Professional Documents

Culture Documents

Legal500 Tax-MG Arrieiro-Papini 2023 Chambers

Uploaded by

barbara.milatoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Legal500 Tax-MG Arrieiro-Papini 2023 Chambers

Uploaded by

barbara.milatoCopyright:

Available Formats

Firm Name

Arrieiro Papini Advogados

Country Brazil

Practice Area

EITHER select Practice Area from this drop-down list ► Brazil - City focus - Belo Horizonte - Tax

OR If you have an earlier version of Word, type in this box: ►

Choose ONE from list of Practice Areas on last page of this document

Contact details to arrange interviews

Name Job Title Email Phone

LETS Marketing Marketing Agency rankings@letsmarketin +55 11 992763848

g.com.br

What is the Team or Department Name (as used by your firm)

Tax practice (litigation and advisory)

Head(s) of Team

Name Location

Eduardo Arrieiro Brazil – Belo Horizonte

Number of NON-PARTNERS in the

Number of PARTNERS in the team team

Non-partners who spend at least

Partners who spend at least 50% of

1 50% of their time in this 3

their time in this department team/department

Please mark anything confidential (not for publication) in red

Your practice: what sets your practice apart from other

firms?

Arrieiro Papini Advogados was founded in 2018 by the lawyers Eduardo Arrieiro and André Papini,

professionals with solid background legal careers in other law firms. We believe that solidity and

depth of knowledge in Law, combined with experience, pragmatism, creativity, ethics, personality

and understanding as to the needs and objectives of our clients are essential factors to the practice

of effective and quality law.

As our first submission to this highly regarded ranking, it’s important to introduce our main

partners. Arrieiro is a lawyer and consultant in tax matters, with a master's degree in Tax Law, who

has been working for approximately 20 years as a tax consultant for large economic groups. See

more about him in his profile on this form.

Our Firm provide legal services to Investment Funds, companies, partners, shareholders, managers,

family businesses, startups, among others in Tax Consulting, Tax Litigation, Corporate Law, Mergers

and Acquisitions (M&A), Business and Succession Planning, Corporate Governance, Contracts,

Strategic Litigation and Arbitration. Our Tax consultancy is for clients from the most diverse

business segments, such as Investment Funds, Steel Industry, Transports, Logistics, Heath Services,

Supermarkets, national and foreign company in application to federal, state, and municipal tax rules.

Our work goes from:

- Survey and appropriation of tax credits referring to direct, indirect, and social security attributes.

- Legal opinions on tax matters.

- Studies and analyses of fiscal and economic feasibility of tax incentives, transfer pricing, among

others.

- Advising individuals on tax matters related to business succession, resource repatriation programs

and the construction of fiscally efficient corporate, financial, and fiduciary structures for asset

allocation, especially investment funds.

- Advising companies on tax matters related to corporate transactions, disposal, and acquisition of

assets, including M&A and investment transactions.

In the last year, the firm advised large economic groups on tax issues involving the establishment of

receivables investment funds, real estate investment funds and exclusive funds with a combined net

worth of more than R$300 million. We also acted in the identification of tax credits over R$ 10

million for industries. In addition, we advise clients on complex tax issues, such as, for example,

transfer pricing reviews. Since its inception in mid-2018, our firm has seen significant revenue

growth, equivalent to 819% between 2018 and 2021. This is due to the fact that, although it is a

young firm, the partners are experienced and a reference in their fields.

Our practice is well-known by relevant clients to Brazilian economy and based in Minas Gerais, focus

of this research. Last year our practice had an increase of revenue. Arrieiro Papini Advogados is

already born as an important boutique firm in the legal scenario of Minas Gerais, a position that will

certainly be even more valued and consolidated from its desired nomination in Legal 500 Belo

Horizonte: Tax ranking.

Such growth is the result of assertive and effective action in highly complex matters.

Please mark anything confidential (not for publication) in red

Initiatives and innovation: what measures has your firm

introduced (or maintained) over the last year to benefit your

clients?

Where possible/relevant, please link these issues to the matters provided and/or provide tangible

examples of how these initiatives has worked in practice.

1. Tech / systems innovations – this may include the updating of the firm’s technology

capability, the introduction of AI, new policies regarding billing systems, collaboration, etc.

2. Socio-cultural initiatives – this should include diversity & inclusion initiatives (not only

women in law, but also concerning minority groups, the differently-abled, LGBQT+ etc.);

sustainability, corporate social responsibility and allied matters.

Please mark anything confidential (not for publication) in red

3. Pro-bono work (with accreditation where possible), with seniority of acting lawyer and/ or

number of hours. Please add any additional supporting information as you see fit.

Please mark anything confidential (not for publication) in red

Your practice: what do you think of our existing

rankings/commentary?

All information given here is in strictest confidence; we would encourage relevant partners to

comment on the overall ranking rather than simply their own firm / practice. Thank you.

Please mark anything confidential (not for publication) in red

IMPORTAN

T

Clients: client referees

Referee feedback is a critical part of our research. Please provide

at least 20 referees we can talk to in confidence.

You may additionally include referees from referring law firms and other organisations that

can comment on the quality of the practice. Client names are received and held by us in

strict confidence; they are not passed to any other organisation; they are not contacted for

any purpose other than The Legal 500 research. We are fully GDPR-compliant.

Please download the referee spreadsheet from submissions.legal500.com.

Please mark anything confidential (not for publication) in red

Clients: publishable clients (Client names in this section will be published)

[Please do not write client names in CAPITAL LETTERS unless strictly necessary.]

Active key clients (over the last New client Length of

12 months) (yes/no) relationship

DOX Brasil Indústria e Comércio de Aços S/A No More than 2 years

Tora Recintos Alfandegados S/A yes More than 2 years

Tora Transportes Ltda. yes More than 2 years

Tora Locações S/A yes More than 2 years

LONAX Indústria de Lonas Ltda. no More than 2 years

SADA Participações S/A no More than 2 years

LOGINVEST – Fundo de Investimento yes More than 2 years

Imobiliário

Fundo de Investimento Imobiliário STAR yes More than 2 years

SADA Transportes e Armazenagem S/A no More than 2 years

AMIS – Associação Mineira de no More than 2 years

Supermercados

sindicato nacional das empresas de No More than 2 years

medicina de grupo - sinamge

associação brasileira de planos de saúde - No More than 2 years

abramge

hospital varginha s/a – grupo serpram No More than 2 years

hospital imesa s/a – grupo serpram No More than 2 years

serpram – serviço de prestação de No More than 2 years

assistência médico-hospitalar s/a – grupo

serpram

solucionare logística jurídica ltda. No More than 2 years

Please mark anything confidential (not for publication) in red

viação fenix ltda. No More than 2 years

construtora oliveira barbosa ltda. No More than 2 years

engetec - comércio, importação e No More than 2 years

exportação de equipamentos ltda.

To add more clients, right-click in any field and select ‘Insert row below’

Clients: non-publishable clients (This list will not be published)

Active key clients (over the last New client Length of

12 months) (yes/no) relationship

DOX Brasil Indústria e Comércio de Aços S/A yes More than 2 years

Endurance Fundo de Investimento yes More than 2 years

Multimercado

Sun Capital Fundo de Investimento em yes More than 2 years

Direitos Creditórios Não Padronizados;

Tora Recintos Alfandegados S/A No 3 years

Tora Transportes. No 3 years

Tora Locações S/A No 3 years

LONAX Indústria de Lonas Ltda. No 5 years

Walter Arantes – partner at supermercado BH no More than 2 years

To add more clients, right-click in any field and select ‘Insert row below’

The Legal 500 rankings and editorial

Please mark anything confidential (not for publication) in red

METHODOLOGY

The firm and its practices

The Legal 500’s key focus remains the law firm, as reflected through each

practice area. Our rankings analyse overall team strength and capability.

Individuals

In the following pages we invite you to nominate the leading partners and senior

associates within your team. All individuals nominated on these pages may be

considered for including in our Leading Individuals, Next Generation Partners, or

Rising Stars associates tables.

While inclusion in tables for nominated individuals cannot be guaranteed, this

information is also used to help us understand notable contributions to the wider

team, which may be recognised in our editorial commentary.

With the exception of any arrivals and departures that are simply noted, all

lawyers mentioned in Legal 500 editorial are by definition recommended.

1. Leading Individuals: this category is designed to identify those that are not

only thoroughly experienced in their sector, but also demonstrate ongoing

involvement with key transactions, cases or matters, broad peer

recognition and at least ten years’ experience as a private practice partner

(or relevant industry-equivalent post).

2. Next Generation Partners: this category is designed to identify standout

younger partners with up to five years’ experience in the role.

3. Rising Stars: this category identifies key senior associates, practice

directors and counsel; in certain cases, editors may take the discretionary

step of adding counsel of seniority -generally those resulting from a lateral

hire- in one of the above categories; similarly, it may be the case that a

semi-senior is included in rising stars.

Note: evaluation of the individual listings is undertaken on an annual basis – ie:

lawyers will not automatically remain in these categories, especially if there is

little/no evidence of their activity in the work highlights included below.

Please note that partners may not automatically move from the Next Generation

Partners to Leading Individuals’ listings.

Please mark anything confidential (not for publication) in red

Your team - Partners

Please detail all partners in the team who spend over 50% of their time in the practice, along with other

partners who participate in the sector whom you wish to bring to our attention, given their contribution.

Please nominate only genuinely exceptional candidates and provide supporting evidence. Please

do not include all of your partners. We only recognise those with excellent referee and peer feedback, who

have had a prominent role in several leading matters this year (and in past years).

The Legal 500 encourages firms to put forward talented women and minority lawyers to be considered for

inclusion as leading individual/next generation/rising stars.

If you need more boxes please copy this page.

Partner 1: leading individual

Name Location Ranked in previous

edition? (Yes/no)

Eduardo Arrieiro Brazil No

Supporting information

Working for 20 years in advisory and litigation tax matters, especially in corporate reorganization

operations, mergers and acquisitions, structured funds, purchase and sale of assets,

implementation of special tax regimes and administrative and judicial tax litigation. He is a

professor in extension and postgraduate courses in Tax Law. He worked as a guest professor of the

discipline "Tax Planning - Tax Avoidance and Evasion", in the postgraduate course in Tax Law at the

Milton Campos Law School, as a guest professor of the discipline "Analysis of STF decisions that

touch the concept of income in Legal Entities ” in the postgraduate course in Tax Law at Faculdade

CEDIN and as a guest professor of the subjects “Business Activity and Contractual Organization of

the Company” and “Business Tax Planning” in the postgraduate course in Business and Tax Law at

the Varginha Law School.

Please mark anything confidential (not for publication) in red

Your team - Partners: next generation

Please provide information about junior/new/younger partners who make a material difference to the

practice. Please nominate only genuinely exceptional candidates and provide

supporting evidence.

If you need more boxes (for more next generation partners) please copy this page.

Partner: next generation 1

Name Location

Supporting information

Please mark anything confidential (not for publication) in red

Your team - Associates: rising stars

Please provide information about senior associates (and counsel) who make a material difference to the

practice, including the length of time they have been at the firm and their date of qualification.

If you need more boxes (for more associates) please copy this page.

Associate: rising star 1

Name Location

Supporting information

Your team: significant recent arrivals and departures

Please only include arrivals and departures in this practice area. Please do

include all partners, counsel and senior associates where necessary.

Name Position/ Joined/ Joined Month/

role Departed/ from/Destinati year?

Promoted? on (firm)

N/A

Please mark anything confidential (not for publication) in red

Publishable matter summary

Please pick up to three work highlights you feel reflect or best represent the capabilities of the

practice, from among those you have included in the detailed work highlights (as set out in the

following pages), and give a brief summary below.

NOTE:

a./ only provide work-highlight summaries for matters you are happy for us

to publish.

b./ we cannot guarantee that work highlights will be published if this

section is not completed.

EXAMPLE SUMMARIES

“Advised [insert company name] on acquisition of [Insert company name]”, or

“Advised consortium of banks on funding for a $6bn acquisition of a tech company”.

1. Client: Associação Mineira de Supermercados (AMIS)

Summary

AMIS is a business entity that brings approximately 90% of sales in the supermarket sector in

Minas Gerais state. AMIS members range from global supermarket giants branch’s to

supermarket micro-companies from small towns in Minas Gerais.

The office provides tax advice to the associates, through the Association, by means of

solutions to tax demands, through legal opinions, specific consultancies involving especially

federal taxes, such as Corporate Income Tax. We defend the interests of the Association and

its members against the unconstitutional collection, by the State of Minas Gerais, of the Fire

Tax.

We were successful before the Court of Appeals of the State of Minas Gerais, in the second

degree of jurisdiction. Our actions benefit hundreds of members, with values estimated in

more.

2. Client: TORA Recintos Alfandegados S/A

Summary

The company is a logistics operator that holds the concession of a Customs Industrial Logistic

Center (CLIA), located in the Metropolitan Region of Belo Horizonte/MG, on the margins of

the BR-381 highway, with easy access to the main ports and airports in the Southeast region.

It has 75 thousand m² of bonded area, including a container yard, with capacity to receive

refrigerated cargo, and rail access. It is inserted in an industrial complex structured for the

Please mark anything confidential (not for publication) in red

installation of companies, facilitating import and export logistics.

Besides being a customs and industrial warehouse, it also has a general warehouse regime. It

counts on the daily performance of consenting agencies (Federal and State Revenue Service,

MAPA and ANVISA), as well as rooms for other intervenients.

Our firm assisted the company in a legal opinion involving the payment of tax debts originally

under the responsibility of USIFAST, a company merged by TORA, in the Special Program for

Tax Regularization ("PERT"), using credits from tax losses and negative basis of calculation of

CSLL.

3. Client: DOX Brasil Indústria e Comércio de Aços S/A

Summary

DOX is one of the main industrial players in flat steel in Brazil, with estimated revenues of R$

1.7 billion in 2021. It has commercial and industrial establishments in the states of Santa

Catarina, Rio de Janeiro, São Paulo, and Minas Gerais. Besides the industrial segment, the

company inaugurated its first retail store in Contagem/MG in 2022 and is finalizing the

construction work to inaugurate other units in São Paulo/SP and Campinas/SP by the second

quarter of 2022.

Our firm assists the company in tax advisory matters, especially in issues related to obtaining

ICMS tax incentives and tax planning.

Since 2016 we had helped the company in more than R$100 million tax incentives.

Your practice - detailed work highlights

Please provide up to 20 highlight matters that represent the practice over the past 12 months.

(a) To add multiple names or jurisdictions within a matter, right-click in any field and select

‘insert row below’.

(b) To add additional matters, simply click a matter box, click the small icon in the top left

corner, then copy and paste onto a new page.

Publishable matter 1

Name of client Industry sector

Associação Mineira de Market association

Supermercados (AMIS)

Matter description

Please mark anything confidential (not for publication) in red

AMIS is a business entity that brings approximately 90% of sales in the supermarket sector in

Minas Gerais state. AMIS members range from global supermarket giants branch’s to supermarket

micro-companies from small towns in Minas Gerais.

The office provides tax advice to the associates, through the Association, by means of solutions to

tax demands, through legal opinions, specific consultancies involving especially federal taxes, such

as Corporate Income Tax. We also act in the Tax Committee, where we usually present

propositions aiming to improve the environment of the Association. The performance of the office

also involves tax advice relating to the taxation of the entity itself.

Deal value No estimate

Was it cross-border?

Jurisdiction

No

Lead partner(s)

Name Office Practice area

Eduardo Arrieiro Brazil Tax Non Contentious

Other key team members

Name Office Practice area

Guilherme Peixoto and Ana Brazil Tax Non Contentious

Brandão

Other firms advising on the matter and their role(s)

Firm name Role details Advising (specify the

firm/company/individual advised)

n/a

Start date End date

Ongoing

Publishable matter 2

Name of client Industry sector

Associação Mineira de Market association

Supermercados (AMIS)

Matter description

Please mark anything confidential (not for publication) in red

AMIS is a business entity that brings approximately 90% of sales in the supermarket sector in

Minas Gerais state. AMIS members range from global supermarket giants branch’s to

supermarket micro-companies from small towns in Minas Gerais.

The office provides tax advice to the associates, through the Association, by means of solutions to

tax demands, through legal opinions, specific consultancies involving especially federal taxes, such

as Corporate Income Tax. We defend the interests of the Association and its members against the

unconstitutional collection, by the State of Minas Gerais, of the Fire Tax.

We were successful before the Court of Appeals of the State of Minas Gerais, in the second

degree of jurisdiction. Our actions benefit hundreds of members, with values estimated in more

than ten million reais.

Deal value Over R$ 10.000.000,00

Was it cross-border?

Jurisdiction

No

Lead partner(s)

Name Office Practice area

Eduardo Arrieiro Brazil Tax Litigation

Other key team members

Name Office Practice area

Guilherme Peixoto and Ana Brazil Tax Litigation

Brandão

Other firms advising on the matter and their role(s)

Firm name Role details Advising (specify the

firm/company/individual advised)

n/a

Start date End date

Ongoing

Please mark anything confidential (not for publication) in red

Publishable matter 3

Name of client Industry sector

TORA Recintos Alfandegados Logistic

S/A

Matter description

The company is a logistics operator that holds the concession of a Customs Industrial Logistic

Center (CLIA), located in the Metropolitan Region of Belo Horizonte/MG, on the margins of the

BR-381 highway, with easy access to the main ports and airports in the Southeast region.

It has 75 thousand m² of bonded area, including a container yard, with capacity to receive

refrigerated cargo, and rail access. It is inserted in an industrial complex structured for the

installation of companies, facilitating import and export logistics.

Besides being a customs and industrial warehouse, it also has a general warehouse regime. It

counts on the daily performance of consenting agencies (Federal and State Revenue Service,

MAPA and ANVISA), as well as rooms for other intervenients.

Our firm assisted the company in a legal opinion involving the payment of tax debts originally

under the responsibility of USIFAST, a company merged by TORA, in the Special Program for Tax

Regularization ("PERT"), using credits from tax losses and negative basis of calculation of CSLL.

Deal value R$ 10.000.000,00

Was it cross-border?

Jurisdiction

No

Lead partner(s)

Name Office Practice area

Eduardo Arrieiro Brazil Tax Non Contentious

Other key team members

Name Office Practice area

n/a Brazil Tax Non Contentious

Other firms advising on the matter and their role(s)

Firm name Role details Advising (specify the

firm/company/individual advised)

n/a

Start date End date

February 2022

Please mark anything confidential (not for publication) in red

Publishable matter 4

Name of client Industry sector

TORA Recintos Alfandegados Logistic

S/A

Matter description

[Description about TORA is in the case above.]

Besides being a customs and industrial warehouse, it also has a general warehouse regime. We

advised the company on an issue related to the ICMS tax owed to the State of Rio de Janeiro,

contesting demands concerning the payment of additional tax intended for the poverty fund and

the state fund for fiscal balance.

The discussion is extremely relevant and has a significant economic impact. It is currently under

discussion in the Court of Justice of the State of Rio de Janeiro.

We acted sponsoring the client's interests from the very beginning of the discussion.

Deal value R$ 10.000.000,00

Was it cross-border?

Jurisdiction

No

Lead partner(s)

Name Office Practice area

Eduardo Arrieiro Brazil Tax Litigation

Other key team members

Name Office Practice area

Guilherme Peixoto Brazil Tax Litigation

Other firms advising on the matter and their role(s)

Firm name Role details Advising (specify the

firm/company/individual advised)

n/a

Start date End date

Ongoing

Please mark anything confidential (not for publication) in red

Publishable matter 5

Name of client Industry sector

Santa Clara Distribuidora Steel Company

Matter description

Since its foundation, the company has been consolidating its position as one of the largest long

steel players in the state of Minas Gerais. Over time, it has been consolidating its brand, for the

careful selection of its suppliers and for the constant development and diversification of its

product line, reaching today the point of offering intelligent solutions for the civil construction and

farming sectors.

The company has robust Distribution and Logistics Center, based in Contagem/MG, in order to

house the Group's new industrial park with a focus on providing services, especially cutting,

folding, and assembly. All this aiming at being a national reference, with world class, in

distribution of products for civil construction, agriculture and cattle-raising, and as a service

center.

Our office assists the company in issues involving the structuring of tax planning and the recovery

of PIS and COFINS tax credits, bringing significant financial results to the company.

Deal value R$ 5.000.000,00 aprox.

Was it cross-border?

Jurisdiction

no

Lead partner(s)

Name Office Practice area

Eduardo Arrieiro Brazil Tax Non Contentious

Other key team members

Name Office Practice area

Guilherme Peixoto Brazil Tax Non Contentious

Other firms advising on the matter and their role(s)

Firm name Role details Advising (specify the

firm/company/individual advised)

no

Start date End date

Current ongoing

Please mark anything confidential (not for publication) in red

Publishable matter 6

Name of client Industry sector

Aço Santa Clara Steel company

Matter description

Description about Aço Santa Clara is above. Read there.

Our office assists the company in litigious tax issues involving matters related to the fiscal war,

which, added together, reach the figure of R$ 20 million, approximately.

Deal value R$ 20 millões

Was it cross-border?

Jurisdiction

no

Lead partner(s)

Name Office Practice area

Eduardo Arrieiro Brazil Tax Litigation

Other key team members

Name Office Practice area

Guilherme Peixoto Brazil Tax Litigation

Other firms advising on the matter and their role(s)

Firm name Role details Advising (specify the

firm/company/individual advised)

no

Start date End date

Ongoing

Please mark anything confidential (not for publication) in red

Publishable matter 7

Name of client Industry sector

True Color Ltda. Pigment supplier

Matter description

The company has been operating in Brazil since 2003, supplying pigments for the paint, plastics,

textile and other markets. It is installed in an industrial condominium located in Atibaia, in the

state of São Paulo, in a modern commercial center with more than 2,000 m2.

It is a German capital company and currently represents and distributes with exclusivity in Brazil

products from distributors located in Asia and Europe.

Our firm has been advising the company, in the last years, on issues involving the revision of

transfer pricing control on the import of goods, as well as on its fiscal impacts on the income tax

legislation.

This work was an important tax compliance measure and allowed the company to avoid tax risks

arising from the complexity of the legislation regarding transfer pricing controls.

Deal value No estimate

Was it cross-border?

Jurisdiction

Yes. Germany and Hong Kong

Lead partner(s)

Name Office Practice area

Eduardo Arrieiro Brazil Tax Non Contentious

Other key team members

Name Office Practice area

n/a Brazil Tax Non Contentious

Other firms advising on the matter and their role(s)

Firm name Role details Advising (specify the

firm/company/individual advised)

n/a

Start date End date

ongoing

Publishable matter 8

Please mark anything confidential (not for publication) in red

Name of client Industry sector

DOX Brasil Indústria e Comércio Steel company

de Aços S/A

Matter description

DOX is one of the main industrial players in flat steel in Brazil, with estimated revenues of R$ 1.7

billion in 2021. It has commercial and industrial establishments in the states of Santa Catarina, Rio

de Janeiro, São Paulo, and Minas Gerais. Besides the industrial segment, the company

inaugurated its first retail store in Contagem/MG in 2022 and is finalizing the construction work to

inaugurate other units in São Paulo/SP and Campinas/SP by the second quarter of 2022.

Our firm assists the company in tax advisory matters, especially in issues related to obtaining ICMS

tax incentives and tax planning.

Since 2016 we had helped the company in more than R$100 million tax incentives.

Deal value Over R$ 100 million

Was it cross-border?

Jurisdiction

no

Lead partner(s)

Name Office Practice area

Eduardo Arrieiro Brazil Tax Non Contentious

Other key team members

Name Office Practice area

n/a Brazil Tax Non Contentious

Other firms advising on the matter and their role(s)

Firm name Role details Advising (specify the

firm/company/individual advised)

n/a

Start date End date

ongoing

Publishable matter 9

Please mark anything confidential (not for publication) in red

Name of client Industry sector

DOX Brasil Indústria e Comércio Steel company

de Aços S/A

Matter description

Description about DOX is in the case above.

We advised the company on an issue related to the ICMS tax owed to the State of Rio de Janeiro,

contesting demands concerning the payment of additional tax intended for the poverty fund and

the state fund for fiscal balance. The discussion is extremely relevant and has a significant

economic impact.

It is currently under discussion in the Court of Justice of the State of Rio de Janeiro. We are

sponsoring the client's interests from the very beginning of the discussion.

Deal value R$ 50.000.000,00

Was it cross-border?

Jurisdiction

no

Lead partner(s)

Name Office Practice area

Eduardo Arrieiro Brazil Tax Litigation

Other key team members

Name Office Practice area

Guilherme Peixoto Brazil Tax Litigation

Other firms advising on the matter and their role(s)

Firm name Role details Advising (specify the

firm/company/individual advised)

n/a

Start date End date

ongoing

Publishable matter 10

Please mark anything confidential (not for publication) in red

Name of client Industry sector

Associação Propagadora Esdeva religious

Matter description

Associação Propagadora Esdeva is the legal name of the Brazil North Province, BRN, of the

Congregation of the Divine Word, which is characterized as a religious congregation represented

and integrated by SVD priests and brothers. In Brazil, the SVD began its activities in the city of

Santa Leopoldina, Espirito Santo, on March 19, 1985, through religious, educational and assistance

works. Later, it extended its activities to several Brazilian states and established its headquarters

in Juiz de Fora, Minas Gerais, where it was constituted as a private legal entity, under the name of

"Sociedade Propagadora de Ciências e Artes".

In 1941 the association changed its name to "Sociedade Propagadora Esdeva". In 1995 the

headquarters of the Esdeva Propagating Society was transferred to the city of Belo Horizonte and

in 2004 it changed its name to "Esdeva Propagating Association".

Our office advised the Association in a lawsuit involving the collection of IPTU by the Federal

District and we obtained definitive success in the discussion, annulling the collection due to the

recognition of tax immunity.

This avoided an undue collection of more than R$ 2 million directly and at least R$ 20 million

indirectly.

Deal value R$ 22.000.000,00

Was it cross-border?

Jurisdiction

No

Lead partner(s)

Name Office Practice area

Eduardo Arrieiro Brazil Tax Litigation

Other key team members

Name Office Practice area

Guilherme Peixoto Brazil Tax Litigation

Other firms advising on the matter and their role(s)

Firm name Role details Advising (specify the

firm/company/individual advised)

Start date End date

Please mark anything confidential (not for publication) in red

March 2022

Publishable matter 11

Name of client Industry sector

LONAX Indústria de Lonas Plastic industry

Matter description

Lonax is the largest producer of plastic tarpaulins in Brazil. Founded in 2002 in the city of Sarzedo

(MG), it invests in the excellence of its products (ISO 9001 certification) and in good management

practices.

Our firm assists LONAX in tax issues involving direct and indirect taxes, especially by providing

consultancy in obtaining tax credits with significant impact on the reduction of the company's tax

burden.

We already won approx.. R$10mm in credit to this company. This is also a contentious work.

We defend the client's interests in relevant discussions involving the use of PIS/COFINS credits on

inputs used in the company's production activities. We have obtained favorable decisions in

lawsuits that assure a very relevant financial return for the company. This case is still in progress

now on the second instance.

Our assessment has been generating tax savings of approximately 100 thousand per month for

the client.

Deal value R$ 10.000.000,00 aprox.

Was it cross-border?

Jurisdiction

no

Lead partner(s)

Name Office Practice area

Eduardo Arrieiro Brazil Tax

Other key team members

Name Office Practice area

n/a

Other firms advising on the matter and their role(s)

Firm name Role details Advising (specify the

firm/company/individual advised)

n/a

Please mark anything confidential (not for publication) in red

Start date End date

Currently ongoing

Publishable matter 12

Name of client Industry sector

LOGINVEST Investment fund

Matter description

LOGINVEST FUNDO DE INVESTIMENTO IMOBILIÁRIO INDUSTRIAL is a real estate investment fund

constituted as a closed-end condominium in accordance with Law 8.668/1993 and CVM

Instruction 472/2008, as amended. Its purpose is to invest in industrial properties.

Our firm has advised the FII and its shareholders on tax issues involving questions from the

Brazilian IRS regarding income tax. In this case, we are defending the taxpayer against an

assessment notice issued by the IRS, which accuses the client of having engaged in abusive tax

planning with the purpose of not paying income tax on rents received.

However, we are demonstrating the full legality of the operations, especially the structure of the

Real Estate Fund, formed years ago and in strict legal terms.

Deal value R$ 5.000.000,00 aprox.

Was it cross-border?

Jurisdiction

no

Lead partner(s)

Name Office Practice area

Eduardo Arrieiro Brazil Tax Litigation

Other key team members

Name Office Practice area

n/a Brazil Tax Litigation

Other firms advising on the matter and their role(s)

Firm name Role details Advising (specify the

firm/company/individual advised)

n/a

Start date End date

Ongoing

Please mark anything confidential (not for publication) in red

Publishable matter 13

Name of client Industry sector

VDF Distribuidora de Alimentos Food company

Matter description

We assist the client in lawsuits seeking the annulment of illegal confessions of tax debts with the

State of Minas Gerais, related to ICMS debts.

Our work consists in annulling the debts in instalments, due to the defects that occurred in the

confession of debts and in the instalment plan of the debts.

We have obtained favourable decisions in the first degree of jurisdiction, ruling out the

requirements and bringing great financial returns to the company.

Deal value R$ 5.000.000,00

Was it cross-border?

Jurisdiction

No

Lead partner(s)

Name Office Practice area

Eduardo Arrieiro Brazil Tax Litigation

Other key team members

Name Office Practice area

Guilherme Peixoto, Ana Brazil Tax Litigation

Brandão

Other firms advising on the matter and their role(s)

Firm name Role details Advising (specify the

firm/company/individual advised)

N/A

Start date End date

Ongoing

Please mark anything confidential (not for publication) in red

Publishable matter 14

Name of client Industry sector

COOPERCON – COOPERATIVA

DE TRABALHO MÉDICO

Matter description

We assisted the client in the defense against the tax assessment notice issued by the Brazilian

Federal Revenue Service, which attributed to the Cooperative the practice of abusive tax planning,

consisting in the creation of legal entities for the provision of medical services.

More than 100 tax assessment notices were issued due to the disregard of the legal entity of the

companies. However, through our defense, we have been successful in demonstrating the legality

of the procedures adopted by the client.

We are assisting the client's interests from the very beginning of the discussion.

Deal value R$ 25.000.000,00

Was it cross-border?

Jurisdiction

No

Lead partner(s)

Name Office Practice area

Eduardo Arrieiro Brazil Tax Litigation

Other key team members

Name Office Practice area

N/A Brazil Tax Litigation

Other firms advising on the matter and their role(s)

Firm name Role details Advising (specify the

firm/company/individual advised)

N/A

Start date End date

Ongoing

Please mark anything confidential (not for publication) in red

Non-publishable matter 15

Name of client Industry sector

Major supplier of biofuel

Matter summary

A task force composed of the Minas Gerais Public Prosecutor's Office, the State Revenue Service

and the Civil Police launched an operation on July 5, 2022, to combat an alleged criminal

organization focused on tax evasion and money laundering crimes in the biodiesel sector in Minas

Gerais.

According to the investigation, a group of companies used front companies in other states to

simulate sales operations of goods to Minas Gerais. The main objective of this scheme was to

generate ICMS tax credits in favor of the companies of the investigated economic group.

According to the accusations, the companies of the group failed to collect more than R$ 240

million from the coffers of Minas Gerais.

Our firm has been advising the group, with the purpose of demonstrating the illegality of the

accusations and the full regularity of the operations carried out.

Link to press coverage:

www.mpmg.mp.br/portal/menu/comunicacao/noticias/deflagrada-operacao-contra-grupo-que-

sonegou-mais-de-r-240-milhoes-de-icms-em-minas-gerais-

8A9480677FFE6C980181CE2130CB7414-00.shtml

g1.globo.com/mg/minas-gerais/noticia/2022/07/05/mp-receita-estadual-e-policia-civil-fazem-

forca-tarefa-para-combater-empresas-suspeitas-de-sonegar-mais-de-r-240-milhoes-em-

icms.ghtml

www.otempo.com.br/cidades/mpmg-mirou-quadrilha-que-provovou-prejuizo-de-r-240-mi-

sonegando-icms-em-mg-1.2694108

Deal value R$ 240 milhões

Was it cross-border?

Jurisdiction

No

Lead partner(s)

Name Office Practice area

Eduardo Arrieiro Brazil Tax Litigation

Other key team members

Please mark anything confidential (not for publication) in red

Name Office Practice area

Other firms advising on the matter and their role(s)

Firm name Role details Advising (specify the

firm/company/individual advised)

n/a

Start date End date

Ongoing

Please mark anything confidential (not for publication) in red

You might also like

- Chambers TaxLitigation NMK Legal500Document27 pagesChambers TaxLitigation NMK Legal500barbara.milatoNo ratings yet

- Constructionline GOLD Checklist - RemovedDocument6 pagesConstructionline GOLD Checklist - Removedamirice70No ratings yet

- Chambers TaxNon-Contentious Arrieiropapini 2023Document22 pagesChambers TaxNon-Contentious Arrieiropapini 2023barbara.milatoNo ratings yet

- Legal500 RealEstate Viseu 2024 ChambersDocument23 pagesLegal500 RealEstate Viseu 2024 Chambersbarbara.milatoNo ratings yet

- How Can I Open A Stripe Account in India - Stripe - Help & SupportDocument9 pagesHow Can I Open A Stripe Account in India - Stripe - Help & SupporttchebroleNo ratings yet

- How Do I Start Making My Business Legal?Document17 pagesHow Do I Start Making My Business Legal?Rey Nerius CalooyNo ratings yet

- Export InfoDocument9 pagesExport InfoRyhan SaifiNo ratings yet

- PVT LTD Co. Reg - EntersliceDocument9 pagesPVT LTD Co. Reg - EntersliceVinod KumarNo ratings yet

- SOP RM08 - L4 - BP - Compliance - QuestionnaireDocument4 pagesSOP RM08 - L4 - BP - Compliance - Questionnairebal sinNo ratings yet

- LegalDocument32 pagesLegalAkriti SinghNo ratings yet

- Business Plan: Legal Practise ManagementDocument10 pagesBusiness Plan: Legal Practise ManagementAnn KamauNo ratings yet

- Partnership BusinessDocument5 pagesPartnership BusinessFaiq AlekberovNo ratings yet

- Legal Requirments of Business ManagementDocument42 pagesLegal Requirments of Business ManagementAasi RaoNo ratings yet

- Faqs Regarding SFM Offshore Company FormationDocument10 pagesFaqs Regarding SFM Offshore Company FormationInition TechnologyNo ratings yet

- Checklist and Data For Your AccountantDocument8 pagesChecklist and Data For Your Accountantmecc2No ratings yet

- Are You Thinking Of: Working For Yourself?Document12 pagesAre You Thinking Of: Working For Yourself?talonisNo ratings yet

- PSI For BusinessDocument60 pagesPSI For BusinesstmsaniNo ratings yet

- EXD - Form A9 - 02MAY2022-Grayscale PDFDocument1 pageEXD - Form A9 - 02MAY2022-Grayscale PDFdindi genilNo ratings yet

- Partnership BusinessDocument4 pagesPartnership BusinessQueenel MabbayadNo ratings yet

- Brief Profile: Tax24.in, Tax24 Advisory ServicesDocument7 pagesBrief Profile: Tax24.in, Tax24 Advisory Servicessushil KumarNo ratings yet

- Bounce Back Loan Scheme Application FormDocument6 pagesBounce Back Loan Scheme Application FormjamNo ratings yet

- Supplier Questionnaire & Code of Conduct - For ENTITIE2Document7 pagesSupplier Questionnaire & Code of Conduct - For ENTITIE2Zubair ChishtiNo ratings yet

- Supplier Due DiligenceDocument18 pagesSupplier Due Diligenceshane.ramirez1980No ratings yet

- Partnership Public or Private Limited Company Sole Proprietorship How To Incorporate?Document15 pagesPartnership Public or Private Limited Company Sole Proprietorship How To Incorporate?kalidasdurgeNo ratings yet

- Plusius - Io - Airwallex EDD FormDocument13 pagesPlusius - Io - Airwallex EDD FormRicha GujjarNo ratings yet

- Steps Followed in Establishing A Home Furnishing Unit/ Design StudioDocument5 pagesSteps Followed in Establishing A Home Furnishing Unit/ Design StudioshashikantshankerNo ratings yet

- Financial Conducts AuthorityDocument6 pagesFinancial Conducts AuthorityIsaac AtterNo ratings yet

- Business Plan Template v4 01092009Document13 pagesBusiness Plan Template v4 01092009Flloyd JardelezaNo ratings yet

- BusinessDocument4 pagesBusinessYhamNo ratings yet

- The Exit Planning Questionnaire: The First Step To Exiting Your Business On Your TermsDocument34 pagesThe Exit Planning Questionnaire: The First Step To Exiting Your Business On Your Termsabhijit duttaNo ratings yet

- RCCA Firm Profile June 2012Document2 pagesRCCA Firm Profile June 2012pave.scgroupNo ratings yet

- Temporary Vendor Registration Form GST Coc WBPDocument15 pagesTemporary Vendor Registration Form GST Coc WBPrashidnyouNo ratings yet

- DD Questionnaire ProviderDocument5 pagesDD Questionnaire ProviderIssam ZouariNo ratings yet

- Limited - Limited Liability PartnershipDocument14 pagesLimited - Limited Liability PartnershipGossy JoshuaNo ratings yet

- Save Cost, Save Time and Increase Profit: To, Business Partner OfferDocument2 pagesSave Cost, Save Time and Increase Profit: To, Business Partner Offermohammedakbar88No ratings yet

- Compliance Questionnaire GDMal April 2011 v.1Document7 pagesCompliance Questionnaire GDMal April 2011 v.1Alexender PearceNo ratings yet

- Self-Employed: Set Up As A Sole TraderDocument2 pagesSelf-Employed: Set Up As A Sole TraderKecskeméty BoriNo ratings yet

- Canada Difference CorporationDocument8 pagesCanada Difference CorporationDayarayan CanadaNo ratings yet

- Regulatory and Government PolicyDocument4 pagesRegulatory and Government PolicySUJIT SONAWANENo ratings yet

- HOME Managing A Business Taxes Taxation of Partnership FirmsDocument3 pagesHOME Managing A Business Taxes Taxation of Partnership FirmsKushagradhi DebnathNo ratings yet

- Newsletter Online VAT Registration Portal v2 PDFDocument3 pagesNewsletter Online VAT Registration Portal v2 PDFNils VanhasselNo ratings yet

- Sales Tax RegistrationDocument11 pagesSales Tax RegistrationLegalRaastaNo ratings yet

- Accounting Fees 2023Document12 pagesAccounting Fees 2023processingNo ratings yet

- TRADEMARK PROPOSAL-6.5k PDFDocument5 pagesTRADEMARK PROPOSAL-6.5k PDFNitin DabholkarNo ratings yet

- How To Register A Sole Proprietor Business in The Philippines?Document23 pagesHow To Register A Sole Proprietor Business in The Philippines?Lei Anne MirandaNo ratings yet

- LBA 1 Compilation of All The Notes.Document19 pagesLBA 1 Compilation of All The Notes.Lisa NNo ratings yet

- BNR Process No NotesDocument52 pagesBNR Process No NotesShaina Shields Quiaoit BasilioNo ratings yet

- Donations Form Jan 2020Document10 pagesDonations Form Jan 2020Becky AntoinetteNo ratings yet

- Forms of Business OrganisationDocument18 pagesForms of Business OrganisationAyushi Dodhia100% (1)

- A To Z Group of Companies ProfileDocument29 pagesA To Z Group of Companies Profileroopesh_1986No ratings yet

- BK Dass ProfileDocument9 pagesBK Dass ProfileShreyas ShrivastavaNo ratings yet

- Association of PersonsDocument18 pagesAssociation of PersonsNadeem AhmadNo ratings yet

- New Compliance ReportsDocument1 pageNew Compliance ReportsJomar TenezaNo ratings yet

- The 4 Major Business Organization FormsDocument6 pagesThe 4 Major Business Organization FormsReno EstrelonNo ratings yet

- Start Up GuideDocument13 pagesStart Up GuideYash GangwaniNo ratings yet

- STEPSDocument35 pagesSTEPSRochel HatagueNo ratings yet

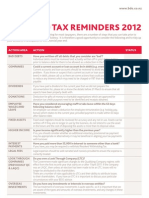

- Year-End Tax Reminders 2012: Action Area Action StatusDocument2 pagesYear-End Tax Reminders 2012: Action Area Action Statusapi-129279783No ratings yet

- Orientation Booklet: I-Law Chambers LLCDocument13 pagesOrientation Booklet: I-Law Chambers LLCLow YiShuNo ratings yet

- Haldiram Application Form DistributorshipDocument13 pagesHaldiram Application Form Distributorshipvarun p.v100% (2)

- Civil Procedure Code Ta5aDocument2 pagesCivil Procedure Code Ta5aSubramaniamNo ratings yet

- People of The Philippines Vs Yu HaiDocument2 pagesPeople of The Philippines Vs Yu HaiClifford ParishNo ratings yet

- Criminal Revisison Petition Format - VIPDocument3 pagesCriminal Revisison Petition Format - VIPknkmurali100% (2)

- Case Digest: Bonifacio Et Al., Vs RTC Makati and Jessie John Gimenez GR No 184800Document2 pagesCase Digest: Bonifacio Et Al., Vs RTC Makati and Jessie John Gimenez GR No 184800Wresen AnnNo ratings yet

- Transcription of Videotaped Deposition of Ryan Anderson BellDocument99 pagesTranscription of Videotaped Deposition of Ryan Anderson BellMike LinNo ratings yet

- 680 Home Appliances, Inc. v. CA, September 29, 2014 DIGESTDocument3 pages680 Home Appliances, Inc. v. CA, September 29, 2014 DIGESTAprilNo ratings yet

- Legend Hotel (Manila) V Hernani RealuyoDocument3 pagesLegend Hotel (Manila) V Hernani RealuyoJohn YeungNo ratings yet

- Memorandum of Areement-Art GalleryDocument3 pagesMemorandum of Areement-Art GalleryJoanna Cruz GuerreroNo ratings yet

- N The Matter BetweenDocument43 pagesN The Matter BetweenVISHESHNo ratings yet

- Citibank v. SabenianoDocument2 pagesCitibank v. SabenianolividNo ratings yet

- 1544 - Jay Walker AcquittalDocument19 pages1544 - Jay Walker AcquittalWeld for BirminghamNo ratings yet

- G.R. No. 225035Document6 pagesG.R. No. 225035Joovs JoovhoNo ratings yet

- A 17 764030 W Case Appeal StatementDocument5 pagesA 17 764030 W Case Appeal StatementWeg OagNo ratings yet

- An Insight To Corporate Law Reform in MalaysiaDocument18 pagesAn Insight To Corporate Law Reform in MalaysiaDatuk BendaharaNo ratings yet

- Tripp Vs TeslaDocument28 pagesTripp Vs TeslaFred LamertNo ratings yet

- Pan Am Vs RapadasDocument12 pagesPan Am Vs RapadasChristopher Joselle MolatoNo ratings yet

- Basic Legal Ethics Chapter 1Document2 pagesBasic Legal Ethics Chapter 1Daniel Galzote100% (1)

- Understanding IMO Conventions, Resolutions and CircularsDocument15 pagesUnderstanding IMO Conventions, Resolutions and CircularsKunal Singh100% (2)

- J&D CourtProcedureDocument208 pagesJ&D CourtProcedureRobert GermanoNo ratings yet

- 02 Bengson III Vs HRETDocument6 pages02 Bengson III Vs HRETHiroshi CarlosNo ratings yet

- Koziol Files Federal Court Civil Rights Lawsuit, NYS Chief Justice & Others NamedDocument41 pagesKoziol Files Federal Court Civil Rights Lawsuit, NYS Chief Justice & Others NamedLeon R. Koziol100% (3)

- OBLBoard LawsuitDocument114 pagesOBLBoard LawsuitNye Lavalle100% (1)

- Estipona v. LobrigoDocument2 pagesEstipona v. LobrigoDGDelfin100% (1)

- Panchayati Raj System in IndiaDocument19 pagesPanchayati Raj System in IndiaShobhit Awasthi100% (2)

- Gonzales v. Court of AppealsDocument6 pagesGonzales v. Court of AppealsLi-an RodrigazoNo ratings yet

- Declaration Cum Indemnity Bond: Annexure 1Document3 pagesDeclaration Cum Indemnity Bond: Annexure 1RuchirNo ratings yet

- Levi Strauss v. Clinton Apparelle (IP Report)Document15 pagesLevi Strauss v. Clinton Apparelle (IP Report)Johney Doe100% (1)

- India Law JusticeDocument10 pagesIndia Law JusticeSudhanshu GuptaNo ratings yet

- Lloyds - Choice of Law, Choice of Jurisdiction and Service of SuitDocument5 pagesLloyds - Choice of Law, Choice of Jurisdiction and Service of SuitJose MNo ratings yet

- Joint Complaint For Absolute DivorceDocument6 pagesJoint Complaint For Absolute DivorceShelly Balsizer-McGeheeNo ratings yet