Professional Documents

Culture Documents

Mac 6

Mac 6

Uploaded by

Thảo Nguyễn Thị Thu0 ratings0% found this document useful (0 votes)

3 views2 pages1) The goods market is in equilibrium when aggregate demand equals actual income, as shown by the IS schedule. The money market is in equilibrium when the demand for money equals the supply, as shown by the LM schedule.

2) The intersection of the IS and LM schedules shows the unique combination of interest rates and income that ensures equilibrium in both markets.

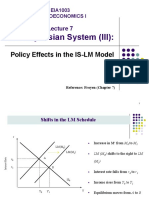

3) Fiscal policy like increased government spending shifts the IS curve to the right, increasing income and interest rates. Monetary policy like increased money supply shifts the LM curve to the right, lowering interest rates and increasing income.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) The goods market is in equilibrium when aggregate demand equals actual income, as shown by the IS schedule. The money market is in equilibrium when the demand for money equals the supply, as shown by the LM schedule.

2) The intersection of the IS and LM schedules shows the unique combination of interest rates and income that ensures equilibrium in both markets.

3) Fiscal policy like increased government spending shifts the IS curve to the right, increasing income and interest rates. Monetary policy like increased money supply shifts the LM curve to the right, lowering interest rates and increasing income.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views2 pagesMac 6

Mac 6

Uploaded by

Thảo Nguyễn Thị Thu1) The goods market is in equilibrium when aggregate demand equals actual income, as shown by the IS schedule. The money market is in equilibrium when the demand for money equals the supply, as shown by the LM schedule.

2) The intersection of the IS and LM schedules shows the unique combination of interest rates and income that ensures equilibrium in both markets.

3) Fiscal policy like increased government spending shifts the IS curve to the right, increasing income and interest rates. Monetary policy like increased money supply shifts the LM curve to the right, lowering interest rates and increasing income.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Goods market equilibrium

The goods market is in equilibrium when

the aggregate demand and actual

IS – LM model income are equal

The IS schedule shows the different

combinations of income and interest

rates at which the goods market is in

equilibrium.

1 2

The IS schedule Money market equilibrium

At a relatively high interest

The money market is in equilibrium

45o line when the demand for real money

AD1 rate r0, consumption and

investment are relatively balances is equal to the supply.

AD0 low – so AD is also low.

Equilibrium is at Y0.

At a lower interest rate r1 The LM schedule shows the different

Consumption, investment combinations of income and interest

Y0 Y1 and AD are higher.

r

Income

rates at which the money market is in

Equilibrium is at Y1.

r0 equilibrium.

The IS schedule shows all

the combinations of real

r1

income and interest rate

IS

at which the goods market

Y0 Y1 Income

is in equilibrium. 3 4

The LM schedule Shifting IS and LM schedules

r r The position of the IS schedule

LM depends upon:

r1

r1 anything (other than interest rates) that

r0 shifts aggregate demand: e.g.

r0

• autonomous consumption

LL1 (Y1)

LL0 (Y0) • autonomous investment

• government spending

L0 Real money Y0 Y1 Income

balances The position of the LM schedule

At income Y0, money demand is at LL0 and equilibrium depends upon

in the money market requires an interest rate of r0.

money supply

At Y1, money demand is at LL1,and equilibrium is at r1.

The LM schedule traces out the combinations of real income

5 6

and interest rate in which the money market is in equilibrium.

1

Equilibrium in goods and

money markets Fiscal policy in the IS-LM model

Y0, r0 represents the

r Bringing together the r initial equilibrium.

LM IS schedule (showing LM When government

goods market equilibrium)

r1 spending (G) increases,

r* and the LM schedule r0 the IS curve shifts to the

(showing money market right, from IS0 to IS1.

equilibrium). IS1

Equilibrium is now at

IS We can identify the IS0 r , Y .

1 1

unique combination of

real income and interest

Some private spending

Y* Income Y0 Y1 Income has been crowded out

rate (r*, Y*) which ensures

overall equilibrium. by the increase in the

7 rate of interest. 8

Monetary policy in the IS-LM Fiscal policy and monetary policy

model Using monetary and fiscal policy together to stabilize

Y0, r0 represents the the level of income around a high average level.

r LM0 initial equilibrium. Income level Y* can

r be attained by:

LM1 An increase in money LM1

r0 supply shifts the LM

LM0

schedule to the right.

r1

r1

Equilibrium is now ‘easy’ fiscal

IS0 at r1, Y1. r2 policy (IS1) with ‘tight’

monetary policy (LM1).

IS1

Y0 Y1 Income

IS0

9 Y* Income

10

Fiscal policy and monetary policy

Using monetary and fiscal policy together to stabilize

the level of income around a high average level.

Income level Y* can

r be attained by:

LM0

LM1

r1 ‘Tight’ fiscal policy (IS1)

r2 with ‘easy’ monetary

policy (LM1)

IS0

IS1

Y* Income

11

2

You might also like

- Venture Capital For Dummies Cheat Sheet - For DummiesDocument9 pagesVenture Capital For Dummies Cheat Sheet - For DummiesNasir Ali RizviNo ratings yet

- EC2102 Topic 9 - Solution SketchDocument3 pagesEC2102 Topic 9 - Solution SketchsqhaaNo ratings yet

- IS-LM Model of Determination of Interest RatesDocument14 pagesIS-LM Model of Determination of Interest Ratesnamanjain2290No ratings yet

- Tema 5Document13 pagesTema 5TRUJILLO MAYRANo ratings yet

- Chapter Four Is - LMDocument10 pagesChapter Four Is - LMEmmanuelNo ratings yet

- MakroekonomiDocument1 pageMakroekonomirizkisembiringNo ratings yet

- IS-LM ModelDocument34 pagesIS-LM ModelAyush AcharyaNo ratings yet

- Chapter 6. Economy in The Short Run: The Is - LM ModelDocument28 pagesChapter 6. Economy in The Short Run: The Is - LM ModelMinh HangNo ratings yet

- Unit 2Document50 pagesUnit 2Astha ParmanandkaNo ratings yet

- Money and Interest Rates: 7.1 Asset Equilibrium, Reviewed 7.2 IS-LM Model 7.3 Price and Aggregate DemandDocument48 pagesMoney and Interest Rates: 7.1 Asset Equilibrium, Reviewed 7.2 IS-LM Model 7.3 Price and Aggregate DemandMara RamosNo ratings yet

- Is-Lm Analysis AND Aggregate Demand: Dr. Laxmi NarayanDocument36 pagesIs-Lm Analysis AND Aggregate Demand: Dr. Laxmi NarayanHappy MountainsNo ratings yet

- Deriving LM Curve and Aggregate Demand: Macroeconomics Session 9Document23 pagesDeriving LM Curve and Aggregate Demand: Macroeconomics Session 9Prateek BabbewalaNo ratings yet

- 4 IS-LM ModelDocument29 pages4 IS-LM ModelKoeNo ratings yet

- Is LM Model Class LectureDocument35 pagesIs LM Model Class LectureRamaranjan Chatterjee100% (3)

- IS LM CurveDocument29 pagesIS LM CurveutsavNo ratings yet

- Aggregate Demand I: Building The IS-LM Model: Questions For ReviewDocument10 pagesAggregate Demand I: Building The IS-LM Model: Questions For ReviewErjon SkordhaNo ratings yet

- Macroeconomics: Lecture 7: IS-LM ModelDocument18 pagesMacroeconomics: Lecture 7: IS-LM ModelBakchodi NhiNo ratings yet

- Macroeconomics 6Document28 pagesMacroeconomics 6Quần hoaNo ratings yet

- Session 8 & 9 - IsLMDocument30 pagesSession 8 & 9 - IsLMAyusha MakenNo ratings yet

- 2022 Introduction To Economics Notes 18Document42 pages2022 Introduction To Economics Notes 18Nghia Tuan NghiaNo ratings yet

- The IS-LM Model Monetary and Fiscal Policy in The ISLM ModelDocument33 pagesThe IS-LM Model Monetary and Fiscal Policy in The ISLM ModelSobi RajaNo ratings yet

- Is LM PDFDocument9 pagesIs LM PDFShivam SoniNo ratings yet

- Lec 2 IS - LMDocument42 pagesLec 2 IS - LMDương ThùyNo ratings yet

- Macroeconomic Policy in An Open Economy: EconomicsDocument26 pagesMacroeconomic Policy in An Open Economy: EconomicsAman PratikNo ratings yet

- Is-Lm Model of The Economy 4Document11 pagesIs-Lm Model of The Economy 4Akshay PatilNo ratings yet

- By: Isha Jain (2921) Pavi Gupta (2925) Megh Anand (2945) Chayan Kurra (2930)Document32 pagesBy: Isha Jain (2921) Pavi Gupta (2925) Megh Anand (2945) Chayan Kurra (2930)Pavi GuptaNo ratings yet

- EMPA19th Batch Online Roll No.12 Public Finance AssignmentDocument5 pagesEMPA19th Batch Online Roll No.12 Public Finance AssignmentmaynannooNo ratings yet

- Is LM SummaryDocument16 pagesIs LM SummaryReal LiveNo ratings yet

- The Is-Lm Model: ECON 2123: MacroeconomicsDocument56 pagesThe Is-Lm Model: ECON 2123: MacroeconomicskatecwsNo ratings yet

- IS-LM ModelDocument6 pagesIS-LM ModelsnehashisNo ratings yet

- International Macroeconomics Chapter 2: Macroeconomic CrisesDocument11 pagesInternational Macroeconomics Chapter 2: Macroeconomic CrisesdkwlNo ratings yet

- C) IS LM ModelDocument19 pagesC) IS LM ModelJeny ChatterjeeNo ratings yet

- Is-Lm Model: ContentDocument9 pagesIs-Lm Model: ContentGiàu Nguyễn Thị NgọcNo ratings yet

- Session 11Document15 pagesSession 11Akash HamareNo ratings yet

- The Effectiveness of Emp Efp - Is-Lm-Bp AnalysisDocument10 pagesThe Effectiveness of Emp Efp - Is-Lm-Bp AnalysisNurul FatihahNo ratings yet

- ECO531 Chapter 8 Mind MapDocument10 pagesECO531 Chapter 8 Mind MapASMA HANANI BINTI ANUARNo ratings yet

- IS-LM ModelDocument19 pagesIS-LM ModelManas ChandaranaNo ratings yet

- Module 6 Is - LM ModelDocument50 pagesModule 6 Is - LM ModelHetvi JasaniNo ratings yet

- Macroeconomics Presentation FilesDocument30 pagesMacroeconomics Presentation FilesKlaus SchimidstNo ratings yet

- CH09 Is-Lm Ad-AsDocument58 pagesCH09 Is-Lm Ad-AsNickNo ratings yet

- Topic 2 ContinuationDocument18 pagesTopic 2 ContinuationERICK LOUIS ADOKONo ratings yet

- Module 19 Integration of The Real and Monetary Sectors of The EconomyDocument7 pagesModule 19 Integration of The Real and Monetary Sectors of The EconomyPatrickNo ratings yet

- Eia1003 - Lecture 7Document40 pagesEia1003 - Lecture 7Jia Yun YapNo ratings yet

- LM R R : The Open EconomyDocument20 pagesLM R R : The Open EconomyZeNo ratings yet

- 9.LM Curve Derivation and IS-LM FrameworkDocument15 pages9.LM Curve Derivation and IS-LM FrameworkHARSHALI KATKAR0% (1)

- IS Curve Lyst7231Document14 pagesIS Curve Lyst7231Narendran PNo ratings yet

- Y Cyt Ir G Nxe: The Mundell-Fleming ModelDocument8 pagesY Cyt Ir G Nxe: The Mundell-Fleming ModelHenok FikaduNo ratings yet

- Monetary and Fiscal PolicyDocument27 pagesMonetary and Fiscal Policyapi-3757629100% (2)

- 07 The Is-Lm AnalysisDocument11 pages07 The Is-Lm AnalysisrohanagaleNo ratings yet

- Money Market and is-LM ModelDocument32 pagesMoney Market and is-LM ModelArush saxenaNo ratings yet

- Goods Market and The IS Curve: R B I I R F IDocument6 pagesGoods Market and The IS Curve: R B I I R F INikhil kumarNo ratings yet

- Is-Lm Vanita Agarwal Chapter 16-17: B. Chatterjee Nmims-SocDocument14 pagesIs-Lm Vanita Agarwal Chapter 16-17: B. Chatterjee Nmims-SocHarjas anandNo ratings yet

- ISLM ModelDocument28 pagesISLM Modelsanjay63202No ratings yet

- IS-LM (Macroeconomics)Document11 pagesIS-LM (Macroeconomics)GETinTOthE SySteMNo ratings yet

- Chapter 11Document17 pagesChapter 11Teak TatteeNo ratings yet

- Macroeconomics I: Aggregate Demand II: Applying The IS-LM ModelDocument27 pagesMacroeconomics I: Aggregate Demand II: Applying The IS-LM Model우상백No ratings yet

- Exercise RevisionDocument44 pagesExercise Revisionk58 Vu Viet Yen LinhNo ratings yet

- Lecture 7Document10 pagesLecture 7GKNo ratings yet

- Lecture 2Document26 pagesLecture 2PratyushGarewalNo ratings yet

- Fiscal and Monetary PolicyDocument18 pagesFiscal and Monetary PolicyFarzad TouhidNo ratings yet

- DBA Macroeconomics Topic 3Document23 pagesDBA Macroeconomics Topic 3raul velazquez tepepaNo ratings yet

- Embedding Neoliberalism: The Evolution of A Hegemonic Paradigm (By Philip Cerny, From The Journal of International Trade and Diplomacy 2 (1), Spring 2008: 1-46)Document46 pagesEmbedding Neoliberalism: The Evolution of A Hegemonic Paradigm (By Philip Cerny, From The Journal of International Trade and Diplomacy 2 (1), Spring 2008: 1-46)skasnerNo ratings yet

- Dwnload Full International-Economics-9th-Edition-Appleyard-Solutions-Manual PDFDocument35 pagesDwnload Full International-Economics-9th-Edition-Appleyard-Solutions-Manual PDFgyrationenmeshs5il100% (9)

- 02 - The Bascis of Supply and Demand - sp2014 ChairutDocument24 pages02 - The Bascis of Supply and Demand - sp2014 ChairutMohammad Ehsanul HoqueNo ratings yet

- Sustainability - Wikipedia, The Free EncyclopediaDocument27 pagesSustainability - Wikipedia, The Free EncyclopediaBaguma Grace GariyoNo ratings yet

- Brochure Lean Sales enDocument4 pagesBrochure Lean Sales enMarcelo AlibertiNo ratings yet

- Present ValueDocument8 pagesPresent ValueFarrukhsgNo ratings yet

- Econ4415 International TradeDocument5 pagesEcon4415 International TradeTanya SinghNo ratings yet

- World Economic Forum Annual Meeting 2011: ReportDocument36 pagesWorld Economic Forum Annual Meeting 2011: ReportWorld Economic Forum100% (1)

- Risk & Return and CapmDocument49 pagesRisk & Return and CapmAayushNo ratings yet

- Shiller 2003Document36 pagesShiller 2003JanitscharenNo ratings yet

- Sapm PPT FinalDocument13 pagesSapm PPT FinaldudhatmehulNo ratings yet

- Intraday Trade For Gap Up OpeningsDocument14 pagesIntraday Trade For Gap Up OpeningsMarket PanditsNo ratings yet

- Demand and SupplyDocument3 pagesDemand and SupplyShalu AgarwalNo ratings yet

- International MarketingDocument31 pagesInternational MarketingRaza MalikNo ratings yet

- Dương Nguyễn - FIN 440 - Week 1 - Quiz 1Document3 pagesDương Nguyễn - FIN 440 - Week 1 - Quiz 1Dương NguyễnNo ratings yet

- Chapter 8Document54 pagesChapter 8Tegegne AlemayehuNo ratings yet

- Lampiran M - Booklet Applied ScienceDocument17 pagesLampiran M - Booklet Applied ScienceSarah Sabreina ZamriNo ratings yet

- Imed BBA CBCS 2014 SyllabusDocument146 pagesImed BBA CBCS 2014 SyllabusSaurabhNo ratings yet

- R14 Aggregate Output, Prices, and Economic GrowthDocument8 pagesR14 Aggregate Output, Prices, and Economic Growthdar shilNo ratings yet

- LookatdjosDocument4 pagesLookatdjosProfessor XNo ratings yet

- Global Perestroika Robert CoxDocument18 pagesGlobal Perestroika Robert CoxMontse Santacruz SadaNo ratings yet

- 2 TCW Chapter 2 Globalization of Markets and Economic RelationsDocument12 pages2 TCW Chapter 2 Globalization of Markets and Economic RelationsMiya LaideNo ratings yet

- Bus. Philo Chapter ReportDocument13 pagesBus. Philo Chapter ReportAna GonzalgoNo ratings yet

- Background of Campbell Soup CompanyDocument18 pagesBackground of Campbell Soup CompanyLuis Miguel Da SilvaNo ratings yet

- FII Investment in IndiaDocument38 pagesFII Investment in IndiaKhushbu GosherNo ratings yet

- Diass 9-10Document5 pagesDiass 9-10Sarmiento, Alexandrea Nicole B. 12 HUMSS BNo ratings yet

- Managerial Economics - 2020-22 - RevisedDocument3 pagesManagerial Economics - 2020-22 - RevisedVedant HingeNo ratings yet

- European Studies Thesis TopicsDocument7 pagesEuropean Studies Thesis Topicsclaudiabrowndurham100% (2)