Professional Documents

Culture Documents

The Influence of Internal and External Players On The Perception of MSME Players in Decisions On The Application of Financial Technology

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Influence of Internal and External Players On The Perception of MSME Players in Decisions On The Application of Financial Technology

Copyright:

Available Formats

Volume 9, Issue 1, January – 2024 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

The Influence of Internal and External Factors on the

Perception of MSME Actors in Decisions on the

Application of Financial Technology

(Study on MSMEs in Bandung City)

Indah Noer Fatimah1 Lin Oktris2

Universitas Mercu Buana Universitas Mercu Buana

Jakarta, Indonesia Jakarta, Indonesia

Deden Tarmidi3 Agustin Fadjarenie4

Universitas Mercu Buana Universitas Mercu Buana

Jakarta, Indonesia Jakarta, Indonesia

Abstract:- Financing technology is an innovation in the I. INTRODUCTION

financial industry in loans, payments, financial records,

and investments that can be accessed by MSME actors. The world of technology is now developing so quickly,

However, business actors are still not familiar with that internet access has become very easy with just a device as

financing technology so that the use of financing small as the palm of a hand. The availability of the internet

technology is low. This study aims to (1) Analyze the and advances in digital technology have reduced expenses

influence of Internal Factors and External Factors on the while facilitating daily work to be faster, easier, accurate and

Perception of MSME actors in the Application of efficient

Financial Technology; (2) Analyze the influence of

Internal Factors and External Factors on the Decisions of Financial technology or more commonly known as

MSME actors in the Application of Financial Technology; FinTech is one of the digital breakthroughs in finance which

(3) Analyze the Influence of MSME Actors' Perceptions was first introduced in 2004, it is known that FinTech

on Financial Technology Implementation Decisions. The companies in Indonesia are currently dominated by lending

research design uses quantitative. The sample used by the companies, consisting of 166 companies (50%). After lending,

research was 100 MSME actors in the city of Bandung. payment companies contributed a large number of 73

The analyzer uses SEM-PLS. The results showed that companies (23%), followed by blockchain and cryptocurrency

internal and external factors have an influence and are as many as 26 companies (8%), investment/personal finance

significant on the perception of MSME actors in the as many as 24 companies (7%),

application of financial technology. Internal actors and

External Factors have a significant influence on the Mechanisms or activities carried out by business people

Decisions of MSME actors in the Application of Financial that connect fund owners with fund borrowers are called

Technology. The perception of MSME actors has a FinTech lending. The development of the number of FinTech

significant influence on the decision to implement lending companies is presented on the chart.

financial technology. Then it is suggested that MSME

actors can seek and consider access to affordability,

availability and suitability in order to get socio-cultural

support to decide on the application of Financial

Technology.

Keywords:- MSME, Financial Technology.

IJISRT24JAN1023 www.ijisrt.com 655

Volume 9, Issue 1, January – 2024 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Fig 1 Development of the Number of FinTech

Lending Companies in Indonesia. Shows that licensing especially in the financial sector regardless of education, age

issues have led to a year-on-year decline in the number of factors, to the knowledge of MSME players about FinTech

FinTech lending companies. itself.

In October 2022, the United Nations Conference on II. LITERATURE STUDY

Trade and Development (UNCTAD) released its ASEAN

investment report 2022 which showed that 65.46 million Financial Behavior

MSMEs in Indonesia contributed 60.3 percent to the country's According to Mudzingiri et al., (2018) Financial

GDP and absorbed 97 percent of the workforce. Based on this, behavior can also have a significant impact on the well-being

the MSME sector. of individuals at home, community, country and even the

whole world. The set of financial activities that can be

Overall, the value of transactions through FinTech observed by economic agents best describes Financial

increases every year. Dataindonesia.id., (2021) based on a Behavior. Fachrudin et al., (2022).

report from AFTECH ( Indonesian FinTech Association ),

the targets that have been served by 62 percent of FinTech Financial Technology

companies are Micro, Small and Medium Enterprises This Martono, (2021) Payment services FinTech is one of the

shows that FinTech has proven to provide many benefits, one services for buying and selling transactions where consumers

of which is for MSME players can pay to sellers without using physical money. This can

increase efficiency in buying and selling transactions both for

According to Muhamad, (2023) There are three main business actors and for consumers. Then there is also a

markets of the company FinTech in Java Island the first most financial recording service in FinTech. Digital payment

is Jakarta 88%, then followed by Bandung City as much as services through FinTech Provide benefits in the form of

29.3% and third is Surabaya City as much as 28%. The convenience and ease of making transactions, then recording

growth of MSMEs in Bandung City can be seen that the and financial planning can be recorded easily because in the

number continues to grow every year between 2016 - 2021. system will be recorded the history of transactions made.

According to statistics from the Bandung City Cooperative There is no denying how large the contribution of small and

and MSME Office, there are various types of MSMEs in the medium enterprises to the economic development of a

city of Bandung such as fashion, culinary, handicrafts, country.

services, and others. When examined back to the era when

digitalization does require MSME players to be aware of the Perception

rapid development of digitalization today, especially product Hermuningsih & Wardani, (2016) Perception defines

marketing applications and payment systems (such as OVO, perception as the act of responding directly to something and

QRIS, SHOPEEPAY, GOPAY, etc.). Then the condition of receiving it, or as the process by which a person learns things

the Covid-19 pandemic that hit yesterday greatly encouraged through his five senses and has a tendency to perceive the

MSME players to be able to use the digitalization system, same item in various ways.

IJISRT24JAN1023 www.ijisrt.com 656

Volume 9, Issue 1, January – 2024 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Decision-Making Based on the Theory, Previous Research and the

According to Steiner (1998) decision making is a human Framework of Thought Stated above, the Following

process involving individual and societal phenomena, based Research Hypotheses can be Proposed:

on facts and value premises, and ending with a choice made

from a series of choices with the aim of achieving the desired H1: There is a positive influence of internal and external

result. While Koontz, (1998) says that decision making is factors on the perception of MSME actors in the

choosing one of several possible actions. application of Financial Technology

H2: There is a positive influence of internal and external

factors on the decision to implement Financial Technology

H3: There is an influence on the perception of MSME

actors on the decision to implement Financial Technology

III. RESEARCH METHODOLOGY

The object of this study is the decision of MSME actors

in implementing Financial Technology. This research design

uses a quantitative design of causality., Data Analysis Data

collection techniques or information used in this study

Interviews and Questionnaires.

The population in this study is MSME actors in the city

of Bandung which amounts to 464,346 MSMEs, the number

of samples needed for the study is as many as 100

respondents of MSME actors in the city of Bandung. Data

Management and Analysis used is Test Instrument and

Fig 2 Thinking Framework Structural Equation Model (SEM) – Partial Least Square

(PLS)

IV. RESULTS AND DISCUSSION

A. Reliability Item

The loading value of this factor is the magnitude of the correlation between each indicator and its contract. A loading factor

value above 0.7 can be said to be ideal, meaning that the indicator can be said to be valid as an indicator to measure contracts.

However, standardized loading factor values above 0.5 are acceptable. While the value of the standardized loading factor below

0.5 can be excluded from the Chin W model, (1998). The following are the item reability values that can be seen in the

standardized loading column:

Fig 3 Standardized Loading Factor Inner dan Outer Model Awal

IJISRT24JAN1023 www.ijisrt.com 657

Volume 9, Issue 1, January – 2024 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Based on the loading factor for internal factors that have The perception factor with the indicator that has the

the greatest value, namely Revenue (X1.5) with a value of largest loading factor is Reliability (Y1.3) with a loading

0.923. This shows that income has the most influence on the factor value of 0.944. This indicates that FinTech Institutions

decisions of MSME players in implementing FinTech. In are institutions that pay more attention to and understand the

external factors, the indicator that has the largest loading needs of MSME actors. In Decision, the indicator that has the

factor is access affordability, availability and suitability largest loading factor is preferential decision (Y2.3) with a

(X2.3) with a loading factor of 0.939. This shows that access, value of 0.941. This shows that FinTech is the main

affordability, availability and suitability are the dominant preference for MSME players to support their business

factors that determine MSME players decide to implement activities.

FinTech.

Value cronbach’s alpha and D.G rho (PCA) above 0.7

indicates that the construct has high reliability or reliability as

a measuring instrument. Cut-off values of 0.7 and above are

acceptable and above 0.8 and 0.9 are very satisfactory

Nunnally and Bernstein, (1994); Yamin, (2011).

Tabel 1 Composite Reliability Result

Composite Reliability

Internal Factors 0,963

External factors 0,922

Perseption 0,976

Results 0,945

Composite reliability for internal factors (X1) of 0.963; B. Average Variance Extracted (AVE)

external factors (X2) of 0.922; Meanwhile, the perception of If the AVE value is above 0.5, it can be said that the

MSME actors and the decisions of MSME actors are 0.976 construct has good convergent validity. This means that

and 0.945. The four latents obtain a composite reliability latent variables can explain on average more than half the

value above 0.7 so that it means that all factors that influence variance of its indicators.

the decisions of MSME actors in the use of Financial

Technology in the city of Bandung have good reliability or

reliability as a measuring instrument

Table 2 Average Variance Extracted (AVE) Result

AVE

Internal Factor (X1) 0,790

External factors (X2) 0,747

Perseption (Y1) 0,869

Results (Y2) 0,812

C. Discriminant Validity

Based on table 2 shows that the AVE value of the four The measure of cross loading is to compare the

variables has an AVE above 0.5 so that the construct has a correlation of the indicator with its contracts and the

good convergent validity where the latent variable can constructs of other blocks. A good discriminant validity will

explain the average of more than half of the variance of the be able to explain the indicator variables higher than

indicators. explaining the variants of other indicator parameters. the

discriminant validity or loading factor value for (X1.1) is

0.869. The correlation of indicators (X 1.1) is higher internally (X 1)

than externally (X2), which is 0.590; in perception (Y 1) of 0.560, in

decision (Y2) of 0.746. The correlation of indicators (X 2.1) is

higher in external conditions (X 2) than in internal (X 1) perception (Y

1), in decision (Y 2) of, and so on.

IJISRT24JAN1023 www.ijisrt.com 658

Volume 9, Issue 1, January – 2024 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Structural Model Evaluation

Fig 4 T-Value Inner and Outer Model

Based on the statistical t value, the largest path The largest path coeffient value in perception is

coefficient in internal factors (X1) is education (X1.1) with a Empathy (Y1.4) which is 73,254 which means that MSME

path coefficient value of 55,919 which means that education players perceive FinTech institutions to have paid more

has the most influence on the decisions of MSME actors in attention to them in using FinTech. In the decision variable

implementing Fintech. In external factors (X2), the largest (Y2), the path coefficient value that has the greatest value is

path coefficient value is Access, affordability, availability, the Preferential decision (Y2.3), which is 62,782, which

and suitability (X2.3) with a value of 53,212 which means that means that MSME players make FinTech institutions the

this is the dominant indicator that affects the perception of main preference to support their current business activities.

MSME actors in deciding to implement FinTech. This

indicates that FinTech understands the needs of MSME The results of the t-test p-value in the next figure will be

actors by easily reaching, providing and providing services compared with the significant level value. The following are

that are in accordance with the needs of MSME actors. the results of the t test of the influence of internal factors and

external factors on the perception of MSME actors in

Bandung City:

Table 3 Test Results t the Influence of Internal Factors and External Factors on the Perception of MSME Actors

Original Sample Sample Mean Standard Deviation T Statistics

P Values

(O) (M) (STDEV) (|O/STDEV|)

Internal Factors ->

0.230 0.241 0.104 2.219 0.027**

Perception

External Factors ->

0.477 0.468 0.104 4.579 0.000**

Perception

a. Test t The Influence of Internal Factors and External Factors on the Perception of MSME Actors

The influence of internal factors (X1) on the perception of MSME actors (Y1) has a p-value of 0.027 each. A positive path

coefficient shows that the better the internal conditions, the better the perception of MSME actors. Meanwhile, the influence of

external factors (X2) on the perception of MSME actors (Y1) has a p-value of 0.000 each. A positive path coefficient shows that

the better the external conditions, the better the perception of MSME actors.

IJISRT24JAN1023 www.ijisrt.com 659

Volume 9, Issue 1, January – 2024 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Table 4 Test Results t The Influence of Internal Factors and External Factors on the Decisions of MSME Actors

Original Sample Standard Deviation T Statistics

Sample Mean (M) P Values

(O) (STDEV) (|O/STDEV|)

Internal Factors ->

0.687 0.674 0.101 6.772 0.000**

Decision

External Factors ->

0.305 0.310 0.100 3.047 0.002**

Decision

b. Test Results t The Influence of Internal Factors and External Factors on the Decisions of MSME Actors

It can be seen that the p-value for internal factors (X1) against the decisions of MSME actors (Y2) is 0.000. The magnitude

of the influence of internal factors on the perception of MSME actors is 0.687. The positive path coefficient can be concluded that

there is a significant influence of internal conditions on the decisions of MSME actors.

The external factor variable (X2) on the decision of MSME actors (Y2) obtained a p-value of 0.002. The magnitude of the

influence of internal factors on the perception of MSME actors is 0.305. The positive path coefficient can be concluded that there

is a significant influence of external conditions on the decisions of MSME actors.

Table 5 Test Results t The Influence of Internal Factors and External Factors on the Decisions of MSME Actors

Original Sample Sample Mean Standard Deviation T Statistics

P Values

(O) (M) (STDEV) (|O/STDEV|)

Perceptual > Results 0.202 0.204 0.100 2.025 0.043**

c. The results of the t test have a direct influence on the perception of MSME actors on the decisions of MSME actors.

It can be seen that the p-value for the perception of MSME actors on the decisions of MSME actors in Bandung City is

0.043. Thus, it can be concluded that there is a significant influence on the perception of MSME actors on the decisions of MSME

actors. The magnitude of the influence of MSME actors' perceptions on MSME decisions is 0.202. The positive path coefficient

shows that the better the perception of MSME actors, the better the decisions of MSME actors in Bandung City.

Goodness Fit

Table 6 GoF Results

Average Variance Extracted (AVE) R square

Internal Factors 0.790

External factors 0.747

Persepsi 0.869 0.784

Result 0.812 0.860

Average 0.805 0.822

GoF 0.813

The results of the R-square calculation show that V. DISCUSSION

simultaneously the contribution of internal factors, external

factors, perceptions and decisions of MSME actors amounted The Influence of Internal Factors and External Factors

to 82.2%, the rest was explained by other variables. Based on the Perception of MSME Actors

on, the average result of communalities is 0.813. This value Based on the test results, it shows that internal and

is further multiplied by R2 and rooted Chin W, (1998) gives external factor variables have a significant influence on the

the criteria of R Square values of 0.67, 0.33 and 0.19 as perception of MSMEs. The results show that the proposed

strong, moderate, and weak Chin W, (1998); Ghozali, Imam hypothesis is proven, meaning that Ho is rejected and H-1 is

& Latan, (2015). The calculation results show that the GoF accepted. An indicator of internal factors that have an

value of 0.5412 is greater than 0.33. The calculation results influence on perception is the level of education. The

show that the GoF value of 0.5412 is greater than 0.33 so it is education referred to in this study is formal education

categorized as a moderate or good enough GoF, meaning that completed by MSME actors. Research by Sardiana &

the hypothesized model is in accordance with empirical data Ningtyas (2022), which reveals that the level of education

affects the perception of business actors in implementing

FinTech.

IJISRT24JAN1023 www.ijisrt.com 660

Volume 9, Issue 1, January – 2024 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

However, in this study the average condition of formal The Influence of MSME Actors' Perceptions on MSME

education completed among MSME actors is relatively low Actors' Decisions in FinTech Implementation

so that non-formal education such as counseling, training and MSME perceptions are measured from compliance,

assistance from the government and private sector is very reliability, tangibel, empathy and responsiveness has a direct

helpful. Non-formal education aims to replace, add and and significant influence on MSME decisions in

complement formal education. When norformal education is implementing FinTech. This shows that the proposed

carried out based on educational standards, the results of non- research hypothesis is in accordance with the results of the

formal education can also be valued on par with formal analysis test conducted. The influence of each indicator will

education (Laila &; Salahudin, 2022). The results of this have an impact on MSME decisions. The better the

study are also in line with Marisa's research, (2020); perception of MSME actors, the stronger and more impactful

Romadhon &; Fitri, (2020) revealed that internal factors have the decisions of MSME actors in implementing FinTech. In

an influence on the perception of MSME actors in financial line with the research of Lestari et al., (2020); Khadijah &;

technology. Janrosl, (2022); that perception has a significant influence on

MSME decisions towards FinTech institutions.

External factor variables have a positive and significant

effect on the perception of MSME actors both simultaneously The results of the SEM-PLS analysis show that internal

and partially. Thus, any indicators of external factors such as and external factors influence the perception of MSME actors

social and cultural support, support of family, neighbors, in the decision to implement Financial Technology. The

friends, access affordability, availability and suitability, and variables that have a big influence are external factors on the

FinTech services, can account for external environmental perception of MSME actors towards FinTech, which when

support variables. The better the support of the external viewed the value of the influence is much greater than other

environment, the better the perception of MSME actors variables.

towards the application of Financial Technology. And

according to research Tambogo et al., (2020) shows that the Thus, external factors will be the determining factor of

environmental support subsystem, most of its variables the decision of MSME actors in the city of Bandung in the

influence perception. application of Financial Technology. And the hypothesis of

this study is tested in accordance with the initial hypothesis,

The Influence of Internal Factors and External Factors namely the perception factor of MSME actors is influenced

on the Decisions of MSME Actors by internal factors and external factors of support both

Internal and external factors have a positive and partially and simultaneously, business actors' decision factors

significant influence on the decisions of MSME actors. Based are influenced by internal factors and external factors both

on the acquisition of a path coefficient value of 55,919, it partially and simultaneously and business actors' decisions

shows that education has a significant influence on FinTech are influenced by perceptions both partially and

implementation decisions. This is in line with Gupta & simultaneously.

Varma's research, (2019) revealed that the level of education

has a significant influence on the decision to use Financial VI. CONCLUSION AND SUGGESTION

Technology.

A. Conclusion:

Based on the acquisition of a path coefficient value of

53,212, it shows that access to affordability, availability, and Internal factors and external factors have an influence and

suitability has an influence on the decision to implement are significant on the perception of MSME actors in the

Financial Technology. This means that MSME players Application of Financial Technology.

consider that Financial Technology is easy to use, has a Internal factors and external factors have an influence and

variety of interesting, innovative products and their are significant on the decisions of MSME actors in the

usefulness in accordance with the perceived benefits. This Application of Financial Technology

result is in line with Mentari's research, (2018) there is a The perception of MSME actors has an influence and is

significant influence on the perception of convenience on significant on the decision to implement Financial

usage decisions. Research by N. R. Lestari &; Rachmat, Technology

(2018) also found that the perception of convenience has an

influence on FinTech usage decisions. B. Suggestion:

This research is supported by previous research, Silvia For MSME Players

& Azmi, (2019) which shows that internal factors have an

influence on the decisions of MSME actors in financial Should seek access to affordability, availability and

technology. Then research conducted by Tambogo et al., suitability in order to get socio-cultural support to decide

(2020) states that external factors also have an influence on on the application of Financial Technology.

business actors' decisions on the financing sector. So the Making the results of this research as a guide in applying

second hypothesis in this study is acceptable. Financial Technology.

IJISRT24JAN1023 www.ijisrt.com 661

Volume 9, Issue 1, January – 2024 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

For Financial Technology Institutions [13]. Fachrudin, K. A., Pirzada, K., & Iman, M. F. (2022).

The results of this study are suggested so that they can Cogent Business & Management The role of financial

be used as material for future policy making. behavior in mediating the influence of socioeconomic

characteristics and neurotic personality traits on

REFERENCES financial satisfaction The role of financial behavior in

mediating the influence of socioeconomic ch. Cogent

[1]. Agam, B., Risa, N. E. W., & Wahyuni, A. P. (2022). Business & Management, 9(1).

Pengaruh Faktor Sosial Ekonomi Terhadap https://doi.org/10.1080/23311975.2022.2080152

Pendapatan Usaha Ikan Asin di Kecamatan [14]. Fajar, M., & Larasati, C. W. (2021). Peran Financial

Pemangkat Kabupaten Sambas. PAPALELE (Jurnal Technology (Fintech) dalam Perkembangan UMKM

Penelitian Sosial Ekonomi Perikanan Dan Kelautan), di Indonesia: Peluang dan Tantangan. Humanis

6(1), 57–67. (Humanities, Management and Science Proceedings),

[2]. Akinwale, Y. O., & Kyari, A. K. (2022). Factors 1(2), 702–715.

influencing attitudes and intention to adopt financial [15]. Fintechnews.sg. (2021). Indonesia Fintech Report and

technology services among the end-users in Lagos Map 2020.

State, Nigeria. African Journal of Science, [16]. Fuadi, N., Khairawati, S., & Sasono, H. (2019).

Technology, Innovation and Development, 14(1), Pengaruh Tata Letak Toko, Kualitas Layanan, dan

272–279. Motivasi Rasional terhadap Keputusan Pembelian

https://doi.org/10.1080/20421338.2020.1835177 Konsumen. At-Tauzi: Islamic Economic Journal,

[3]. Anwar, A, I., Putri, R., S. (2020). Analisis Faktor- 19(2), 79–85.

faktor yang Mempengaruhi Literasi Keuangan pada [17]. German Ruiz-Herrera, L., Valencia-Arias, A.,

Petani Tanaman Pangan dan Holtikultura di Gallegos, A., Benjumea-Arias, M., & Flores-Siapo, E.

Kabupaten Maros Sulawesi Selatan. Jurnal Ekonomi (2023). Technology acceptance factors of e-commerce

Bisnis Dan Akutansi, 7(2), 125–130. among young people: An integration of the

[4]. Ardiyanti, D. A., & Mora, Z. (2019). Pengaruh Minat technology acceptance model and theory of planned

Usaha Dan Motivasi Usaha Terhadap Keberhasilan behavior. Heliyon, 9(6), e16418.

Usaha Wirausaha Muda Di Kota Langsa. Jurnal https://doi.org/10.1016/j.heliyon.2023.e16418

Samudra Ekonomi Dan Bisnis, 10(2), 168–178. [18]. Ghozali, Imam & Latan, H. (2015). Konsep, Teknik,

https://doi.org/10.33059/jseb.v10i02.1413 Aplikasi Menggunakan. Smart PLS 3.0 Untuk

[5]. Candraningrat, I. R., Abundanti, N., Mujiati, N. W., Penelitian Empiris. BP Undip.

Erlangga, R., & Jhuniantara, I. M. G. (2021). The role [19]. Ghozali, I. (2014). Structural Equation Modeling,

of financial technology on development of MSMEs. Metode Alternatif dengan Partial Least Square (PLS)

Accounting, 7(1), 225–230. (Edisi 4). Badan Penerbit Universitas Diponegoro.

https://doi.org/10.5267/j.ac.2020.9.014 [20]. Ghozali, I. (2018). Aplikasi Analisis Multivariate

[6]. Chin W, M. G. (1998). The Partial Least Squares dengan Program IBM SPSS 25. Badan Penerbit

Approach to Structural Formula Modeling. Advances Universitas Diponegoro.

in Hospitality and Leisure, 8(2)(January 1998), 5. [21]. Gupta, R., & Varma, S. (2019). A structural equation

model to assess behavioural intention to use biometric

[7]. Clyde Kluckhohn, W. H. K. (1944). The Concept of

enabled e-banking services in India. International

Culture.

Journal of Business Information Systems, 31(4), 555–

[8]. Darmawan, R. (2013). Pengalaman, usability, dan

572. https://doi.org/10.1504/IJBIS.2019.101586

antarmuka grafis: sebuah penelusuran teoritis. Journal

[22]. Hamdaini, Y., & Syatiri, A. (2016). Pengaruh Persepsi

of Visual Art and Design, 4(2), 95–102.

dan Minat Terhadap Keberadaan Baitul Mal

[9]. Darwanto, D., Raharjo, S. T., & Hendra, A. (2018).

Wattamwil (BMT) di Kota Palembang. Jurnal

Pengembangan produksi usaha Mikro, Kecil dan

Manajemen Dan Bisnis Sriwijaya, 14(3), 395–406.

Menengah (UMKM) sektor pertanian berbasis potensi

[23]. Herliansyah, Y. (2017). Pengaruh

lokal. Jurnal REKOMEN (Riset Ekonomi

pengetahuan,pengalaman spesifik, dan. 10(1), 126–

Manajemen), 1(2).

155.

[10]. Davenport, Thomas, H., and L. P. (1998). Working

[24]. Hermawan, A. (2022). Pengaruh Strategi Promosi

Knowledge: How Organizations manage What They

Terhadap Minat Beli Pada Umkm Rojo Sosis.

Know. Harvard Business School Press.

SMART Management Journal, 2(2), 163–179.

[11]. Donal E. Kieso, Jerry J. Weygandt, and T. D. W.

[25]. Hermuningsih, S., & Wardani, K. (2016). Persepsi

(2007). Akuntansi Intermediate (Edisi Kedu).

mahasiswa terhadap metode simulasi online trading di

Erlangga.

Bursa Efek Indonesia di Fakultas Ekonomi

[12]. Effendy, F., Simarmata, J., Rumondang, A., &

Yogyakarta. Jurnal Ekonomi Dan Bisnis, 17(2), 199–

Sudirman, A. (2019). Fintech: Inovasi Sistem

207.

Keuangan di Era Digital.

IJISRT24JAN1023 www.ijisrt.com 662

Volume 9, Issue 1, January – 2024 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

[26]. Hidayat, H., Mubyarto, N., & Ma’ani, B. (2021). [41]. Marlius, D. (2018). Loyalitas Nasabah Bank Nagari

Pengaruh Akses Keuangan Terhadap Pertumbuhan Syariah Cabang Bukittinggi Dilihat dari Kualitas

UMKM Dengan Literasi Keuangan Syariah Sebagai Pelayanan. Jurnal Pundi, 1(3), 237–250.

Variabel Mediator di Kota Jambi. UIN Sulthan Thaha https://doi.org/10.31575/jp.v1i3.60

Saifuddin Jambi. [42]. Martono, S. (2021). Analisis Faktor-Faktor Yang

[27]. Karnadi, A. (2022). Mayoritas Transaksi Fintech dari Mempengaruhi Minat Menggunakan Fintech Lending.

UMKM di Atas Rp80 Miliar. DataIndonesia.Id. Jurnal Ekonomi Bisnis Dan Kewirausahaan, 10(3),

https://dataindonesia.id/ekonomi- 246. https://doi.org/10.26418/jebik.v10i3.45827

digital/detail/mayoritas-transaksi-fintech-dari-umkm- [43]. Mentari, A. D. (2018). Pengaruh Kesadaran,

di-atas-rp80-miliar Kecepatan Transaksi, Keamanan, Manfaat yang

[28]. Kemenkopukm. (2021). Jumlah Perusahaan per Dirasakan dengan Mediasi Persepsi Kemudahan

Kategori Lapangan usaha Tahun 2015 – 2021. Penggunaan terhadap Adopsi m-banking BRI

[29]. Khadijah, K., & Janrosl, V. S. E. (2022). Pengaruh Makassar Raya. Journal of Business and Banking,

Persepsi Manfaat Dan Persepsi Kemudahan Terhadap 8(1), 157–175.

Fintech Menggunakan Tam (Technology Acceptance [44]. Mudzingiri, C., Mwamba, J. W. M., & Keyser, J. N.

Model) Di Kota Batam. JRAK (Jurnal Riset (2018). and financial literacy of university students

Akuntansi Dan Bisnis), 8(1), 48–55. Financial behavior , confidence , risk preferences and

[30]. Koontz. (1998). Manajemen (terj. Tim D). Erlangga. financial literacy of university students. 2039.

[31]. Kotler Philip. (2005). Manajemen Pemasaran (Jilid 1 https://doi.org/10.1080/23322039.2018.1512366

da). PT Indeks Kelompok Gramedia. [45]. Muhamad, N. (2023). Mayoritas Pasar Utama

[32]. Kusuma, R. D., Sutjipto, S. S. U., Sujana, S., & Perusahaan FinTech Indonesia Berada di Pulau

Maretha, H. A. (2020). Pelatihan Optimasi Media Jawa. Katadata.Co.Id.

Sosial Untuk Peningkatan Omzet UMKM. Jurnal [46]. Muhammad, A. F. (2019). Fintech Mesti

Abdimas Dedikasi Kesatuan, 1(2), 215–222. Sederhanakan Teknologi untuk Desa. Validnews.Id.

[33]. Laila, D. A., & Salahudin, S. (2022). Pemberdayaan https://validnews.id/ekonomi/Fintech-Mesti-

masyarakat Indonesia melalui pendidikan nonformal: Sederhanakan-Teknologi-untuk-Desa-Tmr

Sebuah kajian pustaka. Jurnal Pembangunan [47]. Mulyani, S. I., & Afnan, A. (2020). Peran PT

Pendidikan: Fondasi Dan Aplikasi, 9(2), 100–112. Permodalan Nasional Madani (Pt Pnm) Dalam

https://doi.org/10.21831/jppfa.v9i2.44064 Pembiayaan Pelaku Usaha Agribisnis Di Kota

[34]. Lestari, D. A., Purnamasari, E. D., & Setiawan, B. Tarakan. Jurnal Borneo Saintek, 3(1), 29–34.

(2020). Pengaruh payment gateway terhadap kinerja https://doi.org/10.35334/borneo_saintek.v3i1.1409

keuangan UMKM. Jurnal Bisnis, Manajemen, Dan [48]. Najib, M., Ermawati, W. J., Fahma, F., Endri, E., &

Ekonomi, 1(1), 1–10. Suhartanto, D. (2021). Fintech in the small food

[35]. Lestari, N. R., & Rachmat, B. (2018). Faktor-Faktor business and its relation with open innovation. Journal

Yang Mempengaruhi Keputusan Menggunakan of Open Innovation: Technology, Market, and

Internet Banking Nasabah Bank Bri Di Surabaya. Complexity, 7(1), 88.

Journal of Business & Banking, 8(1). https://doi.org/10.3390/joitmc7010088

https://doi.org/10.14414/jbb.v8i1.1003 [49]. Ningsih, D. R. (2020). Peran Financial Technology

[36]. Lestari, S., Marniati, M., Dewi, S. V., & Dian, C. (Fintech) Dalam Membantu Perkembangan Wirausaha

(2023). The effect of innovation capability and digital UMKM. Prosiding Seminar Nasional Program

technology on the profitability of MSMEs in the Pascasarjana Universitas PGRI Palembang.

Covid-19 pandemic time. AIP Conference [50]. Nugraha, D. P., Setiawan, B., Nathan, R. J., & Fekete-

Proceedings, 2484(1). Farkas, M. (2022). Fintech Adoption Drivers for

[37]. Lupiyoadi, R. (2018). Manajemen pemasaran jasa. Innovation for SMEs in Indonesia. Journal of Open

[38]. Malikah, I. M., Mulyadi, D., & Sandi, S. P. H. (2022). Innovation: Technology, Market, and Complexity,

Pengaruh Persepsi Kemudahan, Persepsi Risiko, 8(4), 208. https://doi.org/10.3390/joitmc8040208

Kepercayaan, dan Persepsi Kenyamanan terhadap [51]. Nurcahya, Y. A., & Dewi, R. P. (2019). Analisis

Minat Financial Technology Peer To Peer Lending ( pengaruh perkembangan fintech dan e-commerce

Pinjaman Online ) Pada Mahasiswa Manajemen 2018- terhadap perekonomian masyarakat. Jurnal Akuntansi

2019 Universitas Buana Perjuangan Karawang. Jurnal & Bisnis, 5(02).

Mahasiswa Manajemen Dan Akuntansi JMMA, 2(3), [52]. Nurdin, N., Azizah, W. N., & Rusli, R. (2020).

451–467. Nurdin, N., Azizah, W. N., & Rusli, R. (2020).

[39]. Marginingsih, R. (2021). Financial Technology Pengaruh Pengetahuan,Kemudahan dan Risiko

(Fintech) Dalam Inklusi Keuangan Nasional di Masa Terhadap Minat Bertransaksi Menggunakan Finansial

Pandemi Covid-19. Moneter - Jurnal Akuntansi Dan Technology (Fintech) Pada Mahasiswa Institut Agama

Keuangan, 8(1), 56–64. https://doi.org/10.31294/ Islam Negeri (IAIN) Palu. In Jurnal Perbankan dan

moneter.v8i1.9903 Keuangan Syaria. Jurnal Perbankan Dan Keuangan

[40]. Marisa, O. (2020). Persepsi Kemudahan Penggunaan, Syariah, 2(2), 199–222. https://www.bi.go.id

Efektivitas, Dan Risiko Berpengaruh Terhadap Minat [53]. Oktris, L., Tarmidi, D., Nugroho, L., Anasta, L., &

Bertransaksi Menggunakan Financial Technology. Fadjarenie, A. (2022). Tips & Trik Cara Praktis

Jurnal Administrasi Kantor, 8(2), 139–152. Menyusun Skripsi dan Tesis. Pustaka Pranala.

IJISRT24JAN1023 www.ijisrt.com 663

Volume 9, Issue 1, January – 2024 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

[54]. Prastuti, D. I., & Karyanti, Y. (2020). Pengaruh [65]. Sardiana, A., & Ningtyas, D. R. (2022). Kontribusi

electronic word of mouth terhadap keputusan Fintech Syariah dalam Pengembangan UMKM di

pembelian tiket kereta api daring. Faktor Exacta, Masa Pandemi COVID 19. OPTIMAL: Jurnal

13(3). Ekonomi Dan Manajemen, 2(1), 41–70.

[55]. Pratiwi, S., & Sofwan, A. (2022). Pengaruh Perceived [66]. Sekaran, U., & Bougie, R. (2017). Metode Penelitian

Usefulness, Perceived Ease of Use, Perceived Risk untuk Bisnis: Pendekatan Pengembangan-Keahlian

dan Trust terhadap Minat Menggunakan Fintech (6th ed., V). Salemba empat.

Shopeepay. Jurnal Rekognisi Akuntansi, 6(2), 141– [67]. Shefrin Hersh. (2000). Beyond Greed and Fear:

154. https://journal.unisnu.ac.id/jra/article/view/ Understanding Behavioral Finance and Psychology of

jra.v6i2.434/259 Investing.

[56]. Purnomo, A., Fathorrazi, M., & Viphindrartin, S. [68]. Silvia, B., & Azmi, F. (2019). analisis faktor-faktor

(2018). Pengaruh Biaya Produksi, Lama Usaha, yang mempengaruhi persepsi pengusaha UMKM

Produktivitas Terhadap Pendapatan Petani Salak terhadap laporan keuangan berbasis SAK EMKM.

Pondoh di Desa Pronojiwo Kecamatan Pronojiwo Jurnal Analisis Bisnis Ekonomi, 17(1), 57–73.

Kabupaten Lumajang. E-Journal Ekonomi Bisnis Dan [69]. Simmons, G., Armstrong, G. A., & Durkin, M. G.

Akuntansi, 5(1), 44–47. (2008). A Conceptualization of the Determinants of

[57]. Putri, N., & Jember, I. M. (2016). Pengaruh modal Small Business Website Adoption. International Small

sendiri dan lokasi usaha terhadap pendapatan Usaha Business Journal: Researching Entrepreneurship,

Mikro Kecil Menengah (UMKM) di Kabupaten 26(3), 351–389. https://doi.org/10.1177/026624260

Tabanan (modal pinjaman sebagai variabel 8088743

intervening). Jurnal Ekonomi Kuantitatif Terapan, [70]. Sitompul, M. G. (2018). Urgensi Legalitas Financial

9(2), 142–150. Technology (Fintech): Peer To Peer (P2P) Lending Di

[58]. Rahadian, A., & Thamrin, H. (2023). Analysis of Indonesia. Jurnal Yuridis Unaja, 1(2), 68–79.

Factors Affecting MSME in Using Fintech Lending as [71]. Sternberg, R. J. (2008). Psikologi kognitif (Pustaka

Alternative Financing: Technology Acceptance Model Pelajar (ed.)).

Approach. Brazilian Business Review, 20(3), 301– [72]. Sufitrayati, S., & Nailufar, F. (2018). Faktor-Faktor

322. https://doi.org/10.15728/bbr.2023.20.3.4.en yang Mempengaruhi Keputusan Nasabah dalam

[59]. Ramayah, T., Ling, N. S., Taghizadeh, S. K., & Memilih Bank Syari’ah di Kota Banda Aceh. Ihtiyath:

Rahman, S. A. (2016). Factors influencing SMEs Jurnal Manajemen Keuangan Syariah, 2(1).

website continuance intention in Malaysia. Telematics [73]. Sugiyono, P. D. (2017a). Metode Penelitian Bisnis:

and Informatics, 33(1), 150–164. Pendekatan Kuantitatif, Kualitatif, Kombinasi, dan

https://doi.org/10.1016/j.tele.2015.06.007 R&D. Penerbit CV. Alfabeta: Bandung.

[60]. Rohmah, I. L., Ibdalsyah, I., & Kosim, A. M. (2020). [74]. Sugiyono, P. D. (2017b). Metode Penelitian Bisnis:

Pengaruh Persepsi Kemudahan Berdonasi, Dan Pendekatan Kuantitatif, Kualitatif, Kombinasi, dan

Efektifitas Penyaluran Menggunakan Fintech R&D. CV ALfabeta.

Crowdfunding Terhadap Minat Membayar Zakat, [75]. Sugiyono, P. D. (2022). Metode Penelitian Kuantitatif.

Infaq, Shadaqoh [The Influence of Perceived Ease of Alfabeta.

Donating, and Effectiveness of Distribution Using [76]. Sukma, A., Hermina, N., & Novan, D. (2020).

Fintech Crowdfunding on. Kasaba: Jurnal Ekonomi Pengaruh Produk, Distribusi Dan Digital Marketing

Islam, 13(1), 42–51. Terhadap Minat Beli Produk Umkm Binaan Kadin

[61]. Romadhon, F., & Fitri, A. (2020). Analisis Peluang Jabar Pada Situasi Covid-19. Manners, 3(2), 91–102.

dan Tantangan Penggunaan Financial Technology [77]. Sundjaja, A. M., & Tina, A. (2019). The factors of the

Sebagai Upaya optimalisasi Potensi UMKM (Studi intention to use P2P lending financial technology

Kasus UMKM di Gresik). TECHNOBIZ: (Fintech) website at Jadetabek intervening by

International Journal of Business, 3(1), 30–44. perceived value. International Journal of Recent

[62]. Safii, A. A., & Anom, L. (2021). Peran Moderasi Technology and Engineering, 8(3), 3102–3107.

Financial Access Pada Pengaruh Human Capital Dan https://doi.org/10.35940/ijrte.C4975.098319

Social Capital Terhadap Kinerja UMKM. Jurnal [78]. Suyanto, S. (2022). Faktor Demografi, Financial

Manajemen Dan Penelitian Akuntansi, 14(1), 36–49. Technology, Dan Kinerja Keuangan Usaha Mikro

[63]. Salmah, R. (2021). Pendapatan, Pendidikan, Persepsi Kecil Dan Menengah (Umkm): Inklusi Keuangan

Kemudahan, dan Sikap sebagai Mediasi terhadap Sebagai Mediasi. Akuntansi Dewantara, 6(1), 1–20.

Keputusan Penggunaan Mobile Banking Syari’ah. [79]. Suyanto, S., & Kurniawan, T. A. (2019). Faktor yang

Jurnal Ilmiah Ekonomi Islam, 7(2), 798–805. Mempengaruhi Tingkat Kepercayaan Penggunaan

https://doi.org/10.29040/jiei.v7i2.2473 FinTech pada UMKM Dengan Menggunakan

[64]. Saputri, N. A., Haryanti, A. D., & Nur, T. (2022). Technology Acceptance Model (TAM). Akmenika:

Digitalisasi Pembiayaan: Atensi UMKM Dalam Jurnal Akuntansi Dan Manajemen, 16(1).

Memanfaatkan Pembiayaan Peer To Peer Lending. https://doi.org/10.31316/akmenika.v16i1.166

Ekonomi, Keuangan, Investasi Dan Syariah

(EKUITAS), 3(3), 603–610.

https://doi.org/10.47065/ekuitas.v3i3.1235

IJISRT24JAN1023 www.ijisrt.com 664

Volume 9, Issue 1, January – 2024 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

[80]. Tambogo, M. R. R., Noor, T. I., & Setiawan, I.

(2020). Structural equation modeling to analysis of

customer’s decision in the utilization of Baitul Maal

Wat Tamwil for agribusiness development.

International Journal of Advanced Science and

Technology, 29(6), 3320–3328.

https://www.scopus.com/inward/record.uri?eid=2-

s2.0-85085154064&partnerID=40&md5=f7f2

b3368bbc835d49f37e52969ed725

[81]. Teruna, D., & Ardiansyah, T. (2021). Pola Kredit

Usaha Mikro Kecil Menengah (UMKM) Kelompok

Bank dan Fintech di Indonesia. Jurnal Pendidikan Dan

Kewirausahaan, 9(1), 145–167.

[82]. Thoha, M. (2004). Kepemimpinan dalam manajemen.

[83]. Waris, N. B. D. W. (2015). Pengaruh tingkat

pendidikan, usia, dan lama beternak terhadap

pengetahuan manajemen reproduksi ternak sapi

potong di desa Kedungpring Kecamatan

Balongpanggang Kabupaten Gresik. Jurnal Ternak,

6(1), 30–33.

[84]. Wexler, P. (1998). Review of holy parts: Social

Theory, Educations, and Religion (Union thec).

Martins press.

[85]. Wismantoro, Y., & Susilowati, M. W. K. S. (2021).

How does Unified Theory of Acceptance and Use of

Technology (UTAUT) Work on Adopting Financial

Technology (FinTech) by MSMEs? Jurnal Penelitian

Ekonomi Dan Bisnis, 6(2), 90–99.

https://doi.org/10.33633/jpeb.v6i2.4826

[86]. Yahya, M. F., Pratitha, N. K., & Puspaningtyas, M.

(2021). Peran fintech dalam membantu umkm

memperoleh modal berwirausaha di era digital.

Prosiding National Seminar on Accounting, Finance,

and Economics (NSAFE), 1(11).

[87]. Yamin, S. dan H. K. (2011). Generasi Baru Mengolah

Data Penelitian dengan Partial Least Square Path

Modeling : Aplikasi dengan Software XLSTAT,

SmartPLS, dan Visual PLS. Salemba infotek.

[88]. Yudha, A. T. R. C. (2021). Fintech syariah dalam

sistem industri halal: Teori dan praktik. Syiah Kuala

University Press.

[89]. Zahro, R. J., Andani, Y. N., Sari, S. I. F., Hilman, I.,

Jasmine, R., Salsabella, L. S., Kholiza, B., Saputra, R.

D., Rachim, K. V., & Bungaswara, P. (2021).

SCRIPTA, VOL. IV, DESEMBER 2021. UPT

Penerbitan & Percetakan Universitas Jember.

[90]. Zusryn, A. S. (2020). Cause and Effect Analysis

Penyaluran Kredit P2P Lending Pada Umkm Di

Indonesia. Jurnal Orientasi Bisnis Dan

Entrepreneurship (JOBS), 1(2), 83–96.

IJISRT24JAN1023 www.ijisrt.com 665

You might also like

- Indonesia’s Technology Startups: Voices from the EcosystemFrom EverandIndonesia’s Technology Startups: Voices from the EcosystemNo ratings yet

- The Influence of Social Influence, Trust, Data Security and Privacy, Administrative Quality On Customer Loyalty Fintech Koinworks Mediated by Customer SatisfactionDocument21 pagesThe Influence of Social Influence, Trust, Data Security and Privacy, Administrative Quality On Customer Loyalty Fintech Koinworks Mediated by Customer SatisfactionInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Structure and Conduct Analysis of P2P Lending in IndonesiaDocument11 pagesStructure and Conduct Analysis of P2P Lending in IndonesiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- 2372-Article Text-3797-1-10-20221102Document10 pages2372-Article Text-3797-1-10-20221102Omar AlshamestiNo ratings yet

- Financial Technology As An Innovation Strategy For Digital Payment Services in The Millenial GenerationDocument10 pagesFinancial Technology As An Innovation Strategy For Digital Payment Services in The Millenial GenerationViaNo ratings yet

- 7078-Article Text-43147-2-10-20220808Document9 pages7078-Article Text-43147-2-10-20220808Alfishan RehmatNo ratings yet

- Research ProposalDocument14 pagesResearch ProposalFerdyana LieNo ratings yet

- 14678-Article Text-42592-1-10-20201231Document12 pages14678-Article Text-42592-1-10-20201231Nia Lusiana DewiNo ratings yet

- Fintech in India-Opportunities and ChallengesDocument14 pagesFintech in India-Opportunities and Challengescaalokpandey2007No ratings yet

- ArticleText 37965 1 10 20200617Document11 pagesArticleText 37965 1 10 20200617ngu mahNo ratings yet

- A Study On Effect of Fintech On FinancialDocument11 pagesA Study On Effect of Fintech On FinancialDarshit MistryNo ratings yet

- PS34Document14 pagesPS34abdsmd1249No ratings yet

- Factors Affecting The Intention To Adopt Digital Banking by Digital Saving Customers (Case Study of Syariah Mandiri Bank)Document10 pagesFactors Affecting The Intention To Adopt Digital Banking by Digital Saving Customers (Case Study of Syariah Mandiri Bank)International Journal of Innovative Science and Research TechnologyNo ratings yet

- Fintech Industry in India The Digital Transformation of Financial ServicesDocument9 pagesFintech Industry in India The Digital Transformation of Financial ServicesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Digital Literacy Using E-Peken in MSMEs: Bibliometric AnalysisDocument7 pagesDigital Literacy Using E-Peken in MSMEs: Bibliometric AnalysisInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- 30-07-2022-1659161461-7-IJBGM-2. Reviewed - IJBGM - An Overview - Impact of FinTech in Indian Banking SectorDocument4 pages30-07-2022-1659161461-7-IJBGM-2. Reviewed - IJBGM - An Overview - Impact of FinTech in Indian Banking Sectoriaset123No ratings yet

- Talent Mapping: A Strategic Approach Toward Digitalization Initiatives in The Banking and Financial Technology (Fintech) Industry in IndonesiaDocument23 pagesTalent Mapping: A Strategic Approach Toward Digitalization Initiatives in The Banking and Financial Technology (Fintech) Industry in IndonesiaHertinaNo ratings yet

- Fin Tech or Tech Fin Discovery of An ExtantDocument9 pagesFin Tech or Tech Fin Discovery of An ExtantMaryam IraniNo ratings yet

- An Analysis of How COVID-19 Revolutionized India's Payment InfrastructureDocument11 pagesAn Analysis of How COVID-19 Revolutionized India's Payment InfrastructureIJRASETPublicationsNo ratings yet

- Analysis of Factors Affecting BehavioralDocument9 pagesAnalysis of Factors Affecting BehavioralmahesaNo ratings yet

- I J M E R: Online Copy Available: WWW - Ijmer.inDocument8 pagesI J M E R: Online Copy Available: WWW - Ijmer.insatish kumar jhaNo ratings yet

- Examining The Factors Influencing Fintech Adoption Behaviour of Gen Y in IndiaDocument26 pagesExamining The Factors Influencing Fintech Adoption Behaviour of Gen Y in IndiaAlfishan RehmatNo ratings yet

- 2393 8501 1 PBDocument11 pages2393 8501 1 PBarry widodoNo ratings yet

- 9 - Fintech & Milenial GenrtDocument12 pages9 - Fintech & Milenial GenrtDiah Tiffani AnnisaNo ratings yet

- ANALYSIS OF CONSUMERS PERCEPTION TOWARDS DIGITALIZATION IN BANKING SECTOR WITH SPECIAL-with-cover-page-v2Document9 pagesANALYSIS OF CONSUMERS PERCEPTION TOWARDS DIGITALIZATION IN BANKING SECTOR WITH SPECIAL-with-cover-page-v2Shweta ChaudharyNo ratings yet

- DETERMINANTS OF FINANCIAL TECHNOLOGY ADOPTION BY MSMEs IN LOMBOK USING THE UNIFIED THEORY OF ACCEPTANCE AND USE OF TECHNOLOGY 2 (CASE STUDY ON PEER TO PEER LENDING PLATFORM)Document17 pagesDETERMINANTS OF FINANCIAL TECHNOLOGY ADOPTION BY MSMEs IN LOMBOK USING THE UNIFIED THEORY OF ACCEPTANCE AND USE OF TECHNOLOGY 2 (CASE STUDY ON PEER TO PEER LENDING PLATFORM)AJHSSR JournalNo ratings yet

- Analysis of Factors Affecting The Acceptance or Use of E-Wallet in JakartaDocument6 pagesAnalysis of Factors Affecting The Acceptance or Use of E-Wallet in JakartaElma Roxanne DalaNo ratings yet

- Factors Influencing Customers To Use Digital Banking Application in Yogyakarta, IndonesiaDocument11 pagesFactors Influencing Customers To Use Digital Banking Application in Yogyakarta, IndonesiaNguyễn Ngọc Đoan DuyênNo ratings yet

- Factors Affecting The Use of Quick Response Code Indonesian Standard (QRIS) With The Unified Theory of Acceptance and Use of Technology ModelDocument6 pagesFactors Affecting The Use of Quick Response Code Indonesian Standard (QRIS) With The Unified Theory of Acceptance and Use of Technology ModelInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Banking Assingnment Final PDFDocument20 pagesBanking Assingnment Final PDFAdlin KujurNo ratings yet

- E-Commerce Strategic Business Environment Analysis in IndonesiaDocument5 pagesE-Commerce Strategic Business Environment Analysis in IndonesiaArchana mittalNo ratings yet

- LiteratureReview 16042023 v01 1Document4 pagesLiteratureReview 16042023 v01 1raj vihariNo ratings yet

- Neo Banks A Paradigm Shift in BankingDocument15 pagesNeo Banks A Paradigm Shift in Bankingdosah93991No ratings yet

- Factors Affection Intention To Use On The Digital Banking ServicesDocument14 pagesFactors Affection Intention To Use On The Digital Banking ServicesTrishia CabasagNo ratings yet

- Zijmr3jan21 13817Document13 pagesZijmr3jan21 13817Rajni KumariNo ratings yet

- P2P Lending Customer Behavior Viewed From The Perspective of Security, Compatibility and Trust With Attitude As Variable MediationDocument11 pagesP2P Lending Customer Behavior Viewed From The Perspective of Security, Compatibility and Trust With Attitude As Variable MediationInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- 715-Article Text-2310-1-10-20180618Document11 pages715-Article Text-2310-1-10-20180618Ali ImranNo ratings yet

- Startupreneur Bisnis Digital (SABDA) : Vol. 1 No. 1, April 2022Document12 pagesStartupreneur Bisnis Digital (SABDA) : Vol. 1 No. 1, April 2022JemyNo ratings yet

- IJCRT2302233Document8 pagesIJCRT2302233dosah93991No ratings yet

- "Determinants of Digital Financial Inclusion and Its Impact On Micro Enterprises" Ease of Doing Business, A Comprehensive ReviewDocument8 pages"Determinants of Digital Financial Inclusion and Its Impact On Micro Enterprises" Ease of Doing Business, A Comprehensive ReviewPriyanka KilaniyaNo ratings yet

- Rural BankDocument5 pagesRural BankRobby FajarNo ratings yet

- Indian Fintech Industry - Gunjit KalraDocument80 pagesIndian Fintech Industry - Gunjit KalraGunjit Kalra ROT16xxNo ratings yet

- International Journal of Data and Network Science: A B B B C D e F G H BDocument8 pagesInternational Journal of Data and Network Science: A B B B C D e F G H BpchbrryyyNo ratings yet

- 693-Article Text-1187-2-10-20210911Document16 pages693-Article Text-1187-2-10-20210911FachrumNo ratings yet

- Fintech Innovations in The Financial Service IndusDocument20 pagesFintech Innovations in The Financial Service IndusSevda AliyevaNo ratings yet

- Group 7 - C4 IndiaDocument13 pagesGroup 7 - C4 IndiaSRISHTI NARANGNo ratings yet

- ALiterature Study of Consumer Perception Towards Digital Payment Mode in IndiaDocument17 pagesALiterature Study of Consumer Perception Towards Digital Payment Mode in IndiaManipal SinghNo ratings yet

- FinTech Services and Network Economics Mediating Effect of FinTech Adoption Ijariie18175Document14 pagesFinTech Services and Network Economics Mediating Effect of FinTech Adoption Ijariie18175Roshani PrasadNo ratings yet

- The Effect of Electronic Coupon Value To Perceived Usefulness and Perceived Ease-of-Use and Its Implication To Behavioral Intention To Use Server-Based Electronic MoneyDocument12 pagesThe Effect of Electronic Coupon Value To Perceived Usefulness and Perceived Ease-of-Use and Its Implication To Behavioral Intention To Use Server-Based Electronic MoneyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Importance of Digital Financial Literacy To Anticipaye Impulsive Buying Behavior in Buy-Now-Pay-Later ModeDocument13 pagesThe Importance of Digital Financial Literacy To Anticipaye Impulsive Buying Behavior in Buy-Now-Pay-Later Modehuonggiang1412No ratings yet

- The Current Situation and Analysis of Lending To Small Business EntitiesDocument8 pagesThe Current Situation and Analysis of Lending To Small Business EntitiesResearch ParkNo ratings yet

- Effect of Financial Innovation On The Performance of Deposit Money Banks in NigeriaDocument11 pagesEffect of Financial Innovation On The Performance of Deposit Money Banks in NigeriaEditor IJTSRDNo ratings yet

- 81-91 CEMERLANG - Penerapan Fintech Financial Technolog) Pada Pt. Bank Rakyat Indonesia Persero) TBK KCP Slamet Riyadi MakassarDocument11 pages81-91 CEMERLANG - Penerapan Fintech Financial Technolog) Pada Pt. Bank Rakyat Indonesia Persero) TBK KCP Slamet Riyadi Makassar07. Geraldo joshua sinuhajiNo ratings yet

- Interest of Technology AdoptionDocument11 pagesInterest of Technology AdoptionvataxNo ratings yet

- Paper Fintech Financial TechnologyDocument11 pagesPaper Fintech Financial Technologysusanto17No ratings yet

- Jurnal Riset Sains Manajemen: Volume 3, Nomor 1, 2019Document19 pagesJurnal Riset Sains Manajemen: Volume 3, Nomor 1, 2019Hanny Tri MeilindaNo ratings yet

- 16thSAMF 2021 FullPaperDocument16 pages16thSAMF 2021 FullPaperRoshani PrasadNo ratings yet

- Fintech in India - Opportunities and ChallengesDocument13 pagesFintech in India - Opportunities and ChallengesViijai CNo ratings yet

- Innovation and Trust Determinants of Intention UsiDocument14 pagesInnovation and Trust Determinants of Intention UsiVIOMITA ANINDANo ratings yet

- 2020 - Medici - India Fintech ReportDocument125 pages2020 - Medici - India Fintech Reportdevang bohra100% (3)

- Sustainable Energy Consumption Analysis through Data Driven InsightsDocument16 pagesSustainable Energy Consumption Analysis through Data Driven InsightsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Vertical Farming System Based on IoTDocument6 pagesVertical Farming System Based on IoTInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Entrepreneurial Creative Thinking and Venture Performance: Reviewing the Influence of Psychomotor Education on the Profitability of Small and Medium Scale Firms in Port Harcourt MetropolisDocument10 pagesEntrepreneurial Creative Thinking and Venture Performance: Reviewing the Influence of Psychomotor Education on the Profitability of Small and Medium Scale Firms in Port Harcourt MetropolisInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Influence of Principals’ Promotion of Professional Development of Teachers on Learners’ Academic Performance in Kenya Certificate of Secondary Education in Kisii County, KenyaDocument13 pagesInfluence of Principals’ Promotion of Professional Development of Teachers on Learners’ Academic Performance in Kenya Certificate of Secondary Education in Kisii County, KenyaInternational Journal of Innovative Science and Research Technology100% (1)

- Ambulance Booking SystemDocument7 pagesAmbulance Booking SystemInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Utilization of Waste Heat Emitted by the KilnDocument2 pagesUtilization of Waste Heat Emitted by the KilnInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Digital Finance-Fintech and it’s Impact on Financial Inclusion in IndiaDocument10 pagesDigital Finance-Fintech and it’s Impact on Financial Inclusion in IndiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Detection and Counting of Fake Currency & Genuine Currency Using Image ProcessingDocument6 pagesDetection and Counting of Fake Currency & Genuine Currency Using Image ProcessingInternational Journal of Innovative Science and Research Technology100% (9)

- An Overview of Lung CancerDocument6 pagesAn Overview of Lung CancerInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Osho Dynamic Meditation; Improved Stress Reduction in Farmer Determine by using Serum Cortisol and EEG (A Qualitative Study Review)Document8 pagesOsho Dynamic Meditation; Improved Stress Reduction in Farmer Determine by using Serum Cortisol and EEG (A Qualitative Study Review)International Journal of Innovative Science and Research TechnologyNo ratings yet

- An Efficient Cloud-Powered Bidding MarketplaceDocument5 pagesAn Efficient Cloud-Powered Bidding MarketplaceInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Designing Cost-Effective SMS based Irrigation System using GSM ModuleDocument8 pagesDesigning Cost-Effective SMS based Irrigation System using GSM ModuleInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Impact of Stress and Emotional Reactions due to the Covid-19 Pandemic in IndiaDocument6 pagesImpact of Stress and Emotional Reactions due to the Covid-19 Pandemic in IndiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Effect of Solid Waste Management on Socio-Economic Development of Urban Area: A Case of Kicukiro DistrictDocument13 pagesEffect of Solid Waste Management on Socio-Economic Development of Urban Area: A Case of Kicukiro DistrictInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Computer Vision Gestures Recognition System Using Centralized Cloud ServerDocument9 pagesComputer Vision Gestures Recognition System Using Centralized Cloud ServerInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Auto Tix: Automated Bus Ticket SolutionDocument5 pagesAuto Tix: Automated Bus Ticket SolutionInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Examining the Benefits and Drawbacks of the Sand Dam Construction in Cadadley RiverbedDocument8 pagesExamining the Benefits and Drawbacks of the Sand Dam Construction in Cadadley RiverbedInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- An Industry That Capitalizes Off of Women's Insecurities?Document8 pagesAn Industry That Capitalizes Off of Women's Insecurities?International Journal of Innovative Science and Research TechnologyNo ratings yet

- Forensic Advantages and Disadvantages of Raman Spectroscopy Methods in Various Banknotes Analysis and The Observed Discordant ResultsDocument12 pagesForensic Advantages and Disadvantages of Raman Spectroscopy Methods in Various Banknotes Analysis and The Observed Discordant ResultsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Predictive Analytics for Motorcycle Theft Detection and RecoveryDocument5 pagesPredictive Analytics for Motorcycle Theft Detection and RecoveryInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Comparative Evaluation of Action of RISA and Sodium Hypochlorite on the Surface Roughness of Heat Treated Single Files, Hyflex EDM and One Curve- An Atomic Force Microscopic StudyDocument5 pagesComparative Evaluation of Action of RISA and Sodium Hypochlorite on the Surface Roughness of Heat Treated Single Files, Hyflex EDM and One Curve- An Atomic Force Microscopic StudyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Study Assessing Viability of Installing 20kw Solar Power For The Electrical & Electronic Engineering Department Rufus Giwa Polytechnic OwoDocument6 pagesStudy Assessing Viability of Installing 20kw Solar Power For The Electrical & Electronic Engineering Department Rufus Giwa Polytechnic OwoInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Unmasking Phishing Threats Through Cutting-Edge Machine LearningDocument8 pagesUnmasking Phishing Threats Through Cutting-Edge Machine LearningInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Cyber Security Awareness and Educational Outcomes of Grade 4 LearnersDocument33 pagesCyber Security Awareness and Educational Outcomes of Grade 4 LearnersInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Blockchain Based Decentralized ApplicationDocument7 pagesBlockchain Based Decentralized ApplicationInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Smart Health Care SystemDocument8 pagesSmart Health Care SystemInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Visual Water: An Integration of App and Web To Understand Chemical ElementsDocument5 pagesVisual Water: An Integration of App and Web To Understand Chemical ElementsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Parastomal Hernia: A Case Report, Repaired by Modified Laparascopic Sugarbaker TechniqueDocument2 pagesParastomal Hernia: A Case Report, Repaired by Modified Laparascopic Sugarbaker TechniqueInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Factors Influencing The Use of Improved Maize Seed and Participation in The Seed Demonstration Program by Smallholder Farmers in Kwali Area Council Abuja, NigeriaDocument6 pagesFactors Influencing The Use of Improved Maize Seed and Participation in The Seed Demonstration Program by Smallholder Farmers in Kwali Area Council Abuja, NigeriaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Impact of Silver Nanoparticles Infused in Blood in A Stenosed Artery Under The Effect of Magnetic Field Imp. of Silver Nano. Inf. in Blood in A Sten. Art. Under The Eff. of Mag. FieldDocument6 pagesImpact of Silver Nanoparticles Infused in Blood in A Stenosed Artery Under The Effect of Magnetic Field Imp. of Silver Nano. Inf. in Blood in A Sten. Art. Under The Eff. of Mag. FieldInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- 2023 BW 320 Vantage Owners ManualDocument202 pages2023 BW 320 Vantage Owners ManualVolker DietrichNo ratings yet

- Procurement Management: Semester Project Develop A Request For Proposal (RFP)Document2 pagesProcurement Management: Semester Project Develop A Request For Proposal (RFP)Linh LilinNo ratings yet

- BCG Matrix of PranDocument3 pagesBCG Matrix of PranPrithibi IshrakNo ratings yet

- Statement of Comprehensive IncomeDocument6 pagesStatement of Comprehensive IncomeChinchin Ilagan DatayloNo ratings yet

- Module 3 - ABC S23 Supplementary NotesDocument19 pagesModule 3 - ABC S23 Supplementary NotesPrachi YadavNo ratings yet

- Batch-06 DGM101 1Document3 pagesBatch-06 DGM101 1Arbaz khanNo ratings yet

- Lecture 1.1 Introduction To Design Thinking CourseDocument26 pagesLecture 1.1 Introduction To Design Thinking Courseyann olivierNo ratings yet

- Attendance Sponsorship Broadcast Merchandise Other: Tottenham RevenuesDocument28 pagesAttendance Sponsorship Broadcast Merchandise Other: Tottenham RevenuesHzl ZlhNo ratings yet

- Crossfit Journal - JuneCompliation2016 - 2Document41 pagesCrossfit Journal - JuneCompliation2016 - 2Luciano CellucciNo ratings yet

- Timeliness of Filing BP 22 CasesDocument2 pagesTimeliness of Filing BP 22 CasesConcepcion CejanoNo ratings yet

- Syngene International Closes Deal With Strand Life Sciences To Purchase Systems Biology and Pharma Services Practice (Company Update)Document4 pagesSyngene International Closes Deal With Strand Life Sciences To Purchase Systems Biology and Pharma Services Practice (Company Update)Shyam SunderNo ratings yet

- Medicard Phil Inc. vs. CIRDocument2 pagesMedicard Phil Inc. vs. CIRhigoremso giensdks100% (1)

- Chapter 1Document52 pagesChapter 1zahidahNo ratings yet

- A Study On Performance Management System in Manatec Electronic Private LimitedDocument65 pagesA Study On Performance Management System in Manatec Electronic Private LimitedSHAHUL100% (1)

- APRA Enforceable Undertaking From Zurich General InsuranceDocument11 pagesAPRA Enforceable Undertaking From Zurich General InsurancejustinsofoNo ratings yet

- Unit 12 Organising For New Product DevelopmentDocument10 pagesUnit 12 Organising For New Product DevelopmentSyrill CayetanoNo ratings yet

- Windows 8.1 SDK LicenseDocument20 pagesWindows 8.1 SDK LicenseJohan VargasNo ratings yet

- Frame 9001E Combustion PDFDocument2 pagesFrame 9001E Combustion PDFfrdnNo ratings yet

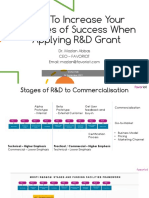

- How To Increase Your Chances of Success When Applying R&D GrantDocument19 pagesHow To Increase Your Chances of Success When Applying R&D GrantMazlan AbbasNo ratings yet

- Cbse Question Bank Admission of PartnersDocument6 pagesCbse Question Bank Admission of Partnersvsy9926No ratings yet

- 2022 135 Taxmann Com 349 CCI 24 02 2022Document3 pages2022 135 Taxmann Com 349 CCI 24 02 2022Anushka SharmaNo ratings yet

- Micro Small Med Entpr in India (IIBF) ContentsDocument6 pagesMicro Small Med Entpr in India (IIBF) ContentsPrashant ShindeNo ratings yet

- Leave MatrixDocument3 pagesLeave MatrixTeoxNo ratings yet

- Chapter 5 Foreign Currency TranslationDocument22 pagesChapter 5 Foreign Currency TranslationjammuuuNo ratings yet

- Templates For Canada ImmigrationDocument6 pagesTemplates For Canada ImmigrationChialuNo ratings yet

- Dhiman S The Routledge Companion To Leadership and Change 2023Document484 pagesDhiman S The Routledge Companion To Leadership and Change 2023maxxion.hrNo ratings yet

- BureacracyDocument11 pagesBureacracyPriya Pri AryaNo ratings yet

- Facebook Initial Complaint (Filed)Document24 pagesFacebook Initial Complaint (Filed)Karen KaslerNo ratings yet

- Indian Farming January 2020 Min PDFDocument76 pagesIndian Farming January 2020 Min PDFdhivirajNo ratings yet

- SOCEBSKE2023 SPAAuthorityto Submit SOCEDocument2 pagesSOCEBSKE2023 SPAAuthorityto Submit SOCEJoan Basmayor100% (1)