Professional Documents

Culture Documents

FA2 TextBook

Uploaded by

Nang Phyu Sin Yadanar KyawCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FA2 TextBook

Uploaded by

Nang Phyu Sin Yadanar KyawCopyright:

Available Formats

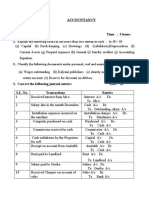

Chapter (1)

2.

↑ ↑

↑ ↑

↑

↓

↓ ↓

↓ ↓

Bookkeeping & Accounting 1

Question(1) Complete the gaps in the following table:

Assets liabilities Capital

$ $ $

(a) 30,000 18,000 ?

(b) 69,400 32,100 ?

(c) 47,500 ? 11,700

(d) 71,800 ? 19,400

(e) ? 30,500 28,100

(f) ? 47,200 36,500

Question (2) Complete the gaps in the following table:

Assets liabilities Capital

$ $ $

(a) 93,000 44,000 ?

(b) ? 36,200 38,900

(c) 107,300 ? 41,500

(d) 125,500 77,400 ?

(e) 114,700 ? 33,400

(f) ? 64,600 21,300

Question (3) Which of the items in the following list are liabilities and which of them are assets?

(a) Motor vehich (d) Bank overdraft

(b) Amounts owed to us by customers (e) Inventory of good held for sale

(c) Land (f) Amounts owed by us to suppliers

Question (4) Classify the following items into liabilities and assets:

(a) Computers (f) cash in bank

(b) Buildings (g) bank overdraft

(c) Accounts payable (h) loan from bank

(d) Inventory (i) Vans

(e) Accounts receivable

Question(5) State which of the following are wrongly classified:

Assets Liabilities

Loan from K.Jones Delivery van

bank overdraft Accounts payable

Accounts receivable Computer equipment

Warehouse Machinery

Office furniture Cash in hand

Question (6) Which of the following are shown under the wrong headings?

Assets Liabilities

Cash at bank Bank overdraft

Fixtures and fittings Equipment

Accounts payable Computers

Premises Loan from building society

Inventory

Accounts receivable

Capital (Equity)

2 Bookkeeping & Accounting

Chapter (2)

⇒

⇒

Bookkeeping & Accounting 3

Question (1) Write up the asset, liability and capital accounts to record the following transactions in the

records of B.Spector’s business:

July 1 Started business by putting $ 15,000 of his own money into a business bank account.

2 Bought office furniture by internet transfer from bank account $2,800.

3 Bought computer equipment $1,260 on time from TVC Ltd.

5 Bought a car paying by cheque $4,950.

8 Sold some of the office furniture - orginal cost $750 - for $ 750 on time to Jevons & Co.

15 Paid the amount owing to TVC Ltd $1260 by Internet transfer from bank account.

23 Received the amount due from Jevons & Co $750 by cheque.

31 Bought machinery using the business’s debit card $710.

Question (2) Yor are required to open the asset and liability and capital accounts and record the following

transactions for June in the records of P. Bernard:

June 1 Started business with $17,500 in cash.

2 Paid $9,400 of the opening cash into a bank account for the business.

5 Bought office furniture on time from Dream Ltd for $2,100.

8 Bought a van paying by Internet transfer from the bank account $5,250.

12 Bought equipment from Pearce & Sons on time $2,300.

18 Returned faulty office furniture costing $260 to Dream Ltd.

25 Sold some of the equipment for $200 cash (its original cost).

26 Paid amount owing to Dream Ltd $1,840 by Internet transfer from the bank account.

28 Took $130 out of the bank and added to cash.

30 F. Brown lent us $4.000 - sending us the money by Internet transfer.

Question (3) Write up the assets, capital and liability accounts in the books of D. Gough to record the

following transactions:

2019

June 1 Started business with $16,000 in the bank.

2 Bought van paying by cheque $6,400.

5 Bought office fixtures $900 on time from Old Ltd.

8 Bought van on time from Carton Cars Ltd $7,100.

12 Took $180 out of the bank and put it into the cash till.

15 Bought office fixtures paying by cash $120.

19 Paid Carton Cars Ltd by Internet transfer from the bank account.

21 A loan of $500 cash is received from B.Berry.

25 Paid $400 of the cash in hand into the bank account.

30 Bought more office fixtures paying with the business debit card $480.

4 Bookkeeping & Accounting

Chapter (3)

Bookkeeping & Accounting 5

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

6 Bookkeeping & Accounting

Question (2) Enter the following transactions in the accounts of L. Linda:

July 1 Started in business with $20,000 in the bank.

2 D.Rupert lent us $5,000 in cash.

3 Bought goods on time from B.Brown $1,530 and I. Jess $4,162.

4 Sold goods for cash $1,910.

6 Took $200 of the cash and paid it into the bank.

8 Sold goods on time to H. Rise $1,530.

10 Sold goods on time to P. Taylor $341.

11 Bought goods on time from B. Brown $560.

12 H.Rise returned goods to us $65.

14 Sold goods on time to G.Farm $535 and R. Sim $262.

15 We returned goods to B.Brown $94.

17 Bought van on time from Aberdeen Cars Ltd $9,100.

18 Bought office furniture on time from J.Winter Ltd $1,800.

19 We returned goods to I. Jess $130.

20 Bought goods for cash $770.

24 Goods sold for cash $110.

25 Paid money owing to B.Brown by cheque $1,924.

26 Goods returned to us by G.Farm $34.

27 Returned some of office furniture costing $180 to J. Winter Ltd.

28 L. Linda put a further $2,500 into the business in the form of cash.

29 Paid Aberdeen cars Ltd $9,100 by cheque.

31 Bought office furniture for cash $365.

Question (3) Enter the following transactions in the accounts:

2020

May 1 Started in business with $18,000 in the bank.

2 Bought goods on time from B. Hind $1,455.

3 Bought goods on time from G. Smart $472.

5 Sold goods for cash $210.

6 We returned goods to B. Hind $82.

8 Bought goods on time from G. Smart $370.

10 Sold goods on time to P.Syme $483.

12 Sold goods for cash $305.

18 Took $250 of the cash and paid it into the bank.

21 Bought a printer by cheque $620.

22 Sold goods on time to H. Buchan $394.

23 P.Syme returned goods to us $160.

25 H.Buchan returned goods to us $18.

28 We returned goods to G Smart $47.

29 We paid B. Hind by cheque $1,373.

31 Bought machinery on time from A.Cobb $419.

Bookkeeping & Accounting 7

Chapter (4)

8 Bookkeeping & Accounting

/

/

/

/

/

/

/

Question (2) Enter the following transactions in the accounts, completing the double entry in the books for

the month of August:

August 1 Started in business with $31,000 in the bank and $4,000 in cash.

2 Purchased goods $1,160 on time from A Cliff.

3 Bought fixtures and fittings $4,600 paying by cheque.

5 Sold goods for cash $600.

6 Bought goods on time $1,300 from S. Bell.

10 Paid rent by cash $800.

12 Bought stationery $180, paying in cash.

18 Goods returned to A. Cliff $164.

21 Received rent of $480 by cheque for sublet of corne space.

23 Sold goods on time to R. Coat for $ 3,200.

24 Bought a van paying by cheque $16,400.

30 Paid the month’s wages by cash $1,220.

31 The proprietor took cash for her own personal use $1,020.

Bookkeeping & Accounting 9

Quesiton (3) Write up the following transaction in the T-accounts of F. Fernandes:

Feb 1 Started in business with $11,000 in the bank and $1,600 cash.

2 Bought goods on time: J. Biggs $830; D. Martin $610,P Lot $590.

3 Bought goods or cash $370.

4 Paid rent in cash $75.

5 Bought stationery paying by cheque $62.

6 Sold goods on time: D. T wigg $370; B. Hogan $290; K. Fletcher $410.

7 Paid wages in cash $160.

10 We returned goods to D. Martin $195.

11 Paid rent in cash $75.

13 B. Hogan returns goods to us $35.

15 Sold goods on time to: T. Lee $205; F. Sharp $280; G. Rae $426.

16 Paid business rates by cheque $970.

18 Paid insurance in cash $280.

19 Paid rent by cheque $75.

20 Bought van on time from B. Black $6,100.

21 Paid motor expenses in cash $24.

23 Paid wages in cash $170.

24 Received part of amount owing from K. Fletcher by cheque $250.

28 Received refund of business rates $45 by cheque.

28 Paid by cheque: J. Biggs $830; D. Martin $415; B. Black $6,100.

10 Bookkeeping & Accounting

Chapter ( )

4. Example of Trial Balance

x x x

Trial balance as at

Account Name Dr bal Cr bal

$ $

Assets A/c xx

Liabilities A/c xx

Equity A/c xx

Purchase A/c xx

Revenue A/c xx

Return Inward A/c xx

Return Outward A/c xx

Expenses A/c xx

Income A/c xx

Drawings A/c xx

xx xx

Bookkeeping & Accounting 11

Question(1) Record the following details relating to a carpet wholesaler for the month of November and

extract a trial balance as at 30 November.

Nov 1 Started in business with $15,000 in the bank.

3 Bought goods on time from J. Small $290; F. Brown $1,200; R. Charles $530; T. Rae $610.

5 Cash sales $610.

6 Paid rent by cheque $175.

7 Paid business rates by cheque $130.

11 Sold goods on time to: T. Potts $85; J. Field $48; T. Bray $1,640.

17 Paid wages by cash $290.

18 We returned goods to: J. Small$18; R. Charles $27.

19 Bought goods on time:R.Charles $110: T.Rae $320;F.Jack $165.

20 Goods were returned to us by: J. Field $6; T.Bray $14.

21 Bought van on time from Turnkey Motors $4950.

23 We Paid the following by cheque: J. Small $272; F. Brown $1200; T. Rae $500.

25 Bought another van, paying by cheque immediately $6,200.

26 Received loan of $750 cash from B. Bennet.

28 Received cheques from: T. Potts $71; J. Field $42.

30 Proprietor brings a further $900 into the business by a payment into the business bank account.

Question(2) Record the following transactions for the month of June of a small finishing retailer balance-

off all the accounts and then extract a trial balance as at 30 June.

June 1 Started in business with $10,500 cash.

2 Put $9,000 of the cash into a bank account.

3 Bought goods for cash $550.

4 Bought goods on time from: T. Dry $800; F. Hood $930; M. Smith $160; G. Low $510.

5 Bought stationery on time from Buttons Ltd $89.

6 Sold goods on time to: R. Tong $170; L. Fish $240; M. Singh $326; A. Tom $204.

8 Paid rent by cheque$220.

10 Bought fixtures on time from Chiefs Ltd $89.

11 Paid salaries in cash $790.

14 Returned goods to: F. Hood $30; M. Smith $42.

15 Bought van by cheque $6,500

16 Received loan from B. Barclay by cheque $2,000.

18 Goods returned to us by: R. Tong $5; M. Singh $20.

21 Cash sales $145.

24 Sold goods on time to: L Fish $130; A. Tom $410; R. Pleat $158.

26 We paid the following by cheque: F. Hood $900; M. Smith $118.

29 Received cheques from: R. Pleat $158; L. Fish $370.

30 Received a further loan from B. Barclay by cash $500.

30 Received $614 cash from A. Tom.

12 Bookkeeping & Accounting

Question (3)

Question (4)

Bookkeeping & Accounting 13

Chapter ( )

14 Bookkeeping & Accounting

Bookkeeping & Accounting 15

Question (2) From the following trial balance of G . Still, draw up statement of profit and loss for the year ending 30

September 2020, and statement of financial position as at that date.

Dr Cr

$ $

Inventory: 1 October 2019 41,600

Carriage outwards 2,100

Carriage inwards 3,700

Returns inwards 1,540

Returns outwards 3,410

Purchases 188,430

Sales 380,400

Salaries and wages 61,400

Warehouse rent 3,700

Insurance 1,356

Motor expenses 1910

Office expenese 412

Lighting and heating expenses 894

General expenses 245

Premises 92,000

Motor vehicles 13,400

Fixtures and fittings 1,900

Accounts receivable 42,560

Accounts payable 31,600

Cash at bank 5,106

Drawing 22,000

Capital 68,843

484,253 484,253

Inventory at 30 September 2020 was $44,780.

Question (3) The following trial balance was extracted from the books of F. Sorley on 30 April 2020. From it,

and the note about inventory, prepare statement of profit and loss for the year ending 30 April 2020

and statement of financial position as at that date.

Dr Cr

$ $

Sales 210,420

Purchases 108,680

Inventory: 1 May 2019 9,410

Carriage outwards 1,115

Carriage inwards 840

Returns inwards 4,900

Returns outwards 3,720

Salaries and wages 41,800

16 Bookkeeping & Accounting

Motor expenses 912

Rent 6,800

Sundry expenses 318

Motor vehicles 14,400

Fixtures and fittings 912

Accounts receivable 23,200

Accounts payable 14,100

Cash at bank 4,100

Cash in hand 240

Drawings 29,440

Capital 18,827

247,067 247,067

Inventory at 30 April 2020 was $11,290.

Question (4)

Bookkeeping & Accounting 17

You might also like

- LEVEL 1-2-2015 New SyllDocument100 pagesLEVEL 1-2-2015 New SyllEmilyNo ratings yet

- LCCI LEVEL 1&2 TextbookDocument100 pagesLCCI LEVEL 1&2 TextbookJohn Sue Han100% (2)

- Acco EquationDocument4 pagesAcco EquationAsima ZubairNo ratings yet

- S4 BAFS 1st Term Test 2020-2021 Q PaperDocument5 pagesS4 BAFS 1st Term Test 2020-2021 Q PaperjjjjjjjjjjjjjjjjjjNo ratings yet

- Basic of GR 8Document4 pagesBasic of GR 8Aejaz MohamedNo ratings yet

- CAMPERDOWN HIGH SCHOOL - Accounting Grade 9 TestDocument6 pagesCAMPERDOWN HIGH SCHOOL - Accounting Grade 9 TestLatoya SmithNo ratings yet

- Poa 2017 PDFDocument78 pagesPoa 2017 PDFAlyssa BrownNo ratings yet

- 1 - ExercisesDocument6 pages1 - ExercisesTrang Nguyễn QuỳnhNo ratings yet

- Mudio Islamic Examination Board (Mieb)Document5 pagesMudio Islamic Examination Board (Mieb)MmaryNo ratings yet

- Double Entry Book Keeping Rules Chapter - 03Document10 pagesDouble Entry Book Keeping Rules Chapter - 03Ramainne RonquilloNo ratings yet

- 1 - ExercisesDocument6 pages1 - ExercisesTrang Nguyễn QuỳnhNo ratings yet

- Worksheet - Unit 3 - Double Entry Accounting - Part 1Document4 pagesWorksheet - Unit 3 - Double Entry Accounting - Part 1LearnJa Online SchoolNo ratings yet

- Principles of Accounts - Sir Eddie: Saraswati Vidya NiketanDocument5 pagesPrinciples of Accounts - Sir Eddie: Saraswati Vidya NiketanRafena MustaphaNo ratings yet

- Financial Accounting - Problems 2 Exercise 2.1Document8 pagesFinancial Accounting - Problems 2 Exercise 2.1Akshay SawhneyNo ratings yet

- Dwnload Full Financial Accounting Canadian Canadian 5th Edition Libby Test Bank PDFDocument35 pagesDwnload Full Financial Accounting Canadian Canadian 5th Edition Libby Test Bank PDFxatiaaumblask100% (12)

- Problems On Journal, Ledger and Accounting EquationDocument11 pagesProblems On Journal, Ledger and Accounting EquationGopiNo ratings yet

- 202AF13A Financial AccountingDocument14 pages202AF13A Financial AccountingkalpanaNo ratings yet

- Review Questions: Answers To ActivitiesDocument3 pagesReview Questions: Answers To ActivitiesNhật Tâm HuỳnhNo ratings yet

- QP - As Level (Acc) (20.9.23) - MT Exam - 23-24Document7 pagesQP - As Level (Acc) (20.9.23) - MT Exam - 23-24vedamandaliyaNo ratings yet

- Revision Accountancy XI Term II 8.12.2022 FinalDocument15 pagesRevision Accountancy XI Term II 8.12.2022 FinalNIRMALA COMMERCE DEPTNo ratings yet

- 11th AccountancyDocument7 pages11th Accountancygamerbeast367No ratings yet

- Namma Kalvi 11th Accountancy Model Questin Paper EM 221452Document8 pagesNamma Kalvi 11th Accountancy Model Questin Paper EM 221452sharonjamesappuNo ratings yet

- Special Transactions (2019) by Millan Solman PDFDocument157 pagesSpecial Transactions (2019) by Millan Solman PDFMichael Angelou Raymundo90% (20)

- Accountancy Class 11 Final Set ADocument7 pagesAccountancy Class 11 Final Set AmahonidhinareddyNo ratings yet

- AFAR1 Chap 1Document7 pagesAFAR1 Chap 1CilNo ratings yet

- Accounts Mega ModelDocument8 pagesAccounts Mega Modellekha ram100% (1)

- FA2 - Mock PaperDocument9 pagesFA2 - Mock PaperLinh ThuyNo ratings yet

- Foundation Course Examination: Suggested Answers To QuestionsDocument20 pagesFoundation Course Examination: Suggested Answers To Questionstapwater722No ratings yet

- Full Download Financial Accounting 7th Edition Harrison Test BankDocument34 pagesFull Download Financial Accounting 7th Edition Harrison Test Banklarisaauresukus100% (36)

- Book Keeping: Form Two Midterm Examination March 2020Document5 pagesBook Keeping: Form Two Midterm Examination March 2020Mohamed NgundeNo ratings yet

- Accounting Analysis of TransactionsDocument14 pagesAccounting Analysis of TransactionscamilleNo ratings yet

- Chapter (2) Eg Ex No 1 To 6 AnswersDocument3 pagesChapter (2) Eg Ex No 1 To 6 AnswersJames Milzer100% (1)

- 02 AddDocument14 pages02 AddHà My NguyễnNo ratings yet

- Accounting Revision TestDocument1 pageAccounting Revision TestmollermazNo ratings yet

- Accounting Equation Chapter - 02Document6 pagesAccounting Equation Chapter - 02Ramainne Ronquillo100% (1)

- Assignment 1 A FaDocument3 pagesAssignment 1 A Faeater PeopleNo ratings yet

- T1 - YAL - Qns (12-5-2011Document9 pagesT1 - YAL - Qns (12-5-2011Jennifer EdwardsNo ratings yet

- Assessment No. 3-Midterm - Exam SheetDocument7 pagesAssessment No. 3-Midterm - Exam Sheetarnel buanNo ratings yet

- Objective Test Questions: Section 1Document8 pagesObjective Test Questions: Section 1Renato WilsonNo ratings yet

- FR2 Past Papers 24 AttemptsDocument107 pagesFR2 Past Papers 24 AttemptsAbdullah FarooqiNo ratings yet

- Explain The Following Terms in Not More Than Two Sentences Each: 1x 10 10Document4 pagesExplain The Following Terms in Not More Than Two Sentences Each: 1x 10 10Anita PanigrahiNo ratings yet

- Part - A: (Financial Accounting - I)Document16 pagesPart - A: (Financial Accounting - I)Adit Bohra VIII BNo ratings yet

- Exam (3) ASDocument6 pagesExam (3) ASUsama AslamNo ratings yet

- Accounts Form 3Document3 pagesAccounts Form 3dennychiwarahNo ratings yet

- Midterm Exam Answer Sheet Course 8110Document8 pagesMidterm Exam Answer Sheet Course 8110kajalNo ratings yet

- Accounting For Special Transactions 2019 Ed. MIllan Solution ManualDocument157 pagesAccounting For Special Transactions 2019 Ed. MIllan Solution ManualRaven PicorroNo ratings yet

- Grade 10 Poa MC 2018Document4 pagesGrade 10 Poa MC 2018Regina CunninghamNo ratings yet

- Review Questions Volume 1 - Chapter 1: Assets Liabilities CapitalDocument2 pagesReview Questions Volume 1 - Chapter 1: Assets Liabilities CapitalHassan AsgharNo ratings yet

- Test 2 2014Document7 pagesTest 2 2014muyan zouNo ratings yet

- 1001 Practice QuestionsDocument95 pages1001 Practice QuestionsMohamad El-JadayelNo ratings yet

- Instruction: 1. Closed Book Exam 2. Use Calculator For All Calculations Use of Laptop/Mobile Is Not AllowedDocument2 pagesInstruction: 1. Closed Book Exam 2. Use Calculator For All Calculations Use of Laptop/Mobile Is Not AllowedPalak MendirattaNo ratings yet

- Xi Pre Final AccountsDocument7 pagesXi Pre Final AccountsDrishti ChauhanNo ratings yet

- Assignment 1Document7 pagesAssignment 1Meerab MukhtarNo ratings yet

- S4 BAFS 1st Term Test 2019-2020 Question PaperDocument3 pagesS4 BAFS 1st Term Test 2019-2020 Question PaperjjjjjjjjjjjjjjjjjjNo ratings yet

- Solution CH 2Document14 pagesSolution CH 2razaffd410No ratings yet

- F3 Mock Exam 2Document12 pagesF3 Mock Exam 2HiraNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Audit of Cash and Cash EquivalentsDocument9 pagesAudit of Cash and Cash Equivalentspatricia100% (1)

- Review Sessqergwtgwtegwtron 4 TEXTDocument7 pagesReview Sessqergwtgwtegwtron 4 TEXTMelissa WhiteNo ratings yet

- Yashpreet Kaur 7834156Document8 pagesYashpreet Kaur 7834156Hardeep KaurNo ratings yet

- Bni Bilingual 30 Juni 2020 ReleasedDocument331 pagesBni Bilingual 30 Juni 2020 ReleasedGiovanno HermawanNo ratings yet

- CH 01Document16 pagesCH 01Neamul hasan AdnanNo ratings yet

- Dashboard Template: Business Unit Revenue ($000) Profit Margin ($000)Document1 pageDashboard Template: Business Unit Revenue ($000) Profit Margin ($000)GolamMostafaNo ratings yet

- Chapter 5 - Consolidated Financial Statements - Intercompany Asset TransactionsDocument28 pagesChapter 5 - Consolidated Financial Statements - Intercompany Asset TransactionsBLe BerNo ratings yet

- CH 10 Accruals and PrepaymentsDocument8 pagesCH 10 Accruals and PrepaymentsSumiya YousefNo ratings yet

- Accounting RTPDocument40 pagesAccounting RTPMayur KundarNo ratings yet

- Talakag2017 Audit Report PDFDocument137 pagesTalakag2017 Audit Report PDFGabriel uyNo ratings yet

- Eskimo PieDocument30 pagesEskimo PieMing Yang100% (1)

- Pertemuan 1 - Shareholder EquityDocument11 pagesPertemuan 1 - Shareholder EquityIvonie NursalimNo ratings yet

- WCADocument18 pagesWCAleninanthony89488No ratings yet

- FAR Assignment 1Document3 pagesFAR Assignment 1The Psycho100% (1)

- Ross 11e Chap016 PPT AccessibleDocument35 pagesRoss 11e Chap016 PPT AccessibleIvan FongNo ratings yet

- L3 Accounting TermsDocument9 pagesL3 Accounting Termsritu gofficeNo ratings yet

- Chap 010Document50 pagesChap 010mas azizNo ratings yet

- Sample Paper 3Document16 pagesSample Paper 3TrostingNo ratings yet

- Forecasting For Financial Planning: "If You Are Going To Forecast, Forecast Often."Document26 pagesForecasting For Financial Planning: "If You Are Going To Forecast, Forecast Often."Trần Huyền MyNo ratings yet

- Property Plant and EquipmentDocument13 pagesProperty Plant and EquipmentWilsonNo ratings yet

- Cash and ReceivablesDocument30 pagesCash and ReceivablesAira Mae Hernandez CabaNo ratings yet

- Trial Balance For Company ABC Difference As On DD-MM-YYYY 0Document2 pagesTrial Balance For Company ABC Difference As On DD-MM-YYYY 0WaqasNo ratings yet

- Kurt Sullivan Income Statement To Republic Bank 2020-2022Document7 pagesKurt Sullivan Income Statement To Republic Bank 2020-2022Stephen FrancisNo ratings yet

- Accounting For Managers: Financial Statement Analysis ofDocument25 pagesAccounting For Managers: Financial Statement Analysis of21AD01 - ABISHEK JNo ratings yet

- 150.curren and Non Current Assets and Liabilities 2Document3 pages150.curren and Non Current Assets and Liabilities 2Melanie SamsonaNo ratings yet

- Investment PlanDocument23 pagesInvestment PlanKhizar WaheedNo ratings yet

- FUNDAMENTALS OF ABM 1 Section 7Document13 pagesFUNDAMENTALS OF ABM 1 Section 7Allysa Kim RubisNo ratings yet

- BUSI 1001/1004 - Financial Accounting Sample Final ExaminationDocument19 pagesBUSI 1001/1004 - Financial Accounting Sample Final ExaminationThe oneNo ratings yet

- Hoyle Ch3 SolutionsDocument32 pagesHoyle Ch3 SolutionskhawlaNo ratings yet

- Greenergy Holdings Incorporated - SEC Form 17-Q - 14 August 2020Document61 pagesGreenergy Holdings Incorporated - SEC Form 17-Q - 14 August 2020John AzellebNo ratings yet