Professional Documents

Culture Documents

OF India: Permanent

OF India: Permanent

Uploaded by

Indranil MajhiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

OF India: Permanent

OF India: Permanent

Uploaded by

Indranil MajhiCopyright:

Available Formats

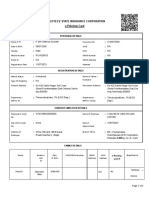

INCOME TAX DEPARTMENT GOVT.

OF INDIA

e - Permanent Account Number (e-PAN) Card

HUVPMO796R

TH/Name INDRANIL MAJHI

f4dT 51 HH / Father's name NIKHILRANJAN MAJHI

GH arErE / Date of Birth

11/10/2004

fe / Gender Male

1R /Signature

Permanent Account Number (PAN) facilitate Income Tax Department linking of various documents, including payment of taxes, assessment, tax

demand tax arrears, matching of information and easy maintenance & retrieval ofelectronic information etc. relating to a taxpayer.

V Quoting ofPAN is now mandatory for several transactions specified under Income Tax Act, 1961 (Refer Rule 114B ofIncome Tax Rules, 1962)

Possessing or using more than one PAN is against the law & may attract penalty of upto Rs. 10,000.

The PAN Card enclosed contains Enhanced QR Code which is readable by a specific Android Mobile App. Keyword to search this specific Mobile

App on Google Play Store is "Enhanced QR Code Reader for PAN Card.

"Enhanced QR Code Reader for PAN Card"l

INCOME TAX DEPARTMENT GOVT. OF INDIA

efei. 341, Hd 4. 997/8,

Permanent Account Number Card qu - 411 016.

HUVPM0796R If this card is lost / someone s lost card is found,

please inform / return to :

HI4/ Name Income Tax PAN Services Unit, NSDL

INDRANIL MAJHI 5th Floor, Mantri Sterling,

Plot No. 341, Survey No. 997/8,

fuT 5T HTH/Father's Name Model- Colony, Near Deep Bungalow Chowk,

NIKHILRANJAN MAJHI Pune 411 016.

Date of Birth

Tel: 91-20-2721 8080, Fax: 91-20-2721 8081

e-mail: tininfo@nsdl.co.in

11/10/2004 B1R/ Signature

Electronically issued and Digitally signed ePAN is a valid mode of issue of Permanent Account Number (PAN) post amendments in clause (c) in the

Explanation occurring after sub-section (8) of Section 139A of Income Tax Act, 1961 and sub-rule (6) of Rule 114 of the Income Tax Rules, click here

You might also like

- Pan CardDocument1 pagePan CardPradeep SagarNo ratings yet

- Pan CardDocument2 pagesPan CardRiya AssociatesNo ratings yet

- GJCPP5643 H: Income Tax Department Govt. of IndiaDocument1 pageGJCPP5643 H: Income Tax Department Govt. of Indiaswathi100% (1)

- Application Form Account Opening06102017112302Document4 pagesApplication Form Account Opening06102017112302arjun vsNo ratings yet

- Adobe Scan 26 Oct 2023Document1 pageAdobe Scan 26 Oct 2023jyothisree720No ratings yet

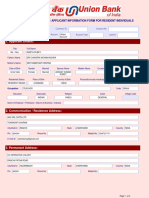

- Applicant Details:: Online Account Opening / Applicant Information Form For Resident IndividualsDocument4 pagesApplicant Details:: Online Account Opening / Applicant Information Form For Resident IndividualsMuram AliNo ratings yet

- Application Form Account Opening17092021013803Document4 pagesApplication Form Account Opening17092021013803nani kannaNo ratings yet

- PDF DownloadDocument2 pagesPDF DownloadKnitting ProductionNo ratings yet

- Application Form Account Opening03042019012137Document4 pagesApplication Form Account Opening03042019012137vasant upaseNo ratings yet

- View - Print Submitted FormDocument2 pagesView - Print Submitted FormVaibhavNo ratings yet

- Applicant Details:: Online Account Opening / Applicant Information Form For Resident IndividualsDocument4 pagesApplicant Details:: Online Account Opening / Applicant Information Form For Resident IndividualsArjit GidwaniNo ratings yet

- Application Form Account Opening28112022032954Document4 pagesApplication Form Account Opening28112022032954PUNALE MICHEL REDDYNo ratings yet

- Applicant Details:: Online Account Opening / Applicant Information Form For Resident IndividualsDocument4 pagesApplicant Details:: Online Account Opening / Applicant Information Form For Resident Individualsrajesh rathodeNo ratings yet

- Member Data Record: Fajardo JR, Roberto DiaresDocument1 pageMember Data Record: Fajardo JR, Roberto DiaresErnie SolNo ratings yet

- Application Form Account Opening08062021072437Document4 pagesApplication Form Account Opening08062021072437Sandeep SinghNo ratings yet

- Applicant Details:: Online Account Opening / Applicant Information Form For Resident IndividualsDocument4 pagesApplicant Details:: Online Account Opening / Applicant Information Form For Resident IndividualsBalakrishna AnemNo ratings yet

- Ferhtt: Govt OfindiaDocument2 pagesFerhtt: Govt Ofindiamr copy xerox100% (2)

- Application Form Account Opening26112021014636Document4 pagesApplication Form Account Opening26112021014636TECH 9tvNo ratings yet

- Application Form Account Opening18042022034606Document4 pagesApplication Form Account Opening18042022034606dawokel726No ratings yet

- BharatDocument2 pagesBharatHarshith SNo ratings yet

- Application Form Account Opening14062022015722Document4 pagesApplication Form Account Opening14062022015722Mahesh RaoNo ratings yet

- Application Form Account Opening 23011213510314358475Document5 pagesApplication Form Account Opening 23011213510314358475CSC PAKALANo ratings yet

- Applicant Details:: Online Account Opening / Applicant Information Form For Resident IndividualsDocument4 pagesApplicant Details:: Online Account Opening / Applicant Information Form For Resident Individualsaashish patidarNo ratings yet

- Morselim Molla PANDocument1 pageMorselim Molla PANmollamorselim621No ratings yet

- X-10 Identity Card: District Employment and Career Guidance Centre-ThirunelveliDocument1 pageX-10 Identity Card: District Employment and Career Guidance Centre-ThirunelvelidanielNo ratings yet

- UAN FORM11Document2 pagesUAN FORM11sai tejaNo ratings yet

- Application Form Account Opening02022019024204Document4 pagesApplication Form Account Opening02022019024204Dinesh DinnuNo ratings yet

- Appointment Reciept PassportDocument3 pagesAppointment Reciept PassportKirru KiranNo ratings yet

- Application Form Account Opening15092021104717Document4 pagesApplication Form Account Opening15092021104717nani kannaNo ratings yet

- Member Data Record: Philippine Health Insurance CorporationDocument1 pageMember Data Record: Philippine Health Insurance CorporationKyle HernandezNo ratings yet

- Application FormDocument2 pagesApplication Formzamren kafelaNo ratings yet

- Applicant Details:: Online Account Opening / Applicant Information Form For Resident IndividualsDocument4 pagesApplicant Details:: Online Account Opening / Applicant Information Form For Resident IndividualsDhineshkumar SNo ratings yet

- Invoice 2Document1 pageInvoice 2mobile.sclinic.1No ratings yet

- Application Form Account Opening28072021071646Document4 pagesApplication Form Account Opening28072021071646kksonroblox.realNo ratings yet

- MDR EncaboDocument1 pageMDR EncabobernelencaboNo ratings yet

- Commissioner of Transport Government of Tamilnadu: Ajitha - C7@yahoo - Co.inDocument4 pagesCommissioner of Transport Government of Tamilnadu: Ajitha - C7@yahoo - Co.inAnonymous 58PWHENo ratings yet

- Application Form Account Opening21032019123026Document4 pagesApplication Form Account Opening21032019123026romeo ghouseNo ratings yet

- वदे श मंालय भारत सरकार Ministry of External Affairs Government of India Online Appointment ReceiptDocument1 pageवदे श मंालय भारत सरकार Ministry of External Affairs Government of India Online Appointment ReceiptSahil RajputNo ratings yet

- Member Data Record: Dimaculangan, Joanabel RelativoDocument1 pageMember Data Record: Dimaculangan, Joanabel RelativoJobel DimaculanganNo ratings yet

- UnSignedAOFDocument25 pagesUnSignedAOFkeanepinto73No ratings yet

- Aishwarya Passport FormDocument2 pagesAishwarya Passport FormMohit ChinchkhedeNo ratings yet

- Appointment RecieptDocument3 pagesAppointment RecieptNipam patelNo ratings yet

- Applicant Details:: Online Account Opening / Applicant Information Form For Resident IndividualsDocument4 pagesApplicant Details:: Online Account Opening / Applicant Information Form For Resident IndividualsDinesh sakharam GawaliNo ratings yet

- Official MDR PDFDocument1 pageOfficial MDR PDFBesarioLouiseCassandraNo ratings yet

- PASSPORT Application FormDocument2 pagesPASSPORT Application Formdev oholNo ratings yet

- Applicant Details:: Online Account Opening / Applicant Information Form For Resident IndividualsDocument4 pagesApplicant Details:: Online Account Opening / Applicant Information Form For Resident IndividualsAnantNo ratings yet

- Passport FileDocument3 pagesPassport FileHP ElitebookNo ratings yet

- Employees' State Insurance Corporation E-Pehchan Card: Personal DetailsDocument2 pagesEmployees' State Insurance Corporation E-Pehchan Card: Personal Details0034-l-SRI HARISH KUMAR PNo ratings yet

- Application Form Account Opening22092022020433Document4 pagesApplication Form Account Opening22092022020433Deshbhsuhan SangaleNo ratings yet

- Application Form Account Opening 2109261535367715Document4 pagesApplication Form Account Opening 2109261535367715Dhana LakshmiNo ratings yet

- Application Form Account Opening14122023020736Document5 pagesApplication Form Account Opening14122023020736Sameer SyamNo ratings yet

- Application Form Account Opening26042022011150Document4 pagesApplication Form Account Opening26042022011150Pinkey KumariNo ratings yet

- Ministry of External Affairs Government of India Online Application ReceiptDocument3 pagesMinistry of External Affairs Government of India Online Application ReceiptPurabi KalitaNo ratings yet

- 1 PDFDocument2 pages1 PDFRam SadhwaniNo ratings yet

- Ram 1 PFDocument2 pagesRam 1 PFRam SadhwaniNo ratings yet

- Pak Telecom Mobile Limited: Sixty Three Rupees Eighty Nine Paisas OnlyDocument1 pagePak Telecom Mobile Limited: Sixty Three Rupees Eighty Nine Paisas OnlyMohsin Ali Shaikh vlogsNo ratings yet

- View - Print Submitted Form PDFDocument2 pagesView - Print Submitted Form PDFbusiness serviceNo ratings yet

- Profile - Public Distribution System-INFODocument3 pagesProfile - Public Distribution System-INFOjack sNo ratings yet

- View - Print Submitted Form PassportDocument2 pagesView - Print Submitted Form PassportRAMESH LAISHETTYNo ratings yet

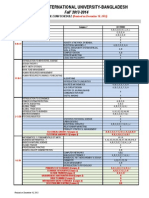

- Undergraduate Final Exam Schedule of Fall 2013-14-2Document4 pagesUndergraduate Final Exam Schedule of Fall 2013-14-2Sk PrinceNo ratings yet

- Syllable Hunt (Fundations) Lesson PlanDocument3 pagesSyllable Hunt (Fundations) Lesson Planapi-242343220No ratings yet

- Jones v. Pollard - Document No. 4Document4 pagesJones v. Pollard - Document No. 4Justia.comNo ratings yet

- The Family and Economic Development PDFDocument9 pagesThe Family and Economic Development PDFmineasaroeunNo ratings yet

- Exp 2Document3 pagesExp 2Farhatul Abrar AnandaNo ratings yet

- Linkedin Sales Automation Sequences That ConvertDocument53 pagesLinkedin Sales Automation Sequences That ConvertVictor BustillosNo ratings yet

- Heat EffectsDocument3 pagesHeat EffectscarlNo ratings yet

- Different Modeling For Amharic PDFDocument14 pagesDifferent Modeling For Amharic PDFInderjeetSinghNo ratings yet

- Guidelines For Maxillary Incisal Edge Position A Pilot Study The Key Is The Canine J Prosthodont 2007Document5 pagesGuidelines For Maxillary Incisal Edge Position A Pilot Study The Key Is The Canine J Prosthodont 2007Iulia Florina SimaNo ratings yet

- Ricef DocumentDocument8 pagesRicef DocumentRaju PokalaNo ratings yet

- Datasheet+Fech3+Fixed+03gf0348 2Document2 pagesDatasheet+Fech3+Fixed+03gf0348 2andalibazarNo ratings yet

- Abhay ResumeDocument3 pagesAbhay ResumeGuneet GargNo ratings yet

- AOA Assignment 1 - Aiman Ansari - 272Document19 pagesAOA Assignment 1 - Aiman Ansari - 272Sachin AlamNo ratings yet

- 6-8 R WorksheetsDocument40 pages6-8 R Worksheetssuchi ravaliaNo ratings yet

- Written Report Ed 4 (Visual Impairment)Document4 pagesWritten Report Ed 4 (Visual Impairment)Manayam CatherineNo ratings yet

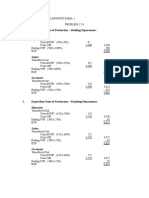

- Equivalent Units of Production - Molding Department:: MaterialsDocument3 pagesEquivalent Units of Production - Molding Department:: MaterialsElaine Fiona VillafuerteNo ratings yet

- Isokinetic Flow and SamplingDocument3 pagesIsokinetic Flow and SamplingMuthu KumarNo ratings yet

- Seven Themes of Social StudiesDocument16 pagesSeven Themes of Social StudiesHazel AbellanoNo ratings yet

- Unit 1: Atmosphere, Environment and Climate ChangeDocument24 pagesUnit 1: Atmosphere, Environment and Climate Changenidhi140286No ratings yet

- Towards Fast AI-Infused Human-Centered ContouringDocument77 pagesTowards Fast AI-Infused Human-Centered ContouringParakhModyNo ratings yet

- Cambridge University Press Unlock ListenDocument2 pagesCambridge University Press Unlock ListenPiono pionNo ratings yet

- Absolute IR-spectra From The Measurement of Fourier-Spectrometers Aboard Meteor 25 and 28Document14 pagesAbsolute IR-spectra From The Measurement of Fourier-Spectrometers Aboard Meteor 25 and 28ገዛኽኝ ሱፋNo ratings yet

- FileGocHOMOMoiDocument235 pagesFileGocHOMOMoilvminhtriet100% (3)

- Makarova 2020 CRISPR ClassificationDocument17 pagesMakarova 2020 CRISPR ClassificationRin ChanNo ratings yet

- Cooling Tower - SPX Catalog PDFDocument64 pagesCooling Tower - SPX Catalog PDFBruno de RossoNo ratings yet

- Blank Communication Letter For TeachersDocument18 pagesBlank Communication Letter For TeachersEJZIRUNo ratings yet

- Grounding and Bounding PPT Sept. 2007 Erico IncDocument46 pagesGrounding and Bounding PPT Sept. 2007 Erico IncmitaNo ratings yet

- Ieq 13Document39 pagesIeq 13urexalg AlgériaNo ratings yet

- 6 HypertensionDocument95 pages6 HypertensionZeleke temechewNo ratings yet