Professional Documents

Culture Documents

How To Master The Crypto Cosmos

Uploaded by

approvedOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

How To Master The Crypto Cosmos

Uploaded by

approvedCopyright:

Available Formats

How to Master the Crypto Cosmos:

A Comprehensive Guide to Spot Trading and Beyond

Prepared for CVB University

Created by Trade Vault Ltd.

In the ever-evolving landscape of cryptocurrencies, this comprehensive guide serves as a beacon

for both novices and seasoned traders alike. "How to Master the Crypto Cosmos" delves into the

intricate realms of spot trading, unraveling the enigmatic tapestry that weaves together technical

analysis, emotional alchemy, economic intricacies, and the transformative potential of emerging

technologies.

Whether you are navigating the cryptic waters of decentralized finance, deciphering the emotional

thermodynamics of trading, or exploring the alchemy of decentralized governance, this guide

provides the tools and insights needed to navigate the complex world of cryptocurrencies.

Embark on this journey, and let the whispers of the crypto cosmos be your guide.

Publish Date: 28 January 2024

Creator: Trade Vault Ltd. & Chat GPT

Owner: CVB University

Typer: xTrade Admin

What's Needed:

● Curiosity to explore the intricate realms of cryptocurrency trading.

● Dedication to mastering the principles outlined in each chapter.

● Willingness to adapt and learn as the crypto landscape evolves.

● An open mind to embrace the transformative potential of decentralized technologies.

● The desire to become not just a trader but a steward of change in the crypto cosmos.

Сonsult your own legal counsel about exact wording

This document is meant to serve as a reference

Chapter 1: The Cryptic Prelude

In the beginning, as Bitcoin's genesis block echoed through the digital corridors, so began our cryptic tale. Spot

trading emerged as the protagonist in this unfolding drama, a dance with assets in the vast arena of the

cryptosphere.

Question 1: What is the primary purpose of cryptocurrency spot trading?

The answer lies not in the explicit words, but in the rhythm of the narrative. Spot trading, a symphony of buy and

sell orders, holds the power to orchestrate gains and losses. As you traverse these pages, let the essence of this

purpose echo within.

Question 2: Define the term "wallet" in the context of cryptocurrencies.

The wallet, a vessel of cryptographic secrets, harbors the soul of digital wealth. Within its confines, security and

accessibility dance a delicate waltz. As the chapters unfold, look closely, and you might glimpse the key to

safeguarding this vessel.

Question 3: Explain the difference between a market order and a limit order.

Orders, akin to the sorcerer's spell, dictate the ebb and flow of the crypto realm. A market order is the

incantation of immediacy, while a limit order, a patient invocation, sets a specific cadence. The nuances are

painted in the strokes of the narrative; observe and unravel their magic.

The journey into the crypto cosmos has just begun. Let the whispers guide you, and as you decipher the

concealed truths, mastery over spot trading shall become your reward. The "Whispers of the Crypto Cosmos"

await your unraveling.

Сonsult your own legal counsel about exact wording

This document is meant to serve as a reference

Chapter 2: Echoes of Satoshi's Legacy

As we venture further into the cryptic expanse, we encounter the echoes of Satoshi's legacy—the foundational

resonance that birthed an entire digital universe. Within the labyrinth of decentralized brilliance, the tale of

Bitcoin's genesis unfolds.

Question 4: How does technical analysis differ from fundamental analysis in crypto trading?

In the shadow of candlestick patterns and trendlines, technical analysis unveils its enigmatic dance. Yet, on the

other side of the spectrum, fundamental analysis delves into the essence of blockchain projects. Their divergence

is not just in methodology but in the narratives they weave within the cryptic tapestry.

Question 5: What is the significance of trendlines in chart analysis?

Trendlines, the silent architects of price trajectories, sketch the journey of market sentiment. Observe their

subtle strokes as they carve stories on the charts. Within their angles, the significance unveils itself like

constellations in the night sky.

Question 6: Briefly explain the concept of candlestick patterns and how they are used in market analysis.

Candlestick patterns, the visual poetry of market movements, narrate tales of bulls and bears. Decipher the

language etched in the patterns—their wicks and bodies conceal the essence of price action, waiting for adept

eyes to interpret their rhythmic dance.

Сonsult your own legal counsel about exact wording

This document is meant to serve as a reference

Chapter 3: Unraveling the Tapestry

The cryptosphere's tapestry is intricate, woven with threads of risk and reward, strategy, and intuition. In this

chapter, we navigate through the warp and weft of spot trading, unraveling the concealed truths.

Question 7: Define the term "risk-reward ratio" and why it is important in trading.

Risk and reward, the twin forces that guide the trader's hand, are encapsulated in the delicate balance of the

risk-reward ratio. Discover its significance, not just as a numerical concept but as the heartbeat of strategic

decision-making in the cryptic realm.

Question 8: How can diversification help manage risk in a crypto portfolio?

Diversification, the armor against the storms of market volatility, transforms risk into a strategic advantage. It's

not merely spreading assets; it's the alchemy that turns vulnerability into resilience. In the chapters that follow,

witness how the diversified portfolio becomes a shield in the cryptic battleground.

Question 9: Explain one risk management strategy traders use to protect their capital.

Within the folds of risk management lies a strategy—a shield forged in the fires of experience. As you read on,

this strategy, with its subtle nuances, shall emerge like a guardian, shielding the capital from the unpredictable

tides of the market.

The echoes of Satoshi's legacy resonate through the tapestry, and the threads of risk and reward weave a

narrative that demands the reader's discernment. As you navigate these chapters, let the whispers guide you

through the labyrinth of crypto mastery. The "Whispers of the Crypto Cosmos" beckon you to unveil their secrets.

Сonsult your own legal counsel about exact wording

This document is meant to serve as a reference

Chapter 4: The Heralds of Hodl

In the heart of the cryptic domain, a term emerged—an incantation, a battle cry, and a philosophy. The term was

"Hodl," whispered through forums and social media, marking the birth of a unique strategy that transcends mere

trading.

Question 10: What is the "golden cross" in technical analysis, and how might traders interpret it?

Behold the golden cross—an omen inscribed on the charts. Its significance lies not just in its visual manifestation

but in the messages it carries. Interpret its movements, for within its golden embrace, traders find guidance and

conviction.

Question 11: Briefly describe the "Hodl" strategy and its origins in the crypto community.

In the midst of market fluctuations and volatility, a community forged a strategy—an ideology born out of

resilience and unwavering belief. Uncover the origins and philosophy of Hodl, for it is more than a strategy; it is a

testament to the steadfast spirit of the crypto community.

Question 12: How does leverage impact potential profits and losses in trading?

Leverage, the double-edged sword of the crypto realm, amplifies both triumphs and tribulations. Within the

narrative, traverse the terrain of leveraged trading, understanding its implications on potential profits and the

perilous precipice of losses.

Сonsult your own legal counsel about exact wording

This document is meant to serve as a reference

Chapter 5: Beyond the Veil of Analysis

As we delve deeper into the cryptic narrative, the chapters unfold like veils, each revealing a layer of

understanding that goes beyond the surface-level analysis.

Question 13: Define the term "moving average" and explain its role in trend analysis.

Moving averages, the spectral trails left by price movements, guide the discerning trader through the fog of

market trends. Unravel the mystery of moving averages as they become the compass in navigating the currents of

the cryptic seas.

Question 14: How do traders use the Relative Strength Index (RSI) in technical analysis?

The RSI, a subtle whisper in the oscillations of price, unveils the strength and weakness of an asset. Observe its

oscillations as they carve a melody in the market symphony, revealing the intricate dance between buyers and

sellers.

Question 15: Explain the concept of "support-turned-resistance" and its significance.

In the cryptic arena, support and resistance are not static entities; they morph and transform like shadows in the

night. Witness the metamorphosis of support into resistance and vice versa—a subtle but powerful phenomenon

that carries implications for market movements.

The heralds of Hodl beckon you further into the heart of the cryptic narrative. As you decipher the golden cross,

embrace the Hodl philosophy, and navigate the leverage-laden landscapes, the answers to the questions entwined

within the pages will reveal themselves. The "Whispers of the Crypto Cosmos" grow louder, urging you to seek

mastery in the layers beyond the veil.

Сonsult your own legal counsel about exact wording

This document is meant to serve as a reference

Chapter 6: The Alchemy of Fundamental Analysis

The cryptic journey takes a turn towards the profound realms of fundamental analysis—the alchemy that

transforms mere data into strategic insights and guides the discerning trader through the depths of project

evaluation.

Question 16: Name two factors that are considered in fundamental analysis of a cryptocurrency.

Fundamental analysis transcends price charts and delves into the essence of a project. Two factors, akin to

alchemical ingredients, form the foundation of this analysis. As you traverse these pages, grasp the significance

of these factors in unraveling the cryptic mysteries.

Question 17: How might news and events impact the price of a cryptocurrency in fundamental analysis?

In the crucible of the cryptic realm, news and events are catalysts that can ignite or dampen the flames of

market enthusiasm. Understand their influence, for within their ripples lie opportunities and pitfalls, waiting for

the adept trader to navigate.

Question 18: Explain the significance of a project's whitepaper in fundamental research.

A whitepaper, a manuscript of dreams and technological ingenuity, is more than a document—it is the blueprint of

a project's vision. Uncover the significance of this foundational artifact as it becomes a guiding star in the cryptic

cosmos.

Chapter 7: Navigating the Crypto Constellations

As we sail through the constellations of the crypto cosmos, the trader becomes an astronomer, gazing upon the

celestial bodies of projects and technologies.

Question 19: What is the purpose of CoinMarketCap, and how can traders use it for research?

CoinMarketCap, a celestial observatory of crypto assets, offers a panoramic view of the market sky. As you peer

through the lens, recognize its purpose and how it serves as a compass for traders navigating the vastness of the

cryptic constellations.

Question 20: Name a popular cryptocurrency exchange and outline two key features it offers to traders.

Cryptocurrency exchanges, the celestial hubs of trading activity, differ in their offerings and features. Identify a

prominent exchange and discern the two key features it provides, for within these features lie tools that

empower traders in their cosmic journeys.

The alchemy of fundamental analysis unfolds, and the constellations of the crypto sky become navigable. As you

discern the factors influencing fundamental analysis, comprehend the impact of news, and grasp the significance

of whitepapers, the trader's toolkit expands. The "Whispers of the Crypto Cosmos" guide you through this celestial

navigation, beckoning you to unveil the mysteries concealed within the alchemical process.

Сonsult your own legal counsel about exact wording

This document is meant to serve as a reference

Chapter 8: Social Media Alchemy and the Web3 Revolution

The cryptic journey takes a turn towards the dynamic intersection of social media and the revolutionary concept

of Web3. Within this chapter, the alchemy of community influence and the transformative power of decentralized

technologies are unveiled.

Question 21: How can social media platforms, such as Twitter, be used in crypto trading analysis?

Social media platforms are not mere platforms for socializing but powerful tools for market sentiment analysis.

Uncover the ways in which platforms like Twitter become alchemical crucibles, distilling the essence of

community chatter into valuable insights for the discerning trader.

Question 22: In the context of crypto, what does "Web3" refer to, and how might it shape the future of the

internet?

Web3, a term whispered in the corridors of technological innovation, is not just a concept but a paradigm shift.

Understand its cryptic definition and ponder upon its potential impact on the future of the internet. Within this

understanding lies the key to navigating the ever-evolving landscape of the digital realm.

Сonsult your own legal counsel about exact wording

This document is meant to serve as a reference

Chapter 9: Emerging Trends and Scarcity's Secret

As we navigate through the alchemical concoction of social media influence and the transformative power of

Web3, the cryptic journey leads us to the revelation of emerging trends and the secret held within scarcity.

Question 23: Name two emerging trends in the blockchain and cryptocurrency space.

The crypto realm is a dynamic landscape, continually evolving with emerging trends. Identify and understand two

trends that are shaping the future, for within these trends lie opportunities and challenges awaiting the astute

trader.

Question 24: Explain how the concept of scarcity relates to the value of certain cryptocurrencies.

Scarcity, a mystical force in the world of finance, breathes life into the value of cryptocurrencies. Explore its

cryptic connection with digital assets, as scarcity becomes the secret elixir that influences demand and value in

the crypto realm.

The alchemy of social media influence, the revolutionary essence of Web3, and the secrets of scarcity shape the

narrative. As you unravel the cryptic meanings within the chapters, the trader transforms into a sorcerer,

wielding the knowledge of emerging trends and scarcity's secret. The "Whispers of the Crypto Cosmos" echo

through the alchemical corridors, urging you to fathom the depths of these transformative concepts.

Сonsult your own legal counsel about exact wording

This document is meant to serve as a reference

Chapter 10: Decoding Emotional Alchemy in Trading

In the crucible of crypto trading, emotions are the elusive alchemy that can elevate or shatter strategies. Within

this chapter, the cryptic journey delves into the impact of emotions on trading decisions and the strategies to

master this emotional alchemy.

Question 25: How does the law of supply and demand influence the price of a cryptocurrency?

Supply and demand, the elemental forces of economics, converge in the crypto realm to shape price movements.

Understand the cryptic dance between these forces, for within their equilibrium lies the essence of market

dynamics.

Question 26: Briefly discuss the impact of emotions on trading decisions and strategies to manage them.

Emotions, the ethereal currents that surge through the trader's psyche, can lead to brilliance or downfall. Delve

into the impact of emotions on trading decisions, and learn the strategies that transform emotional turbulence

into calculated responses.

Chapter 11: FOMO, Hot, and Cold: The Emotional Thermodynamics of Trading

As we navigate the emotional alchemy, the chapters unfold like scrolls of ancient wisdom, revealing the FOMO

phenomenon and the contrasting realms of hot and cold wallets.

Question 27: Define the term "FOMO" in the context of crypto trading and explain its implications.

FOMO, the specter that haunts the markets, is more than an acronym—it is a force that can sway decisions. Grasp

its cryptic definition and ponder upon its implications, for within the fear of missing out lies the potential for

both triumph and peril.

Question 28: What are the primary differences between a hot wallet and a cold wallet?

Wallets, the vessels of digital wealth, come in different temperatures. Unravel the differences between hot and

cold wallets, understanding the nuances that make each suitable for specific crypto journeys.

The cryptic journey through emotional alchemy, supply and demand dynamics, and the realms of FOMO and

wallet temperatures unfold. As you navigate these chapters, the trader becomes an emotional alchemist,

mastering the arcane forces that influence decisions. The "Whispers of the Crypto Cosmos" resonate through the

emotional thermodynamics of trading, inviting you to grasp the cryptic keys hidden within the emotional realms.

Сonsult your own legal counsel about exact wording

This document is meant to serve as a reference

Chapter 12: ICOs, Risks, and Miner's Rewards: The Economic Alchemy

As the cryptic journey continues, we delve into the economic alchemy of ICOs, explore the risks intertwined with

them, and uncover the intricate mechanisms that drive miners in the crypto ecosystem.

Question 29: What does ICO stand for, and how does it differ from an IEO (Initial Exchange Offering)?

Initial Coin Offerings (ICOs) and Initial Exchange Offerings (IEOs) are not just acronyms; they represent distinct

chapters in the economic alchemy of crypto fundraising. Decipher the differences between ICOs and IEOs, for

within this understanding lies the key to navigating the fundraising landscape.

Question 30: Name two potential risks associated with investing in ICOs.

In the crucible of investment decisions, risks are the shadows that dance around potential rewards. Identify and

understand two risks inherent in ICO investments, for within the acknowledgment of risks lies the wisdom to

make informed decisions.

Question 31: Explain the role of miners in the blockchain and how they are rewarded.

Miners, the unsung heroes of the blockchain, engage in a form of economic alchemy as they secure networks and

validate transactions. Peer into the cryptic world of mining and understand the mechanisms by which miners are

rewarded, for within their efforts lies the stability of the entire crypto ecosystem.

Chapter 13: The Code of Smart Contracts and Regulatory Alchemy

In the next chapters of the cryptic odyssey, the journey leads us through the alchemy of smart contracts and

regulatory landscapes, where the code and compliance merge in a delicate dance.

Question 32: What is a smart contract, and how does it function in blockchain technology?

Smart contracts are more than lines of code; they represent a fundamental shift in how agreements are

executed. Delve into the cryptic world of smart contracts, understanding their essence and the transformative

role they play in blockchain technology.

Question 33: Why is regulatory compliance important for cryptocurrency exchanges and projects?

Regulatory compliance, the alchemy that bridges traditional and crypto landscapes, is not just a bureaucratic

necessity; it is a safeguard for participants in the crypto realm. Explore the reasons why compliance is crucial,

for within the understanding of regulatory landscapes lies the path to responsible innovation.

The economic alchemy of ICOs, miner's rewards, smart contracts, and regulatory landscapes unfold. As you

navigate these chapters, the trader becomes an economic alchemist, understanding the forces that shape the

economic foundations of the crypto realm. The "Whispers of the Crypto Cosmos" resonate through the economic

alchemy, inviting you to uncover the hidden truths within the economic mechanisms of the crypto world.

Сonsult your own legal counsel about exact wording

This document is meant to serve as a reference

Chapter 14: Know Your Crypto: The KYC Alchemy

The journey through the cryptic odyssey ventures into the realm of Know Your Customer (KYC) procedures—a

necessary alchemy in the crypto landscape. As we explore KYC, the intricacies of identity verification and user

protection come to light.

Question 34: Briefly explain the Know Your Customer (KYC) process in the context of crypto trading.

KYC is not just an administrative hurdle; it is a shield against illicit activities and a means of fostering a secure

trading environment. Unveil the cryptic layers of the KYC process, understanding its role in the protection of

users and the integrity of the crypto space.

Question 35: Define the term "altcoin" and provide an example.

Altcoins, the diverse siblings of Bitcoin, populate the cryptic universe. Decipher the cryptic definition of "altcoin"

and identify an example, for within the variety of altcoins lies a spectrum of opportunities for the discerning

trader.

Chapter 15: Ethereum's Emissary: The Alchemy of Decentralized Applications

As the odyssey continues, the spotlight turns to Ethereum—a beacon in the crypto cosmos. In this chapter, the

alchemy of decentralized applications (DApps) and Ethereum's transformative role unfolds.

Question 36: Describe the role of Ethereum in the cryptocurrency ecosystem.

Ethereum is not just a cryptocurrency; it is a platform that birthed a new era of possibilities. Explore the role of

Ethereum in the crypto ecosystem, for within its capabilities lies the potential to shape the decentralized future.

Question 37: How do smart contracts enable programmable and decentralized applications?

Smart contracts are the architectural blueprints of decentralized applications, ushering in an era of

programmable and trustless interactions. Uncover the alchemy of smart contracts, understanding how they

empower the creation of decentralized applications and redefine the nature of transactions.

The KYC alchemy, the altcoin spectrum, and the Ethereum emissary chapters reveal the layers of identity

verification, the diversity of cryptocurrencies, and the transformative role of Ethereum in the crypto landscape.

As you navigate these chapters, the trader becomes a KYC adept, a connoisseur of altcoins, and an emissary of

Ethereum's potential. The "Whispers of the Crypto Cosmos" guide you through the alchemical corridors, inviting

you to uncover the hidden truths within the realms of identity verification, diverse altcoins, and Ethereum's

transformative capabilities.

Сonsult your own legal counsel about exact wording

This document is meant to serve as a reference

Chapter 16: The DeFi Alchemy: Decentralizing Finance

The cryptic odyssey leads us into the revolutionary landscape of Decentralized Finance (DeFi). Within the DeFi

alchemy, traditional financial structures crumble, and a new paradigm emerges.

Question 38: What is DeFi, and how does it differ from traditional finance?

Decentralized Finance (DeFi) is not just a buzzword; it is a transformative force challenging the foundations of

traditional finance. Explore the cryptic definition of DeFi and grasp how it diverges from traditional financial

systems, for within this divergence lies the potential to reshape the future of finance.

Question 39: Name two types of decentralized financial products or services in the crypto space.

The DeFi landscape is a tapestry of innovative financial instruments. Identify and understand two types of

decentralized financial products or services, for within their functionalities lies the potential for redefining

financial interactions.

Chapter 17: The Altar of Altcoins: Unraveling the Altcycle

As we journey deeper into the cryptic cosmos, the spotlight turns to the alchemy of altcoins. The altcycle

unfolds—a rhythm of rises and falls that echo through the markets.

Question 40: How does the use case of a token impact its value in the market?

Tokens are not just symbols; they are vessels of utility and purpose. Grasp the cryptic connection between a

token's use case and its market value, for within this understanding lies the ability to discern the promising from

the ephemeral in the altcoin realm.

Question 41: How can traders use technical analysis to identify potential entry and exit points in the market?

Technical analysis is the compass that guides traders through the cryptic waves of price movements. Understand

how technical analysis becomes the key to identifying entry and exit points, for within the charts lie patterns

that foretell potential market directions.

The DeFi alchemy and the altcycle chapters delve into the transformative nature of decentralized finance and

the rhythmic cycles of altcoins. As you navigate these chapters, the trader becomes a DeFi pioneer, a connoisseur

of altcoins, and a skilled navigator of technical analysis. The "Whispers of the Crypto Cosmos" beckon you to

unveil the hidden truths within the realms of decentralized finance and altcoin cycles.

Сonsult your own legal counsel about exact wording

This document is meant to serve as a reference

Chapter 18: The NFT Renaissance: Artistry in the Crypto Cosmos

In this chapter, the cryptic odyssey takes a vibrant turn towards the NFT Renaissance—an artistic and cultural

phenomenon within the crypto cosmos.

Question 42: What does NFT stand for, and how do NFTs revolutionize ownership in the digital realm?

Non-Fungible Tokens (NFTs) are not just digital assets; they are the brushstrokes of a digital renaissance. Dive into

the cryptic definition of NFTs and unravel how they revolutionize the concept of ownership in the boundless

digital canvas.

Question 43: Name a popular blockchain platform for NFTs, and explain its significance in the NFT space.

Blockchain platforms provide the foundation for NFTs to flourish. Identify a prominent platform and understand

its significance in the NFT space, for within these platforms lies the stage for artists and creators to showcase

their digital masterpieces.

Chapter 19: The Crypto Futures: Forecasting the Unknown

As we traverse the NFT Renaissance, the journey leads us to the alchemy of crypto futures. In this chapter, we

explore the tools and strategies that enable traders to navigate the unpredictable paths of the crypto landscape.

Question 44: What are crypto futures, and how do they differ from spot trading?

Crypto futures are not just speculative contracts; they are instruments that allow traders to peer into the future

of markets. Decipher the cryptic definition of crypto futures and understand how they differ from the traditional

realm of spot trading.

Question 45: Briefly discuss one risk management strategy traders can employ in the futures market.

The futures market is a realm of potential rewards and pitfalls. Delve into one risk management strategy that

becomes the beacon guiding traders through the uncertain seas of futures trading. Within this strategy lies the

safeguard against the volatility that defines the crypto futures landscape.

The NFT Renaissance and the crypto futures chapters illuminate the artistic renaissance within the crypto cosmos

and equip traders with the tools to navigate the speculative futures market. As you navigate these chapters, the

trader becomes an appreciator of digital artistry, a participant in the NFT space, and a navigator of the futures

landscape. The "Whispers of the Crypto Cosmos" echo through the NFT renaissance and crypto futures, inviting

you to uncover the hidden truths within the realms of digital art and speculative futures.

Сonsult your own legal counsel about exact wording

This document is meant to serve as a reference

Chapter 20: The Regulation Conundrum: Legal Dimensions of Crypto

As the cryptic odyssey continues, we delve into the regulatory landscape—the multifaceted terrain where legality

intersects with the decentralized ethos of cryptocurrencies.

Question 46: Why is regulatory clarity important for the crypto industry, and how does it impact market

participants?

Regulatory clarity is more than legal formalities; it is the foundation upon which the crypto industry builds trust

and legitimacy. Unravel the cryptic reasons why regulatory clarity is crucial and understand its profound impact

on market participants.

Question 47: Briefly discuss the challenges posed by regulatory uncertainty in the crypto space.

Regulatory uncertainty casts a shadow over the crypto landscape, introducing challenges that ripple through the

markets. Delve into the nuances of these challenges, for within their understanding lies the wisdom to navigate

the uncertain legal currents.

Chapter 21: The Quantum Leap: Emerging Technologies in Crypto

In this chapter, the cryptic journey propels us into the future, exploring the quantum leap of emerging

technologies that promise to redefine the crypto landscape.

Question 48: Name one emerging technology that has the potential to transform the crypto space, and explain

its significance.

Emerging technologies are the catalysts of innovation within the crypto realm. Identify one technology and

unravel its significance, for within its transformative capabilities lies the potential to reshape the future of the

crypto landscape.

Question 49: Discuss the concept of quantum computing and its potential impact on cryptocurrency security.

Quantum computing is the harbinger of a new era, but its implications extend beyond innovation. Explore the

cryptic concept of quantum computing and understand its potential impact on the security of cryptocurrencies.

Within this understanding lies the preparation for the quantum age.

The regulation conundrum and the quantum leap chapters shed light on the legal intricacies of the crypto

landscape and the horizon of emerging technologies. As you navigate these chapters, the trader becomes a legal

adept, aware of the regulatory dimensions, and a visionary, prepared for the quantum leap in technologies. The

"Whispers of the Crypto Cosmos" echo through the legal and technological corridors, inviting you to unveil the

hidden truths within the realms of regulation and emerging technologies.

Сonsult your own legal counsel about exact wording

This document is meant to serve as a reference

Chapter 22: The Decentralized Governance Frontier

As the cryptic journey unfolds, we venture into the decentralized governance frontier—a realm where community

consensus and blockchain technology converge to shape the destiny of crypto projects.

Question 50: What is decentralized governance in the context of blockchain projects, and how does it empower

token holders?

Decentralized governance is not just a mechanism; it is a paradigm shift in decision-making. Delve into the

cryptic definition of decentralized governance and understand how it empowers token holders, for within this

governance model lies the potential for community-driven evolution.

Question 51: Name a popular decentralized finance (DeFi) project that utilizes decentralized governance, and

explain its significance.

Decentralized finance projects often embrace decentralized governance to foster community engagement.

Identify a prominent DeFi project and unravel its significance in utilizing decentralized governance, for within

these projects lies the embodiment of community-driven decision-making.

Chapter 23: The Social Impact Nexus: Cryptocurrencies and Beyond

In this chapter, the cryptic odyssey transcends the financial dimensions of cryptocurrencies, exploring their

potential for social impact and global change.

Question 52: Discuss one example of how cryptocurrencies have been used for social impact or charitable causes.

Cryptocurrencies are not just financial instruments; they are tools for change. Delve into one example illustrating

how cryptocurrencies have been employed for social impact or charitable causes. Within these narratives lies the

testament to the transformative potential of crypto in the real world.

Question 53: What challenges and opportunities arise when cryptocurrencies intersect with global social issues?

The intersection of cryptocurrencies and global social issues creates a tapestry of challenges and opportunities.

Explore the cryptic dynamics between cryptocurrencies and societal challenges, understanding the potential for

positive change and the obstacles that lie in the path.

The decentralized governance frontier and the social impact nexus chapters unveil the realms where community

consensus and blockchain technology intersect with social change. As you navigate these chapters, the trader

becomes a participant in decentralized governance, aware of the potential for social impact, and a steward of

change in the global context. The "Whispers of the Crypto Cosmos" echo through the decentralized corridors,

inviting you to unveil the hidden truths within the realms of decentralized governance and the social impact of

cryptocurrencies.

Сonsult your own legal counsel about exact wording

This document is meant to serve as a reference

Epilogue: The Odyssey Continues

As we conclude our journey through the pages of "How to Master the Crypto Cosmos," let these parting words

echo in the vast expanse of the crypto cosmos. The odyssey you've undertaken is not a destination but a

continuum, an ever-evolving exploration of the dynamic and transformative world of cryptocurrencies.

As a trader armed with the knowledge gained from this guide, you stand on the precipice of endless possibilities.

The crypto cosmos is a tapestry of innovation, and your journey is far from over. Markets will shift, technologies

will advance, and new frontiers will emerge.

Remember, the mastery of spot trading is not merely a skill; it's a mindset, a continuous commitment to learning,

adapting, and embracing the evolution of the crypto landscape. The whispers of the crypto cosmos will guide you

as you navigate the unknown, uncover hidden truths, and contribute to the unfolding narrative of this

decentralized revolution.

In the ever-shifting currents of the crypto world, remain vigilant, curious, and resilient. Forge connections with

fellow travelers, share insights, and contribute to the collective wisdom of the community. As the chapters of this

guide come to a close, let them be the stepping stones for your ongoing odyssey.

May your trades be prosperous, your analyses insightful, and your journey in the crypto cosmos be marked by

both challenges and triumphs. The future of decentralized finance, governance, and technology is in your hands.

The odyssey continues, and you, dear reader, are the protagonist of this ever-expanding tale. May your ventures

be bold, and may the whispers of the crypto cosmos guide you toward new horizons.

Safe travels, and may your crypto odyssey be filled with discovery, growth, and success.

Acknowledgments: I extend gratitude to all those who contributed to this guide, directly or indirectly, and to you,

the reader, for embarking on this odyssey with an open mind and a thirst for knowledge. May your crypto journey

be extraordinary.

Thanks

Сonsult your own legal counsel about exact wording

This document is meant to serve as a reference

You might also like

- The Cryptocurrency and Digital Asset Fraud CasebookDocument201 pagesThe Cryptocurrency and Digital Asset Fraud Casebookmoh1209No ratings yet

- Laurent Bernut - Algorithmic Short-Selling With Python - Refine Your Algorithmic Trading Edge, Consistently Generate Investment Ideas, and Build A Robust Long - Short Product-Packt Publishing (2021)Document377 pagesLaurent Bernut - Algorithmic Short-Selling With Python - Refine Your Algorithmic Trading Edge, Consistently Generate Investment Ideas, and Build A Robust Long - Short Product-Packt Publishing (2021)pardhunani143100% (4)

- Crypto Trading Secrets How To Earn Big in The Cryptocurrency MarketDocument25 pagesCrypto Trading Secrets How To Earn Big in The Cryptocurrency MarketSiddharth KaulNo ratings yet

- The Crypto Revolution: A Comprehensive Guide To Understanding And Trading CryptocurrenciesFrom EverandThe Crypto Revolution: A Comprehensive Guide To Understanding And Trading CryptocurrenciesNo ratings yet

- Crypto Trading For Ambitious Beginners A Practical Guide To Profitable Trading in Bitcoin and Other Cryptocurrencies (Schutte Jan Robert, Peters Jelle Etc.)Document161 pagesCrypto Trading For Ambitious Beginners A Practical Guide To Profitable Trading in Bitcoin and Other Cryptocurrencies (Schutte Jan Robert, Peters Jelle Etc.)naqibigamerz100% (1)

- Coti GIW Rep 26x28LSA PDFDocument3 pagesCoti GIW Rep 26x28LSA PDFjohan diazNo ratings yet

- Philip J. Romero - Tucker Balch - Hedge Fund Secrets - An Introduction To Quantitative Portfolio Management-Business Expert Press (2018)Document117 pagesPhilip J. Romero - Tucker Balch - Hedge Fund Secrets - An Introduction To Quantitative Portfolio Management-Business Expert Press (2018)Mohamed Hussien100% (1)

- Bondar - Stablecoins From Electronic Money On Blockchain To A Cryptocurrency Basket PDFDocument97 pagesBondar - Stablecoins From Electronic Money On Blockchain To A Cryptocurrency Basket PDFДмитрий БондарьNo ratings yet

- Guide - How To Invest in CryptocurrencyDocument28 pagesGuide - How To Invest in CryptocurrencyMuli sa EmmanuelNo ratings yet

- Model LLP AgreementDocument20 pagesModel LLP AgreementSoumitra Chawathe71% (21)

- Nuisance of TranslucenceDocument9 pagesNuisance of TranslucenceTumisang MasalelaNo ratings yet

- Module 1 For Acctg 3119 - Auditing and Assurance PrinciplesDocument21 pagesModule 1 For Acctg 3119 - Auditing and Assurance PrinciplesJamille Causing AgsamosamNo ratings yet

- Stock Trading: Dos And Don’ts To Make Stock Trading Profitable Even In Economic UncertaintiesFrom EverandStock Trading: Dos And Don’ts To Make Stock Trading Profitable Even In Economic UncertaintiesRating: 4.5 out of 5 stars4.5/5 (3)

- Dragons and Bulls - Profitable Investment StrategiesDocument147 pagesDragons and Bulls - Profitable Investment StrategiesAnonymous qtHTK6ONo ratings yet

- Crypto IntroDocument11 pagesCrypto IntroFY MicroNo ratings yet

- Chris Lowe - Bitcoin and Cryptocurrency Trading For Beginners How To Make Money Investing in Crypto Exchanges Using Technical Analysis and - Libgen - LiDocument128 pagesChris Lowe - Bitcoin and Cryptocurrency Trading For Beginners How To Make Money Investing in Crypto Exchanges Using Technical Analysis and - Libgen - LiAnish SharmaNo ratings yet

- Crypto Trading For Beginners: A Step-by-Step Guide to Making Consistent Money from Crypto TradingFrom EverandCrypto Trading For Beginners: A Step-by-Step Guide to Making Consistent Money from Crypto TradingRating: 5 out of 5 stars5/5 (1)

- Crypto Trading Mastery: Build Your Portfolios, Master trading strategies and Trade Crypto like a ProFrom EverandCrypto Trading Mastery: Build Your Portfolios, Master trading strategies and Trade Crypto like a ProNo ratings yet

- Inside the Black Box: A Simple Guide to Quantitative and High Frequency TradingFrom EverandInside the Black Box: A Simple Guide to Quantitative and High Frequency TradingRating: 3.5 out of 5 stars3.5/5 (6)

- BITCOIN, ETHEREUM AND CRYPTOCURRENCY TRADING AND INVESTING FOR BEGINNERS: What To Do With Privacy Coins And Smart Contract Blockchains In 2022 And BeyondFrom EverandBITCOIN, ETHEREUM AND CRYPTOCURRENCY TRADING AND INVESTING FOR BEGINNERS: What To Do With Privacy Coins And Smart Contract Blockchains In 2022 And BeyondNo ratings yet

- The Golden Age of Meme Coins: Navigating the Pre-2017 Crypto Market: The Rise of Meme Coins: Exploring the Pre-2017 Crypto Landscape, #2From EverandThe Golden Age of Meme Coins: Navigating the Pre-2017 Crypto Market: The Rise of Meme Coins: Exploring the Pre-2017 Crypto Landscape, #2No ratings yet

- Crypto Trading Unveiled: Navigating Profits in the Digital Currencies: A Comprehensive Guide to Cryptocurrency Trading – Master the Art, Understand Market Dynamics, and Unlock the Secrets to Sustained SuccessFrom EverandCrypto Trading Unveiled: Navigating Profits in the Digital Currencies: A Comprehensive Guide to Cryptocurrency Trading – Master the Art, Understand Market Dynamics, and Unlock the Secrets to Sustained SuccessNo ratings yet

- The Only Altcoin Investing Book You'll Ever Need: Unlocking the Secrets of Cryptocurrency: Strategies for Wealth, Freedom, and Impact in the Digital Finance RevolutionFrom EverandThe Only Altcoin Investing Book You'll Ever Need: Unlocking the Secrets of Cryptocurrency: Strategies for Wealth, Freedom, and Impact in the Digital Finance RevolutionNo ratings yet

- CryptoAlchemy: The Art of Profitable Trading for Beginners Unlocking Crypto Wealth: way to wealth, #16From EverandCryptoAlchemy: The Art of Profitable Trading for Beginners Unlocking Crypto Wealth: way to wealth, #16No ratings yet

- The Crypto Revolution: A Guide to Building Wealth with CryptocurrenciesFrom EverandThe Crypto Revolution: A Guide to Building Wealth with CryptocurrenciesNo ratings yet

- The Only Crypto Story You Need - Sal BayatDocument8 pagesThe Only Crypto Story You Need - Sal BayatA. O. GilmoreNo ratings yet

- Crypto Millionaire Handbook: A Comprehensive Guide to Cryptocurrency SuccessFrom EverandCrypto Millionaire Handbook: A Comprehensive Guide to Cryptocurrency SuccessNo ratings yet

- Cryptocurrency Boom, or Bubble - .Document11 pagesCryptocurrency Boom, or Bubble - .Team JobbersNo ratings yet

- The 5 Key PrinciplesDocument24 pagesThe 5 Key PrinciplesGHISLAIN N'ZINo ratings yet

- Crypto CurrenciesDocument18 pagesCrypto Currenciesศรุต พึ่งพระNo ratings yet

- Crypto Treasure Map: A Guide To Investing In Bitcoin And CryptocurrenciesFrom EverandCrypto Treasure Map: A Guide To Investing In Bitcoin And CryptocurrenciesNo ratings yet

- Crypto Horizons: Beyond Bitcoin: Unraveling the Potential of Altcoins and New Crypto ProjectsFrom EverandCrypto Horizons: Beyond Bitcoin: Unraveling the Potential of Altcoins and New Crypto ProjectsNo ratings yet

- Navigating the Crypto Jungle: A Day Trader's Guide to Surviving the Next Bull RunFrom EverandNavigating the Crypto Jungle: A Day Trader's Guide to Surviving the Next Bull RunNo ratings yet

- CryptocurrencyDocument1 pageCryptocurrencyTNo ratings yet

- Cryptocurrency Trading Guide- Unlocking the Secrets of Cryptocurrency Trading: A Step-by-Step Guide to Financial IndependenceFrom EverandCryptocurrency Trading Guide- Unlocking the Secrets of Cryptocurrency Trading: A Step-by-Step Guide to Financial IndependenceNo ratings yet

- Cryptocurrencies Have Been Gaining A Lot of Attention in Recent Years As A Potential Store of ValueDocument5 pagesCryptocurrencies Have Been Gaining A Lot of Attention in Recent Years As A Potential Store of ValuefadhlyhafizNo ratings yet

- En 1 70Document70 pagesEn 1 70Vitaliy KlimenkoNo ratings yet

- Lesson 1 Notes CryptocurrencyDocument6 pagesLesson 1 Notes CryptocurrencySeif KhaledNo ratings yet

- Money Without Boundaries: How Blockchain Will Facilitate the Denationalization of MoneyFrom EverandMoney Without Boundaries: How Blockchain Will Facilitate the Denationalization of MoneyNo ratings yet

- Crypto Craft: Cryptocurrency Market Dynamics: Analyzing Trends for Optimal Trading OutcomesFrom EverandCrypto Craft: Cryptocurrency Market Dynamics: Analyzing Trends for Optimal Trading OutcomesNo ratings yet

- BIS Working Papers: Understanding The Role of Debt in The Financial SystemDocument42 pagesBIS Working Papers: Understanding The Role of Debt in The Financial SystemFarinaNo ratings yet

- The Blockchain Revolution: Discover How Blockchain is Revolutionizing Money, Business, and the World: The Game-Changing Technology Behind Bitcoin!From EverandThe Blockchain Revolution: Discover How Blockchain is Revolutionizing Money, Business, and the World: The Game-Changing Technology Behind Bitcoin!No ratings yet

- Altcoin Secret Hacks: Altcoin Hacks They Do Not Want You To KnowFrom EverandAltcoin Secret Hacks: Altcoin Hacks They Do Not Want You To KnowNo ratings yet

- Brand New Line of Credit No Photo (2004)Document2 pagesBrand New Line of Credit No Photo (2004)parkparadigmNo ratings yet

- Smart Money, Dumb Money, and Learning Type From PriceDocument23 pagesSmart Money, Dumb Money, and Learning Type From Pricesatish sNo ratings yet

- Las diferentes criptomonedas disponibles y sus usos.: Economía DescentralizadaFrom EverandLas diferentes criptomonedas disponibles y sus usos.: Economía DescentralizadaNo ratings yet

- 12 Steps of Crypto Fundamental Analysis Series 1. Market CapDocument3 pages12 Steps of Crypto Fundamental Analysis Series 1. Market CapGiggly HadidNo ratings yet

- العملات الافتراضية - تقارير بنك التوسيات الدولى BISDocument6 pagesالعملات الافتراضية - تقارير بنك التوسيات الدولى BISWael HassanNo ratings yet

- Cryptocurrency For Beginners by William RickDocument109 pagesCryptocurrency For Beginners by William RickDaouia DendaniNo ratings yet

- Authorito Capital - WhitepaperDocument14 pagesAuthorito Capital - WhitepaperAnonymous FTp3tLP9ToNo ratings yet

- OSL - Blockchain & Cryptocurrency: A Primer 2023Document41 pagesOSL - Blockchain & Cryptocurrency: A Primer 2023Geoff K. ChengNo ratings yet

- Individual Assignment FIN657Document8 pagesIndividual Assignment FIN657Iman NadzirahNo ratings yet

- Unit 1 Iot An Architectural Overview 1.1 Building An ArchitectureDocument43 pagesUnit 1 Iot An Architectural Overview 1.1 Building An Architecturedurvesh turbhekarNo ratings yet

- Strother v. 3464920 Canada Inc.Document2 pagesStrother v. 3464920 Canada Inc.Alice JiangNo ratings yet

- Wiley CFA Test Bank 180527 (20 Preguntas)Document12 pagesWiley CFA Test Bank 180527 (20 Preguntas)rafav10No ratings yet

- Chapter 6 PRACTICING AS AN ETHICAL ADMINISTRATIONDocument8 pagesChapter 6 PRACTICING AS AN ETHICAL ADMINISTRATIONJR Rolf NeuqeletNo ratings yet

- CSE4003 - Cyber Security: Digital Assignment IDocument15 pagesCSE4003 - Cyber Security: Digital Assignment IjustadityabistNo ratings yet

- Topic 1 The Corporation and StakeholdersDocument3 pagesTopic 1 The Corporation and StakeholdersAprilNo ratings yet

- Freight CalculatorDocument2 pagesFreight CalculatorOverhauled ArtsNo ratings yet

- Working Capital Management (Bhavani)Document86 pagesWorking Capital Management (Bhavani)gangatulasiNo ratings yet

- Social Compact SummaryDocument5 pagesSocial Compact SummaryAlisa OngNo ratings yet

- Presentation 4 - Cost & Management Accounting - March 10, 209 - 3pm To 6pmDocument45 pagesPresentation 4 - Cost & Management Accounting - March 10, 209 - 3pm To 6pmBhunesh KumarNo ratings yet

- QC Senior Compliance Attorney in Washington DC Resume Tina GreeneDocument2 pagesQC Senior Compliance Attorney in Washington DC Resume Tina GreeneTinaGreeneNo ratings yet

- Unit-5&6 Inst. Support To Ent. in Nepal-2Document65 pagesUnit-5&6 Inst. Support To Ent. in Nepal-2notes.mcpu0% (2)

- Data Dictionary+Document4 pagesData Dictionary+Abirami SivakumarNo ratings yet

- Food DayDocument15 pagesFood DaydigdagNo ratings yet

- Customer Satisfaction Analysis For A Service Industry of Al-Arafah Islami Bank LimitedDocument25 pagesCustomer Satisfaction Analysis For A Service Industry of Al-Arafah Islami Bank LimitedOmor FarukNo ratings yet

- GPOA (PR Consultant)Document7 pagesGPOA (PR Consultant)Jeydrew TVNo ratings yet

- Hdpe Pipe Electro Fusion Fittings Price ListDocument18 pagesHdpe Pipe Electro Fusion Fittings Price ListSantiago MoraNo ratings yet

- John Cockerill Industry BrochureDocument15 pagesJohn Cockerill Industry BrochureEstelle CordeiroNo ratings yet

- G11 1ST SemDocument2 pagesG11 1ST SemKrichel Mikhaela CorroNo ratings yet

- MC4 Matcha Creations: (For Instructor Use Only)Document2 pagesMC4 Matcha Creations: (For Instructor Use Only)Reza eka PutraNo ratings yet

- Attempt All QuestionsDocument5 pagesAttempt All QuestionsApurva SrivastavaNo ratings yet

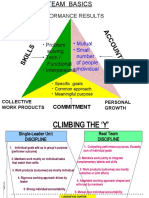

- Team BasicsDocument3 pagesTeam BasicsSoumya Jyoti BhattacharyaNo ratings yet

- Sage Pastel Partner Courses...Document9 pagesSage Pastel Partner Courses...Tanaka MpofuNo ratings yet

- Golden Rules For AccountingDocument4 pagesGolden Rules For AccountingRoshani ChaudhariNo ratings yet

- Midterm International Economics 2023Document4 pagesMidterm International Economics 2023Nhi Nguyễn YếnNo ratings yet

- Cambridge IGCSE™: Business Studies 0450/11Document23 pagesCambridge IGCSE™: Business Studies 0450/11eulalialamNo ratings yet

- Vendor DetailDocument4 pagesVendor DetailKamal PashaNo ratings yet