Professional Documents

Culture Documents

09 Understanding The Entity's Internal Control

Uploaded by

randomlungs121223Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

09 Understanding The Entity's Internal Control

Uploaded by

randomlungs121223Copyright:

Available Formats

ReSA - THE REVIEW SCHOOL OF ACCOUNTANCY

CPA Review Batch 45 May 2023 CPA Licensure Examination AT-09

AUDITING (Auditing Theory) J. IRENEO E. ARAÑAS F. TUGAS C. ALLAUIGAN

UNDERSTANDING THE ENTITY’S INTERNAL CONTROL

Audit Risk and Risk Assessment Procedures

Definition of Terms:

Audit Risk- the risk that financial statements may contain material misstatements (i.e., inherent and

control risks) coupled with the possibility that the auditor may fail to detect those material

misstatements those misstatements (i.e., detection risk) that may lead the auditor to express an

inappropriate audit opinion.

a. Risk of Material Misstatements (RMM)

- Inherent Risk

- Control Risk

b. Detection Risk

RISK ASSESSMENT PROCEDURES (RAP)

Objective:

The auditor shall design and perform risk assessment procedures to obtain audit evidence that

provides an appropriate basis for:

(a) The identification and assessment of risks of material misstatement, whether due to

fraud or error, at the financial statement and assertion levels; and

(b) The design of further audit procedures in accordance with ISA 330

PART II: Understanding the Components of the Entity’s System of Internal Control

A. Controls- Policies or procedures that an entity establishes to achieve the control objectives of

management or those charged with governance.

i. Policies are statements of what should or should not be done within the entity to

effect control.

ii. Procedures are actions to implement policies.

B. The auditor shall understand the Components of the Entity’s System of Internal

Control

System of internal control

1. The system designed, implemented, and maintained by

a. those charged with governance

b. Management

c. other personnel

2. Providing reasonable assurance about the achievement of an entity’s objectives

which include:

a. reliability of financial reporting

b. effectiveness and efficiency of operations

c. compliance with applicable laws and regulations.

Components of the Entity’s System of Internal Control

(i) Control environment;

(ii) The entity’s risk assessment process;

(iii) The entity’s process to monitor the system of internal control;

(iv) The information system and communication; and

(v) Control activities.

In the information system and communication and control activities components,

the controls are primarily direct controls. Direct controls are controls that are

sufficiently precise to prevent, detect, or correct misstatements at the assertion level.

In the control environment, the entity’s risk assessment process and the entity’s

process to monitor the system of internal control components, the controls are primarily

indirect controls (although there may be some direct controls, these are likely less in

these components). Indirect controls are controls that support direct controls.

C. Specific Consideration

The auditor shall obtain an understanding of the COMPONENTS relevant to the preparation

of the financial statements AND evaluate these components through performing risk

assessment procedures.

Page 1 of 7 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

UNDERSTANDING the ENTITY’S INTERNAL CONTROL AT-09

CONTROL ENVIRONMENT

UNDERSTAND EVALUATE

(a) Understanding the set of controls, processes and structures and

that address:

(b) Evaluating whether:

(i) How management’s oversight responsibilities are carried out,

such as the entity’s culture and (i) Management, with the oversight of

management’s commitment to integrity and ethical values; those charged with governance, has

created and maintained a culture

(ii) When those charged with governance are separate from of honesty and ethical behavior;

management, the independence of, and

oversight over the entity’s system of internal control by, (ii) The control environment provides an

those charged with governance; appropriate foundation for the other

components of the entity’s system of

(iii) The entity’s assignment of authority and responsibility; internal control, considering the

nature and complexity of the entity;

(iv) How the entity attracts, develops, and retains competent and

individuals; and

(iii) Control deficiencies identified in the

(v) How the entity holds individuals accountable for their control environment undermine the

responsibilities in the pursuit of the objectives of the system other components of the entity’s

of internal control, system of internal control.

RISK ASSESSMENT PROCESS

UNDERSTAND EVALUATE

(a) Understanding the entity’s process for: and

(i) Identifying business risks relevant to financial reporting (b) Evaluating whether the entity’s risk

objectives; assessment process is appropriate to

the entity’s circumstances considering

(ii) Assessing the significance of those risks, including the the nature and complexity of the

likelihood of their occurrence; and entity.

(iii) Addressing those risks;

MONITORING PROCESS

UNDERSTAND EVALUATE

(a) Understanding those aspects of the entity’s process that and

address:

(b) Evaluating whether the entity’s

(i) Ongoing and separate evaluations for monitoring the process for monitoring the system of

effectiveness of controls, and the identification and remediation internal control is appropriate to the

of control deficiencies identified; entity’s circumstances considering

the nature and complexity of the

(ii) The entity’s internal audit function, if any, including its entity.

nature, responsibilities and activities;

(b) Understanding the sources of the information used in the

entity’s process to monitor the system of internal control, and the

basis upon which management considers the information to be

sufficiently reliable for the purpose; and

Page 2 of 7 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

UNDERSTANDING the ENTITY’S INTERNAL CONTROL AT-09

INFORMATION SYSTEM & COMMUNICATION

UNDERSTAND EVALUATE

(a) Understanding the entity’s information processing activities, and

including its data and information, the

resources to be used in such activities and the policies that (c) Evaluating whether the entity’s

define, for significant classes of transactions, account balances information system and

and disclosures; communication appropriately

support the preparation of the

(i) How information flows through the entity’s information system, entity’s

including how: financial statements in accordance

with the applicable financial

a. Transactions are initiated, and how information about them is reporting framework.

recorded, processed, corrected as necessary, incorporated in

the general ledger and reported in the financial statements;

and

b. Information about events and conditions, other

than transactions, is captured, processed and

disclosed in the financial statements;

(ii) The accounting records, specific accounts in the FS and other

supporting records relating to the flows of information in the

information system;

(iii) The financial reporting process used to prepare the entity’s FS,

including disclosures; and

(iv) The entity’s resources, including the IT

environment, relevant to (a)(i) to (a)(iii) above;

(b)Understanding how the entity communicates significant matters

that support the preparation of the financial statements and

related reporting responsibilities in the information system and

other components of the system of internal control:

(i) Between people within the entity, including how financial

reporting roles and responsibilities are

communicated;

(ii) Between management and those charged with governance; and

(iii) With external parties, such as those with regulatory

authorities;

Definition of terms:

General information technology (IT) controls – Controls over the entity’s IT processes that

support the continued proper operation of the IT environment, including the continued effective

functioning of information processing controls and the integrity of information (i.e., the completeness,

accuracy and validity of information) in the entity’s information system. Also see the definition of IT

environment.

Information processing controls – Controls relating to the processing of information in IT

applications or manual information processes in the entity’s information system that directly address

risks to the integrity of information (i.e., the completeness, accuracy and validity of transactions and

other information).

IT environment – The IT applications and supporting IT infrastructure, as well as the IT processes and personnel

involved in those processes, that an entity uses to support business operations and achieve business strategies.

For the purposes of this ISA:

(i) An IT application is a program or a set of programs that is used in the initiation, processing, recording

and reporting of transactions or information. IT applications include data warehouses and report writers.

(ii) The IT infrastructure comprises the network, operating systems, and databases and their related

hardware and software.

(iii) The IT processes are the entity’s processes to manage access to the IT environment, manage program

changes or changes to the IT environment and manage IT operations.

Page 3 of 7 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

UNDERSTANDING the ENTITY’S INTERNAL CONTROL AT-09

CONTROL ACTIVITIES

UNDERSTAND EVALUATE

(a) Identifying (and understanding) controls that address risks of and

material misstatement at the assertion level in the control

activities component as follows: (d) For each control identified in (a) or

(c)(ii):

(i) Controls that address a risk that is determined to be a

significant risk; (i) Evaluating whether the control is

designed effectively to address the

(ii) Controls over journal entries, including nonstandard journal risk of material misstatement at

entries used to record nonrecurring, unusual transactions or the assertion level, or effectively

adjustments; designed to support the operation

of other controls; and

(iii) Controls for which the auditor plans to test operating

effectiveness in determining the nature timing and extent of (ii) Determining whether the control

substantive testing, which shall include controls that address has been implemented by

risks for which substantive procedures alone do not provide performing procedures in addition

sufficient appropriate audit evidence; and to inquiry of the entity’s personnel.

(iv) Other controls that the auditor considers to be appropriate to

enable the auditor to meet the objectives of RAP, based on the

auditor’s professional judgement.

(b) Based on controls identified in (a), identifying the IT

applications and the other aspects of the entity’s IT

environment that are subject to risks arising from the use of IT;

(c) For such IT applications and other aspects of the IT

environment identified in (b), identifying:

(i) The related risks arising from the use of IT; and

(ii) The entity’s general IT controls that address such risks;

D. Control Deficiencies

Based on the auditor’s evaluation of each of the components of the entity’s system of internal

control, the auditor shall determine whether one or more control deficiencies have been

identified.

E. Assessing Control Risk

A. If the auditor plans to test the operating effectiveness of controls, the auditor shall assess

control risk.

B. If the auditor does not plan to test the operating effectiveness of controls, the auditor’s

assessment of control risk shall be such that the assessment of the RMM is the same as the

assessment of inherent risk.

F. Documentation

The auditor shall include in the audit documentation the evaluation of the design of identified

controls, and determination whether such controls have been implemented.

G. Limitations of Internal Control

No matter how well designed and operated, IC can provide an entity with only reasonable

assurance about achieving the entity’s financial reporting objectives.

• human judgment in decision making

• breakdowns in internal control

• errors or mistakes

• collusion

Design, implementation, and monitoring of internal control varies depending on the entity’s

size and complexity of the processes.

Page 4 of 7 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

UNDERSTANDING the ENTITY’S INTERNAL CONTROL AT-09

MULTIPLE CHOICE QUESTIONS

1. Which of the following is incorrect statement in relation to internal controls?

A. Internal controls are process designed, implemented and maintained by those charged

with governance, management, and other personnel

B Internal controls provide absolute assurance about the achievement of the entity’s

objectives on financial reporting, operations, and compliance.

C. There is a direct relationship between an entity’s objectives and the controls it

implements to provide reasonable assurance about their achievement.

D. Effective control scan reduce the cost of external audit.

2. Internal controls maybe classified as?

I. Manual, automated or-IT-dependent controls

II. Preventive, detective or corrective controls.

A. I only B. II only C. Both I and II D. Neither I nor II

3. Internal control can only provide reasonable, not absolute, assurance of achieving entity control

objectives. Which of the following is a limiting factor of achieving those objectives?

I. In the performance of most control procedures, there are possibilities of errors arising from

mistakes in judgment.

II. The board of directors is active and independent.

III. The cost of internal control should not exceed its benefits.

IV. Collusion may occur even if incompatible functions or duties have been segregated.

A. I and III only B. I, II and III only C. I, III and IV only D. I, II, III and IV

4. Which of the following conditions supports strong internal control?

A. Strict monitoring by the Bureau of Internal Revenue.

B. The existence of related parties and related party transactions.

C. Pressure by the financial community to improve earnings performance.

D. An economic downturn.

5. Which of the following is not useful for obtaining an understanding of internal controls?

A. Observe client activities and operations C. Make inquiries of the client’s personnel

B. Examine documents and records D. Read industry trade magazines

6. Evaluate the following statements:

I. When obtaining an understanding of an entity's control environment, an auditor should

concentrate on the substance of management's policies and procedures rather than their form

because management may establish appropriate policies and procedures but not act on them.

II. In the assessment of control risk, the auditor is basically concerned that the client's internal

control provides reasonable assurance that errors and fraud have been prevented or detected.

A. Both statements are false C. Only the first statement is true

B. Both statements are true D. Only the second statement is true

7. The 5 components of the system of internal control have been split into two types that align with the

nature of the controls within each component, and may affect the auditor’s identification and assessment

of risks of material misstatement, as well as responding to the assessed risks. Which among these

components have controls that are primarily indirect controls?

I. Control environment

II. The entity’s risk assessment process

III. The entity’s process to monitor the system of internal control

IV. The information system and communication

V. Control activities.

A. I, II,III

B. I, IIII

C. IV,IV

D. II, IV, V

8. S1 The control environment does not directly prevent, or detect and correct, misstatements.

S2 Control environment may provide an appropriate foundation for the system of internal control

and may help reduce the risk of fraud, an appropriate control environment is not necessarily

an effective deterrent to fraud.

A. False, True

B. True, False

C. True, True

D. False, False

Page 5 of 7 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

UNDERSTANDING the ENTITY’S INTERNAL CONTROL AT-09

9. Which of the following statements best describes “control activities”?

A. The entity’sprocessforidentifyingbusinessrisksrelevanttofinancialreportingobjectives

and deciding about actions to address those risks, and the results thereof.

B. The system for transferring information from transaction processing systems to the general

ledger or the financial reporting system.

C. Policies and procedures that help ensure that management directives are carried out.

D. This includes the governance and management functions and the attitudes, awareness,

and actions of those charged with governance and management concerning the entity’s

internal control and its importance to the entity.

10. Which of the following is not an element of “control environment”?

A. Commitment to competence

B. Communication and enforcement of integrity and ethical values

C. Assignment of authority and responsibility

D. Leadership responsibilities for quality within the firm

11. Management’s attitude towards aggressive financial reporting and its emphasis on meeting

projected profit goals most likely would significantly influence an entity’s control environment

when:

A. Management is dominated by one individual who is also a shareholder.

B. External policies established by parties outside the entity affect its accounting practices.

C. The audit committee is active in overseeing the entity’s financial reporting policies.

D. Internal auditors have direct access to the board of directors and entity management.

12. An entity’s risk assessment process includes how management:

I. Identifies business risks relevant to financial reporting objectives

II. Estimates the significance of the risks

III. Assesses the likelihood of the occurrence of risks

IV. Decides on actions to address the risks.

A. I and III only B.I, II and III only C.I, III and IV only D.I, II, III and IV

13. Risks can arise or change due to circumstances such as the following, except:

A. There is a change in the regulatory or operating environment.

B. No new employees have been hired by the company.

C. The company switched from manual information systems to a computerized system.

D. The accounting and financial reporting framework has experienced significant revisions.

14. Which of the following pertains to risk assessment?

I. An audit client’s process for identifying business risks relevant to the financial reporting

objective

II. Business procedures, within both IT and manual systems, by which those transactions are

initiated, recorded, processed, corrected, transferred to the general ledger and reported

in the financial statements

III. Client policies on limiting physical access to assets and records

A. I and III only B. I only C.II and III only D.I, II and III

15. The information system consists of the following:

A. Infrastructure (physical and hardware components) and software

B. People

C. Procedures and data

D. All of these.

16. Control activities are the policies and procedures that help ensure that management directives are

carried out. These include activities relating to authorization, performance reviews, information

processing, physical controls and segregation of duties. There is proper segregation of duties when

an individual who

A. Authorizes a transaction records it.

B. Authorizes a transaction maintains custody of the asset that resulted from the transaction.

C. Records a transaction do not compare the accounting record of the asset with the asset itself.

D. Maintains custody of an asset has access to the accounting records for the asset.

Page 6 of 7 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

UNDERSTANDING the ENTITY’S INTERNAL CONTROL AT-09

17. The objective of the recording function of transactions (in the context of internal accounting control) is

to

A. Limit access to assets and to permit preparation of financial statements in accordance with GAAP.

B. Assure compliance with the rules of all regulatory bodies having jurisdiction over the reporting

entity.

C. Permit preparation of financial statements in accordance with GAAP and to maintain accountability

of assets.

D. Encourage operational efficiency and adherence to prescribed managerial policies.

18. Which of the following descriptions pertain to performance reviews?

A. Control activities that include reviews and analyses of actual performance versus budgets,

forecasts, and prior period performance.

B. Controls performed to check accuracy, completeness, and authorization of transactions.

C. Physical security of assets, including adequate safeguards such as secured facilities over access

to assets and records.

D. The assignment of incompatible functions to different people.

E. Control activities involving the specific or general authorization of a transaction.

19. An entity’s ongoing monitoring activities often include:

A. Periodic audits by the audit committee.

B. Reviewing the purchasing function.

C. The audit of the annual financial statements.

D. Control risk assessment in conjunction with quarterly reviews.

20. Which of the following is not a detective control?

A. The use of batch totals.

B. Reconciling the accounts receivable subsidiary file with the control account.

C. Requirement that two persons open mail.

D. Preparation of bank reconciliation.

21. Not an example of general transaction authorization is the:

A. Setting of automatic reorder points.

B. Establishment of sales prices.

C. Establishment of a customer’s credit limits.

D. Approval of a construction budget for a new warehouse.

22. A control that reduces the risk that an existing or potential control weakness will result in a failure

to meet a control objective is referred toas:

A. Compensating control C. Conditional control

B. Non-routine control D. Offset control

23. Which of the following is (are) a correct statement(s) for internal control systems of small

companies?

I. Elements of internal control for small entities may not be available in documentary form

II. Segregation of incompatible duties are often inadequate due to staff limitations

III. The involvement of the owner-manager may be a compensatory control for the inadequate

segregation of incompatible duties

A. I and III only B. II only C. II and III only D. I, II and III

24. According to PSA315, the auditor uses the understanding of internal control to:

I. Identify types of potential misstatements

II. Consider factors that affect the risk of material misstatements

III. Design the nature, timing and extent of further audit procedures (i.e., tests of controls and

substantive tests)

A. I and III only B. II only C. II and III only D. I, II and III

- END -

Page 7 of 7 0915-2303213 www.resacpareview.com

You might also like

- At.3508 - Considering Internal Controls and Assessing Control RiskDocument9 pagesAt.3508 - Considering Internal Controls and Assessing Control RiskJohn MaynardNo ratings yet

- At.3209 - Internal Control ConsiderationsDocument12 pagesAt.3209 - Internal Control ConsiderationsDenny June CraususNo ratings yet

- 02 Handout 1Document15 pages02 Handout 1Zednem JhenggNo ratings yet

- CIS SynthesisDocument10 pagesCIS SynthesisChristian AribasNo ratings yet

- Risk AsssesmentDocument13 pagesRisk Asssesmentutkarsh agarwalNo ratings yet

- Lecture Notes: Auditing Theory AT.0107-Understanding The Entity's Internal Control MAY 2020Document6 pagesLecture Notes: Auditing Theory AT.0107-Understanding The Entity's Internal Control MAY 2020MaeNo ratings yet

- AT.111 - Undestanding The Entity's Internal ControlDocument6 pagesAT.111 - Undestanding The Entity's Internal Controlandrew dacullaNo ratings yet

- Midterms 2Document2 pagesMidterms 2moreNo ratings yet

- 05GeneralInternalControl NotesDocument13 pages05GeneralInternalControl NotesMussaNo ratings yet

- At.3208-Understanding The Entity and Its EnvironmentDocument6 pagesAt.3208-Understanding The Entity and Its EnvironmentDenny June CraususNo ratings yet

- AU 9 Consideration of ICDocument11 pagesAU 9 Consideration of ICJb MejiaNo ratings yet

- Lecture 20 - Risk Assessment and Internal Control PDFDocument4 pagesLecture 20 - Risk Assessment and Internal Control PDFAruna RajappaNo ratings yet

- Group 3 - SECTION 404 AUDITS OF INTERNAL CONTROL AND CONTROL RISKDocument45 pagesGroup 3 - SECTION 404 AUDITS OF INTERNAL CONTROL AND CONTROL RISKFlamive VongNo ratings yet

- AT.3608 - Considering Internal Controls and Assessing Control RiskDocument9 pagesAT.3608 - Considering Internal Controls and Assessing Control Riskrichshielanghag627No ratings yet

- Understanding The Entity'S InternalcontrolDocument44 pagesUnderstanding The Entity'S Internalcontrolgandara koNo ratings yet

- Auditing Internal Control LectureDocument35 pagesAuditing Internal Control LectureSamsam RaufNo ratings yet

- Internal ControlDocument18 pagesInternal ControlJohn Cesar PaunatNo ratings yet

- Lesson 8 Overview of Internal ControlDocument4 pagesLesson 8 Overview of Internal ControlJoseph NashNo ratings yet

- At.3009-Internal Control ConsiderationsDocument9 pagesAt.3009-Internal Control ConsiderationsSadAccountant100% (1)

- AIS Reviewer 4Document2 pagesAIS Reviewer 4DANIELLE TORRANCE ESPIRITUNo ratings yet

- Isa 315 GermicDocument3 pagesIsa 315 GermicDanica Christele AlfaroNo ratings yet

- Chapter 2.2022 EnglishDocument59 pagesChapter 2.2022 Englishcamnhu622003No ratings yet

- Sulaiha Wati - Chapter 8 NewDocument6 pagesSulaiha Wati - Chapter 8 Newsulaiha watiNo ratings yet

- 14 and 15 - Overview of Internal Control Fraud and ErrorDocument7 pages14 and 15 - Overview of Internal Control Fraud and ErrorNiña YastoNo ratings yet

- MODULE 4 Control FrameworkDocument9 pagesMODULE 4 Control FrameworkEric CauilanNo ratings yet

- AUD 0 Finals MergedDocument41 pagesAUD 0 Finals MergedBea MallariNo ratings yet

- Part 2 Examination - Paper 2.6 (INT) Audit and Internal ReviewDocument12 pagesPart 2 Examination - Paper 2.6 (INT) Audit and Internal ReviewkhengmaiNo ratings yet

- CONSIDERATIONS OF ENTITY'S INTERNAL CONTROL Red Sirug Lecture NoteDocument7 pagesCONSIDERATIONS OF ENTITY'S INTERNAL CONTROL Red Sirug Lecture NoteMikaNo ratings yet

- Auditing IT Controls Part I: Sarbanes-Oxley and IT GovernanceDocument64 pagesAuditing IT Controls Part I: Sarbanes-Oxley and IT GovernanceJoness Angela BasaNo ratings yet

- (Retirada) ISA - 400 - Risk - Assessments - and - Internal - ControlDocument14 pages(Retirada) ISA - 400 - Risk - Assessments - and - Internal - ControlMiss LunaNo ratings yet

- Pemeriksaan Akuntansi I (Modul 9)Document19 pagesPemeriksaan Akuntansi I (Modul 9)Sri WulandariNo ratings yet

- Chapter 2 - Audit Strategy, Planning & Programming: Stages of Audit ExecutionDocument17 pagesChapter 2 - Audit Strategy, Planning & Programming: Stages of Audit Executionmaulesh bhattNo ratings yet

- 4 - AIS ReviewerDocument1 page4 - AIS ReviewerAira Jaimee GonzalesNo ratings yet

- BAB 5 Ed5 PDFDocument37 pagesBAB 5 Ed5 PDFAgus TinaNo ratings yet

- Audit Theory 8Document3 pagesAudit Theory 8CattleyaNo ratings yet

- Study Note 1Document2 pagesStudy Note 1Lurysa Ocate Dela CalzadaNo ratings yet

- Lecture Notes: Auditing Theory AT.0106-Understanding The Entity and Its Environment MAY 2020Document7 pagesLecture Notes: Auditing Theory AT.0106-Understanding The Entity and Its Environment MAY 2020MaeNo ratings yet

- Internal ControlDocument6 pagesInternal ControlVarun jajalNo ratings yet

- Chapter 6-8Document10 pagesChapter 6-8DeyNo ratings yet

- Risk Assessment - : Reported By: Jenny Mae E. Estioco, CPADocument41 pagesRisk Assessment - : Reported By: Jenny Mae E. Estioco, CPAJoyce Anne GarduqueNo ratings yet

- Lecture 1 Overview of AuditDocument24 pagesLecture 1 Overview of AuditMs. VelNo ratings yet

- Aud 1.3Document12 pagesAud 1.3Marjorie BernasNo ratings yet

- CHAPTER 3 Auditing-Theory-MCQs-by-Salosagcol-with-answersDocument2 pagesCHAPTER 3 Auditing-Theory-MCQs-by-Salosagcol-with-answersMichNo ratings yet

- CM 03 PsaDocument9 pagesCM 03 PsaLucy HeartfiliaNo ratings yet

- Risk of Material MisstatementDocument3 pagesRisk of Material Misstatementbobo kaNo ratings yet

- LS 2.80A - PSA 315 Identifying and Assessing The Risk of Material MisstatementDocument6 pagesLS 2.80A - PSA 315 Identifying and Assessing The Risk of Material MisstatementSkye LeeNo ratings yet

- Qiozzer At-Internal Control ConsiderationDocument11 pagesQiozzer At-Internal Control ConsiderationKyla de SilvaNo ratings yet

- Question Bank - Chapter 4BDocument9 pagesQuestion Bank - Chapter 4Bngcamusiphesihle12No ratings yet

- Internal Controls and Risk Management: Learning ObjectivesDocument24 pagesInternal Controls and Risk Management: Learning ObjectivesRamil SagubanNo ratings yet

- Chapter 11 Consideration of Internal ControlDocument30 pagesChapter 11 Consideration of Internal ControlPam IntruzoNo ratings yet

- Auditing and Assurance - Mock Test Paper - Answers - Oct 2022 - CA Inter (New)Document9 pagesAuditing and Assurance - Mock Test Paper - Answers - Oct 2022 - CA Inter (New)KM ASSOCIATESNo ratings yet

- Assurance Chapter-5 (04-09-2018)Document9 pagesAssurance Chapter-5 (04-09-2018)Shahid MahmudNo ratings yet

- Modul 13Document19 pagesModul 13Jangkarmas Textile142No ratings yet

- Unit 2: Internal ControlDocument9 pagesUnit 2: Internal ControltemedebereNo ratings yet

- Audit Theory Paper 7 August 2015 SolutionsDocument7 pagesAudit Theory Paper 7 August 2015 Solutionsahmad.khalif9999No ratings yet

- Ch-13 - Other Audit Considerations-1Document3 pagesCh-13 - Other Audit Considerations-1hoxhiiNo ratings yet

- Internal Control DocumentationDocument42 pagesInternal Control DocumentationJhoe Marie Balintag100% (1)

- Chapter 4 SalosagcolDocument3 pagesChapter 4 SalosagcolElvie Abulencia-BagsicNo ratings yet

- CONTROLSDocument3 pagesCONTROLSReyn BangayanNo ratings yet

- Public Office, Private Interests: Accountability through Income and Asset DisclosureFrom EverandPublic Office, Private Interests: Accountability through Income and Asset DisclosureNo ratings yet

- Sol. Man. - Chapter 5 - Books of Accounts and Double-Entry SystemDocument7 pagesSol. Man. - Chapter 5 - Books of Accounts and Double-Entry SystemTali0% (1)

- Sol. Man. - Chapter 7 - Posting To The LedgerDocument28 pagesSol. Man. - Chapter 7 - Posting To The LedgerPeter PiperNo ratings yet

- Sol. Man. - Chapter 1 - Introduction To AcctgDocument3 pagesSol. Man. - Chapter 1 - Introduction To AcctgAmie Jane MirandaNo ratings yet

- Sol. Man. - Chapter 4 - Types of Major AccountsDocument6 pagesSol. Man. - Chapter 4 - Types of Major AccountsAmie Jane MirandaNo ratings yet

- Sol. Man. - Chapter 8 - Adjusting Entries PDFDocument11 pagesSol. Man. - Chapter 8 - Adjusting Entries PDFPerdito John VinNo ratings yet

- Sol. Man. - Chapter 6 - Business Transactions and Their Analysis 1Document17 pagesSol. Man. - Chapter 6 - Business Transactions and Their Analysis 1Lableh Arpyah100% (3)

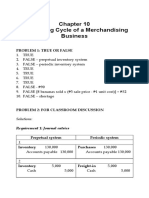

- Sol. Man. - Chapter 10 - Acctg Cycle of A Merchandising BusinessDocument65 pagesSol. Man. - Chapter 10 - Acctg Cycle of A Merchandising BusinessPeter Piper67% (3)

- Sol. Man. - Chapter 3 - The Accounting EquationDocument9 pagesSol. Man. - Chapter 3 - The Accounting EquationAmie Jane Miranda100% (2)

- Audit Theory 3 AccountingDocument6 pagesAudit Theory 3 Accountingrandomlungs121223No ratings yet

- Auditing Theory Test Bank Escala - pdf-14-18Document5 pagesAuditing Theory Test Bank Escala - pdf-14-18randomlungs121223No ratings yet

- Sol. Man. - Chapter 2 - Accounting Concepts and PrinciplesDocument3 pagesSol. Man. - Chapter 2 - Accounting Concepts and PrinciplesAmie Jane MirandaNo ratings yet

- Reo Consideration of Fraud Error and Noncompliance 9 14Document6 pagesReo Consideration of Fraud Error and Noncompliance 9 14randomlungs121223No ratings yet

- DocxDocument30 pagesDocxrandomlungs121223No ratings yet

- c3 ReviewerDocument42 pagesc3 Reviewerrandomlungs121223No ratings yet

- IT Audit CH 09Document23 pagesIT Audit CH 09randomlungs121223No ratings yet

- Quiz 2Document20 pagesQuiz 2randomlungs121223No ratings yet

- Final Requirement in AdvaccDocument143 pagesFinal Requirement in AdvaccShaina Kaye De Guzman100% (1)

- IT Audit 4ed SM Ch10Document45 pagesIT Audit 4ed SM Ch10randomlungs121223No ratings yet

- 15 Audit SamplingDocument7 pages15 Audit Samplingrandomlungs121223No ratings yet

- 1 Fundamentals of Auditing and Assurance Services RESADocument5 pages1 Fundamentals of Auditing and Assurance Services RESArandomlungs121223No ratings yet

- IT Audit 4ed SM Ch9Document62 pagesIT Audit 4ed SM Ch9randomlungs121223No ratings yet

- c3 ReviewerDocument42 pagesc3 Reviewerrandomlungs121223No ratings yet

- IT Audit 4ed SM Ch10Document45 pagesIT Audit 4ed SM Ch10randomlungs121223No ratings yet

- 04 Absorption & Variable Costing With Pricing DecisionsDocument6 pages04 Absorption & Variable Costing With Pricing Decisionsrandomlungs121223No ratings yet

- Resa ContractsDocument12 pagesResa ContractsArielle D.No ratings yet

- IT Audit 4ed SM Ch7Document10 pagesIT Audit 4ed SM Ch7randomlungs121223No ratings yet

- CooperativesDocument15 pagesCooperativesArielle D.No ratings yet

- 06C Investment Property & Other InvestmentsDocument8 pages06C Investment Property & Other Investmentsrandomlungs121223No ratings yet

- IT Audit 4ed SM Ch7Document10 pagesIT Audit 4ed SM Ch7randomlungs121223No ratings yet

- IT Audit CH 06Document23 pagesIT Audit CH 06randomlungs121223No ratings yet

- FDA Assignment NOV 2023Document9 pagesFDA Assignment NOV 2023skrsharma165No ratings yet

- P&A GipsyDocument558 pagesP&A GipsysmashfacemcgeeNo ratings yet

- Risk Aversion and Capital AllocationDocument38 pagesRisk Aversion and Capital AllocationVishwak SubramaniamNo ratings yet

- Analytics P&C Insurance v1Document1 pageAnalytics P&C Insurance v1Kunal DeshmukhNo ratings yet

- DRRR DLL 1 WeekDocument6 pagesDRRR DLL 1 WeekMichael Jhon Funelas MinglanaNo ratings yet

- 3.2 ESG IntegrationDocument7 pages3.2 ESG IntegrationChoi hiu lamNo ratings yet

- NHAI Safety Manual PDFDocument239 pagesNHAI Safety Manual PDFSonia MazumderNo ratings yet

- Cash-Flow Reporting Between Potential Creative Accounting Techniques and Hedging Opportunities Case Study RomaniaDocument14 pagesCash-Flow Reporting Between Potential Creative Accounting Techniques and Hedging Opportunities Case Study RomaniaLaura GheorghitaNo ratings yet

- IT Audit CH 12Document13 pagesIT Audit CH 12Ganessa RolandNo ratings yet

- Osh ReportDocument10 pagesOsh ReportUgeswran ThamalinggamNo ratings yet

- SSRN Id983342 PDFDocument80 pagesSSRN Id983342 PDFmanojNo ratings yet

- Risk Management PlanDocument19 pagesRisk Management PlanChinh Lê ĐìnhNo ratings yet

- (Construction Management Series) Bower, Denise-Management of Procurement-Thomas Telford, LTD (2003)Document275 pages(Construction Management Series) Bower, Denise-Management of Procurement-Thomas Telford, LTD (2003)daliaabdirNo ratings yet

- An Operational Approach To Ground Co - 2022 - Journal of Rock Mechanics and Geot PDFDocument15 pagesAn Operational Approach To Ground Co - 2022 - Journal of Rock Mechanics and Geot PDFRsmoothNo ratings yet

- Risk Management HandbookDocument32 pagesRisk Management HandbookMorais JoseNo ratings yet

- GCSE Combined Science PDFDocument198 pagesGCSE Combined Science PDFMpumelelo Langalethu MoyoNo ratings yet

- Annex B - Technical Proposal FormDocument3 pagesAnnex B - Technical Proposal FormSahibzada NizamuddinNo ratings yet

- PPSM, FST, UKM Semester II Session 2017/2018Document36 pagesPPSM, FST, UKM Semester II Session 2017/2018Allien WangNo ratings yet

- Public Science Public GoodDocument6 pagesPublic Science Public GoodAbilNo ratings yet

- CMC Markets Four Principles For Trading in The Zone Oct 2022Document16 pagesCMC Markets Four Principles For Trading in The Zone Oct 2022David BataNo ratings yet

- A New Breed of Battery: Investor PresentationDocument55 pagesA New Breed of Battery: Investor PresentationtempvjNo ratings yet

- Nebosh: Management of Health and Safety Unit Ng1: Unit Ngc1Document11 pagesNebosh: Management of Health and Safety Unit Ng1: Unit Ngc1juanjo caceres80% (10)

- McKinsey On Risk Issue 4Document56 pagesMcKinsey On Risk Issue 4servo haulingNo ratings yet

- What Are They? How Do They Differ From "Traditional" Investments?Document3 pagesWhat Are They? How Do They Differ From "Traditional" Investments?api-118535366No ratings yet

- Bozek-Risk AssessmentDocument7 pagesBozek-Risk AssessmentANAND MADHABAVINo ratings yet

- Preventing and Mitigating COVID-19 at Work: Policy Brief 19 May 2021Document21 pagesPreventing and Mitigating COVID-19 at Work: Policy Brief 19 May 2021Desy Fitriani SarahNo ratings yet

- Internal Control Policy (1) AustraliaDocument8 pagesInternal Control Policy (1) AustraliabulmezNo ratings yet

- The National Payment Systems Regulatory Sandbox FRAMEWORK, 2021Document12 pagesThe National Payment Systems Regulatory Sandbox FRAMEWORK, 2021Manvi PareekNo ratings yet

- A Project Report On 360 Degree Fiancial PlanningDocument133 pagesA Project Report On 360 Degree Fiancial PlanningRoyal ProjectsNo ratings yet

- Chartered Member Application GuidanceDocument20 pagesChartered Member Application GuidancemigelNo ratings yet