Professional Documents

Culture Documents

Meskerem Kidane Final

Uploaded by

likmezekerCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Meskerem Kidane Final

Uploaded by

likmezekerCopyright:

Available Formats

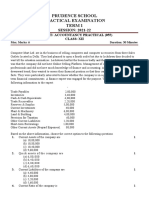

CBE- CREDIT UNIT NIFAS SILK DISTRICT

1. Basic Customer’s Information:

Borrower/Applicant: Meskerem Kidane Gudeta Date Business Established: 2011 E.C

Date Credit Relationship Started: New

Branch: Saris Abo Kelebet Branch

Business Address: Region: ---, City/Town: Addis Ababa, Nifas Total Applicant’s Credit Exposure: 3 million

Silk Lafto sub-city wereda, 06 Kebele --: H.No. 79/1 Sister Company/s Credit Exposure: N.A

Tel. No. +251911138762, P.O. Box. --, Fax No. --, E-mail: -- Credit Exposure Grand Total: 3 million

Customer Classification: Previous Credit Risk Grade: N.A

SME Current Credit Risk Grade:3

Corporate Risk grade of sister company(s): NA

Reason for change of Grade (in short): N.A

Ownership: Sole proprietor Collateral to the outstanding loan ratio: 279%

Business/Economic Sector: DTS Credit Facility Utilization: NA

Business type/Line: Cosmetics and Beauty Product Sales Policy Exception:

Trade License No. AA/NL/W06/14/666/773952/2011 Yes No

Date issued: 08/01/2011 E.C If Yes State Briefly:

Renewed for: 2015 E.C _________________________________________

Principal registration: AA/NL/W06/1/0006965/2011

TIN: 0025071567 PERFORMERS :

Financial Statement CRM : Henok Asefa

Provisional statement: 2021,2022 & 2023 A/CAO : Gedion Gebrehiwot

Interim: As of October,07/2023

Opinion: Unqualified Qualified Disclaimer Approving Team :

CAT –A CAT –B CAT –C

CAT –District

Items/ Period Value per 07.07.2022 07.07.2023

‘000 Date Application Received :

Contributed capital 50,000 50,000 By CRM : 07/05/2016 EC

Capital employed: 1,643,056.49 1,875,310.51 By CAO : 15/01/2024 @2 :00 local time

Tangible Net Worth: 1,693,056.49 1,925,310.51 Last document Received : 17/01/2024

Operating Profit Ratio: 22.58% 19.83% Case Complete on : 23/01/2024

Net Profit Ratio: 14.68% 12.89% Décision Date:

Current Ratio 1.88 1.98

Bank Debt/TNW ratio:

Total Liability/TNW ratio: 0.52 0.53

Net profit/loss: 1,643 1,875

Annex to LAF No. NSD/HA/0128/23 Meskerem Kidane Jan,2024 1

CBE- CREDIT UNIT NIFAS SILK DISTRICT

2. Current Request

The applicant, Meskerem Kidane Gudeta, under her credit application letter dated 25/08/2023

E.C. and CAF filled on 18/12/2015 EC. has requested working capital term loan of birr 3,000,000 to

be repaid within 5 years on semiannually basis.16.

3. Purpose of the request

As per the loan request letter, the applicant is engaged retail tread of different kind of sanitary

ware and cosmetics products. Sales are generated from wide range of high quality cosmetics

products. As per her letter of request dated 25/08/2023, the purpose of the fund is to purchase

sanitary ware and high quality cosmetics products, and for hiring additional employee to increase

amount of sales volume. Therefore, the purpose of the request is to relief from shortage of

working capital for running the business activity smoothly at full capacity.

4. Collaterals

The requested term loan is secured against the residential building in the name of Ato Kidane

Gudeta Denboba with LHC No 582/3/7/30761/01 located in Addis Abeba , Nifas Silk Lafto, Woreda

07,House No 341 , Estimation Value Birr 5,149,339.63 .

Estimated

Descriptions & Owner of the By Bank

Evidenced by Estimation Net

property Engineer

Value. collateral

on

value

residential building in the name of

LHC:No

Ato Kidane Gudeta Denboba with 25/10/2023

582/3/7/30761/01 5,149339.63 5,149,339.63

LHC No 582/3/7/30761/01

Less engineer remark 390,691.28 390,691.28

Total 4,758,648.63 4,758,648.63

Source; LAF NO, NSD/HA/0128/23 dated 16/01/2024

Engineer remarks

10.52 %(22.68 m2) of the compound area reserved for future rode expansion scheme

27.27% of Building C is in the area of future read expansion

260,460.85*1.5= 390,691.28

The lease agreement is not considered since it doesn’t provide clear information

Building C reduced by 11.29%

Annex to LAF No. NSD/HA/0128/23 Meskerem Kidane Jan,2024 2

CBE- CREDIT UNIT NIFAS SILK DISTRICT

Security Coverage Ratios:

Net Security Value to the requested term loan is

= 4,758,648.63/ 3,000,000=158%

Net Security Value to the recommended term loan

= 4,758,648.63/ 1,700,000.00 = 280% and the recommended term loan is sufficiently secured

5. Establishment, Management and owner of the business

5.1 Establishment and ownership

Ms. Meskerem Kidane Gudeta has started her business in retail trade of sanitary ware and

cosmetics business License Number AA/NL/W06/14/666/773952/2011 with Sole Proprietorship at

Nifas Sil Lafto Sub City Woreda 06 H.No 79/1 .The business was established in 2011E.C. with paid

up capital of Birr 50,000.00.

Business Premise of the customer is located at Mebrat Condominun infront of Venus commercial

Center The business shop is granted by rent for two years’ monthly birr 5,000.

5.2 Management Profile

As per the DDR of respective CRM dated 16/01/2024 the business is managed by Meskerem

Kidane Gudeta. She has more than 4 years’ experience in the same business. She also has Diploma

in marketing & sales.

6. OWNERSHIP AND BUSINESS LEGAL REQUIRMENT

OWNERSHIP

The business was established on 08/01/2011E.C formed as sole proprietorship. As per DDR dated

16/01/2024 the business is owned and managed by Meskerm Kidane Gudeta. The owner and

general manager of the business retail of a wide range of high quality cosmetics product.

The applicant presents following documents;

Renewed trade License.( when the loan Request is presented the license is Renewed but

now in the process of renewal it has expired)

Tax payer’s registration certificate and Tax clearance certificate.

Trade registration certificate.

Non-Marital certificate.

Power of attorney.

Rent agreement with legal opinion.

Saris Abo Kelebet branch confirmed that the applicant is not under mal operation list as

30/11/2023.

Rent agreement, current land tax repayment receipt etc.

Annex to LAF No. NSD/HA/0128/23 Meskerem Kidane Jan,2024 3

CBE- CREDIT UNIT NIFAS SILK DISTRICT

BUSINESS LEGAL REQUIRMENT;

Legal opinion

Regarding the power of attorney, the legal opinion has been given dated 02/02/2016 E.C

with reference number ///0597/2023 & it is possible to entertain the request of

applicant since the power of attorney fulfils legal requirement.

Regarding rent agreement; the legal opinion has been given dated 12/03/2016 E.C with

reference number ///0672/2023 & it is possible to entertain the request of

applicant since the power of attorney of the renter fulfils legal requirement.

7. KEY CUSTOMERS AND SUPPLIERS OF THE BUSINESS

The customer as per CAF dated 12/09/2023. Has not declared the any major customers and

suppliers of the business only engage in retail to any kind of customers.

S. no. Major Customers Major Suppliers

1 Various customers Various suppliers from Merkato & Dubai

Source: CAF

CREDIT EXPOSURE

The applicant Meskerem Kidane Gudeta as per NBE enquiry ID: 2093540 dated 22/12/2023 has not

a credit relationship with CBE.

Type of Amount/Limit Date Terms Outstanding Expiry Status

Loans/Facilities Approved Granted of balance as Date

Payment of

Term loan Nil Nil Nil Nil Nil

8.1 With the Other banks

The applicant Meskerem Kidane Gudeta as per NBE enquiry ID: 2093540 dated 22/12/2023 has a

credit relationship with other Banks as a spouse; but she provides us a non-marriage (single)

certificate document and also she wrote a justification about the relationship is only having a

child together.

Type of Amount/Limit Date Terms Outstanding Expiry Status

Loans/Facilities Approved Granted of balance as of Date

Payment 31/08/2023

1,300,000.00 30-11- 24 1,288,830.78 2025-12-

Term loan

2023 month 03

8. BORROWER’S ACCOUNT PERFORMANCE

9.1 Loan Account Performance:

Applicant is new to CBE and has not yet started credit relationship before.

Annex to LAF No. NSD/HA/0128/23 Meskerem Kidane Jan,2024 4

CBE- CREDIT UNIT NIFAS SILK DISTRICT

9.2 Deposit Performance

The customer as per CAF dated 16/01/2024. Does not have any major deposit performance with

the bank. the customer has no credit relationship with us, she doesn’t deposit but she promised to

channel the whole sales through CBE.

Period Sales Credit Ratio of sales

Turnover

7/7/2021 G.C 8,610,999.54 295,393.95 3%

7/7/2022 G.C 11,194,299.22 3,634,729.02 32%

2023 G.C 14,552,589.22 1,952,576.68 13%

Oct,30/2023 5,630,268.92 624,792.92 11%

Source: LAF NSD/HA/0128/23 dated 16/01/2024

From the above table we observe that the applicant’s sales turnover of three years’ average is 16 %.

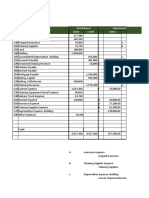

9. FINANCIAL STATEMENT ANALYSIS

Financial statement analysis is a judgmental process which aims to estimate current and past

financial positions and the results of the operation of a business, with primary objective of

determining the best possible estimates and predictions about the future conditions. As far as the

financial statements are concerned, the customer has submitted provisional financial statement of

2021,2022 and 2023. Interim financial statement as of 07/10/2023 is submitted.

Here are the most commonly used techniques of financial analysis: Trend and Ratio Analysis:

10.1 TREND ANALYSIS

Among the tools of Trend Analysis, the following are employed:

FIXED ASSET

As it is noted from provisional financial statements, fixed asset of the applicant shows decrement

trend from year to year. The fixed asset & office equipment and computers and printers has the

highest share of the fixed asset in all accounting periods.

Period ended 07/072021 07/07/2022 07/07/2023 07/10/2023

Account status provisional provisional provisional Interim

Fixed Assets- Property 1,074,389 907,467 936,737 989,046

Other Fixed Assets

FIXED ASSETS 1,074,389 907,467 936,737 989,046

Source: Financial Analysis Spreadsheet

Annex to LAF No. NSD/HA/0128/23 Meskerem Kidane Jan,2024 5

CBE- CREDIT UNIT NIFAS SILK DISTRICT

CURRENT ASSET

The current assets of the business in the three full years’ statement are composed of cash and

receivables in which Stock and Work in Progress took the largest share from the three years’

trend.

07/072021 07/072022 07/07/2023 07/10/2023

Cash and Bank Accounts 303,512 345,093 348,743 88,074

Stock and Work in Progress 688,142 675,304 816,442 133,540

Trade Debtors/Receivables 526,220 653,919 838,177 132,511

Other Debtors and Prepayments

Total current asset 378,811 848,568 1,817,550 354,125

Source: Financial Analysis Spreadsheet

CURRENT LIABILITY

The current liabilities of the business in the three full years are showing increasing trend which is

composed of current tax only in the reviewed years.

07/072021 07/072022 07/07/2023 07/10/2023

Bank Short Term Debt

Bank Long Term Debt (Current Portion)

Trade Creditors

Current Taxes 898,874.51 888,727.95 1,014,789.11 196,154.45

Shareholder/owner Accounts

Total current liability 891,874.51 888,727.95 1,014,789.11 196,154.45

Source: Financial Analysis Spreadsheet

SALES

Sales are generated from selling various types of cosmetics on daily basis. From three years’

provisional data the company’s sales trend from the year 2021 to 2023 shows increment from year

to year.

PERIOD ENDED 07/072021 07/072022 07/07/2023 07/10/2023

Net Sales 8,610,999 11,194,299 14,552,589 5,630,268

Sales growth 30.00% 30.01%

Source: Financial Analysis Spreadsheet

As it is shown from the table, the sales growth of 2022 & 2023 increased by 30% respectively from

cosmetics retail business.

Annex to LAF No. NSD/HA/0128/23 Meskerem Kidane Jan,2024 6

CBE- CREDIT UNIT NIFAS SILK DISTRICT

10.2 RATIO ANALYSIS

Ratio analysis is a quantitative method of gaining insight into a company's liquidity, operational

efficiency, and profitability by studying its financial statements such as the balance sheet and

income statement.

Liquidity Ratio

Liquidity ratios are financial ratios that measure a company’s ability to repay its obligations. The

liquidity ratio is used to determine the firm’s ability to pay its obligation without raising external

capital.

Period 3 years average

07/072021 07/072022 07/07/2023

Current Ratio

1.70 1.89 1.98 1.86

Quick Asset Ratio

0.93 1.13 1.17 1.08

Source: Financial Analysis Spreadsheet

Current Ratio

The current ratio measures a company’s ability to pay off short-term liabilities with current assets.

As it can be seen from above table, the average current liquidity ratio in the last three years is 1.86.

However, the current ratio for DTS above 1.75 - 2.5 is rated as Very Good & the businesses current

ratio is 1.86 & implies that, the business is in a Very Good position to discharge its short term

obligation (current liabilities) from current asset without it sales non-current assets. This implies

the company will have enough cash or other liquid assets to cover its immediate liabilities. so, the

business is lower risk of falling if suddenly faced with unexpected debt.

Quick Asset Ratio

Quick Asset ratio measures a company’s ability to pay off short –term liabilities with quick assets.

As it can be seen from above table, the average quick asset liquidity ratio in the last three years is

1.08 to 1 known standard of quick asset ratio is (1:1).

Leverage Ratio

The term 'leverage ratio' refers to a set of ratios that highlight a business's financial leverage in

terms of its assets, liabilities, and equity. It is used to assess the company’s long term solvency by

analyzing the proportion of the company’s equity and debt financing.

Leverage Ratio is any one of several financial measurements that look at what much capital comes

in the form of debt (loan) or assesses the ability of a company to meet its financial obligations.

Annex to LAF No. NSD/HA/0128/23 Meskerem Kidane Jan,2024 7

CBE- CREDIT UNIT NIFAS SILK DISTRICT

Period 3 Yrs. average

07/072021 07/07/2022 07/07/2023

Tangible Net Worth

1,700,388 1,693,056 1,925,311

Total Liabilities /Tangible Net Worth

0.52 0.52 0.53 0.52

Bank Debt/Tangible Net Worth

Source: Financial Analysis Spreadsheet

A gearing ratio between 51% and 125% is typically considered optimal or normal (no more than

half of the company’s asset should be financed by debt). As it is shown from the above table, three

years’ average is 0.52 and hence the business is not geared. The business has a higher proportion

of equity versus debt. For DTS leverage ratio 0.51_1.25 is very good, and the business leverage ratio

is in good condition, which means the customer’s debt is low; or the business has a higher

proportion of equity versus debt

10. Profitability Ratio

Profitability ratio measures a company’s profit relative to its expenses

period 3Yrs. average

07/072021 07/07/2022 07/07/2023

Net Sales Growth Rate (%) 30.00%

30.04% 30.01%

Gross Profit Margin (%) 34.17%

37.57% 37.56% 27.38%

Operating Profit Margin (%) 23.97%

29.50% 22.58% 19.83%

Net Profit Margin (%) 15.18%

19.17% 14.68% 12.89%

Source: Financial Analysis Spreadsheet

A good margin varies from industry and size of business. As per our credit business procedure,

DTS business operating profit margin > 6 is excellent and applicants operating profit ratio is 23.97

%. So, the business profitability is excellent as it is shown on the above table.

Turnover Ratio

A turnover ratio represents the amount of assets or liabilities that a company replaces in relation

to its sales. The Asset turnover ratio measures the efficiency of a company’s assets in generating

revenue or sales (how efficiently a company is using its assets). A higher ratio is favored because it

implies that the company is efficient in generating sales or revenues from its asset. A lower ratio

indicates that a company is not using its assets efficiently and may have internal problem.

PERIOD ENDED Average

07/072021 07/07/2022 07/07/2023

Sales to Asset Ratio 4.2

3.3 4.3 5.0

Sales to Fixed Asset Ratio 12

8.0 12.3 15.5

Annex to LAF No. NSD/HA/0128/23 Meskerem Kidane Jan,2024 8

CBE- CREDIT UNIT NIFAS SILK DISTRICT

Sales to Asset Ratio: how efficiently a company is using its assets: commonly 2.

From the above table three years’ average is 4.2 which are more than the bench mark which

implies the applicant extensive use of her asset; it implies that the company is efficient in

generating sales or revenues from its asset.

Sales to Fixed Asset Ratio: how efficient a company is at generating sales from its existing fixed

assets. The standard is five. When sales to fixed ratio is below 5 the business underutilizing and if

above 5 it is overtrading. Here, as we have seen from the above table the applicant overtrading the

fixed assets by the ratio of 12.

ACTIVITY RATIO (OPERATIONAL EFFICIENCY)

Activity ratios measure the efficiency of a business in using and managing its resources to

generate maximum possible revenue. The different types of activity ratios show the business'

ability to convert different accounts within the balance sheet such as capital and assets into cash

or sale. The following activity ratio can be assessed using the company stock turn over, debtor’s

turnover, creditors turnover and overall working capital cycle in days of business based on the

spread sheet of financial analysis. The following table shows the trend of activity ratios:

Working capital Mgt. 3 Years average

07/072021 07/07/2022 07/07/2023

Stock Turnover (Days) 37

47 35 28

Debtors Turnover (Days)

22 21 21 22

Creditors Turnover (Days)

Working Capital Cycle (Days)

69 57 49 58

Source: Financial Analysis Spreadsheet

Stock turnover days

Inventory turnover measures how often a business replaces inventory relative to its cost of sales.

It indicates how many days the firm averagely needs to turn its inventory into sales. Many experts

agree that good days of inventory can vary based on the product but on average between 30 and

60 days is acceptable. Generally, a lower inventory-holding period indicates good efficiency since

it indicates that less time is required for the stock to be realized as sales income so the average

days needs to convert inventory to cash 37 which is implies that a good management of stocks.

Debtors collection period

This is calculated as account receivable divided by annual credit sale multiplied by 365-days. A

shorter average collection period (60 days or less) is generally preferable and means a business

has higher liquidity. The average collection period of the firm in the last three years’ ranges from

Annex to LAF No. NSD/HA/0128/23 Meskerem Kidane Jan,2024 9

CBE- CREDIT UNIT NIFAS SILK DISTRICT

21 days to 22 days, & on average 22 days, which implies that the firm took 22 days to collect the

outstanding receivables. The applicant collects payments faster & this indicates the effectiveness

of applicant’s receivable management practices to ensure enough cash on hand to meet its

financial obligations.

Creditors payable period

The customer has no credit payable but in general, the creditor payment period measures the

average time it takes the company to pay its creditors. This is performance ratio which indicated

efficiency of the business. A good creditor ratio shouldn’t be too high or too low. If it is very high,

it means the company is waiting while to repay its debts which may damage relationships with

suppliers and even results termination of supplies in the future. A business is generally seen as

having good credit rating if it can pay debts within 30 -60 days.

Working Capital Cycle (Days)

Days working capital describes how many days it takes for the company to convert its working

capital into revenue. Companies that take fewer days to turn working capital into ales revenue are

more efficient than companies that take more days to generate the same amount of revenue. If

day’s working capital number is decreasing it might be due to an increase in sales. Conversely, if

the day of working capital is high or increasing, it could mean that sales are decreasing or perhaps

the business is taking longer to collect payments for its payables.

From the above table, the business takes on average 58 days to convert its working capital into

revenue. This implies the business will gate revenue 6.2 times per year and hence average time is

required for the business to get a good cash flow.

11. RISK ANALYSIS

Risk analysis is the process of identifying and analyzing potential issues that could negatively

impact key business initiatives or projects. Risk analysis involves examining how business

outcomes and objectives might change due to the impact of the risk event. There are different

types of risks in the business however we focus on the following risks.

Management Risk

As per the listed management profile on DDR of the CRM dated 03/01/2024 Meskerem Kidane

Gudeta is engaged a sanitary ware and cosmetics sale which is formed as Sole Proprietorship and

the business owned by Meskerm Kidane Gudeta who has 5 years of experience and sales and

Marketing Diploma. From its very nature of the business which formed as a sole proprietor, it

may face problem of business continuity and succession. However, family members are

Annex to LAF No. NSD/HA/0128/23 Meskerem Kidane Jan,2024 10

CBE- CREDIT UNIT NIFAS SILK DISTRICT

participating in the business willingly. Thus, in this regard the anticipated management or

ownership risk is moderate.

Business Risk

Sanitary ware and cosmetics product Demand is growing in Ethiopian. In many cities of the

country, growing health consciousness and awareness of the harmful effects bad chemicals used

in beauty and personal care products has driven the demand for products containing natural

ingredients. Africa consumers want low chemical products because of this Cosmo Market players

are focusing on producing beauty and personal care by those fact and market trend the Business

Risk of the firm is moderate.

Mitigating mechanisms

The business owner shall improve his quality of product.

Obey rules and regulations as per the agreement.

Additional working hours might be required to increase sales.

Building the capacity for higher market share.

Diversifying income sources.

Financial Risk

Comparing the ability to generate cash with the need for cash, including its use in repaying

obligations, is the most critical component of financial risk analysis. The applicant has presented

Provisional financial statements for the year 2021, 2022 & 2023 and interim period financial

statement. The financial performance of the business is satisfactory in terms of profitability &

leverage ratio and it has a moderate Risk Because we cannot depend on provisional financial

statement.

Collateral Risk

The collateral offered is residential building in the name of Ato Kidane Gudeta Denboba with

LHC No 582/3/7/30761/01 located in Addis Abeba, Nifas Silk Lafto, Woreda 07, House No 341,

Estimation Value less 27.27% building area is Birr 4,758,648.63. Therefore, it can be concluded

that the offered collateral is insurable, transferable to third body, easily convertible in to cash and

appreciated over time. Moreover, the collateral adequately covers the recommended term loan

and hence, associated collateral risk is minimal.

12. CURRENT REQUEST ASSESSMENT

The customer, Meskerem Kidane Gudeta in her application letter dated 18/12/2015 E.C and CAF

filled on same date requested fresh Term loan of birr 3,000,000 to be paid within 5 years on

Annex to LAF No. NSD/HA/0128/23 Meskerem Kidane Jan,2024 11

CBE- CREDIT UNIT NIFAS SILK DISTRICT

quarterly instalments secured against the offered collateral in the name of the guarantor Kidane

Gudeta Denboba. The applicant business revenue is from retail business on sanitary ware and

cosmetics product. The main goal providing customer oriented sales service with integrity,

accountability, clarity and prompt retail service in order to have sustainable business growth.

The reason behind additional working capital request is due to difficulty of the applicant to work

with full capacity because of shortage of working capital which is used for building a business that

will strive on its own cash flow without the need for another capital injection from external source

ones the business officially running, the applicant brought business plan to show future operative

and financial forecast of the business.

Business plan

The applicant presented a business plan which shows her business future main operations and

financial forecasts for sanitary ware and cosmetics business.

Sales Revenues

As per presented business plan, the applicant planned to sale 18,190,736 in the first year the total

sales revenues of the business during the plan periods are depicted in the table below.

Projected Years

Description

1 2 3

Annual Revenues 18,190,736 24,698,008 29,637,610

Source: business plan.

13. WORKING CAPITAL DETERMINATION

There is no specific way in which working capital should be financed. In general Investment in

current asset is realized during the firms operating cycle which is usually less than a year.

Different methods are used to determine the working capital requirement of business, for this

case we consider the cost of goods method and based on presented business plan.

THE COST OF GOODS SOLD METHOD

The following data available from previous 3 years’ financial statements.

PERIOD ENDED 07/072021 07/07/2022 07/07/2023 3Yrs. average

PERIOD LENGTH (DAYS) 365 365 365

Net Sales 8,611 11,194 14,553

Cost Of Goods Sold 5,376 6,989 10,568

CGS Ratio 60.1% 60.1% 72.1% 64.14%

Sales growth rate 30.00% 30.01% 30.00%

Source: Financial Analysis Spreadsheet

Annex to LAF No. NSD/HA/0128/23 Meskerem Kidane Jan,2024 12

CBE- CREDIT UNIT NIFAS SILK DISTRICT

Scenario I: Based on historical sales performance (CGS method)

Assumptions;

The sales growth rate in the three years 30.00% and we take this growth rate to forecast

next year sales based on 2023 sales (base year). The actual base year (2023) sales for the

year ended on 07 July, 2023 was Birr 14,552,589

The forecasted sale for next year will be 14,552,589.22 *1.300= Birr 18,918,366

Since the working cycle days from actual is 58 days, the working capital cycle of the

business is 6.26 (365/58)

Average cost of goods sold ratio is 64%.

Net current asset of the business as per the recent Interim financial statement is Birr

157,970.31

Scenario II: Based on customer business plan

A forecasted sale of the business plan is = 18,190,737

Average cost of goods sold ratio from historical sales is 64%

Scenario I Scenario II

A. Forecasted sales

18,918,366.00 18,190,737.00

B Cost of goods sold (64%)

12,107,754.05 11,642,072.00

C. Average working capital cycle

6.26 6.26

D. Net working capital requirement per one cycle (B/C)

1,934,146.01 1,859,755.91

E. Net current asset (Interim FS)

157,970.31 157,970.31

F Available unutilized facility

0 0

G. Net Working capital requirement (D-(F+E))

1,776,175.70 1,701,785.60

Working capital determination under Scenario I show that the business requires birr

1,776,175.70 additional finance.

Working capital determination under Scenario II shows that the business requires birr

1,701,785.60 additional finance.

Concluding Remarks

Based on the facts stated in the above two scenarios the applicant’s working capital requirement

determination in the actual business performance, the business requires 1,776,175.70 additional

working capital and in the business plan case it requires 1,701,785.60. Here, I prefer to stick to

some logical justifications.

Annex to LAF No. NSD/HA/0128/23 Meskerem Kidane Jan,2024 13

CBE- CREDIT UNIT NIFAS SILK DISTRICT

The customer requests birr 3,000,000 to be repaid within 5 years on quarterly instalments.

The Net value of the offered collateral is birr 4,758,648.63

Since the customer is new, the risk grade is 3.

Moreover, the offered collateral Net Value is 4,758,648.63 birr. Due to these facts, the under

writer recommends 1,700,000.00 birr (280 % of the collateral value even if customer is new and

credit worthiness is not attested yet) to be repaid within 3 years on quarterly instalments against

the offered collateral.

Projected profit and loss & Cash flow statement

Projected Profit and Loss statement for 3 years

The projected profit and loss statement is computed based on the following assumptions.

Forecasted revenue for 2016 E.C based base years’ sales is birr 18,918,366

Interest rate of recommended loan is incorporated.

Admin and operating expense is calculated based on trend against sales of the previous

years. The average admin expense against sales for the last two years is 9.0%

Depreciation assumed to be constant which is 213,431

Forecasted Profit and Loss statement of the business

Item Years

I 2 3

Revenue 18,918,366.00 24,593,875.80 31,972,038.54

Cost of sale 12,107,754.24 15,740,080.51 20,462,104.67

Gross Profit 6,810,611.76 8,853,795.29 11,509,933.87

Less : Depreciation -213,431.00 -213,431.00 -213,431.00

Less : Interest expenses -438,318.49 -290,005.58 -115,499.05

Less: Operating Expense -142,745.13 -142,745.13 -142,745.13

Operating Income 6,016,117.14 8,207,613.58 11,038,258.69

Tax 2,087,641.00 2,872,664.75 3,863,390.54

Net Income after tax 3,928,476.14 5,334,948.83 7,174,868.15

Source: own computation from business plan

As it is shown in the table above, the business will generate net income after tax birr

3,928,476.14, 5,334,948.83and 7,174,868.15 in the next three years.

Annex to LAF No. NSD/HA/0128/23 Meskerem Kidane Jan,2024 14

CBE- CREDIT UNIT NIFAS SILK DISTRICT

Forecasted cash flow of the business

Item Years

I 2 3

Beginning balance 1,788,073.00 667,137.55 1,388,947.22

Net Income after tax 3,928,476.14 5,334,948.83 7,174,868.15

Add Depreciation 213,431.00 213,431.00 213,431.00

Sub total 5,929,980.14 6,215,517.38 8,777,246.37

Less: principal repayment -839,818.08 -988,131.00 -1,154,782.94

End cash balance 5,090,162.06 5,227,386.38 7,622,463.44

As it is depicted from the above table, the forecasted cash flow for the next 3 years portrays that

the applicant business will have a capacity to repay the loan within 3 years.

14. SWOT ANALYSIS

Strength /Opportunity

The business is running profitably

The applicant has five years of experience in the business;

The cash flow projection and the income statement shows the applicant will be

profitable and generate positive cash flow.

Weakness/Threats

The business is sole proprietor it may face the issue of successor and business continuity.

Higher competition from the same business.

The customer is new and its credit worthiness is not yet attested.

15. Exception: NA

16. Condition:

i. As per memo dated 14.11.2023, portion of the recommended loan should be

credited to suppliers account.

ii. Trade license should be renewed

17. BASIS OF RECOMMENDATION

The business requires additional working capital.

Profitable business.

Good working capital management.

Adequate collateral coverage

Annex to LAF No. NSD/HA/0128/23 Meskerem Kidane Jan,2024 15

CBE- CREDIT UNIT NIFAS SILK DISTRICT

The cash flow projection and the income statement shows the applicant will be profitable

and generate positive cash flow

For referral marketing from the same business.

18. RECOMMENDATION

Based on the above analysis, I hereby recommend a fresh working capital term loan of birr

1,700,000 Birr to be repaid within three years on quarterly bases of repayment against the offered

collateral.

Advice to CRM

The CRM should follow up her deposit performance & end use of fund.

____________________

Gedion Gebrehiwot

Credit Appraisal Officer

January, 2024

Annex to LAF No. NSD/HA/0128/23 Meskerem Kidane Jan,2024 16

You might also like

- Education LoanDocument2 pagesEducation Loanzuheb80% (10)

- Form B VXL Realtors Pvt. Ltd.Document8 pagesForm B VXL Realtors Pvt. Ltd.Vikram Singh BaidNo ratings yet

- Standard Bank Vehicle and Asset Finance Dealer Commission ScheduleDocument3 pagesStandard Bank Vehicle and Asset Finance Dealer Commission ScheduleLelani Van Der Merwe100% (1)

- California Infrastructure Projects: Legal Aspects of Building in the Golden StateFrom EverandCalifornia Infrastructure Projects: Legal Aspects of Building in the Golden StateNo ratings yet

- Rockboro Machine Tools Corporation: Source: Author EstimatesDocument10 pagesRockboro Machine Tools Corporation: Source: Author EstimatesMasumi0% (2)

- Letter of Credit DetailsDocument3 pagesLetter of Credit Details배동식No ratings yet

- Bajaj Housing Finance Limited: Loan Details Customer DetailsDocument7 pagesBajaj Housing Finance Limited: Loan Details Customer DetailsOm PandyaNo ratings yet

- Entrepreneurship Relevance to SHS StudentsDocument7 pagesEntrepreneurship Relevance to SHS StudentsAndrea Grace Bayot AdanaNo ratings yet

- Purchase and Refinance Mortgage Process: A Handbook and Guide for Real Estate Mortgage!From EverandPurchase and Refinance Mortgage Process: A Handbook and Guide for Real Estate Mortgage!No ratings yet

- SS en 934-6-2008 (2015)Document16 pagesSS en 934-6-2008 (2015)Heyson JayNo ratings yet

- Education Loan InterestDocument1 pageEducation Loan Interestravi lingam100% (2)

- Bsa - Finman - SyllabusDocument13 pagesBsa - Finman - SyllabusAbdulmajed Unda MimbantasNo ratings yet

- Lender Provides $25M Loan to Indonesian CooperativeDocument16 pagesLender Provides $25M Loan to Indonesian CooperativeVILATUZ100% (2)

- Privatization and Management Office v. Court of Tax AppealsDocument7 pagesPrivatization and Management Office v. Court of Tax AppealsBeltran KathNo ratings yet

- Muhaba ShewmoloDocument11 pagesMuhaba Shewmolosabrinzo zomaNo ratings yet

- Firehiwote Shimelis Follow Up-1Document21 pagesFirehiwote Shimelis Follow Up-1Melak YizengawNo ratings yet

- TINYIKDocument1 pageTINYIKVee-kay Vicky KatekaniNo ratings yet

- hemanth sanction ltrDocument1 pagehemanth sanction ltralive_incompleteNo ratings yet

- Solution - 9.1 - Audit Observation Memo On Breaches of WarrantiesDocument3 pagesSolution - 9.1 - Audit Observation Memo On Breaches of WarrantiesrickmortyNo ratings yet

- Ms Winled HK Cables Wire Products Co LTD Vs Ms Velankani Electronics PVT LTD Nclat ChennaiDocument7 pagesMs Winled HK Cables Wire Products Co LTD Vs Ms Velankani Electronics PVT LTD Nclat Chennaimokshgodani45No ratings yet

- Jotting SheetDocument107 pagesJotting SheetVignesh NarayananNo ratings yet

- Abel DanielDocument7 pagesAbel Danielfirehiwotmisganaw3No ratings yet

- Notice demanding payment for goods suppliedDocument4 pagesNotice demanding payment for goods suppliedSandeep Kumar GuptaNo ratings yet

- Hinglaj Light Renewal 2018Document4 pagesHinglaj Light Renewal 2018jitendra tirthyaniNo ratings yet

- Certificates Revised 18042022Document102 pagesCertificates Revised 18042022sreedev sureshbabuNo ratings yet

- 4559908728-September-2022 22 00 32.41928-September-2022 22 00 32.651Document75 pages4559908728-September-2022 22 00 32.41928-September-2022 22 00 32.651Kasthuri PNo ratings yet

- Adugna Shibabaw (Waklara Import & Export) LC Settlement Annex 2023Document13 pagesAdugna Shibabaw (Waklara Import & Export) LC Settlement Annex 2023Meseret LemmaNo ratings yet

- Complain Info - Funds Non ReceiptDocument1 pageComplain Info - Funds Non ReceiptVinod KumarNo ratings yet

- Dihp23254 11620557ab52w7kdo5Document1 pageDihp23254 11620557ab52w7kdo5hemant sharmaNo ratings yet

- M dt.16.05.2023 - Ms Duttcon Consultant Engrs P Ltd. KolkataDocument5 pagesM dt.16.05.2023 - Ms Duttcon Consultant Engrs P Ltd. Kolkataduttcon engineeringNo ratings yet

- Charge Slip - 1708623292755Document8 pagesCharge Slip - 1708623292755Sachin ChaudharyNo ratings yet

- GM Default - 240308 - 182301Document8 pagesGM Default - 240308 - 182301Raghu DattaNo ratings yet

- HDFC Bank LTDDocument2 pagesHDFC Bank LTDLogesh Waran Kml100% (1)

- Ref. No.: HO/Credit/ . Tfi.'f/2021 - 22 Date: 09.03.2022: UU UcobankDocument1 pageRef. No.: HO/Credit/ . Tfi.'f/2021 - 22 Date: 09.03.2022: UU UcobankRavi PaliwalNo ratings yet

- Helena Catharina de BeerDocument4 pagesHelena Catharina de BeerKennedy SimumbaNo ratings yet

- 83453460Document6 pages83453460utkarshlegal96No ratings yet

- Pol 129298Document2 pagesPol 129298summu paulNo ratings yet

- DiviDocument6 pagesDiviDeena dayalanNo ratings yet

- 2224 HomeLoan1Document1 page2224 HomeLoan1Tirumalesha DadigeNo ratings yet

- 20.2.3.0030WT Authorization For DrawdownDocument4 pages20.2.3.0030WT Authorization For DrawdownHùng NguyễnNo ratings yet

- Summit ACJ Food Service ContractDocument36 pagesSummit ACJ Food Service ContractAllegheny JOB WatchNo ratings yet

- Adobe Scan Aug 01, 2022Document1 pageAdobe Scan Aug 01, 2022biswajit prustyNo ratings yet

- Loan Term Sheet - 06 - 33 - 30Document7 pagesLoan Term Sheet - 06 - 33 - 30COSMO WELDNo ratings yet

- Mcqs Based On Bank'S Circulars During July, 2021Document8 pagesMcqs Based On Bank'S Circulars During July, 2021Shilpa JhaNo ratings yet

- FN File RequisitionDocument20 pagesFN File RequisitionMayur JadejaNo ratings yet

- NBFCDocument6 pagesNBFCSandeep KhuranaNo ratings yet

- Chandni Devani Co-Operative Banking Its Credit Appraisal MechanismDocument20 pagesChandni Devani Co-Operative Banking Its Credit Appraisal MechanismManasi VichareNo ratings yet

- Case CommentaryDocument7 pagesCase CommentaryHritik KashyapNo ratings yet

- StatementDocument10 pagesStatementchefrinkuNo ratings yet

- KB220502AIMCU - Sanction Letter PDFDocument3 pagesKB220502AIMCU - Sanction Letter PDFRatnesh ShuklaNo ratings yet

- Shyam KVAP235716-11848293KU1VBTQNMWDocument1 pageShyam KVAP235716-11848293KU1VBTQNMWMasood RabbaniNo ratings yet

- Sanction Letter FAST7651617444854859 371328176989144Document7 pagesSanction Letter FAST7651617444854859 371328176989144hm7072302No ratings yet

- Truck Proposal TLDocument10 pagesTruck Proposal TLwamiqhasanNo ratings yet

- 1684303940-ITA No.1070-D-2022 - Havells India LTDDocument5 pages1684303940-ITA No.1070-D-2022 - Havells India LTDArulnidhi Ramanathan SeshanNo ratings yet

- KVWB227127 112213836u6e7sat7rDocument1 pageKVWB227127 112213836u6e7sat7rMOSTOFA SHAMIM FERDOUSNo ratings yet

- Signature-1Document6 pagesSignature-1Phumi PhumiNo ratings yet

- 83492564 (1)Document6 pages83492564 (1)utkarshlegal96No ratings yet

- Lightfield Less Lethal Research Contract With Allegheny County JailDocument30 pagesLightfield Less Lethal Research Contract With Allegheny County JailAllegheny JOB WatchNo ratings yet

- Versus: Efore Anmohan AND Anjeev ArulaDocument9 pagesVersus: Efore Anmohan AND Anjeev Arulaveer vikramNo ratings yet

- SignatureDocument13 pagesSignatureVee-kay Vicky KatekaniNo ratings yet

- 426 PTT HH 322214Document2 pages426 PTT HH 322214ESS AARNo ratings yet

- 83453460-2Document6 pages83453460-2utkarshlegal96No ratings yet

- UCV4622 Civil Procedure II Midterm QuestionDocument3 pagesUCV4622 Civil Procedure II Midterm QuestionHairi ZairiNo ratings yet

- GST - High Court directs Respondents to allow ISD credit correctionDocument17 pagesGST - High Court directs Respondents to allow ISD credit correctionJAYKISHAN VIDHWANINo ratings yet

- The Art of Persuasion: Cold Calling Home Sellers for Owner Financing OpportunitiesFrom EverandThe Art of Persuasion: Cold Calling Home Sellers for Owner Financing OpportunitiesNo ratings yet

- Just Dial Limited Letter of OfferDocument68 pagesJust Dial Limited Letter of Offervarun_bhuNo ratings yet

- Contract Law - Premium ChocolatesDocument9 pagesContract Law - Premium Chocolatesprathmesh agrawalNo ratings yet

- ABBA - Annual Report 2019Document232 pagesABBA - Annual Report 2019Bambang HarsonoNo ratings yet

- Financial Statements ExercisesDocument3 pagesFinancial Statements ExercisesNaresh Sehdev100% (1)

- Do a SWOT analysis for business ideasDocument4 pagesDo a SWOT analysis for business ideasOliver SyNo ratings yet

- Chapter 2 The Concept of Audit Syllabus 2023Document88 pagesChapter 2 The Concept of Audit Syllabus 2023nguyenanleybNo ratings yet

- GOPRO Written Case DraftDocument3 pagesGOPRO Written Case DraftBritney BissambharNo ratings yet

- Empowering Others Through DelegationDocument8 pagesEmpowering Others Through DelegationMonique LasolaNo ratings yet

- MANGILIMAN, Neil Francel Domingo (Sep 28)Document8 pagesMANGILIMAN, Neil Francel Domingo (Sep 28)Neil Francel D. MangilimanNo ratings yet

- E ChoupalDocument8 pagesE ChoupalRakesh NandanNo ratings yet

- Tyco fraud investigation timelineDocument12 pagesTyco fraud investigation timelineSumit Sharma100% (1)

- Principles of Business SBADocument26 pagesPrinciples of Business SBAChillTrap StateNo ratings yet

- Prudence School Accountancy Practical ExamDocument2 pagesPrudence School Accountancy Practical Examicarus fallsNo ratings yet

- CH 3Document17 pagesCH 3FBusinessNo ratings yet

- No. Account Title Trial Balance Adjustments Debit Credit DebitDocument7 pagesNo. Account Title Trial Balance Adjustments Debit Credit DebitJoanah Aquino100% (1)

- OST Report - Christ UniversityDocument44 pagesOST Report - Christ UniversityRNo ratings yet

- Comparative Analysis of Advantages and Disadvantages of The Modes of Entrying The International MarketDocument9 pagesComparative Analysis of Advantages and Disadvantages of The Modes of Entrying The International MarketTròn QuayyNo ratings yet

- House RentDocument4 pagesHouse RentMayurNo ratings yet

- Ez Mill: Low-Cost Portable Hammer Mill Helps Small FarmersDocument37 pagesEz Mill: Low-Cost Portable Hammer Mill Helps Small FarmersANIME CHANNo ratings yet

- Ifr-Apc 311Document8 pagesIfr-Apc 311hkndarshanaNo ratings yet

- Economics of The AirlinesDocument40 pagesEconomics of The AirlinesAdriel M.No ratings yet

- Evoe MarketingDocument1 pageEvoe MarketingSwapnil NagareNo ratings yet

- Analysts See Upside in These Stocks Like Netflix & TeslaDocument14 pagesAnalysts See Upside in These Stocks Like Netflix & TeslaBenjamin ChongNo ratings yet

- Circular Guidelines and Schedule of Design Engineering Module ForDocument3 pagesCircular Guidelines and Schedule of Design Engineering Module ForAnmol KingNo ratings yet

- Semper Avanti - InfopackDocument9 pagesSemper Avanti - InfopackFlorinel Valentin AlbuNo ratings yet