Professional Documents

Culture Documents

International Financial Management Chapter 6

International Financial Management Chapter 6

Uploaded by

1954032027cucOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

International Financial Management Chapter 6

International Financial Management Chapter 6

Uploaded by

1954032027cucCopyright:

Available Formats

3. International banks are different from domestic banks in what way(s)?

A. International banks can arrange trade financing.

B. International banks can arrange for foreign exchange transactions.

C. International banks can assist their clients in hedging exchange rate risk.

D. All of the above

Topic: International Banking Services

4. Major distinguishing features between domestic banks and international banks are

A. the types of deposits they accept.

B. the types of loans and investments they make.

C. membership in loan syndicates.

D. all of the above

Topic: International Banking Services

5. Since international banks have the facilities to trade foreign exchange,

A. they generally also make a market as a dealer in foreign exchange.

B. they generally also make a market as a dealer in foreign exchange derivatives.

C. they generally also trade foreign exchange products for their own account.

D. none of the above

Topic: International Banking Services

6. Banks that both perform traditional commercial banking functions and engage in investment

banking activities are often called

A. international service banks.

B. investment banks.

C. commercial banks.

D. merchant banks.

Topic: International Banking Services

7. Merchant banks are different from traditional commercial banks in what way(s)?

A. Merchant banks can engage in investment banking activities.

B. Merchant banks can arrange for foreign exchange transactions.

C. Merchant banks can assist their clients in hedging exchange rate risk.

D. All of the above

Topic: International Banking Services

8. By far the most important international finance centers are

A. New York and London.

B. New York, London, and Tokyo.

C. New York, London, Tokyo, Paris, and Zurich.

D. New York, London, Tokyo, Paris, Zurich, and Frankfurt.

Topic: The World's Largest Banks

9. Multinational banks are often not subject to the same regulations as domestic banks.

A. There may be increased need to publish adequate financial information.

B. There may be reduced need to publish adequate financial information.

C. There requirements to publish adequate financial information are the same.

D. None of the above

Topic: Reasons for International Banking

10. A domestic bank that follows a multinational client abroad to preserve that banking relationship

A. is playing the role of the desperate housewife in this relationship.

B. is pursuing a wholesale defensive strategy.

C. is pursuing a retail defensive strategy.

D. none of the above

Topic: Reasons for International Banking

11. A domestic bank that becomes a multinational bank to prevent erosion by foreign banks of the

traveler's checks, touring, and foreign business market

A. is playing the role of the desperate housewife in this relationship.

B. is pursuing a wholesale defensive strategy.

C. is pursuing a retail defensive strategy.

D. none of the above

Topic: Reasons for International Banking

12. Banking tends to be

A. a low marginal cost industry.

B. a high marginal cost industry.

C. a constant average cost industry.

D. none of the above

Topic: Reasons for International Banking

13. A U.S.-based multinational bank

A. would not have to provide deposit insurance and meet reserve requirements on foreign

currency deposits.

B. would have to provide deposit insurance and meet reserve requirements on foreign currency

deposits.

C. would not have to provide deposit insurance but would have to meet reserve requirements

on foreign currency deposits.

D. would have to provide deposit insurance but not meet reserve requirements on foreign

currency deposits.

Topic: Reasons for International Banking

14. A bank may establish a multinational operation for the reason of low marginal costs. The

underlying rationale being that

A. banks follow their multinational customers abroad to prevent the erosion of their clientele to

foreign banks seeking to service the multinational's foreign subsidiaries.

B. multinational banking operations help a bank prevent the erosion of its traveler's check,

tourist, and foreign business markets from foreign bank competition.

C. managerial and marketing knowledge developed at home can be used abroad with low

marginal costs.

D. the foreign bank subsidiary can draw on the parent bank's knowledge of personal contacts

and credit investigations for use in that foreign market.

Topic: Reasons for International Banking

15. A bank may establish a multinational operation for the reason of knowledge advantage. The

underlying rationale being that

A. local firms may be able to obtain from a foreign subsidiary bank operating in their country

more complete trade and financial market information about the subsidiary's home country

than they can obtain from their own domestic banks.

B. by maintaining foreign branches and foreign currency balances, banks may reduce

transaction costs and foreign exchange risk on currency conversion if government controls

can be circumvented.

C. greater stability of earnings is possible with international diversification. Offsetting business

and monetary policy cycles across nations reduces the country-specific risk of any one

nation.

D. the foreign bank subsidiary can draw on the parent bank's knowledge of personal contacts

and credit investigations for use in that foreign market.

Topic: Reasons for International Banking

16. A bank may establish a multinational operation for the reason of prestige. The underlying

rationale being that

A. local firms may be able to obtain from a foreign subsidiary bank operating in their country

more complete trade and financial market information about the subsidiary's home country

than they can obtain from their own domestic banks.

B. the foreign bank subsidiary can draw on the parent bank's knowledge of personal contacts

and credit investigations for use in that foreign market.

C. very large multinational banks have high perceived prestige, liquidity, and deposit safety

that can be used to attract clients abroad.

D. multinational banks are often not subject to the same regulations as domestic banks. There

may be reduced need to publish adequate financial information, lack of required deposit

insurance and reserve requirements on foreign currency deposits, and the absence of

territorial restrictions.

Topic: Reasons for International Banking

17. A bank may establish a multinational operation for the reason of risk reduction. The underlying

rationale being that

A. by maintaining foreign branches and foreign currency balances, banks may reduce

transaction costs and foreign exchange risk on currency conversion if government controls

can be circumvented.

B. greater stability of earnings is possible with international diversification. Offsetting business

and monetary policy cycles across nations reduces the country-specific risk of any one

nation.

C. multinational banks are often not subject to the same regulations as domestic banks. There

may be reduced need to publish adequate financial information, lack of required deposit

insurance and reserve requirements on foreign currency deposits, and the absence of

territorial restrictions.

D. multinational banking operations help a bank prevent the erosion of its traveler's check,

tourist, and foreign business markets from foreign bank competition.

Topic: Reasons for International Banking

18. A bank may establish a multinational operation for the reason of regulatory advantage. The

underlying rationale being that

A. banks follow their multinational customers abroad to prevent the erosion of their clientele to

foreign banks seeking to service the multinational's foreign subsidiaries.

B. multinational banking operations help a bank prevent the erosion of its traveler's check,

tourist, and foreign business markets from foreign bank competition.

C. by maintaining foreign branches and foreign currency balances, banks may reduce

transaction costs and foreign exchange risk on currency conversion if government controls

can be circumvented.

D. multinational banks are often not subject to the same regulations as domestic banks. There

may be reduced need to publish adequate financial information, lack of required deposit

insurance and reserve requirements on foreign currency deposits, and the absence of

territorial restrictions.

Topic: Reasons for International Banking

19. Currently, the biggest bank in the world is

A. Citigroup.

B. Bank of America.

C. UBS.

D. The World Bank.

Topic: Reasons for International Banking

20. A bank may establish a multinational operation for the reason of retail defensive strategy. The

underlying rationale being that

A. banks follow their multinational customers abroad to prevent the erosion of their clientele to

foreign banks seeking to service the multinational's foreign subsidiaries.

B. multinational banking operations help a bank prevent the erosion of its traveler's check,

tourist, and foreign business markets from foreign bank competition.

C. by maintaining foreign branches and foreign currency balances, banks may reduce

transaction costs and foreign exchange risk on currency conversion if government controls

can be circumvented.

D. multinational banks are often not subject to the same regulations as domestic banks. There

may be reduced need to publish adequate financial information, lack of required deposit

insurance and reserve requirements on foreign currency deposits, and the absence of

territorial restrictions.

Topic: Reasons for International Banking

21. A bank may establish a multinational operation for the reason of wholesale defensive strategy.

The underlying rationale being that

A. banks follow their multinational customers abroad to prevent the erosion of their clientele to

foreign banks seeking to service the multinational's foreign subsidiaries.

B. multinational banking operations help a bank prevent the erosion of its traveler's check,

tourist, and foreign business markets from foreign bank competition.

C. by maintaining foreign branches and foreign currency balances, banks may reduce

transaction costs and foreign exchange risk on currency conversion if government controls

can be circumvented.

D. multinational banks are often not subject to the same regulations as domestic banks. There

may be reduced need to publish adequate financial information, lack of required deposit

insurance and reserve requirements on foreign currency deposits, and the absence of

territorial restrictions.

Topic: Reasons for International Banking

22. Which of the following are reasons why a bank may establish a multinational operation?

A. Low marginal and transaction costs

B. Home nation information services, and prestige

C. Growth and risk reduction

D. All of the above

Topic: Reasons for International Banking

23. A bank may establish a multinational operation for the reason of transaction costs. The

underlying rationale being that

A. banks follow their multinational customers abroad to prevent the erosion of their clientele to

foreign banks seeking to service the multinational's foreign subsidiaries.

B. multinational banking operations help a bank prevent the erosion of its traveler's check,

tourist, and foreign business markets from foreign bank competition.

C. by maintaining foreign branches and foreign currency balances, banks may reduce

transaction costs and foreign exchange risk on currency conversion if government controls

can be circumvented.

D. multinational banks are often not subject to the same regulations as domestic banks. There

may be reduced need to publish adequate financial information, lack of required deposit

insurance and reserve requirements on foreign currency deposits, and the absence of

territorial restrictions.

Topic: Reasons for International Banking

24. A bank may establish a multinational operation for the reason of growth. The rationale being

that

A. growth prospects in a home nation may be limited by a market largely saturated with the

services offered by domestic banks.

B. multinational banks are often not subject to the same regulations as domestic banks. There

may be reduced need to publish adequate financial information, lack of required deposit

insurance and reserve requirements on foreign currency deposits, and the absence of

territorial restrictions.

C. greater stability of earnings is possible with international diversification. Offsetting business

and monetary policy cycles across nations reduces the country-specific risk of any one

nation.

D. by maintaining foreign branches and foreign currency balances, banks may reduce

transaction costs and foreign exchange risk on currency conversion if government controls

can be circumvented.

Topic: Reasons for International Banking

25. A bank may establish a multinational operation for the reason of home country information

services. The underlying rationale being that

A. by maintaining foreign branches and foreign currency balances, banks may reduce

transaction costs and foreign exchange risk on currency conversion if government controls

can be circumvented.

B. local firms may be able to obtain from a foreign subsidiary bank operating in their country

more complete trade and financial market information about the subsidiary's home country

than they can obtain from their own domestic banks.

C. the foreign bank subsidiary can draw on the parent bank's knowledge of personal contacts

and credit investigations for use in that foreign market.

D. greater stability of earnings is possible with international diversification. Offsetting business

and monetary policy cycles across nations reduces the country-specific risk of any one

nation.

Topic: Reasons for International Banking

26. A correspondent bank relationship is established when

A. two banks maintain deposits with one another.

B. two banks write to each other about the credit conditions of their countries.

C. a group of banks form a syndicate to spread out the risk and cost of a large bond offering.

D. all of the above

Topic: Correspondent Bank

Topic: Types of International Banking Offices

27. Correspondent bank relationships can be beneficial

A. because a bank can service its MNC clients at a very low cost.

B. because a bank can service its MNC clients without the need to have personnel in many

different countries.

C. because a bank can service its MNC clients without developing its own foreign facilities to

service its clients.

D. all of the above

Topic: Correspondent Bank

Topic: Types of International Banking Offices

28. Consider a U.S. importer desiring to purchase merchandise from a Dutch exporter invoiced in

euros, at a cost of €160,000. The U.S. importer will contact his U.S. bank (where of course he

has an account denominated in U.S. dollars) and inquire about the exchange rate, which the

bank quotes as €0.6250/$1.00. The importer accepts this price, so his bank will proceed to

____________ the importer's account in the amount of ____________.

A. Debit; $256,000

B. Credit; €512,100

C. Credit; $500,000

D. Debit; €100,000

Topic: Correspondent Bank

Topic: Types of International Banking Offices

29. The current exchange rate is £1.00 = $2.00. Compute the correct balances in Bank A's

correspondent account(s) with bank B if a currency trader employed at Bank A buys £45,000

from a currency trader at bank B for $90,000 using its correspondent relationship with Bank B.

A. Bank A's dollar-denominated account at B will rise by $90,000.

B. Bank B's dollar-denominated account at A will fall by $90,000.

C. Bank A's pound-denominated account at B will rise by £45,000.

D. Bank B's pound-denominated account at A will rise by £45,000.

Topic: Correspondent Bank

Topic: Types of International Banking Offices

30. Correspondent bank services include

A. prepaid postage and packing materials.

B. letters of introduction.

C. foreign exchange conversions.

D. both b and c

Topic: Correspondent Bank

Topic: Types of International Banking Offices

31. The current exchange rate is £1.00 = $2.00. Compute the correct balances in Bank A's

correspondent account(s) with bank B if a currency trader employed at Bank A buys £45,000

from a currency trader at bank B for $90,000 using its correspondent relationship with Bank B.

A. Bank A's dollar-denominated account at B will fall by $90,000.

B. Bank B's dollar-denominated account at A will rise by $90,000.

C. Bank A's pound-denominated account at B will rise by £45,000.

D. Bank B's pound-denominated account at A will fall by £45,000.

E. All of the above are correct

Topic: Correspondent Bank

Topic: Types of International Banking Offices

32. The current exchange rate is €1.00 = $1.50. Compute the correct balances in Bank A's

correspondent account(s) with bank B if a currency trader employed at Bank A buys €100,000

from a currency trader at bank B for $150,000 using its correspondent relationship with Bank

B.

A. Bank A's dollar-denominated account at B will fall by $150,000.

B. Bank B's dollar-denominated account at A will fall by $150,000.

C. Bank A's pound-denominated account at B will fall by €100,000.

D. Bank B's pound-denominated account at A will rise by €100,000.

Topic: Correspondent Bank

Topic: Types of International Banking Offices

33. A representative office

A. is what lawyers' offices are called in Mexico.

B. is a small service facility staffed by parent bank personnel that is designed to assist MNC

clients of the parent bank in dealings with the bank's correspondents.

C. is a small service facility staffed by correspondent bank personnel that is designed to assist

MNC clients of the parent bank in dealings with the bank's correspondents.

D. none of the above

Topic: Representative Offices

34. A representative office

A. is a way for the parent bank to provide its MNC clients with a level of service greater than

that provided through merely a correspondent relationship.

B. is a small service facility staffed by parent bank personnel that is designed to assist MNC

clients of the parent bank in dealings with the bank's correspondents.

C. is a step up from a correspondent relationship, but below a foreign branch.

D. all of the above

Topic: Representative Offices

35. A foreign branch bank

A. is a small service facility staffed by parent bank personnel that is designed to assist MNC

clients of the parent bank in dealings with the bank's correspondents.

B. operates like a local bank, but legally is a part of the parent bank.

C. is subject to domestic regulation only.

D. all of the above

Topic: Foreign Branches

36. A foreign branch bank

A. is a small service facility staffed by parent bank personnel that is designed to assist MNC

clients of the parent bank in dealings with the bank's correspondents.

B. operates like a local bank, but legally is a part of the parent bank.

C. is subject to domestic regulation only.

D. all of the above

Topic: Foreign Branches

37. Why would a U.S. bank open a foreign branch bank?

A. Because this form of bank organization can allow a U.S. bank to provide a fuller range of

services for its MNC customers than it can through a representative office.

B. To avoid U.S. banking regulation on transactions routed through that foreign country.

C. Because this form of organization allows the bank to service MNC clients at low cost and

without the need of having bank personnel located in the country.

D. both a and b

Topic: Foreign Branches

38. Why would a U.S. bank open a foreign branch bank instead of a foreign chartered subsidiary?

A. This form of bank organization allows the bank to be able to extend a larger loan to a

customer than a locally chartered subsidiary bank of the parent.

B. To slow down check clearing and maximize the bank's float.

C. To avoid U.S. banking regulation.

D. Both a and c

Topic: Foreign Branches

39. The most popular way for a U.S. bank to expand overseas is

A. branch banks.

B. representative offices.

C. subsidiary banks.

D. affiliate banks.

Topic: Foreign Branches

40. A foreign branch bank operates like a local bank, but legally

A. it is a part of the parent bank.

B. a branch bank is subject to both the banking regulations of its home country and the

country in which it operates.

C. a branch bank is subject to only the banking regulations of its home country and not the

country in which it operates.

D. both a and b

Topic: Foreign Branches

41. The major legislation controlling the operation of foreign banks in the U.S.

A. specifies that foreign branch banks operating in the U.S. must comply with U.S. banking

regulations just like U.S. banks.

B. specifies that foreign branch banks operating in the U.S. must comply with their country-of-

origin banking regulations just like U.S. banks operating abroad.

C. specifies that the "shell" branches are illegal for U.S. and foreign banks.

D. both a and c

Topic: Foreign Branches

42. A subsidiary bank is

A. a locally incorporated bank that is wholly owned by a foreign parent.

B. a locally incorporated bank that is majority owned by a foreign parent.

C. a locally incorporated bank that is partially owned (but not controlled) by a foreign parent.

D. both a and b

Topic: Subsidiary and Affiliate Banks

43. An affiliate bank is

A. a locally incorporated bank that is wholly owned by a foreign parent.

B. a locally incorporated bank that is majority owned by a foreign parent.

C. a locally incorporated bank that is partially owned (but not controlled) by a foreign parent.

D. both a and b

Topic: Subsidiary and Affiliate Banks

44. Both subsidiary and affiliate banks

A. operate under the banking laws of the country in which they are incorporated.

B. operate under the banking laws of the U.S.

C. can underwrite securities, but not accept dollar-denominated deposits.

D. both a and b

Topic: Subsidiary and Affiliate Banks

45. U.S. banks that establish subsidiary and affiliate banks

A. are allowed to underwrite securities.

B. must provide FDIC insurance on their foreign-currency denominated demand deposits.

C. can underwrite securities, but not accept dollar-denominated deposits.

D. both a and b

Topic: Subsidiary and Affiliate Banks

46. Foreign banks that establish subsidiary and affiliate banks in the U.S.

A. tend to locate in states that are major centers of financial activity.

B. tend to locate in the highly populous states of New York, California, Illinois, Florida,

Georgia, and Texas.

C. can underwrite securities, but not accept dollar-denominated deposits.

D. both a and b

Topic: Subsidiary and Affiliate Banks

47. Edge Act banks are so-called because

A. the are Federally chartered subsidiaries of U.S. banks that are physically located in the

United States and are allowed to engage in a full range of international banking activities.

B. Senator Walter E. Edge of New Jersey sponsored the 1919 amendment to Section 25 of the

Federal Reserve Act to allow U.S. banks to be competitive with the services foreign banks

could supply their customers.

C. they can only be chartered in states that are on the borders of the United States—on the

"edge" of the map.

D. none of the above

You might also like

- Gas Billing Format For ClientDocument2 pagesGas Billing Format For ClientRyan Williams100% (2)

- International Finance Final Exam Study GuideDocument23 pagesInternational Finance Final Exam Study GuideOscar WongNo ratings yet

- Bank L0 DumpDocument503 pagesBank L0 Dumpdhootankur60% (5)

- Are Taxes EvilDocument5 pagesAre Taxes Evilpokeball0010% (1)

- Tanzania February Updater 2023Document7 pagesTanzania February Updater 2023Anonymous FnM14a0No ratings yet

- CT1 PDFDocument6 pagesCT1 PDFfireaterNo ratings yet

- International Banking and Money MarketDocument28 pagesInternational Banking and Money MarketNiharika Satyadev JaiswalNo ratings yet

- International BankingDocument50 pagesInternational Bankingkevalcool250100% (1)

- Chap 12Document74 pagesChap 12NgơTiênSinhNo ratings yet

- Test Bank For World Politics Interests Interactions Institutions Third EditionDocument15 pagesTest Bank For World Politics Interests Interactions Institutions Third Editiontinajacksonrwecgjsaty100% (13)

- International BankingDocument28 pagesInternational BankingVijay KumarNo ratings yet

- StudentDocument34 pagesStudentKevin CheNo ratings yet

- Banking and Financial InstitutionsDocument6 pagesBanking and Financial InstitutionsAriel ManaloNo ratings yet

- The Currency Trader's Handbook: by Rob Booker, ©2002-2006Document23 pagesThe Currency Trader's Handbook: by Rob Booker, ©2002-2006Pandelis NikolopoulosNo ratings yet

- Simple and Compund InterestDocument18 pagesSimple and Compund Interestsanat kr pratihar100% (1)

- Classic Essentials AccountDocument6 pagesClassic Essentials AccountMariaNo ratings yet

- International BankingDocument20 pagesInternational Bankingamit098765432150% (6)

- International BankingDocument19 pagesInternational BankingAshishBhardwajNo ratings yet

- Fin656 U1Document73 pagesFin656 U1Elora madhusmita BeheraNo ratings yet

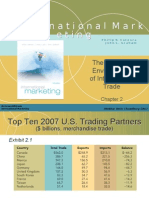

- International Marketing Chapter 2 (The Dynamic Environment of International Trade)Document39 pagesInternational Marketing Chapter 2 (The Dynamic Environment of International Trade)Nitin Jain0% (1)

- A Study On International BankingDocument36 pagesA Study On International Bankinganilpeddamalli0% (1)

- 12 International Banking Issues and Country Risk Analysis: Chapter ObjectivesDocument16 pages12 International Banking Issues and Country Risk Analysis: Chapter ObjectivesJayant312002 ChhabraNo ratings yet

- Chapter 11 Test BankDocument49 pagesChapter 11 Test BankMariA YAGHINo ratings yet

- Tema 8. International Capital Markets and Regulations of International BankingDocument9 pagesTema 8. International Capital Markets and Regulations of International Bankingot2023juantinNo ratings yet

- International Banking LawDocument10 pagesInternational Banking LawMir ArastooNo ratings yet

- Chap 020Document11 pagesChap 020Mitra MallahiNo ratings yet

- International Banking, Money MarketDocument42 pagesInternational Banking, Money MarketranusnNo ratings yet

- What Is An International Bank?: AnswerDocument22 pagesWhat Is An International Bank?: AnswerSonetAsrafulNo ratings yet

- International BanksDocument21 pagesInternational BanksPrince KaliaNo ratings yet

- Bai Tap Chuong 12Document5 pagesBai Tap Chuong 12Phương Nghi LêNo ratings yet

- International BankingDocument30 pagesInternational BankingKarissa Jun MustachoNo ratings yet

- Chapter 02 - Commercial BanksDocument45 pagesChapter 02 - Commercial BanksKhang Tran DuyNo ratings yet

- International: Financial ManagementDocument56 pagesInternational: Financial ManagementJasmine AroraNo ratings yet

- MBA 7427 Sample Questions CH 6: Multiple ChoiceDocument5 pagesMBA 7427 Sample Questions CH 6: Multiple ChoiceAlaye OgbeniNo ratings yet

- IB QUESTIONNAIRE W ANSWERSDocument8 pagesIB QUESTIONNAIRE W ANSWERSKarissa Jun MustachoNo ratings yet

- International Corporate Finance 1st Edition Robin Test BankDocument30 pagesInternational Corporate Finance 1st Edition Robin Test BankNatalieRojaswskrf100% (16)

- Test ReviewDocument9 pagesTest Reviewanh2901202No ratings yet

- International BankingDocument9 pagesInternational Bankingshahd naserNo ratings yet

- International Banking: Globalisation and Liberalisation, Brief History of International BankingDocument18 pagesInternational Banking: Globalisation and Liberalisation, Brief History of International BankingBalaji KalyanNo ratings yet

- International FinanceDocument47 pagesInternational Financedohongvinh40No ratings yet

- CH 1Document5 pagesCH 1bsodoodNo ratings yet

- FILE - 20201227 - 123609 - Sample TestDocument4 pagesFILE - 20201227 - 123609 - Sample TestNguyễn Thị TuyênNo ratings yet

- 06 Banking CH 6Document8 pages06 Banking CH 6sabit hussenNo ratings yet

- Eun Resnick 8e Chapter 11Document18 pagesEun Resnick 8e Chapter 11Wai Man NgNo ratings yet

- Test Bank FMT-84-97Document14 pagesTest Bank FMT-84-97Đỗ Minh HuyềnNo ratings yet

- International Banking & FinanceDocument10 pagesInternational Banking & FinanceVenkateshNo ratings yet

- Chapter Twenty Three Geographic Diversification: InternationalDocument5 pagesChapter Twenty Three Geographic Diversification: InternationaliuNo ratings yet

- Multiple Choices PracticeDocument42 pagesMultiple Choices PracticetrucNo ratings yet

- International Banking and FinanceDocument7 pagesInternational Banking and FinanceravikungwaniNo ratings yet

- CISI Mock Exam Questionnaires (Consolidated)Document17 pagesCISI Mock Exam Questionnaires (Consolidated)Jerome GaliciaNo ratings yet

- Financial Market QuestionsDocument25 pagesFinancial Market Questionspvervint0121No ratings yet

- MergedDocument42 pagesMergedUrvashi RNo ratings yet

- IH AnsweresDocument29 pagesIH AnsweresAsif GhaziNo ratings yet

- Econ 442 - Problem Set 3Document6 pagesEcon 442 - Problem Set 3Nguyễn Hải GiangNo ratings yet

- Econ310 - Test 2Document7 pagesEcon310 - Test 2Jimmy TengNo ratings yet

- Overview of Market Participants and Financial InnovationDocument5 pagesOverview of Market Participants and Financial InnovationLeonard CañamoNo ratings yet

- Eun7e CH 011Document44 pagesEun7e CH 011Shruti AshokNo ratings yet

- Bofi QuizzesDocument9 pagesBofi QuizzesChristine Joy MauroNo ratings yet

- FRM Test 04 AnsDocument16 pagesFRM Test 04 AnsKamal BhatiaNo ratings yet

- International Banking TrendsDocument26 pagesInternational Banking TrendsbrynaNo ratings yet

- Advertising Strategies of Banking Sectors in IndiaDocument77 pagesAdvertising Strategies of Banking Sectors in Indiakevalcool250No ratings yet

- 14 Financing Foreign Investment: Chapter ObjectivesDocument18 pages14 Financing Foreign Investment: Chapter ObjectivesJayant312002 ChhabraNo ratings yet

- International Banking (Assignment)Document18 pagesInternational Banking (Assignment)JILPA76% (17)

- MoneyBankingQestions - AbdusalomDocument4 pagesMoneyBankingQestions - AbdusalomAbdusalom MuhammadjonovNo ratings yet

- Basic Understanding of Financial Investment, Book 6- For Teens and Young AdultsFrom EverandBasic Understanding of Financial Investment, Book 6- For Teens and Young AdultsNo ratings yet

- Group AssignmentDocument4 pagesGroup Assignment1954032027cucNo ratings yet

- International Financial Management Chapter 4Document34 pagesInternational Financial Management Chapter 41954032027cucNo ratings yet

- International Financial Management Chapter 3Document14 pagesInternational Financial Management Chapter 31954032027cucNo ratings yet

- International Financial Management Chapter 1Document14 pagesInternational Financial Management Chapter 11954032027cucNo ratings yet

- FABM ActivityDocument7 pagesFABM ActivityAshlee BaguioNo ratings yet

- Report On Financial Analysis of Textile Industry of BangladeshDocument39 pagesReport On Financial Analysis of Textile Industry of BangladeshSaidur0% (2)

- Investment (PQ)Document2 pagesInvestment (PQ)Jamal Hossain ShuvoNo ratings yet

- Digital Banking Notes 1 PDF1Document8 pagesDigital Banking Notes 1 PDF1AnuradhaNo ratings yet

- N SKTQK 7 DV Ev LFSMaDocument3 pagesN SKTQK 7 DV Ev LFSMas/gfoergNo ratings yet

- Management and Financial Accounting Assignment 1Document17 pagesManagement and Financial Accounting Assignment 1Aretha MwaleNo ratings yet

- FI 305 - First Solar ProjectDocument23 pagesFI 305 - First Solar ProjectKhoai TâyNo ratings yet

- Profit & Loss: Prof.b.p.mshra XimbDocument28 pagesProfit & Loss: Prof.b.p.mshra XimbSudhansuSekharNo ratings yet

- 2-Policy Questions AllDocument134 pages2-Policy Questions Allgolden79034No ratings yet

- Economics Assingment - 1st Sem - Radhika KhaitanDocument20 pagesEconomics Assingment - 1st Sem - Radhika KhaitanSandeep TomarNo ratings yet

- Withholding TaxesDocument54 pagesWithholding TaxesCherry WongNo ratings yet

- Chapt 26Document39 pagesChapt 26Adnan Rais KhanNo ratings yet

- Lecture 01 Slides - Accounting in Business & FS OverviewDocument52 pagesLecture 01 Slides - Accounting in Business & FS OverviewandyNo ratings yet

- Problem-Set-Math-Day-13 - EDITEDDocument12 pagesProblem-Set-Math-Day-13 - EDITED2018-103863No ratings yet

- Deposits and Financing of Islamic BanksDocument12 pagesDeposits and Financing of Islamic BanksAzah Atikah Anwar BatchaNo ratings yet

- Money Market vs. Capital Market: What's The Difference? Money Market vs. Capital Market: An OverviewDocument16 pagesMoney Market vs. Capital Market: What's The Difference? Money Market vs. Capital Market: An OverviewyanaNo ratings yet

- AccountingDocument29 pagesAccountingMaryam Fellous MelnykNo ratings yet

- Apple Inc.: September 30, 141,048 Cost of Sales Gross Margin September 24, 131,376 September 93,626Document8 pagesApple Inc.: September 30, 141,048 Cost of Sales Gross Margin September 24, 131,376 September 93,626Juan LaverdeNo ratings yet

- Impact of Farm Loan Waiver in EconomyDocument22 pagesImpact of Farm Loan Waiver in EconomySanket Soni100% (1)

- Book Review - What Has Government Done To Our Money?Document2 pagesBook Review - What Has Government Done To Our Money?Anda IrimiaNo ratings yet

- GSTR1 27aaece1594j1ze 122023Document4 pagesGSTR1 27aaece1594j1ze 122023ca.priyanka025No ratings yet

- Unit 2Document6 pagesUnit 2malarastogi611No ratings yet