Professional Documents

Culture Documents

11 Acc

Uploaded by

s425703110 ratings0% found this document useful (0 votes)

4 views3 pagesOriginal Title

11 ACC

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views3 pages11 Acc

Uploaded by

s42570311Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

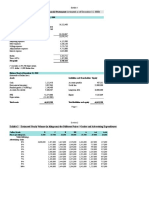

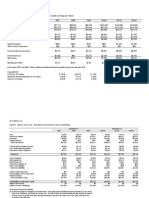

XI - ACCOUNTANCY

MODEL PROBLEMS

UNIT 3.BOOKS OF PRIME ENTRY

1. Accounting Equation

Assets = Capital + Liabilities

2.Identify - Personal, Real & Nominal Accounts. 3.Journal entries

UNIT 4.LEDGER

1. Journal entries to Ledger. 2. Compound journal entries to Ledger

3. Opening journal entries to Ledger. 4. Direct Ledger

UNIT 5. TRIAL BALANCE

1. Identify the balance placed in the debit or credit column of the trial balance

2.Debit and Credit are equal. 3.Debit and Credit are not equal open suspense account

4.Redrafted trial balance

UNIT 6.SUBSIDIARY BOOKS-I

1. Purchases book. 2. Sales book. 3. Purchases returns book. 4. Sales returns book

5. Bills receivable book. 6. Bills payable book

UNIT 7. SUBSIDIARY BOOKS-II

1. Single column cash book. 2. Double column cash book

3. Three column cash book. 4. Petty cash book

UNIT 8. RECONCILIATION STATEMENT

1. Balance as per cash book to Balance as per bank statement

2. Balance as per bank statement to Balance as per cash book

3.Overdraft as per bank statement to Overdraft as per cash book

4. Overdraft as per cash book to Overdraft as per bank statement

UNIT 9. RECTIFICATION OF ERRORS

1. Before preparation of trial balance

(i)Single side errors - Small explanation (ii) Double side errors - Rectification entries

2. While preparing trial balance

(i)Single side errors - Small explanation (ii) Double side errors - Rectification entries

3. After preparing trial balance but before preparing final accounts

(i)Single side errors - Rectification journal entries using suspense account

(ii) Double side errors - Rectification entries

4. After preparing final accounts

(i). Rectification entries - Using suspense account is not necessary

Depreciation Accounting

1. Amount of depreciation 2. Rate of depreciation 3. Find out profit or loss ( Working notes only )

3. Journal to Ledger (i) Assets account (ii) Depreciation account

* Straight line method * Written down value method

UNIT 11.CAPITAL AND REVENUE TRANSACTION

1.Capital. (1).Expenditure (2).Receipts 2. Revenue (1).Expenditure (2).Receipts

3. Deferred revenue expenditure

12. FINAL ACCOUNTS OF SOLE PROPRIETORS-1

1. Trading & Profit and loss account 2. Balance sheet

13. FINAL ACCOUNTS OF SOLE PROPRIETORS - II

1. Trading & Profit and loss account. 2. Balance sheet

Adjustments: 1. Closing stock 2. Outstanding expense 3. Prepaid expenses 4. Accrued income.

5. Income received in advance 6. Interest on capital 7.Interest on drawings 8. Interest on loan. 9.

Interest on investment. 10. Depreciation. 11.Bad debts 12. Provision for doubtful debts. 13.

Provision for discount on debtors 14. Income tax 15. Manager's commission.

(i)Adjusting entries (ii) Transfer entries

Prepared by : N Ravichandran

PG Commerce - 9789665166

You might also like

- LONG TERM FINANCING Finma FinalDocument36 pagesLONG TERM FINANCING Finma FinalJane Baylon100% (2)

- Module 1 - Recording Business TransactionDocument11 pagesModule 1 - Recording Business Transactionem fabi100% (1)

- Behavioral FinanceDocument31 pagesBehavioral Financevy phạm100% (1)

- Assignment-1 IMB2020024 IMB2020036Document22 pagesAssignment-1 IMB2020024 IMB2020036Nirbhay Kumar MishraNo ratings yet

- Entrepreneurship: Chart of Accounts/ JournalizingDocument8 pagesEntrepreneurship: Chart of Accounts/ JournalizingSeigfred SeverinoNo ratings yet

- Fabm1 & 2 - ReviewDocument77 pagesFabm1 & 2 - ReviewBernice Jayne MondingNo ratings yet

- AccountingDocument20 pagesAccountingKim CaNo ratings yet

- Delhi Public School (Joka) South Kolkata SYLLABUS - 2020 - 2021 Class - Xi Accountancy Examinations TopicsDocument2 pagesDelhi Public School (Joka) South Kolkata SYLLABUS - 2020 - 2021 Class - Xi Accountancy Examinations Topicssab108No ratings yet

- Accountancy - Chapter 4 & 5Document5 pagesAccountancy - Chapter 4 & 5maricarNo ratings yet

- The Accounting Equation & The Accounting Cycle: Steps 1 - 4: Acct 1A&BDocument5 pagesThe Accounting Equation & The Accounting Cycle: Steps 1 - 4: Acct 1A&BKenneth Christian WilburNo ratings yet

- Single Entry Bookkeeping SystemDocument3 pagesSingle Entry Bookkeeping System=shey=No ratings yet

- Unit - 2 Primary Books (Journal) : 1.1 Meaning and Definition: Journal Is Derived From The French Word " Jour" Which MeansDocument6 pagesUnit - 2 Primary Books (Journal) : 1.1 Meaning and Definition: Journal Is Derived From The French Word " Jour" Which MeansdeepshrmNo ratings yet

- THE Accounting Cycle: CB Lecture 102Document13 pagesTHE Accounting Cycle: CB Lecture 102kunyangNo ratings yet

- The Accounting CycleDocument3 pagesThe Accounting CyclekyncjsNo ratings yet

- Acc Chapter 2 LSCMDocument80 pagesAcc Chapter 2 LSCMwoleliemekieNo ratings yet

- 2023 S1 Week 12 Revision Lecture IA (I) FA Topics NCADocument7 pages2023 S1 Week 12 Revision Lecture IA (I) FA Topics NCAadelaideglxNo ratings yet

- Chapter 4 Review 11th EdDocument9 pagesChapter 4 Review 11th EdJoey AbrahamNo ratings yet

- Fa1 Notes Chapter Four PDFDocument3 pagesFa1 Notes Chapter Four PDFPrincess ThaabeNo ratings yet

- Untitled DocumentDocument6 pagesUntitled Document25d827gn96No ratings yet

- Chapter 4.2 - Debit & Credit TheoryDocument12 pagesChapter 4.2 - Debit & Credit TheoryMT - 07LJ - Lougheed MS (1486)No ratings yet

- 1 The Accounting Equation Accounting Cycle Steps 1 4Document6 pages1 The Accounting Equation Accounting Cycle Steps 1 4Jerric CristobalNo ratings yet

- 04.recording Process Journal - TB FinalDocument49 pages04.recording Process Journal - TB FinalChowdhury Mobarrat Haider Adnan100% (1)

- Week 4: Ledgers and Trial BalanceDocument23 pagesWeek 4: Ledgers and Trial BalanceIris NguNo ratings yet

- Accounting 复习提纲Document73 pagesAccounting 复习提纲Ming wangNo ratings yet

- SUMMATIVE 4thDocument3 pagesSUMMATIVE 4thCattleya78% (9)

- WPSingle Entry NotesDocument1 pageWPSingle Entry NotesseshalNo ratings yet

- Namma Kalvi 12th Accountancy Unit 1 Power Point Presentation Material em 218231Document23 pagesNamma Kalvi 12th Accountancy Unit 1 Power Point Presentation Material em 218231Mohit ShahNo ratings yet

- ACTG123 (Reviewer)Document3 pagesACTG123 (Reviewer)Jenna BanganNo ratings yet

- Ch4 Recording Transactions and Balancing The Ledgers v6Document13 pagesCh4 Recording Transactions and Balancing The Ledgers v6Soputivong NhemNo ratings yet

- Act 202 SS1Document25 pagesAct 202 SS1estherNo ratings yet

- ch02 The Recording ProcessDocument12 pagesch02 The Recording ProcessMạnh Hoàng Phi ĐứcNo ratings yet

- Chapter 4Document33 pagesChapter 4Vin FajardoNo ratings yet

- Accountancy: Study MaterialDocument20 pagesAccountancy: Study MaterialandroidappsNo ratings yet

- ACCY111 Spring 2019 Week 3 Lecture Powerpoint PresentationDocument29 pagesACCY111 Spring 2019 Week 3 Lecture Powerpoint PresentationStephanie BuiNo ratings yet

- Solution Manual For Accounting Volume 1 Canadian 9th Edition Horngren Harrison Oliver Norwood Johnston Meissner 013309863X 9780133098631Document36 pagesSolution Manual For Accounting Volume 1 Canadian 9th Edition Horngren Harrison Oliver Norwood Johnston Meissner 013309863X 9780133098631thomasweissadsxcjgbry100% (28)

- 4 Recording Business TransactionsDocument20 pages4 Recording Business TransactionsJohn Alfred CastinoNo ratings yet

- Worksheet 1 q2 Acctg. 2Document11 pagesWorksheet 1 q2 Acctg. 2Allan TaripeNo ratings yet

- Chapter 2 ReviewDocument11 pagesChapter 2 ReviewKim Ngan TranNo ratings yet

- Basic Accounting: By: Dr. Alejandro L. MedranoDocument10 pagesBasic Accounting: By: Dr. Alejandro L. Medranoangelika dijamcoNo ratings yet

- Stress Level of ABM Students in Their Accounting Subject and Its Implications To Their Academic PerformancesDocument2 pagesStress Level of ABM Students in Their Accounting Subject and Its Implications To Their Academic PerformancesRalph Rivera SantosNo ratings yet

- TVL Accounting12 Quarter2 Worksheet Week1 10pagesDocument10 pagesTVL Accounting12 Quarter2 Worksheet Week1 10pagesAllan TaripeNo ratings yet

- Abms3 Topic 05 - 2022Document22 pagesAbms3 Topic 05 - 2022Bernard TejamoNo ratings yet

- INFORMATION SHEET 1 Entrep 4thDocument22 pagesINFORMATION SHEET 1 Entrep 4thAndrea Mae CenizalNo ratings yet

- Steps in The Accounting CycleDocument8 pagesSteps in The Accounting CycleMarianne GonzalesNo ratings yet

- Accounts Project 11thDocument6 pagesAccounts Project 11thRishi VithlaniNo ratings yet

- Accounting Fundamentals in Society ACCY111: DR Sanja PupovacDocument21 pagesAccounting Fundamentals in Society ACCY111: DR Sanja PupovacStephanie BuiNo ratings yet

- Study Important QuestionsDocument6 pagesStudy Important QuestionsVrinda TayadeNo ratings yet

- TS Grewal Accountancy Class 11 Solution Chapter 1Document3 pagesTS Grewal Accountancy Class 11 Solution Chapter 1Abeer batraNo ratings yet

- Week 15 18Document33 pagesWeek 15 18Johncarlo GenestonNo ratings yet

- Chapter 1Document5 pagesChapter 1palash khannaNo ratings yet

- ACCT 1026 Lesson 4 PDFDocument5 pagesACCT 1026 Lesson 4 PDFAnnie RapanutNo ratings yet

- Accountancy MaterialDocument11 pagesAccountancy MaterialAfzal KuttyNo ratings yet

- Fundamentals Accounting IDocument42 pagesFundamentals Accounting IKhalid Muhammad100% (1)

- FA-I (Lecture Note Ch-2)Document51 pagesFA-I (Lecture Note Ch-2)samioro746No ratings yet

- Outline Topic:: Financial Accountng and ReportingDocument4 pagesOutline Topic:: Financial Accountng and ReportingChristine joyce MagoteNo ratings yet

- BSA Review Mod 3Document11 pagesBSA Review Mod 3Johar MesugNo ratings yet

- Double Entry SystemDocument11 pagesDouble Entry SystemPraveenNo ratings yet

- Lesson 1 Analyzing Recording TransactionsDocument6 pagesLesson 1 Analyzing Recording TransactionsklipordNo ratings yet

- A Review of The Accounting CycleDocument40 pagesA Review of The Accounting CyclePapsie Popsie100% (2)

- 2.2 - LedgerDocument3 pages2.2 - LedgerABHAYNo ratings yet

- MBA Chp-7 - LedgerDocument11 pagesMBA Chp-7 - LedgerNitish rajNo ratings yet

- Chapter Two The Accountig CycleDocument20 pagesChapter Two The Accountig Cyclehayelom50% (4)

- Bookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursFrom EverandBookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursNo ratings yet

- Understanding Crypto: Crypto Affairs of Pakistan SycapDocument17 pagesUnderstanding Crypto: Crypto Affairs of Pakistan SycapNOUMAN AHMED BUTTNo ratings yet

- How To Invest in Philippine Stock Market For Beginners - Smart Pinoy Investor - Investing and Personal Finance For Pinoys PDFDocument59 pagesHow To Invest in Philippine Stock Market For Beginners - Smart Pinoy Investor - Investing and Personal Finance For Pinoys PDFDeuvyn BautistaNo ratings yet

- Mtrading Ebook 10 RulesDocument14 pagesMtrading Ebook 10 RulesIndika WithanageNo ratings yet

- PL 4312 CLASS 1 Development Feasibility AnalysisDocument54 pagesPL 4312 CLASS 1 Development Feasibility AnalysisWana PurnaNo ratings yet

- Mini Cases FMDocument3 pagesMini Cases FMAishwaryaNo ratings yet

- Analisis Kelayakan Usaha Produksi Tahu Sumedang (Studi Kasus Di Pabrik Tahu XY Kecamatan Conggeang)Document9 pagesAnalisis Kelayakan Usaha Produksi Tahu Sumedang (Studi Kasus Di Pabrik Tahu XY Kecamatan Conggeang)nur 119330034No ratings yet

- UntitledDocument5 pagesUntitledCristel TannaganNo ratings yet

- An20230925 1407Document7 pagesAn20230925 1407oluwasegunNo ratings yet

- PROBLEM Set 3 AnswerDocument5 pagesPROBLEM Set 3 AnswerAmalia RosadiNo ratings yet

- Application Summary FormDocument3 pagesApplication Summary FormnatalieNo ratings yet

- Chandan - A Study On Risk Management System For Equity Portfolio Managers' in India With Reference To Karvy Stock Broking LimtedDocument89 pagesChandan - A Study On Risk Management System For Equity Portfolio Managers' in India With Reference To Karvy Stock Broking LimtedVenky PoosarlaNo ratings yet

- Chapte R: Dividend TheoryDocument19 pagesChapte R: Dividend TheoryArunim MehrotraNo ratings yet

- Transes RFBTDocument4 pagesTranses RFBTdave excelleNo ratings yet

- Kuliah I AkpDocument51 pagesKuliah I AkpMuhammad Tamul FikriNo ratings yet

- MR A Bhattacharjee CEO Concalve KolkataDocument27 pagesMR A Bhattacharjee CEO Concalve KolkataJagadeesh YathirajulaNo ratings yet

- Bill Ackman Case Study of GGP - Incentives Matter - Value Investing Congress - 10.1Document102 pagesBill Ackman Case Study of GGP - Incentives Matter - Value Investing Congress - 10.1Caleb Peter Hobart100% (1)

- Chapter-5: Statement of Cash FlowDocument43 pagesChapter-5: Statement of Cash FlowBAM ZAHARDNo ratings yet

- Foreign Exchange QuotesDocument4 pagesForeign Exchange QuotesVishant ChopraNo ratings yet

- AKL 2 - Tugas 1Document14 pagesAKL 2 - Tugas 1Marselinus Aditya Hartanto TjungadiNo ratings yet

- Chapter 19: Sales and Operations Planning: Mcgraw-Hill/IrwinDocument30 pagesChapter 19: Sales and Operations Planning: Mcgraw-Hill/IrwinMitali SapraNo ratings yet

- Quiz3 ADM4354 Winter2014 Solutions2Document4 pagesQuiz3 ADM4354 Winter2014 Solutions2jenniferNo ratings yet

- Required: Chapter 10 / Segmented Reporting, Investment Center Evaluation, and Transfer PricingDocument3 pagesRequired: Chapter 10 / Segmented Reporting, Investment Center Evaluation, and Transfer Pricingdwcc ms2No ratings yet

- Unity Small Finance Bank LimitedDocument1 pageUnity Small Finance Bank Limitedprakash kushwahaNo ratings yet

- Paper - Iii Commerce: Note: Attempt All The Questions. Each Question Carries Two (2) MarksDocument26 pagesPaper - Iii Commerce: Note: Attempt All The Questions. Each Question Carries Two (2) MarksashaNo ratings yet

- Exhibits and Student TemplateDocument7 pagesExhibits and Student Templatesatish.evNo ratings yet

- Flash Memory ExcelDocument4 pagesFlash Memory ExcelHarshita SethiyaNo ratings yet

- Finance Exam 2 Cheat Sheet: by ViaDocument2 pagesFinance Exam 2 Cheat Sheet: by ViaKimondo KingNo ratings yet