Professional Documents

Culture Documents

MMMM

Uploaded by

Parthiban ManiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MMMM

Uploaded by

Parthiban ManiCopyright:

Available Formats

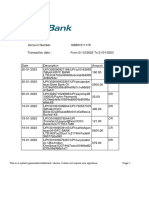

07/12/202 Interest Certificate

Date: 26/12/2023

To Whomsoever It May Concern

This is to inform that HDFC Credila Financial Services Limited (Formerly known as HDFC Credila

Financial Services Private Limited) sanctioned an education loan of Rs. 1,800,000 /- to Mr.

PARTHIBAN.S(Student), Mr. SUBRAMANIAN.V(Coborrower1) for pursuing course in POST

GRADUATE DIPLOMA IN MANAGEMENT: conducted by LOYOLA INSTITUTE OF

BUSINESS ADMINISTRATION in CHENNAI. The details of the loan as of date are as follows

Tranche No. Education Loan Account Number Date of Disbursement Amount of Disbursement

1 A4390277643 16/03/2023 Rs. 1,000,000/-

TOTAL Rs. 1,000,000/-

The details of repayment for financial year 2023- 2024 are given below: -

Amount of Amount of Amount of Projected Total Amount

Education

Tranche Installment Interest Principal Additional of Interest Due

Loan Account

No. Paid as of Paid as Paid as ofAmount of for FY 2023-

Number

Date of Date Date Interest Payable 2024

in FY 2023- 2024

1 A4390277643 Rs. 30158/- Rs. 21994/- Rs. 8164/- Rs. 235760 /- Rs. 257754/-

TOTAL Rs. 30158/- Rs. 21994/- Rs. 8164/- Rs. 235760/- Rs. 257754/-

Note: This certificate is issued at the request of the borrower(s) and neither the company nor any of its official shall be

responsible or liable directly or indirectly with regards the issuance of this certificate. Further though reasonable care and

diligence has been exercised in generating this certificate, however, pursuant to the education loan agreements, nothing

herein shall prejudice HDFC Credila’s interest or rights if there is any clerical or arithmetical error in the statement and / or

the calculations due and payable by the borrowers.

We further advise that the above details of tentative principal and interest payable are given on the assumption that there will

be no further drawal from your unavailed sanctioned limit or changes to the amortisation schedule on account of tenure or

rate of interest as applicable at the given point of time. The above interest would qualify for deduction under section 80E of

the Income Tax Act, 1961, subject to fulfillment of the conditions prescribed therein and the rules defined therein. These

conditions have not been verified by HDFC Credila. Customer should seek professional tax advice to confirm the eligibility

for deduction under this section.

This is a computer generated document, does not require signature.

https://www.hdfccredila.net/loan2/provi_IntCertificate1.asp?rd=1 1/1

You might also like

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Education Loan InterestDocument1 pageEducation Loan Interestravi lingam100% (2)

- Ravi Education Loan Interest-2023Document1 pageRavi Education Loan Interest-2023Cut Copy PateNo ratings yet

- Divyanshu Shekhar Interest CertificateDocument1 pageDivyanshu Shekhar Interest CertificateDIVYANSHU SHEKHAR100% (1)

- Education LoanDocument2 pagesEducation Loanzuheb80% (10)

- InterestDocument1 pageInterestsatya.undapalliNo ratings yet

- Education Loan PDFDocument1 pageEducation Loan PDFmac martinNo ratings yet

- Provisional Interest CertificateDocument2 pagesProvisional Interest Certificateashutosh sahuNo ratings yet

- Education LoanDocument1 pageEducation LoanAjinkya Bagade100% (1)

- NotesDocument1 pageNotessrinath330440No ratings yet

- 1682612446899Document1 page1682612446899JitendraBhartiNo ratings yet

- 1708059296839Document1 page1708059296839pinjarissNo ratings yet

- Chandra496 - Provisional Interest CertificateDocument2 pagesChandra496 - Provisional Interest CertificateChandrasekhar Nandigam100% (1)

- 1690715737039Document1 page1690715737039Rishi JakarNo ratings yet

- Vamsi Krishna Loan Sanction Letter 456Document7 pagesVamsi Krishna Loan Sanction Letter 456Venkatesh DoodamNo ratings yet

- Education Loan Interest CertDocument1 pageEducation Loan Interest Certshekismail mvjNo ratings yet

- Rakeshkaydalwar - Provisional Interest CertificateDocument2 pagesRakeshkaydalwar - Provisional Interest CertificaterakeshkaydalwarNo ratings yet

- Sudheer Loan Letter PDFDocument7 pagesSudheer Loan Letter PDFmr copy xeroxNo ratings yet

- Interest CertificateDocument1 pageInterest CertificatepankajgujjarNo ratings yet

- 1643730083633Document1 page1643730083633Saurabh ChoudharyNo ratings yet

- Balbheemloan Sanction LetterDocument6 pagesBalbheemloan Sanction LetterVenkatesh DoodamNo ratings yet

- Nagoor SANCTION - LETTER - PSI - AVFSDocument16 pagesNagoor SANCTION - LETTER - PSI - AVFSgudavalli0088No ratings yet

- Housing LoanDocument1 pageHousing LoanJeeva MNo ratings yet

- Education Loan PDFDocument1 pageEducation Loan PDFBikram Mudi80% (5)

- PDFDocument1 pagePDFVENKAT RAO0% (1)

- Sanction Letter INST5187568192559754 914871556872853Document10 pagesSanction Letter INST5187568192559754 914871556872853ManiNo ratings yet

- 1622717782153Document1 page1622717782153Jaya BharathiNo ratings yet

- Education Loan CertificateDocument2 pagesEducation Loan CertificateMadhumitha L80% (10)

- Provisional Certificate 2018-2019Document1 pageProvisional Certificate 2018-2019RohanNo ratings yet

- Sanction Letter FAST8661165681156219 356627714819686Document8 pagesSanction Letter FAST8661165681156219 356627714819686Kuldip MajethiyaNo ratings yet

- Car LoanDocument1 pageCar Loansatya.undapalliNo ratings yet

- 4330467076170342677Document1 page4330467076170342677vamsi patnalaNo ratings yet

- HL IT - Certificate - 621058739 FY 23-24 SampleDocument1 pageHL IT - Certificate - 621058739 FY 23-24 SampleGouravpurvi100% (1)

- To Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Document1 pageTo Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Potu RavinderreddyNo ratings yet

- Registered Address: HDFC Bank Ltd. HDFC Bank House, Senapati Bapat Marg, Lower Parel (West), Mumbai-400013Document1 pageRegistered Address: HDFC Bank Ltd. HDFC Bank House, Senapati Bapat Marg, Lower Parel (West), Mumbai-400013Khushi Jain100% (1)

- Interest CertificateDocument1 pageInterest Certificatebhagyaraju67% (15)

- MOD00005448 APPLICATIONFORMFinalDocument19 pagesMOD00005448 APPLICATIONFORMFinalgunjan.solanki90No ratings yet

- LBTRU00005805276 IT Certificate 2021-22Document2 pagesLBTRU00005805276 IT Certificate 2021-22siva kumar reddy kNo ratings yet

- HDFC 876Document1 pageHDFC 876Xen Operation DPHNo ratings yet

- Guide To Investment Proofs FY '24Document18 pagesGuide To Investment Proofs FY '24prasanjit.baruaNo ratings yet

- 40-23-0012664-00 20230820 PCDocument1 page40-23-0012664-00 20230820 PCMukesh ThakurNo ratings yet

- Sanction LetterDocument3 pagesSanction LetterOnis EnergyNo ratings yet

- Interest Certificate - 36185174 - 1054440Document1 pageInterest Certificate - 36185174 - 1054440ganeshbanger73No ratings yet

- Provisional Fy 20-21Document1 pageProvisional Fy 20-21Kedar YadavNo ratings yet

- HHLHYE00424239 Provisional (2019-2020)Document1 pageHHLHYE00424239 Provisional (2019-2020)sanjeevNo ratings yet

- View CertificateDocument1 pageView CertificateadiNo ratings yet

- For Indiabulls Housing Finance LimitedDocument1 pageFor Indiabulls Housing Finance LimitedWild RaacNo ratings yet

- Itr Auth LetrDocument3 pagesItr Auth LetrRajendra SinghNo ratings yet

- To Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Document1 pageTo Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961senthil kumarNo ratings yet

- Hhlkal00211208 17-18Document1 pageHhlkal00211208 17-18RohanNo ratings yet

- DiviDocument6 pagesDiviDeena dayalanNo ratings yet

- Certificate For Income Tax - July 2022 To June 2023: To Whom It May ConcernDocument1 pageCertificate For Income Tax - July 2022 To June 2023: To Whom It May Concernমোঃ জহুরুল ইসলামNo ratings yet

- SUSNEHADocument2 pagesSUSNEHAsusnehanalam47No ratings yet

- Education - Loan - Certificate Fy23 - 24Document1 pageEducation - Loan - Certificate Fy23 - 24Senthil kumarNo ratings yet

- 1563614521775Document1 page1563614521775JatinderPalNo ratings yet

- PBC - Documents - Forms Required For Tax Proofs FY 23-24Document13 pagesPBC - Documents - Forms Required For Tax Proofs FY 23-24saika tabbasumNo ratings yet

- Sanction LetterDocument3 pagesSanction LetterDipak BagadeNo ratings yet

- Know About MediaMintDocument1 pageKnow About MediaMintParthiban ManiNo ratings yet

- Aravindharaj Ad Ops - 110423Document2 pagesAravindharaj Ad Ops - 110423Parthiban ManiNo ratings yet

- DownloadDocument1 pageDownloadParthiban ManiNo ratings yet

- Itr Form 12bDocument6 pagesItr Form 12bprasanthme34No ratings yet

- Number of Instalments and Payment Mode Received Date Coll. Br. Serv. Br. Premium/ Additional Premium Amount Service Tax / GST Amount ReceivedDocument1 pageNumber of Instalments and Payment Mode Received Date Coll. Br. Serv. Br. Premium/ Additional Premium Amount Service Tax / GST Amount Receivedchandresh trivediNo ratings yet

- Statement 1674272376205Document19 pagesStatement 1674272376205Parthiban ManiNo ratings yet

- InvoiceDocument1 pageInvoiceParthiban ManiNo ratings yet

- FAQ On RGESS - v1Document6 pagesFAQ On RGESS - v1Parthiban ManiNo ratings yet

- Goods & Service Tax (GST) - ITCDocument8 pagesGoods & Service Tax (GST) - ITCWaahid KhanNo ratings yet

- Fall Semester - 2020 2021 Assignment III - PayrollDocument2 pagesFall Semester - 2020 2021 Assignment III - PayrollJayagokul SaravananNo ratings yet

- Salary Slip (30385759 October, 2021)Document1 pageSalary Slip (30385759 October, 2021)munafNo ratings yet

- Closing Stock - GSTDocument8 pagesClosing Stock - GSTpuran1234567890No ratings yet

- FIRE CalculatorDocument6 pagesFIRE CalculatorharshahvNo ratings yet

- BIR Form No. 0605Document2 pagesBIR Form No. 0605Ronald varrie BautistaNo ratings yet

- New Bir 2316 Ebs Members DesoDocument5 pagesNew Bir 2316 Ebs Members DesoEMELYN COSTALESNo ratings yet

- Inv 000070Document1 pageInv 000070prasanth mkNo ratings yet

- Interest 234 ABCDocument5 pagesInterest 234 ABCJitendra VernekarNo ratings yet

- (AyslipipsDocument5 pages(AyslipipsJee AlmanzorNo ratings yet

- Pay Advice: Results Alaska IncDocument1 pagePay Advice: Results Alaska Incbktsuna0201No ratings yet

- CGST & Central Excise - Range OfficeDocument2 pagesCGST & Central Excise - Range OfficeAYUSH PRADHANNo ratings yet

- TruckSpace PackageDocument3 pagesTruckSpace PackageTom MillerNo ratings yet

- Kotak Mahindra Bank Limited Payslip For The Month of AUGUST - 2010Document1 pageKotak Mahindra Bank Limited Payslip For The Month of AUGUST - 2010Bharat Shahane33% (3)

- Systra Phils Inc v. CIRDocument1 pageSystra Phils Inc v. CIRBRYAN JAY NUIQUENo ratings yet

- L Lull: Offs:308 H-1, Garg Tower, Netaji Subhash Place Pitampura, Delhi-110034Document4 pagesL Lull: Offs:308 H-1, Garg Tower, Netaji Subhash Place Pitampura, Delhi-110034Nidhi Aggarwal SinghalNo ratings yet

- Jay Bhavani ModelDocument6 pagesJay Bhavani ModelSaurabh JainNo ratings yet

- RINL - Visakhapatnam Steel Plant: Customer Inquiry #Document2 pagesRINL - Visakhapatnam Steel Plant: Customer Inquiry #Sasi Kanth GNo ratings yet

- Archirodon Inv January 2024 (RTTS)Document11 pagesArchirodon Inv January 2024 (RTTS)SyedAsrarNo ratings yet

- CIR v. Gatamco DigestDocument1 pageCIR v. Gatamco DigestJomar TenezaNo ratings yet

- Gross Estate QuizDocument4 pagesGross Estate QuizJose DulaNo ratings yet

- AM Tax Working New RegimeDocument6 pagesAM Tax Working New RegimeabhishekmenonNo ratings yet

- InvoiceDocument1 pageInvoiceprashantNo ratings yet

- Quiz TaxDocument4 pagesQuiz TaxrocketamberNo ratings yet

- FormDocument2 pagesFormBhargav VekariaNo ratings yet

- Irs - 2553 FormDocument4 pagesIrs - 2553 FormmeikaizenNo ratings yet

- 884110520502897RPOSDocument4 pages884110520502897RPOSgopalNo ratings yet

- Minnesota Department of Revenue Form M1PR (2017) - Homestead Credit Refund (Homeowners)Document2 pagesMinnesota Department of Revenue Form M1PR (2017) - Homestead Credit Refund (Homeowners)HansenNo ratings yet

- Payslip To Print - Report Design 03 06 2023Document1 pagePayslip To Print - Report Design 03 06 2023shani ChahalNo ratings yet

- Form 2 PDFDocument22 pagesForm 2 PDFAnonymous h0XgkOUNo ratings yet