Professional Documents

Culture Documents

Bangladesh Financial Situation 2022

Uploaded by

jonhp125977Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bangladesh Financial Situation 2022

Uploaded by

jonhp125977Copyright:

Available Formats

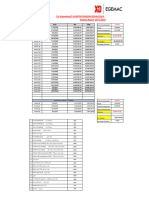

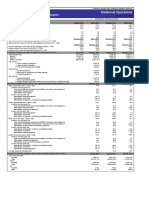

WEEKLY SELECTED ECONOMIC INDICATORS

Chief Economist's Unit

(Policy Support Wing)

12 October 2023

11 October 2022 30 June, 2023 27 September 2023 11 October 2023

1.

Foreign Exchange Reserve (In million US$) 36404.75 31202.98 26907.88 26849.75 21072.31(BPM6)

11 October 2022 26 June, 2023 27 September 2023 11 October 2023

2.

Interbank Taka-USD Exchange Rate (Average) 104.0436 108.3576 110.4900 110.5000

Call Money Rate 11 October 2022 26 June, 2023 27 September 2023 11 October 2023

3.

Weighted Average Rate ( in Percent) 5.79 6.18 6.67 7.38

Percentage change

Broad/Overall Share Price Index 11 October 2022 26 June, 2023 11 October 2023

From June, 2023 From June, 2022

4. @

a) Dhaka Stock Exchange (DSE) 6449.92 6332.52 6256.19 -1.21 1.14

b) Chittagong Stock Exchange (CSE) 19011.68 18710.32 18516.56 -1.04 1.52

September, 2022 July-Sept., FY23 September, 2023P July-Sept., FY24P FY2022-23

5. a) Wage Earners' Remittances (In million US$) 1539.60 5672.85 1343.66 4916.26 21610.73

b) Annual Percentage Change -10.84 4.89 -12.73 -13.34 2.75

August, 2022 July-August, FY23 August, 2023P July-August, FY24P FY2022-23

a) Import (C&F) (In million US$) 7375.30 13713.40 5247.60 10632.20 75061.60

b) Annual Percentage Change 11.96 16.92 -28.85 -22.47 -15.81

6. P P

August, 2022 July-August, FY23 August, 2023 July-August, FY24 FY2022-23

a) Import(f.o.b) (In million US$) 6826.00 12692.00 4871.00 9862.00 69495.00

b) Annual Percentage Change 11.99 16.96 -28.64 -22.30 -15.76

September, 2022 July-Sept, FY23 September, 2023P July-Sept, FY24P FY2022-23

7. a) Export (EPB) (In million US$)* 3905.07 12496.89 4310.33 13685.44 55558.77

b) Annual Percentage Change -48.88 13.38 10.37 9.51 6.67

July-August, FY23 July-August, FY24P FY 2022-23

8.

Current Account Balance (In million US$) -1464.0 1108.0 -3334.0

August, 2022 July-August, FY23 August, 2023P July-August, FY24P FY2022-23

9. a) Tax Revenue (NBR) (Tk. in crore) 22472.36 40293.45 25600.22 46201.67 331454.89

b) Annual Percentage Change 17.41 15.92 13.92 14.66 9.89

Investment in National Savings Certificates P P

August, 2022 July-August, FY23 August, 2023 July-August, FY24 FY2022-23

(Tk. in crore)

10.

a) Net sale 8.08 401.20 2312.33 5562.13 -3295.94

b) Total Outstanding 364411.33 364411.33 366276.33 366276.33 360714.19

Percentage change

August, 2022 June, 2023P August, 2023P

Aug'23 over Aug'22 Aug'23 over Jun'23 Aug'22 over Jun'22 FY2022-23

11.

a) Reserve Money (RM) (Tk. in crore) 341336.50 383585.20 351208.60 2.89 -8.44 -1.68 -4.67

b) Broad Money (M2) (Tk. in crore) 1710814.30 1887167.90 1876865.00 9.71 -0.55 0.16 -0.68

Total Domestic Credit (Tk. in crore) 1689522.10 1926769.20 1922567.70 13.79 -0.22 1.06 -0.34

a) Net Credit to the Govt. Sector 288427.40 387349.80 381879.60 32.40 -1.41 1.80 0.65

12.

b) Credit to the Other Public Sector 38616.80 45164.70 45431.40 17.65 0.59 3.81 -1.00

c) Credit to the Private Sector 1362477.90 1494254.70 1495256.70 9.75 0.07 0.83 -0.58

P

Percentage change

July-August, FY2022-23 July-August, FY2023-24

July-August, FY2023-24 FY 2022-23

L/C Opening and Settlement (million US$) Opening Settlement Opening Settlement Opening Settlement Settlement

a) Consumer Goods 1524.45 1246.89 926.11 1237.93 -39.25 -0.72 7722.24

b) Capital Machinery 488.19 752.52 381.81 490.40 -21.79 -34.83 3417.62

13.

c) Intermediate Goods 996.06 1006.78 798.72 868.08 -19.81 -13.78 5494.75

d) Petroleum 1968.93 2286.62 1529.19 1655.03 -22.33 -27.62 9372.96

e) Industrial Raw Materials 4519.29 5591.01 3270.06 3769.42 -27.64 -32.58 25807.62

f) Others 3354.95 4254.50 3614.82 3748.47 7.75 -11.89 20382.83

Total 11176.65

12851.87 11115.39

15138.32 13140.33

10520.71 11769.33 17.57 -18.14 #VALUE! #REF! -22.25 #VALUE! 72198.02

P

Total ofL/C

Rate duringon

Inflation (July-December )

the basis of Consumer Price Index June, 2021 December, 2021 June, 2022 September, 2022 December, 2022 March, 2023 June, 2023# August, 2023# September, 2023#

for National (Base:2005-06=100)

a) Twelve Month Average Basis 5.56 5.55 6.15 6.96 7.70 8.39 9.02 9.24 9.29

14. b) Point to Point Basis 5.64 6.05 7.56 9.10 8.71 9.33 9.74 9.92 9.63

Corresponding Period June, 2020 December, 2020 June, 2021 September, 2021 December, 2021 March, 2022 June, 2022 August, 2022 September, 2022

a) Twelve Month Average Basis 5.65 5.69 5.56 5.50 5.54 5.75 6.15 6.66 6.96

b) Point to Point Basis 6.02 5.29 5.64 5.59 6.05 6.22 7.56 9.52 9.10

Classified Loan December, 2020 June, 2021 December,2021 March,2022 June,2022 September,2022 December,2022 March,2023 June,2023

15. a) Percentage Share of Classified Loan 7.66 8.18 7.93 8.53 8.96 9.36 8.16 8.80 10.11

to Total Outstanding

b) Percentage Share of Net Classified Loan -1.18 -0.47 -0.43 -0.07 0.49 0.90 -0.08 0.30 1.58

Agricultural and Non-farm Rural Credit (Tk. in crore)

July,'22 August,'22 July-Aug., FY22 July,'23 August,'23p July-Aug., FY23p FY 2022-23 FY 2021-22 FY 2020-21

16. a) Disbursement ** 1664.77 2172.53 3837.30 1991.27 3316.99 5308.26 32829.89 28834.21 25511.35

b) Recovery 2045.80 2077.33 4123.13 2710.32 2540.26 5250.58 33010.09 27463.41 27123.90

c) Outstanding 50757.43 50235.40 50235.40 52361.91 53230.38 53230.38 52704.45 49802.28 45939.80

SME Loan (Tk. in crore) Jul.-Sep.'21-22 Oct.-Dec.'21-22P Jan-Mar.'21-22P Apr-Jun.'21-22P Jul-Sept.'22-23P Oct.-Dec.'22-23P Jan.-Mar.'22-23P FY 2021-22 FY 2020-21

17. a) Disbursement 42075.49 57118.60 51716.69 56484.26 51676.81 60611.61 49068.40 220489.37 173904.82

b) Outstanding 245325.67 252082.09 259704.21 271448.58 273906.60 282896.54 283236.32 271448.58 243074.82

Industrial Term Loan (Tk. in crore) Jul-Sep.'21-22 Oct-Dec.'21-22

P

Jan-Mar.'21-22

P

Apr-Jun.'21-22

P

Jul-Sept.'22-23

P

Oct-Dec.'22-23

P

Jan-Mar.'22-23

P

FY 2021-22 FY 2020-21

a) Disbursement 14834.23 18772.59 17340.49 21413.63 18562.45 29574.55 20907.65 72360.94 68765.25

18

b) Recovery 12979.47 18477.42 16572.97 16832.73 20610.17 50593.69 17899.36 64862.59 58488.71

c) Outstanding 303329.12 308918.45 310572.40 320410.22 328742.50 360051.14 383075.76 320410.22 315294.16

FY2014 -15 FY2015 -16 FY2016 -17N FY2017-18N FY2018-19N FY2019-20N FY2020-21N FY2021-22N FY2022-23NP

19.

GDP Growth Rate (in percent, Base: 2005-06=100) 6.55 7.11 6.59 7.32 7.88 3.45 6.94 7.10 6.03

#

Note: ** = About 15.17% of the target for Agricultural Credit disbursement has been achieved in the first two months of FY2023-24. P=Provisional, R=Revised, N= new base: 2015-16. =Base Index 2021-22 =100

@= DSE has been publishing Broad Index instead of General Index from 1st August, 2013.

*Revised according to the revised definition (Primary Commodities+Manufactured Commodoties) of Commodity exports by EPB.

You might also like

- Weekly Financial Report MarchDocument1 pageWeekly Financial Report MarchTareq AzizNo ratings yet

- SecindiDocument1 pageSecindimoidul ISLAMNo ratings yet

- Monthly Closure.Document1 pageMonthly Closure.Raj RathodNo ratings yet

- Updated Civil Progress Fo EqtesadiaDocument2 pagesUpdated Civil Progress Fo Eqtesadiakarimzakiiii019No ratings yet

- Msci World Consumer Staples Index Usd NetDocument3 pagesMsci World Consumer Staples Index Usd Nettech.otakus.studioNo ratings yet

- Untuk Kestabilan HayatiDocument3 pagesUntuk Kestabilan HayatiM Fahmi NNo ratings yet

- Bursa Malaysia Derivatives Monthly Newsletter-1Document2 pagesBursa Malaysia Derivatives Monthly Newsletter-1SamyakNo ratings yet

- Q1!5 F ETFsDocument108 pagesQ1!5 F ETFsDariana RamirezNo ratings yet

- BUMI InsiderDocument4 pagesBUMI InsiderHerdanang Ahmad FauzanNo ratings yet

- PDF Revised Final BMC Data 08.11.2023Document75 pagesPDF Revised Final BMC Data 08.11.2023V VizNo ratings yet

- 02 EnglishDocument7 pages02 EnglishMalaz.A.S MohamedNo ratings yet

- March 2022Document7 pagesMarch 2022Saiful IslamNo ratings yet

- ValueResearchFundcard ICICIPrudentialBalancedAdvantageFund 2017dec18Document4 pagesValueResearchFundcard ICICIPrudentialBalancedAdvantageFund 2017dec18santoshk.mahapatraNo ratings yet

- Indian Banker Feb 2023Document68 pagesIndian Banker Feb 2023akashNo ratings yet

- Msci India Domestic Large Cap Index Inr GrossDocument3 pagesMsci India Domestic Large Cap Index Inr Grossadcb704No ratings yet

- Fundcard: BNP Paribas Midcap FundDocument4 pagesFundcard: BNP Paribas Midcap FundChiman RaoNo ratings yet

- Msci India Domestic Mid Cap Index Inr GrossDocument3 pagesMsci India Domestic Mid Cap Index Inr Grossadcb704No ratings yet

- Financial Analysis of WSPsDocument3 pagesFinancial Analysis of WSPsAnju KarkiNo ratings yet

- ValueResearchFundcard CanaraRobecoEmergingEquitiesFund DirectPlan 2019mar04Document4 pagesValueResearchFundcard CanaraRobecoEmergingEquitiesFund DirectPlan 2019mar04ChittaNo ratings yet

- Schedule of Loan Application Payment 2021Document2 pagesSchedule of Loan Application Payment 2021Jobeth DaculaNo ratings yet

- Dados - de - Mercado - 2018Document11 pagesDados - de - Mercado - 2018Mrdonis AlvesNo ratings yet

- Msci World Index Usd PriceDocument3 pagesMsci World Index Usd PriceMario FighetosteNo ratings yet

- Msci Acwi Growth Index Usd GrossDocument3 pagesMsci Acwi Growth Index Usd GrossAbudNo ratings yet

- NewgenDocument2 pagesNewgenSubir BhuniaNo ratings yet

- Gmo Resources Strategy: FactsDocument2 pagesGmo Resources Strategy: FactsOwm Close CorporationNo ratings yet

- Portfolio ManagementDocument23 pagesPortfolio ManagementMUHAMMAD QASIMNo ratings yet

- UHI Review (Meeting Regarding ISDF)Document15 pagesUHI Review (Meeting Regarding ISDF)Muhammad AkhtrNo ratings yet

- Fundcard: Tata India Tax Savings FundDocument4 pagesFundcard: Tata India Tax Savings FundKrishnan ChockalingamNo ratings yet

- Abstract of Financial Commitmnet For The Package No.: MPUSIP 2BDocument4 pagesAbstract of Financial Commitmnet For The Package No.: MPUSIP 2Bsanju middyaNo ratings yet

- Homework - Project 2Document13 pagesHomework - Project 2Dươngg Thanh NhànNo ratings yet

- 14 12 23 Presentation by PWC On Regulatory Measures Towards Consumer Credit & Bank Credit To NbfcsDocument8 pages14 12 23 Presentation by PWC On Regulatory Measures Towards Consumer Credit & Bank Credit To NbfcssayalikNo ratings yet

- Msci Colombia Index NetDocument3 pagesMsci Colombia Index NetotmanjavierNo ratings yet

- Msci World Small Cap IndexDocument3 pagesMsci World Small Cap Indexodanodan84No ratings yet

- 2023 - NQS - April 27 - FinalDocument5 pages2023 - NQS - April 27 - FinalPaolo Angelo GutierrezNo ratings yet

- संचार िवभाग, क��ीय कायार्लय, एस.बी.एस.मागर्, मुंबई 400001 फोन/Phone 022-22660502 वेबसाइट ई-मेल emailDocument1 pageसंचार िवभाग, क��ीय कायार्लय, एस.बी.एस.मागर्, मुंबई 400001 फोन/Phone 022-22660502 वेबसाइट ई-मेल emailVasu Ram JayanthNo ratings yet

- Incident Report - July 2023 MCP Fish IncidentDocument4 pagesIncident Report - July 2023 MCP Fish IncidentCoastal Breeze NewsNo ratings yet

- X Creator Ad ShareDocument10 pagesX Creator Ad Sharekiller truongNo ratings yet

- Sector en Cifras Ingles Resumen JulioDocument19 pagesSector en Cifras Ingles Resumen JulioRomel Angel Erazo BoneNo ratings yet

- Cy 2024 Status of Farming Activities As of November 21, 2023Document20 pagesCy 2024 Status of Farming Activities As of November 21, 2023Mark Anthony LimboNo ratings yet

- Overdue Status 28-02-21Document3 pagesOverdue Status 28-02-21HarsimranSinghNo ratings yet

- Msci World Small Cap IndexDocument3 pagesMsci World Small Cap IndexrichardsonNo ratings yet

- Contoh Post-Employment Benefits 2021Document39 pagesContoh Post-Employment Benefits 2021Judiono JoemanaNo ratings yet

- MSCI Indonesia Index (USD)Document3 pagesMSCI Indonesia Index (USD)Frankie TseNo ratings yet

- MSCI Vietnam Index (USD)Document3 pagesMSCI Vietnam Index (USD)AlezNgNo ratings yet

- Marketing Plan: Demand & Supply Analysis Projected Demand Year of Operation Total Projected DemandDocument5 pagesMarketing Plan: Demand & Supply Analysis Projected Demand Year of Operation Total Projected DemandMaritess MunozNo ratings yet

- ValueResearchFundcard NiftyJuniorBeES 2010aug10Document6 pagesValueResearchFundcard NiftyJuniorBeES 2010aug10GNo ratings yet

- DownloadDocument3 pagesDownloadIsaac Adu MensahNo ratings yet

- ValueResearchFundcard PrincipalPersonalTaxSaver 2010nov09Document6 pagesValueResearchFundcard PrincipalPersonalTaxSaver 2010nov09ksrygNo ratings yet

- Varkry Banco Popular MayoDocument1 pageVarkry Banco Popular MayoJose Augusto Nuñez RamosNo ratings yet

- Msci India Index Inr GrossDocument3 pagesMsci India Index Inr GrossadityafantageNo ratings yet

- Msci Europe Real Estate Index Usd PriceDocument3 pagesMsci Europe Real Estate Index Usd Pricesoraya7560No ratings yet

- StockDocument4 pagesStockManan GuptaNo ratings yet

- MSCI China Index (USD) : Cumulative Index Performance - Gross Returns (Usd) (FEB 2007 - FEB 2022) Annual Performance (%)Document3 pagesMSCI China Index (USD) : Cumulative Index Performance - Gross Returns (Usd) (FEB 2007 - FEB 2022) Annual Performance (%)testNo ratings yet

- ValueResearchFundcard CanaraRobecoEquityTaxSaver 2010dec27Document6 pagesValueResearchFundcard CanaraRobecoEquityTaxSaver 2010dec27Prakash SainiNo ratings yet

- 2023 Nqs Final 10 AugustDocument6 pages2023 Nqs Final 10 AugustMissy MiroxNo ratings yet

- Msci Indonesia Index NetDocument3 pagesMsci Indonesia Index NetMOCH IRFANNo ratings yet

- Sbots Wel-15-March-2024Document8 pagesSbots Wel-15-March-2024shakeelahmedNo ratings yet

- Data Series 2022 Sep 2022 AugDocument76 pagesData Series 2022 Sep 2022 AugKROS EffectsNo ratings yet

- Computational Modelling and Simulation of Aircraft and the Environment, Volume 1: Platform Kinematics and Synthetic EnvironmentFrom EverandComputational Modelling and Simulation of Aircraft and the Environment, Volume 1: Platform Kinematics and Synthetic EnvironmentNo ratings yet

- Elevator Speech 2Document1 pageElevator Speech 2api-405930625No ratings yet

- Microsoft Project Lab AssignmentDocument14 pagesMicrosoft Project Lab AssignmentSiddhartha KamatNo ratings yet

- Token Numbers List PDFDocument87 pagesToken Numbers List PDFParkashNo ratings yet

- Economics 1st Edition Acemoglu Test Bank DownloadDocument46 pagesEconomics 1st Edition Acemoglu Test Bank DownloadJohn Mader100% (23)

- Crafting and Executing Stratagy Chapter 5Document40 pagesCrafting and Executing Stratagy Chapter 5Asifkhan Khan50% (2)

- Kevin Byun's Q1 2010 Denali Investors LetterDocument9 pagesKevin Byun's Q1 2010 Denali Investors LetterThe Manual of IdeasNo ratings yet

- INB301 - Assignement-01 - Case Study On Globalization - 09.10.2023Document6 pagesINB301 - Assignement-01 - Case Study On Globalization - 09.10.2023Shabbir AhmedNo ratings yet

- GBP Statement: Beatriz Manchado FloresDocument2 pagesGBP Statement: Beatriz Manchado Floresmr.laravelNo ratings yet

- High Five Prospectus 050108Document100 pagesHigh Five Prospectus 050108Steve KravitzNo ratings yet

- GBI Certification Application Form For Existing Buildings V1.2Document2 pagesGBI Certification Application Form For Existing Buildings V1.2ickankekekNo ratings yet

- USA Today September 13 2017 PDFDocument28 pagesUSA Today September 13 2017 PDFBoki VaskeNo ratings yet

- Contract of LeaseDocument2 pagesContract of LeaseLetty Tamayo100% (1)

- 2019 - Irs - Oid TableDocument141 pages2019 - Irs - Oid Table2PlusNo ratings yet

- CVT Apr.06E A4-1Document2 pagesCVT Apr.06E A4-1Thang Nguyen HuuNo ratings yet

- Third Inaugural Remarks of Mayor William ManziDocument5 pagesThird Inaugural Remarks of Mayor William ManziNoahBombardNo ratings yet

- Skoda AutoDocument5 pagesSkoda AutoshanNo ratings yet

- Lecture Notes Unit 1 2014Document8 pagesLecture Notes Unit 1 2014Peter Jean-jacquesNo ratings yet

- LRPS-2021-9170371 Sum e Inst Film Protector TermicoDocument44 pagesLRPS-2021-9170371 Sum e Inst Film Protector TermicoMarcos DavilaNo ratings yet

- Attraction Inequality and The Dating Economy - QuilletteDocument7 pagesAttraction Inequality and The Dating Economy - Quilletteapi-486381071No ratings yet

- PE Issues PPT MR Hiresh WadhwaniDocument10 pagesPE Issues PPT MR Hiresh WadhwanimonaNo ratings yet

- Fishwealth Canning v. CIRDocument1 pageFishwealth Canning v. CIRRia Kriselle Francia PabaleNo ratings yet

- Elements-Of Money FinancesDocument2 pagesElements-Of Money FinancesMayte DeliyoreNo ratings yet

- Economic Bubbles British English Teacher BW PDFDocument10 pagesEconomic Bubbles British English Teacher BW PDFIwona DudekNo ratings yet

- Industrialisation and De-Industrialisation in IndiaDocument15 pagesIndustrialisation and De-Industrialisation in IndiaJanhavi ShahNo ratings yet

- Practice Question - Absorption & Variable Costing - May 2015Document8 pagesPractice Question - Absorption & Variable Costing - May 2015Muhammad Ali MeerNo ratings yet

- Historical Development of Cost AccountingDocument9 pagesHistorical Development of Cost AccountingBabasab Patil (Karrisatte)No ratings yet

- Investment Banking UnderwritingDocument25 pagesInvestment Banking UnderwritingGaurav GuptaNo ratings yet

- Master Plan For The Conservation and Sustainable Management of Water Catchment Areas in KenyaDocument189 pagesMaster Plan For The Conservation and Sustainable Management of Water Catchment Areas in KenyaEka Sukma AdityaNo ratings yet

- Account Number: Abdu Arya 911 Turnpike RD Claxton Ga 30417 Office Serving You M1 FinanceDocument2 pagesAccount Number: Abdu Arya 911 Turnpike RD Claxton Ga 30417 Office Serving You M1 FinanceAbdu AryaNo ratings yet

- Kalvium Campus Details AY 23-24Document7 pagesKalvium Campus Details AY 23-24Manikandan SundaramNo ratings yet