Professional Documents

Culture Documents

Commission Notes

Uploaded by

ivanjade627Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Commission Notes

Uploaded by

ivanjade627Copyright:

Available Formats

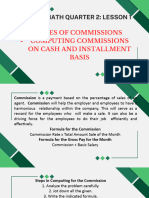

Business Mathematics Quarter 2: Module 1

Lesson 1: Commissions

Commission is paid to an employee or company as an incentive to sell more. A commission is generally

a percentage of sales

Commissions are computed as a portion of the net sales. Some companies pay their salespeople based on

straight commissions. The pay of these salespeople is entirely based on the amount of their sales. No sales

means no pay.

Commission rates may be constant for all sales amounts or it may be a variable scaled on the amount of sales.

Types of Commissions

1. Straight commission – This is given when a person is paid a percentage (%) of sales only.

Examples:

a) A stock broker receives a commission of 7% for selling annuities to her clients.

If she sells ₱250,000, how much commission will she earn?

Solution: Since the stock broker receives 7% commission based on sales, she’ll earn:

250,000 × 0.07 = 17,500

Thus, the stock broker will earn ₱17,500 commission.

b) . Harry receives 30% commission on the appliances he sells. If he sells a TV for ₱17,000, a refrigerator for

₱20,000 and a heater for ₱22,000, how much does Harry make in commission?

Solution: Since Harry receives 30% commission based on sales, he’ll earn:

(17,000 + 20,000 + 22,000) × .3 = 17,700

Thus, the Harry will earn ₱17,700 commission.

2. Salary plus commission – This is exactly as it sounds, a person gets paid a salary and a % of sales.

Examples:

a) Christian works as a sales agent for a company and earns a basic monthly salary of ₱8,000 plus 5%

commission on all his sales. If he made total sales of ₱50,000 for the month, how much is his gross pay for the

month?

Solution:

₱50,000 × .05 = ₱2,500

₱2,500(commission) + ₱8,000(salary) = ₱10,500

Thus, the Christian will earn ₱10,500 salary and commission.

b) Harry decides to work for another company that will pay him ₱17,500 per

week and 6% of any sales above ₱150,000. If he sold goods worth ₱284,400,

what is his gross pay?

Solution: ₱284,400 – ₱150,000 = ₱134,400

₱134,400 × 0.06 = ₱8,064 (Commission)

₱8,064(commission) + ₱17,500(salary) = ₱25,564

3. Graduated Commission – This is when percentage (%) changes based on how much someone sells

Examples:

a) Steve works for a company that pays him 1% on the first ₱250,000 sold, 2%

on the next ₱750,000 and 3% on all sales over ₱1,000,000. What is his gross

pay if he sells ₱1,250,000?

Solution: ₱250,000 × 0.01 = ₱2,500

₱1,250,000 – ₱250,000 = ₱1,000,000

₱750,000 × 0.02 = ₱15,000

₱1,000,000 – ₱750,000 = ₱250,000

₱250,000 × 0.03 = ₱7,500

Total: ₱2,500 + ₱15,000 + ₱7,500 = ₱25,000

Thus, Steve will receive a total of ₱25,000 as his commission

Cash vs. Installment

a. Computing Commissions on Cash Basis – This type of commission is

similar to computing straight commissions.

Example 1:

Kevin works at Luna’s watch store. For every cash purchase of a watch, he gets 6.1% commission. In a

particular month, he was able to sell 10 watches costing ₱8,000 each. How much was his total commission for

such cash sales?

Solution:

Total Sales = ₱18,000/watch × 10 watches = ₱180,000

Cash commission = ₱180,000 × 6.1% = 180,000 × 0.061 = 10,980

Thus, Kevin’s total commission is ₱10,980.

b. Commission on Installment Basis – commission is computed based on partial payments upon the agreed

installment method.

Example 2:

At Luna’s store, some items are paid on installment basis through credit cards. Kevin was able to sell 10

watches costing ₱18,000 each. Each transaction is payable in 6 months divided into 6 equal installments

without interest. Kevin gets 2% commission on the first month for each of the 10 watches. Commission

decreases by 0.3% every month thereafter and computed on the outstanding balance for the

month. How much commission does Mike receive on the first month? On the second month? Third? Fourth?

Fifth? Sixth month? At the end of installment period, how much will be his total commission?

Solution:

First month commission: ₱18,000/watch × 10 watches × 0.02 = ₱3,600

Second month commission: ₱15,000/watch × 10 watches × (0.02 – 0.003)= ₱2,550

Third month commission: ₱12,000/watch × 10 watches × (0.017 – 0.003) =₱1,680

Fourth month commission: ₱9,000/watch × 10 watches × (0.014 – 0.003) =₱990

Fifth month commission: ₱6,000/watch × 10 watches × (0.011 – 0.003) =₱480

Sixth month commission: ₱3,000/watch × 10 watches × (0.008 – 0.003) =₱150

His total commission for six months is:

₱2,550 + ₱1,680 + ₱990 + ₱480 + ₱150 = ₱9,450.

Note: The base price of the watch is subtracted by 3,000 for each month since it was

stated in the problem that the price is will be paid in 6 equal payments. Thus

18,000/6 = 3,000.

THE DOWN PAYMENT

Down payment is an initial payment made when something is bought on credit.The down payment is a first

payment that one makes when one buys something with an agreement to pay the rest later.

How do we obtain the down payment?

Example#1:

When one purchases a car or any big item not through cash but installment terms, normally, a certain down

payment is required of the buyer. Car dealers normally require a minimum down payment, which is usually

20% of the total cost of the vehicle purchased. The interest on the remaining balance is then computed

depending on the number of years a buyer would want to amortize the remaining balance. If a car costs

₱1,000,000 and a minimum 20% down payment is required by the company, then the buyer will have an initial

cash out of ₱200,000; that is, 0.20 × 1,000,000 = 200,000. The remaining ₱800,000 will be amortized monthly

and the amount of monthly amortization depends on the number of years the buyer will want to pay the loan.

Normally, buyers prefer a 3-year or 5-year payment period. The lesser the number of years, the lesser the total

amount paid as interest to the loan. But with this arrangement, the monthly amortization will be considerably

higher

GROSS BALANCE

This refers to the total amount of money a bank has on deposit before adjusting for uncleared checks or

deposits, as well as reserve requirements. than when one chooses to pay the balance for longer number of

years.

CURRENT INCREASED BALANCE

This refers to the total amount you have to pay that includes penalties or interest incurred by unpaid balance

from a loan or payment you are supposed to have made but was not able to do so on time.

You might also like

- Incorporation of Companies BCLDocument19 pagesIncorporation of Companies BCLMinahil ImranNo ratings yet

- Interest & CommissionDocument18 pagesInterest & CommissionAndrea GalangNo ratings yet

- Teil 5 Foreclosure FraudDocument17 pagesTeil 5 Foreclosure FraudNathan BeamNo ratings yet

- Commissions and InterestsDocument8 pagesCommissions and InterestsAxl Fitzgerald Bulawan100% (1)

- Methods of Test For Concrete: Part 2: Tests Relating To The Determination of The Strength of ConcreteDocument45 pagesMethods of Test For Concrete: Part 2: Tests Relating To The Determination of The Strength of ConcreteStephen Dela CruzNo ratings yet

- 2.1 CommissionDocument28 pages2.1 CommissionAnali Barbon100% (1)

- The Passive Income BluePrint - How To Make Money While You SleepFrom EverandThe Passive Income BluePrint - How To Make Money While You SleepRating: 2.5 out of 5 stars2.5/5 (3)

- BUSINESS MATHEMATICS Lesson 4 IONDocument5 pagesBUSINESS MATHEMATICS Lesson 4 IONPurple. Queen95100% (2)

- BUSINESS MATHEMATICS 2ND QUARTER 2nd WEEK LESSON Lesson Commission On Cash Basis, Installment Basis, Downpayment, Gross Balance, Current BalanceDocument12 pagesBUSINESS MATHEMATICS 2ND QUARTER 2nd WEEK LESSON Lesson Commission On Cash Basis, Installment Basis, Downpayment, Gross Balance, Current BalanceDearla Bitoon100% (1)

- Vocabulary: Commission Commission RateDocument21 pagesVocabulary: Commission Commission RateBretana joanNo ratings yet

- Math 11 ABM Business Math Q2-Week 1Document17 pagesMath 11 ABM Business Math Q2-Week 1JESSA FERNANDEZNo ratings yet

- California Government Liability ActDocument5 pagesCalifornia Government Liability ActlegalremedyllcNo ratings yet

- Business Math - W2 - CommissionDocument5 pagesBusiness Math - W2 - Commissioncj100% (3)

- Nickel Ore Sales ContractDocument7 pagesNickel Ore Sales Contractchupenk86No ratings yet

- Bus Math11 Slo QTR2-WK 1 - 2Document5 pagesBus Math11 Slo QTR2-WK 1 - 2Alma Dimaranan-Acuña100% (1)

- Business Math 2nd Quarter Module #2Document34 pagesBusiness Math 2nd Quarter Module #2John Lloyd Regala100% (5)

- Batas Pambansa BLG 185Document2 pagesBatas Pambansa BLG 185Su Kings AbetoNo ratings yet

- Math 11-ABM Business Math-Q2-Week-1Document16 pagesMath 11-ABM Business Math-Q2-Week-1Flordilyn DichonNo ratings yet

- Bank of BarodaDocument2 pagesBank of BarodaSudhir SatyanarayanNo ratings yet

- Business Mathematics: For LearnersDocument12 pagesBusiness Mathematics: For LearnersJet Rollorata BacangNo ratings yet

- Commision BMATDocument4 pagesCommision BMATMylen Noel Elgincolin Manlapaz0% (1)

- Learning Activity Sheet ABM 11 Business Mathematics (Q2-WK1) CommissionDocument10 pagesLearning Activity Sheet ABM 11 Business Mathematics (Q2-WK1) CommissionArchimedes Arvie GarciaNo ratings yet

- Bus. Math Q2 - W1&W2Document7 pagesBus. Math Q2 - W1&W2DARLENE MARTINNo ratings yet

- Calculate Commission Earned on Various Sales AmountsDocument35 pagesCalculate Commission Earned on Various Sales Amounts귀여워gwiyowoNo ratings yet

- Q2 Week 2 Solving Problems InvolvingDocument24 pagesQ2 Week 2 Solving Problems InvolvingKeziah JemimaNo ratings yet

- Business Mathematics: Activity 1Document4 pagesBusiness Mathematics: Activity 1Mary Manzano Nool100% (2)

- Incorporation Engagement LetterDocument3 pagesIncorporation Engagement LetterRyan Dave Alutaya100% (1)

- Urban Bank Vs PenaDocument4 pagesUrban Bank Vs PenaMark JosephNo ratings yet

- Business Math Activity 1Document6 pagesBusiness Math Activity 1gabezarate071No ratings yet

- Business Mathematics Week 1Document24 pagesBusiness Mathematics Week 1Jewel Joy PudaNo ratings yet

- Business Mathematics: For LearnersDocument13 pagesBusiness Mathematics: For LearnersJet Rollorata BacangNo ratings yet

- Q2 1 BM CommissionDocument34 pagesQ2 1 BM CommissionAbbygail MatrizNo ratings yet

- Ommissions: Jerelyn C. Panis Aclc, Part - Time InstructorDocument15 pagesOmmissions: Jerelyn C. Panis Aclc, Part - Time InstructorBrenda PanyoNo ratings yet

- 8 - Interests CommissionsDocument46 pages8 - Interests Commissionsapi-267023512No ratings yet

- LAS For CommissionDocument6 pagesLAS For CommissionJazmin B. LemonerasNo ratings yet

- Business Mathematics: CommissionsDocument12 pagesBusiness Mathematics: CommissionsAki Angel100% (1)

- Business Math - Q2 - W1 - M1 - LDS - Commissions Down Payments Gross Balance and Current Increased BalanceCommissions - JRA RTPDocument8 pagesBusiness Math - Q2 - W1 - M1 - LDS - Commissions Down Payments Gross Balance and Current Increased BalanceCommissions - JRA RTPABMachineryNo ratings yet

- Activity Sheet Business Math Week 1 2 Quarter 2Document12 pagesActivity Sheet Business Math Week 1 2 Quarter 2Frantiska FartelióNo ratings yet

- Computing Commissions On Cash BasisDocument2 pagesComputing Commissions On Cash BasisSecnarfNo ratings yet

- Business Math Grade 12 Week 1Document1 pageBusiness Math Grade 12 Week 1jpauline922No ratings yet

- Business Math Lecture NotesDocument18 pagesBusiness Math Lecture NotesJean Marie LuposNo ratings yet

- Business-Mathematics Module-10 CommissionsDocument11 pagesBusiness-Mathematics Module-10 Commissionsjohnleegiba09No ratings yet

- Business Mathematics Week 2Document37 pagesBusiness Mathematics Week 2Jewel Joy PudaNo ratings yet

- BM Module 1 CommissionsDocument15 pagesBM Module 1 CommissionsHp laptop sorianoNo ratings yet

- q2 1 CommissionsDocument21 pagesq2 1 Commissionsromelyntumabiene3No ratings yet

- 3.6 Mortgages 3.7 Commission and OverridesDocument22 pages3.6 Mortgages 3.7 Commission and OverridesCamille CornelioNo ratings yet

- CommissionsDocument13 pagesCommissionsJannette RamosNo ratings yet

- CommissionsDocument21 pagesCommissionskristylabelidoNo ratings yet

- Commission CalculatorDocument4 pagesCommission CalculatorEmmanuel Villeja LaysonNo ratings yet

- Explore (As) : Types of Commission and InterestsDocument4 pagesExplore (As) : Types of Commission and InterestsTiffany Joy Lencioco GambalanNo ratings yet

- Commission and InterestsDocument5 pagesCommission and InterestsJade ivan parrochaNo ratings yet

- businessmath_lesson1_quarter2Document18 pagesbusinessmath_lesson1_quarter2Lynn DomingoNo ratings yet

- Commissions: Quarter Module 1Document19 pagesCommissions: Quarter Module 1Vhrill PenNo ratings yet

- CommissionDocument22 pagesCommissionBhea D. CruzNo ratings yet

- Business-Mathematics Module-10 CommissionsDocument4 pagesBusiness-Mathematics Module-10 CommissionsLovely Joy Hatamosa Verdon-DielNo ratings yet

- ABM Business - Mathematics 11 Week 1Document4 pagesABM Business - Mathematics 11 Week 1Dominic jarinNo ratings yet

- Business-Mathematics Grade11 Q2 Module1 Week1Document9 pagesBusiness-Mathematics Grade11 Q2 Module1 Week1hiNo ratings yet

- Most Essential Learning CompetenciesDocument6 pagesMost Essential Learning CompetenciesSymphony DiazNo ratings yet

- BusMath Q2 Mod10Document28 pagesBusMath Q2 Mod10Romeo CorporalNo ratings yet

- Commission ExplainedDocument3 pagesCommission ExplainedChristian VerdaderoNo ratings yet

- CommissionDocument44 pagesCommissionDivina Grace Rodriguez - LibreaNo ratings yet

- Finding Discount, Commission and InterestDocument17 pagesFinding Discount, Commission and InterestAiza MalondaNo ratings yet

- Reviewer - Business MathematicsDocument5 pagesReviewer - Business MathematicsJeff ToledoNo ratings yet

- CommissionDocument30 pagesCommissionVince Clifford VestalNo ratings yet

- Welcome To Business Math Class: Mr. Aron Paul San MiguelDocument14 pagesWelcome To Business Math Class: Mr. Aron Paul San MiguelPatrice Del MundoNo ratings yet

- Consumer ArithmeticDocument38 pagesConsumer ArithmeticalexNo ratings yet

- Life Can't Throw A Fast Ball: A Guide to Personal FinanceFrom EverandLife Can't Throw A Fast Ball: A Guide to Personal FinanceNo ratings yet

- 1207 1225Document8 pages1207 1225Dan DiNo ratings yet

- 91-12 CPAR Donors Tax (Batch 91) - HandoutDocument14 pages91-12 CPAR Donors Tax (Batch 91) - HandoutSmurf AccountNo ratings yet

- 8 - PHILAM Vs HEUNG-ADocument3 pages8 - PHILAM Vs HEUNG-AJuvial Guevarra BostonNo ratings yet

- An 170007Document4 pagesAn 170007Lummy82No ratings yet

- NLRB Production 4Document1,479 pagesNLRB Production 4Judicial Watch, Inc.No ratings yet

- 5 Jamer V NLRC G.R. No. 112630Document4 pages5 Jamer V NLRC G.R. No. 112630JunNo ratings yet

- Cisg and UnidroitDocument7 pagesCisg and UnidroitRoxanaT22No ratings yet

- Motor Insurance - Two Wheeler Liability Only: Certificate of Insurance Cum Policy ScheduleDocument3 pagesMotor Insurance - Two Wheeler Liability Only: Certificate of Insurance Cum Policy Schedulepraful rayappanavarNo ratings yet

- Importatnt Case Laws in Valuation-3-42Document40 pagesImportatnt Case Laws in Valuation-3-42officialmailarun123No ratings yet

- Legal Aspect of BusinessDocument146 pagesLegal Aspect of Businesssumitkjham100% (1)

- Core Word List For Unit 8Document7 pagesCore Word List For Unit 8jeruskaNo ratings yet

- International Commercial Terms INCOTERMSDocument21 pagesInternational Commercial Terms INCOTERMSProf S P GargNo ratings yet

- 4 Tort Law 2017.2018Document22 pages4 Tort Law 2017.2018Constantin LazarNo ratings yet

- To sell agricultural land in the PhilippinesDocument3 pagesTo sell agricultural land in the PhilippinesHarrison RigorNo ratings yet

- Template For Law StudentsDocument4 pagesTemplate For Law StudentsAron PanturillaNo ratings yet

- ARISTOTEL VALENZUELA y NATIVIDAD vs. PEOPLE OF THE PHILIPPINESDocument2 pagesARISTOTEL VALENZUELA y NATIVIDAD vs. PEOPLE OF THE PHILIPPINESalltimedeeerpNo ratings yet

- A Life Insurance Policy May Pass by Transfer, Will or Succession To Any Person, Whether He Has Insurable Interest or NotDocument2 pagesA Life Insurance Policy May Pass by Transfer, Will or Succession To Any Person, Whether He Has Insurable Interest or NotJan Kenrick SagumNo ratings yet

- Contract Memo Final..Document12 pagesContract Memo Final..Shubham Brijwani100% (1)

- Right Under Garnishee OrderDocument16 pagesRight Under Garnishee OrderTeja RaviNo ratings yet

- Phil-Am v. Ramos, February 28, 1966, 16 SCRA 298Document2 pagesPhil-Am v. Ramos, February 28, 1966, 16 SCRA 298Wella BrazilNo ratings yet

- Ministry of Corporate Affairs - MCA ServicesDocument1 pageMinistry of Corporate Affairs - MCA Servicesakhil kwatraNo ratings yet