Professional Documents

Culture Documents

Copy B For Student 1098-T: Tuition Statement

Copy B For Student 1098-T: Tuition Statement

Uploaded by

qqvhc2x2prOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Copy B For Student 1098-T: Tuition Statement

Copy B For Student 1098-T: Tuition Statement

Uploaded by

qqvhc2x2prCopyright:

Available Formats

CORRECTED

FILER'S name, street address, city or town, state or province, country, ZIP or 1 Payments received for qualified OMB No. 1545-1574

foreign postal code, and telephone number tuition and related expenses

San Jacinto College

4620 Fairmont Parkway

Pasadena TX 77504 2

$ 931.20

2023 Tuition

Statement

Contact Tel. No: (281)998-6145 Form 1098-T

FILER'S employer identification no. STUDENT'S TIN 3

Copy B

746028285

STUDENT'S name

*****7101

4 Adjustments made for a prior 5 Scholarships or grants

For Student

This is important tax

year

Javi Avila information and is being

Street address (including apt. no.) $ .00 $ .00 furnished to the IRS.

357 Cavil Barrier Ln 6 Adjustments to scholarships or 7 Checked if the amount in box 1

This form must be used

grants for a prior year includes amounts for an to complete Form 8863

academic period beginning to claim education

City or town, state or province, country, and ZIP or foreign postal code January - March 2024 credits. Give it to the

La Porte TX 775712200 $ .00 tax preparer or use it to

Service Provider/Acct. No. (see instr.) 8 Check if at least 9 Checked if a graduate 10 Ins. contract reimb./refund prepare the tax return.

half-time student student

G01097124 X $

38-2099803

Form 1098-T (keep for your records) www.irs.gov/Form1098T Department of the Treasury - Internal Revenue Service

Instructions for Student

You, or the person who can claim you as a dependent, may be able to claim an education year (may result in an increase in tax liability for the year of the refund). See “recapture” in

credit on Form 1040 or 1040-SR. This statement has been furnished to you by an eligible the index to Pub. 970 to report a reduction in your education credit or tuition and fees deduction.

educational Institution in which you are enrolled, or by an insurer who makes reimbursements Box 5. Shows the total of all scholarships or grants administered and processed by

or refunds of qualified tuition and related expenses to you. This statement is required to the eligible educational institution. The amount of scholarships or grants for the

support any claim for an education credit. Retain this statement for your records. To see if calendar year (including those not reported by the institution) may reduce the amount

you qualify for a credit, and for help in calculating the amount of your credit, see Pub. 970, of the education credit you claim for the year.

Form 8863, and the Instructions for Forms 1040. Also, for more information, go to TIP: You may be able to increase the combined value of an education credit and certain

www.irs.gov/Credits-Deductions/Individuals/Qualified-Ed-Expenses. educational assistance (including Pell Grants) if the student includes some or all of

Your institution must include its name, address, and information contact telephone the educational assistance in income in the year it is received. For details, see Pub. 970.

number on this statement. It may also include contact information for a service provider. Box 6. Shows adjustments to scholarships or grants for a prior year. This amount may

Although the filer or the service provider may be able to answer certain questions about affect the amount of any allowable tuition and fees deduction or education credit that

the statement, do not contact the filer or the service provider for explanations of the you claimed for the prior year. You may have to file an amended income tax return

requirements for (and how to figure) any education credit that you may claim. (Form 1040X) for the prior year.

Student's taxpayer identification number (TIN). For your protection, this form may show Box 7. Shows whether the amount in box 1 includes amounts for an academic period

only the last four digits of your TIN (SSN, ITIN, ATIN, or EIN). However, the issuer has beginning January–March 2024. See Pub. 970 for how to report these amounts.

reported your complete TIN to the IRS. Caution: If your TIN is not shown in this box, your Box 8. Shows whether you are considered to be carrying at least one-half the normal

school was not able to provide it. Contact your school if you have questions. full-time workload for your course of study at the reporting institution.

Account number. May show an account or other unique number the filer assigned Box 9. Shows whether you are considered to be enrolled in a program leading to a graduate

to distinguish your account. degree, graduate-level certificate, or other recognized graduate-level educational credential.

Box 1. Shows the total payments received by an eligible educational institution in 2023 Box 10. Shows the total amount of reimbursements or refunds of qualified tuition and

from any source for qualified tuition and related expenses less any reimbursements or related expenses made by an insurer. The amount of reimbursements or refunds for

refunds made during 2023 that relate to those payments received during 2023. the calendar year may reduce the amount of any education credit you can claim for

Box 2. Reserved for future use. the year (may result in an increase in tax liability for the year of the refund).

Box 3. Reserved for future use. Future developments. For the latest information about developments related to Form

Box 4. Shows any adjustment made by an eligible educational institution for a prior year 1098-T and its instructions, such as legislation enacted after they were published, go to

for qualified tuition and related expenses that were reported on a prior year Form 1098-T. www.irs.gov/Form1098T.

This amount may reduce any allowable education credit that you claimed for the prior FreeFile. Go to www.irs.gov/FreeFile to see if you qualify fo f no-cost online

federal tax preparation, e-filing, and direct deposite or payment options.

San Jacinto College

4620 Fairmont Parkway

Pasadena TX 77504

Javi Avila

357 Cavil Barrier Ln

La Porte TX 775712200

You might also like

- 2019 Tax Return Documents (CLEAN LIVING LLC)Document28 pages2019 Tax Return Documents (CLEAN LIVING LLC)JuniorNo ratings yet

- Young Acc 137 Kongai, Tsate 1040Document26 pagesYoung Acc 137 Kongai, Tsate 1040Kathy YoungNo ratings yet

- UnknownDocument24 pagesUnknownanyanwuchigozie560No ratings yet

- Rhonda TX RTNDocument18 pagesRhonda TX RTNobriens05No ratings yet

- 2022 TaxReturnDocument9 pages2022 TaxReturnmicheelleeex3No ratings yet

- 2021TaxReturnPDF 221003 100736Document18 pages2021TaxReturnPDF 221003 100736Tracy SmithNo ratings yet

- 2021-2022 Tax ReturnDocument3 pages2021-2022 Tax ReturnMmmmmmmNo ratings yet

- W2 PreviewDocument1 pageW2 Previewmrs merle westonNo ratings yet

- Tax Return - 2018-2019Document30 pagesTax Return - 2018-2019kutner8181No ratings yet

- 2009 Gibbs D Form 1040 Individual Tax Return Tax2009Document23 pages2009 Gibbs D Form 1040 Individual Tax Return Tax2009Jaqueline LeslieNo ratings yet

- Tax Return - Mr. X - AY 2022-23Document12 pagesTax Return - Mr. X - AY 2022-23Rasel AshrafulNo ratings yet

- Imigracion 2Document15 pagesImigracion 2erickNo ratings yet

- FederalDocument20 pagesFederalKim Cyrell DanilaNo ratings yet

- Form - I 9 - 10 21 2019Document3 pagesForm - I 9 - 10 21 2019Mitch SabioNo ratings yet

- 1 5136803172601299942 PDFDocument3 pages1 5136803172601299942 PDFnurulamin00023No ratings yet

- 2021 - TaxReturn 2pagessignedDocument3 pages2021 - TaxReturn 2pagessignedDedrick RiversNo ratings yet

- 2019 Leon California FilingDocument18 pages2019 Leon California FilingPolo PoloNo ratings yet

- Tax Certificate 2022-2023Document1 pageTax Certificate 2022-2023marco.kozilekgoweNo ratings yet

- 16 540-SignedDocument5 pages16 540-Signedapi-352277890No ratings yet

- Federal 2016 :DDocument15 pagesFederal 2016 :DAnguila Angel Anguila AngelNo ratings yet

- Final Return For TARA PDFDocument8 pagesFinal Return For TARA PDFAnonymous NaYWx2vJN100% (1)

- Captura de Pantalla T 2023-05-28 A La(s) 22.18.24Document69 pagesCaptura de Pantalla T 2023-05-28 A La(s) 22.18.24rozaj519No ratings yet

- Greenleaf RhodeIslandDOCSDocument95 pagesGreenleaf RhodeIslandDOCSTimothy TuckNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationMalahk Ben MikielNo ratings yet

- Mart1552 21i FCDocument23 pagesMart1552 21i FCOlga M.No ratings yet

- FIRE 2011 Form 990Document36 pagesFIRE 2011 Form 990FIRENo ratings yet

- County of San Bernardino: Victorville TAD/WTW/Child Care/PID 15010 Palmdale RD VICTORVILLE, CA 92392-2546Document37 pagesCounty of San Bernardino: Victorville TAD/WTW/Child Care/PID 15010 Palmdale RD VICTORVILLE, CA 92392-2546Manuel ChavezNo ratings yet

- Identity and Employment Authorization Identity Employment AuthorizationDocument3 pagesIdentity and Employment Authorization Identity Employment AuthorizationAnonymous olIRceaUNo ratings yet

- Master Promissory Note (MPN) Direct Subsidized Loans and Direct Unsubsidized Loans William D. Ford Federal Direct Loan ProgramDocument15 pagesMaster Promissory Note (MPN) Direct Subsidized Loans and Direct Unsubsidized Loans William D. Ford Federal Direct Loan Programodontologia unibeNo ratings yet

- Please Review The Updated Information Below.: For Begins After This CoversheetDocument3 pagesPlease Review The Updated Information Below.: For Begins After This CoversheetDavid FreiheitNo ratings yet

- Preview Copy Do Not File: Profit or Loss From BusinessDocument1 pagePreview Copy Do Not File: Profit or Loss From BusinessRon KnightNo ratings yet

- Brooklyn Museum 2019 IRS Form 990Document64 pagesBrooklyn Museum 2019 IRS Form 990Lee Rosenbaum, CultureGrrlNo ratings yet

- State District of ColumbiaDocument20 pagesState District of ColumbiaRoger federerNo ratings yet

- 2014 Alabama Possible 990Document39 pages2014 Alabama Possible 990Alabama PossibleNo ratings yet

- New Hire Paperwork 2021aDocument27 pagesNew Hire Paperwork 2021aTom BondalicNo ratings yet

- Instructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDocument72 pagesInstructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDiego12001No ratings yet

- 2019 Chandler D Form 1040 Individual Tax Return - Records-ALDocument7 pages2019 Chandler D Form 1040 Individual Tax Return - Records-ALwhat is thisNo ratings yet

- Invoice 20154352Document2 pagesInvoice 20154352Milan NayekNo ratings yet

- Tax Return 2021Document3 pagesTax Return 2021Mark ThomasNo ratings yet

- 540 FinalDocument5 pages540 Finalapi-350796322No ratings yet

- Child and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)Document2 pagesChild and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)Sarah KuldipNo ratings yet

- Hynum Greg Angela - 20i - CCDocument76 pagesHynum Greg Angela - 20i - CCAdmin OfficeNo ratings yet

- 2020FTFCS 2022-02-26 1645943726435Document5 pages2020FTFCS 2022-02-26 1645943726435Mark Bagliani100% (1)

- Frantz Raymond TaxDocument1 pageFrantz Raymond Taxjoseph GRAND-PIERRENo ratings yet

- TurboTax Print Preview 02-14-2013T20.10.08.460Document13 pagesTurboTax Print Preview 02-14-2013T20.10.08.460glenncannon1973No ratings yet

- Fext 2022-04-17 1650241773772 PDFDocument2 pagesFext 2022-04-17 1650241773772 PDFFera PetersonNo ratings yet

- Partnership AgreementDocument33 pagesPartnership AgreementLawrence TanNo ratings yet

- RTMF 990Document49 pagesRTMF 990Craig MaugerNo ratings yet

- PWC Captive InsuranceDocument13 pagesPWC Captive InsurancehvikashNo ratings yet

- Img 20220411 0006Document1 pageImg 20220411 0006herb flatherNo ratings yet

- Vba 21 674 AreDocument3 pagesVba 21 674 AreCynthia StovallNo ratings yet

- CP575Notice 1641583471945Document2 pagesCP575Notice 1641583471945Dawson BanksNo ratings yet

- Fairmount Heights - Documents 1 PDFDocument88 pagesFairmount Heights - Documents 1 PDFAri AsheNo ratings yet

- Access Florida Application Details 810968014Document11 pagesAccess Florida Application Details 810968014Samantha DuffNo ratings yet

- 2022 8879 (Brashier Misty) 2Document12 pages2022 8879 (Brashier Misty) 2Astrid ReiNo ratings yet

- Nandy Sewing Solutions Private Limited 1668 28-Apr-23: Tax InvoiceDocument1 pageNandy Sewing Solutions Private Limited 1668 28-Apr-23: Tax InvoiceManish ShawNo ratings yet

- 4515512273482Document1 page4515512273482VermaNo ratings yet

- Managerial Economics Quiz 2Document8 pagesManagerial Economics Quiz 2Junayed AzizNo ratings yet

- Paoay vs. ManaoisDocument5 pagesPaoay vs. ManaoischarmssatellNo ratings yet

- 2011 r083020t Toverengwa Chigweremba's Industrial Attachment ReportDocument93 pages2011 r083020t Toverengwa Chigweremba's Industrial Attachment ReportPaul Chibange69% (26)

- Admin Law Digests IDocument3 pagesAdmin Law Digests Ianna beeNo ratings yet

- Make Necessary Changes in Only Orange Colored Fields.: Proceed To Calculation Will Be Initially "No"Document36 pagesMake Necessary Changes in Only Orange Colored Fields.: Proceed To Calculation Will Be Initially "No"xakilNo ratings yet

- Fall 2023 - Tax ProjectDocument4 pagesFall 2023 - Tax Projectacwriters123No ratings yet

- Tabliga Gerwin Andres Agusti Marissa Calzado: Application For Vehicle FinancingDocument3 pagesTabliga Gerwin Andres Agusti Marissa Calzado: Application For Vehicle FinancingJerikah Jec HernandezNo ratings yet

- Tax - 2020-2021 PDFDocument2 pagesTax - 2020-2021 PDFShanto ChowdhuryNo ratings yet

- Income Tax Return 2023 24 Excluding 82C Businesspartnership3Document18 pagesIncome Tax Return 2023 24 Excluding 82C Businesspartnership3Mehedi HasanNo ratings yet

- Windward Fund's 2018 Tax FormsDocument49 pagesWindward Fund's 2018 Tax FormsJoe SchoffstallNo ratings yet

- Zax11 Stockbridge Ga 9061Document4 pagesZax11 Stockbridge Ga 9061Frank ValenzuelaNo ratings yet

- Copy B For Student 1098-T: Tuition StatementDocument1 pageCopy B For Student 1098-T: Tuition Statementqqvhc2x2prNo ratings yet

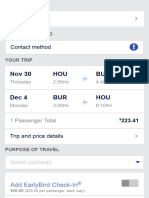

- Southwest AirlinesDocument1 pageSouthwest Airlinesqqvhc2x2prNo ratings yet

- Defensive Driving Cert 1329622Document1 pageDefensive Driving Cert 1329622qqvhc2x2prNo ratings yet

- Line Are Q Find The Errors 2 PagesDocument2 pagesLine Are Q Find The Errors 2 Pagesqqvhc2x2prNo ratings yet

- 5.2 PracticeDocument2 pages5.2 Practiceqqvhc2x2prNo ratings yet

- Icitss Project FileDocument21 pagesIcitss Project FileShrey JainNo ratings yet

- New Microsoft Office Word DocumentDocument5 pagesNew Microsoft Office Word DocumentSupriya SahayNo ratings yet

- CWB Sample Setup 11iDocument38 pagesCWB Sample Setup 11ikarthicsubbu@gmailNo ratings yet

- T25 Final Revision 1Document112 pagesT25 Final Revision 1Andrew Wong100% (2)

- The TRAIN Aims To Make The Philippine Tax System Simpler, Fairer, and More Efficient To Promote Investment, Create Jobs and Reduce PovertyDocument2 pagesThe TRAIN Aims To Make The Philippine Tax System Simpler, Fairer, and More Efficient To Promote Investment, Create Jobs and Reduce PovertyPATRICIA ANGELICA VINUYANo ratings yet

- Bifo 2005 PDFDocument35 pagesBifo 2005 PDFPrince AdyNo ratings yet

- Business Ethics Exam ReviewerDocument5 pagesBusiness Ethics Exam ReviewerGrobotan LuchiNo ratings yet

- Case Laws ReforestationDocument11 pagesCase Laws ReforestationRet GenandoyNo ratings yet

- TAX3761 - Test 2 June 2022Document10 pagesTAX3761 - Test 2 June 2022lennoxhaniNo ratings yet

- Affiliate Agreement: Karatbars International GMBHDocument15 pagesAffiliate Agreement: Karatbars International GMBHddNo ratings yet

- IGCSE-OL - Bus - CH - 23 - Answers To CB ActivitiesDocument4 pagesIGCSE-OL - Bus - CH - 23 - Answers To CB ActivitiesOscar WilliamsNo ratings yet

- W-8BEN: Certificate Status) ) ), .Document1 pageW-8BEN: Certificate Status) ) ), .NierNo ratings yet

- Business Accounting and Taxation BrochureDocument4 pagesBusiness Accounting and Taxation BrochureRudrin DasNo ratings yet

- 165585-2013-Government Service Insurance System v. Prudential Guarantee and Assurance, Inc PDFDocument13 pages165585-2013-Government Service Insurance System v. Prudential Guarantee and Assurance, Inc PDFJovy Norriete dela CruzNo ratings yet

- CapitalDocument5 pagesCapitalnarendravaidya18No ratings yet

- Financial Analysis of Islami Bank BangladeshDocument5 pagesFinancial Analysis of Islami Bank BangladeshMahmudul Hasan RabbyNo ratings yet

- Planters Products V Fertiphil Corp - 166006Document24 pagesPlanters Products V Fertiphil Corp - 166006Joanna ENo ratings yet

- ITAD BIR Ruling No. 032-20Document6 pagesITAD BIR Ruling No. 032-20Paul Erik CaracasNo ratings yet

- Cta 1D CV 08425 D 2014nov17 AssDocument43 pagesCta 1D CV 08425 D 2014nov17 AssbiklatNo ratings yet

- Wealth CheatsheetDocument1 pageWealth CheatsheetMaria EduardaNo ratings yet