Professional Documents

Culture Documents

Cases Under Inherent Limitations

Uploaded by

Manlavi, Girlee N.Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cases Under Inherent Limitations

Uploaded by

Manlavi, Girlee N.Copyright:

Available Formats

Cases under Inherent Limitations

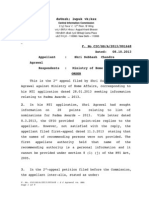

1. Gomez vs Palomar

Facts: The constitutionality of a Republic Act to raise fund for the Philippine Tuberculosis is being

assailed which there shall be printing and issue of semi-postal stamps of different denominations with

face value showing the regular postage charge plus the additional amount of five centavos for the

said purpose, and no mail matter whether domestic or foreign, shall be accepted in the mails unless it

bears such semi-postal stamps. The proceeds from the sale of semi-postal stamps will constitute a

special fund for Phil. Tuberculosis Society in carrying out its noble work to prevent and eradicate

tuberculosis.

Benjamin Gomez mailed a letter in San Fernando Pampanga Post Office but was returned to him

because such mail did not bear the anti- TB stamp. Petitioner sought a declaratory relief testing the

constitutionality contending that it violates the equal protection clause of the Constitution as well as

the rule of uniformity and equality of taxation. More specifically the claim is made that it constitutes

mail users into a class for the purpose of the tax while leaving untaxed the rest of the population.

The petitioner further argues that the tax in question is invalid, first, because it is not levied for a

public purpose as no special benefits accrue to mail users as taxpayers, and second, because it

violates the rule of uniformity in taxation.

Issue: W/N the RA 1635 AN ACT TO REQUIRE THE PRINTING AND ISSUE OF SEMI-POSTAL

STAMPS IN ORDER TO RAISE FUNDS FOR THE PHILIPPINE TUBERCULOSIS SOCIETY is

unconstitutional

Ruling: 1. RA 1635 is constitutional. It is settled that the legislature has the inherent power to

select the subjects of taxation and to grant exemptions. It possesses the greatest freedom in

classification.

The five-centavo levied is in the nature of excise tax upon the privilege of using mails.

It is not accurate to say that the statute constituted mail users into a class. Mail users were

already a class by themselves even before the enactment of the statute and all that the

legislature did was merely to select their class. Granted the power to select the subject of

taxation, the State's power to grant exemption must likewise be conceded as a necessary

corollary.

2. The eradication of a dreaded disease is a public purpose, but if by public purpose the

petitioner means benefit to a taxpayer as a return for what he pays, then it is sufficient

answer to say that the only benefit to which the taxpayer is constitutionally entitled is that

derived from his enjoyment of the privileges of living in an organized society, established and

safeguarded by the devotion of taxes to public purposes

You might also like

- Gomez Vs PalomarDocument2 pagesGomez Vs PalomarKent Ugalde50% (2)

- Constitutionality of Philippine Law Requiring Anti-TB Stamps on MailDocument2 pagesConstitutionality of Philippine Law Requiring Anti-TB Stamps on MailcharmdelmoNo ratings yet

- Gomez Vs PalomarDocument2 pagesGomez Vs PalomarLeigh BarcelonaNo ratings yet

- Gomez v. PalomarDocument2 pagesGomez v. PalomarMarcella Maria KaraanNo ratings yet

- Tax 1 Cases A.F - A.N (Digest)Document57 pagesTax 1 Cases A.F - A.N (Digest)CARLOSPAULADRIANNE MARIANONo ratings yet

- Gomez v. PalomarDocument3 pagesGomez v. PalomarBinkee VillaramaNo ratings yet

- Gomez vs. Palomar 25 SCRA 827, October 29, 1968Document21 pagesGomez vs. Palomar 25 SCRA 827, October 29, 1968Jane Bandoja100% (1)

- Gomez Vs PalomarDocument2 pagesGomez Vs PalomarCelinka Chun100% (1)

- Gomez v. PalomarDocument3 pagesGomez v. PalomarRukmini Dasi Rosemary GuevaraNo ratings yet

- Gomez V Palomar Case DigestDocument2 pagesGomez V Palomar Case DigestRichard Gultiano LibagoNo ratings yet

- Gomez Vs PalomarDocument3 pagesGomez Vs PalomarJerico GodoyNo ratings yet

- W1 6. Gomez v. Palomar, Burce 2BDocument2 pagesW1 6. Gomez v. Palomar, Burce 2BKuyang EcruboimetraNo ratings yet

- Tax Review Cases - General PrinciplesDocument11 pagesTax Review Cases - General PrinciplesAnonymous yisZNKXNo ratings yet

- 8 Gomez v. PalomarDocument15 pages8 Gomez v. PalomarChristian Edward CoronadoNo ratings yet

- Gomez Vs Palomar DigestDocument2 pagesGomez Vs Palomar Digestristocrat100% (5)

- Gomez V Palomar-Public PurposeDocument1 pageGomez V Palomar-Public PurposeIVYJEAN LAGURANo ratings yet

- Benjamin CaseDocument2 pagesBenjamin CaseAndrew M. AcederaNo ratings yet

- Gomez V PalomarDocument1 pageGomez V Palomarartburce30No ratings yet

- Gomez v. PalomarDocument1 pageGomez v. PalomarMadelle PinedaNo ratings yet

- Pascual v. Secretary of Public Works: Legal StandingDocument7 pagesPascual v. Secretary of Public Works: Legal StandingAvarie BayubayNo ratings yet

- Gomez Vs PalomarDocument2 pagesGomez Vs PalomarKim Lorenzo CalatravaNo ratings yet

- Anti-TB Stamp Law UpheldDocument3 pagesAnti-TB Stamp Law UpheldChaDiazNo ratings yet

- Tax Case DigestDocument38 pagesTax Case DigestJonaliza O. Belleza100% (1)

- Digest 25 Scra 827 Gomez vs. PalomarDocument1 pageDigest 25 Scra 827 Gomez vs. PalomarRowell SerranoNo ratings yet

- PCGG Vs Cojuangco: Coconut Levy Funds Are Prima Facie Public FundsDocument8 pagesPCGG Vs Cojuangco: Coconut Levy Funds Are Prima Facie Public FundsImmanuel GranadaNo ratings yet

- Case DigestsDocument124 pagesCase DigestsIan ConcepcionNo ratings yet

- 6 - 10 Inherent LimitationsDocument3 pages6 - 10 Inherent LimitationsLAW10101No ratings yet

- Case Digest - QuizDocument6 pagesCase Digest - Quizjennalyn nemoNo ratings yet

- Gomez v. PalomarDocument13 pagesGomez v. PalomarChill BillNo ratings yet

- Caltex Vs PalomarDocument2 pagesCaltex Vs PalomarNathaline OlivarNo ratings yet

- Case DoctrinesDocument5 pagesCase DoctrinesCes HwangNo ratings yet

- Case Digest TaxDocument75 pagesCase Digest TaxIrish MartinezNo ratings yet

- Taxation NotesDocument6 pagesTaxation NotesLaurene QuirosNo ratings yet

- Pascual v. Secretary of Public Works and CommunicationsDocument22 pagesPascual v. Secretary of Public Works and Communicationsmaria tanNo ratings yet

- The Economic Policies of Alexander Hamilton: Works & Speeches of the Founder of American Financial SystemFrom EverandThe Economic Policies of Alexander Hamilton: Works & Speeches of the Founder of American Financial SystemNo ratings yet

- 2 - 142831-1968-Gomez - v. - Palomar20210505-11-3yvyfwDocument16 pages2 - 142831-1968-Gomez - v. - Palomar20210505-11-3yvyfwliliana corpuz floresNo ratings yet

- Session 8: Tan v. Del Rosario Digest Tan V Del RosarioDocument7 pagesSession 8: Tan v. Del Rosario Digest Tan V Del RosarioMike E DmNo ratings yet

- Case Name: USA College of Law 1F-DuazoDocument2 pagesCase Name: USA College of Law 1F-DuazoLei Jeus TaligatosNo ratings yet

- Equal Protection CasesDocument3 pagesEqual Protection CasesRosie AlviorNo ratings yet

- Petitioner-Appellee vs. VS.: en BancDocument14 pagesPetitioner-Appellee vs. VS.: en BancDaryl YuNo ratings yet

- 13 Task Performance 1 - BUSINESS LAW AND REGULATIONSDocument3 pages13 Task Performance 1 - BUSINESS LAW AND REGULATIONSRynalin De JesusNo ratings yet

- TELEBAP Vs COMELECDocument2 pagesTELEBAP Vs COMELECCanete Jellie GraceNo ratings yet

- Tan To TolentinoDocument5 pagesTan To TolentinoRZ ZamoraNo ratings yet

- Case DigestsDocument7 pagesCase DigestsGerard Relucio OroNo ratings yet

- Iii. Power of Taxation (DGST) Sison Vs Ancheta GR No. L-59431, 25 July 1984 Facts: Section 1 of BP BLG 135 Amended The TaxDocument6 pagesIii. Power of Taxation (DGST) Sison Vs Ancheta GR No. L-59431, 25 July 1984 Facts: Section 1 of BP BLG 135 Amended The TaxMadelle PinedaNo ratings yet

- LABOR LAW CASE DIGEST TITLEDocument292 pagesLABOR LAW CASE DIGEST TITLEJay BagayasNo ratings yet

- Tax Cases 2nd Batch FulltextDocument122 pagesTax Cases 2nd Batch FulltextSinetch EteyNo ratings yet

- Gomez vs. Palomar ruling upholds Anti-TB Stamp LawDocument10 pagesGomez vs. Palomar ruling upholds Anti-TB Stamp LawANgel Go CasañaNo ratings yet

- Philippine Women and Family Law Case DigestsDocument118 pagesPhilippine Women and Family Law Case DigestsAngelina Villaver ReojaNo ratings yet

- Taxation 1 CasesDocument6 pagesTaxation 1 CasesKevin SanlaoNo ratings yet

- Tax 1 - Dean's Circle 2019 26Document1 pageTax 1 - Dean's Circle 2019 26Romeo G. Labador Jr.No ratings yet

- Philex Mining vs CIR Tax Offsetting CaseDocument13 pagesPhilex Mining vs CIR Tax Offsetting Casechristie joiNo ratings yet

- Melencio-Herrera, J.:: 15. Tio V Videogram G.R. No. L-75697 June 18, 1987Document8 pagesMelencio-Herrera, J.:: 15. Tio V Videogram G.R. No. L-75697 June 18, 1987fullpizzaNo ratings yet

- DoctrinesDocument3 pagesDoctrinesRoi Vincent RomeroNo ratings yet

- Notes On TaxationDocument30 pagesNotes On TaxationBeyond PaperNo ratings yet

- Supreme Court upholds constitutionality of tax lawDocument20 pagesSupreme Court upholds constitutionality of tax lawsamNo ratings yet

- Taxation 1 Digested CasesDocument39 pagesTaxation 1 Digested CasesfinserglenNo ratings yet

- Case Digest On Taxation Cases (General Principles)Document8 pagesCase Digest On Taxation Cases (General Principles)WEMD WRMDNo ratings yet

- Right of AssociationDocument21 pagesRight of AssociationMonika LangngagNo ratings yet

- Hamilton's Economic Policies: Works & Speeches of the Founder of American Financial SystemFrom EverandHamilton's Economic Policies: Works & Speeches of the Founder of American Financial SystemNo ratings yet

- Forestry Reform Code of The PhilippinesDocument27 pagesForestry Reform Code of The Philippinesadek_saneNo ratings yet

- Carrying Capacity Has Not Been ConsideredDocument1 pageCarrying Capacity Has Not Been ConsideredManlavi, Girlee N.No ratings yet

- RA 10654 Amending Fisheries CodeDocument15 pagesRA 10654 Amending Fisheries CodeTherese ElleNo ratings yet

- Begun and Held in Metro ManilaDocument2 pagesBegun and Held in Metro ManilaJosephine BercesNo ratings yet

- Case Digest For FinalsDocument23 pagesCase Digest For FinalsManlavi, Girlee N.No ratings yet

- Note For Finals Starting From by LawsDocument7 pagesNote For Finals Starting From by LawsManlavi, Girlee N.No ratings yet

- Failed to prove requirements for Writ of KalikasanDocument1 pageFailed to prove requirements for Writ of KalikasanManlavi, Girlee N.No ratings yet

- Plant Trees to Save the EnvironmentDocument2 pagesPlant Trees to Save the EnvironmentManlavi, Girlee N.No ratings yet

- Corporation LawDocument5 pagesCorporation LawManlavi, Girlee N.No ratings yet

- Anti Terror Memo Manlavi, Girlee N.Document3 pagesAnti Terror Memo Manlavi, Girlee N.Manlavi, Girlee N.No ratings yet

- Government intervention can fail to allocate resources efficientlyDocument11 pagesGovernment intervention can fail to allocate resources efficientlyManlavi, Girlee N.No ratings yet

- Philippines v. Sereno Case AnalysisDocument4 pagesPhilippines v. Sereno Case AnalysisManlavi, Girlee N.No ratings yet

- Human Rights AsssignmentDocument1 pageHuman Rights AsssignmentManlavi, Girlee N.No ratings yet

- Assignment - Joseph RonquilloDocument23 pagesAssignment - Joseph RonquilloJoseph John Santos RonquilloNo ratings yet

- Income Tax Summary TulibasDocument66 pagesIncome Tax Summary TulibasVan DahuyagNo ratings yet

- Understanding The Law of BailmentDocument9 pagesUnderstanding The Law of Bailmentnishant singhalNo ratings yet

- Transparency in Padma AwardsDocument16 pagesTransparency in Padma AwardsSyed Shah Ali HussainiNo ratings yet

- SOLAS Convention: Safety of Life at SeaDocument20 pagesSOLAS Convention: Safety of Life at SeaIekzkad RealvillaNo ratings yet

- JLT Agro v. BalansagDocument9 pagesJLT Agro v. BalansagChaNo ratings yet

- Sample of Contract Agreement: All India Legal ForumDocument3 pagesSample of Contract Agreement: All India Legal ForumsaratveerNo ratings yet

- I. Freedom of Navigation On High Seas: Solution, CNLU LJ (8) (2018-19) 86 at Page 87Document6 pagesI. Freedom of Navigation On High Seas: Solution, CNLU LJ (8) (2018-19) 86 at Page 87simran yadavNo ratings yet

- Abbot Laboratories Vs Alcaraz - G.R. No. 192571Document5 pagesAbbot Laboratories Vs Alcaraz - G.R. No. 192571Christelle Ayn BaldosNo ratings yet

- List of DocumentsDocument3 pagesList of Documentsbzapp1168No ratings yet

- Regulatory and Legal IssuesDocument4 pagesRegulatory and Legal IssuesElizabeth Espinosa ManilagNo ratings yet

- Kalaw V Relova DigestDocument1 pageKalaw V Relova Digestviva_33No ratings yet

- MICHIGAN ZONING ENABLING ACT - Michigan PA 110 of 2006Document23 pagesMICHIGAN ZONING ENABLING ACT - Michigan PA 110 of 2006Stephen BoyleNo ratings yet

- Armed Forces Act 2006Document344 pagesArmed Forces Act 2006Memnon001No ratings yet

- Consultancy Agreement Toli Liljana NewDocument7 pagesConsultancy Agreement Toli Liljana Newpaulatoli06No ratings yet

- Local Government Act SummaryDocument113 pagesLocal Government Act SummaryRANDAN SADIQ100% (1)

- Critical Evaluation of International Laws For Intellectual Property and Challenges Faced by International BusinessesDocument24 pagesCritical Evaluation of International Laws For Intellectual Property and Challenges Faced by International BusinessesRehmia ArshadNo ratings yet

- 57.4400.0100 020115Document546 pages57.4400.0100 020115Andrijana Majo100% (1)

- Rajasthan Urban Areas Rules SummaryDocument17 pagesRajasthan Urban Areas Rules Summaryvijay palNo ratings yet

- Fundamental Rights (Article 12-35)Document15 pagesFundamental Rights (Article 12-35)VishnupriyaNo ratings yet

- Torts SummaryDocument66 pagesTorts SummaryHarsh TamtaNo ratings yet

- J. Bersamin - Legal Ethics PDFDocument46 pagesJ. Bersamin - Legal Ethics PDFLeslie Javier BurgosNo ratings yet

- Jurisprudence @studygowithzeenatDocument63 pagesJurisprudence @studygowithzeenatHabeeb KhanNo ratings yet

- How To Digest A CaseDocument4 pagesHow To Digest A Casemaanyag6685No ratings yet

- EEOC v. Sidley Austin Brown. - Document No. 115Document4 pagesEEOC v. Sidley Austin Brown. - Document No. 115Justia.comNo ratings yet

- ACT180 Module 1Document3 pagesACT180 Module 1Norlaylah Naga LantongNo ratings yet

- Tacao Vs CaDocument1 pageTacao Vs CaXing Keet LuNo ratings yet

- REPUBLIC V Javier - Case DigestDocument2 pagesREPUBLIC V Javier - Case DigestLulu RodriguezNo ratings yet

- Hanzi HSK 1-4Document26 pagesHanzi HSK 1-4Tajibana Kanade100% (7)

- ARRL Recommended Amateur Radio BooksDocument12 pagesARRL Recommended Amateur Radio Booksaustintexas1234100% (2)