoice: SL No. 1 2.000 KG. 2 2.000 KGDNYANESHWAR PAWARNo ratings yet

- Screenshot 2023-12-12 at 12.26.03 PMDocument1 pageScreenshot 2023-12-12 at 12.26.03 PMshashikumarsk0711No ratings yet

- Tax Invoice (Credit)Document3 pagesTax Invoice (Credit)Surajmal TansukhraiNo ratings yet

- Tax Invoice: Description of Goods Amount Per Rate Quantity Hsn/SacDocument2 pagesTax Invoice: Description of Goods Amount Per Rate Quantity Hsn/SacBhavnaben PanchalNo ratings yet

- Accounting Voucher-1Document1 pageAccounting Voucher-1kishorNo ratings yet

- Inv 93 GRDocument3 pagesInv 93 GRkhemelectronics724278No ratings yet

- Inv190 PDFDocument4 pagesInv190 PDFHitesh ThakkerNo ratings yet

- New DB - WB-1 PDFDocument2 pagesNew DB - WB-1 PDFAbhishek PrasadNo ratings yet

- BTI-013 Bolt, Nut, Washer Park GroveDocument2 pagesBTI-013 Bolt, Nut, Washer Park GroveGARIMANo ratings yet

- Invoice 227 Quarantine RevisedDocument2 pagesInvoice 227 Quarantine RevisedkishorNo ratings yet

- B120791636 47143254 PDFDocument1 pageB120791636 47143254 PDFsuresh2250No ratings yet

- 1660bsjsh HSHDHDDocument5 pages1660bsjsh HSHDHDMatiullahNo ratings yet

- InvoiceDocument1 pageInvoiceproc05785No ratings yet

- MP 1451 23 24Document1 pageMP 1451 23 24minarplastic200No ratings yet

- Bill Malout PDFDocument2 pagesBill Malout PDFCuber Anay GuptaNo ratings yet

- CubicDocument1 pageCubicSurajmal TansukhraiNo ratings yet

- JTC - Sales Bill - 29 (Other State)Document2 pagesJTC - Sales Bill - 29 (Other State)rishishekhawat1029No ratings yet

- Tax InvoiceDocument1 pageTax InvoiceAnjani KumariNo ratings yet

- 69858227840019598Document2 pages69858227840019598jeelp625No ratings yet

- JK EleDocument2 pagesJK EleslaxmiindNo ratings yet

- Tax Invoice/Retail Invoice: OptivalDocument1 pageTax Invoice/Retail Invoice: OptivalShashiKiranNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)NAGARJUNANo ratings yet

- Sales TEL 549 23-24Document1 pageSales TEL 549 23-24purchase.tel18No ratings yet

- InvoiceDocument1 pageInvoiceAparna BarmanNo ratings yet

- Money & You The Money Magnet MentalityDocument114 pagesMoney & You The Money Magnet MentalityRandy Haltiwanger100% (1)

- Capital BudgetingDocument67 pagesCapital BudgetingRosanna RosalesNo ratings yet

- Chapter 1-Financial Reporting: Multiple ChoiceDocument20 pagesChapter 1-Financial Reporting: Multiple Choicekabirakhan200733% (3)

- Yoseva Yuliana DH Ruju - Chapter 20Document2 pagesYoseva Yuliana DH Ruju - Chapter 20Septy RujuNo ratings yet

- Beneficial Owner FormDocument1 pageBeneficial Owner FormrichlogNo ratings yet

- BEC Vantage With KeyDocument12 pagesBEC Vantage With KeyNelu Si Elena FurnicaNo ratings yet

- 03P Accounting For Subsequent Share Capital TransactionsDocument11 pages03P Accounting For Subsequent Share Capital TransactionsjulsNo ratings yet

- CA Inter Accounts QP Nov 2022Document15 pagesCA Inter Accounts QP Nov 2022Partibha GehlotNo ratings yet

- Ratio Analysis FormulasDocument2 pagesRatio Analysis Formulassatya100% (2)

- DepositDocument7 pagesDepositRaju RajNo ratings yet

- A Project Report On "Role of Bajaj Finserv in Consumer Durable Lending "Document38 pagesA Project Report On "Role of Bajaj Finserv in Consumer Durable Lending "Aniket KarnNo ratings yet

- Process Flow of The Bond Issuance ProcessDocument14 pagesProcess Flow of The Bond Issuance Processmeor_ayob100% (1)

- Turkey GenDocument285 pagesTurkey GenMuhammad Talha TalhaNo ratings yet

- Credit Card StatementDocument2 pagesCredit Card Statementdeepghosh260897No ratings yet

- Managerial Accounting Solutions Chapter 3 PDFDocument42 pagesManagerial Accounting Solutions Chapter 3 PDFadam_garcia_81No ratings yet

- Agreement This Agreement Is Made This Day of June 13, 2007 BetweenDocument3 pagesAgreement This Agreement Is Made This Day of June 13, 2007 BetweenCA Arpit YadavNo ratings yet

- IFAC PAO Tax Advisor Guidance PDFDocument14 pagesIFAC PAO Tax Advisor Guidance PDFDelia StoicaNo ratings yet

- Crowd Funding For Startups in India: G.UshaDocument5 pagesCrowd Funding For Startups in India: G.Ushaavinish007No ratings yet

- FSFB Acct STMT xxxx9968 From 01aug23 To 02feb24Document2 pagesFSFB Acct STMT xxxx9968 From 01aug23 To 02feb24p6668952No ratings yet

- Deed of PartitionDocument2 pagesDeed of PartitionRagul SivanandNo ratings yet

- Prepare An Income Statements and A Balance Sheet: Senior High School DepartmentDocument10 pagesPrepare An Income Statements and A Balance Sheet: Senior High School DepartmentAira Mae PazNo ratings yet

- Hotel Template CopDocument2 pagesHotel Template CopMuhammad Nur Rachmat SyamNo ratings yet

- Identifying and Assessing Risks of Material MisstatementsDocument2 pagesIdentifying and Assessing Risks of Material MisstatementsCattleyaNo ratings yet

- System of Absolute CommunityDocument17 pagesSystem of Absolute CommunitylitoingatanNo ratings yet

- Andhra Loyola Institute of Engineering and Technology Department of Master of Business Administration Student Major Projects - 2017-19 BatchDocument4 pagesAndhra Loyola Institute of Engineering and Technology Department of Master of Business Administration Student Major Projects - 2017-19 BatchNBD 03 Sree PujithaNo ratings yet

- Prof Charted AccountantDocument3 pagesProf Charted AccountantKomal BhattadNo ratings yet

- 14 Bank of Commerce V San PabloDocument2 pages14 Bank of Commerce V San PabloAleezah Gertrude RaymundoNo ratings yet

- CS Professional Programme Tax NotesDocument47 pagesCS Professional Programme Tax NotesRajey Jain100% (2)