Professional Documents

Culture Documents

YSI Saving 6-11 PDF

Uploaded by

ProbmanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

YSI Saving 6-11 PDF

Uploaded by

ProbmanCopyright:

Available Formats

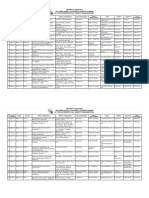

YSI Saving Individual PAMM Account Application

個人 PAMM 管理帳戶申請

PRODUCT EXPERIENCE ( please check the appropriate boxes, all these fields are mandatory )

投資經歷 ( 請在相應的框中作出標記,所有這些選項為必填 )

Nr. of Years Forex CFD Commodities Futures / Options Bonds / Shares Funds

大概年限 外匯 差價合約 商品 期貨 / 期權 債券 / 股票 基金

None / 無 □ □ □ □ □ □

less than 1 / 少於一年 □ □ □ □ □ □

1-3 years / 1-3 年 □ □ □ □ □ □

more than 3 / 超過 3 年 □ □ □ □ □ □

DO YOU ALREADY HAVE AN ACCOUNT AT YSI® CORP.? / 你已經有了 YSI® CORP. 的帳號嗎?

□ No/ □ Yes, account number /

DID YOU OPEN A DEMO ACCOUNT WITH YSI® CORP.? 你有沒有在 YSI® CORP. 開立模擬帳戶?

□ No/ □ Yes, account number /

WERE YOU CONTACTED BY A MEMBER OF YSI® CORP.'S TEAM ? 之前是否有 YSI® CORP. 團隊成員聯繫過您?

□ No/ □ Yes, by Mr./Mrs. /

HAVE YOU BEEN INTRODUCED TO YSI® CORP. BY SOMEBODY ? 曾經有人將您介紹到 YSI® CORP. 嗎?

□ No/ □ Yes, by Mr./Mrs. /

CLIENT FINANCIAL INFORMATION / 客戶財務資訊

Origin of money to invest ( Select as many as apply, min. 1 choice ) /

□ Savings 儲蓄 □ Earned income/pension 工作收入/退休金 □ Inheritance 繼承財產 □ Gift 獲贈

□ Financial markets earnings 金融市場收益 □ Other ( please specify ) 其他 ( 請詳細說明 ) :

DO YOU HAVE AN IMPORTANT PUBLIC FUNCTION ? / 您擔任重要公職嗎?

Do you hold any prominent public office ( e.g. head of state or government; senior politician, high-ranking official in the public administration,

the judiciary, the armed forces or political party; senior executive officer of a state-owned enterprise of national importance )? Or do you have close family,

or personal or business relations with any such person? Or does any person likely to be involved in the client relationship or anyone close to them hold such office?

您是否擔任重要的公職(如國家和政府的主要領導、高級政府官員、公共管理機構的高級官員、法官、軍隊官員或政黨領導、大型國有企業的高級管 理人員等)?

或者您和這些擔任重要公職的人員有緊密的家庭、個人或商業關係嗎?或者任何人可能介入客戶關係嗎?或者任何接近他們的人擔任這樣的職位嗎?

□ No/沒有 □ Yes, please describe / 是的,請描述:

GENERAL CONDITIONS AND CONTRACT DOCUMENTS / 一般條款和合同檔

By signing below, you hereby agree that you have read, understood, consented and accepted any and all of the General Business Conditions and Safe Custody Regulations.

You confirm you have read, understood, consented and accepted the “Special risks in securities trading” .

下方簽名表明您確認,您已經閱讀、理解、贊同並接受所有的一般商業條款和安全保管制度。

您確認已經閱讀、理解、贊同並接受《證券交易的特別風險》。

Place / 地點 Signature / 簽名

Date / 時間

HK/YSI DCT 08.2016 Page 06

YSI Saving Individual PAMM Account Application

個人 PAMM 管理帳戶申請

Please note that this form will not be accepted if it contains any alterations

請注意,本表格塗改無效

VERIFICATION OF THE BENEFICIAL OWNER /

According to the ( CAYMAN ) regulation the Bank must identify the economical beneficial owner(s) of the assets deposited on the account.

If you are the beneficial owner of the assets, please check the first box to confirm that you are the beneficial owner and then sign at the bottom of the page.

If you are not the beneficial owner, please check the second box and fill in all the requested information.

Please also provide us with a notarized copy of the passport or company documents of this person(s) or company(ies).

根據(英屬開曼)法律,銀行必須確認PAMM帳戶資產的經濟受益所有人。

如果您是資產的受益所有人,請在第一個框內作出標記,確認您 是受益所有人,並在頁面下方簽字。

如果您不是財產的受益所有人,請在第二個框內作出標記,並按需求填寫資訊。

另外還請您提供一份這個(這些)人的護照副本。

The contracting partner hereby declares / 簽約人於此聲明

□ That the contracting partner is the beneficial owner of the assets deposited with YSI® CORP.

簽約人即在 YSI® CORP.所存資產的受益所有人

OR / 或

□ That the beneficial owner(s) of the assets deposited with YSI® CORP. is(are) (write below)

在 YSI® CORP.存款資產的受益所有人是(下方填寫)

Family name / Date of birth or Nationality

First name or Company name incorporation 國籍或企業創建所在國 Address 地址 Country 國家

姓/名或企業名稱 出生 / 企業創建日期

The contracting partner(s) undertake(s) to automatically inform YSI® CORP.

of any changes. It is a criminal offence to deliberately provide false information on this item

簽約人承諾,如果資訊有任何更改,將主動通知 YSI® CORP.

在本表格上蓄意提供虛假資訊是犯罪行為

Translation of documents is provided for the added convenience of the Client.

In the event of conflict between the original English text and any translation or any other agreement between the Bank and the Client, the English version shall take precedence.

翻譯檔供客戶方便之用。若英文原文與任何翻譯之內容存在衝突,或者與本行和客戶之間的其他協定存在衝突,均應以英文版本為准。

Place / 地點 Signature / 簽名

Date / 時間

HK/YSI DCT 08.2016 Page 07

YSI Saving Individual PAMM Account Application

個人 PAMM 管理帳戶申請

SIGNATURE SPECIMEN / 簽名樣卡

Family name / 姓*:

First name / 名*:

Nationality / 國籍*:

Date of Birth ( Day / Month / Year ) / 出生日期 ( 日 / 月 / 年 ) *:

Please sign in both boxes below / 請在下面兩個框中簽名

HK/YSI DCT 08.2016 Page 08

YSI Saving

YSI CORPORATION ANTI-MONEY LAUNDERING POLICY (AML)

POLICY STATEMENT AND PRINCIPLES

In compliance with the The Financial Intelligence and Anti-Money Laundering Act 2002 (FIAMLA 2002), the Prevention of

Corruption Act 2002 (POCA 2002) and the Prevention of Terrorism Act 2002 (POTA 2002), YSI CORPORATION have adopted

an Anti-Money Laundering (AML) compliance policy ("Policy") as set forth in the Board minutes.

SCOPE OF POLICY

This policy applies to all YSI CORPORATION officers, employees, appointed producers and products and services offered by

YSI CORPORATION. All business units and locations within YSI CORPORATION will cooperate to create a cohesive effort in the

fight against money laundering. Each business unit and location have implemented risk-based procedures reasonably

expected to prevent, detect and cause the reporting of transactions required under the FIAMLA. All efforts exerted will be

documented and retained in accordance with the FIAMLA. The AML Compliance Committee is responsible for initiating

Suspicious Activity Reports ("SARs") or other required reporting to the appropriate law enforcement or regulatory

agencies. Any contacts by law enforcement or regulatory agencies related to the Policy shall be directed to the AML

Compliance Committee.

POLICY

It is the policy of YSI CORPORATION to prohibit and actively pursure the prevention of money laundering and any activity that

facilitates money laundering or the funding of terrorist or criminal activities. YSI CORPORATION is committed to AML

compliance in accordance with applicable law and requires its officers, employees and appointed producers to adhere to

these standards in preventing the use of its products and services for money laundering purposes. For the purposes of the

Policy, money laundering is generally defined as engaging in acts designed to conceal or disguise the true origins of

criminally derived proceeds so that the unlawful proceeds appear to have been derived from legitimate origins or

constitute legitimate assets.

Generally, money laundering occurs in three stages. Cash first enters the financial system at the "placement" stage, where

the cash generated from criminal activities is converted into monetary instruments, such as money orders or traveler's

checks, or deposited into accounts at financial institutions. At the "layering" stage, the funds are transferred or moved into

other accounts or other financial institutions to further separate the money from its criminal origin. At the "integration"

stage, the funds are reintroduced into the economy and used to purchase legitimate assets or to fund other criminal

activities or legitimate businesses. Terrorist financing may not involve the proceeds of criminal conduct, but rather an

attempt to conceal the origin or intended use of the funds, which will later be used for criminal purposes.

AML COMPLIANCE COMMITTEE

The AML Compliance Committee, with full responsibility for the Policy shall be comprised of the General Counsel; Chief

Compliance Officer, YSI CORPORATION; Deputy Compliance Officer, YSI CORPORATION; Assistant Vice President-Internal

Audit, and Corporate Attorney. The Chief Compliance Officer shall also hold the title Chief AML Officer, and shall have

authority to sign as such. The duties of the AML Compliance Committee with respect to the Policy shall include, but are not

limited to, the design and implementation of as well as updating the Policy as required; dissemination of information to

officers, employees and appointed producers of YSI CORPORATION, training of officers, employees and appointed

producers; monitoring the compliance of YSI CORPORATION operating units and appointed producers, maintaining

necessary and appropriate records, filing of SARs when warranted; and independent testing of the operation of the Policy.

Each YSI CORPORATION business unit shall appoint a contact person to interact directly with the AML Compliance

Committee to assist the Committee with investigations, monitoring and as otherwise requested.

CUSTOMER IDENTIFICATION PROGRAM

YSI CORPORATION has adopted a Customer Identification Program (CIP). YSI CORPORATION will provide notice that they will

seek identification information; collect certain minimum customer identification information from each customer, record

such information and the verification methods and results; and compare customer identification information with OFAC.

HK/YSI DCT 08.2016 Page 09

YSI Saving

NOTICE TO CUSTOMERS

YSI CORPORATION will provide notice to customers that it is requesting information from them to verify their identities, as

required by applicable law.

VERIFYING INFORMATION

Based on the risk, and to the extent reasonable and practicable, YSI CORPORATION will ensure that it has a reasonable belief

of the true identity of its customers. In verifying customer identity, appointed producers shall review photo identification

YSI CORPORATION shall not attempt to determine whether the document that the customer has provided for identification

has been validly issued. For verification purposes, YSI CORPORATION shall rely on a government-issued identification to

establish a customer's identity. YSI CORPORATION, however, will analyze the information provided to determine if there are

any logical inconsistencies in the information obtained. YSI CORPORATION will document its verification, including all

identifying information provided by the customer, the methods used and results of the verification, including but not limited

to sign-off by the appointed producer of matching photo identification.

CUSTOMERS WHO REFUSE TO PROVIDE INFORMATION

If a customer either refuses to provide the information described above when requested, or appears to have intentionally

provided misleading information, the appointed agent shall notify their New Business team. The YSI CORPORATION New

Business team will decline the application and notify the AML Compliance Committee.

CHECKING THE OFFICE OF FOREIGN ASSETS CONTROL ("OFAC") LIST

For all (1) new applications received and on an ongoing basis, (2) disbursements (3) new producers appointed or (4) new

employees, YSI CORPORATION will check to ensure that a person or entity does not appear on Treasury's OFAC "Specifically

Designated Nationals and Blocked Persons" List (SDN List) and is not from, or engaging in transactions with people or

entities from, embargoed countries and regions listed on the OFAC Web Site. YSI CORPORATION shall contract with

World-Check to ensure speed and accuracy in the checks. YSI CORPORATION will also review existing policyholders,

producers and employees against these lists on a periodic basis. The frequency of the reviews will be documented and

retained. In the event of a match to the SDN List or other OFAC List, the business unit will conduct a review of the

circumstances where such match has been identified. If the business unit is unable to confirm that the match is a false

positive, the AML Committee shall be notified.

MONITORING AND REPORTING

Transaction based monitoring will occur with in the appropriate business units of YSI CORPORATION. Monitoring of specific

transactions will include but is not limited to transactions aggregating $5,000 or more and those with respect to which

YSI CORPORATION has a reason to suspect suspicious activity. All reports will be documented and retained in accordance

with the FIAMLA requirements.

There are signs of suspicious activity that suggest money laundering. These are commonly referred to as "red flags". If a

red flag is detected, additional due diligence will be performed before proceeding with the transaction. If a reasonable

explanation is not determined, the suspicious activity shall be reported to the AML Compliance Committee. Examples of

red flags are:

˙The information provided by the customer that identifies a legitimate source for funds is false, misleading, or substantially

incorrect.

˙Upon request, the customer refuses to identify or fails to indicate any legitimate source for his or her funds and other

assets.

˙The customer (or a person publicly associated with the customer) has a questionable background or is the subject of news

reports indicating possible criminal, ivil, or regulatory violations.

˙The customer exhibits a lack of concern regarding risks, commissions, or other transaction costs

˙The customer appears to be acting as an agent for an undisclosed principal, but declines or is reluctant, without legitimate

commercial reasons, to provide information or is otherwise evasive regarding that person or entity.

˙The customer attempts to make frequent or large deposits of currency, insists on dealing only in cash equivalents, or asks

for exemptions from the firm's policies relating to the deposit of cash and cash equivalents.

HK/YSI DCT 08.2016 Page 10

YSI Saving

˙For no apparent reason, the customer has multiple accounts under a single name or multiple names, with a large number

of inter-account or third-party transfers.

˙The customer is from, or has accounts in, a country identified as a non-cooperative country or territory by the Financial

Action Task Force.

˙The customer's account shows numerous currency or cashiers check transactions aggregating to significant sums.

˙The customer's account has a large number of wire transfers to unrelated third parties inconsistent with the customer's

legitimate business purpose.

˙The customer's account has wire transfers that have no apparent business purpose to or from a country identified as

money laundering risk or a bank secrecy haven.

˙The customer's account indicates large or frequent wire transfers, immediately withdrawn by check or debit card without

any apparent business purpose.

˙The customer makes a funds deposit followed by an immediate request that the money be wired out or transferred to a

third party, or to another firm, without any apparent business purpose.

˙The customer makes a funds deposit for the purpose of purchasing a long-term investment followed shortly thereafter by

a request to liquidate the position and transfer of the proceeds out of the account.

˙The customer requests that a transaction be processed in such a manner to avoid the firm's normal documentation

requirements.

INVESTIGATION

Upon notification to the AML Compliance Committee of a match to the OFACSDN List or possible suspicious activity, an

investigation will be commenced to determine if a report should be made to appropriate law enforcement or regulatory

agencies. The investigation will include, but not necessarily be limited to, review of all available information, such as

payment history, birth dates, and address. If the results of the investigation warrant, a recommendation will be made to the

AML Compliance Committee to file a blocked assets and/or a SAR with the appropriate law enforcement or regulatory

agency. The AML Compliance Committee is responsible for any notice or filing with law enforcement or regulatory agency.

Investigation results will not be disclosed or discussed with anyone other that those who have a legitimate need to know.

Under no circumstances shall any officer, employee or appointed agent disclose or discuss any AML concern, investigation,

notice or SAR filing with the person or persons subject of such, or any other person, including members of the officer's

employee's or appointed agent's family.

RECORDKEEPING

The AML Compliance Committee will be responsible to ensure that AML records are maintained properly and that SARs

and Blocked Property Reports are filed as required. YSI CORPORATION will maintain AML records for at least five years.

TRAINING

YSI CORPORATION shall provide general AML training to its officers, employees and appointed producers to ensure

awareness of requirements under the FIAMLA. The training will include, at a minimum: how to identify red flags and signs

of money laundering; what roles the officers, employees and appointed producers have in the YSI CORPORATION

compliance efforts and how to perform such duties and responsibilities; what to do once a red flag or suspicious activity is

detected; YSI CORPORATION record retention policy; and the disciplinary consequences for non-compliance with the Act

and this Policy. In addition, each affected area will provide enhanced training in accordance with the procedures developed

in each area for officers and employees reasonably expected to handle money, requests, or processing that may bring them

into contact with information designated above. Training will be conduted on an annual basis. YSI CORPORATION AML

Compliance Committee will determine the ongoing training requirements and ensure written procedures are updated to

reflect any changes required in such training. YSI CORPORATION will maintain records to document that training has

occurred.

The testing of the Policy will be conducted by an outside independent third party annually. Any findings will be reported to

the AML Compliance Committee, SFG Audit Committee and Senior Management for appropriate action.

HK/YSI DCT 08.2016 Page 11

You might also like

- Holocaust ForgivenessDocument15 pagesHolocaust Forgivenessclinton roNo ratings yet

- 2-accident-claim-form-sampleDocument5 pages2-accident-claim-form-samplemwong66666No ratings yet

- Eminifx, Inc. Compensation Plan: Updated October 2021 V3.5.0Document21 pagesEminifx, Inc. Compensation Plan: Updated October 2021 V3.5.0jeankerlensNo ratings yet

- EXD - Form A9 - 02MAY2022-Grayscale PDFDocument1 pageEXD - Form A9 - 02MAY2022-Grayscale PDFdindi genilNo ratings yet

- AML KYC Questionnaire For Financial InstitutionsDocument8 pagesAML KYC Questionnaire For Financial Institutionspaddy borhadeNo ratings yet

- 2 App Corp eDocument13 pages2 App Corp enzekwesiliekenedilichukwuNo ratings yet

- HSB RFB1596 CMT0011Document8 pagesHSB RFB1596 CMT0011Louis BirNo ratings yet

- Esua D - OM ZILDocument6 pagesEsua D - OM ZILDeborah EsauNo ratings yet

- Cash IsaDocument8 pagesCash IsababaforkumarNo ratings yet

- Important Login Employment Banking DetailsDocument6 pagesImportant Login Employment Banking DetailsMia ValdezNo ratings yet

- Entity Enhanced Due DiligenceDocument3 pagesEntity Enhanced Due Diligencevinodhdreams100% (1)

- Checkwriting 2Document2 pagesCheckwriting 2Brooke A. KellemsNo ratings yet

- Overseas Franchise Application Form TemplateDocument7 pagesOverseas Franchise Application Form TemplatePresident's Office (UB Group)No ratings yet

- Trade Ticket FormDocument2 pagesTrade Ticket FormRenee Barian RomeroNo ratings yet

- aaDocument7 pagesaamwong66666No ratings yet

- Checkwriting PDFDocument2 pagesCheckwriting PDFAnonymous MpvaHSGwNNo ratings yet

- SCM Company Account ApplicationDocument48 pagesSCM Company Account ApplicationjamesmcbrydeNo ratings yet

- Broker-Assisted Customer Account Information Form (CAIF) - IndividualDocument6 pagesBroker-Assisted Customer Account Information Form (CAIF) - Individualmunic14No ratings yet

- SIDBI Fixed Deposit FAQsDocument7 pagesSIDBI Fixed Deposit FAQsRohit MalviyaNo ratings yet

- New Hire Welcome Book - Philippines - Corporate Center Manila & CebuDocument7 pagesNew Hire Welcome Book - Philippines - Corporate Center Manila & CebuRenmar John AbagatNo ratings yet

- 1 Sole Proprietorship Business in IndiaDocument6 pages1 Sole Proprietorship Business in IndiaEMBA IITKGPNo ratings yet

- Application For Funding FormDocument8 pagesApplication For Funding Formthobekathotho79No ratings yet

- Be A Registered Investment AdviserDocument6 pagesBe A Registered Investment AdvisersaurabNo ratings yet

- Be A Registered Investment AdviserDocument6 pagesBe A Registered Investment AdviserShubham NandwalNo ratings yet

- Due Diligence Checklist PDFDocument5 pagesDue Diligence Checklist PDFLjupco TrajkovskiNo ratings yet

- Merrill Edge _ Open an Account _ Review & Agreements zac simDocument4 pagesMerrill Edge _ Open an Account _ Review & Agreements zac simstevenlane211No ratings yet

- PTICM Investment Policy MS - PDFSDDDocument5 pagesPTICM Investment Policy MS - PDFSDDMuhammad Ahsan QureshiNo ratings yet

- Requirements For Mutual Funds Distributor RegistrationDocument3 pagesRequirements For Mutual Funds Distributor RegistrationSATISH BHARADWAJNo ratings yet

- Safeguards For Your Portfolio ServiceDocument1 pageSafeguards For Your Portfolio Servicebhaskar.jain20021814No ratings yet

- Business Plan Including Declaration of Personal Finances - 2Document10 pagesBusiness Plan Including Declaration of Personal Finances - 2hussen seidNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- 100 Business Ideas: Discover Home Business Ideas, Online Business Ideas, Small Business Ideas and Passive Income Ideas That Can Help You Start A Business and Achieve Financial FreedomFrom Everand100 Business Ideas: Discover Home Business Ideas, Online Business Ideas, Small Business Ideas and Passive Income Ideas That Can Help You Start A Business and Achieve Financial FreedomRating: 2.5 out of 5 stars2.5/5 (2)

- Options Application: Helpful To KnowDocument12 pagesOptions Application: Helpful To Knowtrk001kNo ratings yet

- Auto-Invest Enrollment FormDocument2 pagesAuto-Invest Enrollment FormNoknik OllirecNo ratings yet

- Setting up, operating and maintaining Self-Managed Superannuation FundsFrom EverandSetting up, operating and maintaining Self-Managed Superannuation FundsNo ratings yet

- Plan To Invest Capital Management, LLC Investment Policy StatementDocument5 pagesPlan To Invest Capital Management, LLC Investment Policy StatementMuhammad Ahsan QureshiNo ratings yet

- TRP Mutual Fund New Account FormDocument3 pagesTRP Mutual Fund New Account Formambasyapare1No ratings yet

- Paycheck Protection Program Application 3 30 2020 v3Document4 pagesPaycheck Protection Program Application 3 30 2020 v3api-286660111No ratings yet

- Clients-Account-Application-Form - TERNIL GAJETODocument7 pagesClients-Account-Application-Form - TERNIL GAJETOTia Divino GajetoNo ratings yet

- NEW LOAN-APPLICATION-FORM November 2021 v2 PDFDocument4 pagesNEW LOAN-APPLICATION-FORM November 2021 v2 PDFjohnson mwauraNo ratings yet

- YES FIRST Account Opening Annexure MPADocument3 pagesYES FIRST Account Opening Annexure MPAAnkur VermaNo ratings yet

- Start Your Own HOME-BASED BUSINESS: Choose From 25 Great BUSINESS PLANSFrom EverandStart Your Own HOME-BASED BUSINESS: Choose From 25 Great BUSINESS PLANSNo ratings yet

- Plan To Invest Capital Management, LLC Investment Policy StatementDocument5 pagesPlan To Invest Capital Management, LLC Investment Policy StatementMuhammad Ahsan QureshiNo ratings yet

- SME Loan KYC Supplemental FormDocument2 pagesSME Loan KYC Supplemental FormPagalan LorjunNo ratings yet

- My Accounts: Download The ExnessDocument1 pageMy Accounts: Download The ExnessInt’l Joshy NiceNo ratings yet

- Business Law and TaxationDocument7 pagesBusiness Law and TaxationmaryamehsanNo ratings yet

- Account-Opening-Individual - Meezan Sahulat Sarmayakari Account FinalDocument7 pagesAccount-Opening-Individual - Meezan Sahulat Sarmayakari Account FinalSalman ArshadNo ratings yet

- Advocacy On Anti Investment Scams ADZU 2022Document29 pagesAdvocacy On Anti Investment Scams ADZU 2022Ridz TingkahanNo ratings yet

- Consolidated Account Statement - How To Generate CAS OnlineDocument1 pageConsolidated Account Statement - How To Generate CAS OnlineAbhisek BahinipatiNo ratings yet

- Checkwriting Information and TermsDocument2 pagesCheckwriting Information and TermsRich100% (1)

- How To Structure A PartnershipDocument8 pagesHow To Structure A PartnershipNotarysTo GoNo ratings yet

- Know Your CustomerDocument4 pagesKnow Your CustomerANKITA DUBEYNo ratings yet

- Business Structure Guide for EntrepreneursDocument9 pagesBusiness Structure Guide for EntrepreneursGen AbulkhairNo ratings yet

- NabkisanDocument24 pagesNabkisanDnyaneshwar Dattatraya PhadatareNo ratings yet

- Franchise Application Form: (I) APPLICANT INFORMATION (For Individuals, Please Fill in Applicable Fields)Document2 pagesFranchise Application Form: (I) APPLICANT INFORMATION (For Individuals, Please Fill in Applicable Fields)Nha Nguyen HoangNo ratings yet

- Elcome: Last Updated: We May Revise These Terms, Update The Platform and Modify The Services (At Any Time)Document13 pagesElcome: Last Updated: We May Revise These Terms, Update The Platform and Modify The Services (At Any Time)ADIL QAZINo ratings yet

- Holdback Escrows: Security Against The UnpredictableDocument4 pagesHoldback Escrows: Security Against The UnpredictableSusmita DasNo ratings yet

- Letter of Instruction TemplateDocument2 pagesLetter of Instruction TemplateNaratama PradiptaNo ratings yet

- Sublease Agreement: PartiesDocument3 pagesSublease Agreement: PartiesbambamNo ratings yet

- Excellence to Adapt and Grow: Astra Otoparts' 2019 Annual ReportDocument332 pagesExcellence to Adapt and Grow: Astra Otoparts' 2019 Annual ReportFrianta pangaribuanNo ratings yet

- Subscription Agreement Payroll 25 July 2023Document3 pagesSubscription Agreement Payroll 25 July 2023maria claudette lacsonNo ratings yet

- G7 Q1 Learning MaterialDocument22 pagesG7 Q1 Learning MaterialPrincess Nicole LagbaoNo ratings yet

- Rules of Procedure IBA ICCMCC 2023Document26 pagesRules of Procedure IBA ICCMCC 2023A AASHIK KAREEM nalsarNo ratings yet

- Expropriation or Eminent DomainDocument3 pagesExpropriation or Eminent Domaindivine venturaNo ratings yet

- My Chevening Journey, Part 2 - Networking Essay TipsDocument7 pagesMy Chevening Journey, Part 2 - Networking Essay TipsBroker KhanNo ratings yet

- Juvenile Delinquency in India Latest Trends and Entailing Amendments in Juvenile Justice ActpdfDocument19 pagesJuvenile Delinquency in India Latest Trends and Entailing Amendments in Juvenile Justice ActpdfMike WalterNo ratings yet

- Was Ewig Liegt SpielerleitfadenPDF LZ MetaDocument12 pagesWas Ewig Liegt SpielerleitfadenPDF LZ MetaSachmeth94No ratings yet

- Thesis Public Administration PDFDocument10 pagesThesis Public Administration PDFraxdouvcf100% (2)

- Trade Union - Unit IIDocument9 pagesTrade Union - Unit IIPrerna KhannaNo ratings yet

- Umid Customer Information RecordDocument2 pagesUmid Customer Information RecordEdaj Catabman Sotnas SoledNo ratings yet

- Region IV A List of Accredited CSOs 02182022 PDFDocument2 pagesRegion IV A List of Accredited CSOs 02182022 PDFJustin KyleNo ratings yet

- CA FINAL IDT QUESTION BANK FOR MAYNOV 2021 Atul AgarwalDocument463 pagesCA FINAL IDT QUESTION BANK FOR MAYNOV 2021 Atul AgarwalRonita DuttaNo ratings yet

- Chapter 1 RosenbloomDocument37 pagesChapter 1 RosenbloomAmna ChNo ratings yet

- National EmergencyDocument21 pagesNational EmergencyAnupamaNo ratings yet

- Operations Management LectureDocument31 pagesOperations Management LectureAnjan SarkarNo ratings yet

- Political Law Reviewer 2018 Part 1 Atty. MedinaDocument95 pagesPolitical Law Reviewer 2018 Part 1 Atty. MedinayvonneNo ratings yet

- Lijauco v. TerradoDocument1 pageLijauco v. TerradoPatrick Anthony Llasus-NafarreteNo ratings yet

- G R - No - 213972Document5 pagesG R - No - 213972hsjhsNo ratings yet

- Jatiya Kabi Kazi Nazrul Islam University: Trishal, MymensinghDocument10 pagesJatiya Kabi Kazi Nazrul Islam University: Trishal, MymensinghrafatsantoNo ratings yet

- Judgement AnalysisDocument14 pagesJudgement AnalysisGurpuneet GillNo ratings yet

- CPC NotesDocument21 pagesCPC NotesAiman Lazman100% (1)

- Hindi - WikipediaDocument21 pagesHindi - WikipediaArjunNo ratings yet

- Anthony Warner Press Release Dec. 30, 2020Document1 pageAnthony Warner Press Release Dec. 30, 2020Law&CrimeNo ratings yet

- Monopoly PDFDocument13 pagesMonopoly PDFUmer Tariq BashirNo ratings yet

- Statement From Dafonte Miller, Lawyer After Judge Convicts Michael Theriault For BeatingDocument2 pagesStatement From Dafonte Miller, Lawyer After Judge Convicts Michael Theriault For BeatingToronto StarNo ratings yet

- BinderDocument3 pagesBinderBK AcharyaNo ratings yet

- Full Download Test Bank For Human Nutrition Science For Healthy Living 1st Edition Tammy Stephenson Wendy Schiff PDF Full ChapterDocument35 pagesFull Download Test Bank For Human Nutrition Science For Healthy Living 1st Edition Tammy Stephenson Wendy Schiff PDF Full Chapterhoy.guzzler67fzc100% (18)

- Satinder BabejaDocument30 pagesSatinder BabejaduthindaraNo ratings yet