Professional Documents

Culture Documents

BAC 1 Lesson8CompletingtheAccountingProcessforaServiceBusiness PDF

Uploaded by

AndwaeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BAC 1 Lesson8CompletingtheAccountingProcessforaServiceBusiness PDF

Uploaded by

AndwaeCopyright:

Available Formats

70

Lesson 8

Completing the Accounting Process

for a Service Business

Lesson Objectives:

At the end of the lesson, students are expected to:

1. Learn how to prepare at the end of the accounting period the preparation of worksheet, the financial

statements, adjusting entries, closing entries and post-closing trial balance.

2. Review the adjusting entries and the steps in the accounting cycle.

Learning Module on FAR101A

71

DISCUSSION OF CONTENT

WORKSHEET

A Worksheet is needed to gather and “workout” the adjustments at the reporting date. A worksheet is a columnar

paper where the first two columns are provided for the trial balance, which is the starting point for the preparation of the

financial statements. The next two columns are for the adjustments and from which adjusted balances are determined. A

ten-column worksheet has the following money columns:

Trial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet

Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit

ILLUSTRATION – WORKSHEET

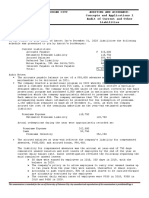

A trial balance and additional information for adjustments appear below for Carla Auto Repair Shop after one

year of operation:

CARLA AUTO REPAIR SHOP

TRIAL BALANCE

December 31, 2020

Debit Credit

Cash On Hand P 25,000

Cash In Bank 45,000

Accounts Receivable 49,000

12% Notes Receivable 30,000

Prepaid Insurance 15,000

Prepaid Supplies 600

Machinery & Equipment 150,000

Furniture & Fixtures 25,000

Accounts Payable P 26,000

18% Notes Payable 50,000

Bella, Capital 132,850

Bella, Personal 5,000

Repair Income 275,000

Referral Income 15,000

Salaries Expense 45,000

Rent Expense 55,000

Taxes & Licenses Expense 7,250

Utilities Expense 46,750

Interest Expense 250

TOTALS P 498, 850 P 498, 850

1. 10% of the accounts receivable should be recognized as doubtful of collection.

2. Insurance Premium recorded as Prepaid Insurance was for six months starting September 1, 2020

3. Supplies amounting to P200 are still on hand.

Learning Module on FAR101A

72

4. The notes receivable represents a 60-day note received from the customer on Nov. 16, 2020.

5. Machinery and equipment were acquired April 1, 2020 with an estimated useful life of 10 years and a scrap

value of P50,000.

6. The furniture and fixtures were acquired January 1, 2020 with an estimated useful life of 10 years and a scrap

value of P2,500

7. The notes payable dated December 1 is for 60 days due to Republic Finance.

8. December gross receipts is P50,000 subject to 3% Percentage tax.

Computations/ Explanations:

1. The amount estimated as doubtful of collection should be treated as uncollectible, hence, deduction to the amount

of account receivable. 10% x P49,000 = P4,900. This will be discussed in detail in Intermediate Accounting

subject.

2. As of December 31, 2020, the expired portion of the Prepaid Insurance acquired for six months recorded

on September 1, 2020 was four months. P15,000 x 4/6 = P10,000. “4” represents the months expired while “6”

represents the full term of the insurance. P10,000 is the expired portion to be recognized as “Insurance Expense”

and will be deducted to the P15,000 amount recorded as Prepaid Insurance.

3. The unadjusted balance of Prepaid Supplies presented was P600. The amount of unused Supplies amounts to

P200 and it follows that the difference of P400 should be recognized as “Supplies Expense” as it was used

during the year. The amount of Prepaid Supplies that should be recognized is P200.

4. The Note Receivable was acquired from customers on November 16, 2020 and the interest from that date up to

the balance sheet date (December 31, 2020) should be recognized. The computation of the ‘Interest Income’

for this note should be computed as: P30,000 x 12% x 45/360 = P450. ‘45’ represents the number of days from

November 16 – December 31, 2020 while ‘360’ represents the number of days in the whole year. (Applying the

banker’s rule in computing interest, 360 should be used instead of 365 unless stated that 365 days will be used)

5. Depreciation is a reduction in the value of an asset with the passage of time, due in particular to wear and

tear.The machinery and equipment were acquired on April 1, 2020 and as of December 31, 2020; these were

already used for 9 months. The statement above provided that the machinery and equipment have a useful life of

10 years and salvage value at the end of its useful life of P50,000. In computing the depreciation:

P150,000 – P50,000 = P10,000 x 9/12 = P7,500 (Depreciation Expense)

10 years

P10,000 – annual depreciation of the equipment

9 – number of months that the machinery and equipment have been used

12 – number of months in a year

9/12 – proration of the annual depreciation if in case the asset is not used for the whole year.

6. Depreciate the furniture and fixtures for one year since it was acquired on January 1,2020:

P25,000 – P 2,500 = P2,250 (Depreciation Expense)

10 years

Learning Module on FAR101A

73

P2,250 – the annual depreciation of P2,250 will be recognized in its totality since the asset was used for the

whole year. No proration of this amount since the date of acquisition and presumed use of the asset is January

1 of this year.

7. The 18% Notes Payable dated December 1, 2020 will have an accrued interest from December 1 to 31 and will be

recognized as “Interest Payable” because it is from a liability. The computation is as follows: P50,000 x 18% x

30/360 = P750 (Interest Payable). ‘30/360’ is the proration because the note was not contracted at the beginning

of the year and ‘30’ represents the number of days the loan was outstanding.

8. The Percentage Tax is a business tax recognized as “Taxes Expense” in the books of the taxpayer and the amount

that should be recognized as expense is computed: P50,000 x 3% = P1,500. This amount should be recognized as

“Taxes Payable” assuming no payment was made to the taxing agency.

Learning Module on FAR101A

74

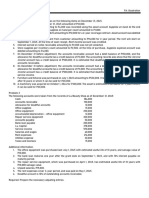

Carla Auto Repair and Paint Shop

Worksheet

For the year ended December 31, 2020

Trial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet

Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit

Cash in Hand 25,000 25,000 25,000

Cash in Bank 45,000 45,000 45,000

Accounts Receivable 49,000 49,000 49,000

Notes Receivable 30,000 30,000 30,000

Prepaid Insurance 15,000 2) 10000 5,000 5,000

Prepaid Supplies 600 3) 400 200 200

Machinery & Equipment 150,000 150,000 150,000

Furniture & Fixtures 25,000 25,000 25,000

Accounts Payable 26,000 26,000 26,000

Notes Payable 50,000 50,000 50,000

Carla, Capital 132,850 132,850 132,850

Carla, Personal 5,000 5,000 5,000

Repair Income 275,000 275,000 275,000

Referral Income 15,000 15,000 15,000

Salaries Expense 45,000 45,000 45,000

Taxes & Licenses Expense 7,250 8) 1500 8,750 8,750

Rent Expense 55,000 55,000 55,000

Utilities Expense 46,750 46,750 46,750

Interest Expense 250 7) 750 1,000 1,000

498,850 498,850

Doubful Accounts Expense 1) 4900 4,900 4,900

Allow for Doubtful Accounts 1) 4900 4,900 4,900

Insurance Expense 2) 10000 10,000 10,000

Supplies Expense 3) 400 400 400

Interest Receivable 4) 450 450 450

Interest Income 4) 450 450 450

Depreciation Exp.-Mach&Eq 5) 7500 7,500 7,500

Accumulated Depr.-Mach&Eq 5) 7500 7,500 7,500

Depreciation Exp.-Fur&Fix 6) 2250 2,250 2,250

Accumulated Depr.-Fur&Fix 6) 2250 2,250 2,250

Interest Payable 7) 750 750 750

Taxes Payable 8) 1500 1,500 1,500

Totals 27,750 27,750 516,200 516,200 181,550 290,450 334,650 225,750

Net Income 108,900 108,900

Totals 290,450 290,450 334,650 334,650

Learning Module on FAR101A

75

Steps in preparing the worksheet:

1. Enter the worksheet heading which consists of three lines shown above: (Name of company, Title ‘Worksheet’

and the period covered)

2. Enter the column headings, providing the first two money columns for the trial balance, and the next eight money

columns two for each of the following: Adjustments, Adjusted Trial Balance, Income Statement and Balance

Sheet.

3. Copy the trial balance in the first two money columns. Do not copy the totals. Prove the trial balance by footing

again. Rule and double rule the totals.

4. Enter the adjustments in the next two money columns. If the account to be adjusted exists in the trial balance, just

write the figure alongside the account. If no account exists in the trial balance, then create an account below it.

Identify each adjustment by using key letters or numbers for easy reference. Prove the equality of what you did by

footing the debit and credit columns, then rule and double rule.

5. Take the adjusted balances of all accounts and extend to the Adjusted Trial Balance column. Accounts with no

adjustments are extended in their original amounts.

A debit account in the trial balance with a debit adjustment is added (refer to interest expense) while a

credit adjustment is deducted to arrive at the adjusted balance (refer to prepaid insurance). If the result is a debit,

extend to the debit column of the adjusted trial balance, if a credit, extend to the credit column of the adjusted trial

balance. A credit account in the trial balance with a credit adjustment is added while a debit adjustment is

deducted to arrive at the adjusted balance. Again extend the balance to the debit or credit side of the adjusted trial

balance. All new accounts below the trial balance are extended directly to the appropriatecolumn of the adjusted

trial balance column.

6. From the adjusted balances, extend all income and expense accounts to the income statement column. Total the

debit column and credit column. The debit total represents the expenses and the credit total represents the income.

If the credit total is more than the debit total, the difference represents a net income from operation and should be

placed on the debit side of the income statement and extended to the credit side of the statement of financial

position. Using the illustrated worksheet, it will appear as follows:

Income Statement

Debit Credit

Subtotal P181,550 P290,450

Net Income 108, 900

Totals P290,450 P290,450

7. Extend all assets, liabilities, capital and drawing account to the statement of financial position column. Sub-total

the debit and the credit columns. Enter the net income on the credit side and present the totals. Using the

illustrated worksheet, it will appear thus:

Learning Module on FAR101A

76

Statement of Financial Position

Subtotal P334,650 P225,750

Net Income 108, 900

Totals P334,650 P 334,650

If the debit total in the income statement column is more than the credit total, the result is a net loss figure

which should be entered on the credit column. This in turn is extended to the debit column of the statement of

financial position. Care should be taken in preparing the worksheet. If the difference (net income or net loss) in

the income statement column and in the statement of financial position column are not the same, errors may have

been committed either in copying amounts or in the extension process. Balancing the last four money columns,

however, is not an assurance that your work is correct since errors in computations and in analyzing the data for

adjustments will not be reflected in a balanced worksheet. The completed worksheet will assist the accountant in

preparing the financial statements and in recording the adjusting and closing entries.

ADJUSTING ENTRIES RECORDED AND POSTED TO THE LEDGER

Based on the adjustment column of the worksheet we prepared above, the adjusting entries will now be formally

recorded in the general journal. Take note of the ledger page numbers in the F column.

GENERAL JOURNAL

Date Particulars F Debit Credit

2020

Dec. 31 Adjusting Entries:

1) Doubtful Accounts 607 4,900

Allowance for Doubtful Accounts 103 4,900

To provide for uncollectible accounts.

2) Insurance Expense 608 10,000

Prepaid Insurance 107 10,000

To adjust for the expired insurance.

3) Supplies Expense 602 400

Prepaid Supplies 108 400

To adjust for the supplies used up.

4) Interest Receivable 106 450

Interest Income 503 450

To accrue interest on notes.

5) Depreciation Expense - Machinery & Equipment 609 7,500

Accumulated Depreciation - Machinery & Equipment 202 7,500

To take up depreciation on machinery and equipment.

6) Depreciation Expense - Furnitures & Fixtures 610 2,250

Accumulated Depreciation - Furniture & Fixtures 204 2,250

To take up depreciation on furnitures and fixtures.

7) Interest Expense 606 750

Interest Payable 303 750

To accrue for interest on note due to Republic Finance.

8) Taxes and Licenses Expense 603 1,500

Taxes Payable 304 1,500

To record accrued taxes.

Learning Module on FAR101A

77

Note that the date is the end of the accounting period. The entries should next be posted to the general ledger to arrive at

the adjusted balances. Postings for the first two entries will appear thus:

Allowance for Doubtful Accounts Acct. No. 103

Date Explanation Ref Debit Credit Balance

2020 Debit Credit

Dec. 31 AE1 4,900 4,900

Doubtful Accounts Expense Acct. No. 607

Date Explanation Ref Debit Credit Balance

2020 Debit Credit

Dec. 31 AE1 4,900 4,900

Prepaid Insurance Acct. No. 107

Date Explanation Ref Debit Credit Balance

2020 Debit Credit

Sept. 1 CPJ 9 15,000 15,000

Dec. 31 AE2 10,000 5,000

Insurance Expense Acct. No. 608

Date Explanation Ref Debit Credit Balance

2020 Debit Credit

Dec. 31 AE2 10,000 10,000

Note that the Reference (Ref) Column identifies the adjusting entries (AE) with reference numbers copied from

the entry number. After all the postings, the ledger balances will reflect the same amounts as shown in the Adjusted Trial

Balance column of the worksheet. Shown below is the Adjusted Trial Balance after taking into consideration the year-end

adjustments of Carla:

Learning Module on FAR101A

78

CARLA AUTO REPAIR SHOP

ADJUSTED TRIAL BALANCE

December 31, 2020

Debit Credit

Cash On Hand P 25,000

Cash In Bank 45,000

Accounts Receivable 49,000

Allowance for Doubtful Accounts P 4,900

Notes Receivable 30,000

Interest Receivable 450

Prepaid Insurance 5,000

Prepaid Supplies 200

Machinery & Equipment 150,000

Accumulated Depreciation – Machinery & Equipment 7,500

Furniture & Fixtures 25,000

Accumulated Depreciation – Furniture & Fixtures 2,250

Accounts Payable 26,000

Notes Payable 50,000

Interest Payable 750

Taxes Payable 1,500

Carla, Capital 132,850

Carla, Personal 5,000

Repair Income 275,000

Referral Income 15,000

Interest Income 450

Depreciation Expense – Machinery & Equipment 7,500

Depreciation Expense – Furniture & Fixtures 2,250

Doubtful Accounts Expense 4,900

Insurance Expense 10,000

Salaries Expense 45,000

Supplies Expense 400

Rent Expense 55,000

Taxes & Licenses Expense 8,750

Utilities Expense 46,750

Interest Expense 1,000

TOTALS P 516,200 P 516,200

Learning Module on FAR101A

79

PREPARING THE FINANCIAL STATEMENTS

INCOME STATEMENT – An income statement is a summary of revenues earned and expenses incurred for a certain

period of time. This is usually presented first because you need to determine the profit which has to be shown in the

capital statement then the balance of the capital account is transferred in the statement of financial position.

Rules in preparing the Income Statement:

1. The statement consists of four parts: heading, body of the statement for revenues earned and for expenses

incurred and net income or profit.

2. Heading consist of three lines: Name of Business, title of report, time period.

3. There are two margins in the body – the extreme margin on the left side is used to describe the accounts

contained in the major section.

4. There are two money columns in the body – the extreme margin on the left side is for the major amounts and

the inner money column contains the details of the major amounts.

5. Peso signs in the final money column (extreme right) are placed on the first and last amounts.

6. A single line is placed under the last figure to be added or subtracted and a double line is placed under the

final figure.

7. The principal income is always presented first. Expenses may be presented from the highest amount to the

lowest amount (descending order), in which case other operating expenses may be presented first in the

expense section. Or expenses may be arranged alphabetically. Interest expense being a financial cost is always

presented last. The rule is also the same in the arrangement of the expenses in the supporting notes.

Applying the aforementioned rules in preparing an income statement, refer to the adjusted trial balance in the worksheet

of Carla Auto Repair Shop. Presented below is the nature of expense form of income statement of the said auto repair

shop. The two presentation forms of income statement will be tackled in detail in higher accounting subjects so for the

meantime, an income statement based on the nature of expenses is presented:

Learning Module on FAR101A

80

CARLA AUTO REPAIR SHOP

INCOME STATEMENT

For the year ended December 31, 2020

Revenue:

Repair Income ₱ 275,000

Other Income (Note 1) 15,450

Expenses:

Salaries Expense ₱ 45,000

Depreciation Expense (Note 2) 9,750

Other Operating Expense (Note 3) 125,800 - 180,550

Interest Expense - 1,000

PROFIT/(LOSS) ₱ 108,900

Note 1: Other Income

Referral Income ₱ 15,000

Interest Income 450

Total ₱ 15,450

Note 2: Depreciation Expense

Depreciation: Machinery & Equipment ₱ 7,500

Depreciation: Furnitures & Fixtures 2,250

Total ₱ 9,750

Note 2: Other Operating Expense

Rent Expense ₱ 55,000

Utilities Expense 46,750

Insurance Expense 10,000

Taxes & Licenses 8,750

Bad Debts Expense 4,900

Supplies Expense 400

Total ₱ 125,800

STATEMENT OF CHANGES IN EQUITY – Changes in the owner’s capital or owner’s equity are summarized in the

statement also known as the capital statement. This statement is presented for a period of one year and give the owner a

satisfactory explanation of how his/her capital changes throughout the year. The changes that may affect the equity of an

owner are the initial and additional investments made during the year, withdrawal of assets, and net income/net loss

sustained by the entity.

In the example below, take note that in the unadjusted trial balance of Carla, she had P132,850 in her capital account. Her

initial investment in her business was P100,000 and she made an additional investment amounting to P32,850.

Learning Module on FAR101A

81

CARLA AUTO REPAIR SHOP

STATEMENT OF CHANGES IN OWNER'S EQUITY

For the year ended December 31, 2020

Carla, Capital, January 1 ₱ 100,000

Additional Investment 32,850

Add: Net Income 108,900

Total ₱ 241,750

Less: Withdrawals 5,000

Carla, Capital, December 31 ₱ 236,750

STATEMENT OF FINANCIAL POSITION – This statement lists in detail the assets and liabilities of the business and

shows the residual interest of the owner as of a specific date.

The Statement of Financial Position may be presented in two ways, account form and report form, depending on the

preference of users of the financial statements. Note that both ways are accepted by the standarads.

1. The account form balance sheet is presented in a horizontal format, with information in two columns beside

each other. The left column of the account form balance sheet lists assets, while the right column lists liabilities

and equity. Naturally, the last line in each column lists the total value of all assets and liabilities and equity,

respectively. The account form balance sheet can be easier to use when information is being presented for

multiple periods, and it allows the reader to verify that the ledger is in balance at a glance.

2. The report form balance sheet is presented in a vertical orientation, and is essentially one column that spans

the entire width of a page. Starting with assets, the report form balance sheet provides a total value at the end of

the assets section, followed by liabilities and equity, with the final line of the report form balance sheet providing

the total combined value of liabilities and equity.

Rules in presenting the Statement of Financial Position:

1. The heading consists of three lines:

a. Name of the Business

b. Title of the Report

c. Date

2. Margin on the left side for the major classifications: The extreme left margin is used for describing the major

classifications like current assets or current liabilities and the inner margin is used for describing the accounts

herein like cash, accounts receivable and supplies.

3. Money column on the right side: The placement of the amounts usually follows the margin on the left side;

extreme right money column for the major amounts following the major classifications like total current assets

P149,750, total current liabilities P78,250, and inner money columns for the amounts of the described accounts

like Cash P70,000, Trade and Other Receivables P74,550, and Prepaid Expenses P5,200.

4. In the final money column, the peso sign is placed on the first and last amounts per accounting value; while in the

inner money column, the peso sign is placed on the first amount of every column.

5. A single line is placed under the last figure to be added or subtracted and a double line is placed under the final

figure.

Learning Module on FAR101A

82

The rules are to be followed whether the format used is a report format or account format.

Shown below is an example of a Statement of Financial Position for Carla’s Auto Repair Shop in an Report

Form with disclosures (in the previous part of this module, the account form of Statement of Financial Position was

shown for Mr. N Travel and Tours):

CARLA AUTO REPAIR SHOP

STATEMENT OF FINANCIAL POSITION

December 31, 2020

ASSETS

Current Assets:

Cash (Note 1) ₱ 70,000

Trade and Other Receivables (Note 2) 74,550

Prepaid Expenses (Note 3) 5,200

Total ₱ 149,750

Non-Current Assets:

Property & Equipment (Note 4) 165,250

Total Assets ₱ 315,000

LIABILITIES AND OWNER'S EQUITY

Current Liabilities:

Trade & Other Payables (Note 5) ₱ 78,250

Owner's Equity:

Carla, Capital 236,750

Total Liabilities & Owner's Equity ₱ 315,000

Note 1: Cash on Hand ₱ 25,000

Referral Income 45,000

Total ₱ 70,000

Note 2: Accounts Receivable ₱ 49,000

Less: Allowance for Bad Debts 4,900

Net Realizable Value ₱ 44,100

Notes Receivable 30,000

Interest Receivable 450

Total ₱ 74,550

Note 3: Prepaid Insurance ₱ 5,000

Prepaid Supplies 200

Total ₱ 5,200

Note 4: Machinery & Equipment ₱ 150,000

Less: Accumulated Depreciation 7,500 ₱ 142,500

Furnitures & Fixtures ₱ 25,000

Less: Accumulated Depreciation 2,250 22,750

Total ₱ 165,250

Note 5: Accounts Payable ₱ 26,000

Notes Payable 50,000

Interest Payable 750

Taxes Payable 1,500

Total ₱ 78,250

Learning Module on FAR101A

83

Current and Non-Current Classification

Current Assets – include cash and cash equivalents which are not restricted in use, as well as other assets expected to be

realized into cash, or sold or consumed within the normal operating cycle of the business or one year, whichever is longer.

The following are examples of current assets: Cash, Marketable Securities, Receivables that are collectible within one

year or the normal operating cycle of the business, Merchandise Inventory, Prepaid Expenses and Contra-Asset Accounts

such as Allowance for Bad Debts that are treated as deduction to another current asset account.

Non-Current Assets – those assets that are not included in the current assets such as the property, plant and equipment or

fixed assets which are needed to support the operation of the business over a long period of time and are not intended for

sale. Examples are Land, Building, Equipment, Furniture & Fixtures, Leasehold or Lease Right and Contra-Asset Account

such as Accumulated Depreciation which are treated as deduction to another non-current asset account.

Current Liabilities – those debts or obligations reasonably expected to be liquidated in the normal course of the entity’s

operating cycle or paid within a period of one year by the use of current assets or the creation of other current liabilities.

Examples are Accounts Payable, Loan Payable (payable within one year), Utilities Payable, Interest Payable and Taxes

Payable.

Non-Current Liabilities – long term liabilities or obligations which are payable longer than one year such as Note

Payable, Mortgage Payable and Bond Payable.

These will be discussed thoroughly in Intermediate Accounting subjects. I included this for you to have an idea of the

basic classification of accounts and to know the basics as early as now.

Adequate Disclosures – require the inclusion of significant information that will help enhance the entity’s financial

statements. Also helps users be informed of additional facts and other information such as major liabilities and their due

dates, contingent assets and liabilities, subsequent events that may affect the resources that were presented in the

Statement of Financial Position that will aid them in properly interpreting the financial statements. Notes supporting line

items shown in the Income Statement and Statement of Financial Position are included to adequately inform the users of

the contents and relevant information that will help them make their decision based on the financial statement presented to

them.

STATEMENT OF CASH FLOWS – The definition and function of this statement has been given in the previous part of

this module. Relevance of this statement are: a) it will enlighten the owner/entity on how the cash is being managed, b)

being able to monitor the cash flows in the business as it is vital to the financial health of the business and c) some

businesses fail because of its inability to maintain a proper balance between receipts and disbursements.

A summary of cash flows is given below:

Activities Inflows Outflows

Operating Revenue collections Payment of expenses

Investing Sale of securities, plant, property Acquisition of securities, plant,

and equipment property and equipment

Financing Loans extended by creditors or Cash paid to creditors or

contributors of investors withdrawn by investors

Learning Module on FAR101A

84

Shown below is the Statement of Cash Flows for the Auto Repair Shop of Carla. Take note of the following additional

information: Cash on January 1, 2020 was P100,000 with an additional investment of P32,850 in cash during the year.

Accounts Payable came from purchase of machinery.

CARLA AUTO REPAIR SHOP

STATEMENT OF CASH FLOWS

For the year ended December 31, 2020

Cash flows from operating activities:

Cash received from customers (schedule 1) ₱196,000

Collections for referrals made 15,000

Payment of rent - 55,000

Payment of utilities - 46,750

Payment of salaries - 45,000

Payment of insurance (schedule 2) - 15,000

Payment of taxes (schedule 3) - 7,250

Payment of supplies (schedule 4) - 600

Payment for interest expense (schedule 5) - 250

Net cash provided by operating activities ₱ 41,150

Cash flows from investing activities:

Acquisition of machinery & equipment (schedule 6) -₱124,000

Acquisition of furniture - 25,000

Net cash used by investing activities - 149,000

Cash flows from financing activities:

Cash Investment of Carla ₱ 32,850

Cash Withdrawals made by Carla - 5,000

Loan from Republic Finance 50,000

Net cash provided by financing activities 77,850

Increase in cash -₱ 30,000

Cash, January 1 100,000

Cash, December 31 ₱ 70,000

Schedule 1: Repair Income ₱ 275,000

Accounts Receivable, Dec. 31 - 49,000

Notes Receivable, Dec. 31 - 30,000

Collection from customers ₱ 196,000

Schedule 2: Insurance Expense ₱ 10,000

Prepaid Insurance, Dec. 31 5,000

Insurance paid ₱ 15,000

Schedule 3: Taxes and Licenses Expense ₱ 8,750

Prepaid Insurance, Dec. 31 - 1,500

Insurance paid ₱ 7,250

Schedule 4: Supplies Expense ₱ 400

Prepaid Supplies, Dec. 31 200

Insurance paid ₱ 600

Schedule 5: Interest Expense ₱ 1,000

Interest Payable, December 31 - 250

Payment for interest ₱ 750

Schedule 6: Machinery & Equipment ₱ 150,000

Accounts Payable - 26,000

Payment for machinery ₱ 124,000

Learning Module on FAR101A

85

Note that the Statement of Cash Flows tell the users that the cash flows from operation and financing activities are

inadequate to meet the investing activities of the business such as acquisition of needed property and equipment. A more

detailed discussion about this financial statement will be tackled more and elaborated in higher accounting subjects.

CLOSING ENTRIES

After all the adjustments have been journalized and posted, and the financial statements prepared, and income and

expense accounts and owner’s drawing account have to be closed. Income, expense and drawing accounts accumulate

information only for a specific accounting period and must be closed at the end of the calendar or fiscal period.

Closing the book means bringing the nominal and drawing accounts to zero balances by transferring them to the

owner’s equity (capital account of the owner). Remember profit or loss goes to the owner and this is done by adding profit

to or subtracting loss from the owner’s capital account to arrive at ending capital. After the closing entries, the books are

“cleared” of the temporary or nominal accounts, so that in the following accounting period a new set of temporary or

nominal accounts will again be opened and used for recording the revenue and expense transactions for that year. This is

the reason why the heading of the income statement is only for one accounting period.

On the other hand, assets, liabilities, and the capital accounts do not need closing entries since these are real or

permanent accounts whose balances are brought forward to the next accounting period. These accounts are brought to a

zero balance only when the assets are disposed, the liabilities are paid and the capital is recovered by the owner.

In making the closing entries, use the income statement column of the worksheet as a guide. The title Income

Summaryis an account used to close the nominal values and bring them to the capital account. These are the steps in

making the closing entries:

1. Close the revenue accounts such as Repair Income and Interest Income which normally are credit balances by

a debit entry and credit the title ‘Income Summary”.

2. Close the expense accounts such as Salaries Expense and Taxes Expense which normally are debit balances by a

credit entry and debit the title ‘Income Summary”

3. Determine the balance of the Income Summary account. A credit balance, representing a net income, should be

closed by debiting “Income Summary” and crediting to increase the Owner’s capital account. A debit balance,

representing a net loss, should be closed by crediting the Income Summary account and debiting to decrease the

Owner’s Capital Account.

4. The drawing account which normally is a debit balance should be closed by crediting this account and debiting to

decrease the capital account.

The diagram shown below shows the flow of the nominal accounts to the capital account of the owner. This

diagram portrays the steps in making the closing entries we have discussed above. The ledger or T-accounts are used to

explain how we will make the balances of the nominal accounts (revenue and expense accounts) be closed to the “Income

Summary” account and the drawing account be closed ultimately to the capital account of the owner. The ending balance

of the capital account, representing a “catch all” of the nominal accounts as well as the owner’s investment and personal

drawing, is presented in the Statement of Financial Position.

Learning Module on FAR101A

86

Each Expense accounts Each Revenue accounts

Normal debit Normal credit

Credit to close Debit to close

balance 1) balance

2)

Income Summary account

Total Expense Total Income

If a credit balance,

close on the debit

side

Carla, Drawing 3) Carla, Capital

Normal debit Normal credit

Credit to close Withdrawals

balance balance

4)

Net Income

The closing entries for Carla Auto Repair Shop will be recorded as follows:

Date Particulars F Debit Credit

2020

Dec. 31 Closing Entries:

1) Repair Income 275,000

Referral Income 15,000

Interest Income 450

Income & Expense Summary 290,450

To close the credit accounts.

2) Income & Expense Summary 181,550

Salaries Expense 45,000

Supplies Expense 400

Taxes & Licenses 8,750

Rent Expense 55,000

Utilities Expense 46,750

Interest Expense 1,000

Bad Debts Expense 4,900

Insurance Expense 10,000

Depreciation Expense - Machinery 7,500

Depreciation Expense - Furniture 2,250

To close the debit accounts.

3) Income & Expense Summary 108,900

Carla, Capital 108,900

To close profit to capital.

4) Carla, Capital 5,000

Carla, Drawing 5,000

To close drawing to capital.

Learning Module on FAR101A

87

On December 31, 2020, the capital account will show an ending balance of P236,750, the same amount shown

in the statement of financial position. (Kindly get this amount by taking into account all entries that involved the capital

account. You will arrive at this amount by using the T-Accounts or in any other way that is convenient for all of you.

Familiarize yourselves on how every account moves and how a transaction affects that particular account.) Also, take

note that all of the nominal accounts (such as Repair Income, Supplies Expense, Carla, Drawing) are all zero or

cleared accounts.

After the closing entries have been recorded and posted, all accounts in the general ledger whether real or

nominal, have to be double-ruledto show the end of the accounting period. All the real accounts with balances will be

brought forward next accounting period unlike the nominal accounts which will start from the scratch.

PREPARING THE POST-CLOSING TRIAL BALANCE

After accomplishing so many accounting steps, there is a need again to prepare a trial balance to prove the

equality of the debits and credits. This time, the trial balance is called a Post Closing Trial Balance since it is prepared

after closing the books and contains only real accounts. Post Closing Trial Balance has the same accounts and amounts as

those found in the statement of financial position.

Shown below is the Post-Closing Trial Balance of Carla Auto Repair Shop:

CARLA AUTO REPAIR SHOP

POST CLOSING TRIAL BALANCE

December 31, 2020

Debit Credit

Cash On Hand P 25,000

Cash In Bank 45,000

Accounts Receivable 49,000

Allowance for Doubtful Accounts P 4,900

Notes Receivable 30,000

Interest Receivable 450

Prepaid Insurance 5,000

Prepaid Supplies 200

Machinery & Equipment 150,000

Accumulated Depreciation – Machinery & Equipment 7,500

Furniture & Fixtures 25,000

Accumulated Depreciation – Furniture & Fixtures 2,250

Accounts Payable 26,000

Notes Payable 50,000

Interest Payable 750

Taxes Payable 1,500

Carla, Capital 236,750

TOTALS P 329,650 P 329,650

Learning Module on FAR101A

88

REVERSING ENTRIES

Reversing entries are journal entries that are made by an accountant at the beginning of the accounting cycle. This

is an optional step in the accounting cycle and if the bookkeeper wishes can skip it entirely. The purpose of these entries is

to reverse the adjusting entries that were made in the previous financial reporting period. It is commonly used for revenue

and expense account which had accruals or prepayment in the preceding accounting cycle and the accountant prefers not

to keep these in the accounting system.

There are two key benefits to making a reversal entry:

It significantly reduces the chances of making an error of double counting certain expenses or revenues.

It will allow efficient processing of actual invoices during the current accounting period.

Why are Reversal Entries needed?

Reversal entries will significantly make life of a bookkeeper easier, since he won’t have to remember which

expenses and revenues were accrued and prepaid. He can record the reversing entries to negate the effect of the adjusting

entries that were passed in the preceding year and essentially start anew. For the current period, he would just have to

record the expenses and revenue as they come in and not worry about the accrued and prepayments of the last period.

If the bookkeeper does not record these reversal entries, then he would have to remember which portion of the

current expenses, for example, has already been paid out in the previous period. Therefore, there is a high chance of

double-counting certain revenues and expenses. The practice of making reversal entries at the beginning of the accounting

cycle will ensure that this error of double counting is avoided.

It should be emphasized that reversing entries are OPTIONAL. Generally, a reversing entry should be made

for any adjusting entry that increased an asset or liability account. Therefore, all accruals are reversed but only

deferrals initially recorded in income statement – income or expense – accounts are reversed.

Illustration: A certain company has accrued the salaries of their employees on the balance sheet date:

2020 Salaries Expense 18,000

Dec. 31 Salaries Payable 18,000

To record accrued salaries.

When the employees are paid on the next regular payday, the entry would be:

2021 Salaries Payable 18,000

Jan. 10 Salaries Expense 54,000

Cash 72,000

To record accrued salaries.

Note that when the payment is made, without a prior reversing entry, the accountant must look into the records to

find out how much of the P72,000 applies to the current accounting period and how much was accrued at the beginning of

the period.

Learning Module on FAR101A

89

This step may appear easy in this simple case, but think of the problems that may arise if the company has many

employees, especially if some of them are paid on different time schedules such as weekly or monthly. A reversing entry

is an accounting procedure that helps solve this difficult problem. As noted above, a reversing entry is exactly what its

name implies. It is a reversal of the adjusting entry made. For example, observe the following sequence of transactions

and their effects on the ledger account – salaries expense:

1. Adjusting entry

2020 Salaries Expense 18,000

Dec. 31 Salaries Payable 18,000

To record accrued salaries.

2. Closing entry

2020 Income & Expense Summary 18,000

Dec. 31 Salaries Expense 18,000

To record closing of salaries expense account.

3. Reversing entry

2021 Salaries Payable 18,000

Jan. 1 Salaries Expense 18,000

To record reversal of salaries expense account.

4. Payment entry

2021 Salaries Expense 72,000

Jan. 10 Cash 72,000

To record payment of salaries.

These transactions had the following effects on salaries expense:

a. Adjusted salaries expense to accrue P18,000 in the proper accounting period(which is 2020).

b. Closed the amount of Salaries Expense accrued to Income & Expense Summary account (assume that the amount

accrued is the only Salaries Expense to be recognized for 2020).

c. Established a credit balance of P18,000 on January 1, 2021 in salaries expense equal to the expense recognized

through the adjusting entry on December 31, 2020. The liability account Salaries Payable was reduced to a zero

balance. (Effect of reversing entry in #3)

d. Recorded the P72,000 payment of salaries in the usual manner. The reversing entry has the effect of leaving a

balance of P54,000 (P72,000 – P18,000) in the Salaries Expense account. This P54,000 balance represented the

salaries expense which pertains to 2021 expense already.

Making the payment entry was simplified by the reversing entry. Reversing entries apply to all accrued expenses

or revenues.

Learning Module on FAR101A

90

SUMMARY OF THE LESSON

The Income Statement contains the following information: a. Revenue; b. Itemized list of expenses; c. Net

Income or Net Loss

The Statement of Financial Position contains the following information: a. Assets of the business; b. Liabilities

or the amount of the assets funded by the creditors; c. Residual interest of the owner(s)

The Statement of Changes in Owner’s Equity gives details on: a. Capital Balances; b. Drawings; c. Additional

Investments; d. Net Income or Net Loss

A Cash Flow Statement is prepared to show the effect on cash of the following business activities: a. Financing;

b. Operating; c. Investing

The closing process is the method of giving zero balances to the temporary accounts so that these accounts will

be cleared and made ready for recording another set of revenues and expenses for the next accounting period.

The closing process involves the following: a. Close the Revenue accounts to the title “Income Summary”; b.

Close the Expense accounts to “Income Summary”; c. Close the Income Summary to Owner’s Capital; d. Close

the Drawing account to Owner’s Capital

A Post-Closing Trial Balance is prepared after the closing entries to determine if the equality of balances is still

maintained. It shows the real or permanent accounts that should be opened for the next accounting period.

Learning Module on FAR101A

You might also like

- BPCS Shop Order Processing FilesDocument72 pagesBPCS Shop Order Processing Filescrif7175% (4)

- Adjustments Quiz 2Document6 pagesAdjustments Quiz 2Loey ParkNo ratings yet

- Ap A2.1 - FinalDocument7 pagesAp A2.1 - FinalLuna LeeNo ratings yet

- Review Problem WorksheetDocument37 pagesReview Problem WorksheetKyle Ronquillo50% (2)

- Chapter-1 Introduction About The Internship Industry ProfileDocument43 pagesChapter-1 Introduction About The Internship Industry ProfileMani Chowdry100% (4)

- Adjusting Entries and Promissory NotesDocument6 pagesAdjusting Entries and Promissory Noteselma wagwagNo ratings yet

- AE17 Quiz No. 1Document2 pagesAE17 Quiz No. 1nglc srzNo ratings yet

- Rich Angelie Muñez - Adjusting Entries and Promissory NotesDocument9 pagesRich Angelie Muñez - Adjusting Entries and Promissory NotesRich Angelie MuñezNo ratings yet

- Adjusting Entries QuizDocument12 pagesAdjusting Entries QuizJuan Dela CruzNo ratings yet

- Quiz 5Document2 pagesQuiz 5ryan rosalesNo ratings yet

- Far - Long Quiz - Nov 28, 2019Document1 pageFar - Long Quiz - Nov 28, 2019Renalyn ParasNo ratings yet

- Assignment Module 5Document2 pagesAssignment Module 5Hazel Jane MejiaNo ratings yet

- Drill 9.1 Adjusting EntriesDocument7 pagesDrill 9.1 Adjusting EntriesJouhara ObeñitaNo ratings yet

- Adjusting Entry - AnswerDocument8 pagesAdjusting Entry - AnswerReighjon Ashley C. TolentinoNo ratings yet

- (EN) Problem Mojakoe AK1Document11 pages(EN) Problem Mojakoe AK1gebbyNo ratings yet

- Review of The Accounting Process PDFDocument3 pagesReview of The Accounting Process PDFShiela Marie Sta AnaNo ratings yet

- Accounting Battaglia 1 Question and AnswersDocument7 pagesAccounting Battaglia 1 Question and AnswersRina RaymundoNo ratings yet

- NOTES PROBLEMS ACCTG-323-newDocument3 pagesNOTES PROBLEMS ACCTG-323-newJoyluxxiNo ratings yet

- Fundamentals of AccountingDocument50 pagesFundamentals of AccountingCarmina Dongcayan100% (2)

- FAR 01C Review of Accounting Cycle IllustrationsDocument2 pagesFAR 01C Review of Accounting Cycle Illustrationsbyunb3617No ratings yet

- Acc 1 QuizDocument7 pagesAcc 1 QuizAyat MukahalNo ratings yet

- Adjusting Entries ActsDocument5 pagesAdjusting Entries ActsLori100% (1)

- Father Saturnino Urios University Accountancy Program Acc111 - Conceptual Framework & Accounting StandardsDocument2 pagesFather Saturnino Urios University Accountancy Program Acc111 - Conceptual Framework & Accounting StandardsErika BucaoNo ratings yet

- AUDITING-Adjusting Entries-Correction of ErrorsDocument10 pagesAUDITING-Adjusting Entries-Correction of ErrorsJamhel MarquezNo ratings yet

- MCQ Adjusting EntriesDocument7 pagesMCQ Adjusting EntriesMara Clara100% (1)

- Practical Accounting 1-SIR SALVADocument366 pagesPractical Accounting 1-SIR SALVASofia SanchezNo ratings yet

- Topic 6 Sample ProblemsDocument1 pageTopic 6 Sample ProblemsMary Jane Pedere VeranoNo ratings yet

- ADJUSTING Activities With AnswersDocument5 pagesADJUSTING Activities With AnswersRenz RaphNo ratings yet

- ACC 226 Expanded OpportunityDocument4 pagesACC 226 Expanded OpportunityEllen MNo ratings yet

- FAR - Midterms and FinalsDocument14 pagesFAR - Midterms and FinalsShanley Vanna EscalonaNo ratings yet

- Exercise 5 - Completing The Accounting Cycle For Merchandising and Service BusinessDocument4 pagesExercise 5 - Completing The Accounting Cycle For Merchandising and Service BusinessShiela Rengel0% (2)

- ACCT 1026 2nd Dep QuizDocument8 pagesACCT 1026 2nd Dep QuizRizmonley Limbo Paguyod-FernandezNo ratings yet

- Instructions: Write TRUE, If The Statement Is Correct, and FALSE, If Otherwise On The Space Provided. No ErasuresDocument3 pagesInstructions: Write TRUE, If The Statement Is Correct, and FALSE, If Otherwise On The Space Provided. No ErasuresRizhelle CunananNo ratings yet

- Fragment M 11Document7 pagesFragment M 11sm munNo ratings yet

- Basic Accounting Mock PrelimsDocument4 pagesBasic Accounting Mock Prelimshadassah VillarNo ratings yet

- Cash Flow Statements Notes and Practical ExercisesDocument9 pagesCash Flow Statements Notes and Practical ExercisesRNo ratings yet

- FAR 3 Homework No. 03 PDFDocument5 pagesFAR 3 Homework No. 03 PDFAisah ReemNo ratings yet

- January 31: Birendra Mahato Adjusting Entries and WorksheetDocument17 pagesJanuary 31: Birendra Mahato Adjusting Entries and WorksheetAjit UpretyNo ratings yet

- Practice Set 2Document4 pagesPractice Set 2Mylene CandidoNo ratings yet

- Adjusting EntriesDocument7 pagesAdjusting EntriesMichael MagdaogNo ratings yet

- A2.1 April2023Document7 pagesA2.1 April2023thuyhangg0209No ratings yet

- Jan David's Accounting Las 4Document9 pagesJan David's Accounting Las 4Cj ArquisolaNo ratings yet

- Accounting Finals Exam Reviewer Adjusting EntriesDocument4 pagesAccounting Finals Exam Reviewer Adjusting EntriesElleana DNo ratings yet

- Accounting Finals Exam Reviewer Adjusting EntriesDocument4 pagesAccounting Finals Exam Reviewer Adjusting EntriesElleana DNo ratings yet

- Review of The Accounting Process Straight Problems Problem 1Document13 pagesReview of The Accounting Process Straight Problems Problem 1angielynNo ratings yet

- Practice Exercise - Adjusting Entries WorksheetDocument9 pagesPractice Exercise - Adjusting Entries WorksheetRhea Rocha AlfonsoNo ratings yet

- 9016 - IFRS 3 Business Combination MergerDocument4 pages9016 - IFRS 3 Business Combination Mergerせい じよNo ratings yet

- Current Liabilities - PROBLEMSDocument11 pagesCurrent Liabilities - PROBLEMSIra Grace De Castro100% (2)

- Acco 30103 Partnership Formation and Operations 04-2022Document3 pagesAcco 30103 Partnership Formation and Operations 04-2022Zyrille Corrine GironNo ratings yet

- Quiz 2 AuditingDocument18 pagesQuiz 2 Auditingaldrin elsisuraNo ratings yet

- Abm Acctg Firm Section 2am 2Document40 pagesAbm Acctg Firm Section 2am 2Diana Rosales CalNo ratings yet

- Chin Figura - Unit IV Learning ActivitiesDocument7 pagesChin Figura - Unit IV Learning ActivitiesChin FiguraNo ratings yet

- Exercise Chapter 3Document7 pagesExercise Chapter 3leen attilyNo ratings yet

- FABM1 ModuleDocument7 pagesFABM1 ModuleKylie Nadine De Roma50% (2)

- Chapter 2&3 Par - CorDocument31 pagesChapter 2&3 Par - CorJUARE MaxineNo ratings yet

- Partnership Operations HandoutDocument5 pagesPartnership Operations HandoutAlyssa Ashley L. Manaid100% (1)

- ACTIVITY 04 - Analyzing TransactionsDocument6 pagesACTIVITY 04 - Analyzing TransactionsJohn Luis Cordova CacayurinNo ratings yet

- Acctg Ils 2Document2 pagesAcctg Ils 2therese sonzaNo ratings yet

- Polytechnic University of The Philippines College of Accountancy Santa Maria, BulacanDocument3 pagesPolytechnic University of The Philippines College of Accountancy Santa Maria, BulacanJudith Batisan100% (1)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- A Beginners Guide to QuickBooks Online: The Quick Reference Guide for Nonprofits and Small BusinessesFrom EverandA Beginners Guide to QuickBooks Online: The Quick Reference Guide for Nonprofits and Small BusinessesNo ratings yet

- Importance of The Night AuditDocument17 pagesImportance of The Night AuditDeepak GH100% (1)

- Bh5 s4cld1705 BPD en XXDocument34 pagesBh5 s4cld1705 BPD en XXAnonymous Yw2XhfXv100% (1)

- Accounts Dav SolutionDocument7 pagesAccounts Dav SolutionTBG ARMYYTNo ratings yet

- CA2 Pankaj 306Document8 pagesCA2 Pankaj 306Pankaj MahantaNo ratings yet

- Assignment-1: Interpretation of The Financial Statements For Jones Corporation and Smith CorporationDocument8 pagesAssignment-1: Interpretation of The Financial Statements For Jones Corporation and Smith CorporationfatemaNo ratings yet

- Summer Internship Programme 2018-19: National Aluminum Company Limited NalcoDocument59 pagesSummer Internship Programme 2018-19: National Aluminum Company Limited Nalcoanon_849519161No ratings yet

- Dissolution of PartnershipDocument17 pagesDissolution of PartnershipJASKARANNo ratings yet

- B. Cross-Functional: Bài 01: Introduction To Business ProcessesDocument81 pagesB. Cross-Functional: Bài 01: Introduction To Business ProcessesTrương Quốc PhongNo ratings yet

- LU4: Statement of Cash FlowsDocument44 pagesLU4: Statement of Cash FlowsLi YuNo ratings yet

- Accounts Receivables ManagementDocument11 pagesAccounts Receivables ManagementAli xNo ratings yet

- AUD2016Ed Espenilla Solution GuideV2Document156 pagesAUD2016Ed Espenilla Solution GuideV2Stephanie Ann AsuncionNo ratings yet

- Partnership FormationDocument1 pagePartnership FormationBea BonusNo ratings yet

- Ch.2 Techniques of Financial AnalysisDocument74 pagesCh.2 Techniques of Financial Analysisj787100% (1)

- Problems On Journal, Ledger and Accounting EquationDocument11 pagesProblems On Journal, Ledger and Accounting EquationGopiNo ratings yet

- Management of Fin Serv QuizDocument22 pagesManagement of Fin Serv QuizSidharth BharathNo ratings yet

- Auditing Problem ReviewerDocument10 pagesAuditing Problem ReviewerTina Llorca83% (6)

- FI 1: Display Chart of AccountsDocument7 pagesFI 1: Display Chart of AccountsAmitash DeganNo ratings yet

- Module 12 MACC423 Eugene A RuanoDocument14 pagesModule 12 MACC423 Eugene A RuanoCatherine LeroNo ratings yet

- Batch 93 FAR First Preboard February 2023 - SolutionDocument5 pagesBatch 93 FAR First Preboard February 2023 - SolutionlorenzNo ratings yet

- CAT T1 Recording Financial Transactions Course SlidesDocument162 pagesCAT T1 Recording Financial Transactions Course Slideshazril46100% (5)

- Auditing MCQS NotesDocument19 pagesAuditing MCQS Noteskamal sahabNo ratings yet

- Jam QaDocument7 pagesJam QaVinluan JeromeNo ratings yet

- Ca Zambia June 2021 QaDocument415 pagesCa Zambia June 2021 QaESGNo ratings yet

- Finals - Graded Exercises 003 - Journalizing and Adjusting Entries Prep Under MerchandisingDocument2 pagesFinals - Graded Exercises 003 - Journalizing and Adjusting Entries Prep Under MerchandisingGarpt KudasaiNo ratings yet

- Ind As 109 PDFDocument5 pagesInd As 109 PDFashmit bahlNo ratings yet

- J&K Bank Working CapitalDocument26 pagesJ&K Bank Working CapitalSurbhi NargotraNo ratings yet

- Financial Accounting Notes DownloadDocument59 pagesFinancial Accounting Notes Downloadapi-298062858No ratings yet