Professional Documents

Culture Documents

Ola Driver - Basic Case Study

Ola Driver - Basic Case Study

Uploaded by

RAHUL KUMAR MANJHIOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ola Driver - Basic Case Study

Ola Driver - Basic Case Study

Uploaded by

RAHUL KUMAR MANJHICopyright:

Available Formats

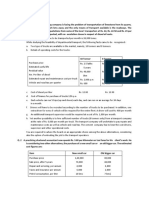

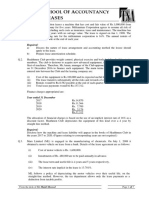

Case Study: Basic Financial Statement

Mr. X (Ola driver) planning to buy a new taxi car for Rs. 5 lacs. Assuming car total life equal to 5 years

and salvage value nil, depreciate the asset using Straight Line Method. To buy this Mr. X has taken a

loan of Rs. 2 lacs from bank at ROI 10% p.a. The loan to be repaid in four equal principal repayments

of Rs. 50,000 each.

Particulars Units Year 1 Remarks

KM car driven Km p.a. 60,000 Thereafter, expected to grow at 10%

Revenue share per km from Ola Rs./km 10 Thereafter, expected to grow at 5%

Petrol expense Rs./km 4 Thereafter, expected to grow at 4%

Maintenance expenses Rs. p.a. 50,000 Thereafter, expected to grow at 10%

MCD charges Rs. p.a. 70,000 Thereafter, expected to grow at 2%

Payment released from Ola Months 1 One-month debtor period

Income tax rate % 10%

You have to prepared financial statement of Mr. X for five years.

You might also like

- Service CostingDocument6 pagesService Costingbinu100% (1)

- Time Value (Financial Management)Document9 pagesTime Value (Financial Management)Keyur BhojakNo ratings yet

- 10-12 Assignment 1Document4 pages10-12 Assignment 1Pavan Kasireddy100% (1)

- A Haven on Earth: Singapore Economy Without Duties and TaxesFrom EverandA Haven on Earth: Singapore Economy Without Duties and TaxesNo ratings yet

- Freedom Unleashed: How to Make Malaysia a Tax Free CountryFrom EverandFreedom Unleashed: How to Make Malaysia a Tax Free CountryRating: 5 out of 5 stars5/5 (1)

- Caselet by DR Aditya P Tripathi AFMDocument1 pageCaselet by DR Aditya P Tripathi AFMGaurav gusaiNo ratings yet

- PR 2Document1 pagePR 2Amar Ahmad FirmansyahNo ratings yet

- FM Module 2 ExerciseDocument1 pageFM Module 2 ExercisePrayag GokhaleNo ratings yet

- Time Value of Money - Ques For PracticeDocument3 pagesTime Value of Money - Ques For PracticeNitesh NagdevNo ratings yet

- PERFORMING FINANCIAL CALCULATION AssignmentDocument2 pagesPERFORMING FINANCIAL CALCULATION AssignmentAbdi Mucee TubeNo ratings yet

- Lease Financing Final NotesDocument2 pagesLease Financing Final NotesGLOBUS CYBERNo ratings yet

- CF Assignment - 2Document2 pagesCF Assignment - 2vishnu607No ratings yet

- Unit - 2 IllustrationsDocument2 pagesUnit - 2 IllustrationsRakesh SriNo ratings yet

- Problems-Financial ManagementDocument13 pagesProblems-Financial ManagementGajendra Singh Raghav50% (2)

- Chapter 5 Exercises - CorrectedDocument3 pagesChapter 5 Exercises - Correctedde.augustin.godefroyNo ratings yet

- Cost of CapitalsDocument11 pagesCost of Capitals29_ramesh170No ratings yet

- TVM - QuestionsDocument2 pagesTVM - QuestionsUdittiNo ratings yet

- CF AssignmentDocument3 pagesCF AssignmentP.Umasankar SubudhiNo ratings yet

- QuestionsDocument2 pagesQuestionsnitesh jainNo ratings yet

- Problems - Time Value of Money PDFDocument1 pageProblems - Time Value of Money PDFShubham AggarwalNo ratings yet

- BMS Class 14Document2 pagesBMS Class 14KoliNo ratings yet

- Tutorial - I For FM-I: Effective Interest Rate (EIR)Document3 pagesTutorial - I For FM-I: Effective Interest Rate (EIR)Sriram VenkatakrishnanNo ratings yet

- TVM Tutorial SolnDocument3 pagesTVM Tutorial SolnPoornika AwasthiNo ratings yet

- FM TVM Practice Questions G5jmfcwesn PDFDocument2 pagesFM TVM Practice Questions G5jmfcwesn PDFValiant MixtapesNo ratings yet

- Sheet 02 EconomicsDocument1 pageSheet 02 Economicsfaze kingNo ratings yet

- Homework QuestionsDocument6 pagesHomework Questionsgaurav shetty100% (1)

- Maxo LTDDocument1 pageMaxo LTDAnkit SaxenaNo ratings yet

- TVMDocument3 pagesTVMswapnil6121986No ratings yet

- Midterm BDocument4 pagesMidterm Bsanjeet_kaur_10No ratings yet

- Exam Practice Question MBADocument11 pagesExam Practice Question MBAsudhakar dhunganaNo ratings yet

- Tutorial questions-DCF-solved in ClassDocument6 pagesTutorial questions-DCF-solved in ClassLaiba RazaNo ratings yet

- TVM Questions IDocument4 pagesTVM Questions IRUTVIKA DHANESHKUMARKUNDAGOLNo ratings yet

- FM-Math, Time Value of MoneyDocument2 pagesFM-Math, Time Value of Moneymaher213No ratings yet

- Engineering Economics Class ProblemsDocument1 pageEngineering Economics Class ProblemscatcotiNo ratings yet

- VSGHDDocument2 pagesVSGHDReshmith FFNo ratings yet

- Assignment-I FMDocument2 pagesAssignment-I FMArnav ShresthaNo ratings yet

- FM-Imp QuestionsDocument2 pagesFM-Imp QuestionsPau GajjarNo ratings yet

- Lesse Evaluation ProblemsDocument3 pagesLesse Evaluation ProblemsAnshuNo ratings yet

- Leasing NotesDocument7 pagesLeasing NotesSanthoshShivanNo ratings yet

- Solution Time Value of Money 4 PV of Single and Series of Cash Flows and PV of Annuity Ordinary Mf4dtGPKncDocument10 pagesSolution Time Value of Money 4 PV of Single and Series of Cash Flows and PV of Annuity Ordinary Mf4dtGPKncShareshth JainNo ratings yet

- Time Value of Money QuestionDocument1 pageTime Value of Money Questionਨਿਖਿਲ ਬਹਿਲ100% (1)

- Problems in Cost of CapitalDocument6 pagesProblems in Cost of CapitalJasonSpringNo ratings yet

- FM I AssignmentDocument3 pagesFM I AssignmentApeksha S KanthNo ratings yet

- SImple and Compound Interest Notes Lyst6475Document11 pagesSImple and Compound Interest Notes Lyst6475AMIT VERMANo ratings yet

- Ind AS 109 FI - Material 3 (Revisied) Derecogniatoin of FA - FLDocument9 pagesInd AS 109 FI - Material 3 (Revisied) Derecogniatoin of FA - FLjvbsdNo ratings yet

- IFRS-16 LeasesDocument7 pagesIFRS-16 LeasesHuzaifa WaseemNo ratings yet

- Unit 3: Cost of Capital Cost of DebtDocument11 pagesUnit 3: Cost of Capital Cost of DebtTaransh A100% (1)

- Corporate Financing Decisions, Spring 2016Document4 pagesCorporate Financing Decisions, Spring 2016Ashok BistaNo ratings yet

- Assignment Cel 779Document8 pagesAssignment Cel 779Arneet SarnaNo ratings yet

- Econ Assign 5Document2 pagesEcon Assign 5Muhammad AbubakerNo ratings yet

- Fmswe6pZd1hEDocument32 pagesFmswe6pZd1hEsushmitakulkarni2480No ratings yet

- 0ecd7tvm AssignDocument1 page0ecd7tvm AssignAman WadhwaNo ratings yet

- Time Value of Money: Year 2008 2009 2010 2011 2012 2013Document1 pageTime Value of Money: Year 2008 2009 2010 2011 2012 2013Alissa BarnesNo ratings yet

- Features New Car Loan Used Car LoanDocument2 pagesFeatures New Car Loan Used Car LoanRahul JOshiNo ratings yet

- Chapter 1c - Time Value of MoneyDocument16 pagesChapter 1c - Time Value of MoneyOdysseYNo ratings yet

- Installments in SI CIDocument2 pagesInstallments in SI CILin Lae PhyuNo ratings yet

- Mba 2 Semester MID Term Examinations August-2021 (Financial Management)Document2 pagesMba 2 Semester MID Term Examinations August-2021 (Financial Management)Life of Urban PahadiNo ratings yet

- EE Assignment 1-5 PDFDocument6 pagesEE Assignment 1-5 PDFShubhekshaJalanNo ratings yet

- ECONDocument11 pagesECON22-00248No ratings yet

- How to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysFrom EverandHow to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysNo ratings yet