0% found this document useful (0 votes)

1K views7 pagesThroughput Costing

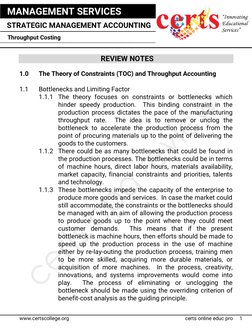

1. The document discusses the Theory of Constraints (TOC) and throughput accounting. TOC focuses on bottlenecks that hinder production throughput and aims to identify and remedy bottlenecks to increase capacity.

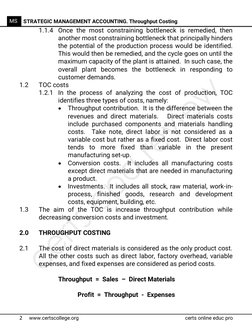

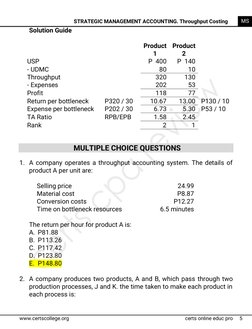

2. Throughput accounting identifies three types of costs: throughput contribution, conversion costs, and investments. It aims to increase throughput while decreasing conversion costs and investments.

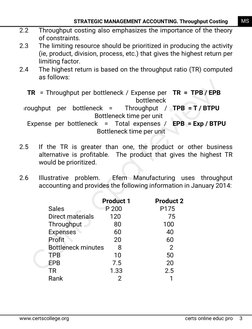

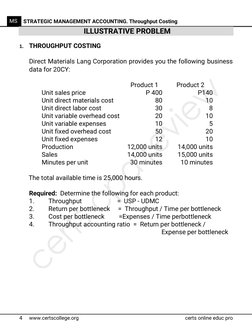

3. Throughput costing considers direct materials as the only product cost and all other costs as period costs. It calculates throughput as sales minus direct materials. Profit equals throughput minus expenses. The document provides an illustrative problem comparing two products using throughput ratios.

Uploaded by

Mae PanganibanCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

1K views7 pagesThroughput Costing

1. The document discusses the Theory of Constraints (TOC) and throughput accounting. TOC focuses on bottlenecks that hinder production throughput and aims to identify and remedy bottlenecks to increase capacity.

2. Throughput accounting identifies three types of costs: throughput contribution, conversion costs, and investments. It aims to increase throughput while decreasing conversion costs and investments.

3. Throughput costing considers direct materials as the only product cost and all other costs as period costs. It calculates throughput as sales minus direct materials. Profit equals throughput minus expenses. The document provides an illustrative problem comparing two products using throughput ratios.

Uploaded by

Mae PanganibanCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd