Professional Documents

Culture Documents

Time Value of Money

Uploaded by

Genner RazOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Time Value of Money

Uploaded by

Genner RazCopyright:

Available Formats

The time value of money is a financial concept that refers to the idea that the value of money changes

over time. Specifically, it suggests that money today is worth more than the same amount of money in

the future, due to the opportunity cost of not having that money available to invest or consume

immediately.

The concept of the time value of money plays a critical role in many areas of finance, including

investment analysis, capital budgeting, and financial planning. One of the most important implications of

the time value of money is that it allows us to compare the value of cash flows that occur at different

points in time.

For example, suppose you have the option to receive $100 today or $100 one year from now. Even

though the nominal amount of money is the same, the $100 today is worth more because you can invest

it and earn a return over the course of the year. Alternatively, if you have a future cash flow, such as an

investment that will pay $100 in one year, you can use the time value of money to calculate its present

value and compare it to other investment opportunities that are available to you.

There are several factors that affect the time value of money, including interest rates, inflation, and risk.

Higher interest rates will generally increase the present value of future cash flows, while inflation will

decrease it. Similarly, higher levels of risk will decrease the present value of future cash flows, as

investors will demand a higher return to compensate for the additional risk.

In summary, the time value of money is a crucial concept in finance that allows us to compare the value

of cash flows that occur at different points in time. By taking into account the potential returns that can

be earned from investing money today, we can make better financial decisions and maximize the value of

our investments over time.

1. What is the time value of money?

Answer: The time value of money is the concept that money available at the present time is worth more

than the same amount in the future due to its potential earning capacity.

2. How does compounding affect the time value of money?

Answer: Compounding refers to the process of earning interest on both the principal amount and the

accumulated interest. This means that over time, the value of money increases exponentially, making it

more valuable in the future.

3. What is the difference between present value and future value?

Answer: Present value refers to the current value of a future sum of money, while future value refers to

the value of an investment at a specific point in the future, after it has earned interest.

4. How can the time value of money be used in financial planning?

Answer: The time value of money can be used to determine the future value of investments, calculate

loan payments, and evaluate the potential return on investment opportunities.

5. What is the formula for calculating the future value of an investment?

Answer: The formula for calculating the future value of an investment is FV = PV x (1 + r)^n, where FV is

the future value, PV is the present value, r is the interest rate, and n is the number of compounding

periods.

You might also like

- An MBA in a Book: Everything You Need to Know to Master Business - In One Book!From EverandAn MBA in a Book: Everything You Need to Know to Master Business - In One Book!No ratings yet

- Financial Management 2: The Basic Knowledge of Financial Management for StudentFrom EverandFinancial Management 2: The Basic Knowledge of Financial Management for StudentNo ratings yet

- Present Value The Current Worth of A Future Sum of Money or Stream of Cash FlowsDocument10 pagesPresent Value The Current Worth of A Future Sum of Money or Stream of Cash FlowsPhamela Mae RicoNo ratings yet

- Handout - 2 - Time Value of MoneyDocument3 pagesHandout - 2 - Time Value of MoneySaith UmairNo ratings yet

- The Time Value of MoneyDocument5 pagesThe Time Value of Moneysunny syNo ratings yet

- Compounding-interest-future-value-step-by-step-approach--11032024-064036pmDocument6 pagesCompounding-interest-future-value-step-by-step-approach--11032024-064036pmAbdul hanan MalikNo ratings yet

- MODULE 4 SVV Time Value of Money StudentDocument5 pagesMODULE 4 SVV Time Value of Money StudentJessica RosalesNo ratings yet

- Explore: Realization: Answer These QuestionsDocument1 pageExplore: Realization: Answer These QuestionsJohnRey EstaresNo ratings yet

- TVM Concepts ExplainedDocument15 pagesTVM Concepts ExplainedIstiaque AhmedNo ratings yet

- Task 17Document7 pagesTask 17Medha SinghNo ratings yet

- Time Value of Money ConceptDocument2 pagesTime Value of Money ConceptSwiss GauchanNo ratings yet

- Money in The Present Is Worth More Than The Same Sum of Money To Be Received in The FutureDocument7 pagesMoney in The Present Is Worth More Than The Same Sum of Money To Be Received in The FutureJohn JamesNo ratings yet

- AdmasDocument11 pagesAdmasAbdellah TeshomeNo ratings yet

- TheoryDocument3 pagesTheorysachinNo ratings yet

- The Time Value of Money - Business FinanceDocument24 pagesThe Time Value of Money - Business FinanceMd. Ruhul- Amin33% (3)

- Capital Budgeting, IRRs, NPVS, Discounting RatesDocument35 pagesCapital Budgeting, IRRs, NPVS, Discounting RatesvinodkothariNo ratings yet

- Time Value of MoneyDocument36 pagesTime Value of MoneyAkeef KhanNo ratings yet

- Philippine Christian University Time Value of MoneyDocument14 pagesPhilippine Christian University Time Value of MoneyRobin Escoses MallariNo ratings yet

- The Importance of The Time Value of MoneyDocument2 pagesThe Importance of The Time Value of MoneyC h r i s t i n 3No ratings yet

- Philippine Christian University: Dasmarinas CampusDocument15 pagesPhilippine Christian University: Dasmarinas CampusRobin Escoses MallariNo ratings yet

- Financial Management Research Paper - Juliana Honeylet L. Amper - MEMDocument10 pagesFinancial Management Research Paper - Juliana Honeylet L. Amper - MEMJuliana Honeylet L. AmperNo ratings yet

- Understanding The Time Value of MoneyDocument5 pagesUnderstanding The Time Value of MoneyMARL VINCENT L LABITADNo ratings yet

- 304A Financial Management and Decision MakingDocument67 pages304A Financial Management and Decision MakingSam SamNo ratings yet

- Time Value of Money-Financial Management: AbstractDocument6 pagesTime Value of Money-Financial Management: AbstractInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Chapter 3 Time Value of MoneyDocument80 pagesChapter 3 Time Value of MoneyMary Nica BarceloNo ratings yet

- Time Value of MoneyDocument15 pagesTime Value of MoneytamtradeNo ratings yet

- 4.1 Time Value of Money PDFDocument13 pages4.1 Time Value of Money PDFPractice AddaNo ratings yet

- Nilai Waktu Dari Uang Dalam Perspektif Ekonomi Islam: AbstractDocument14 pagesNilai Waktu Dari Uang Dalam Perspektif Ekonomi Islam: AbstractIntan putri rengganisNo ratings yet

- ENERGY AUDITING & DCFDocument18 pagesENERGY AUDITING & DCFDIVYA PRASOONA CNo ratings yet

- Mod-2 TIME - VALUE - OF - MONEYDocument80 pagesMod-2 TIME - VALUE - OF - MONEYamrj27609No ratings yet

- Time Value of MoneyDocument16 pagesTime Value of MoneyAnmol Shrestha100% (1)

- Present Value 1Document7 pagesPresent Value 1shotejNo ratings yet

- Electrical Engineering Money-Time Relationships GuideDocument49 pagesElectrical Engineering Money-Time Relationships GuideMc John PobleteNo ratings yet

- The Time Value of Money Concept ExplainedDocument3 pagesThe Time Value of Money Concept ExplainedGabriel PattonNo ratings yet

- Time Value of MoneyDocument2 pagesTime Value of MoneyChristianNo ratings yet

- Importance of Time Value of Money in Financial ManagementDocument16 pagesImportance of Time Value of Money in Financial Managementtanmayjoshi969315No ratings yet

- Solution Manual Introduction To Corporate Finance 5th Edition by Alex Frino SLP1163Document29 pagesSolution Manual Introduction To Corporate Finance 5th Edition by Alex Frino SLP1163Thar Adelei50% (4)

- Topic 3 - Money - Time Relationships and EquivalenceDocument50 pagesTopic 3 - Money - Time Relationships and EquivalenceMc John PobleteNo ratings yet

- Module 2 Time Value of Money (1)Document42 pagesModule 2 Time Value of Money (1)rishabsingh2322No ratings yet

- Module 2 Time Value of MoneyDocument42 pagesModule 2 Time Value of MoneyNani MadhavNo ratings yet

- Personal Finance Guide Breaks Down Income, Spending, Savings & MoreDocument60 pagesPersonal Finance Guide Breaks Down Income, Spending, Savings & MoreRavi JaiswalNo ratings yet

- Unit 2 Tutorials Time Value of Money and Financial SecuritiesDocument84 pagesUnit 2 Tutorials Time Value of Money and Financial SecuritiesAldrin Kevin TamseNo ratings yet

- EconomicsDocument4 pagesEconomicssubroto36No ratings yet

- Time Value of MoneyDocument28 pagesTime Value of MoneyEkta JaiswalNo ratings yet

- TVM: Calculating Present Value, Future Value, & Opportunity CostsDocument3 pagesTVM: Calculating Present Value, Future Value, & Opportunity CostsNitish SenNo ratings yet

- Financial Management: Chapter Three Time Value of MoneyDocument16 pagesFinancial Management: Chapter Three Time Value of MoneyLydiaNo ratings yet

- UntitledDocument89 pagesUntitledRaju RajuNo ratings yet

- Financial MangementDocument3 pagesFinancial MangementAman JainNo ratings yet

- Financial DecisionsDocument45 pagesFinancial DecisionsLumumba KuyelaNo ratings yet

- Time Value of Money - TheoryDocument7 pagesTime Value of Money - TheoryNahidul Islam IUNo ratings yet

- The Concept of CompoundingDocument5 pagesThe Concept of CompoundingErick KibeNo ratings yet

- Assignment #5: Ahmad Shabbir ROLLNO#LCM-3576Document7 pagesAssignment #5: Ahmad Shabbir ROLLNO#LCM-3576Ahmadshabir ShabirNo ratings yet

- CH 5 Time Value of MoneyDocument31 pagesCH 5 Time Value of MoneyMd. Arjit IsalmNo ratings yet

- PVDocument38 pagesPVPratheep GsNo ratings yet

- Corporate Finance Fundamentals GuideDocument223 pagesCorporate Finance Fundamentals GuideSuraj PawarNo ratings yet

- Time Value of MoneyDocument79 pagesTime Value of MoneyAsistio, Karl Lawrence B.No ratings yet

- Time Value of Money: Upon Completion of This Chapter, Students Should Be Able ToDocument39 pagesTime Value of Money: Upon Completion of This Chapter, Students Should Be Able ToAlya HanifahNo ratings yet

- RE ExamDocument2 pagesRE ExamTeh Yi HernNo ratings yet

- Marketing Management - Module 2Document20 pagesMarketing Management - Module 2Genner RazNo ratings yet

- Marketing Mangement - Module 3Document15 pagesMarketing Mangement - Module 3Genner RazNo ratings yet

- Marketing Management - Module 4Document27 pagesMarketing Management - Module 4Genner RazNo ratings yet

- APA 7th Format and Citation Student Guide ASCDocument42 pagesAPA 7th Format and Citation Student Guide ASCGenner RazNo ratings yet

- Marketing Mangement - Module 3Document15 pagesMarketing Mangement - Module 3Genner RazNo ratings yet

- GSD FO 27 Quantitative Research Format IMRAD C 1Document1 pageGSD FO 27 Quantitative Research Format IMRAD C 1Genner RazNo ratings yet

- Marketing Management - Module 1Document25 pagesMarketing Management - Module 1Genner RazNo ratings yet

- Marketing Management - Module 1Document25 pagesMarketing Management - Module 1Genner RazNo ratings yet

- To Sir RazDocument3 pagesTo Sir RazGenner RazNo ratings yet

- Marketing Management - Module 4Document27 pagesMarketing Management - Module 4Genner RazNo ratings yet

- GSD FO 27 Quantitative Research Format IMRAD C 1Document1 pageGSD FO 27 Quantitative Research Format IMRAD C 1Genner RazNo ratings yet

- Philippine Drama: A Concise GuideDocument10 pagesPhilippine Drama: A Concise GuideGenner RazNo ratings yet

- Financial StatementDocument3 pagesFinancial StatementGenner RazNo ratings yet

- Marketing Management - Module 2Document20 pagesMarketing Management - Module 2Genner RazNo ratings yet

- Student Practicum ReportDocument22 pagesStudent Practicum ReportGenner RazNo ratings yet

- Ratio Analysis AnswerDocument2 pagesRatio Analysis AnswerGenner RazNo ratings yet

- UntitledDocument1 pageUntitledGenner RazNo ratings yet

- Module 2Document12 pagesModule 2Genner RazNo ratings yet

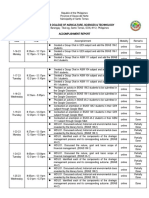

- Feb. 1-15,2023Document2 pagesFeb. 1-15,2023Genner RazNo ratings yet

- Jan.16-15 FulltimeDocument2 pagesJan.16-15 FulltimeGenner RazNo ratings yet

- Module 1Document14 pagesModule 1Genner RazNo ratings yet

- Philippine Lit - Unit 2Document11 pagesPhilippine Lit - Unit 2Genner RazNo ratings yet

- Extra Load Feb.1-15Document1 pageExtra Load Feb.1-15Genner RazNo ratings yet

- Part Time AugustDocument2 pagesPart Time AugustGenner RazNo ratings yet

- Philippine Lit - Unit 3Document8 pagesPhilippine Lit - Unit 3Genner RazNo ratings yet

- Santo Tomas College strategic management moduleDocument11 pagesSanto Tomas College strategic management moduleGenner RazNo ratings yet

- Bonsai ExplanationDocument3 pagesBonsai ExplanationGenner RazNo ratings yet

- A Fortfolio Management Case StudyDocument4 pagesA Fortfolio Management Case StudyGenner RazNo ratings yet

- Philippine LIt - Unit 1Document7 pagesPhilippine LIt - Unit 1Genner RazNo ratings yet

- Module 1Document14 pagesModule 1Genner RazNo ratings yet

- Finance 100Document865 pagesFinance 100jhamez16No ratings yet

- 9 - Segment ReportingDocument4 pages9 - Segment ReportingCathNo ratings yet

- ABC Activity 3 ProblemsDocument6 pagesABC Activity 3 ProblemsHzl ZlhNo ratings yet

- Chapter 04 AnsDocument4 pagesChapter 04 AnsDave Manalo100% (1)

- FM Project Report PDFDocument24 pagesFM Project Report PDFChandan MishraNo ratings yet

- Buisct FactoryDocument88 pagesBuisct Factorylop7317No ratings yet

- Project: Pmbok (Capm)Document2 pagesProject: Pmbok (Capm)Abdulla Jawad AlshemaryNo ratings yet

- IAS 23 Borrowing CostsDocument11 pagesIAS 23 Borrowing Costsksmuthupandian2098No ratings yet

- Warren E Buffett CaseDocument12 pagesWarren E Buffett Casemurary123No ratings yet

- Eleventh Regular Foreign Investment Negative List PromulgatedDocument8 pagesEleventh Regular Foreign Investment Negative List PromulgatedHansel Jake B. PampiloNo ratings yet

- Key factors for Airbnb's success or failureDocument2 pagesKey factors for Airbnb's success or failureVân Anh Phan100% (2)

- Private company can become publicDocument21 pagesPrivate company can become publicKiruba Anand100% (1)

- Harshad Mehta ScamDocument20 pagesHarshad Mehta ScamPooja AroraNo ratings yet

- Hkex New Entrusted Loan Arrangement 信达国际Document9 pagesHkex New Entrusted Loan Arrangement 信达国际Martin JpNo ratings yet

- DR Finan's A Basic Course in The Theory of Interest and Derivatives MarketsDocument677 pagesDR Finan's A Basic Course in The Theory of Interest and Derivatives MarketsErick Castillo100% (1)

- Singapore Property Weekly Issue 93 To 126 PDFDocument436 pagesSingapore Property Weekly Issue 93 To 126 PDFPrasanth NairNo ratings yet

- Product Life CycleDocument3 pagesProduct Life CycleHarry LobleNo ratings yet

- Singapore Institute of Management Financial Reporting ExamDocument21 pagesSingapore Institute of Management Financial Reporting Examduong duongNo ratings yet

- CIS7026 Business Process and Data Analysi1Document14 pagesCIS7026 Business Process and Data Analysi1victor oliverNo ratings yet

- Importance, Reasons and Benefits of Business PlanDocument7 pagesImportance, Reasons and Benefits of Business PlanMamaNo ratings yet

- Sec One 950123 05 2539Document161 pagesSec One 950123 05 2539Minh VănNo ratings yet

- Introduction To The Investment EnvironmentDocument51 pagesIntroduction To The Investment EnvironmentSaish ChavanNo ratings yet

- Deutsche Bank Indonesia - Annual Report - Deutsche Bank Cabang Indonesia - Laporan Tahunan 2011Document125 pagesDeutsche Bank Indonesia - Annual Report - Deutsche Bank Cabang Indonesia - Laporan Tahunan 2011yuanda syahfitraNo ratings yet

- Run On Nepal Bangladesh Bank LimitedDocument11 pagesRun On Nepal Bangladesh Bank LimitedRaju NiraulaNo ratings yet

- Weekend Effect and Stock ReturnsDocument3 pagesWeekend Effect and Stock Returnsthescribd94No ratings yet

- Rocky Road: The Irish Economy Since The 1920s by Cormac Ó'GrádaDocument256 pagesRocky Road: The Irish Economy Since The 1920s by Cormac Ó'GrádazoomtardNo ratings yet

- Transforming Company with Value AssuranceDocument40 pagesTransforming Company with Value Assurancezing65100% (5)

- Chapter-9 Strategy Analysis and ChoiceDocument39 pagesChapter-9 Strategy Analysis and ChoiceShradha Saxena50% (2)

- Bernardo Corporation Statement of Financial Position As of Year 2019 AssetsDocument3 pagesBernardo Corporation Statement of Financial Position As of Year 2019 AssetsJean Marie DelgadoNo ratings yet

- Principles of Managerial Finance Chapters 1Document50 pagesPrinciples of Managerial Finance Chapters 1sacey20.hbNo ratings yet