Professional Documents

Culture Documents

Iat 2

Uploaded by

Ajisha GodsonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Iat 2

Uploaded by

Ajisha GodsonCopyright:

Available Formats

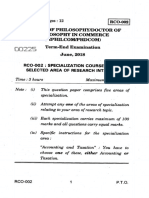

ASSESSMENT II QUESTIONS

PART A

1. What are industrial disputes?

2. State the difference between lockout and layoff

3. Define Corporate Tax

4. What is input tax credit?

5. What is income tax? What is an assessment year?

6. What is Value Added Tax?

7. Who is a consumer?

8. Name any five cybercrimes

9. How do digital signatures acquire legal recognition?

10. What is called as Copy rights?

PART B

1. How is the bonus calculated under the Payment of Bonus Act, 1965?

2. Describe the settlement of disputes through conciliation, arbitration and adjudication explain the

authorities under the Industrial Disputes Act.

3. Explain the essential features of corporate tax planning.

4. Discuss the overview of Central Sales Tax Act 1956.

5. How will you perform tax planning for your company?

6. Explain the procedures involved in handling Levy and collection of CGST and IGST

7. Explain the role and functions of Consumer Protection Act in maintaining the consumerism

8. Bring out the provisions of the Information Technology Act, 2000 regarding:

a) Authentication of electronic records

b) Electronic Governance.

9. State the procedure for the settlement of disputes by consumer dispute redressal agencies

10. Mention the salient features of Information Technology Act relating to Cybercrimes.

________________________________

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- BA7107 LegalAspectsofBusinessquestionbankDocument6 pagesBA7107 LegalAspectsofBusinessquestionbankPriya SekarNo ratings yet

- National Law School of India University Bangalore M.B.L Part 1 Supplementary Exmination (Dec.) 2012 Paper Iv - Industrial Relation LawDocument1 pageNational Law School of India University Bangalore M.B.L Part 1 Supplementary Exmination (Dec.) 2012 Paper Iv - Industrial Relation Lawsct.vijayNo ratings yet

- BA7107-Legal Aspects of Business Question Bank - EditedDocument6 pagesBA7107-Legal Aspects of Business Question Bank - EditedUma UmamaheswariNo ratings yet

- LAB Ques (1) .Bank 1Document12 pagesLAB Ques (1) .Bank 1kakka22No ratings yet

- Unit I Part-ADocument2 pagesUnit I Part-AsaravmbaNo ratings yet

- Legal Law Important QuestionsDocument4 pagesLegal Law Important QuestionsKishore kumarNo ratings yet

- BUSINESS LAWS IMPORTANT QUESTIONS - LL SemDocument3 pagesBUSINESS LAWS IMPORTANT QUESTIONS - LL Semprashita GuptaNo ratings yet

- Time: 3 Hours Total Marks: 100: Printed Pages: 02 Sub Code: KMB207 Paper Id: 270247 Roll NoDocument2 pagesTime: 3 Hours Total Marks: 100: Printed Pages: 02 Sub Code: KMB207 Paper Id: 270247 Roll NoHimanshuNo ratings yet

- Corporate Taxation Question BankDocument4 pagesCorporate Taxation Question Bankshubhamrawat072003No ratings yet

- 9th Sem Syllabus AnalysisDocument17 pages9th Sem Syllabus AnalysisTanurag GhoshNo ratings yet

- Bba 6th GenDocument6 pagesBba 6th GenvinaybabaNo ratings yet

- Business Law BBA: 206-B Bba 4 SEM Question Bank: Unit-1Document2 pagesBusiness Law BBA: 206-B Bba 4 SEM Question Bank: Unit-1monikaNo ratings yet

- Question Bank of Corporate LawsDocument2 pagesQuestion Bank of Corporate LawsPraful GhosiyaNo ratings yet

- COMPLETE Important BcomDocument13 pagesCOMPLETE Important BcomImmad AhmedNo ratings yet

- IT and Computer Application - Question PapersDocument6 pagesIT and Computer Application - Question PapersSngHAjit RevoNo ratings yet

- PK Worksheet BS Class 11Document6 pagesPK Worksheet BS Class 11Krish PatidarNo ratings yet

- IE01 Theory QuestionDocument2 pagesIE01 Theory QuestionNajmul HossainNo ratings yet

- DBA7107Document21 pagesDBA7107Bhat MerajNo ratings yet

- Taxation Theory QuestionsDocument7 pagesTaxation Theory QuestionsAtiaTahiraNo ratings yet

- Jun16 MBL II 35282Document7 pagesJun16 MBL II 35282Shrikant BudholiaNo ratings yet

- Advanced Accounting-III SuggestionDocument3 pagesAdvanced Accounting-III SuggestionIbrahim Arafat ZicoNo ratings yet

- Candidates Are Required To Give Their Answers in Their Own Words As Far As Practicable. The Figures in The Margin Indicate Full MarksDocument2 pagesCandidates Are Required To Give Their Answers in Their Own Words As Far As Practicable. The Figures in The Margin Indicate Full MarksSamikshya DahalNo ratings yet

- Important Questions: BC: 402 AuditingDocument2 pagesImportant Questions: BC: 402 AuditingMuhammad UmarNo ratings yet

- Assignment Mba Ii Semester 51204-E: Business FundamentalsDocument2 pagesAssignment Mba Ii Semester 51204-E: Business Fundamentalsanandilal dhabaiNo ratings yet

- Syllabus. Income Tax. Mvavjanuary 15, 2018Document6 pagesSyllabus. Income Tax. Mvavjanuary 15, 2018Christine Ang CaminadeNo ratings yet

- SyllabusDocument13 pagesSyllabussaransh yadavNo ratings yet

- Chapter 12 IMSMDocument19 pagesChapter 12 IMSMZachary Thomas CarneyNo ratings yet

- BA5104 LEGAL ASPECTS OF BUSINESS Reg 2017 MBA Question BankDocument7 pagesBA5104 LEGAL ASPECTS OF BUSINESS Reg 2017 MBA Question BankAngemin AfexenaNo ratings yet

- Financial Accounting B.B.A.Document1 pageFinancial Accounting B.B.A.subba1995333333No ratings yet

- E Bussiness Law and Stuff DraftDocument5 pagesE Bussiness Law and Stuff DraftRajat SethiNo ratings yet

- Tech IPO Research PaperDocument26 pagesTech IPO Research PaperoatsubscribedNo ratings yet

- Law IMP QuestionsDocument5 pagesLaw IMP Questionsnisarg_No ratings yet

- Chap 012Document20 pagesChap 012Hemali MehtaNo ratings yet

- Ba5011 Merchant Banking and Financial Services Reg 17 Question BankDocument5 pagesBa5011 Merchant Banking and Financial Services Reg 17 Question BankAnusha kanmaniNo ratings yet

- Fs 2Document2 pagesFs 2absharaliks82No ratings yet

- R1 Exam Questions-Chapter Wise (Dec 2015-Dec 2019)Document7 pagesR1 Exam Questions-Chapter Wise (Dec 2015-Dec 2019)Ezazul HassanNo ratings yet

- BA 9207 - Legal Aspects of Business: Srinivasan Engineering College PERAMBALUR-621 212 Department of Management StudiesDocument57 pagesBA 9207 - Legal Aspects of Business: Srinivasan Engineering College PERAMBALUR-621 212 Department of Management StudiesKarthikeyan ElangovanNo ratings yet

- Syllabus - Tax Law Rev.-Corporate Income Taxation - Mvavaug3-2019Document8 pagesSyllabus - Tax Law Rev.-Corporate Income Taxation - Mvavaug3-2019doraemoanNo ratings yet

- Audit Question For Bcom HonsDocument4 pagesAudit Question For Bcom HonsSUBHENDU KUNDUNo ratings yet

- Uco 5501 - Auditing and AssuranceDocument6 pagesUco 5501 - Auditing and AssurancePaatrickNo ratings yet

- Q.May19 Sem ExamDocument9 pagesQ.May19 Sem ExamSanvi NarayanNo ratings yet

- Ewu Mba Summer 2020 FinalDocument3 pagesEwu Mba Summer 2020 FinalChowdhury Mobarrat Haider AdnanNo ratings yet

- Celibacy and Spiritual LifeDocument12 pagesCelibacy and Spiritual LifeDebi Prasad SahooNo ratings yet

- E-Commerce & Wto - Indian Considerations: Nishith Desai AssociatesDocument47 pagesE-Commerce & Wto - Indian Considerations: Nishith Desai AssociatesArunav DasNo ratings yet

- Financial Reporting and The Securities and Exchange CommissionDocument18 pagesFinancial Reporting and The Securities and Exchange CommissionJordan YoungNo ratings yet

- (II) Law 2005 RegularDocument2 pages(II) Law 2005 RegularVinod GandhiNo ratings yet

- Taxation Course OutlineDocument6 pagesTaxation Course OutlineMawanda Ssekibuule SuudiNo ratings yet

- Paper 11 PDFDocument6 pagesPaper 11 PDFKaysline Oscar CollinesNo ratings yet

- Preview Activity (I) : Discuss The Questions Below..Document7 pagesPreview Activity (I) : Discuss The Questions Below..Ruben FloresNo ratings yet

- Hapter EST ANK: Ultiple Choice QuestionsDocument19 pagesHapter EST ANK: Ultiple Choice QuestionsMalinga LungaNo ratings yet

- MSIT - 4A Web Commerce Assignment-Ta 10X5 50 Answer ALL QuestionsDocument6 pagesMSIT - 4A Web Commerce Assignment-Ta 10X5 50 Answer ALL QuestionsSeshadri KrishnaNo ratings yet

- AuditingDocument2 pagesAuditingparthamazumdar93No ratings yet

- Quiz 1 - EthicsDocument1 pageQuiz 1 - EthicsJEANNE PAULINE OABELNo ratings yet

- Test 11Document3 pagesTest 11LuckyNo ratings yet

- Legal Aspects of Business 1Document7 pagesLegal Aspects of Business 1rodric johnNo ratings yet

- Auditing AnalysisDocument13 pagesAuditing AnalysisAmmarah Rajput ParhiarNo ratings yet

- Icse 2024 Specimen 631 CSTDocument7 pagesIcse 2024 Specimen 631 CSTShweta SamantNo ratings yet

- Business Law: Institute of Management TechnologyDocument5 pagesBusiness Law: Institute of Management Technologyarun1974No ratings yet