Professional Documents

Culture Documents

Quiz 1 Forex

Uploaded by

Sara ChanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quiz 1 Forex

Uploaded by

Sara ChanCopyright:

Available Formats

X`

UNIVERSAL COLLEGE OF PARAÑAQUE

COLLEGE OF BUSINESS & ACCOUNTANCY

ADVANCED FINANCIAL ACCOUNTING AND REPORTING REVIEW 2 SCORE

MAJOR QUIZ 1

NAME:____________________ YEAR & SECTION:____________ DATE:______________

Instructions: from the following multiple-choice questions below, choose the letter

of the best answer. Shade your answer on the separate sheet provided.

PART I: SITUATIONAL

1. The following information applies to DATU MAMADRA Corporation’s sale of 10,000

foreign currency units under a forward contract dated November 1, 2023 for delivery

on January 31, 2024:

November 1, 2023 December 31, 2023

Spot rates P0.80 P0.83

30-day forward 0.79 0.82

90-day forward 0.78 0.81

DATU MAMADRA entered into forward contract to speculate in the foreign currency. In

DATU MAMADRA’s statement of comprehensive income for the year December 31, 2023,

what amount of forex loss should be reported from this forward contract?

A. P400

B. P300

C. P200

D. P0

Exposed is asset; FCP

[(0.78 – 0.82) x 10,000] P400

2. LEE Corporation purchased merchandise from MISAKI Company of Japan for 1,000,000

Yen. The merchandise was received on December 1, 2023, with payment due in 60 days

or on January 30, 2024. Also on December 1, 2023, LEE entered into a 60-day forward

contract with the bank to purchase the necessary 1,000,000 Yen for delivery on

January 30, 2024 to hedge the MISAKI transaction. Exchange rates for Yen on selected

dates were as follows:

12/1/2023 12/31/2023 1/30/2024

Spot rates P6.01 P6.16 P6.01

30-day forward 6.05 6.07 6.07

60-day forward 6.06 6.08 6.08

What is the forex gain (loss) from this transaction and hedge that will be reported

on LEE’s 2023 statement of comprehensive income?

A. (P130,000)

B. P130,000

C. P20,000

D. (P140,000)

Exposed is liability; FCR

Hedged item [(6.01 – 6.16) x 1,000,000 yen] = (150,000)

Hedge instrument [(6.06 – 6.07) x 1,000,000 yen] = 10,000

Net forex loss = 10,000 – 150,000 = 140,000

Advanced Financial Accounting and Reporting by Juan Miguel S. Ungsod, CPA

Trust the process. Page 1

3. KIM TAN, a money changer speculate in foreign currency as her business. On October

1, 2023, KIM bought a 180-day forward contract to purchase 5,000 US Dollar at a

forward rate of $1 = P56.50 when the spot rate was P56.000. Other exchange rates

were as follows:

Spot Rate Forward Rate for

3/31/2024

12/31/2023 P56.30 P56.60

3/31/2024 56.32

The forex gain (loss) recognized by KIM from this forward contract on 2023 is:

A. P1,500

B. (P900)

C. P500

D. (P10,000)

CF Hedge = for speculation

[(56.50 – 56.32) x 5,000] = (P900)

4. The Indian subsidiary of GHWEN Company reported cost of goods sold of 70,000

rupee on December 31, 2023. The January 1, 2023 inventory was 10,000 rupee and the

December 31, 2023 was 20,000 rupee.

Spot rate for various dates are as follows:

Date beginning inventory was acquired P1.60 = 1 rupee

Rate at January 1, 2023 P1.58 = 1 rupee

Weighted average rate for 2023 P1.50 = 1 rupee

Rate at ending inventory was acquired P1.45 = 1 rupee

What is the translated amount of cost of goods sold that should appear in the

consolidated statement of comprehensive income on December 31, 2023?

A. P105,000

B. P107,000

C. P101,000

D. P91,000

COGS (70,000 x 1.50) = 105,000

5. RIZALYN Company owns a subsidiary in Canada whose balance sheets in Canadian

Dollar for the last two years follow (in thousands):

Assets December 31, December 31,

2021 2022

Cash and Cash Equivalents 25,000 20,000

Receivables 112,500 137,500

Inventory 170,000 180,000

Property and Equipment - net 250,000 225,000

Total 557,500 562,500

Liabilities and Equity

Accounts Payable 65,000 85,000

Long-term Debt 312,500 275,000

Common Stock 125,000 125,000

Retained Earnings 55,000 77,500

Total 557,500 557,500

RIZALYN formed the subsidiary on January 1, 2021 when the exchange rate was 40

Canadian Dollar for 1 Philippine Peso. The exchange rate for 1 PHP on December 31,

2021 had increased to 45 Canadian Dollar and to 35 Canadian Dollar on December 31,

2020. Income earned evenly over the year, and the subsidiary declared no dividends

during its first two years of existence. How much is the cumulative translation

adjustment for 2022? (Round-off to 3 decimal places)

A. P1,350,000

B. P1,912,500

C. P975,000

D. P865,000

Advanced Financial Accounting and Reporting by Juan Miguel S. Ungsod, CPA

Trust the process. Page 2

6. On July 1, 2022, KARMINA Company forecasted the purchase of 50,000 units of

inventory from a foreign vendor. The purchase would probably occur on September 30

and require payment of 1,000,000 foreign currency. It is anticipated that the

inventory could be further processed and delivered to customers by early October.

On June 1, the company purchased a call option to buy 1,000,000 FC at a strike price

of 1 FC = P1.535 during September. An option premium of P900 was paid. Change in

the time value of the option will be excluded from the assessment of hedge

effectiveness. KARMINA Company’s accounting period ends every June 30.

June 1, 2022 June 30, 2022 September 30, 2022

Market Price (Spot P1.531 P1.5352 P1.536

Rate)

Fair value of Option P900 P1,300 P1,000

On September 30, 2022, the company purchased 5,000 units of inventory at cost of

103,000 FC. The option was settled/sold on September 30, 2022. What is the gain or

loss on option contract on September 30?

Equity Earnings

A. P1,000 (P1,100)

B. P800 (P1,100)

C. P1,100 (P1,000)

D. P1,100 P800

June 1, 2022 June 30, 2022 September 30, 2022

Intrinsic Value - 200 1,000

Time Value 900 1,100 -

Fair Value 900 1,300 1,000

Intrinsic Value

June 1 -

June 30 200

September 30 1,000 800

Time Value

June 1 900

June 30 1,100

September 30 - (1,100)

Use the following information in answering the next item(s):

The following assets of DESIREE Corporation’s South Korean subsidiary have been

converted into Philippine pesos at the following exchange rates:

Current Rates Historical Rates

Accounts Receivable P850,000 P875,000

Inventories 600,000 575,000

PPE 1,200,000 900,000

Totals P2,650,000 P2,350,000

7. If the South Korean subsidiary maintains an integrated operations with the

Philippine parent’s operations, the assets should be reported in the consolidated

financial statements of Manila Corporation and subsidiary in the total amount of

A. P2,650,000

B. P2,325,000

C. P2,350,000

D. P2,320,000

AR 850,000 + Inventories 575,000 + PPE 900,000 = 2,325,000

8. If the South Korean subsidiary maintains a stand-alone operations fully

independent from the parent’s operations, the assets should be reported in the

consolidated financial statements of Manila Corporation a subsidiary in the total

amount of

A. P2,320,000

B. P2,325,000

C. P2,350,000

D. P2,650,000

Advanced Financial Accounting and Reporting by Juan Miguel S. Ungsod, CPA

Trust the process. Page 3

9. Certain accounts of a foreign subsidiary in Japan of JENNY Corporation at December

31, 2022 have been translated into Philippine Peso as follows:

Translated at

Current rates Historical rates

Accounts receivable 120,000 100,000

Prepaid expenses 55,000 50,000

Property and equipment (net) 275,000 285,000

What total amount should be included in JENNY’s December 31, 2022 consolidated

statement of financial position for the above translated amounts.

A. P450,000

B. P425,000

C. P440,000

D. P450,000

10. On September GIAN Company entered into a firm commitment to buy machinery.

Delivery and passage of title would be on January 30, 2023 at the price of $63,000

Singapore dollars. On the same date, GIAN Company entered into a 150-day forward

contract with China Bank to buy the $63,000 Singapore dollars. Direct exchange rate

were as follows:

Spot rate Forward rate

September 1, 2022 P33.25 P31.30

December 31, 2022 P34.40 P33.70

January 31, 2023 P36.50 P36.50

Compute the gain or loss recognized by GIAN Company on the firm commitment in 2022

A. P176,400 gain

B. P151,200 loss

C. P176,400 loss

D. P151,200 gain

[(31.30 – 33.70) x 63,000] 151,200 loss

11. On December 31, 2022,YASMEEN Company, a foreign subsidiary in Hong Kong submitted

the following accounts stated in its local currency which is the functional currency

of the foreign operation. The subsidiary in Hong Kong acquired in 2022 is not

integrated with the operations of the parent in the Philippines. Moreover, its cash

flows do not directly affect the parent company. The foreign operation is self-

sufficient and is not dependent on the parent company for financing.

Total Assets HK$ 245,000

Total Liabilities 49,000

Ordinary Shares 122,500

Retained Earnings (Net Income) 73,500

The exchange rates are: Current rate, P8.75; Historical rate, P8.10; Weighted average

rate, P8.50.

Compute the cumulative translation adjustment (Dr) Cr on December 31, 2022

A. (P250,250)

B. P127,400

C. P98,000

D. P250,250

Total Assets (245,000 x 8.75) 1,715,000

Liabilities (49,000 x 8.75) 428,750

Ordinary Shares (122,500 x 8.10) 992,250

Retained Earnings (73,500 x 8.50) 624,750

Translation Adjustment - Credit 98,000

Total 1,715,000

Advanced Financial Accounting and Reporting by Juan Miguel S. Ungsod, CPA

Trust the process. Page 4

Use the following information in answering the next item(s):

DON JUAN MIGUEL Company entered into some derivatives during 2023 to mitigate the

risks involved to their foreign currency transactions. The following are the

transactions happened during 2023:

A. On November 1, 2023 DON JUAN MIGUEL Company entered into a firm commitment to

acquire a machinery from ALOLA Company in Hawaii. Delivery and passage of title

would be on February 28, 2024 at the price of $47,750. On the same date, to hedge

against unfavorable changes in the exchange rate, DON JUAN MIGUEL entered into a

120- day forward contract with PEE EN BII Bank for $47,750.

Spot rate Forward rate

November 1, 2023 P56.60 P58.50

December 31, 2023 P57.95 P57.75

February 28, 2024 P60.70 P60.70

Hedge Item Hedging Instrument

11/1/23 NO ENTRY 11/1/23

FCR 2,793,375

FCP (58.50 x 47,750) 2,793,375

12/31/23 12/31/23

Forex Loss 35,812.50 FCP 35,812.50

Firm commitment 35,812.50 Forex Gain 35,812.50

[(57.75 – 58.50) x 47,750]

2/28/24 2/28/24

Firm Commitment 140,862.50 Forex Loss 140,862.50

Forex Gain 140,862.50 FCP 140,862.50

[(60.70 – 57.75) x 47,750]

Machinery 2,793,375 FCP 2,898,425

(58.50 x 47,750) Cash 105,050

Cash (60.70 x 47,750) 2,898,425 FCR 2,793,375

Firm Commitment 105,050

(140,862.50 – 35,812.50)

B. DON JUAN MIGUEL also purchased inventory on November 30 for $25,000 payable March

31, 2024. On December 1, 2023, the entity entered into a forward contract to purchase

$25,000 and to be delivered on March 1, 2024 to hedge the purchase of inventory on

November 30, 2023. The relevant exchange rates are:

11/30/2023 12/1/2023 12/31/2023 2/28/2024 3/1/2024

Spot rate P45.00 P46.00 P50.00 P51.00 P55.00

Forward buying 90-days 44.00 43.00 42.00 41.50 45.00

Forward selling 90-days 47.00 48.00 42.50 44.50 46.00

Forward buying 60-days 50.00 51.50 48.50 54.00 50.00

Forward selling 60-days 52.00 53.50 51.00 55.00 51.50

Forward buying 30-days 55.00 50.50 49.50 56.50 47.50

Forward selling 30-days 54.00 51.00 52.50 53.00 56.00

Hedge Item Hedging Instrument

11/30/2023 12/1/2023

Purchases 1,125,000 FCR 1,200,000

AP 1,125,000 FCP 1,200,000

(25,000 x P45) (25,000 x P48)

12/31/2023 12/31/2023

Forex Loss 125,000 FCR 75,000

AP 125,000 Forex Gain 75,000

[(45 – 50) x 25,000] [(51 – 48) x 25,000]

3/31/2024 2/28/2023

Forex Loss 125,000 FCR 100,000

AP 125,000 Forex Gain 100,000

[(50 – 55) x 25,000] [(55 – 51) x 25,000]

AP (55 x 25,000) 1,375,000 FCP 1,200,000

Cash 1,375,000 Cash 175,000

FCR 1,375,000

Advanced Financial Accounting and Reporting by Juan Miguel S. Ungsod, CPA

Trust the process. Page 5

C. Lastly, on October 31, 2023, DON JUAN MIGUEL bought inventory from GALAR Company,

an Italian supplier costing 145,000 euros and the and the payment is due on January

31, 2024. The company also paid P50,000 to acquire an at-the-money call option for

145,000 euros and the option price was P17.50. Relevant data are given below:

10/31/2023 11/30/2023 12/31/2023 1/31/2024

Selling spot rate ? P17.61 P17.92 P18.33

Fair value of option ? P65,850 P72,500 ?

10/31/2023 11/30/2023 12/31/2023 1/31/2024

Intrinsic value - 15,950 60,900 120,350

Time value 50,000 49,900 11,600 -

Fair value 50,000 65,850 72,500 120,350

12. On the settlement date, the firm commitment should be debited/credited on the

amount of

A. P35,812.50

B. P140,862.50

C. P105,050

D. None

13. The amount of the forward contract receivable before settlement on February 28,

2023?

A. P1,200,000

B. P1,375,000

C. P1,187,500

D. P1,400,000

14. How much is the forex gain/loss to be recognized in OCI on December 31, 2023?

A. P44,950 loss

B. P60,900 gain

C. P60,900 loss

D. P44,950 gain

15. How much is the net effect in relation to the derivatives in current earnings

in 2023?

A. P110,812.50

B. P120,350

C. P29,262.50

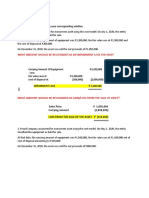

D. P72,412.50

Firm Commitment – FX GAIN 35,812.50

Forward Contract – FX GAIN 75,000

Option Contract – TIME VALUE (11,600 – 50,000) (38,400)

NET AMOUNT to P/L = 72,412.50

PART II: THEORY OF ACCOUNTS

16. Which of the following statements involving the conversion of amounts from

foreign currency to functional currency is false?

A. A foreign currency transaction shall be recorded in the entity’s functional

currency by applying the spot exchange rate at the date when such transaction

becomes accountable in accordance with PFRS.

B. Foreign exchange rates can be expressed directly or indirectly. Indirect exchange

rates are divided to the units in foreign currency to arrive at its functional

currency equivalent.

C. An entity involved in an exportation transaction shall use the buying spot rate

in converting foreign currency to functional currency.

D. An entity involved in an importation transaction shall use the buying spot rate

in converting foreign currency to functional currency.

17. Under PAS 21, what is the accounting treatment of exchange differences arising

from translating financial statement in entity’s functional currency into entity’s

presentation currency?

A. It shall be presented and recognized in other comprehensive income with

reclassification adjustment to profit or loss.

Advanced Financial Accounting and Reporting by Juan Miguel S. Ungsod, CPA

Trust the process. Page 6

B. It shall be presented and recognized in other comprehensive income without

reclassification adjustment to profit or loss.

C. It shall be presented and recognized in profit or loss.

D. It shall be presented and recognized as change in accounting policy in statement

of changes in equity.

18. In comparing the translation and the remeasurement process, which of the

following is true?

A. The reported balance of inventory is normally the same under both methods

B. The reported balance of equipment is normally the same under both methods.

C. The reported balance of sales is normally the same under both methods.

D. The reported balance of depreciation expense is normally the same under both

methods.

19. As regards the series of statements below, identify the incorrect combination/s

of an essential terminology related to foreign currency transaction to its given

definition/ description.

I. Hedging and hedge accounting are one and the same.

II. A hedged item refers to an asset, liability, firm commitment, highly probable

forecast transaction or net investment in foreign operation which exposes the entity

to risk of changes in fair value or future cash flows.

III. In a fair value hedge, provided the hedge is effective, changes in the fair

value of the hedging instrument are initially recognized in OCI. The ineffective

portion of the change in the fair value of the hedging instrument

(if any) is recognized directly in P&L.

IV. In a cash flow hedge, the carrying value of the hedged item is adjusted for fair

value changes attributable to the risk being hedged, and those fair value changes

are recognized in P&L. The hedging instrument is measured at fair value, with changes

in fair value also recognized in P&L.

A. I, III and IV

B. I, II and III

C. I and IV

D. I and III

20. Statement 1: Dividend receivable, loans receivable, and lease payments receivable

denominated in a foreign currency are remeasured at the closing rate on the balance

sheet date.

Statement 2: Both a call option and a put option are purchased to make the value of

the commodity either the holder will buy or sell fixed in amount.

A. Both statements are true

B. Both statements are false

C. Statement 1 is true; Statement 2 is false

D. Statement 1 is false; Statement 2 is true

21. Hedging a forecasted transaction is a

A. Cash flow hedge

B. Fair value hedge

C. Net investment hedge

D. None of the above

22. In accordance with PAS 21 (generally accepted accounting principles), which

translation combination is appropriate for a foreign operation whose functional

currency is the U.S. dollar?

Method Treatment of Translation Adjustment

A. Temporal Other Comprehensive Income

B. Temporal Profit or Loss

C. Closing Rate Other Comprehensive Income

D. Closing Rate Profit or Loss

23. At what rates should the following balance sheet accounts in foreign statements

be translated (rather than remeasured) into pesos?

Accumulated Depreciation Equipment

A. Current Current

B. Current Average

C. Historical Current

D. Historical Historical

Advanced Financial Accounting and Reporting by Juan Miguel S. Ungsod, CPA

Trust the process. Page 7

24. After a purchase or sale denominated in a foreign currency occurs, what is

created on a Philippine company’s financial records as a result of the change in

the exchange rate of a foreign currency?

A. Foreign exchange option

B. Exchange gains and losses

C. Settlement date

D. Foreign currency forward contract

25. According to PAS 21 The effects of changes in foreign exchange rates, exchange

differences should be recognized either in profit or loss or in other comprehensive

income. Are the following statements about the recognition of exchange differences

in respect of foreign currency transactions reported in an entity's functional

currency true or false according to PAS 21?

I. Any exchange difference on the settlement of a monetary item should be recognized

in profit or loss.

II. Any exchange difference on the translation of a monetary item at a rate different

to that used at initial recognition should be recognized in other comprehensive

income.

A. False, False

B. False, True

C. True, False

D. True, True

END OF EXAMINATION

Advanced Financial Accounting and Reporting by Juan Miguel S. Ungsod, CPA

Trust the process. Page 8

You might also like

- Afar ProblemsDocument8 pagesAfar ProblemsSheena BaylosisNo ratings yet

- Advanced Accounting1Document8 pagesAdvanced Accounting1lykaNo ratings yet

- Foreign Currency Transactions-HedgingDocument2 pagesForeign Currency Transactions-HedgingMixx MineNo ratings yet

- Advanced Accounting1Document8 pagesAdvanced Accounting1precious mlb100% (1)

- ABC FinalsDocument10 pagesABC Finalsnena cabañesNo ratings yet

- ReSA B43 AFAR Final PB Exam - Questions, Answers - SolutionsDocument25 pagesReSA B43 AFAR Final PB Exam - Questions, Answers - SolutionsElaine Joyce GarciaNo ratings yet

- Chapter 4 - Audit of InvestmentsDocument45 pagesChapter 4 - Audit of InvestmentsClene DoconteNo ratings yet

- Audit Pre TestDocument13 pagesAudit Pre Testpwcpresident.nfjpia2324No ratings yet

- ReSA B46 AFAR Final PB Exam Questions Answers SolutionsDocument24 pagesReSA B46 AFAR Final PB Exam Questions Answers SolutionsJohair BilaoNo ratings yet

- 01 - Preweek Lecture and ProblemsDocument15 pages01 - Preweek Lecture and ProblemsMelody GumbaNo ratings yet

- Afar 2 Practice Test (3rd Year)Document8 pagesAfar 2 Practice Test (3rd Year)Rianne NavidadNo ratings yet

- A. The Machine's Final Recorded Value Was P1,558,000Document7 pagesA. The Machine's Final Recorded Value Was P1,558,000Tawan VihokratanaNo ratings yet

- FAR - Level 1 TestDocument3 pagesFAR - Level 1 TestRay Joseph LealNo ratings yet

- RESA FAR PreWeek (B43)Document10 pagesRESA FAR PreWeek (B43)MellaniNo ratings yet

- FTME Reviewer Part 2Document7 pagesFTME Reviewer Part 2Mel BoqueNo ratings yet

- FAR Final PreboardDocument13 pagesFAR Final PreboardMarvin ClementeNo ratings yet

- Comprehensive Quiz No. 007-Hyperinflation Current Cost Acctg - GROUP-3Document4 pagesComprehensive Quiz No. 007-Hyperinflation Current Cost Acctg - GROUP-3Jericho VillalonNo ratings yet

- SM09 4thExamReview-2 054657Document4 pagesSM09 4thExamReview-2 054657Hilarie JeanNo ratings yet

- 162 001Document1 page162 001Christian Mark AbarquezNo ratings yet

- Financial Accounting and ReportingDocument15 pagesFinancial Accounting and Reportingjoyce KimNo ratings yet

- Final Exam Fin 2Document3 pagesFinal Exam Fin 2ma. veronica guisihanNo ratings yet

- Legend - Docx 1Document101 pagesLegend - Docx 1Juberlina CerbitoNo ratings yet

- Finals Bcacc MQCDocument12 pagesFinals Bcacc MQCLaurence BacaniNo ratings yet

- ReviewerDocument4 pagesReviewerDrie LimNo ratings yet

- 2022 Accele4 M5 AssignmentDocument6 pages2022 Accele4 M5 AssignmentPYM MataasnakahoyNo ratings yet

- Financial Liabilities ProblemsDocument20 pagesFinancial Liabilities ProblemsEvelyn LabhananNo ratings yet

- InvestmentsDocument7 pagesInvestmentsIvan LandaosNo ratings yet

- Acctg 100C 08Document2 pagesAcctg 100C 08Maddie ManganoNo ratings yet

- ForexDocument3 pagesForexhotdog kaNo ratings yet

- Seatwork #4: What Amount Should Be Recognized As An Impairment Loss For 2020?Document4 pagesSeatwork #4: What Amount Should Be Recognized As An Impairment Loss For 2020?Joseph AsisNo ratings yet

- 206B 3rd Preboard ActivityDocument9 pages206B 3rd Preboard ActivityJERROLD EIRVIN PAYOPAYNo ratings yet

- Investment Quizzers Investment QuizzersDocument16 pagesInvestment Quizzers Investment QuizzersAnna Taylor0% (1)

- IA Practice Problems InvestmentsDocument6 pagesIA Practice Problems InvestmentsbiancavitasaNo ratings yet

- Quiz Foreign Currency Transaction, Hedging & Translation: U AnsweredDocument25 pagesQuiz Foreign Currency Transaction, Hedging & Translation: U AnsweredDenise Jane RoqueNo ratings yet

- Resa Afar 1Document26 pagesResa Afar 1Princess JoannaNo ratings yet

- 6898 - Equity InvestmentsDocument2 pages6898 - Equity InvestmentsAljur SalamedaNo ratings yet

- ACP Task 3 (20230328164424)Document2 pagesACP Task 3 (20230328164424)Roque LestieNo ratings yet

- Audit of Biological AssetsDocument3 pagesAudit of Biological AssetsJohnallenson DacosinNo ratings yet

- Hyperinflation and Current CostDocument2 pagesHyperinflation and Current CostAna Marie IllutNo ratings yet

- How Much Is The Adjusted Book Disbursements For September?: Part Ii: Practical Problems Problem No.1Document8 pagesHow Much Is The Adjusted Book Disbursements For September?: Part Ii: Practical Problems Problem No.1Raenessa FranciscoNo ratings yet

- 6902 - Investment Property and Other InvestmentDocument3 pages6902 - Investment Property and Other InvestmentAljur SalamedaNo ratings yet

- CHAPTER 10 - Pre-Board Examinations-1Document35 pagesCHAPTER 10 - Pre-Board Examinations-1Mr.AccntngNo ratings yet

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument10 pagesIdentify The Letter of The Choice That Best Completes The Statement or Answers The QuestionAngelo Payawal100% (1)

- PRACTICAL ACCOUNTING 1 Part 2Document9 pagesPRACTICAL ACCOUNTING 1 Part 2Sophia Christina BalagNo ratings yet

- Midterm - Quiz SolutionDocument4 pagesMidterm - Quiz SolutionANSLEY CATE C. GUEVARRANo ratings yet

- Accounting ReviewDocument76 pagesAccounting Reviewjoyce KimNo ratings yet

- ACC-ACF2100 Assignment 2019 S2Document8 pagesACC-ACF2100 Assignment 2019 S2mattNo ratings yet

- AFAR Self Test - 9005Document6 pagesAFAR Self Test - 9005King MercadoNo ratings yet

- FAR 2&3 Test BankDocument63 pagesFAR 2&3 Test BankRachelle Isuan TusiNo ratings yet

- Resa Oct 2012 Pract 1 First Preboard W Answers PDFDocument10 pagesResa Oct 2012 Pract 1 First Preboard W Answers PDFGuinevereNo ratings yet

- Consolidated Financial Statements - IntercomapnyDocument6 pagesConsolidated Financial Statements - IntercomapnyCORNADO, MERIJOY G.No ratings yet

- Icandocumentsnovemebr 2017 Pathfinder Skills PDFDocument179 pagesIcandocumentsnovemebr 2017 Pathfinder Skills PDFDaniel AdegboyeNo ratings yet

- Finals Drill1Document14 pagesFinals Drill1Cedric Legaspi TagalaNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Finding Balance 2023: Benchmarking Performance and Building Climate Resilience in Pacific State-Owned EnterprisesFrom EverandFinding Balance 2023: Benchmarking Performance and Building Climate Resilience in Pacific State-Owned EnterprisesNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Asset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceFrom EverandAsset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- Asian Development Bank Trust Funds Report 2020: Includes Global and Special FundsFrom EverandAsian Development Bank Trust Funds Report 2020: Includes Global and Special FundsNo ratings yet

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet

- RMK Akl Kelompok 5Document25 pagesRMK Akl Kelompok 5rico zachariNo ratings yet

- Audit and Internal ReviewDocument6 pagesAudit and Internal Reviewkhengmai100% (1)

- Lagos Audit Manual - Part OneDocument83 pagesLagos Audit Manual - Part OneAndy WynneNo ratings yet

- B. Woods 8th Edition Chapter 16Document32 pagesB. Woods 8th Edition Chapter 16lastovwNo ratings yet

- Microsoft Dynamics 365 Business Central On Premises Licensing GuideDocument18 pagesMicrosoft Dynamics 365 Business Central On Premises Licensing GuideAdebola OgunleyeNo ratings yet

- 0452 s11 QP 21Document24 pages0452 s11 QP 21Athul TomyNo ratings yet

- Maf 5101 Financial AccountingDocument2 pagesMaf 5101 Financial AccountingertaudNo ratings yet

- Problem 1Document10 pagesProblem 1Shannen D. CalimagNo ratings yet

- Analysis and Interpretation of Financial StatementDocument30 pagesAnalysis and Interpretation of Financial StatementHazel Rovi Molo100% (2)

- م بتخطيط تدقيق الكشوفات المالية -دراسة عينة من محافظي الحسابات والخبراء المحاسبين بالجزائر العاصمة وبومرداس خلال سنة 2020Document12 pagesم بتخطيط تدقيق الكشوفات المالية -دراسة عينة من محافظي الحسابات والخبراء المحاسبين بالجزائر العاصمة وبومرداس خلال سنة 2020Tassadit BOUSBAINENo ratings yet

- Leverage AND TYPES of LeaverageDocument10 pagesLeverage AND TYPES of Leaveragesalim1321100% (2)

- Lesson 7 - Financial Analysis and Accounting Basics-1Document34 pagesLesson 7 - Financial Analysis and Accounting Basics-1Khatylyn MadroneroNo ratings yet

- Class DiscussionsDocument59 pagesClass DiscussionsS.GIRIDHARANNo ratings yet

- Bank ReconcilaitionDocument2 pagesBank ReconcilaitionLUCELLE ESCANONo ratings yet

- Viewing Business Through The Lens of Financial StatementsDocument55 pagesViewing Business Through The Lens of Financial StatementsAkib Mahbub KhanNo ratings yet

- BUU33532 - Financial Accounting II - HT - WK1 - 30.01.22Document2 pagesBUU33532 - Financial Accounting II - HT - WK1 - 30.01.22simiNo ratings yet

- Ciadmin,+Journal+Manager,+490 1918 1 CEDocument4 pagesCiadmin,+Journal+Manager,+490 1918 1 CEKathNo ratings yet

- Vallix QuestionnairesDocument14 pagesVallix QuestionnairesKathleen LucasNo ratings yet

- Strategic Cost Management CabreraDocument5 pagesStrategic Cost Management CabreraJyrah Mae Aceron0% (1)

- Solved Following Is A Partially Completed Balance Sheet For Hoeman IncDocument1 pageSolved Following Is A Partially Completed Balance Sheet For Hoeman IncDoreenNo ratings yet

- The Grady Tire Company Manufactures Racing Tires For Bicycles GradyDocument2 pagesThe Grady Tire Company Manufactures Racing Tires For Bicycles GradyAmit PandeyNo ratings yet

- 5 AmalgamationDocument52 pages5 AmalgamationsmartshivenduNo ratings yet

- 222Document1 page222parhNo ratings yet

- FINAL Examination - Applied Auditing 1 SY 2017-2018: College of Accounting EducationDocument17 pagesFINAL Examination - Applied Auditing 1 SY 2017-2018: College of Accounting EducationAiron Keith Along100% (1)

- Auditing Completed NotesDocument68 pagesAuditing Completed NotesArnoldQuiranteJustinianaNo ratings yet

- Chapter 5: The Cash Flow StatementDocument3 pagesChapter 5: The Cash Flow StatementLysss EpssssNo ratings yet

- CHAPTER 3 The Accounting Cycle (I)Document33 pagesCHAPTER 3 The Accounting Cycle (I)Addisalem Mesfin0% (2)

- Managerial Acc AssignmentDocument3 pagesManagerial Acc AssignmentDũng PhanNo ratings yet

- 01 Configuration Phase I - Financial AccountingDocument36 pages01 Configuration Phase I - Financial Accountingsumber kocakNo ratings yet

- Financial Accounting 2 Assignment 2Document3 pagesFinancial Accounting 2 Assignment 2BhodzaNo ratings yet