Professional Documents

Culture Documents

ACK660988680240723

Uploaded by

Harsh JainOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACK660988680240723

Uploaded by

Harsh JainCopyright:

Available Formats

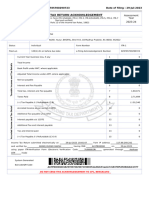

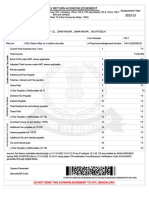

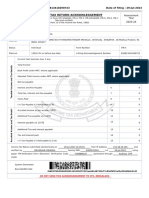

Acknowledgement Number:660988680240723 Date of filing : 24-Jul-2023*

INDIAN INCOME TAX RETURN ACKNOWLEDGEMENT Assessment

[Where the data of the Return of Income in Form ITR-1(SAHAJ), ITR-2, ITR-3, ITR-4(SUGAM), ITR-5, ITR-6, ITR-7 Year

filed and verified]

(Please see Rule 12 of the Income-tax Rules, 1962) 2023-24

PAN ALVPJ3994J

Name DIVYA JAIN

Address C - 6,Anand Niketan , Awanti Vihar, Shankar Nagar, Raipur, 33-Chhattisgarh, 91-India, 492007

Status Individual Form Number ITR-4

Filed u/s 139(1)-On or before due date e-Filing Acknowledgement Number 660988680240723

Current Year business loss, if any 1 0

Total Income 2 3,94,240

Taxable Income and Tax Details

Book Profit under MAT, where applicable 3 0

Adjusted Total Income under AMT, where applicable 4 3,94,240

Net tax payable 5 0

Interest and Fee Payable 6 0

Total tax, interest and Fee payable 7 0

Taxes Paid 8 0

(+) Tax Payable /(-) Refundable (7-8) 9 0

Accreted Income and Tax Detail

Accreted Income as per section 115TD 10 0

Additional Tax payable u/s 115TD 11 0

Interest payable u/s 115TE 12 0

Additional Tax and interest payable 13 0

Tax and interest paid 14 0

(+) Tax Payable /(-) Refundable (13-14) 15 (+) 0

Income Tax Return submitted electronically on 24-Jul-2023 19:37:20 from IP address 49.36.18.203 and

verified by DIVYA JAIN having PAN ALVPJ3994J on 24-Jul-2023 using paper ITR-

Verification Form /Electronic Verification Code 7U98BB5WHI generated through Aadhaar OTP mode

System Generated

Barcode/QR Code

ALVPJ3994J02660988680240723be4dee5bcdb03ef926f75816af593b06fcc168bc

DO NOT SEND THIS ACKNOWLEDGEMENT TO CPC, BENGALURU

*If the return is verified after 30 days of transmission of return data electronically, then date of verification will be considered as date of

filing the return (Notification No.05 of 2022 dated 29-07-2022 issued by the DGIT (Systems), CBDT).”

You might also like

- Final Self Hypnosis Paperback For PrintDocument150 pagesFinal Self Hypnosis Paperback For PrintRic Painter100% (12)

- 2020 07 21 14 18 51 966 - 1595321331966 - XXXPA5493X - Acknowledgement PDFDocument1 page2020 07 21 14 18 51 966 - 1595321331966 - XXXPA5493X - Acknowledgement PDFVasanth Kumar AllaNo ratings yet

- 2020 10 17 15 39 31 472 - 1602929371472 - XXXPP3112X - Acknowledgement PDFDocument1 page2020 10 17 15 39 31 472 - 1602929371472 - XXXPP3112X - Acknowledgement PDFParmeshwar PrasadNo ratings yet

- PDF 487599040240820Document1 pagePDF 487599040240820kotasrihariNo ratings yet

- 829785700290723-Manoj BakshDocument1 page829785700290723-Manoj BakshArchana BakshNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearAmiya Ranjan PaniNo ratings yet

- Itr 22-23 PDFDocument1 pageItr 22-23 PDFPixel computerNo ratings yet

- Umesh ITR A.Y. 2023-2024Document1 pageUmesh ITR A.Y. 2023-2024swatigrv2004No ratings yet

- PDF - 933662320220722.pdf ITR 22-23Document1 pagePDF - 933662320220722.pdf ITR 22-23smpNo ratings yet

- PDF 467415410030922Document1 pagePDF 467415410030922QunalNo ratings yet

- Aaecc2134l 2023 PDFDocument4 pagesAaecc2134l 2023 PDFVineet KhuranaNo ratings yet

- PDF 990850220061221Document1 pagePDF 990850220061221Olympia FitnessNo ratings yet

- PDFReportsDocument6 pagesPDFReportsDeeptimayee SahooNo ratings yet

- Itr 23-24Document1 pageItr 23-24addy01.0001No ratings yet

- PDF 828490820141121Document1 pagePDF 828490820141121Aditya SinghNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDipak Ranjan RathNo ratings yet

- Power System TransientsDocument11 pagesPower System TransientsKhairul AshrafNo ratings yet

- Ack 504547400170723Document1 pageAck 504547400170723varsha sardesaiNo ratings yet

- Ashok S R 2021-22 AckDocument1 pageAshok S R 2021-22 AckSHIFAZ SULAIMANNo ratings yet

- GSTR3B 09ehmpm8928j1zf 062021Document2 pagesGSTR3B 09ehmpm8928j1zf 062021Ankur mittalNo ratings yet

- DR S GurusamyDocument15 pagesDR S Gurusamybhanu.chanduNo ratings yet

- Ack 367661020050723Document1 pageAck 367661020050723Sivaram PopuriNo ratings yet

- PDF 254872900180623Document1 pagePDF 254872900180623Sachin KumarNo ratings yet

- 2122 ItrDocument1 page2122 ItrAjay PratapNo ratings yet

- PDF 236811830140623Document1 pagePDF 236811830140623Akeybo 340No ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearSUDHEESH KUMARNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearIshita shahNo ratings yet

- PDF 691846850250723Document1 pagePDF 691846850250723Anish MishraNo ratings yet

- Itr 2021.2022Document1 pageItr 2021.2022MoghAKaranNo ratings yet

- Final MS Access Project Class-10Document17 pagesFinal MS Access Project Class-10aaas44% (9)

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurumahesh bhorNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruNANDAN SALESNo ratings yet

- Ack Cdhpa3843f 2022-23 220950670290722Document1 pageAck Cdhpa3843f 2022-23 220950670290722rtaxhelp helpNo ratings yet

- ACK158216300200523Document1 pageACK158216300200523Ritu RajNo ratings yet

- PDF 628846520240522Document1 pagePDF 628846520240522Narayana Rao GanapathyNo ratings yet

- Ack Ejaps7559m 2022-23 763168490080722Document1 pageAck Ejaps7559m 2022-23 763168490080722Rashi SrivastavaNo ratings yet

- MeharwanDocument1 pageMeharwanSteve BurnsNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment Yeartejeswararao ronankiNo ratings yet

- PDF 769819660090722 PDFDocument1 pagePDF 769819660090722 PDFRAJENDRA MODNo ratings yet

- PDF 776152000311221Document1 pagePDF 776152000311221NandhakumarNo ratings yet

- RK 1Document1 pageRK 1Sharada ShankarNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearVINAY verma100% (1)

- Paramjeet Kaur 2023-2024Document1 pageParamjeet Kaur 2023-2024thinkpadt480tNo ratings yet

- PDF 816776770290723Document1 pagePDF 816776770290723Sunita SinghNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearRavi KumarNo ratings yet

- Itr21 22Document1 pageItr21 22RahulMahajanNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearAditya Adi SinghNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearPrateeksha SharmaNo ratings yet

- PDF 441907670270322Document1 pagePDF 441907670270322shryeasNo ratings yet

- PDF 949279100021221Document1 pagePDF 949279100021221MUTHUMUNEESH WARANNo ratings yet

- Ack Aacar1829b 2021-22 562508250310322Document1 pageAck Aacar1829b 2021-22 562508250310322Amma FoundationNo ratings yet

- PDF 169223670270722Document1 pagePDF 169223670270722adhya100% (1)

- EP001 LifeCoachSchoolTranscriptDocument13 pagesEP001 LifeCoachSchoolTranscriptVan GuedesNo ratings yet

- Ack Eoppk3398n 2021-22 950983730021221Document1 pageAck Eoppk3398n 2021-22 950983730021221sandeep thakurNo ratings yet

- Itr 22-23Document1 pageItr 22-23MoghAKaranNo ratings yet

- 1st Page ITRV FY 20-21Document1 page1st Page ITRV FY 20-21naveen kumarNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearAbhinaba SahaNo ratings yet

- Itr-V FKTPM7864L 2023-24 756976760270723Document1 pageItr-V FKTPM7864L 2023-24 756976760270723Samrat AseshNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearRavi KumarNo ratings yet

- ACK131773880020523Document1 pageACK131773880020523Ritu RajNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment Yearshyam krishnaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAdarsh KeshariNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDattatraya JoshiNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearNarayan KumbharNo ratings yet

- PDF 615803240220723Document1 pagePDF 615803240220723mohammadgausraza229No ratings yet

- Daewoo 710B PDFDocument59 pagesDaewoo 710B PDFbgmentNo ratings yet

- STS Module 11Document64 pagesSTS Module 11Desiree GalletoNo ratings yet

- CAREDocument11 pagesCARELuis SementeNo ratings yet

- PGCRSM-01-BLOCK-03 Research Design ExperimentalDocument29 pagesPGCRSM-01-BLOCK-03 Research Design ExperimentalVijilan Parayil VijayanNo ratings yet

- Alphabetic KnowledgeDocument8 pagesAlphabetic KnowledgejsdgjdNo ratings yet

- Chief Complaint: History TakingDocument9 pagesChief Complaint: History TakingMohamad ZulfikarNo ratings yet

- Guncha Arora: Professional Profile Career HistoryDocument1 pageGuncha Arora: Professional Profile Career HistoryNitin MahawarNo ratings yet

- First - Second and Third Class Levers in The Body - Movement Analysis in Sport - Eduqas - Gcse Physical Education Revision - Eduqas - BBC BitesizeDocument2 pagesFirst - Second and Third Class Levers in The Body - Movement Analysis in Sport - Eduqas - Gcse Physical Education Revision - Eduqas - BBC BitesizeyoyoyoNo ratings yet

- Chapter 20 AP QuestionsDocument6 pagesChapter 20 AP QuestionsflorenciashuraNo ratings yet

- Gujarat Urja Vikas Nigam LTD., Vadodara: Request For ProposalDocument18 pagesGujarat Urja Vikas Nigam LTD., Vadodara: Request For ProposalABCDNo ratings yet

- Multimedia System DesignDocument95 pagesMultimedia System DesignRishi Aeri100% (1)

- Chapter 5 - CheerdanceDocument10 pagesChapter 5 - CheerdanceJoana CampoNo ratings yet

- Vygotsky EssayDocument3 pagesVygotsky Essayapi-526165635No ratings yet

- RSC Article Template-Mss - DaltonDocument15 pagesRSC Article Template-Mss - DaltonIon BadeaNo ratings yet

- B. Inggris X - 7Document8 pagesB. Inggris X - 7KabardiantoNo ratings yet

- Lenovo NotebooksDocument6 pagesLenovo NotebooksKamlendran BaradidathanNo ratings yet

- 4B - Urp - Shavya's FarmDocument22 pages4B - Urp - Shavya's FarmSnehansh KishoreNo ratings yet

- Calculus For The Life Sciences 2nd Edition Greenwell Solutions ManualDocument26 pagesCalculus For The Life Sciences 2nd Edition Greenwell Solutions ManualSharonPerezozqy100% (56)

- ABI TM 13 16 SL - EngDocument1 pageABI TM 13 16 SL - EngJuan Carlos Benitez MartinezNo ratings yet

- Income Tax and VATDocument498 pagesIncome Tax and VATshankar k.c.100% (2)

- Introducing The Thinkcentre M70A. A Desktop You DefineDocument3 pagesIntroducing The Thinkcentre M70A. A Desktop You DefineSiti RohayatiNo ratings yet

- Cipet Bhubaneswar Skill Development CoursesDocument1 pageCipet Bhubaneswar Skill Development CoursesDivakar PanigrahiNo ratings yet

- Newsletter 1-2021 Nordic-Baltic RegionDocument30 pagesNewsletter 1-2021 Nordic-Baltic Regionapi-206643591100% (1)

- Operating Instructions: HTL-PHP Air Torque PumpDocument38 pagesOperating Instructions: HTL-PHP Air Torque PumpvankarpNo ratings yet

- Additional Article Information: Keywords: Adenoid Cystic Carcinoma, Cribriform Pattern, Parotid GlandDocument7 pagesAdditional Article Information: Keywords: Adenoid Cystic Carcinoma, Cribriform Pattern, Parotid GlandRizal TabootiNo ratings yet