Professional Documents

Culture Documents

Maf201 - Test 2 - Jan2023 - Q

Uploaded by

sajidah0703Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Maf201 - Test 2 - Jan2023 - Q

Uploaded by

sajidah0703Copyright:

Available Formats

CONFIDENTIAL AC/JAN2023/MAF201

UNIVERSITI TEKNOLOGI MARA

TEST 2

COURSE : COST AND MANAGEMENT ACCOUNTING 1

COURSE CODE : MAF201

EXAMINATION : JANUARY 2023

TIME : 1 HOUR 30 MINUTES

INSTRUCTIONS TO CANDIDATES

1. This question paper consists of TWO (2) parts: PART A (8 MC Questions)

PART B (2 Questions)

2. Answer ALL questions in English.

3. Do not bring any material into the examination room unless permission is given by the

invigilator.

DO NOT TURN THIS PAGE UNTIL YOU ARE TOLD TO DO SO

This test paper consists of 5 printed pages

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 2 AC/JAN2023/MAF201

PART A

MULTIPLE CHOICE QUESTIONS

(One mark for each question)

1. The break-even point is where total sales equal total variable costs.

A. True

B. False

2. For purposes of CVP analysis, mixed costs must be classified into their fixed and variable

elements.

A. True

B. False

3. A CVP income statement shows contribution margin instead of gross profit.

A. True

B. False

4. Budgetary control system acts as a guide to the:

A. Management

B. Employees

C. Shareholders

D. Creditors

5. Which of the following is not objective of budgetary control process?

A. To define the goals of the organisation

B. To coordinate different department or sub-units

C. To establish a system of planning and control

D. To help in fixation of selling price

6. The basic difference between a flexible budget and fixed budget is that a fixed budget:

A. Is concerned with fixed expenses whereas flexible budget is on different activity levels

B. Cannot be changed whereas flexible budget can easily be changed

C. Is a budget for single measure of activity whereas flexible budget is on different activity

levels

D. None of the above

7. Regarding the sales budget, which of the following statements is incorrect:

A. Sales budget is a functional budget

B. Sales budget is based on production budget

C. Usually the sales budget is stated in terms of quantity and value

D. Starting point of the development of master budget is preparation of sales budget

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 3 AC/JAN2023/MAF201

8. While preparing a cash budget which of the following items would not be included?

A. Cash sales

B. Gain on disposal of fixed assets

C. Receipt of interest and dividends from investments outside the business

D. Depreciation

(8 marks)

PART B

STRUCTURED QUESTIONS

QUESTION 1

Lovely Scents Sdn Bhd is a newly established perfume manufacturing company based in Dungun,

Terengganu. Currently the company is producing only one product called Lavender Bliss Perfume.

Below is the information regarding the costs and revenues incurred in producing 80,000 bottles of

Lavender Bliss Perfume in the current year:

RM

Sales revenue 9,600,000

Variable costs:

- Direct material 2,000,000

- Direct labour 1,600,000

- Production overhead 1,200,000

- Variable selling expenses is 10% of selling price per bottle

Fixed production overhead 1,500,000

Fixed selling expenses 800,000

Fixed administrative expenses 700,000

Required:

(Each question is to be treated independently)

a. Classify the current cost into:

i. Total variable cost per unit

ii. Total fixed cost for the year

(3 marks)

b. Determine for the current year:

i. The break-even point (in bottles and RM)

ii. The margin of safety (in bottles and RM)

iii. Number of bottles to be sold if the company plans to achieve a profit of RM648,000

(6 marks)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 4 AC/JAN2023/MAF201

c. The company's manager is proposing to repackage the perfume in a more attractive bottle

that may cause the company to incur additional direct expense of RM8 per bottle. In addition,

the manager expects advertisement cost to increase by RM250,000 and expected sales

increase by 25%. All other costs remain unchanged.

Based on the above proposal:

i. Compute the new break-even point (in bottles and RM)

ii. Advise the manager as to whether the proposal should be implemented or otherwise.

(Support your answer with the comparison of annual profits)

(6 marks)

d. In order to improve the company's performance, the manager proposes producing and selling

new products, Citrus Paradise Perfume and Sweet Jasmine Perfume, in addition to the

current production. The projected information related to the new proposed products is as

follows:

Citrus Paradise Perfume Sweet Jasmine Perfume

Selling Price (RM) 110 140

Variable Cost (RM) 65 87

The company plans to sell the products at the following sales mix:

Products Bottles to be sold

Lavender Bliss Perfume 80,000

Citrus Paradise Perfume 70,000

Sweet Jasmine Perfume 100,000

The introduction of the new products requires the company to revise its total fixed cost by

taking into consideration the following:

i. Fixed production overhead will increase by 10%

ii. Extra promotion cost of RM45,400

Required:

Advise whether the company should proceed with the new products to improve its

performance with reference to break-even point in bottles.

(7 marks)

(Total: 22 marks)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 5 AC/JAN2023/MAF201

QUESTION 2

Beauty Blossom Sdn Bhd is a company selling skin care products located in Kuala Terengganu.

One of the best-selling products is Blissful Face Serum. The company sells Blissful Face Serum for

RM100 per bottle.

The following data and estimates are available for you to prepare the cash budget for Beauty

Blossom Sdn Bhd for the fourth quarter of 2022.

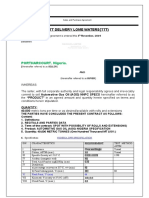

Particulars JUL AUG SEP OCT NOV DEC

Sales (RM) 190,000 220,000 70,000 100,000 130,000 98,000

Purchases (RM) 73,000 94,000 25,500 52,000 87,000 50,800

Overheads (RM) 30,000 35,000 32,000 33,600 31,000 32,000

Additional Information:

1. All purchases are made on credit and the payments are made two months after purchases.

2. 10% of sales are cash sales. 30% of credit sales are collected in the month after sales while

the remainder is collected in the following month.

3. Advertising expenses is 10% of the monthly sales and is paid as it is incurred.

4. Office expenses is 15% of the monthly sales and is paid as it is incurred.

5. Overheads include a monthly depreciation of motor van amounting RM10,000. There is a

one-month delay in the payments of overheads.

6. The company is expected to receive an interest on fixed deposit amounting to RM14,000 in

November 2022.

7. The company will receive dividends of RM21,000 which will be paid in three (3) equal

installments starting from October 2022.

8. Shop equipment will be replaced on 1 October 2022. The cost of the new shop equipment

will cost RM10,000. 10% cash deposit will be paid in October 2022 and the balance will be

paid in two (2) equal installments starting November 2022. The old shop equipment will be

sold at RM3,000.

9. Cash balance as at 30th September 2022 is RM20,000.

Required:

Prepare a Cash Budget for Beauty Blossom Sdn Bhd for the months of October, November and

December 2022.

(20 marks)

(Total: 20 marks)

END OF QUESTION PAPER

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

You might also like

- Management Accounting Exam Paper August 2012Document23 pagesManagement Accounting Exam Paper August 2012MahmozNo ratings yet

- Gropu 4 Quiz Expenditure CycleDocument4 pagesGropu 4 Quiz Expenditure Cyclerheazeenylaya16No ratings yet

- Marketing Strategy of PROCTER AND GAMBLE (P&G)Document69 pagesMarketing Strategy of PROCTER AND GAMBLE (P&G)Vishwas Mehta0% (1)

- 4a. Maf201 Fa - Jul2021 - Q Set1Document9 pages4a. Maf201 Fa - Jul2021 - Q Set1Natasha GabrielNo ratings yet

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- HRM732 Final Exam Review Practice Questions SUMMER 2022Document12 pagesHRM732 Final Exam Review Practice Questions SUMMER 2022Rajwinder KaurNo ratings yet

- TT T Delivery Lome Waters (TT T) : PORTHARCOURT. NigeriaDocument6 pagesTT T Delivery Lome Waters (TT T) : PORTHARCOURT. NigeriaABUBAKARNo ratings yet

- 3.5 ExercisesDocument13 pages3.5 ExercisesGeorgios MilitsisNo ratings yet

- Pathao-MIS205-Group-Project FinalDocument18 pagesPathao-MIS205-Group-Project FinalAmir Nahian100% (1)

- Maf201 Test 2 Jan 2023 QDocument5 pagesMaf201 Test 2 Jan 2023 Qediza adhaNo ratings yet

- Maf201 Test 2 July23Document5 pagesMaf201 Test 2 July232022624622No ratings yet

- Maf201 Test 2 Jan 2022 QDocument5 pagesMaf201 Test 2 Jan 2022 Qediza adhaNo ratings yet

- Maf201 Test 2 July 2021 QDocument4 pagesMaf201 Test 2 July 2021 Qediza adhaNo ratings yet

- Faculty - Accountancy - 2022 - Session 1 - Diploma - Maf251Document7 pagesFaculty - Accountancy - 2022 - Session 1 - Diploma - Maf251NUR FARISHA MOHD AZHARNo ratings yet

- Tax317 Ctmay2022Document10 pagesTax317 Ctmay2022sharifah nurshahira sakinaNo ratings yet

- TAX317 TEST Q Dec2021Document10 pagesTAX317 TEST Q Dec2021sharifah nurshahira sakinaNo ratings yet

- Universiti Teknologi Mara Final Assessment: Confidential 1 AC/FEB 2022/FAR560Document7 pagesUniversiti Teknologi Mara Final Assessment: Confidential 1 AC/FEB 2022/FAR560NURUL IRA SHAFINAZ ARMENNo ratings yet

- Assignment October BatchDocument3 pagesAssignment October BatchVimmal MysterioNo ratings yet

- Ukam3043 Management Accounting IiiDocument9 pagesUkam3043 Management Accounting IiiBay Jing TingNo ratings yet

- 2022 Dec Maf651 Test Q RevisedDocument3 pages2022 Dec Maf651 Test Q RevisedTVN àdraNo ratings yet

- Far570 SoalanDocument7 pagesFar570 SoalanNURUL NAZAHANNIE MOHAMAD NAJIBNo ratings yet

- Mock Exam Paper For Accounting - MBADocument14 pagesMock Exam Paper For Accounting - MBARasanjaliGunasekeraNo ratings yet

- BAC 4254 Exam QuestionsDocument10 pagesBAC 4254 Exam Questionsdarshini mariappanNo ratings yet

- Tutorial 4 QDocument2 pagesTutorial 4 QDashania GregoryNo ratings yet

- BAFB3013 Financial ManagementDocument9 pagesBAFB3013 Financial ManagementSarah ShiphrahNo ratings yet

- D Ltd. manufacturing budget analysis and cash flow forecastDocument3 pagesD Ltd. manufacturing budget analysis and cash flow forecastIzwan JamaluddinNo ratings yet

- Tutorial Questions FMF June 2022 Tutorial 3 B - 6Document12 pagesTutorial Questions FMF June 2022 Tutorial 3 B - 6Clarinda LeeNo ratings yet

- Far570 Q Test December 2022Document4 pagesFar570 Q Test December 2022fareen faridNo ratings yet

- 10JUNE23 Quiz Question FinanceDocument2 pages10JUNE23 Quiz Question FinanceShaleeena Aihara0% (1)

- Management Decision & Control - Paper 11Document8 pagesManagement Decision & Control - Paper 11Jacob Baraka OngengNo ratings yet

- Task 1: Managerial Planning and Decisions: Cost Schedule Variable Costs RMDocument7 pagesTask 1: Managerial Planning and Decisions: Cost Schedule Variable Costs RMmazni2002No ratings yet

- Faculty Accountancy 2022 Session 1 - Degree Maf551Document7 pagesFaculty Accountancy 2022 Session 1 - Degree Maf551afrina shazleenNo ratings yet

- ACC 308 2022 ExamDocument15 pagesACC 308 2022 ExamMonowalehippie MangaNo ratings yet

- August 2022 R: Page 1 of 7Document6 pagesAugust 2022 R: Page 1 of 7Salai SivagnanamNo ratings yet

- MML 5202Document6 pagesMML 5202MAKUENI PIGSNo ratings yet

- Faculty Accountancy 2022 Session 2 - Degree Maf551Document7 pagesFaculty Accountancy 2022 Session 2 - Degree Maf551afrina shazleenNo ratings yet

- Budgeting and Cash Flow ForecastingDocument3 pagesBudgeting and Cash Flow ForecastingJing ZeNo ratings yet

- Faculty of Economics Name: - Andalas University Padang Final Exam Student No.: - SECOND SEMESTER 2018/2019Document3 pagesFaculty of Economics Name: - Andalas University Padang Final Exam Student No.: - SECOND SEMESTER 2018/2019bananaNo ratings yet

- Finance 242Document11 pagesFinance 242norfitrahmNo ratings yet

- FIN420 Individual Assignment 20214Document3 pagesFIN420 Individual Assignment 20214Admin & Accounts AssistantNo ratings yet

- Advanced Financial ManagementDocument12 pagesAdvanced Financial Managementnitin bajajNo ratings yet

- Take Home Final Exam1Document4 pagesTake Home Final Exam1Sindura RamakrishnanNo ratings yet

- PE Exam March 2012Document31 pagesPE Exam March 2012Shahzada Khayyam NisarNo ratings yet

- AIOU Managerial Accounting Assignment 1Document9 pagesAIOU Managerial Accounting Assignment 1AR KhanNo ratings yet

- All India Shri Shivaji Memorial Society's Institute of Management Question Bank 302 Management Control SystemsDocument5 pagesAll India Shri Shivaji Memorial Society's Institute of Management Question Bank 302 Management Control SystemsAadeel NooraniNo ratings yet

- Acc406 - Q - Set 1 - Sesi 1 July 2020Document12 pagesAcc406 - Q - Set 1 - Sesi 1 July 2020NABILA NADHIRAH ROSLANNo ratings yet

- Questn WK 2 & WK 3 Assgn Case StudyDocument8 pagesQuestn WK 2 & WK 3 Assgn Case StudykonosubaNo ratings yet

- P1.PROO - .L Question CMA September 2022 ExaminationDocument7 pagesP1.PROO - .L Question CMA September 2022 ExaminationS.M.A AwalNo ratings yet

- Topic 1: Cost-Volume-Profit (CVP) Analysis Exercise 1: BKAM3023 Management Accounting IIDocument4 pagesTopic 1: Cost-Volume-Profit (CVP) Analysis Exercise 1: BKAM3023 Management Accounting IINur WahidaNo ratings yet

- Maf603-Question Test 2 - June 2022Document8 pagesMaf603-Question Test 2 - June 2022Zoe McKenzieNo ratings yet

- Universiti Teknologi Mara Final Assessment: Confidential 1 AC/FEB 2022/FAR570Document7 pagesUniversiti Teknologi Mara Final Assessment: Confidential 1 AC/FEB 2022/FAR570NURUL NAZAHANNIE MOHAMAD NAJIBNo ratings yet

- BAC1614 - 2110 - Final ExaminationDocument9 pagesBAC1614 - 2110 - Final ExaminationNABILA HADIFAH BINTI MOHAMAD PATHANNo ratings yet

- Cost Accounting - 2 2020Document5 pagesCost Accounting - 2 2020Shone Philips ThomasNo ratings yet

- Coca-Cola's Micro Environment FactorsDocument25 pagesCoca-Cola's Micro Environment FactorsSakshi GargNo ratings yet

- Exercise 5 (7 Dec 2022)Document6 pagesExercise 5 (7 Dec 2022)NaaNo ratings yet

- Maf151 July 2021Document9 pagesMaf151 July 2021FATIN BATRISYIA MOHD FAZILNo ratings yet

- f2 MGMT Accounting April 2015Document18 pagesf2 MGMT Accounting April 2015Isavic AlsinaNo ratings yet

- F2.1-Management Accounting (QP) APRIL 2023Document9 pagesF2.1-Management Accounting (QP) APRIL 2023NKURUNZIZA FrancoisNo ratings yet

- CPAR B94 MAS Final PB Exam - QuestionsDocument13 pagesCPAR B94 MAS Final PB Exam - QuestionsSilver LilyNo ratings yet

- CMA Srilanka PDFDocument7 pagesCMA Srilanka PDFFerry SihalohoNo ratings yet

- FAR160 PYQ FEB2023Document8 pagesFAR160 PYQ FEB2023nazzyusoffNo ratings yet

- D FAR110 Test Jun 2022 QuestionDocument6 pagesD FAR110 Test Jun 2022 QuestionNADIYATUL AMIRAH AHMAD NAZMINo ratings yet

- Faculty Accountancy 2022 Session 1 - Degree Far510Document13 pagesFaculty Accountancy 2022 Session 1 - Degree Far510Wahida AmalinNo ratings yet

- Griffith College Dublin financial management past examDocument5 pagesGriffith College Dublin financial management past examLuísaNegriNo ratings yet

- Chapter 6Document25 pagesChapter 6syafikaabdullahNo ratings yet

- ACC0 20053 - Intermediate Accounting 1 - 2022 Final Departmental ExamDocument41 pagesACC0 20053 - Intermediate Accounting 1 - 2022 Final Departmental ExamNathalie Faye TajaNo ratings yet

- BE 604 - January 27 2022 Class DeckDocument40 pagesBE 604 - January 27 2022 Class DeckChan DavidNo ratings yet

- Pipe Cistern0Document4 pagesPipe Cistern0AbhishekNo ratings yet

- Demonetisation Case StudyDocument17 pagesDemonetisation Case StudyRidhtang DuggalNo ratings yet

- Pantaloons Loyalty Program Rewards CustomersDocument5 pagesPantaloons Loyalty Program Rewards CustomersSrimon10No ratings yet

- Activity-2 Accounting EquationDocument3 pagesActivity-2 Accounting EquationAwais ur RehmanNo ratings yet

- QP-DILG-BLGS-RO-03-Issuance of Certificate For Foreign Travel Authority of Local Government Officials and EmployeesDocument12 pagesQP-DILG-BLGS-RO-03-Issuance of Certificate For Foreign Travel Authority of Local Government Officials and EmployeesCar DilgopcenNo ratings yet

- HRM PairingDocument8 pagesHRM PairingsyahNo ratings yet

- MBA 4th Sem TQM AssignmentDocument33 pagesMBA 4th Sem TQM AssignmentSibaram PattanaikNo ratings yet

- R.Chitra Devi 10MBA58: Click To Edit Master Subtitle StyleDocument17 pagesR.Chitra Devi 10MBA58: Click To Edit Master Subtitle StyleShyamala RajendranNo ratings yet

- Essential Guide to Marketing StrategyDocument10 pagesEssential Guide to Marketing StrategyMayank BishtNo ratings yet

- Dak WsaDocument47 pagesDak WsasugamsehgalNo ratings yet

- Ch03 - The Environment and Corporate CultureDocument28 pagesCh03 - The Environment and Corporate CultureRISRIS RISMAYANINo ratings yet

- Expired Loans - BalancesDocument14 pagesExpired Loans - Balancessalam abuNo ratings yet

- ICCE 2017: Invitation to SponsorsDocument6 pagesICCE 2017: Invitation to Sponsorsajaythermal100% (1)

- Corporate Finance 11Th Edition Ross Solutions Manual Full Chapter PDFDocument35 pagesCorporate Finance 11Th Edition Ross Solutions Manual Full Chapter PDFvernon.amundson153100% (10)

- End of Term 1 Higher TestDocument3 pagesEnd of Term 1 Higher TestbussybeeNo ratings yet

- Thought: by Constance E. BagleyDocument3 pagesThought: by Constance E. Bagleyjitender KUMARNo ratings yet

- ENVIRONMENTDocument22 pagesENVIRONMENTNilesh MangwaniNo ratings yet

- ISO 9001 Auditing Practices Group Guidance On:: The Need For A 2 Stage Approach To AuditingDocument2 pagesISO 9001 Auditing Practices Group Guidance On:: The Need For A 2 Stage Approach To AuditingAgus SupriadiNo ratings yet

- MBA Project Guidelines (Synopsis and Project Report)Document34 pagesMBA Project Guidelines (Synopsis and Project Report)rebelrahul04No ratings yet

- Manajemen Persediaan Bahan BakuDocument95 pagesManajemen Persediaan Bahan BakuAnto San JaYaNo ratings yet

- FIN433 Ahm BEST REPORT Alif Akhi Samia JulfiqureDocument31 pagesFIN433 Ahm BEST REPORT Alif Akhi Samia JulfiqureMd Al Alif Hossain 2121155630No ratings yet

- Economics of Strategy (Rješenja)Document227 pagesEconomics of Strategy (Rješenja)Antonio Hrvoje ŽupićNo ratings yet

- T1-Phe2035 - Acc1005 Foundations of Finance-Tutorial 7Document11 pagesT1-Phe2035 - Acc1005 Foundations of Finance-Tutorial 7mavisNo ratings yet