Professional Documents

Culture Documents

What Is Insurance - Meaning, Types, Importance & Benefits

Uploaded by

Ayush VermaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

What Is Insurance - Meaning, Types, Importance & Benefits

Uploaded by

Ayush VermaCopyright:

Available Formats

LOGIN

ABOUT INSURANCE

What is Insurance?

Sagar Chikane • 21 February 2023

Insurance is a legal contract between two parties i.e. the insured

and the insurance company; it is also known as insurance coverage

or insurance policy which can be purchased from an insurance

company in exchange of premium.

:

The insurance company provides financial protection against the losses incurred

by the policyholder. Under an insurance policy, the insurer provides coverage to

the policyholder in the event of regular premiums payment. Coverage is provided

to the insured in case of damages, death or disability as per the policy terms and

conditions.

Insurance: Definition and Meaning

Insurance can be defined as a contract between the insurance company and the

insured, offering financial protection against unpredictable events. Insured is the

policyholder whereas, the insurer is the insurance providing company, also

known as underwriter or insurance carrier. Financial protection is provided to the

insured in cashless form or reimbursement.

In exchange for the coverage provided by the insurance company, the insurer has

to pay a premium which is decided based on various factors such as age, income,

requirement, etc. The coverage is offered to the insured based on policy terms

and conditions.

Insurance: Coverage Features

Given below are a few features of insurance:

:

It is a risk management tool that acts as a hedge against an uncertain loss

Under insurance, the policyholders pool in their money and pay the

premiums. Hence, when one or a few incur any loss, the claimed money is

offered from the accumulated amount

Insurance coverage is provided for medical expenses, property loss, vehicle,

mobile phones, etc.

The main components of an insurance policy are the premium, deductible

and the policy limit. Hence, when buying the policy, it is imperative that the

policyholder checks on these aspects

Insurance: Coverage Benefits

An insurance policy comes with multiple benefits and given below are a few of

them. The policy provides financial reimbursement in case of financial crisis, thus

providing peace of mind. Given below are few of the benefits of insurance.

Provides Protection:

In the times of financial crisis, insurance provides monetary compensation,

thus saving the insured from financial woes and thereby ensuring peace of

mind.

Risk Sharing:

Under insurance, money is pooled in from various policyholders. The

company takes collective risks and premiums, covering a large group of risk

exposed people. The payout in case of any uncertainty is made from the

fund. Thus, all the policyholders share the risk of the one who actually

suffered from the loss.

Provides Certainty:

With insurance, policyholders get a sense of assurance since the risk is

:

handled by the insurer. Insurance protects the policyholder in case of

accident, hazards or vulnerabilities.

Savings:

Insurance policies, for instance, life insurance helps the policyholder

inculcate the habit of saving money. This, thus, encourages people to save

and invest.

Types of Insurance

Insurance policies are classified in the below types i.e. general and life insurance.

General insurance is further categorized in categories such as health insurance,

motor insurance, home insurance, etc.

1). Life Insurance

This type of insurance helps you protect your and your family’s financial

future by providing you coverage for a specific period of time. Lump sum

amount is given to the nominee in the event of death of the insured. This,

thus, helps the grieving family overcome financial struggles that may

otherwise occur in the absence of the policyholder.

2). Few of the types of life insurance are

term insurance, ULIP, endowment plan, retirement plan, money back plan,

etc.

3). Endowment Policy

An endowment policy pays out to the policyholder under both

circumstances i.e. even on death and survival. One part of the premium paid

is allocated towards life cover while another part is invested.

4). Money Back Policy

:

In simple terms, a money back plan offers periodic payments to the investor.

The periodic payments made are generally a fixed percentage of the sum

assured.

5). Whole Life Insurance Policy

As the name suggests, this type of policy provides coverage to the

policyholder as long as he survives. The policy is designed to cover

individuals up to the age of 100 or whole life even.

6). Unit Linked Insurance Plan

Under this insurance, a part of the premium you pay is invested in the

market, while the other part is invested towards providing you life cover.

Investing in ULIP gives you a chance to choose the funds you want to invest

in.

General Insurance

1). Health Insurance

Health insurance protects the health of the family including spouse,

parents, siblings, children. Insurance companies have tie ups with hospitals

where one can avail cashless hospitalization.

2). Motor Insurance

Buying third party insurance is mandatory as per the law as it offers

coverage against damages caused to third party or property. One can also

choose to buy a comprehensive policy as it covers damages caused to third

party as well as own damages.

3). Travel insurance

:

Travel insurance covers an uncertain event that takes place when you are

traveling. Events such as flight cancellation, baggage loss, flight delay, etc.

are covered.

4). Home Insurance

This type of insurance provides coverage to property, covering financial loss

and providing monetary aid. Losses caused due to flood, theft, mishaps are

covered.

Articles What Is Insurance

SECURE LICENSED BY

PAYMENT OPTIONS

GENERAL INSURANCE HEALTH INSURANCE LIFE INSURANCE INSURANCE IN HINDI OTHER LINKS

Car Insurance Family Health Insurance Term Insurance कार इन्शुरन्स Learn About Insurance

Bike Insurance Senior Citizens Insurance ULIP टू व्हीलर इं श्योरेंस Network Hospitals

Motor Insurance Group Insurance e-Term Plan टमर् इं श्योरेंस Cashless Garages

Commercial Vehicle Insurance Corona Rakshak Policy 1 Cr Term Insurance हेल्थ इं श्योरेंस Get Android App

Travel Insurance Corona Kavach Policy मेिडक्लेम पॉिलसी Get iOS App

Car Insurance Premium Calculator

Super Topup Plan

COMPANY

Learn About Us Contact Us Careers Sitemap FAQs

CONNECT WITH Become a Partner

US Become a Coverdrive POS

Agent

:

Coverfox Insurance Broking Pvt. Ltd. : C Wing, 6111-6118, 6th Floor, Oberoi Garden Estate, Chandivali Farm Road,

Chandivali, Andheri (East), Mumbai - 400072

Licence No. 478 , IRDA Direct Broker Code: IRDA/ DB 556/ 13 , Valid till: 26/12/2025, CIN: U66000MH2013PTC243810

Shipping & Delivery Policy Privacy Policy Legal Policies Cancellation & Refund Terms & Conditions

Copyright © 2023 Coverfox.com. All Rights Reserved

:

You might also like

- Insurance - Definition and Meaning 2Document4 pagesInsurance - Definition and Meaning 2ЕкатеринаNo ratings yet

- Remaining ProjectDocument81 pagesRemaining ProjectvickychapterNo ratings yet

- COMPANY PprrooffileDocument12 pagesCOMPANY PprrooffileKai MK4No ratings yet

- Daniel AyoolaDocument10 pagesDaniel AyoolaSalim SulaimanNo ratings yet

- Insurance and Risk ManagementDocument10 pagesInsurance and Risk Managementhitesh gargNo ratings yet

- New Microsoft Word DocumentDocument3 pagesNew Microsoft Word DocumentShantam GulatiNo ratings yet

- Presentation On InsuranceDocument40 pagesPresentation On InsurancedevvratNo ratings yet

- 3-Financial Services - Non Banking Products-Part 2Document47 pages3-Financial Services - Non Banking Products-Part 2Kirti GiyamalaniNo ratings yet

- 5-RISK MANAGEMENT AND LIFE INSURANCE (Insurance Planning)Document45 pages5-RISK MANAGEMENT AND LIFE INSURANCE (Insurance Planning)Haliyana HamidNo ratings yet

- Chapter - 1 Introduction of InsuranceDocument12 pagesChapter - 1 Introduction of InsuranceErica MaldonadoNo ratings yet

- 5-Insurance Planning (Insurance Planning)Document35 pages5-Insurance Planning (Insurance Planning)Farahliza RosediNo ratings yet

- Aid To Trade Insurance: Aditva SharmaDocument20 pagesAid To Trade Insurance: Aditva Sharmaaditva SharmaNo ratings yet

- Subject: Risk & Insurance Management: Submitted By: Nitin Mahindroo Roll-No-617 Submitted To: Mr. Naresh SharmaDocument18 pagesSubject: Risk & Insurance Management: Submitted By: Nitin Mahindroo Roll-No-617 Submitted To: Mr. Naresh SharmaNitin MahindrooNo ratings yet

- UNIT 3 InsuranceDocument10 pagesUNIT 3 InsuranceAroop PalNo ratings yet

- Fin221 Ca1Document22 pagesFin221 Ca1Devanshi SharmaNo ratings yet

- Chap Iii - FinaldraftDocument12 pagesChap Iii - FinaldraftOjo Meow GovindhNo ratings yet

- Child Insurance PlanDocument72 pagesChild Insurance PlanAnvesh Pulishetty -BNo ratings yet

- InsuranceDocument18 pagesInsuranceDRUVA KIRANNo ratings yet

- General InsuranceDocument65 pagesGeneral InsurancePaul MeshramNo ratings yet

- Insurance ProvisionDocument8 pagesInsurance ProvisionJake GuataNo ratings yet

- New Health Insurance Project Swati Sarang (Tybbi) UmDocument64 pagesNew Health Insurance Project Swati Sarang (Tybbi) UmMikant Fernando63% (8)

- Child Insurance PlanDocument72 pagesChild Insurance Plan6338250% (4)

- Insurance and Risk Management Unit IDocument9 pagesInsurance and Risk Management Unit Ipooranim1976No ratings yet

- Apollo MunichDocument52 pagesApollo MunichSumit ManglaniNo ratings yet

- Insurance & UTIDocument22 pagesInsurance & UTIReeta Singh100% (1)

- Law of Insurance AnswersheetDocument55 pagesLaw of Insurance Answersheetkhatriparas71No ratings yet

- Banking and InsuranceDocument17 pagesBanking and InsuranceDeepak GhimireNo ratings yet

- Unit - IiDocument9 pagesUnit - Iihitesh gargNo ratings yet

- Final DraftDocument71 pagesFinal DraftPayal RaghorteNo ratings yet

- PROJECT On HDFC Standard LifeDocument74 pagesPROJECT On HDFC Standard LifeVishal GuptaNo ratings yet

- Mhatre 30Document98 pagesMhatre 30sandeepNo ratings yet

- INTRODUCTIONDocument20 pagesINTRODUCTIONLEARN WITH AGALYANo ratings yet

- Insurance and It'S Importance: SANHITH REDDY (191127) Sec.ADocument13 pagesInsurance and It'S Importance: SANHITH REDDY (191127) Sec.AsanhithNo ratings yet

- Definition of InsuranceDocument11 pagesDefinition of InsurancePuru SharmaNo ratings yet

- UNIT 1 InsuranceDocument9 pagesUNIT 1 InsuranceHarleenNo ratings yet

- Insurance TemplateDocument41 pagesInsurance Templatereimart sarmientoNo ratings yet

- Institution That Offers A Person, Company, or Other Entity Reimbursement or Financial Protection Against Possible Future Losses or DamagesDocument16 pagesInstitution That Offers A Person, Company, or Other Entity Reimbursement or Financial Protection Against Possible Future Losses or DamagesHrishikesh DharNo ratings yet

- Insurance NotesDocument46 pagesInsurance NotespuruNo ratings yet

- General InsuranceDocument100 pagesGeneral InsuranceShivani YadavNo ratings yet

- Summary Sheet - Insurance Lyst7304Document19 pagesSummary Sheet - Insurance Lyst7304smriti kumariNo ratings yet

- My ProjectDocument30 pagesMy ProjectPriyanka satamNo ratings yet

- Executive SummaryDocument25 pagesExecutive SummaryRitika MahenNo ratings yet

- Consumer Awareness Regarding PNB MetlifeDocument51 pagesConsumer Awareness Regarding PNB MetlifeKirti Jindal100% (1)

- Contractual Savng 1Document10 pagesContractual Savng 1Farid Kae KhamisNo ratings yet

- InsuranceDocument18 pagesInsuranceYash SinglaNo ratings yet

- Life Insurance Kotak Mahindra Group Old MutualDocument16 pagesLife Insurance Kotak Mahindra Group Old MutualKanchan khedaskerNo ratings yet

- Insurance AwarenessDocument12 pagesInsurance Awarenessbhaskardoley30385215No ratings yet

- Insurance ManagementDocument25 pagesInsurance ManagementDeepak ParidaNo ratings yet

- InsuranceDocument45 pagesInsuranceAlex HaymeNo ratings yet

- Insurance CompaniesDocument5 pagesInsurance CompaniesangelicamadscNo ratings yet

- Insurance CompanyDocument9 pagesInsurance CompanyMD Abdur RahmanNo ratings yet

- Ibis Unit 03Document28 pagesIbis Unit 03bhagyashripande321No ratings yet

- Hum ADocument119 pagesHum Ajyoti8mishra100% (2)

- InsurancelawDocument136 pagesInsurancelawStuti SinhaNo ratings yet

- Project On Maxlife InsuranceDocument41 pagesProject On Maxlife Insurancejigna kelaNo ratings yet

- ArtDocument54 pagesArtpoojatolani3667No ratings yet

- Property, Liability and Auto Insurance: A Handbook and Guide for Insurance Concepts and Coverage!From EverandProperty, Liability and Auto Insurance: A Handbook and Guide for Insurance Concepts and Coverage!Rating: 5 out of 5 stars5/5 (1)

- Chapter 8 Adjusting EntriesDocument19 pagesChapter 8 Adjusting EntriesBLANKNo ratings yet

- Questions DEC - 2020 DIP IFRS CBEDocument9 pagesQuestions DEC - 2020 DIP IFRS CBEahmed redaNo ratings yet

- ABM11 BussMath Q2 Wk2 Gross-And-Net-EarningsDocument9 pagesABM11 BussMath Q2 Wk2 Gross-And-Net-EarningsArchimedes Arvie Garcia100% (1)

- CLASSIFICIATION OF ACCOUNTS - QuestionsDocument2 pagesCLASSIFICIATION OF ACCOUNTS - QuestionsRohit ChandraNo ratings yet

- PAYE Return SampleDocument42 pagesPAYE Return Sampleoyesigye DennisNo ratings yet

- Bonus Rates FY 2019 - 2020 PDFDocument10 pagesBonus Rates FY 2019 - 2020 PDFJnyanendra Kumar PradhanNo ratings yet

- Salary Bill Form Tr22 NGDocument5 pagesSalary Bill Form Tr22 NGSolangi Ahmed Aftab67% (3)

- Chapter 9 THE MANAGEMENT OF EMPLOYEE BENEFITS SERVICESDocument25 pagesChapter 9 THE MANAGEMENT OF EMPLOYEE BENEFITS SERVICESmariantrinidad98No ratings yet

- CH 13 3Document2 pagesCH 13 3Meghna CmNo ratings yet

- Ceci Est La Version HTML Du Fichier - Lorsque G o o G L e Explore Le Web, Il Crée Automatiquement Une Version HTML Des Documents RécupérésDocument3 pagesCeci Est La Version HTML Du Fichier - Lorsque G o o G L e Explore Le Web, Il Crée Automatiquement Une Version HTML Des Documents RécupérésJoel Christian MascariñaNo ratings yet

- Tax - Midterm NTC 2017Document12 pagesTax - Midterm NTC 2017Red YuNo ratings yet

- Early Preparation For Timely Pension: Dear VRS Optee of BSNL Gujarat CircleDocument2 pagesEarly Preparation For Timely Pension: Dear VRS Optee of BSNL Gujarat CircleShailesh BansalNo ratings yet

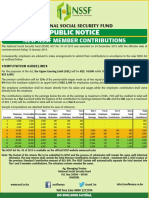

- Public Notice: New NSSF Member ContributionsDocument1 pagePublic Notice: New NSSF Member ContributionsDiana Dekatrinah KatrineNo ratings yet

- Government Policies in Various SectorsDocument32 pagesGovernment Policies in Various SectorskhyatiNo ratings yet

- Deferred Compensation OutlineDocument45 pagesDeferred Compensation OutlineEli ColmeneroNo ratings yet

- ECTSDocument17 pagesECTSsamuel debebeNo ratings yet

- Pensions and Other Postretirement BenefitsDocument40 pagesPensions and Other Postretirement BenefitsAlyssa Paula AltayaNo ratings yet

- Tabang vs. National Labor Relations CommissionDocument6 pagesTabang vs. National Labor Relations CommissionRMC PropertyLawNo ratings yet

- Labour Law in Zambia - An IntroductionDocument449 pagesLabour Law in Zambia - An Introductionalouissagota100% (1)

- 2Q - STEM - GenMath - LEC 07 - Simple AnnuitiesDocument12 pages2Q - STEM - GenMath - LEC 07 - Simple AnnuitiesKim Cinderell PestijoNo ratings yet

- Deduction From Gross Income QuizzerDocument2 pagesDeduction From Gross Income QuizzerAcademeNo ratings yet

- Vanisha Patika Sari - c1c020055 - Tugas Minggu Ke 14 BingDocument7 pagesVanisha Patika Sari - c1c020055 - Tugas Minggu Ke 14 BingVanisha PatikaNo ratings yet

- Salaxy Examples (Taxation)Document21 pagesSalaxy Examples (Taxation)PARTH NAIKNo ratings yet

- Pakistan - United States Income Tax TreatiesDocument12 pagesPakistan - United States Income Tax TreatiesMoazzamDarNo ratings yet

- Labour Law-Ii Study MaterialDocument30 pagesLabour Law-Ii Study MaterialElon MuskNo ratings yet

- 2014LHC6381 Proforma PromotionDocument8 pages2014LHC6381 Proforma PromotionAbdul HafeezNo ratings yet

- CHAPTER 10 Pay - For - Performance - Incentive RewardsDocument37 pagesCHAPTER 10 Pay - For - Performance - Incentive RewardsAmir ShafiqNo ratings yet

- Gen Math Quarter 2 Summative TestDocument6 pagesGen Math Quarter 2 Summative TestAngelie ButalidNo ratings yet

- Pension Dissertation TopicsDocument5 pagesPension Dissertation TopicsSomeoneWriteMyPaperSingapore100% (1)

- Regular Income Taxation: Individuals: Chapter Overview and ObjectivesDocument27 pagesRegular Income Taxation: Individuals: Chapter Overview and ObjectivesJane HandumonNo ratings yet