Professional Documents

Culture Documents

Guide When Buying Real Estate in The Philippines

Guide When Buying Real Estate in The Philippines

Uploaded by

Citoy LabadanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Guide When Buying Real Estate in The Philippines

Guide When Buying Real Estate in The Philippines

Uploaded by

Citoy LabadanCopyright:

Available Formats

Guide when Buying real Estate in the Philippines

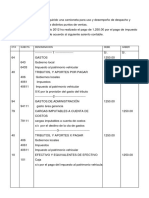

This is the standard sharing of expenses between the buyer and the seller when transferring the

real estate property title (TCT - Transfer Certificate of Title or CCT - Condominium Certificate

of Title) to a new owner:

The SELLER pays for the:

Capital Gains Tax equivalent to 6% of the selling price on the Deed of Sale or the zonal

value, whichever is higher. (Withholding Tax if the seller is a corporation)

Unpaid real estate taxes due (if any).

Agent / Broker's commission.

The BUYER pays for the cost of Registration:

Documentary Stamp Tax - 1.5% of the selling price or zonal value or fair market value,

which ever is higher.

Transfer Tax - 0.5% of the selling price, or zonal value or fair market value, which ever is

higher.

Registration Fee - 0.25% of the selling price, or zonal value or fair market value, which

ever is higher.

Incidental and miscellaneous expenses incurred during the registration process. These

payments may seem high but other countries have significant taxes too. Try looking at

what they pay in Australia!

The above sharing of expenses is the standard practice in the Philippines. However, buyers and

sellers can mutually agree on other terms as long as it is done during the negotiation period

(before the signing of the "Deed of Sale").

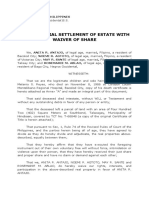

The "Deed of Sale" or "Deed of Absolute Sale" is the document showing legal transfer of real

estate property ownership. The deed of sale is then taken to the Registry of Deeds to be officially

recorded after paying the documentary stamp, transfer tax and registration fees. Always verify

from the Registry of Deeds the authenticity of a Transfer Certificate of Title before buying a

property. If the seller only has a tax declaration, be extra cautious and check with neighbours, the

Barangay captain or anyone in the know in the community to verify the seller/owner's true

identity and the property's history.

Your Agent / Broker will usually do the registration process (sometimes for a fee). However, all

government taxes, transfer fees and incidental or miscellaneous expenses will be shouldered by

the buyer.

Documents needed when transferring the title (TCT or CCT) to the new owner:

Certified true copy of the title

Notarized copies of the Deed of Sale

Latest tax declaration of the property

Certificate from the Bureau of Internal Revenue that the capital gains tax and

documentary stamps have been paid

Receipt of payment of the transfer tax and registration fees

An adapted form of the "Torrens" system of land registration is used in the Philippines. The

system was adapted to assure a buyer that if he buys a land covered by an Original Certificate of

Title (OCT) or the Transfer Certificate of Title (TCT) issued by the Registry of Deeds, the same

will be absolute, indefeasible and imprescriptible.

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Rental-Property Profits: A Financial Tool Kit for LandlordsFrom EverandRental-Property Profits: A Financial Tool Kit for LandlordsNo ratings yet

- Ontario Tax Sale Property Buyer's GuideFrom EverandOntario Tax Sale Property Buyer's GuideRating: 3 out of 5 stars3/5 (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- 80 Lessons Learned - Volume III - Real Estate Lessons: On the Road from $80,000 to $80,000,000From Everand80 Lessons Learned - Volume III - Real Estate Lessons: On the Road from $80,000 to $80,000,000Rating: 4 out of 5 stars4/5 (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Ultimate Guide to Successful Real Estate Investing: A Step-by-Step Handbook for Novice InvestorsFrom EverandThe Ultimate Guide to Successful Real Estate Investing: A Step-by-Step Handbook for Novice InvestorsRating: 5 out of 5 stars5/5 (1)

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionFrom EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNo ratings yet

- Property Case DigestDocument27 pagesProperty Case DigestMariel Angela BuenoNo ratings yet

- The Book on Advanced Tax Strategies: Cracking the Code for Savvy Real Estate InvestorsFrom EverandThe Book on Advanced Tax Strategies: Cracking the Code for Savvy Real Estate InvestorsRating: 4.5 out of 5 stars4.5/5 (3)

- Reading Materials Sustainable Development of Real EstateDocument513 pagesReading Materials Sustainable Development of Real EstateArafat DomadoNo ratings yet

- Real Estate investing: 2 books in 1: Create Passive Income with Real Estate, Reits, Tax Lien Certificates and Residential and Commercial Apartment Rental Property InvestmentsFrom EverandReal Estate investing: 2 books in 1: Create Passive Income with Real Estate, Reits, Tax Lien Certificates and Residential and Commercial Apartment Rental Property InvestmentsNo ratings yet

- Banco de Preguntas Verificador CatastralDocument5 pagesBanco de Preguntas Verificador CatastralChristian Castro88% (8)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5811)

- Tax Liens: How To Generate Income From Property Tax Lien CertificatesFrom EverandTax Liens: How To Generate Income From Property Tax Lien CertificatesNo ratings yet

- Justice Martires: Pilipinas Makro, Inc., Petitioner vs. Coco Charcoal Philippines, INC. and LIM KIM SAN, RespondentsDocument2 pagesJustice Martires: Pilipinas Makro, Inc., Petitioner vs. Coco Charcoal Philippines, INC. and LIM KIM SAN, RespondentsjoyfandialanNo ratings yet

- Rental Properties: Create Passive Income through Real Estate Management. Learn How to Find the Best Properties in the Right Location and Start Building Your HeritageFrom EverandRental Properties: Create Passive Income through Real Estate Management. Learn How to Find the Best Properties in the Right Location and Start Building Your HeritageNo ratings yet

- Make Money: Work at Home with a Tax Lien Certificates & Tax Deeds BusinessFrom EverandMake Money: Work at Home with a Tax Lien Certificates & Tax Deeds BusinessNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Tax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesFrom EverandTax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesNo ratings yet

- Rental Property Investing: A Handbook and Guide for Becoming a Landlord!From EverandRental Property Investing: A Handbook and Guide for Becoming a Landlord!No ratings yet

- Succession - CasesDocument14 pagesSuccession - CasesAnthea Louise RosinoNo ratings yet

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Real Estate Broker (REB): Passbooks Study GuideFrom EverandReal Estate Broker (REB): Passbooks Study GuideNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- J.K. Lasser's Real Estate Investors Tax Edge: Top Secret Strategies of Millionaires ExposedFrom EverandJ.K. Lasser's Real Estate Investors Tax Edge: Top Secret Strategies of Millionaires ExposedNo ratings yet

- Structured Settlements: A Guide For Prospective SellersFrom EverandStructured Settlements: A Guide For Prospective SellersNo ratings yet

- Parking Space Lease AgreementDocument2 pagesParking Space Lease Agreementsonu singhNo ratings yet

- Appraisal Feasibility Study Ethics Business Valuation ConsultancyFrom EverandAppraisal Feasibility Study Ethics Business Valuation ConsultancyNo ratings yet

- Real Estate Lead GenerationDocument1 pageReal Estate Lead Generationorin.bintehNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- The Insider Secret of Business: Growing Successful Financially and ProductivelyFrom EverandThe Insider Secret of Business: Growing Successful Financially and ProductivelyNo ratings yet

- Decrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationFrom EverandDecrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationNo ratings yet

- How to have a Brilliant Career in Estate Agency: The ultimate guide to success in the property industry.From EverandHow to have a Brilliant Career in Estate Agency: The ultimate guide to success in the property industry.Rating: 5 out of 5 stars5/5 (1)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Defi, Bitcoin and Cryptocurrency Trading and Investing for Beginners: Utilizing Decentralized Finance, Binance Trading, Tax Strategies, and Technical Analysis for Lending And Borrowing (2022)From EverandDefi, Bitcoin and Cryptocurrency Trading and Investing for Beginners: Utilizing Decentralized Finance, Binance Trading, Tax Strategies, and Technical Analysis for Lending And Borrowing (2022)No ratings yet

- Basics About Sales, Use, and Other Transactional Taxes: Overview of Transactional Taxes for Consideration When Striving Toward the Maximization of Tax Compliance and Minimization of Tax Costs.From EverandBasics About Sales, Use, and Other Transactional Taxes: Overview of Transactional Taxes for Consideration When Striving Toward the Maximization of Tax Compliance and Minimization of Tax Costs.No ratings yet

- A comprehensive guide to buying property in Spain: A comprehensive guide to buying property in Spain: This eBook would cover everything a potential property buyer needs to know about the specific country they are interested in. It could cover topics like the buying process, legal considerations, taxes, anFrom EverandA comprehensive guide to buying property in Spain: A comprehensive guide to buying property in Spain: This eBook would cover everything a potential property buyer needs to know about the specific country they are interested in. It could cover topics like the buying process, legal considerations, taxes, anNo ratings yet

- Basic Understanding of Financial Investment, Book 6- For Teens and Young AdultsFrom EverandBasic Understanding of Financial Investment, Book 6- For Teens and Young AdultsNo ratings yet

- Crypto Taxation in USA: A Comprehensive Guide to Navigating Digital Assets and TaxationFrom EverandCrypto Taxation in USA: A Comprehensive Guide to Navigating Digital Assets and TaxationNo ratings yet

- Property & Taxation: A Practical Guide to Saving Tax on Your Property InvestmentsFrom EverandProperty & Taxation: A Practical Guide to Saving Tax on Your Property InvestmentsNo ratings yet

- The Comprehensive Guide to Real Estate Investing: Real Estate Strategies and Techniques UncoveredFrom EverandThe Comprehensive Guide to Real Estate Investing: Real Estate Strategies and Techniques UncoveredNo ratings yet

- Shares and Taxation: A Practical Guide to Saving Tax on Your SharesFrom EverandShares and Taxation: A Practical Guide to Saving Tax on Your SharesNo ratings yet

- Just Fell Out of Escrow: Top 5 reasons a property does not sellFrom EverandJust Fell Out of Escrow: Top 5 reasons a property does not sellNo ratings yet

- Homeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransFrom EverandHomeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Real Estate Investing Secrets: How to Make Money with Rental Properties, Tax Advantages, and MoreFrom EverandReal Estate Investing Secrets: How to Make Money with Rental Properties, Tax Advantages, and MoreNo ratings yet

- A Real Estate Agent's Guide to Pay Less Tax & Build More WealthFrom EverandA Real Estate Agent's Guide to Pay Less Tax & Build More WealthNo ratings yet

- Learning to Love Form 1040: Two Cheers for the Return-Based Mass Income TaxFrom EverandLearning to Love Form 1040: Two Cheers for the Return-Based Mass Income TaxNo ratings yet

- Contrato Arrendamiento 01Document5 pagesContrato Arrendamiento 01Saidy AcostaNo ratings yet

- PD 464Document36 pagesPD 464Nath VillenaNo ratings yet

- Incorporacao ImobiliariaDocument2 pagesIncorporacao Imobiliariaclaudio.silv8390100% (2)

- Contrato de Arrendamiento de OmairaDocument2 pagesContrato de Arrendamiento de OmairaRONEL GONZALEZNo ratings yet

- Projeto SITEDocument4 pagesProjeto SITELia MagalhãesNo ratings yet

- Contrato de Arrendamiento 2Document6 pagesContrato de Arrendamiento 2Anonymous MF92YjMNo ratings yet

- CASA FILIPINA REALTY V Office of The PresidentDocument3 pagesCASA FILIPINA REALTY V Office of The PresidentKEith KatNo ratings yet

- ExtraJudicial SettlementDocument3 pagesExtraJudicial SettlementGwynn BonghanoyNo ratings yet

- Part LLDocument50 pagesPart LLRuiz, CherryjaneNo ratings yet

- Company Profile - Oriental GroupDocument20 pagesCompany Profile - Oriental GroupMohd Naqdyuzen NordinNo ratings yet

- Documentos Leasing TotalDocument5 pagesDocumentos Leasing TotalJuan Carlos Obeso BenitesNo ratings yet

- Fair Housing Act Design ManualDocument334 pagesFair Housing Act Design ManualalivnasaelNo ratings yet

- Matematicas IV SERIE DE FOURIER PDFDocument79 pagesMatematicas IV SERIE DE FOURIER PDFCesar RiosNo ratings yet

- Demanda Amparo PosesionDocument5 pagesDemanda Amparo Posesionabogados bogota en lineaNo ratings yet

- Ipuic Formato Compra de Bienes InmueblesDocument2 pagesIpuic Formato Compra de Bienes InmueblesWilmerJoseVegaNo ratings yet

- BPTPDocument20 pagesBPTPniceidNo ratings yet

- BLRReportDocument204 pagesBLRReportspydraNo ratings yet

- Tala Vs Banco FilipinoDocument9 pagesTala Vs Banco FilipinoAnonymous 96BXHnSziNo ratings yet

- Niif 16 Casos PrácticosDocument4 pagesNiif 16 Casos PrácticosCLAUDIA Lovon LozanoNo ratings yet

- Qué Es La Ley de Arrendamiento para LeerDocument8 pagesQué Es La Ley de Arrendamiento para LeerJohana LeyvaNo ratings yet

- RockFord Plaza For SaleDocument7 pagesRockFord Plaza For SaleabrealtyNo ratings yet

- Casos PracticosDocument2 pagesCasos PracticosEdissgre AclivNo ratings yet

- List of Real Estate Agents: S.No Name of CP Address & Contact Details RERA Registration NumberDocument1 pageList of Real Estate Agents: S.No Name of CP Address & Contact Details RERA Registration NumberAyush GuptaNo ratings yet